Introduction

British American Tobacco (BAT) is one of the world’s largest tobacco companies and a tobacco producer and distributor of various kinds of cigarettes, tobacco products, and nicotine-containing merchandise. The company is present in 180 nations. As a multinational corporation, BAT operates in a multilevel, diverse external environment with many risks and dangers. The task of the assignment is to analyze BAT, which shall be achieved by examining the global business climate’s power on the company’s risk management practices.

The first section deals with the owner’s operations, motivation for FDI, and the picture of revenue and regional profitability by region in the last five years. The following part of the report discusses BAT’s significant political and exchange rate risks, which BAT should cope with. Risk mitigation weighed against the hazards by the BAT is covered in the third section. In the end, recommendations are proposed to upgrade BAT’s risk-management approach; data back each proposal. Agency Responsibilities: The introduction is restructured without bullet points, which improves the flow and coverage of the scope of areas.

Analysis of BAT’s Global Operations and Performance Trends

Having London as its main European base, BAT supplies its tobacco products worldwide, leading these markets to Europe, Africa, Asia and Australasia, North or South America, and Asia (BAT, 2022). BAT, an internationally renowned multinational company, has been successful in its globalization mainly because of foreign direct investments (FDI) rather than other factors. Dunning argues that firms seek efficiency, market, knowledge, and capability (Dunning & Lundan, 2008).

The FDI of market-seeking nature permits organizations like BAT to achieve their sales purposes in the more imminent markets while going international (Dunning & Lundan, 2008). BAT has spread from developing countries reminiscent of Western industrialized countries where there is a growing population as the majority are young, rising incomes, and a demand for tobacco products are escalating in the Middle East, Asia, and Africa. The outlook-seeking principle has enhanced BAT’s position in the global arena. The only corporation before BAT in the world in 2021 was the China National Tobacco Corporation, according to Euro-meter research in 2022, with a market share of 11.2%.

Fast-developing FDI is an efficient tool that reduces export inputs and production costs and achieves lower levels (Dunning & Lundan, 2008). In BAT’s attempt to boost its profit margins, the product is procured at relatively low prices in regions such as Brazil, India, and Africa through its multiple manufacturing sites across the globe. Concentrating on manufacturing in less cost-effective countries heightens the organization’s effectiveness due to higher productivity.

Learning-based foreign direct investment can efficiently arouse the necessary skills, know-how, and resources across various kinds of subsidiaries (Dunning & Lundan, 2008). R&D investment is a priority for BAT. Therefore, having facilities in strategic markets to cooperate with professionals establishes excellence in knowledge gain, such as the R&D center of BAT in South Korea, which creates unique and technical vaping and heating devices that offer low-risk smoking alternatives. BAT’s networks were established in the local societies that take part in the programs with the aim of information and technologies.

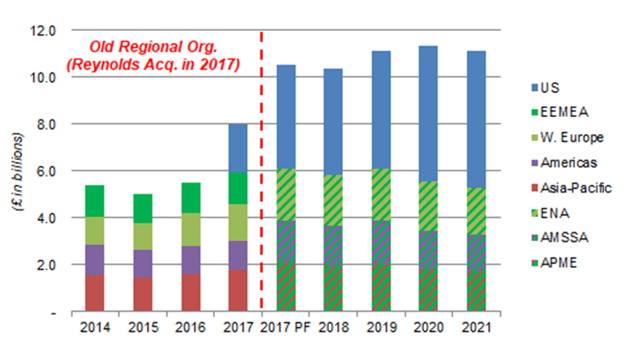

A careful analysis of BAT’s sales figures during the previous five years shows that the company has country development as a significant growth strategy. “Figure 1” shows the trend of BAT’s earnings mainly generated from the developed regions like Western Europe recessed in 2018. For example, a move from £4,204 million in 2018 to £3,909 million in 2022 for the region of Western Europe again represents a loss. However, the developing countries come out on top, especially in the Asia-Pacific area and the Middle East. Their income dominates that demonstrated by developed countries. Emerging markets contribute much to BAT’s business, which leads to country-related political risk and foreign exchange fluctuation, which may be significant risks when analyzed closely.

Figure 1: BAT Revenue by Region 2014-2021. Source: https://seekingalpha.com/article/4486813-british-american-tobacco-solid-2021-earnings.

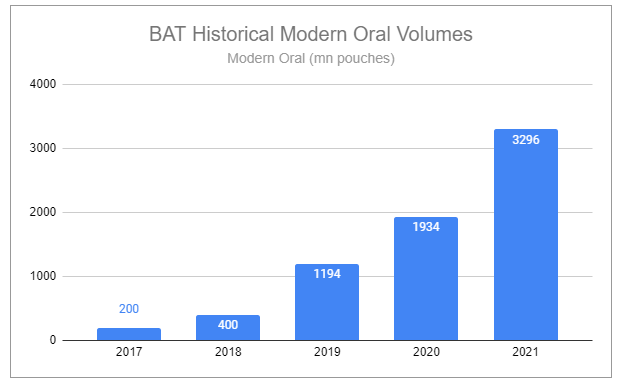

The U.S. market is a crucial playing field, and simultaneously, there are some strategic directions to oral tobacco and RRPs (reduced-risk products). More than half of the revenue was created in the U.S. Region, and the curve representing its dynamics constantly rises, as shown in Figure 2. In fact, this, together with its brand portfolio’s robustness in the substantial American tobacco market and its positioning as a competitor, emphasizes BAT’s superiority. In the inner battle between cigarette sales and oral tobacco products, moist snuff and snus are two silver linings that bring the hope of more profits and growth. RRPs, by the same token, have been highly successful weapons in restructuring BAT into a multinational tobacco and tobacco products business. On the other hand, while these hoped-for revenue streams exist, there are many legal concerns over the targeting of teens, and at the same time, there are also fuzzy rules on rating practically everything.

Figure 2: BAT Profit by Segment 2017-2021. Source: https://invariant.substack.com/p/british-american-tobacco-bti-analysis

Identification and Critical Analysis of Key Risks

Facing the risks of MNCs, such as political and financial issues, the industry is especially vulnerable to currency exchange fluctuations. Below is a critical analysis of these: Below is a critical analysis of these:

Exchange Rate Risks

There are three primary risks that the BAT network may encounter due to its vast international activities and operating currency. BAT exchange rate risk is another matter caused by the company’s dealing with several currencies like Pound Sterling, euro, Turkish lira, Russian rouble, and Malaysian ringgit (British American Tobacco plc, 2022). This implies that currency fluctuations tend to reduce, although not to a zero level, the revenues and costs, which ultimately lead to fluctuations in profits. As an example, BAT’s latest financial account (2022) indicates that profit was significantly reduced by £205 million in the year 2021 as a result of the depreciation of the Turkish Lira and Romanian Leu currency value vis-a-vis the British Pound.

BAT’s currency exposure comes from numerous trade activities; hence, it is exposed to transaction risk. In 2021, only BAT spent 9.4 billion USD apiece to purchase raw materials, and from this amount, EUR 5.7 billion payable was used to purchase raw materials in the eurozone. By definition, a company with Sterling liabilities is subject to the risk associated with these payments when exchange rates, such as EUR/GBP and USD/GBP, fluctuate and could lead to gains or losses due to transactional foreign exchange.

The translation risk is also present in the subsidiaries of BAT, as their financial statements carried out in different foreign currencies will need to be converted to sterling to be consolidated (Shapiro & Hanouna, 2019). Such a high vulnerability of the BAT to fluctuations in accounting exchange rates becomes a financial factor and may influence the financial state of BAT. For example, the depreciation of the Turkish Lira pound sterling was 979 million. The UCL equivalent blighted the value of the recorded assets (BAV 2022). BAT sees exchange rate risk as a fundamental factor to be managed actively because 63% of its income in 2021 may be sourced outside the U.K. They are exposed to volatile currencies like the Turkish Lira, Romanian Leu, Russian Rouble, and Malaysian Rinage.

Political Risks

BAT is an international regulation, law, or political and corporate governance representing the tobacco industry as an MNC. Firstly, as nations continuously enhance tobacco control laws by sliding excise taxes on tobacco products, BAT becomes vulnerable to the risks of going through regulatory issues (Ng et al., 2014). During the past years, significant markets such as Australia, the United Kingdom, Russia, and Indonesia have set stricter rules on granting, placing, and marking manufacture (Campaign for Tobacco-Free Kids, 2022). Thus, such legal adjustments might provide a decline in the sale of BAT’s products, an increase in expenses, and inhibition of operations costs.

Youngsters fervently reject cigarettes, imposing responsibility for developing tobacco malignancies and setbacks for reputation and rights. In the USA, federal and state legislation has provisions for legal action by individual and class action lawsuits to hold tobacco companies accountable for both punitive and compensatory damages (Abdalla & Abdalla, 2021). Indeed, lots of legal actions fail, but for the department to clear them is a very costly affair. Not only are the financial damages, but the wrong name of BAT as a tobacco company is contributed by the continuous lawsuits of the wrong images. This is so since the intention is to merge geopolitical volatility with the competition between major economies, BAT would have political and trade-related risks. A US-China trade conflict like that may affect the exports of BAT, whose leaves are tax-spiked and shipped to the U.S. (Rietveld & Schilling, 2021). These necessitate activating trade protectionist efforts, which would, in turn, increase BAT’s input costs and reduce its profit margins. BAT’s political and legal risks are compounded in those critical regions because of permanent regulatory strengthening, the public’s dislike of the industry, legal pressures, and geopolitical concerns. Good exposure management stands for reducing this type of disagreement.

Critical Evaluation of BAT’s Risk Management Strategies

To handle the risks stated above, BAT uses a variety of financial and operational risk management techniques, which are assessed below To handle the risks stated above, BAT uses a variety of financial and operational risk management techniques, which are assessed below:

Management of F.X. Risk through Forward and Derivatives Contracts

BAT accomplishes this by mainly employing currency swaps and internal hedging to manage short-term transactional and translation risks. The management of market risks for BAT entities is achieved through two mechanisms: direct and indirect. About the implications of the direct exchange rate (Daily Buzz, 2022), changes in the functional currency (BAT, 2022) can be viewed as a direct hedge as the BAT entities choose to conduct transactions in this currency. Buyers pay in the functional currency while suppliers receive it. To manage the risk of internal currency risk and capitalize on arbitrage opportunities, in U.S. subsidiaries, the staffers receive revenue in USD and pay their expenses in USD. Market hedging is utilized via forward contracts and swaps to protect against current exposures and obligations. The foreign exchange transaction risk amounted to slightly over half in 2021 (BON, 2022). There were currency derivatives that were used in hedging. Volatility is one of the aspects which BAT tries to block by hedging. These imply that the company intends to stabilize its earnings range and maturity run.

BAT is stifled with excessively operating currency anxiety because of too much usage of short-term hedging agents. Diversifying away from the primary currency may have a hedging effect. However, more is needed to help resolve the long-term currency mismatch of the regional operating costs relative to BAT’s revenue. Figure 1 shows that although the sales of BAT have continued to be fueled mainly by developing countries, as shown in Figure 2, it is Western regions that cover significant import and other operating costs. The view that this calculated embracing of foreign exchange risk is a justification for an increase in the product range and manufacture of the product in developing countries is now being shelved.

International debt is unclassified from BAT’s standpoint as a hedge, and hence, BAT will be losing potential hedging opportunities. Even with an outstanding £12.9 billion E.U. bond, BAT thinks they are no natural hedge to the risk of their Euro revenues (BAT, 2022). Profit on assets that may be transacted with EUR may not necessarily offset loss from foreign currency debt, which is reported in another currency if the hedge accounting was in use. This would help to prevent a fluctuating revenue as the remaining E.U. exposure is less critical.

This difference between the income and cost report currencies makes the exchange rate risk keep even the non-volatility period of currencies in the short term through short-term derivative use. A strategic localization of production processes in developing nations and debt usage on a more comprehensive scale could help prevent structural currency mismatches in the long term.

Coordination of Political and Regulatory Risks

BAT supports regulations worldwide through its extended NGO and youth empowerment activities to steer tobacco control laws toward BAT’s specific objectives. For an absolute example, The BAT Principle intends to prevent burdening on prices, taxes, and advertisement restrictions in developing nations like Kenya, which would, to a certain extent, preserve cigarette affordability and use (Katsinde, 2014). Even when adopting harsher laws is crucial, BAT uses its power to provide people with the requisite time to fulfill the laws. This balance lies between the epidemiological aspect and the viability of marketing.

The BAT company, in Peter and Gilmore’s words (2015), is a significant investor in both the development and marketing of RRPs in oral forms and e-cigarettes, as well as helping to reduce the harm caused by conventional smoking. This implies that BAT products can be applied in creative ways to help solve amusing problems related to cigarette desire. BAT has resorted to gun-to-gun marketing and tactical product and market positioning in reaction to falling cigarette demand in an attempt to increase customer loyalty and sustain the business.

The WHO acknowledges the fact that tobacco has been linked to health risks. Still, Bat’s efforts to eliminate the regulation of tobacco products are controversial. The RRPs demonstrated by BAT could reduce risk, but the long-term actions are unknown as they are not verified. Therefore, independent verification is still required to determine damage, health, or harm these products have on health. It is not reliable to believe in the assertion of the BAT companies that the RRPs contribute to improving public health and even policy matters because they seem obsessed with the interests of businesses to keep people hooked on nicotine (Peeters & Gilmore, 2014).

BAT’s risk management must also align with their public health objectives while RRPs mitigate anti-tobacco views or facilitate BAT’s compliance with the relevant regulation. Such an action requires involvement in policymaking and does not overlap or interfere with the world’s initiative against having industry manipulate the battle. Besides, additional funding must go towards checking the average percentage of harm reduction that RRPs can cause and publishing that information openly. By implementing these measures, BAT will strengthen the ethical and fairness-oriented nature of its risk management and mitigate the consequences the country may face for international trade.

Management of Legal Risks

BAT uses their great litigation strategy and the fact that the company is a multinational corporation with thousands of assets worldwide to defend any cases and keep the number of liability claims down. On the contrary, the company had succeeded spectacularly in disputing the individual/class action suits by exploiting technical legal loopholes in the U.S. court system (Abdalla & Abdalla, 2021). The recommendations are also professionally crafted tactics to add and appeal, ending legal disputes to avoid creating states of precedence. So, as an illustration, in exchange for industry compensation, BAT agreed on the historical US$206 billion design to tobacco accord in 1998, meaning that the amount could limit the additional state litigation as stated in 2009 (Abdalla & Abdalla, 2021).

Sustaining strategic lawsuits converts company funds and punctures the reputation of BAT at all times. For managing risk, on the part of BAT, it may aim at a more comprehensive and well-weighed settlement with the U.S. plaintiffs. This strategy could comprise the industry’s apology, which may include repatriations in the form of treating affected individuals with a program that will help them remove harmful substances from their bodies or the funding of medical research, which will be used to find sustainable solutions to ensure that the adverse effects of tobacco are reversed. The last one, far less common, is the broader settlement. It covers all the previous disputes and considerably lowers the future lawsuit risk and the verdict’s impact on reputation, even if it is initially costly. This will mean we can write an example of risk management for the long term.

Conclusion and Recommendations

To sum up, this project raised the question as to what extent BAT’s risk management processes were adequate for conducting business across the globe and whether any modifications could be made to improve these. Companies had many risk factors, such as increasing exposure in emerging countries, new product categories, foreign exchange, and challenging legal systems. BAT sets cases with varying degrees of result with banking, financialized hedging tools, and lobbying tactics.

The potential solution that BAT should implement is relocating their other production and leaf sourcing operations to core areas (i.e., in growing regions of top importers), thus improving its risk management in the long run. If revenues and expenses are aligned with the same currencies rather than being continuously traded and translated, transaction and translation risks will be attenuated.

BAT should be based more on inclusivity and fairness concerns instead of avoiding its interests while being neutral or politically impartial in policymaking. In addition, BAT should also aid in unfolding scientific investigations that are independent of their claim that RRPs have actual harm reduction potential. Given the position of society towards nicotine products as harmful ones, these steps will help BAT to play by the rules when it comes to this health topic in particular.

The last and most viable remedy is to enter into a settlement agreement with the defendant and offer a significant settlement amount in the U.S. Although it can be a costly process initially, an amicable settlement may embody the end of long-standing disputes, reduce the expenses of frequent litigations, and preserve one’s reputation. Taking the future effect into context, implementing the said stages would serve to employ all possible preferred long-term solutions for financial, operational, and legal risks.

Taking those steps will help the BAT company handle the business-related strategic, compliance, and financial risks on the global level in a sustainable and manageable way. The ever-changing political environment is essential for the significant tobacco corporation, BAT, to adopt responsible risk management, which eventually enables the company to stay in business for an extended period.

References

Abdalla, M., & Abdalla, M. (2021, July). The Grey Hoodie Project: Big tobacco, big tech, and the threat on academic integrity. In Proceedings of the 2021 AAAI/ACM Conference on A.I., Ethics, and Society (pp. 287-297).

BAT, 2022. Annual Report and Form 20-F 2021. [online] London: British American Tobacco p.l.c. Available at: https://www.bat.com/group/sites/UK__9D9KCY.nsf/vwPagesWebLive/DOBWGJRS/$file/Annual_Report_and_Form_20-F_2021.pdf.

Campaign for Tobacco-Free Kids, 2022. The Global Cigarette Industry. [online] Available at: https://www.tobaccofreekids.org/assets/global/pdfs/en/Global_Cigarette_Industry_pdf.pdf.

Dunning, J. H., & Lundan, S. M. (2008). Multinational enterprises and the global economy. Edward Elgar Publishing.

Euromonitor International, 2022. Tobacco in the U.S. [online] Available at: https://www.euromonitor.com/tobacco-in-the-us/report.

Katsinde, C. S. (2014). Hypertension- The New Silent Killer in Zimbabwe: Is Primary Prevention a Solution?

Ng, M., Freeman, M. K., Fleming, T. D., Robinson, M., Dwyer-Lindgren, L., Thomson, B., … & Gakidou, E. (2014). Smoking prevalence and cigarette consumption in 187 countries, 1980-2012. Jama, 311(2), 183-192.

Peeters, S., & Gilmore, A. B. (2014). Understanding the emergence of the tobacco industry’s use of tobacco harm reduction to inform public health policy. Tobacco control.

Rietveld, J., & Schilling, M. A. (2021). Platform competition: A systematic and interdisciplinary review of the literature. Journal of Management, 47(6), 1528-1563.

Shapiro, A. C., & Hanouna, P. (2019). Multinational financial management. John Wiley & Sons.

World Health Organization. (2008). WHO report on the global tobacco epidemic, 2008: the MPOWER package. World Health Organization.

World Health Organization. (2016). Electronic nicotine and non-nicotine delivery systems (ENDS/ENNDS).

write

write