1 Overview of the Company

Founded in 1979, Agility is a publicly traded, worldwide logistics company with its headquarters in Kuwait. Agility Company is active in several sectors in Kuwait, including supply chain service & investment, e-commerce logistics, warehouse parks, and facility management. The business provides businesses, governments, and non-profit organizations worldwide with supply chain management, freight forwarding, transportation, and warehousing services. Agility shares have been traded on the Kuwait Stock Exchange since 1984 and on the Dubai Financial Market since 2006. Agility is a market leader, with more than 50,000 employees operating in over 65 countries. Agility is a top provider of supply chain services and supports supply chain innovation. It is important to note that Agility’s primary business is commercial logistics.

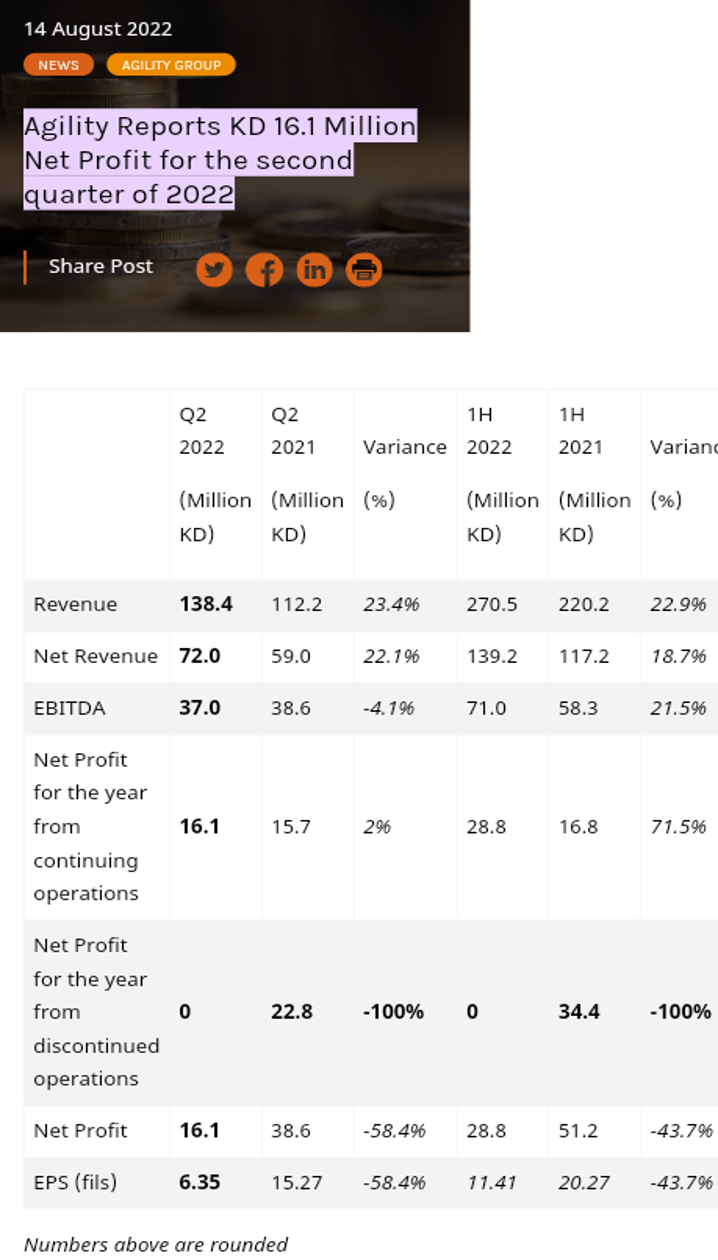

The company’s commercial business, Agility Global Integrated Logistics (GIL), is situated in Kuwait’s Sulaibiya and is in charge of overseeing the transportation of cargo by air, sea, land, or a combination of these modes, including raw materials, finished goods, components, and other cargo. GIL provides warehousing and delivery services and services and technology for tracking and managing inventory and shipping. Agility Project Logistics, Agility Chemicals, and trade shows and events are notable examples of GIL’s logistics-specific businesses providing customers with large, complex jobs in the mining, energy, and maritime sectors (Agility Fairs & Events). Agility (2022) claims that the company On a net profit of KD 28.8 million, the company announced first-half 2022 earnings of 11.41 fils per share, a rise of 71.5 percent from KD 16.8 million to KD 28.8 million in profits from ongoing operations, which exclude the results of the GIL business that Agility sold in 2021. EBITDA increased by 21.5 percent to KD 71 million, and income increased by 22.9 percent to KD 270.5 million.

2 Rationale

According to CFI Team (2022), researching a company and its operational environment to develop a strategy constitutes strategic analysis. I needed to select a company I am well-versed in for this task since it will provide me the finest insights on its keys to success, its entrance point (flaws in its existing strategy), degree of competitiveness and associated problems, untapped prospects, etc.

2.1 Reasons I Choose Agility Group of Companies

That was the foundation of my decision to do a strategic analysis at Agility Logistics Company; First off, according to Agility (n.d.), the business is a leader in supply chain services, innovation, and infrastructure. It is also one of the world’s most significant aviation service providers by the number of countries in which it operates. Second, it was one of the biggest private owners of warehouse space and industrial real estate in Africa and the Middle East. Thirdly, it is the top fuel logistics provider for new markets and businesses that provide remote infrastructure services, customs digitalization, e-commerce enablement, and management of commercial real estate and facilities (Agility, n.d.).

Fourthly, despite the Covid19 epidemic, which negatively interrupted and harmed the supply chain industry globally, the company has maintained its financial performance. For instance, according to ZAWYA (2022), the business generated net revenue of KD 72.0 million in the second quarter of 2022, an increase from the KD 15.7 million it earned in the second quarter of 2021. (KD 59.0 million). Finally, the business has a broad range of products and services and works in several industries. It is indisputable that a firm must have an operational strategy and strategic planning to be recognized as a global leader in any industry.

Agility Logistics Company possesses the elements necessary to make a case for its solid strategies and well-considered future goals with authority and credibility.

2.2 Motivations towards choosing Agility Group of Companies

I chose Agility Group of Companies because despite working in a supply chain sector that is constantly evolving due to technological advancement and digitization. Only businesses with outstanding strategies can handle such continuous distribution network development. In addition, to providing remote infrastructure services, real estate development, customs modernization, electronic transportation, ecommerce enablement, and facilities management, the Agility Group of Companies is a market leader in the liquid fuel logistics industry for emerging markets. With a growing portfolio of listed and non-listed capital partners striving to alter their product ranges along various sectors, the company is also an investor in technology, sustainability, and adaptability. In a nutshell, the company’s strategic goals, which are focused on integrating the global economy by improving supply chains and making them faster, greener, equitable, and much more adaptable, mostly inspired me to examine its strategies, which appear to have been carefully considered.

2.3 Preferred Entry point for Agility Group of Companies and Why

The management team at the Agility Group of Companies has consistently delivered good results in the various industries in which it now works. This is due to their ability to implement excellent and successful strategies. However, the management team needs to pay more attention to a critical issue when developing the company’s product/service portfolio. Kuwait and the Middle East still provide new prospects that the company’s strategic management should consider and seize. Similar problems arise with a competitive advantage. For instance, the management and strategic team of the Agility Group of Companies should assess and invest in the Kuwaiti food market. Investments in the building industry represent the second unexplored opportunity. These entrance points are covered in the section on SWOT analysis.

2.3.1 Agility Group of Companies SWOT analysis

2.3.1.1 Strengths

The critical business characteristics of the Agility Group of Companies are its greatest assets and unquestionably offer it a competitive advantage over competitors. First of all, the business is global in scope. Agility (n.d.) claims that the company operates in more than 65 nations, giving them access to a worldwide market. Second, the company enjoys a solid reputation and brand recognition. Agility (n.d.) lists the company as one of the top owners and developers of light industrial and warehouse parks in the Middle East, South Asia, Africa, and South Asia. The company is also a part of Engineering Systems Group (ESG), a provider of incorporated engineering explanations in Kuwait and the Middle East, which trains Kuwaiti youth and university graduates intensively in facility management.

Thirdly, the company provides specialized services and goods. Agility (n.d.) claims that integrating a warehouse management system allows for quicker processing of orders and real-time stock changes as part of Agility’s solution. This optimized inventory management produced 99% accuracy, which allowed the customer to save time and money. Fourthly, the business adopts technology quickly. Agility (n.d.) claims that the company is successfully integrating a significant tech player into the Kuwaiti market. Lastly, the firm operates sustainably. According to MBA Skool (2020), the Vietnam Supply Chain Community was presented with the Green and Corporate Social Responsibility Award in 2011. Lastly, Agility has a fantastic management team that can handle its numerous businesses within Kuwait and other countries and records ongoing success and growth.

2.3.1.2 Weaknesses

According to MBA Skool (2020), the organization only has a small worldwide footprint in the interior and rural areas. The corporation is notably widely recognized in the Middle East, and its presence in the continents of Europe, North America, and Asia is pitiful. Last but not least, the business was accused of fraud, damaging its reputation, for allegedly overcharging the American public for more than $8.5 billion in food supply contracts in the Iraq war zone (Chatterjee, 2010). This doubtlessly cut short the company’s prowess in the food sector as it was the leading supplier of food products to the US.

2.3.1.3 Opportunities

Due to the company’s 2.15 million square meters of worldwide storage capacity, which can enable it to expand its activities globally, there is scope for facility growth (MBA Skool, 2020). The company also has untapped opportunities, such as operating in the food and construction industries.

Bolst Global (n.d.) anticipated that Kuwait’s food sector, which presently has the fastest food intake in the whole Gulf region, will grow by 9.6 percent yearly in the next five to ten years. Additionally, the Agility Group of Companies can benefit significantly from investing in this industry because according to the International Trade Administration (n.d.). Notably, one of the main pillars of Kuwait’s National Development Plan is promoting sustainable agriculture, nutrition improvement, and food security. As a result, Agility Group of Company, which has dominated the supply chain industries, could increase its earnings by establishing a new commercial division to handle food imports to Kuwait. It will be able to compete with the nation’s well-known food importers, such as Aleid foods, Alzoba Co. W.L.L, Azzad Trading Group, and Food Choice (Canned Food. IT, n.d.). The company’s ability to implement excellent strategic plans that have kept it in the lead in domestic and foreign industries is also a critical factor in its success in Kuwait’s food business. Since this industry is one of Kuwait’s fastest-growing, the corporation should consider it.

Another undiscovered possibility for Agility is to invest in the Kuwaiti construction industry. Notably, Global Data (2022) estimates that Kuwait’s construction market size was $11.2 billion in 2021 and is expected to increase at an AAGR of more than 3% from 2023 to 2026. According to Global Data (2022), Kuwaiti government initiatives to encourage the development of transportation and renewable energy infrastructure will aid the industry’s growth. The building industry will also benefit from Kuwait’s aim to expedite structural liberalization and broaden its economy beyond its dependence on crude products. Agility Group of Companies should assess the construction industry’s promising future and make investments there.

2.3.1.4 Threats

The company is up against fierce competition from several players in the markets in which it competes, including, most notably, DB Schenker, which has excelled at offering door-to-door services for your shipment. Second, the CEVA has demonstrated outstanding fortitude and steadfast cooperation by offering specialized solutions during a challenging period in the airline sector (Gartner Peer Insights, n.d.). Locally, Porter Express, TransCrate International Logistics, Kuwait Transcontinental Shipping Co.W.L.L., Gazal Logistics Services and Warehousing Co., and Agility are competitors for Agility, according to Lusha (n.d.).

2.3.2 VRIO Analysis

According to Messineo (n.d.), the VRIO framework is, by definition, a strategic planning tool created to assist firms in identifying and safeguarding the assets and competencies that provide them with a sustained competitive edge. Because I want to offer recommendations on Agility Company’s strategy, it is the perfect instrument for strategic analysis.

2.3.2.1 Valuable

Agility company has valuable resources which confer it a competitive advantage. For instance, according to Agility (n.d.), the company has an outstanding management team, a leader in technological adoption, excellent innovation strategies, sustainable operations, and a strong brand name. Similarly, the company has a global and local presence, which confers a large customer base. Moreover, the company has a customer network and loyalty because it has focused on its customer’s well-being and satisfaction through the application of IT in its operations and BPM (Business Process Management). Lastly, the company’s supply chain network flexibility is a valuable resource (IvyPanda, 2022).

2.3.2.2 Rare

Citing Agility (n.d.), the company’s global and local presence and supply chain network flexibility is valuable and rare resources, as not all companies can operate in multiple locations. Similarly, its brand name is a rare resource because it takes a long time for companies to establish a strong brand name. Additionally, the company’s positive customer relationship and fast adoption of technological advancements is a rare resource as companies have to be aggressive to gain customer trust and loyalty. Besides, its outstanding management team is a rare resource. Lastly, its ability to embrace technology is a rare resource. The above resources confer Agility Company a competitive advantage.

2.3.3.3 Inimitable

The company’s global and local presence is an imitable resource as its rivals can invest in the exact locations with the required capital to enter those markets. Besides, the company’s supply chain network flexibility is an imitable resource. However, its firm brand name remains a unique resource. Its management (level of employee competence) is a unique resource. Its ability to adapt to changing technologies is a unique resource, as it is difficult to align a business’s goals with the evolving technologies and supply chain.

2.3.3.4 Organized

The company’s global and local presence, outstanding management team, supply chain network flexibility, and brand strength are well organized and, without a doubt, are the company’s keys to success. The company’s ability to adapt to technology in its supply chain operations is well organized, as evidenced by its use of Cargo X. This platform is looking to revolutionize how road freight is booked in complex markets (Sultan, 2017). Additionally, the company’s supply chain network flexibility is well managed, as evidenced by the company being recognized as a supply chain leader.

2.4 Beneficiary to this strategic analysis for Agility Group of Companies

First and foremost, private and public corporate organizations, business owners, and governmental institutions would benefit from automation: they could adopt technology in all facets of their organizational operations. This strategic research, for instance, has shown that Agility Kuwait is a market leader in contract logistics and oil and gas projects. The business can manage multiple temperature storage zones, cold chain solutions, and real-time insight into freight thanks to tracking and tracing systems. Therefore, corporate and governmental organizations should automate activities using digital technologies to improve efficiency and reduce expenses.

Second, our strategic analysis has shown that Agility has effectively provided various supply chain solutions and customer-tailored logistics to the region’s top oil and gas companies. Entrepreneurs, private and public institutions, as well as government parastatals, would gain from this conclusion since it would enable them to tailor their operations to meet client expectations. Thirdly, this strategic research showed that the Agility Group of Companies’ warehousing is dependable and adaptable, giving them an advantage in enhancing inventory control. This research will help corporations (both public and private), government institutions/parastatals, and business owners manage their inventory more effectively by lowering instances of theft, wastage, etc.

In general, based on this strategic analysis, I advise corporate entities, governmental agencies, and aspiring businesspeople to embrace digital technology to ensure their operations’ efficiency. Second, they should adapt their business practices to serve their consumers better, who will feel appreciated and that they are a part of the corporation. Thirdly, since the future is unclear, they (the beneficiaries mentioned above in this strategic analysis) should diversify their product/service portfolio so that they may serve a more extensive client base and mitigate the risks and losses related to operating in a single sector.

3 Findings and Conclusions

The following strategic study revealed that Agility has a superb management team. This group has enabled the business to maintain its leadership position in the global supply chain industry. This team has also been at the forefront in ensuring that the company meets its primary business objectives and aims, such as connecting the world through improved supply chains, as is seen from the numerous nations the company has operated thus far. Second, Agility enjoys a solid reputation among its clientele and a well-known brand name. With a total market worth of $232 million, Agility was listed eighth in Kuwait’s top 10 2022 rankings by Brand Finance (2023).

Thirdly, Agility has made significant technological investments, as seen by the operations’ increasing automation. Sultan (2017) claims that Agility has founded a new technology company to invest in innovative logistics-related technology. For instance, it owns a stake in Cargo X, a platform that aims to transform the way road freight is scheduled in intricate markets like Brazil. This effort aims to assist in spreading the model to other developing nations where the company already has established connections with local shippers, authorities, and transportation providers. Like this, Colle Capital, an early-stage venture capitalist, and Agility have teamed. Notably, Hyliion, a portfolio company of Colle Capital, has created a hybrid solution for the trucking industry that drastically cuts fuel usage and associated pollutants by 30% (Sultan, 2017).

Fourth, Agility enjoys a solid rapport with its clients. Agility (n.d.) claims that the company worked closely with clients to establish its supply chain. The company offered services like customs clearance for all air and sea shipments into Kuwait, indoor and outdoor cargo storage, inbound, outbound, and returns handling, goods receipt and verification, order processing and scheduling, and round-the-clock warehouse access. Without a doubt, this has resulted in more than 250 sites in Kuwait receiving network installation and maintenance on schedule, and 99% of the inventory is accurate. Similarly, Agility helped customers manage their inventory better by offering a dependable warehouse management solution that met all of its requirements across all product lines. It is important to note that the company shipped more than 3 million units for the client in December 2016.

Fifth, the corporation must contend with local, regional, and international competitors. Sixth, the corporation intends to grow its activities by constructing a customs and logistics hub in Egypt’s Suez Canal Economic Zone. Arab News (2022, October) reports that Agility will collaborate with SCZone on putting into practice its strategic vision in service, logistics, and support by establishing a technological and logistics arm that will automate customs procedures and processes.

The results show that Agility has a strong strategic management team, which is necessary for a firm to be recognized as a global leader in any industry.

4 Recommendations

Because the company has primarily focused on the Middle East region, I advise Agility’s management to concentrate more on growing the company’s global presence. It must launch multi-sectoral plans to penetrate markets in America, Europe, and Africa. Additionally, as recognized as untapped prospects in the earlier conversations, the company’s management should engage actively in the food business and construction. Agility’s investment in Kuwait’s food industry, which has been defined as quickly expanding, is the potential to provide an extra income source, as explained in the SWOT section (Bolst Global, n.d.).

Similar to this, Global Data (2022) estimates that the size of the construction market was $11.2 billion in 2021 and is expected to increase at an AAGR of more than 3% from 2023 to 2026. These two are profitable industries to invest in. Kuwait’s National Development Plan, which is focused on promoting sustainable agriculture, bettering nutrition, and ensuring food security, will boost the food industry, according to the International Trade Administration (n.d.). However, Kuwait’s commitment to expedite economic reforms and diversify its economy from relying on hydrocarbons would also benefit the construction sector.

References

Agility. (2022, August 14th). Agility Reports a KD 16.1 million net profit for the second quarter of 2022. https://www.agility.com/en/investor-relations-news/agility-reports-kd-16-1-million-net-profit-for-the-second-quarter-of-2022/

Agility. (2022, August 17th). Agility and Engineering Systems Group Host Training for Kuwait Youth. https://www.agility.com/en/agility-and-engineering-systems-group-host-training-for-kuwaiti-youth/

Agility. (2022, June 8th). Coded Academy strategically partners with Agility to launch “UniCODE” for undergraduate students. https://www.agility.com/en/coded-academy-strategically-partners-with-agility-to-launch-unicode-for-undergraduate-students/

Agility. (n.d.). About Us. https://www.agility.com/en/about-agility-company/

Agility. (n.d.). Agility Logistics. https://www.devex.com/organizations/agility-logistics-118219

Agility. (n.d.). Agility.com. https://www.agility.com/en/

Agility. (n.d.). Agility_SalesCollateral_CountryProfile. https://www.agility.com/wp-content/uploads/2020/09/Agility-Kuwait-Profile-2020-EN.pdf

Agility. (n.d.). Logistics parks Kuwait. https://www.agility.com/en/logistics-parks-warehouse/kuwait/

Arab News. (2022, October 3rd). Kuwait’s Agility to invest $60m to modernize Suez Canal Economic Zone. https://www.arabnews.com/node/2174281/business-economy

Bolst Global. (n.d.). The Food and Drink Landscape of Kuwait. https://bolstglobal.com/portfolio-items/the-food-and-drink-landscape-of-kuwait/

Brand Finance. (2023). Kuwait 10 2022 Ranking. https://brandirectory.com/rankings/kuwait/

Canned Food.IT. (n.d.). Kuwait canned food importers. https://www.cannedfood.it/importers/kuwaitcannedfoodimporters.html

CFI Team. (2022, November 28th). What is Strategic Analysis. https://corporatefinanceinstitute.com/resources/management/strategic-analysis/

CIMA. (n.d.). Strategic Analysis Tools. https://www.cimaglobal.com/Documents/ImportedDocuments/cid_tg_strategic_analysis_tools_nov07.pdf.pdf

Gartner Peer Insights. (n.d.). Agility Logistics Alternatives. https://www.gartner.com/reviews/market/third-party-logistics-worldwide/vendor/agility/alternatives

Global Data. (2023). Kuwait Construction Market Size, Trends and Forecasts by sector – commercial, industrial and infrastructure. https://www.globaldata.com/store/report/kuwait-construction-market-analysis/

International Trade Administration. (n.d.). Kuwait Agriculture. https://www.trade.gov/market-intelligence/kuwait-agriculture

Lucy Barnard. (2014). Arabtec shares rise on reports of Dh5.5bn deal with Kuwait’s Kharafi Group. The National News. https://www.thenationalnews.com/business/arabtec-shares-rise-on-reports-of-dh5-5bn-deal-with-kuwaits-kharafi-group-1.310617

Lusha. (n.d.). Logistics and supply chain companies in Kuwait. https://www.lusha.com/company-search/logistics-and-supply-chain/48/kuwait/120/

MBA Skool. (2020). Agility SWOT Analysis, Competitors & USP. https://www.mbaskool.com/brandguide/transport-and-logistics/3256-agility.html

Pratap Chatterjee. (2010). Agility Attempts to Vault Fraud Charges. CORPWATCH. https://www.corpwatch.org/article/agility-attempts-vault-fraud-charges

Tarek Sultan. (2017). How Kuwait-Based Logistics Giant Agility is embracing digital disruption. https://www.entrepreneur.com/en-ae/technology/how-kuwait-based-logistics-giant-agility-is-embracing/290496

ZAWYA. (2022, August 14th). Agility reports KD 16.1mln net profit for the second quarter of 2022. https://www.zawya.com/en/press-release/companies-news/agility-reports-kd-161mln-net-profit-for-the-second-quarter-of-2022-a802gzti

5 Annex Analysis

I selected the Agility Group of Companies from Kuwait for this strategic analysis because it was founded in 1979, has its headquarters there, and is a leading supplier of supply chain services and a proponent of supply chain innovation. The business is involved in the supply chain industry. Its primary industries and product lines include facility management, warehouse parks, and e-commerce logistics. Notably, its shares have been traded on the Dubai Financial Market since 2006 and the Kuwait Stock Exchange since 1984. More than 50 000 people work for the corporation, which operates in more than 65 countries. The company reported first-half 2022 earnings of 11.41 fils per share, a rise of 71.5 percent from KD 16.8 million to KD 28.8 million in profits from ongoing operations, which excludes the results of the GIL business that Agility sold in 2021. Its financial performance can be attributed to its committed workforce.

This strategic analysis was undertaken to examine some of the company’s unrealized potential (entry points). Additionally, the SWOT and VRIO frameworks were applied in this strategic analysis. Regarding the company I chose, I went with Agility for several reasons, including that it is the best fuel logistics provider for emerging markets and companies that offer a wide range of services. Additionally, the business has maintained its financial performance despite the Covid19 pandemic, which negatively impacted companies worldwide. The business also excels in infrastructure, innovation, and supply chain services. By the number of nations, it serves, it is among the top global providers of aviation services. It was also one of the largest private owners of industrial property and warehouse space in Africa and the Middle East. Additionally, the company operates in numerous industries and offers a wide range of goods and services. The factors above persuaded me to select Kuwait’s Agility Company.

I chose Kuwait’s Agility Company for various reasons, many of which are very similar to those stated above. Because supply chain management is dynamic, just like technology, I was inspired to do this strategic study on it due to its success and degree of embracing technology in its supply chain operations and other areas. Agility is therefore a significant inspiration because only companies with exceptional strategies can manage such continual supply chain network development. I was mainly motivated to examine the company’s plans because of its strategic aims, which center on integrating the global economy by enhancing supply chains and making them faster, greener, more equal, and more adaptive.

I decided to examine its latent potential in relation to the selected entrance point. Despite dominating the global supply chain industry, the corporation still has untapped growth potential that might further diversify its offering of goods and services. For instance, there is little involvement by the corporation in the global food industry, the building industry, or Kuwait. These industries have strong growth potential going forward and should be taken advantage of. In addition, areas outside of the Middle East have much room for expansion.

Using strategic tools, I employed the SWOT and VRIO frameworks to examine Kuwait’s Agility. The SWOT analysis was employed in Agility’s strategic analysis because the assignment’s objective was to examine a company’s strategic plan. An evaluation of Agility’s entry point, which I did in terms of untapped potential, served as the basis for the task. Notably, to properly take advantage of an untapped opportunity, a SWOT analysis must be carried out to identify internal (strengths and weaknesses) and external (opportunities and threats) components that may favor or hinder the strategic move. In conclusion, a SWOT analysis is an excellent technique for a company to capture its primary business goals when assessing an opportunity it should grab, according to CIMA (n.d.).

Table 1: Kuwait’s Agility SWOT analysis

| Internal Factors | External Factors |

| Strengths;

Ø Brand name Ø Global presence Ø Outstanding workforce/management team Ø Pioneer in digitalization Ø Positive customer relations Ø Customer-tailored products |

Opportunities

Ø Investment in the food sector Ø Investment in the construction sector Ø Penetration in other regions |

| Weaknesses

Ø Small worldwide footprint in interiors and rural areas Ø Fraud charges tainted Its image in the U.S. food market |

Threats

Ø Changing technology in the supply chain sector Ø Stiff competition |

With regards to assessing its competitive advantage that would enable the company to succeed in the discussed opportunities in the SWOT analysis, I used the VRIO strategic analysis tool. The choice of the VRIO strategic tool lies in that it helps assess a company’s resources. Additionally, it offers insightful information about how competitive the firm is by analyzing a company’s resources.

Table 2: Kuwait’s Agility Company VRIO analysis

| Valuable

Ø Outstanding management team Ø Strong brand name Ø Leader in technological adoption Ø Excellent innovation strategies Ø Global and local presence Ø Customer network and loyalty Ø Flexible supply chain network |

Rare

Ø Global and local presence Ø Positive customer relationship Ø Fast adoption of technological advancements Ø Outstanding management team Ø Strong brand name |

| Inimitable

Ø Global and local presence Ø Positive customer relationship Ø Fast adoption of technological advancements Ø Outstanding management team Ø Strong brand name |

Organization

Ø Fast adoption of technological advancements Ø Outstanding management team Ø Strong brand name Ø Flexible supply chain network |

This Kuwait Agility Company’s strategic analysis would benefit private and public, corporate organizations, prospective entrepreneurs, and governmental institutions in various ways. The use of digital technologies by the company in various aspects encourages the beneficiaries to adopt similar practices to ensure the effectiveness and efficiency of their operations. In conclusion, I recommend that corporate entities, governmental organizations, and aspiring businesspeople embrace digital technology to ensure their operations’ effectiveness. This advice is based on the strategic analysis I have done. In order to better serve their customers and make them feel like valued members of the company, they should secondly modify their business processes. Thirdly, given the future uncertainty, they (the beneficiaries of this strategic analysis) should diversify their product/service offering to reach a wider clientele and lessen the risks and losses associated with doing business in a particular industry.

According to Kuwait’s strategic study, Agility has an excellent management team, assisting it in improving its financial performance. Agility has a strong reputation with its clientele and a well-known brand name. As evidenced by the rising automation of its operations, Agility has made considerable technology expenditures. Similar untapped business prospects exist in Kuwait’s food and construction industries and in other nations worldwide. Even though Agility has a strong relationship with its customers, it faces competition from national, regional, and worldwide rivals. The company also plans to expand its operations by building a customs and logistics hub in Egypt’s Suez Canal Economic Zone.

In conclusion, Agility has an effective strategic management team, which is essential for a company to be regarded as a worldwide leader in any market.

Table 3: Valuable Brands in Kuwait 2022

Table 4: Agility financial performance 2021 and 2022

Regarding recommendations to Kuwait’s Agility Company’s management team, I advise them to invest more in other regions and reduce their focus on the Middle East region. Secondly, invest in Kuwait’s construction and food sectors and global presence, as these sectors have shown indicators of further growth in the future.

write

write