Introduction

Digital banking can have various impacts on the elderly people in Singapore. However, these impacts can either be positive or negative. This paper aims to examine the impacts of digital banking on elderly users in DBS Bank in Singapore. To achieve this aim, this project will explore various objectives which expound the research aim. These will include the level of adoption of digital banking in Singapore, the perception of digital banking by elderly people in Singapore, the benefits and effects of digital banking on the elderly individuals in Singapore, and the suggestion on how the digital banking experience can be improved for the elderly people in Singapore. DBS Bank is one of the biggest banks in Singapore, which has embraced digital banking to deliver services to its customers.

Research Background

In the recent world, technology has been advancing at an alarming rate. As a result, many industries, including banks such as DBS Bank in Singapore, have embraced digital banking in their service delivery. The term “digital banking” refers to conducting financial transactions using a digital platform, eliminating the need for traditional banking documents such as checks, Demand Drafts, pay-in slips, etc. It refers to the fact that all banking operations may be completed online. DBS Bank began as a Singapore-based financial organization and has since expanded to Southeast Asia’s biggest Bank in terms of assets. The Bank offers comprehensive financial services, including institutional banking, wealth management, and consumer banking (DBS, 2019). When it was initially created, the primary objective of DBS was to acquire funds to contribute to the government’s goals for the urban expansion and commercialization of Singapore.

The Bank has developed to the point that it is currently the largest in Southeast Asia. With the establishment of the DBS, the government of Singapore gave the green light to the private sector to fully fund manufacturing alongside other industrial activities for the first time (Chang, 2019). In 2003, DBS Bank Ltd. changed its name to reflect its growing influence on a worldwide scale. As a result of DBS, Singapore enjoyed economic success in its early years as an independent nation. Since then, DBS has developed into a highly successful and well-established financial services provider. The Bank consists of various age groups as their customers. This includes elderly individuals who find it difficult to use digital banking as opposed to the younger population.

Research Aim

This study aims to investigate the impacts of digital banking on elderly users at DBS Bank in Singapore.

Research Objectives

- To assess the extent of digital banking adoption among Singapore’s older population and identify variables impacting their adoption decision.

- To determine how older people in Singapore perceive digital banking services and the difficulties and hurdles they encounter while trying to utilize these services.

- To investigate the advantages and effects of digital banking on elderly consumers in terms of convenience and financial inclusion

- To provide suggestions for improving the digital banking experience for elders in Singapore, taking into account the issues and obstacles that have been found.

Research Questions

- What is the extent of digital banking adoption among Singapore’s older population, and what variables impact their adoption decision?

- How do the older people in Singapore perceive digital banking services and the difficulties and hurdles they encounter while trying to utilize these services?

- What are the advantages and effects of digital banking on elderly consumers in terms of convenience and financial inclusion?

- What are some suggestions for improving the digital banking experience for elders in Singapore, considering the issues and obstacles that have been found?

Problem Statement

Some seniors find it difficult to conduct digital banking transactions due to a lack of familiarity with technology or technical difficulties with online banking systems, in which case they would benefit from assistance from a third party. However, bank employees often need more time to provide this assistance. An additional barrier for the elderly is that most digital banking services are only available in English, so those who are illiterate or otherwise unfamiliar with the language may be hesitant to try them. As a result, some elderly people may be reluctant to embrace digital financial services, and some may even be afraid to try.

Research Methodology

In this investigation, a methodology for conducting quantitative research will be used. The primary focus of quantitative research techniques is collecting and examining data that has been arranged logically and can be expressed quantitatively (Goertzen, 2017). In preparation for the survey, a questionnaire that contains solely closed-ended questions will be compiled. After that, duplicates of this questionnaire will be distributed to the respondents who have been targeted; these respondents will be selected at random from among the staff members of DBS Bank in Singapore.

Sampling

A random sampling strategy will be used to get a sample of respondents from DBS Bank in Singapore representing the Bank’s customer base. A form of probability sampling known as random sampling is one in which the researcher randomly chooses individuals from a population to make up a sample of that population (Etikan & Bala, 2017). There is an equal possibility of selection for every member of the population. The research will take into account an aggregate sample size of sixty responses from a variety of respondents. A check will be run on the respondents who will be contacted to ensure that the data acquired are accurate and have the potential to provide the desired outcome.

Limitations

Every inquiry that is conducted to discover a solution has certain limitations that must be taken into account. In addition, there will not be an exception to this rule in this study. The researcher must work under certain budgetary limits during the study, and some human resources must be more cooperative. As a result of this, it will be much more challenging to get the most exact facts. The investigation will be limited to focusing only on the effect that digital banking has had on elderly customers at DBS Bank in Singapore. In addition, this study will be conducted in Singapore only rather than in any other place in the world.

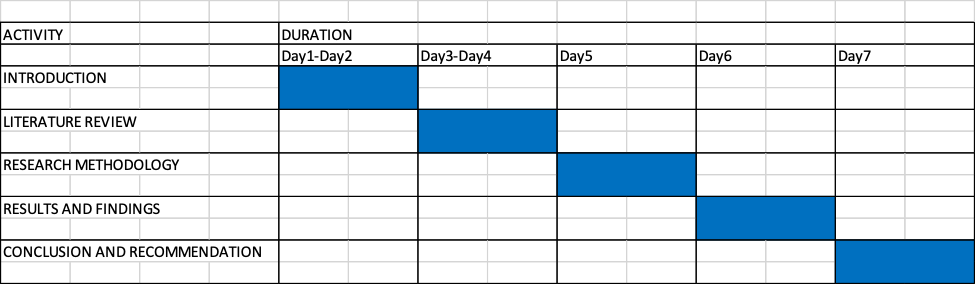

Research Plan

The research plan for this project will be as follows:

Research Ethics

The ethics form will be completed and sent to the institution’s responsible department. It will ensure that the study adheres to the guidelines established by the institution so as not to violate human rights. Some of these moral principles include:

- Every respondent will be handled with the utmost respect and politeness, and they will be given the greatest degree of consideration.

- Participation in the data collection process will be voluntary for all the respondents.

- The university’s committee will sort out the approval before the beginning of the data-gathering procedure.

References

Chang, Y. (2019). Green finance in Singapore: barriers and solutions. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3326287

DBS annual report 2019 (no date) DBS Bank: https://www.dbs.com/annualreports/2019/index.html?pid=sg-group-pweb-investors-cardtiles-pursuing-the-greater-good

Etikan, I. and Bala, K., 2017. Sampling and sampling methods. Biometrics & Biostatistics International Journal, 5(6), p.00149. https://www.academia.edu/download/76605654/BBIJ-05-00149.pdf

Goertzen, M.J., 2017. Introduction to quantitative research and data. Library Technology Reports, 53(4), pp.12-18. https://journals.ala.org/index.php/ltr/article/view/6325

write

write