Introduction

The banking industry is very important to the distribution of financial resources around the world. This is due to its role in intermediation, which entails transferring money from units with surpluses to those with deficits. However, Ali et al. (2011) noted that the business environment of the twenty-first century is more complex and multidimensional than ever. Most organisations must deal with uncertainty and hesitation in every aspect of their business operations. These are not different financial institutions, as Shetty and Yadav (2019) pointed out, as all banks face significant risks in the volatile and unpredictable current business environment. The effects of the risks that banks confront become apparent when we consider financial crises like the “Global Financial Crisis of 2008–2009”. The “Global Financial Crisis of 2008–2009” was a period in which the world experienced a severe financial crisis from 2008 to 2009 (Copestake, 2010). According to Loo (2023), the financial crisis had far-reaching effects on millions of people and institutions worldwide. Financial institutions began to fail at this time, bigger companies took over a number of them, and governments were compelled to provide bailouts to keep many of the institutions afloat. The crisis, which is commonly known as “The Great Recession,” did not occur suddenly (Grusky et al., 2011). The crisis resulted from a number of variables, many of which are still present today because of the many risks that banks confront. This essay examines the main risks that banks face as well as how banking regulation helps to advance financial stability.

Main Risks Faced By Banks

Financial risk in the banking industry is the potential of losing money on an investment or business venture.Malini (2021) noted that due to the size of some banks, excessive exposure to risks can result in the failure of banks and have an impact on millions of people. As such, banks and governments should enact stricter regulations to better understand the risks that banks confront and encourage careful management and decision-making. Bank’s capacity to manage risk also affects the investors’ decisions (Laeven and Levine, 2009). In essence,a bank’s earnings may decline as a result of insufficient risk control. It is, therefore, important to understand the main risks that banks face so that policymakers can devise the best strategies to deal with them. The main risks that banks face include “credit risk, interest risk, liquidity risk, price risk, foreign exchange risk and compliance risk” (Badawi, 2017).

Jones and Jones (2018) defined credit risks as the losses to capital or earnings that result from borrowers’ inability to fulfil their end of an agreement or from their failure to repay. Credit risk exists in any action where the outcome depends on the issuer, other party, or borrower’s conduct. Explicit or tacit binding agreements that extend, guarantee, invest, or expose bank money in any other way also result in credit risk. Additionally, a wide range of bank operations, such as choosing foreign exchange counterparties, derivatives trading partners, and investment portfolio products, come with credit risk. Another factor that might lead to credit risk is exposure to a country or sovereign, as well as indirectly from the performance of guarantors. Credit risk is a common threat to banks and is one of the commonly linked risks to banks’ profitability. For instance, Statista 2023 daily data showed that 2.0 percent of credit card borrowers in New York alone failed to repay their loans in the third quarter of 2023 (Richter, 2023).

Interest rate risk involves the threats that changes in interest rates pose to banks’ earnings (Dhanani et al., 2008). Feltham and Ohlson (1999) noted that interest rate risk results from variations in the timing of cash flows and rate changes, rate relationships that fluctuate across a range of maturities and among various yield curves that impact bank operations, and interest-related options that are incorporated into bank products. Interest rate risk is a common challenge facing banks especially in Europe. For instance, Bank of England (2023) report showed that many financial institutions’ balance sheets have been weakened by losses noted due to a rise in interest rates, and it is possible that some institutions are still vulnerable to damages due to derivatives of interest rate they hold or liquidity risk from increasing interest rates.

Liquidity risk is the threat a bank faces to its equity or revenues when it cannot make its financing obligations on schedule (Arif and Nauman Anees, 2012). One risk associated with liquidity is the incapacity to handle unforeseen reductions or adjustments to financial sources. According to Adalsteinsson (2014), the bank’s inability to identify and manage shifts in the market that impact its capacity to dispose assets promptly and with little value loss also contributes to liquidity risk. Similar to interest rate risk, liquidity risk is sometimes included in a larger market risk category by many banks. But in recent years, the nature of liquidity risk has evolved and includes many other factors that make liquidity risk even more common. A few examples of variables that exacerbate liquidity risk include more investment options for retail depositors, and a general rise in banks customers’ credit sensitivity. The collapse of Silicon Valley Bank, a once reputable bank in the USA, is an example of a bank that failed as a result of liquidity risk. the core cause of SVB’s downfall was the high rate in which startup clients withdrew deposits to keep their businesses afloat leaving SVB short of cash (Son et al., 2023). Son et al. (2023) noted that the bank suffered a $1.8 billion loss when it was obliged to liquidate every bond it had to avail cash to its clients.

According to Jensen (1969), price risk is the threat that fluctuating financial instrument portfolio values pose to income or capital. This risk results from the interest rate, foreign exchange, equities, and commodity markets, market-making, trading, and position-taking activities. Many institutions use price risk and market risk synonymously because price risk is centered on how shifts in market variables like market liquidity, interest rates and volatilities which affect the value of traded assets. The Bank of England is an example of a bank that suffered huge loses due to price risk. According to a 2023 Financial Times article, the Bank of England suffered larger losses from its quantitative easing programme than other central banks because it purchased longer-dated bonds than foreign counterparts that implemented QE programmes on a comparable scale following the 2008–09 financial crises (Strauss, 2023). The Bank of England’s strategy increased its exposure to price risk as the Monetary Policy Committee started raising interest rates significantly in an attempt to control inflation in 2021.

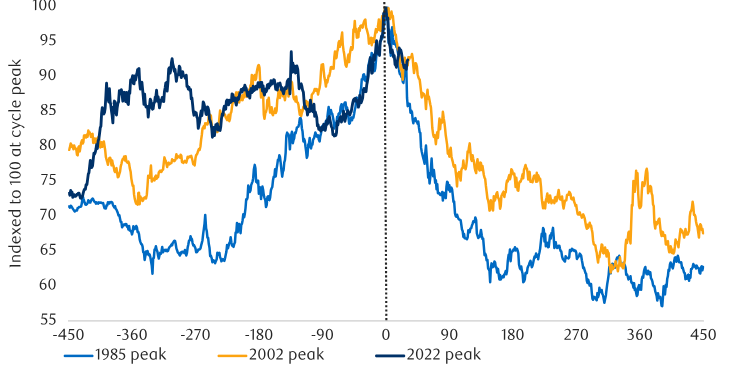

Foreign exchange risk is the threat that fluctuating exchange rates pose to bank’s capital or revenues (Homaifar, 2003). These risks are more common in cross-border operational and investment activities. Giddy and Dufey (1992) noted that the source of foreign exchange risk is the accrual accounts—loans, savings, and equity investments that are valued in foreign currencies. As per the accounting rules, these accounts must be revalued quarterly at current spot rates and these reevaluations cover the foreign-denominated balances into US dollars. Foreign Exchange risk is a serious problem in banking institutions, and many have lost millions due to volatile currencies that are easily impacted by foreign exchange rates, as shown in Figure 1. For instance, Standard Chartered Bank made $120 million in 2023 in Nigeria but lost the money later due to Naira value depreciation. According to Bloomberg news, Standard Chartered bank incurred losses amounting to millions in the year 2023 as the Naira value slumped by 49% against the US dollar (Changole and Wilson, 2024)

Figure 1: The Fluctuations of US Dollar

Source: RBC Global Asset Management (2023)

Compliance risks are threats to revenues arising from breaking regulations, laws, rules, recommended practices (Toma and Alexa, 2012). Terblanché (2013) pointed out that compliance risk often arise from unclear or untested laws or rules controlling specific bank products or customer behaviour. Compliance risk puts the organisation at danger of fines, civil money penalties, having contracts voided, and having to pay damages. Compliance risks can negatively impacts bank’s reputation, franchise value, business prospects, capacity for growth, and enforceability of contracts. However, compliance risk is frequently disregarded because it melts into operational risk and transaction processing. Nevertheless, compliance risk is a significant threat to banks profitability particularly through heft fines it attracts. For instance, “HSBC Bank plc (HBEU)” and “HSBC UK Bank plc (HBUK)” were fined £57,417,500 by the Prudential Regulations Authority for historical depositor protection violations resulting from the Firms’ repeated failures to correctly carry with the guidelines provided in the Depositor Protection Rules between 2015 and 2022 (Bank of England, 2024).

The Different Types of Climate Risk and Its Potential Impact on Financial Stability

Climate Risk

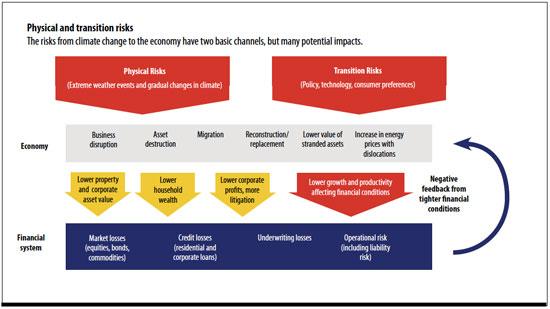

Climate risks are financial risks resulting from the natural disasters influenced by climate change and can have an influence on banks’ safety and solidity (Kress, J.C., 2022). These risks have an impact on many economic sectors and could compromise appropriate customer treatment and access to financial services. According to Boros (2020), climate change has emerged as one of the largest rising risks that bank institutions face as the world works to create a lower-carbon economy, and extreme weather continuing to impact every continent in the world. The two main categories of climate-related risks, as identified by the US Environmental Protection Agency, are transition risk and physical risk (Environmental Protection Agency, 2024).

Figure 2: The two Types of Climate Risks

Source: International Monetary Fund (2019)

Transition Risks

Transition risks are financial threats related to banks’ ability to control and adjust to the internal and external speed of change (Carattini et al., 2023). Transitioning necessitates changes in market dynamics, technology, legislation, and policy in order to satisfy the needs for mitigation and adaptation associated to external factors such the climate change (Environmental Protection Agency, 2024). Risks associated with policy and legal transitions include rising greenhouse gas emission prices and increased requirements for reporting emissions mandates, regulations, and legal risk for already-existing goods and services. Risks associated with technological transition include costs related with making the switch to lower emission technologies, unsuccessful investments in new technologies, and replacing current goods and services with alternatives with lower emissions. Risks associated with a market transition include shifting consumer behaviour and erratic market signals.

Physical Risks

Physical risks are the financial threats climate change impacts pose to the banks. These risks are linked to both short-term and long-term changes in climatic patterns. According to Caselli and Figueira (2020), changes in market, policy, and technology are also necessary to mitigate physical risks. Short-term physical risks are event-driven and are those triggered by specific occurrences, such as stronger extreme weather events like hurricanes, cyclones, heat waves, or floods. Longer-term physical threats are those associated with longer-term changes in climate patterns, such as persistently high temperatures, rising sea levels, altered precipitation patterns, and the potential to bring on frequent heat waves or sea level rise.

Financial Stability

Financial stability is a financial condition in which the financial systems as a whole operate optimally without any failure (World Bank Group, 2016). Therefore, the ability of financial systems to withstand stress is what defines financial stability. Houben et al. (2004) noted that signs of a stable financial system include an efficient use of resources, risk assessment and management, job growth rates that are in line with the normal pace of the economy, and the removal of fluctuations in the relative prices of real or financial assets that could compromise the stability of the currency or labour levels. According to Yue et al. (2022) and Ahmad (2018), in a stable state, the system largely uses self-corrective mechanisms to absorb shocks, avoiding unfavourable occurrences from upsetting other financial systems or the actual economy. Financial stability is necessary for the growth of the economy considering that the financial system supports most transactions in the economy. However, the stability is impacted by the climate risk in several fronts.

Impacts of Climate Risks on Financial Stability

There are three possible ways in which climate-related risk may affect financial stability. Firstly, physical risks like cyclones and excessive rainfall, water-related occurrences like floods, and other climatological phenomena like extreme temperatures, drought, and wildfire reduce the value of financial assets. Moreover, Zhou et al. (2023) noted that risks associated with climate change and natural catastrophes typically reduce insurer earnings and the capacity for sharing risks, stability of banks and credit availability, stock and bond price appreciation and stability, foreign direct investment inflows, and foreign borrowing. Physical risk also has a detrimental impact on GDP growth. Alogoskoufis et al. (2021), for example, noted that the total economic losses resulting from extreme events in the euro area in 2019 amounted to 1% of GDP.

Second, Campiglio and van der Ploeg (2022) noted that transition risks mayinduce a change in asset values in the context of a low-carbon economy.Transition risks may arise in a regulatory framework that mandates increased financial asset transparency and imposes new duties to transition to a lower-carbon economy. Even though these adjustments are good, they may have an effect on the asset prices of major economic sectors like coal, oil, and gas, as well as businesses that build automobiles, ships, and aeroplanes. Investors’ opinions of these assets’ profitability and long-term viability could shift. A classic fire sale could occur if the adjustments are sudden, which could lead to a financial crisis.

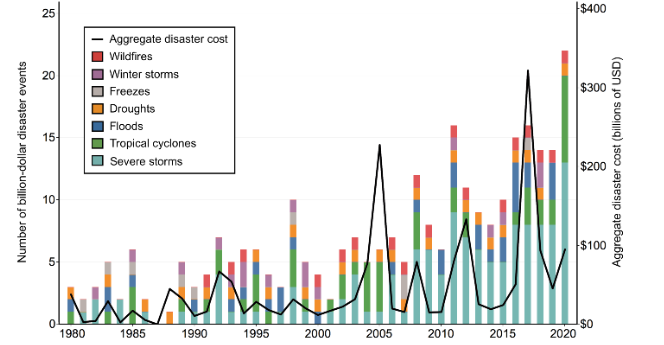

Lastly, the increasing compensation paid to economic actors impacted by climate change can raise liability concerns associated with climate change (Caselli and Figueira, 2020). The amount of insured and uninsured losses due to climate-related risk is increasing, amounting to billions, as shown in Figure 3. For example, the Prudential Regulation Authority (2015) stated that Lloyd’s of London calculated that the surge losses from Superstorm Sandy (2012) in New Yorkincreased by thirty percent as a result of the sea level rise of 20 cm during the 1950s.. These losses have an effect on the insurer’s financial standing as well as the stock value of companies that are vulnerable to similar weather-related incidents.

Figure 3: The Financial Loses due to Climatic Risks

Source: Hale (2022).

The Rationale of Banking Regulation

Banking Regulations

Bank regulation is the practice of creating and enforcing rules for banking and other financial institutions (Alexander, 2004). Previous financial crises have demonstrated how important it is to have sensible and efficient bank regulation systems in place in order to protect and sustain a robust financial system. Bank stability and soundness are essential to averting financial crises, as they play a big part in the economy. This is because banks are now more exposed to risk due to advances in banking operations and changes in the market. The collapse of one bank could have a substantial effect on other banks as well as the financial system overall because of the contagion effect. Accordingly, Tshikovhele (2018) pointed out that stronger and more efficient banking regulation is necessary to protect the financial sector.

Importance of Banking Regulations in Financial Stability

According to Heimler, A. (2006), the main rationale for banking regulation is to overcome the risks associated with the security and stability of financial institutions, the financial industry at large, and the systems of payments. For example, insurance programmes are implemented in order to prevent bank runs and mandatory deposit. Other regulations include requirements for capital adequacy to protect banks against excessive risk exposure. Other noteworthy regulatory limitations that define banks include limits on market access, interest rate and credit volume restrictions, and, in certain situations, controls over the distribution of financing among alternative borrowers (Hayes and Pacces, 2012). These regulatory limitations fulfilled several policy goals. For instance, China employed direct controls to provide funding to favoured industries in order to support national champion policies (Thun, 2004); limitations on market access and competition which were partially driven by worries about the stability of the financial system which often resulted in credit rationing.

Regulation of banks contributes to financial stability by strengthening the system’s resilience (Tarullo, 2019). According to Otto Syk (2021), there are numerous imbalances and hazards facing the banking industry as a result of excessive debt levels, shifting dynamics within the financial system, the growing threat of cyberattacks, and geopolitical tensions. Since banks are unable to predict when or if these or other dangers would materialise, it is in their best interests as a group to enact regulatory changes that will secure the advantages of increased financial system resilience. This is particularly true since it’s possible that the public sector might not have the resources, financial and otherwise, or the political will to react to a future crisis with the same vigour and determination that it did during the Great Financial Crisis.

Conclusion

The banking industry is essential to the growth of the economy, and understanding the main risk they face is important in ensuring that the sector remains stable. This essay explored the main risk that banks faces including the climate-related risks and their impacts on financial stability. The main risks that banks faces include “credit risk, interest risk, liquidity risk, price risk, Foreign Exchange risk and Compliance risk”. These risks pose danger to the sustainability of the banks as they have the potential to significantly reduce the profitability of the banks and eventually hampering the normal operations of the banks and the economy. The main climate related risk includes the physical risk and transition risk. Physical risks are risk that arises from natural calamities such as floods and tsunamis. These events affect the economic activities that eventually affect banks. Transition risks are those related to how quickly and how thoroughly an organisation handles and adjusts to the rate of change both within and outside. These changes, such as the need to take part in reducing carbon emissions, forces banks to incur more costs, further reducing their profit margins. In the wake of the many risks that banks face, financial regulations serve as the main tool to help mitigate the impact of these risks. Banking regulations address worries about the security and stability of banking organisations, the payments system, and the financial industry as a whole.

References

Adalsteinsson, G. (2014). The liquidity risk management guide: From policy to pitfalls. John Wiley & Sons.

Ahmad, D. (2018). Financial inclusion and financial stability: Survey of the Nigeria’s financial system. International Journal of Research in Finance and Management, 1(2), pp.47-54.

Alexander, K. (2004). Corporate governance and banking regulation.

Ali, K., Akhtar, M.F. and Sadaqat, S. (2011). Financial and non-financial business risk perspectives–empirical evidence from commercial banks. Middle Eastern Finance and Economics, 11(11), pp.150-160.

Alogoskoufis, S. et al. (2021). Climate-related risks to financial stability, European Central Bank. Available at: https://www.ecb.europa.eu/pub/financial-stability/fsr/special/html/ecb.fsrart202105_02~d05518fc6b.en.html# (Accessed: 20 March 2024).

Arif, A. and Nauman Anees, A. (2012). Liquidity risk and performance of banking system. Journal of Financial Regulation and Compliance, 20(2), pp.182-195.

Badawi, A. (2017). Effect of credit risk, liquidity risk, and market risk banking to profitability bank (study on devised banks in Indonesia stock exchange). European Journal of Business and Management, 9(29), pp.1-8.

Bank of England (2023). Financial stability in focus: Interest rate risk in the economy and Financial System, Bank of England. Available at: https://www.bankofengland.co.uk/financial-stability-in-focus/2023/july-2023 (Accessed: 20 March 2024).

Bank of England (2024). The Prudential Regulation Authority (PRA) fines HSBC £57,417,500 for failures in Deposit Protection Identification and notification, Bank of England. Available at: https://www.bankofengland.co.uk/news/2024/january/pra-fines-hsbc-for-failures-in-deposit-protection-identification-and-notifcation# (Accessed: 20 March 2024).

Boros, E. (2020). Risks of climate change and credit institution stress tests. Financial and Economic Review, 19(4), pp.107-131.

Campiglio, E. and van der Ploeg, F. (2022). Macrofinancial risks of the transition to a low-carbon economy. Review of Environmental Economics and Policy, 16(2), pp.173-195.

Carattini, S., Heutel, G. and Melkadze, G. (2023). Climate policy, financial frictions, and transition risk. Review of Economic Dynamics, 51, pp.778-794.

Caselli, G. and Figueira, C. (2020). The impact of climate risks on the insurance and banking industries. Sustainability and financial risks: The impact of climate change, environmental degradation and social inequality on financial markets, pp.31-62.

Caselli, G. and Figueira, C. (2020). The impact of climate risks on the insurance and banking industries. Sustainability and financial risks: The impact of climate change, environmental degradation and social inequality on financial markets, pp.31-62.

Changole, A. and Wilson, H. (2024). Nigerian naira (NGN) volatility has stanchart gain, lose Millions, Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2024-02-27/nigerian-naira-s-wild-ride-saw-stanchart-gain-and-lose-millions (Accessed: 20 March 2024).

Copestake, J. (2010). The global financial crisis of 2008–2009: an opportunity for development studies?. Journal of International Development, 22(6), pp.699-713.

Dhanani, A., Fifield, S., Helliar, C. and Stevenson, L. (2008). The management of interest rate risk: evidence from UK companies. Journal of Applied Accounting Research, 9(1), pp.52-70.

Environmental Protection Agency (2024). Climate Risks and Opportunities Defined, EPA. Available at: https://www.epa.gov/climateleadership/climate-risks-and-opportunities-defined (Accessed: 20 March 2024).

Feltham, G.A. and Ohlson, J.A. (1999). Residual earnings valuation with risk and stochastic interest rates. The Accounting Review, 74(2), pp.165-183.

Giddy, I.H. and Dufey, G. (1992). The management of foreign exchange risk. The Handbook of International Accounting, Wiley. J & Sons.

Grusky, D.B., Western, B. and Wimer, C. eds. (2011). The Great Recession. Russell Sage Foundation.

Hale, G. (2022). What are the financial risks from climate change?, Econofact. Available at: https://econofact.org/what-are-the-financial-risks-from-climate-change (Accessed: 21 March 2024).

Heimler, A. (2006). COMPETITION POLICY, ANTITRUST ENFORCEMENT AND BANKING: SOME RECENT DEVELOPMENTS , oecd. Available at: https://www.oecd.org/daf/competition/prosecutionandlawenforcement/38821319.pdf (Accessed: 21 March 2024).

Homaifar, G.A. (2003). Managing global financial and foreign exchange rate risk (Vol. 159). John Wiley & Sons.

Houben, A.C., Kakes, J., Schinasi, G.J. and International Monetary Fund (2004). Toward a framework for safeguarding financial stability (Vol. 4). Washington, DC: International Monetary Fund.

International Monetary Fund (2019). Climate change, central banks and financial risk – IMF F&D: December 2019, IMF. Available at: https://www.imf.org/en/Publications/fandd/issues/2019/12/climate-change-central-banks-and-financial-risk-grippa (Accessed: 21 March 2024).

Jensen, M.C. (1969). Risk, the pricing of capital assets, and the evaluation of investment portfolios. The Journal of Business, 42(2), pp.167-247.

Jones, S.A. and Jones, S.A. (2018). Credit Risk. Trade and Receivables Finance: A Practical Guide to Risk Evaluation and Structuring, pp.87-98.

Kress, J.C. (2022). Banking’s climate conundrum. American Business Law Journal, 59(4), pp.679-724.

Laeven, L. and Levine, R. (2009). Bank governance, regulation and risk-taking. Journal of financial economics, 93(2), pp.259-275.

Loo, A. (2023). 2008-2009 global financial crisis, Corporate Finance Institute. Available at: https://corporatefinanceinstitute.com/resources/economics/2008-2009-global-financial-crisis/ (Accessed: 20 March 2024).

Malini, H. (2021). Transparency and accountability contribution toward sustainability of banking sector in Indonesia. Business Innovation and Entrepreneurship Journal, 3(4), pp.275-282.

Otto Syk, M. (2021). Geopolitics of Finance; Modelling the role of states in the international financial system.

Pacces, A.M. and Heremans, D. (2012). Regulation of banking and financial markets. Encyclopedia of Law and Economics: Regulation and Economics, 2nd Edition, AM Pacces and RJ Van den Bergh, eds., Elgar.

Prudential Regulation Authority (2015). The impact of climate change on the UK insurance sector. A climate change adaptation report.

RBC Global Asset Management (2023). Global currency outlook – summer 2023, RBC Global Asset Management. Available at: https://www.rbcgam.com/en/ca/article/global-investment-outlook-summer-2023-global-currency-outlook/detail (Accessed: 21 March 2024).

Richter, F. (2023). Infographic: Credit card delinquencies return to pre-pandemic levels, Statista Daily Data. Available at: https://www.statista.com/chart/31233/credit-card-delinquencies-in-the-united-states/ (Accessed: 20 March 2024).

Shetty, C. and Yadav, A.S. (2019). Impact of financial risks on the profitability of commercial banks in India. management, 7, p.550.

Son, H., Goswami, R. and Vanian, J. (2023). Here’s how the second-biggest bank collapse in U.S. history happened in just 48 Hours, CNBC. Available at: https://www.cnbc.com/2023/03/10/silicon-valley-bank-collapse-how-it-happened.html (Accessed: 20 March 2024).

Strauss , D. (2023). Bank of England losses on QE greater than other central banks, says ex-rate setter. Available at: https://www.ft.com/content/a411ebdf-1086-4537-af15-c6c5878353aa (Accessed: 20 March 2024).

Tarullo, D.K. (2019). Financial regulation: Still unsettled a decade after the crisis. Journal of Economic Perspectives, 33(1), pp.61-80.

Terblanché, J.R. (2013). Legal risk and compliance risk in the banking industry in South Africa (Doctoral dissertation, North-West University).

Thun, E. (2004). Industrial policy, Chinese-style: FDI, regulation, and dreams of national champions in the auto sector. Journal of East Asian Studies, 4(3), pp.453-489.

Toma, S.V. and Alexa, I.V. (2012). Different Categories of Business Risk. Annals of the University Dunarea de Jos of Galati: Fascicle: I, Economics & Applied Informatics, 18(2).

Tshikovhele, M. (2018). The Role of Prudential Regulation of Banks in Promoting Financial Stability. University of Pretoria (South Africa).

World Bank Group (2016). Financial stability, World Bank. Available at: https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-stability (Accessed: 20 March 2024).

Yue, H., Nordin, N.H. and Nordin, N.N. (2022). Overview the Impact of China’s Financial Stability on China’s Macroeconomy in the Post-Epidemic Era. POSTGRADUATE COLLOQIUM PROCEEDING 2022, p.49.

Zhou, F., Endendijk, T. and Botzen, W.W. (2023). A review of the financial sector impacts of risks associated with climate change. Annual Review of Resource Economics, 15, pp.233-256.

write

write