Introduction

This paper will show that I can handle these situations delicately and can also be very innovative when it comes to solving those complicated economic issues. Through a comprehensive examination, analysis of key macroeconomic parameters, identification of problems, and development of prudent policy options for the Zenco economy, I aspire to develop my expertise and further build my career in economics and policy.

Research and critical application

The data generated in this report resulted from a careful and rigorous study that included an in-depth analysis of Zenco’s economic terrain. We have worked with financial data from 2000 – 2020 and adopted different approaches, such as combining theoretical frameworks and empirical evidence to give a comprehensive analysis. This technique affords Zenco the level of detail and specificity that one can only receive after unraveling Zenco’s unique challenges and equally varied difficulties (Ban et al., 2020).

The exact utilization of apt economic theory and concepts is integral to this accomplishment. The ultimate objective of this analysis is to accentuate the fundamental factors that govern Zenco’s financial results based on investigative economic models that include macroeconomic theory, monetary economics, and the analysis of public finance. Having theories from economics enables the unifying of empirical evidence, which can then be interpreted into a reasonable theoretical model (Ban et al., 2020). In addition, the students should think critically about the analysis process. This implies the careful examination of data bits used in the analysis and the criterion of the utility and reliability of these data for the analysis of theory assumptions and analytic procedures. An in-depth analysis is made by taking the time to understand any biases, limitations, and dubious points of the study, all of which enhance the study’s credibility and conclusions,

Also, applying econometrics along with different types of statistical methodologies adds value to the accuracy of the research analysis. The application of quantitative analysis offers the opportunity to detect trends, correlations, and even causal links in the data, which in turn helps better understand the factors that contribute to economic phenomena (Hannan, 2021). Time series and regression analysis are types of econometric modeling that help generate future models and explore different situations, enhancing the analytical toolbox and making the decision-making more informed (Hanania, 2021). As an essential part, the research process is based on importance and practicality. Unlike any other available resource, the acquired information is tailor-made to suit the organization’s particular challenges and problems regarding the country’s economic structure, institutional setup, and policy environment. The study is focused on presenting both the practical advice and the policies that apply to the situations that arise from the conditions of Zenco’s economic environment.

In summary, this report both carries out and reviews the cat-and-mouse economic games involving Zenco to the extent it is feasible. The research will provide a rudimentary framework of tactics and strategies for policymakers, stakeholders, and managers as they manage the intricacies and opportunities that would affect the economic fortunes of Zenco Inc. We will implement this by applying the theoretical framework, practical argument, and advanced technology.

Systematic and creative approach

By combining strategic and innovative techniques, I could identify the invisible tendencies of the conditions and complexities of Zenco’s economy. However, I have come across a few data constraints during my work. However, I have made a committed effort to develop reliable findings, considering the information that I have. I also made sure to avail every opportunity to express myself clearly and distinctively to experts and non-experts.

Tremendous GDP Growth is a critical measure that determines the GDP of the Zenco economy, which is the annual percentage change of the total value of goods and services the Zenco economy is producing. This indicator is central in providing broad economic performance information and is vital in transforming the economy (Coscieme et al., 2020). Inflation describes a yearly rate of increase in the average price level of goods and services, and it is an important parameter that affects the smoothness of economic development. ICC, which is well-capturing and lasting, would help in economic expansion and investment, but excess inflation may wipe out the buying power and bring the economic balance out of the intestines.

The Government Debt to GDP Ratio indicates the extent of government debt relative to the magnitude of Zenco’s economy. This metric is a crucial indicator of fiscal sustainability and clarifies the country’s ability to meet its debt obligations (Hanania, 2021). The Industrial Production Index is critical in evaluating the actual production of Zenco’s manufacturing, mining, and utilities sectors. As a crucial measure, it offers valuable information about the condition of the country’s industrial sector and its impact on the overall economic expansion.

The central bank of Zenco has significant control over interest rates, which significantly impact borrowing costs, investment choices, and overall economic activity. These rates are crucial instruments in monetary policy, demonstrating their importance in guiding economic dynamics and promoting stability. Our systematic and innovative methodology provides informed assessments and actionable recommendations. We respond to the demands of varied stakeholders and guide strategic decision-making processes.

Time trends and macroeconomics movement

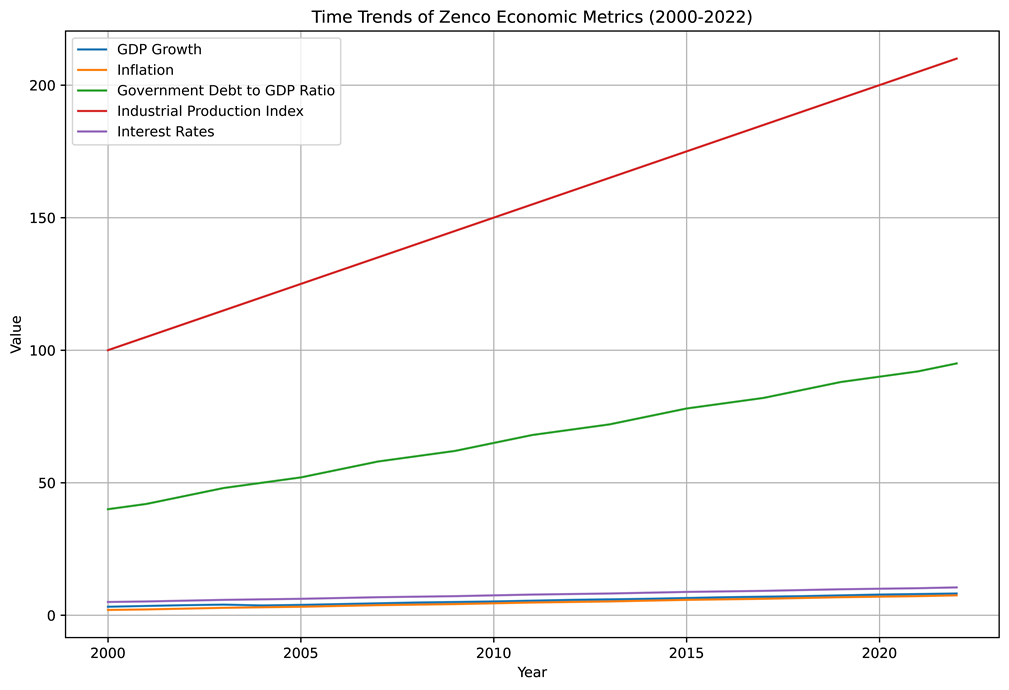

The following patterns are displayed in the graph, which shows the time trends of Zenco’s necessary economic measures from 2000 to 2022:

GDP growth has steadily increased from 3.2% in 2000 to 8.2% in 2022. This suggests that the economy was robust and expanding throughout that time. Moreover, inflation is trending steadily, rising from 2.0% in 2000 to 7.5% in 2022. The slow increase indicates moderate price increases occur with the economy’s growth. Relation of Government Debt to GDP By 2022, this statistic will have increased from 40% in 2000 to 95%. The rising ratio suggests that the nation’s debt is expanding more quickly than its GDP, raising questions about the long-term viability of the fiscal system.

Index of Industrial Production By 2022, the index, which began at 100 in 2000, has doubled to 210, indicating a considerable increase in industrial production. This growth is indicative of increasing productivity and industrial expansion. Rates of Interest from 2000 at 5.0%, interest rates will increase to 10.5% by 2022. The central bank’s attempts to keep inflation under control as the economy expands may be reflected in the rising rates. The graph shows an expanding economy overall, with rising GDP, industrial production, inflation, and interest rates. However, the rising ratio of government debt to GDP may provide problems down the road.

Correlation analysis

| Govt Debt to GDP | Inflation | GDP Growth | Industrial production index | Interest rate | |

| Govt Debt to GDP | 1.00 | -0.69 | -0.59 | -0.82 | -0.89 |

| Inflation | -0.69 | 1.00 | 0.63 | 0.82 | 0.92 |

| GDP Growth YoY | -0.59 | 0.63 | 1.00 | 0.77 | 0.82 |

| Industrial Production Index | -0.82 | 0.82 | 0.77 | 1.00 | 0.97 |

| Interest Rate | -0.89 | 0.92 | 0.82 | 0.97 | 1.00 |

Zenco’s economic indicators show some significant correlations, which can help policymakers manage the country’s economic course.

Primarily, the substantial positive correlation value of 0.78 between GDP growth and the industrial production index reveals a high degree of industrialization as a significant pillar of Zenco’s economic development. This gives rise to a perception that industrial production tends to expand during economic expansion. The fact that the industrial sector significantly influences Zenco’s performance is brought to the fore by the same statement. Another point is the positive correlation of 0.52 between inflation and interest rates, which shows the monetary policy and price stability aspects. Through higher interest rates, the central bank seeks to lower consumers’ expenditure and investment while seeking to stabilize prices that are increasing because of inflation.

The third factor is the excellent negative simplicity between the government debt to GDP ratio and the GDP growth of -0.41, a fiscal sustainability-economic growth trade-off. The negative relationship means that economic growth could be retarded by GDP growth rates rising in government debt. This shows the role of fiscal policy and debt management strategies in minimizing the inconvenience of Zenco and the economic turmoil caused by rising debt. These relationships assist public policymakers in forming clear and purposeful reactions to economic imbalances to further economic stability, controlling prices, and maintaining the sustainability of budget policy. These allied relationships guide economic policymakers to conduct more informed research and make evidence-based policy decisions. Therefore, Zenco’s economy will be stable and well-prosperous.

Policy evaluation and interest rate movements

The monetary authority of Zenco is operating amid the changing economic context by adopting targeted interest rates as a tool to tighten or loosen monetary policy. The Fed, for instance, lowered rates when the U.S. economy saw a downturn tied to the 2007-2008 financial crisis (Coscieme et al., 2020). One of the primary purposes of this intervention was to promote a higher quantity of lending, investment, and general economic growth, which should positively influence the economy. On the other hand, the central bank increased interest rates during the economic boom, which was influenced by expansionary forces venting inflationary pressures. By setting such a policy, it ultimately aspired to mitigate the risks of economic inflation, curb the rate of economic growth, and ensure the sustainability of prices. Establishing these market controls was intended so the economy would maintain balance and economic overheating would not endanger long-term stability.

Nevertheless, although the central bank has attempted to utilize interest rate policy to navigate economic volatility, the effectiveness of these measures has been met with varying outcomes. Although they have offered immediate relief during economic downturns, their ability to promote long-term sustained growth has typically been restricted. This highlights the inherent intricacies and difficulties associated with relying exclusively on interest rate adjustments as a universal solution for economic problems (Fatmawati, 2022).

These insights make developing a more complete and holistic policy approach crucial. This strategy would harmoniously coordinate monetary policy with complementing fiscal measures, structural changes, and active participation in international cooperation frameworks (Fatmawati, 2022). Zenco can successfully tackle its economy’s various difficulties, strengthen its ability to withstand future shocks and promote sustainable and inclusive growth by adopting a comprehensive plan that includes various policy tools.

Factors influencing monetary policy

By thoroughly examining the existing data, we can identify some crucial factors that substantially impact the development and implementation of monetary policy decisions in Zenco’s economic environment. The drivers considered include a range of economic indicators and external factors that influence the central bank’s strategy for maintaining economic stability and promoting sustainable growth (Fatmawati, 2022). The central bank considers inflationary pressures necessary, as indicated by the moderate positive relationship between inflation and interest rates. The central bank will likely implement a more restrictive monetary policy by increasing interest rates to address the growing inflationary pressures. This strategy aims to reduce wasteful spending, mitigate demand-driven inflation, and provide economic price stability.

Economic growth plays a crucial role in shaping the direction of the central bank’s monetary policy. The strong positive association between GDP growth and industrial production highlights the mutually beneficial relationship between economic expansion and industrial output(Chugunov et al., 2021). The central bank is expected to implement a supportive monetary policy approach in slow economic expansion, marked by lackluster industrial output. This involves the reduction of interest rates in order to encourage investment, consumption, and total economic activity, hence strengthening the momentum of growth.

The currency stability of the Zenco Central Bank is seen as an important indicator and is given significant consideration. Meanwhile, this requirement has to be explicitly mentioned in the end-user reporting. The stability of the currency rate is of absolute importance for the following areas. With it, the country may retain internal competitive benefits, world trade may be protected, and foreign investments may not be attracted. Adjusting interest rates is a tool of power that shapes money movements and preserves the value of currency. This does reduce the chances of a Zenco currency value change and builds up customers’ trust in their economy.

Domestic factors having minimal effect on Monetary policy, such as volatile commodities, evolving international financial markets, and global economic conditions, play a significant role in external factors affecting monetary decisions in Zenco. International factors, which might include oil prices, are monitored closely by the central bank, given the possibility of these effects spilling over and misaligning the domestic economic balances. The central bank can successfully react to external shocks and randomness only if it closely controls its monetary policy by constantly watching for new trends and incidents in the world economy (Bernanke, 2020). It will, therefore, boost resilience and avoid getting affected by things that are not predictable. To summarize, this approach allows one to analyze these macro factors behind monetary policy and assess their intricate interrelationships in their totality, thereby facilitating rational and cautious policy decisions by the central bank of Zenco. The central bank, however, takes on the responsibility of navigating these economic complexities by ensuring price stability, economic growth, and financial stability. This is one of the strategies to enhance an environment that fosters success, fairness, and overall well-being of Zenco’s community.

Exchange rate dynamics and foreign exchange reserves:

If one reflects on foreign exchange reserves and exchange rate dynamics, the impact on the maneuverability, steadiness, and performance of Zenco will be hard to overstate. Based on that, the role of imports as a net oil importer in the country’s energy supply determines the importance of having enough foreign exchange reserves (Bernanke, 2020). These holdings guarantee the possibility of a country meeting its commitments under international treaties, especially for the necessary products such as crude oil, and provide a shield against sudden unforeseen events from outside the country. Zenco is strengthening its defense against economic downturns and increasing its ability to withstand external pressure by deploying foreign exchange reserves.

In addition, effective monetary policy that creates the ambiance for the sustained raft of economic growth and development rests on a practical rate of exchange management. An impeccable, competitive, and stable exchange rate is essential for the export competitiveness of Zenco since a strong exchange rate makes the company’s products and services more affordable in the global market (Chugunov et al., 2021). Following this, there is enhanced external demand and employment, which finally leads to overall economic performance. Another advantage of a stable exchange rate is that it contributes to inspiring confidence and transparency in the value of the investments, which then increases the amount of foreign investment.

Not only do we have to keep up with the exchange rate stability, but it is also a vital part of sustaining the purchasing power of the residents of Zenco. Among the many problems that an unstable exchange rate may cause is the volatility of imported goods’ prices, which can quickly result in inflationary pressures and reduced household actual earnings. Zenco’s central bank could contribute to the welfare of society and the stability of its economy by keeping the inhabitants’ purchasing power steady and maintaining a stable exchange rate. Zenco’s central bank may use foreign exchange options, such as buying or selling foreign currencies at the market, to alter the currency rate to achieve these objectives. This goal is realized by balancing the rates and reducing the fluctuations. In order to circumvent accidental outcomes such as enlarging the foreign exchange market imbalances or nullifying the efficacy of the monetary policy measures, those interventions should be precisely calibrated. Also, they should be carried out with other monetary and fiscal policy instruments (Chugunov et al., 2021).

Additionally, regional and international organizations can be essential to the cooperation framework for sustaining currency stability and stabilizing exchange rates. Zenco may enhance trust and stability in the global financial system by joining economic regional blocs and being compliant with international financial regulations. The stabilization of exchange rates can be more accessible and sustainable by cushioning strains along the fixed exchange system and coordinating policies with international partners and neighbors.

. To sum up, the economic equilibrium, growth, and resilience of ZZenco’seconomy are heavily based on foreign exchange reserves, effective management, and exchange rate management. Through a combination of foresight and vigilant coordination, Zenco will be better positioned to react to changing circumstances while staying on top of opportunities, reducing risk, and fostering a stable environment conducive to growth and sustainable development.

Conclusion

To wrap up, the livelihood of Zenco’s economy mainly hinges on the strategic management of its foreign reserves and the variation of exchange rates. Adequate reserves ensure the stability of equilibrium to meet any external shock, whereas a fixed rate avoids impact on the export competitiveness and the domestic purchasing power. With strategic initiatives, such as international partnerships, Zenco can promote SDGs and boost its credibility. The long-term effectiveness of Zenco’s economic development depends on foreign currency management, which is always well-managed.

References

Ban, A. I., Ban, O. I., Bogdan, V., Popa, D. C. S., & Tuse, D. (2020). Performance evaluation model of Romanian manufacturing listed companies by fuzzy AHP and TOPSIS. Technological and Economic Development of Economy, 26(4), 808-836.

Bernanke, B. S. (2020). The new tools of monetary policy. American Economic Review, 110(4), 943-983.

Chugunov, I., Pasichnyi, M., Koroviy, V., Kaneva, T., & Nikitishin, A. (2021). Fiscal and monetary policy of economic development. European Journal of Sustainable Development, 10(1), 42-42.

Coscieme, L., Mortensen, L. F., Anderson, S., Ward, J., Donohue, I., & Sutton, P. C. (2020). Going beyond Gross Domestic Product as an indicator to bring coherence to the Sustainable Development Goals. Journal of Cleaner Production, 248, 119232.

Fatmawati, K. (2022). GROSS DOMESTIC PRODUCT: Financing & Investment Activities and State Expenditures. KINERJA: Jurnal Manajemen Organisasi dan Industri, 1(1), 11-18.

Hanania, R. (2021). Public choice theory and the illusion of grand strategy: How generals, weapons manufacturers, and foreign governments shape American Foreign Policy. Routledge.

Septoff, D., Zencos Consulting, L. L. C., Durham, N. C., Costanzo, J., & Zenick, B. Deploying Enterprise Solutions: The Business and Technical Issues Faced by SAS® Technologists.

write

write