While tobacco products are on the one hand, society is broken on the other, as evidenced by the article “Economists, health experts push for a steep increase in tobacco taxes.” This article will look at price elasticity for smokers and how pricing influences consumer behavior and rationality. In microeconomics, price elasticity of demand refers to how customers react to price increases or decreases (Marquez, 2020). Price fluctuations produce the biggest purchasing and selling volatility. The tobacco business stands out because the price elasticity of demand, which assesses consumer responses to tax policy, is critical to the state. My issue is how taxes affect population spending, as described in the essay. I would incorporate the own-price elasticity demand theory in this debate.

Choice: Demand Price Elasticity.

Price elasticity of demand measures demand for goods as prices fall (Almeida, 2021). High price elasticity suggests that a little price change results in a large proportion of quantity required relative to steady demand, whereas price elastically inelastic means that an extremely large price shift has the same effect on demand. When it comes to revenue, the price elasticity of demand illustrates how sensitive customers are to tax increases.

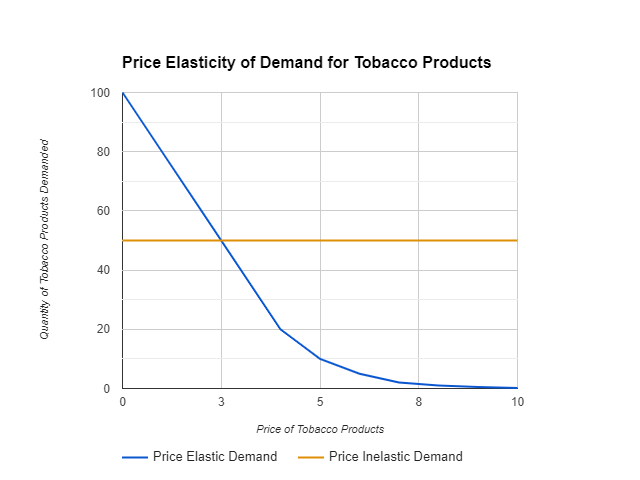

Graph 1 shows that the elasticity of tobacco expenditure is twice as high.

The x-axis shows the volume of tobacco goods purchased, while the y-axis shows the price. The Tobacco Supply Curve graph illustrates how product demand varies with price (x-axis).

Analysis of Graph 1

Tobacco demand is thought to be price elastic when the demand and supply lines intersect at a 45-degree angle. It means that consumers calculate prices when purchasing and frequently consider price changes when making judgments. A flat demand curve resulting from cigarette pricing inelasticity also exhibits an inverse reaction (DeCicca, 2022). As a result, lowering tobacco costs reduces user sensitivity to the shift.

Economists and health officials monitor tax advocates to prevent this tendency from spreading. It’s worth noting that the state’s policy is to raise tobacco taxes to cover external deficits. More taxes result in a limited response, according to the price elasticity of demand theory, because consumers are more sensitive to price rises than usual.

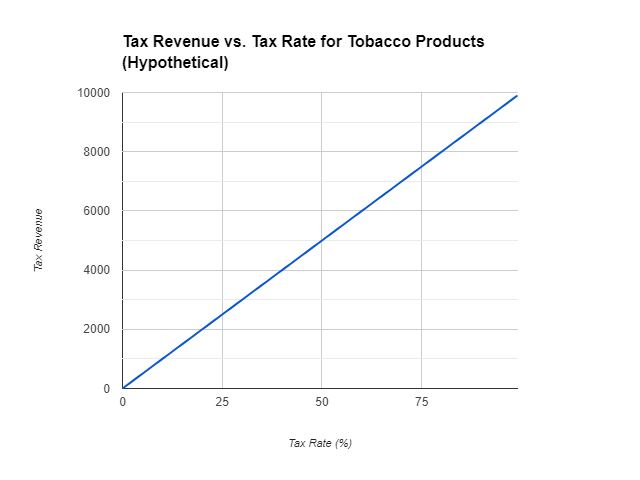

Additional graph: Tobacco tax revenue vs. rate

On the one hand, there is government revenue; on the other, there is a tax policy that affects the economy in addition to everything else (Nargis, 2021). Tax rate on tobacco products.

Graph 2: Tax money will be combined with other sources of income to guarantee that basic services are budgeted for. Increased tobacco product taxes encourage governments to engage in the process of gradually increasing citizens’ use. In this graph, the x-axis shows taxation, with values ranging from 0 to 120 signifying the tax levied on tobacco goods, and the y-axis represents the estimated revenue received by tobacco products.

Analysis of Graph 2

We may see that tax revenue increases in lockstep with the tax rate, and customers cannot endure firms selling tobacco products at higher prices before reaching a tipping point where they cannot buy them. Furthermore, once at the upper tier tax rates, each consecutive increase in income results in a reduced tax rate (Adrison, 2023). This is the issue: a very high tax reduces the ability to obtain cigarettes and surpasses the amount of tax levied on the same units of products supplied.

The essay suggests that requiring higher tobacco taxes could involve economists and physicians working together to create new legislation. The graph shows that income from tobacco varies despite the same tax rate being imposed. Initially, increased tax rates lead to increased revenue, indicating that people are still willing to purchase tobacco products. However, if tax rates don’t stay within specific bands, their return is likely to fall due to marginal impacts and low rate productivity. The increase in the average tax paid for tobacco per individual is significantly higher than the income tax, affecting the level of desired tobacco products and reducing the benefits of higher taxes due to increased prices.

As a result, authorities are addressing the fact that taxes are an effective tool for influencing consumer behavior in terms of tobacco purchases. Understanding how price elasticity of demand affects tax revenue output, and how this relationship is dialectic in nature, is valuable information for policymakers to draw conclusions that will assist them in dealing with the issue of tobacco use in society, as well as implementing programs that will redirect resources to public health. Tax rises on tobacco products are not only a fiscal measure; they also have the potential to multiply situations that result in a better environment than would otherwise exist, which may be offset by the economic strain imposed by tobacco-related ailments.

References

Almeida, A., Golpe, A. A., Iglesias, J., & Martín Álvarez, J. M. (2021). The price elasticity of cigarettes: new evidence from Spanish regions, 2002–2016. Nicotine and Tobacco Research, 23(1), 48-56.

Adrison, V., & Dauchy, E. (2023). The impact of tax and price reforms on companies’ prices in a complex cigarette tax system. Applied Economics, 1-20.

DeCicca, P., Kenkel, D., & Lovenheim, M. F. (2022). The economics of tobacco regulation: a comprehensive review. Journal of economic literature, 60(3), 883-970.

Marquez, P. V. (2020). Expanding the Global Tax Base: Taxing to Promote Public Goods–Tobacco Taxes. Winning the Tax Wars, 143.

Nargis, N., Stoklosa, M., Shang, C., & Drope, J. (2021). Price, income, and affordability as the determinants of tobacco consumption: a practitioner’s guide to tobacco taxation. Nicotine and Tobacco Research, 23(1), 40-47.

write

write