Introduction

Laobaixing (LBX) pharmacy is a supplier of pharmaceutical products in China as the company’s main headquarters are located in Changsha, Human Province. It is one of the largest pharmacy chain stores in China. The company not only sells its products in retail stores, but it also manufactures drugs and sells them as wholesalers. The report focuses on one of their stores located at 1705 Xishan Road, Pudong District, Shanghai, China. This store provides its customers with traditional Chinese medicinal products as well as western medicine and non-medicine drug products. The store is very popular among the people living nearby as it provides them with products at fair prices. This store has been strategically chosen as a representation of the company as a whole as it is located in the most developed city in China, Shanghai. This report analyses the threats that the retail store may face and the opportunities they may encounter as well as recommendations on how the store may better itself.

Threats and Opportunities to the Business

Threats

The complexity of the Public Sector

The government of China has the mandate to fund and oversee the majority of the healthcare needs of its people. According to Meng et al.(2015), the government has instituted reforms that ensure its control of the sector, such as the national healthcare insurance scheme that covers over 90 percent of the county’s population and this number increases by the day. The drastic increase in insurance coverage has resulted in a huge blow to the private pharmaceutical companies since the government is now in charge of the country’s major supply of pharmaceutical products. Most of the patients who visit public hospitals in China are offered the drugs prescribed to them by the physician within the hospital setting. Therefore, they have no need to visit the private pharmaceutical retail stores to access these drugs (Dou, Wang & Ying, (2018). Additionally, the drugs offered by the government in the public hospitals are cheap and, most often than not, covered by the insurance provider; this means that the target market for LBX retail stores would prefer to get their medicine from hospitals rather than the private retail stores.

The solution to this hurdle would be for the private pharmaceutical companies to partner up with the government’s insurance programs in order for them to profit from these reforms. However, this, in turn, bring new challenges. The large breadth of healthcare insurance coverage in China would eventually push the program to a breaking point. Mou, Hou & Chen (2021) point out that with so many people having access to cheaper medicine, this would result in a shortage in the supply of pharmaceutical products, which would reduce customer satisfaction within private pharmaceutical retail stores such as LBX. Although the government may try to institute reforms to combat the inefficiencies within the system, the process may take a long time since there are so many stakeholders in the healthcare providers sector. They include the Ministry of Health, which regulates doctors; the Ministry of Finance, which oversees the funds for coverage, the Ministry of Human Resources and Social Security, which are responsible for reimbursement and many more. The coordination of all these stakeholders may derail the process, and this would only add to the woes of the private pharmaceutical retail stores.

Digital Disruption

Another threat that the LBX store may face is the advent of eCommerce stores which have made it possible for customers to access their products online without having to visit a brick and mortar store such as the one LBX operates. This evolution in shopping practices continues to grow immensely, especially in China. Gai (2022) stipulates that the eCommerce market in China has caught up rapidly as it is propped up by the high internet speeds and the penetration of smartphone technology in the country. China currently has the largest eCommerce market in the world as the consumers in the country aggressively shift from physical shopping to online shopping. According to Li (2022), the eCommerce market in China recorded an impressive 17.2 percent growth from 2021 and the sector is projected to record growth at a CAGR of 11.6 percent from 2021 to 2025.

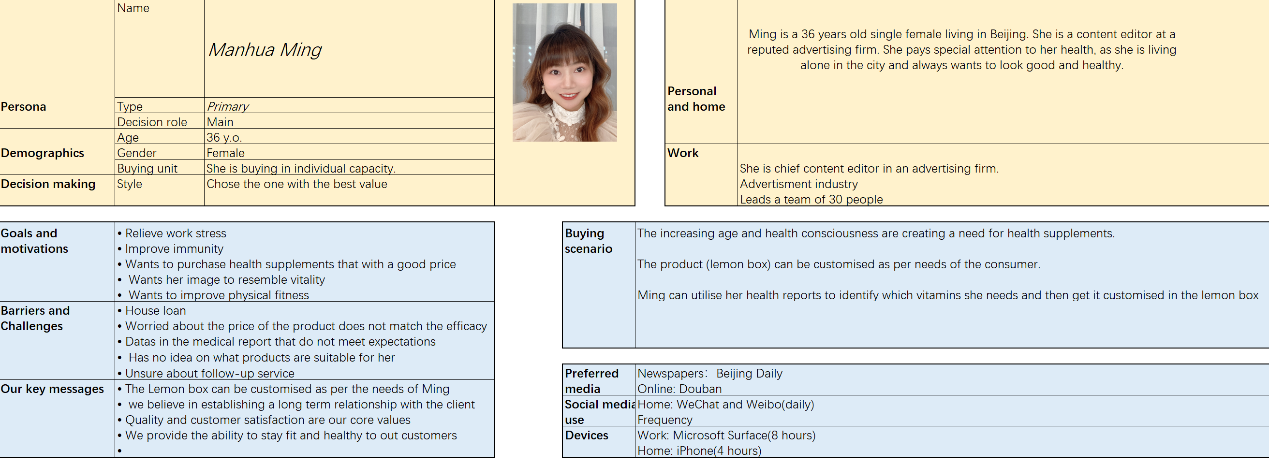

Online stores are much easier to set up than brick and mortar stores meaning that in the coming years, more and more of these eCommerce stores that provide pharmaceutical products will emerge, and they will be in direct competition with the LBX store. This means that the physical store will continually lose customers as more and more will shift to buying their pharmaceutical products online in the comforts of their homes. Vadwala (2017) ascertains that the eCommerce business environment will give the LBX store fierce competition, and if the store does not evolve to fit in the changing business climate, it may find itself in a very precarious position. Although this is not a serious threat the store may face, it is sure to become of the main threats in a couple of years, and the store needs to start taking measures to mitigate this. According to the buyer Persona profile in Appendix I, their consumers spend a lot of time on their devices and access to the internet. This means that the consumers may prefer to also do their shopping online in days to come.

Opportunities

Growth in the Pharmaceutical Market

The Chinese Pharmaceutical market is expected to grow over the coming years due to a number of reasons. There has been a trend of globalization in the healthcare industry, accelerated by a need for better medication in China and abroad. Since the store’s parent company is a licensed manufacturer of pharmaceuticals, the company can invest in research and development to meet this need for better quality drugs both in the domestic and foreign markets. Hu et al. (2019) point out that China is also home to approximately 20 percent of the world population, and the population of the senior citizens in the country is drastically increasing. Senior citizens make up the majority of consumers of pharmaceutical products in the country as they buy medication to aid them in living with cardiovascular diseases such as hypertension, diabetes and coronary diseases. This means that the consumer base is likely to increase in the coming years. Coupled with the economic growth in the emerging market of China that is expected over the coming years, the pharmaceutical industry in the nation is sure to grow (Wu & Hsu, 2018).

Research and Development

One of the main advantages that LBX pharmaceuticals have as a pharmaceutical manufacturing company is the availability of sources of information for research and the development of new drugs. Chan & Daim (2018) affirm that due to the large population in China, they have access to a vast number of patient samples, a broad spectrum of diseases that the Chinese citizens may be suffering from, biodiversity, and a strong foundation in traditional Chinese medicine. The increasingly diversifying populations of China and the wide array of diseases that may be affecting them would provide the company with an opportunity to increase the scope of the drugs they would research and provide the market with cutting edge new pharmaceutical technology that would not only benefit their customer base in Shanghai but also in international markets as well. Diseases such as diabetes and cancer are highly prevalent in the region, and the patients suffering from these diseases would provide the company with a patient pool for research and the development of therapies that would alleviate these illnesses (Liu, 2016). The rich background in Chinese traditional medicine would also give the company insight into long-forgotten cures that they use to combat some of these illnesses.

Recommendations

Digital Transformation

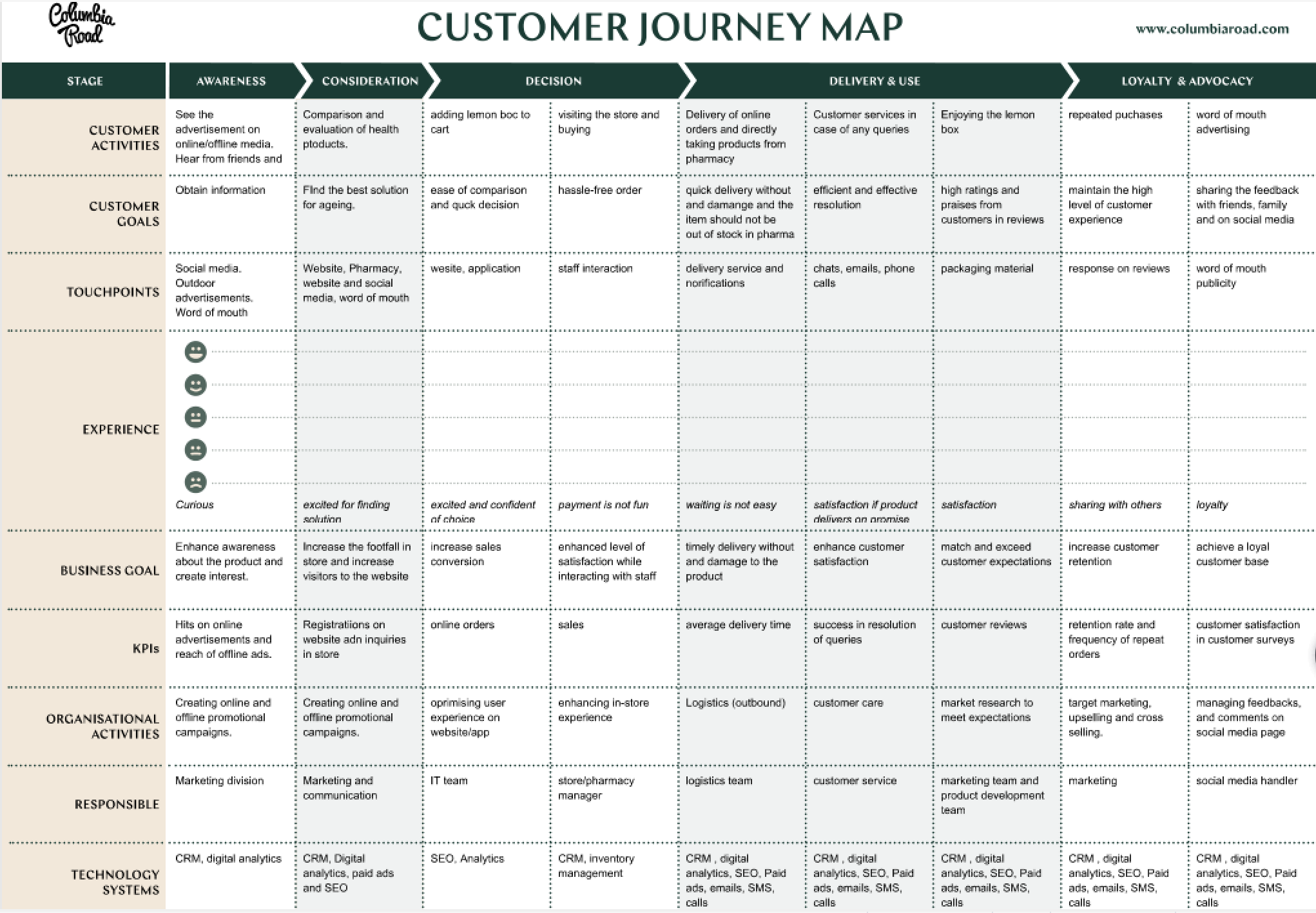

In order to keep up with their rapidly digitizing customer base, LBX pharmacy needs to undergo an intensive digital transformation so as to make the processes in the store much easier and improve their online presence. Imgrund et al. (2018) affirm that the process would involve incorporating a digital system in their brick and mortar store, making checking out of products much easier. They can also utilize artificial intelligence-powered chat boxes on their website in order to offer customer service to their clients 24/7. As indicated by the customer journey map in Appendix II, one of the main touch points that the customer uses when making considerations on the pharmacy website; therefore, a chat box would help the customer navigate the website much more easily and have a better user experience (Bhalerao & Mathur, 2022), which would make it more likely that they visit the store. The process of digitization can be time-consuming and laborious. The company can incorporate these measures in two years.

Start an eCommerce Store

Th company could also start an eCommerce site where the consumers would shop for the pharmaceuticals they need, and the store would deliver them to them all over Shanghai. This would help the store compete in the rapidly growing eCommerce market. This online store would be highly advantageous to the company as, unlike the brick and mortar store, it would be open twenty-four hours a day (Kumar & Kashyap, 2018). The company can market its products on various social media platforms and provide a link to the customer, which would lead them directly to the online store, where they would buy the product at any time of day and any place. With the advent of courier services, they can also ship their products to consumers outside Shanghai, increasing their consumer base. Since setting up an online store is relatively easy and cost-effective, the store can accomplish this in six months.

Provide Free Consultations

In order to have an advantage over their competition both in the brick and mortar stores and online stores, the LBX pharmacy can hire a physician that would come to the store on specified days of the week and offer free consultations. According to Erni et al. (2016), the physician would also give free checkups on blood pressure and blood sugar. The physician could also advise the patients suffering n cardiovascular disease on what to do and what not to do. Any recommendations on medication and prescriptions that the physician writes can be easily accessed in the store. This would attract consumers all over Shanghai and increase the existing clients’ customer loyalty. The store can be able to accomplish this in three months.

Strategy

The first thing that the store would do is find a physician to provide free consultations. The company can liaise with doctors from the Shanghai International Hospital and ask if there would be any one of them who would like to offer their services to the company for a fee. The store can pay the doctor about 300 Yuan an hour. The company should then establish an online store. They can partner with an eCommerce Agency such as the Shanghai Jungle Agency. The agency can help the store set up a profitable eCommerce store. This project would cost the store about 7500 Yuan. The store can then set up its digitization process. They can utilize the services of System in Motion, a digitization company based in Shanghai. The entire cost of digitization for the store would amount to 2.7 million Yuan.

Conclusion

LBX Pharmacy is a pharmaceutical products provider situated in Shanghai, China. Over the next five years, the company is bound to face some threats and encounter new opportunities. Some of the threats the company may face include the complexity of the public healthcare sector in China and the rapid growth of eCommerce. The growth in the pharmaceutical industry in China will offer the store an opportunity to grow. The company will also have an advantage when it comes to research and the development of new drugs. It is recommended that the store invests in digital transformation, establish an eCommerce Store and hire a physician to offer free consultation services within the store.

References

Bhalerao, H. R., & Mathur, A. (2022). Awareness and Perception of Chatbots/Chatbox Amongst Customers. ECS Transactions, 107(1), 1781. https://iopscience.iop.org/article/10.1149/10701.1781ecst/meta

Chan, L., & Daim, T. (2018). A research and development decision model for pharmaceutical industry: case of China. R&D Management, 48(2), 223-242. https://onlinelibrary.wiley.com/doi/abs/10.1111/radm.12285

Dou, G., Wang, Q., & Ying, X. (2018). Reducing the medical economic burden of health insurance in China: achievements and challenges. Bioscience trends, 12(3), 215-219. https://www.jstage.jst.go.jp/article/bst/12/3/12_2018.01054/_article/-char/ja/

Erni, P., von Overbeck, J., Reich, O., & Ruggli, M. (2016). netCare, a new collaborative primary health care service based in Swiss community pharmacies. Research in Social and Administrative Pharmacy, 12(4), 622-626. https://www.sciencedirect.com/science/article/pii/S1551741115001667

Gai, S. (2022). Ecommerce Reimagined: Retail and Ecommerce in China. https://link.springer.com/content/pdf/10.1007/978-981-19-0003-7.pdf

Hu, L., Yu, Z., Yuan, Q., Hu, Y., & Ung, C. O. L. (2019). Opportunities and challenges of multinational pharmaceutical Enterprises in transforming pharmaceutical market in China. Therapeutic innovation & regulatory science, 53(2), 207-214. https://link.springer.com/article/10.1177/2168479018772820

Imgrund, F., Fischer, M., Janiesch, C., & Winkelmann, A. (2018). Approaching digitalization with business process management. Proceedings of the MKWI, 1725-1736. https://www.researchgate.net/profile/Christian_Janiesch/publication/32366598 5_Approaching_Digitalization_with_Business_Process_Management/links/5d c2fd7992851c81803321cf/Approaching-Digitalization-with-Business-Process-Management.pdf

Kumar, A., & Kashyap, A. K. (2018). Leveraging utilitarian perspective of online shopping to motivate online shoppers. International Journal of Retail & Distribution Management. https://www.emerald.com/insight/content/doi/10.1108/IJRDM-08-2017- 0161/full/html

Li, X. (2022). The Development of Southeast Asia’s Digital Economy and China’s Cross-border E-commerce in the Region. Science Insights, 40(5), 493-498. https://bonoi.org/index.php/si/article/view/729

LIU, C. X. (2016). Recognizing healthy development of Chinese medicine industry from resources-quality-quality markers of Chinese medicine. Chinese Traditional and Herbal Drugs, 3149-3154. https://pesquisa.bvsalud.org/portal/resource/pt/wpr-853264

Ma, C., Huo, S., & Chen, H. (2021). Does integrated medical insurance system alleviate the difficulty of using cross-region health Care for the Migrant Parents in China–evidence from the China migrants dynamic survey. BMC health services research, 21(1), 1-19. https://link.springer.com/article/10.1186/s12913-021-07069-w

Meng, Q., Fang, H., Liu, X., Yuan, B., & Xu, J. (2015). Consolidating the social health insurance schemes in China: towards an equitable and efficient health system. The Lancet, 386(10002), 1484-1492. https://www.sciencedirect.com/science/article/pii/S0140673615003426

Vadwala, A. Y., & Vadwala, M. M. S. (2017). E-Commerce: Merits and demerits a review paper. International Journal of Trend in Scientific Research and Development, 1(4), 117-120. https://www.researchgate.net/profile/Msayushi- Vadwala/publication/320547139_E- Commerce_Merits_and_Demerits_A_Review_Paper/links/59eb1daaa6fdccef8 b08f4f5/E-Commerce-Merits-and-Demerits-A-Review-Paper.pdf

Wu, J. Z., & Hsu, Y. C. (2018). Decision analysis on entering the China pharmaceutical market: Perspectives from Taiwanese companies. Computers & Industrial Engineering, 125, 751-763. https://www.sciencedirect.com/science/article/pii/S0360835218302638

Appendix

Appendix I

Buyer Persona Profile

Appendix II

Customer Journey Map

Appendix III

Swot Analysis

| Opportunities | Threats |

| Growth in the Pharmaceutical Market | The complexity of the public sector |

| Research and Development | Digital Disruption |

write

write