Executive Summary

CSL Limited, a global leader in the biopharmaceutical industry, is exploring expansion to India owing to its favorable market conditions and is considering entering through Greenfield investment. The economy in India is highly attractive, as it demonstrates significant economic growth despite facing macroeconomic issues. Technological infrastructure advances rapidly while legal concerns are reduced thanks to user-friendly environments. To be successful, it is imperative to implement an efficient International Human Resources Management plan. CSL stands to reap numerous advantages from this expansion plan, such as increasing market presence, accessing a wider customer base, developing new revenue streams, and better understanding local customs and laws. CSL may succeed in India depending on its planning and execution; success can be measured through increased profits, customer satisfaction ratings, market share gains, and revenue increases.

Introduction

Global expansion refers to the process by which businesses expand into foreign markets. Companies seeking global expansion will often select markets with unique opportunities and growth potential and offer improved access to resources for maximum profits. Global expansion enables companies to gain a competitive advantage, diversify operations, and achieve greater success (Osano, 2019). CSL Limited, a global leader in the biopharmaceutical industry, is considering expanding to India. It presents an attractive market due to its large population size, rising economy, and policies encouraging local and foreign firms to do business there. This paper intends to analyze the opportunities and risks related to CSL Limited’s entry into India’s biopharmaceutical market. This paper will also identify CSL’s likely entry mode and present recommendations for their International Human Resource Management (IHRM) method as they expand operations in India. Finally, this paper summarises CSL’s potential success in this market.

Company Background

CSL Limited is an industry-leading biopharmaceutical powerhouse and one of the world’s premier providers of essential medicines and innovative vaccines, listed on the Australian Securities Exchange. Operating across 36 countries worldwide with almost 24,000 highly trained employees. CSL began life in Melbourne, Australia, as Commonwealth Serum Laboratories in 1916 with the aim of producing sera and vaccines for Australia’s animal and human populations (Ward & Osiyevskyy, 2023). Since its founding, however, CSL has expanded significantly by adding protective hygienic products like RenolineTM and Q-VaxTM combined vaccine. CSL remains a research-driven, integrated global bio-therapeutics organization with a robust technology platform comprising process development and manufacturing expertise, research platforms, and medical excellence (Perez, 2019). Over the years, CSL Group has led the global industry to create cutting-edge products and set up manufacturing operations for products such as neuromuscular products and vaccines. CSL reported $10.6 billion in revenues during the 2021-22 financial year (Wasan et al., 2022). Their plasma collection operations account for an annualized revenue stream exceeding $1 billion, collected at over 300 donor centers located throughout North America, Australia, and Germany. Their Australian operations comprise 13 sites spread throughout Australia – seven dedicated specifically for donor plasma collection; Melbourne serves as their global headquarters (BackerCEO, 2023).

Findings and Discussion

Market Analysis: India

India is an emerging biopharmaceutical market. Accounting for approximately five percent of the global market and producing three of Asia’s four highest volume biological drug producers, it accounts for five percent of total sales and the three largest producers, respectively (Jakovljevic et al., 2022). Due to India’s large population size and rising economic prosperity, biopharmaceutical drug demand is estimated to increase significantly within ten years. India’s biopharmaceutical market is dominated by domestic players such as Biocon, Indian Immunologicals, and Zydus Cadila. This industry was valued at $41 billion in 2021 and is projected to reach $65 billion by 2023 and surpass this amount to $130 by 2030 as demand increases for vaccines, biologics, and biotechnology drugs (Thakur-Wernz & Wernz, 2022). India provides incentives for both domestic and foreign companies investing in biopharmaceuticals to invest. These incentives include tax exemptions and subsidies for producing drugs in India while simultaneously encouraging bio-pharmaceutical development. Furthermore, India invests heavily in research and development efforts that lead to new drugs or biotechnology products being created.

Intellectual property protection regulations and laws have posed one the major hurdles to this industry ever since the Indian Patent Act was implemented in 1970 and amended again in 2005. The act restricted foreign firms’ market access and led to slow approval times from government patent offices to provide patent protection to foreign firms (Jakovljevic et al., 2022). Indian biopharmaceutical companies also face the daunting challenge of competing against international firms. Johnson & Johnson, Merck & Co, Sanofi, and Pfizer are some of CSL Limited’s main competitors in the global biopharmaceutical industry. Although these firms do not compete directly with CSL Limited for product lines like those they produce, successful marketing strategies remain vital components of success for them all as part of a highly competitive industry landscape (Bhattacharya & Bhattacharya, 2023).

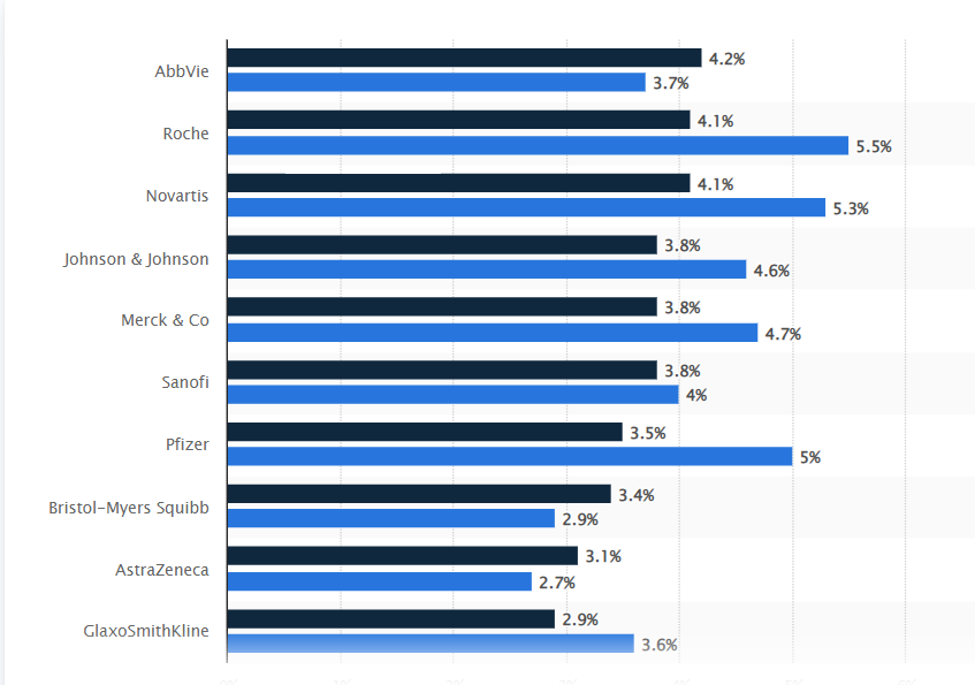

The market Share of CSL Limited Competitors in 2019 was 21.2% which is expected to drop to 15.9% by 2026. Johnson & Johnson was CSL Limited’s most significant competitor, controlling 4.6% of the total market share, followed by Merck & Co (4.7%), Sanofi (4%), and Pfizer (5%), as shown in Figure 1. The recent financial performance of these competitors has been impressive. Johnson & Johnson generated nearly $100 billion in sales revenue and over $27 billion in net income by 2022, while Merck saw almost $59.283 billion with revenue near $59.283 billion and around $13.03 billion net income (Lavarello et al., 2023). On the other hand, Sanofi earned $47.37 billion with $47.822 billion of gross sales, while Pfizer made revenues exceeding $100 billion and gross earnings exceeding $31.4 billion, respectively, in 2022 (Bhattacharya & Bhattacharya, 2023). The prospects of these four key competitors look bright. Even though the global pandemic has caused a financial impact on all biopharmaceutical companies, these four MNCs are expected to regain market share quickly as technology improves and consumer demand grows.

Figure 1: Top 20 pharmaceutical companies worldwide based on prescription drug market share in 2019 and 2026. Source: https://www.statista.com/statistics/309425/prescription-drugs-market-shares-by-top-companies-globally/

Country Analysis

CSL Limited needs to conduct an analysis using a PESTEL framework in India to comprehend market conditions better and determine potential risks related to its expansion plans. This could aid in understanding external macro-environmental influences which could have an effect on CSL Limited’s business operations in India. With this model in place, external influences that might impede CSL Limited can be studied and analyzed.

Political: India is a federal nation comprising 29 states and 7 Union Territories with a three-tier federal, state, and local governance system. At present, it is led by the Bharatiya Janata Party (BJP), who have implemented several pro-business reforms since coming into power, including pro-Make in India campaigns as well as the passage of Goods and Services Tax bills that will benefit CSL’s manufacturing plans (Panda et al., 2023).

Economic: India boasts the fifth-largest nominal GDP worldwide and an impressive economic growth record. Furthermore, it is home to one of the world’s largest consumer markets, which provides CSL with an ample customer base. Unfortunately, its economic expansion has been stunted by various macroeconomic issues, including rising fiscal deficits, high inflation, and weak currency conditions (Yadav et al., 2022). Therefore, CSL must undertake a careful evaluation of these factors before investing.

Social: India has extremely diverse population makes its socio-cultural aspects essential for conducting business there. India is a democracy, with most citizens having access to basic services and receiving basic levels of education – something CSL will benefit from this providing it with access to well-educated workers that will better promote its products among local populations (Varah & Desai, 2023). Also, the large population means more potential customers for the company’s products.

Technological: India is rapidly progressing economically, and its technological infrastructure is improving significantly. This is particularly in telecommunications and information technology, providing CSL with better communications and more efficient operations in India (Yadav et al., 2022). Furthermore, technological advancements within medical and biopharmaceutical industries will also benefit CSL operations there.

Environmental: India faces numerous environmental challenges, such as air and water pollution, deforestation, and poor waste management. CSL should take note of these environmental conditions and take all the necessary measures to ensure its operations in India do not cause additional environmental damage (Varah & Desai, 2023).

Legal: India has developed an impressive legal and regulatory environment that is user-friendly to foreign investors, which will benefit CSL as it operates more smoothly. However, laws and regulations vary from state to state as multiple overlapping jurisdictions are making its regulatory environment even more complex (Varah & Desai, 2023). As a result, CSL must ensure its operations in India comply with all relevant laws and regulations.

Entry Mode

CSL Limited should consider entering the Indian market via Greenfield Investment as its best entry mode due to the risks and opportunities involved. Greenfield investments involve creating an entirely new enterprise in a foreign market instead of investing in or merging with an existing enterprise. In this entry mode, CSL Limited will start from scratch and maintain full control of its venture from day one (Nguyen, 2023). CSL must conduct extensive market research in order to develop an understanding of both opportunities and risks associated with their venture. Moreover, the company should research its competitors, consumer demand, and product pricing before beginning operations in India. CSL must establish all necessary infrastructure, including manufacturing plants, distribution networks, and sales/marketing staff in India, to make this venture successful (Ti et al., 2022). For it all to run as smoothly as possible, all relevant regulations and laws will also need to be observed, as well as training their staff appropriately in the Indian market.

Greenfield investment allows CSL to demonstrate high dedication to their venture and gives them more control over operations in a new market. Furthermore, CSL could leverage its international brand image and market experience to gain an immediate presence in India, providing it with an edge (Ahmed et al., 2022). Furthermore, Greenfield investments allow companies to form new relationships with suppliers and customers in that new market, opening up more potential growth opportunities. While Greenfield investments offer many advantages, their implementation can be more time and resource intensive due to starting from scratch in a new market. Furthermore, such investments may carry greater risk due to insufficient infrastructure.

International Human Resource Management (IHRM)

International Human Resources Management (IHRM) refers to overseeing a company’s talent globally to meet its goals across its various international locations. It encompasses recruiting, training, and managing workers across borders while considering differences such as rules, laws, payrolls, cultural norms, and language barriers in each nation they operate in (Sandler et al., 2019). CSL will need an effective human resource management strategy in India for its newly established operations to operate efficiently. The company must also plan its HR management strategy accordingly, including recruiting and managing Indian nationals and expatriates from other countries. Utilizing host country nationals will allow CSL to leverage the knowledge and expertise of employees who already understand India’s market regulations and laws. Moreover, employing host country nationals will also reflect local culture and language better, helping build stronger relationships with customers and suppliers locally (Amendolagine et al., 2022).

However, this approach does have some drawbacks. Establishing an affordable salary package and appropriate remuneration system may be more challenging when hiring local workers. Moreover, finding staff with similar levels of skills and experience may prove a greater challenge than expected (Sandler et al., 2019). To address these issues, CSL should consider hiring expatriates from other countries as a supplement to its domestic workers. This will help to maximize its global network and leverage employee knowledge across its international locations. Employing staff from different nationalities also allows CSL to gain a better understanding of cultural aspects present in local Indian markets as well as regulations and laws which apply. Furthermore, recruiting expatriates creates a more multicultural and dynamic working environment fostering innovation and creativity for the company.

Recommendation

Based on the above analysis, it is recommended that CSL Limited expand their operations in India due to the tremendous potential for growth and returns. Such expansion offers CSL numerous opportunities in terms of innovation and market presence as they enter one of the largest consumer markets and medical industries with advanced infrastructure. Moreover, India is well-positioned to become a key player in biotech/biopharmaceutical drug development due to research efforts that continuously produce novel pharmaceutical drugs (Zhou et al., 2021). CSL should implement an aggressive expansion plan by conducting market research to understand consumer needs, local regulations for imports and exports, taxes, and labor laws, as well as developing strong local staff for managing Indian operations. It should also consider hiring qualified expatriates from other countries to leverage their global experience and networks. CSL stands to gain from this expansion plan in many ways, including increased market presence, expanded customer bases, new revenue streams, and a better understanding of local cultures and regulations (Sandler et al., 2019). CSL’s success can be measured in increased profits, customer satisfaction, market share growth, and revenue increases; ultimately, this expansion plan will strengthen their brand while expanding their global reach.

Conclusion

Overall, CSL Limited should invest in India due to its potential short and long-term growth prospects. By conducting in-depth market research and hiring an experienced local and international workforce, a company can achieve its desired goals of increased market presence, customer base growth, and brand recognition. CSL must carefully plan their expansion strategy and approach in order to guarantee its success. This should include meeting the needs of local customers, understanding local taxation regulations for imports and exports, as well as staying abreast of industry developments. CSL should conduct further analysis of the Indian market and local regulations to devise the optimal entry strategy to guarantee their success in that country. The company must assemble an effective team of local and expatriate personnel to oversee its operations and devise a suitable pricing strategy that meets local consumers’ needs. By taking such steps, CSL can strive for lasting success in India’s market.

References

Ahmed, B., Xie, H., Ali, Z., Ahmad, I., & Guo, M. (2022). Internationalization of emerging economies: Empirical investigation of cross-border mergers & acquisitions and greenfield investment by Chinese firms. Journal of Innovation & Knowledge, 7(3), 100200.

Amendolagine, V., Crescenzi, R., & Rabellotti, R. (2022). The geography of acquisitions and greenfield investments: firm heterogeneity and regional institutional conditions.

BackerCEO, D. M. (2023). Careers & recruitment. nature biotechnology, 41(300), 300.

Bhattacharya, A., & Bhattacharya, S. (2023). Integrating ESG Pillars for Business Model Innovation in the Biopharmaceutical Industry. Australasian Accounting, Business and Finance Journal, 17(1), 127-150.

Jakovljevic, M., Lamnisos, D., Timofeyev, Y., Khan, H. N., Ranabhat, C. L., & Godman, B. (2022). Emerging Markets’ Health and Pharmaceutical Sectors at the Dawn of a Potential Global Financial Crisis of the early 2020s. Frontiers in Pharmacology, 13.

Lavarello, P., Sztulwark, S., Mancini, M., & Juncal, S. (2023). Creative imitation in late industrializing countries: the case of biopharmaceutics in South Korea and India. Innovation and Development, 13(1), 133-152.

Nguyen, N. M. (2023). The effect of FDI on domestic entrepreneurship: the case of greenfield investment and cross-border M&A activities. Journal of Economics and Development, 25(1), 62-78.

Osano, H. M. (2019). Global expansion of SMEs: role of global market strategy for Kenyan SMEs. Journal of Innovation and Entrepreneurship, 8(1), 13.

Panda, S., Singh, P. K., Mishra, S., Mitra, S., Pattnaik, P., Adhikary, S. D., & Mohapatra, R. K. (2023). Indian Biosimilars and Vaccines at Crossroads–Replicating the Success of Pharma generics. Vaccines 2023, 11, 110.

Pérez, P. F. (2019). Pioneers and Challengers in the Global Plasma Protein Industry, 1915-2015. Historical Social Research/Historische Sozialforschung, 44(4 (170), 75-95.

Sandler, M., Bobek, V., Maček, A., & Horvat, T. (2019). Greenfield investment vs. merger and acquisition as an entry strategy in Mexico-the case of Austrian companies. Journal for International Business and Entrepreneurship Development, 12(1), 6-21.

Thakur-Wernz, P., & Wernz, C. (2022). Does R&D offshore outsourcing improve innovation in vendor firms from emerging economies? A study of the biopharmaceutical industry in India. International Journal of Emerging Markets, 17(6), 1373-1403.

Ti, L. L., Ng, B. K., & Rasiah, R. (2022). Motivations behind SME greenfield investment in emerging markets. Management Decision (ahead-of-print).

Varah, F., & Desai, P. N. (2023). Mapping the emerging innovation system in the Indian ethnobotany genomics. Technology Analysis & Strategic Management, 35(3), 352-364.

Ward, M. P., & Osiyevskyy, O. (2023). How CSL Biotech became a global player: getting ahead of the competition. Journal of Business Strategy, 44(2), 87-95.

Wasan, H., Singh, D., Reeta, K. H., Gupta, P., & Gupta, Y. K. (2022). Drug development process and COVID-19 pandemic: Flourishing era of outsourcing. Indian Journal of Pharmacology, 54(5), 364.

Yadav, V., Jaiswal, S., & Shyam, S. (2022). Prescription analysis of rheumatology and endocrinology departments of a teaching hospital in Western India. Journal of Current Research in Scientific Medicine, 8(2), 168.

Zhou, K., Kumar, S., Yu, L., & Jiang, X. (2021). The economic policy uncertainty and the choice of entry mode of outward foreign direct investment: Cross-border M&A or Greenfield Investment. Journal of Asian Economics, 74, 101306.

write

write