INTRODUCTION

Deloitte Company profile

Deloitte is a leading multinational corporation providing consulting services in finance, accounting, legal, and auditing. The company operates in 150 countries and employs about 415,000 people (Deloitte, 2023). The company was established in 2001 and has its headquarters in London, United Kingdom (PitchBook, 2022). The external environment in which the company operates is characterized by stiff competition. Its main rival includes PWC, EY, and KPMG. Deloitte enjoys the largest market share; hence, it has relatively favourable economies of scale compared to rival firms. The company’s main customers include governments, real estate, insurance, automotive, healthcare providers, and technology firms. This report will examine the external and internal environment of the company, its leadership approach, and its competitive strategy. With more insightful business strategies, Deloitte Company helps its clients to focus on their strengths, push their capabilities and innovate for the future. Since it began to design and realize shared services models for its worldwide clients, this company’s goals have been to research and develop an integrated business strategy.

Deloitte Company Leadership

In the last ten years, the leadership at Deloitte Company and other multinational companies has changed. Only a few businesses were untouched by the late 2000s global shutdown. Such changes led to several challenges leading to mergers, acquisitions, retrenchment, structural changes and reappraisal of priorities. These global challenges added pressure on this company draining its balance sheets of cash and resource organization to effect change. Today’s leadership challenge is managing the turmoil of the present while promoting a sustainable future and protecting the companies. Organizations like Deloitte recognize that leadership is vital for its performance as much as leadership strength is usually intangible. However, this company has challenged this notion and attempted to showcase effective leadership’s impact.

In Deloitte’s recent survey, most executives rated the organization’s leadership as very effective. At this company, the development of leaders is looked after by someone several reporting lines under the human resource director.

Punit Renjen served as the CEO of Deloitte Company from 2015, and he made this company operational in 150 countries with many professionals. He was born and raised in India. In his career as the CEO of this multinational company, Punit helped clients and the company to address several issues such as Mergers and acquisitions (M&A), strategic development and operations improvement. His clients included large global organizations spanning the telecommunications, utilities and energy industries. Despite a continuing recession, this consulting industry saw great development during his time as Consulting CEO, aiding Deloitte Consulting LLP in becoming one of the top consulting firms, per prominent analysts’ rankings. He led Deloitte Consulting LLP to be named one of the consulting magazines.

In 2014 he created a culture of purpose in this company, thereby building business confidence while at the same time driving growth by commissioning the Deloitte core beliefs and culture survey. A global initiative to equip 100 million impoverished individuals for a world of opportunity was established by Deloitte under Punit’s leadership, with the idea that business thrives when society does. He also led Deloitte’s World Climate initiative, which aims to reduce greenhouse gas emissions by 2030.

In December 2022, Deloitte Company announced Joe Ucuzoglu as the successor of Punit Renjen. As the CEO of this largest professional services company in the world, Joe is actively engaged with many clients and a wide range of stakeholders who work together to ensure that this company is leveraging its full breadth to deliver impactful results to the clients. He served in the capacity of the CEO of this company’s subsidiary in the US and previously as the leader of US audit and assurance practice. Joe deals with a broad range of issues facing the business today, including building a culture of inclusivity and purpose, the ever-changing nature of leadership, and the role that companies must play to lead society through a quick pace of technology-driven change. In response to change, Deloitte Company ensures that its clients are inspired to move to a new reality by easily adapting to the changes that are brought about by any transformation in a sustainable way.

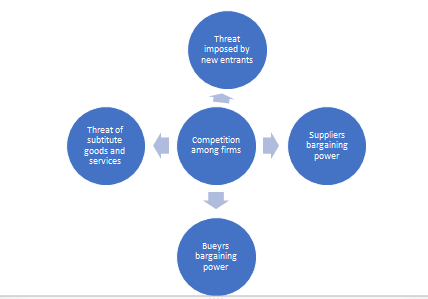

PORTER’S 5 FORCES MODEL

This model is used to examine a firm’s competitive strategy. It can be illustrated using the diagram below:

Figure 1: Porter’s 5 Forces Model

Threat Imposed by New Entrants

New entrants are firms that enter into a particular industry to compete with existing firms. The threat of new entrants in this industry is weak due to existing entry barriers that make it hard for such firms to survive the competitive nature of this business. The growing demand for professional consultancy services creates new and lucrative markets that may attract new companies. However, existing multinational corporations enjoy large economies of scale, which, when put into effect, create entry barriers that overwhelm new entrants. In most instances, new firms lack sufficient resources to compete effectively with a well-established brand like Deloitte.

The threat of substitute services

This industry is characterized by product similarity. As such, there are no substitute products in the market for clients to choose from. Therefore, the threat of substitute services in professional consultancy relatively still exists.

Consumer bargaining power

The presence of several competitors provides varied alternatives for consumers. The availability of alternatives provides consumers with relatively higher bargaining power. The customer has the freedom to evaluate and compare pricing before choosing which service provider to consult. Therefore, competitive pricing is a highly necessary competitive strategy for sustainable profitability. In this case, the most competitive company must develop a relatively cheaper pricing model while offering the highest quality services. Such has been the pricing model of Deloitte. The company’s strategic pricing is intended to proactively manage the buyers’ perceptions (Nagle and Müller, 2017). The customers are hence attracted and retained by this pricing model.

Suppliers bargaining power

The firm’s main suppliers are professionals delivering their services. The availability of different companies in need of these professional services creates a relatively high bargaining power for talented professionals. As such, this industry’s human resource and professionals enjoy a relatively higher bargaining power. As such, it is necessary for the company to adopt an employment contract that attracts top talents and minimizes employee turnover.

Rivalry among existing firms

Most of the Deloitte Company’s rivals are large in size but few in number, implying that firms in this industry will not make moves without being noticed. Few competitors mean a large market share among the competitors. Therefore, Deloitte rivals will tend to engage in competitive actions to become market leaders, making the competition among the existing firms a strong force within the industry. To counter the rivalry among the existing firms, Deloitte Company should focus on new clients rather than winning the ones from the existing firms. This company can also invest in product differentiation and conduct market research to determine the demand-supply situation within the consultancy industry.

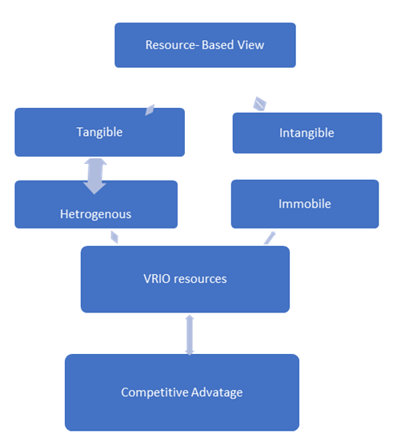

Resource-Based View Analysis

RBV is an analysis framework that examines the resources available in a company as a crucial necessity for a firm’s performance. The resources provide a firm with the essential competitive advantages required to thrive in e competitive industry. Deloitte’s resource-based view analysis can be summarized with the below diagram:

This framework divides resources into tangible and intangible. Deloitte has tangible resources like equipment, plant, buildings, and digital technologies. Among the intangible resources include the experiences of the professionals providing services at the firm. The VRIO model examines if these resources are rare and valuable and the issue of copying or imitating. The valuable resources include the experiences of the professionals and the innovative technologies owned by the company.

The company expanded its innovative capabilities by acquiring Monitor alongside its Doblin enterprises. This allowed the company to differentiate its services to meet the varying consumer demands. The top talents employed by the firm are a rare resource. This provides the company with a rare competitive advantage because of the quality of its service delivery. The company has distinct innovations that are rare and hard to copy or imitate. These resources, coupled with its large and favourable economies of scale, provide the company with the necessary competitive advantages required to compete and thrive.

SWOT ANALYSIS

SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats a company is exposed to.

| STRENGTHS | WEAKNESSES |

| · Trusted brand

· Competitive pricing strategy · Large economies of scale · Skilled professionals · Low employee turnover · Distinct innovative technologies · Large market share |

· Low brand awareness

· Low market share in Asia and Africa · Poor social media presence · Intense Rivalry Disputes · Litigation and Regulatory Action |

| OPPORTUNITIES | THREATS |

| · New markets in Asia and Africa

· Product differentiation · experience in financing and auditing · small firm acquisition |

· Rapidly advancing technology

· Growing competition · government policy · currency fluctuation |

Strengths

Deloitte is a trusted brand. Customer confidence in their service delivery is an essential strength because it plays a critical role in customer retention and satisfaction. Trust builds loyalty. With consumer loyalty, consumers build a solid relationship with a firm that ensures consistent and repeat purchases. The company also enjoys a larger fraction of the market share. Deloitte has outgrown the industrial average market share growth in the consulting industry. While the industrial average rate is 16.4%, the company reported a growth percentage of 19.9% (Deloitte, 2022). The same report ranked the company as the leading firm in consulting and technologies industry (Deloitte, 2022). This large market share provides the company with customers, which enables consistent and sustainable profitability. The size of a firm’s market share has also been identified as a crucial competitive advantage. It’s a large-scale operation, and global dominance provides the company with large economies of scale. Large economies of scale are strong because it minimizes the cost of operations compared to smaller firms. The company also has skilled human resources that ensure quality service delivery which can be linked to consumer satisfaction. The employee remuneration, motivation, and benefits scheme at the company also ensures employee job satisfaction and minimizes employee turnover. Low turnover is an indicator of job satisfaction. Job satisfaction is an indicator of good performance. This ensures a smooth flow of operations and enhances the quality of consultancy services provided to the firm’s vast and varied client base.

Weaknesses

These are the elements in which Deloitte Company may be strengthened. This company has flaws when it comes to brand awareness, especially in most parts of Asia and Africa. Additionally, Deloitte Company faces intense rivalry due to the presence of large consultancy firms globally, which competes for the clients hence limited growth in the market share. This company has also had a number of lawsuits that it had to settle with hefty charges, including the one for Delphi Communicators and Standard Chartered.

Opportunities

These are areas where Deloitte need to focus on to enhance outcomes by expanding business. The experience that Deloitte Company has in financing and auditing is a benefit to global financial services. This company is also opening new subsidiaries in Africa and Asia, which is boosting its market size that will turn to increase its productivity. Additionally, Deloitte Company is attempting to acquire small firms, thereby expanding its business.

Threats

These are variables that may damage Deloitte Company’s growth, and they include;

Government policies like increased taxation are one of the main things that have an impact on the operations of a company like Deloitte.

Stiff competition – if the market is crowded with rival products, a company may suffer. Deloitte’s market share will eventually continue to decline when there is stiff competition from established firms in the sector.

Currency fluctuation: International initiatives seem to be succeeding where there is currency volatility which poses a severe problem for Deloitte Company.

Deloitte Company will also be forced to invest highly in the ever-growing technology in the consultancy industry.

DELOITTE STEEP ANALYSIS

This refers to the combined analysis of Deloitte’s Social, Technological, Economic, Environmental and Political factors. The STEEP analysis gives important information on the daily business challenges that a company is facing.

Social factors

One of the major social factors that affect Deloitte Company is the ever-changing preference of the clients. This company can decide on the type of service they can provide to the clients depending on the income of the local population. Deloitte Company should be steadfast in staying connected with the latest trends to attract its target clients.

Technological factors

The major technological factor that contributes to the success of Deloitte Company is its online brand marketing through social media. Advancements in technology can also help this organization to obtain greater customer support with fewer delays in making requests for further actions. Therefore, there is a need for this company to stay updated on any new technologies that gain sudden popularity and how much is leveraged by its competitors. This company should therefore keep track of the technological aspects of the competitors to ensure that its technological advancements are not used or copied by any competitor. This will have a great impact on the profitability of Deloitte Company.

Economic factors

The fluctuation in GDP due to the effects of Covid-19 greatly influenced the economic condition of Deloitte Company. The pandemic brought down the GDP of most countries that this company relies on by disrupting the supply chain and the currency exchange rates. The host country’s interest rates and the willingness of the countries to improve their economic situations are the two most crucial economic factors that Deloitte must consider before moving forward with new investments.

Environmental factors

Deloitte is sensitive about the environment, just like any other company with a large market, and has been actively participating in the changes impacting sustainable development. Deloitte is continuously looking for methods to reduce its carbon footprint by partially turning paperless. Also, Deloitte expanded its assistance to the neighbourhood’s environmental policy implementation. This company needs to get up to speed on the legal framework supporting environmental protection before making a splash in the new market. Moreover, Deloitte urges clients to use renewable energy sources.

Political factors

Deloitte Company is constantly under pressure from rapid changes in government policies because of its global presence. While the political ramifications of the host nation must be observed, this company’s business operations are, in a way, impacted. Deloitte consulting group, for instance, has faced a significant challenge from the unanticipated changes in the European market as a result of Brexit (Jones and Hameiri, 2022). The United Kingdom and European Union’s altered trade deal threatens cross-border businesses in areas like financial services, service disruption, the difficulty of short-term business trips between the two nations, and reciprocal recognition of professional demands. Deloitte Company should therefore be aware of the political situation of every host country.

THE ROLE OF BUSINESS FUNCTIONS AT DELOITTE

Deloitte provides audit, consulting, financial advising, and tax services to clients in a range of industries because it is a professional services firm. The various business units that makeup Deloitte are interconnected and work together to further the organization’s goals. The business functions at Deloitte Company are listed below, along with their contributions to the company and interrelatedness.

Deloitte’s Audit and Assurance practice assists businesses in managing risks, adhering to rules, and improving their financial reporting. By offering clients impartial and objective assurance services, Deloitte’s audit division benefits the business. Due to the fact that it offers data and information that is helpful to the consulting and financial advice functions, the audit function is connected to various business units at Deloitte.

Consulting

Through the use of technology, strategy, and operational assistance, the consulting practice at Deloitte Company aids businesses in enhancing their performance. Deloitte’s consulting division benefits the business by offering clients strategic, operational, and technical services. As it employs data and information from the audit and financial advice functions to offer recommendations to customers, the consulting function is connected to other business functions at Deloitte.

Risk and Financial Advisory

This practice assists businesses that receive services from Deloitte Company in managing regulatory, financial, and cyber risks. Deloitte’s financial advising division benefits the business by offering customers valuation, transaction, and restructuring services. Due to the fact that it offers data and analysis that is helpful to the consulting and audit functions, Deloitte’s risk and financial advice function is connected to different business activities inside the company.

Tax

The Tax practice offers various services to assist clients with various tax forms, including corporate tax, international tax, and indirect tax. Deloitte’s tax division benefits the business by offering clients tax compliance, planning, and advisory services. Due to the fact that it offers data and analysis that is helpful to the audit and financial advice functions, the tax function is connected to various business areas at Deloitte.

Technology, Media, and Telecommunications

Deloitte offers several services to assist customers in the technology, media, and telecommunications industry in enhancing operational efficiency, cutting expenses, and boosting profitability. As evidenced by the growth of digitally-driven networks of consultants or groups of independent consultants, technology is enabling consulting organizations like Deloitte to operate more quickly. While some other collectives have embraced technology to provide digital matching platforms, certain collectives use it to collaborate more successfully.

Banking and Capital Markets

Deloitte offers various services to assist companies in the banking and capital markets sector in enhancing their performance. Investment banks assist corporations in carrying out big financial transactions, whereas Deloitte, a consulting firm, offers advice to businesses on their most difficult strategic difficulties. Therefore, industries employ various business strategies, develop various skill sets over time, and adopt various lifestyles. In conclusion, Deloitte Company’s business functions are integrated and work together to accomplish the company’s objectives by offering a wide range of professional services to clients in many industries in over 150 countries. Deloitte’s audit, consulting, financial advising, and tax divisions all positively impact the company’s performance and depend on one another to benefit clients.

CONCLUSION

According to the analysis of Deloitte’s external and internal environment, it can be confirmed that the company functions in a highly competitive market but has several strengths that give it a competitive advantage. Deloitte’s leadership approach is also a strength, focusing on innovation and collaboration. The competitive strategy analysis using Porter’s Five Forces Model discloses that Deloitte has weak threats of new entrants but still faces challenges from substitute services and high consumer bargaining power.

The SWOT analysis shows that Deloitte has several opportunities for growth, including expanding into new markets, differentiation of products, and small firm acquisitions. However, the company has some weaknesses, such as low brand awareness and market share in certain regions. In addition, the company faces threats from rapidly advancing technology, growing competition, government policies, and currency fluctuation. To ensure continued success, Deloitte must focus on social, technological, economic, and environmental factors. Deloitte has a strong foundation and is well-positioned for continued success in the highly competitive market. However, it must continue to adapt to changing market conditions and customer needs.

References

Deloitte. (2022, 6 7). Deloitte ranked the No. 1 consulting service provider worldwide by revenue according to the Gartner® Market Share report. Retrieved from Deloitte: https://www.tandfonline.com/doi/full/10.1080/08963568.2013.825102

Deloitte. (2023). About Deloitte. Retrieved from Deloitte: https://www2.deloitte.com/sg/en/pages/about-deloitte/articles/about-deloitte.html

Nagle, T., and Müller, G. (2017). The Strategy and Tactics of Pricing. Routledge.

PitchBook. (2022). Deloitte. Retrieved from PitchBook: https://pitchbook.com/profiles/advisor/10014-31#overview

Jones, L. and Hameiri, S., 2022. COVID-19 and the failure of the neoliberal regulatory state. Review of international political economy, 29(4), pp.1027-1052. https://www.tandfonline.com/doi/abs/10.1080/09692290.2021.1892798

write

write