Currently, Inflation is the most significant economic problem in the United States. Individuals living in the United States are experiencing high prices at the gas pump, grocery stores, and malls. It is clear that Inflation has settled in, and most economists are projecting that this might continue into early next year. The rapid increase in Inflation has threatened the Biden Administration’s plan for economic recovery.

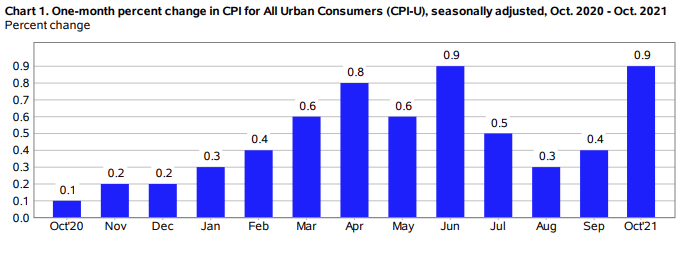

The current inflation rates are the highest in three decades. The Consumer Price Index measures consumers’ prices for services and goods every day. This index increased to 0.9 percent in October 2021 (Thorbecke, 2021). Compared with the same period last year, this was a 6.2 percent increase in Consumer prices within one year (Thorbecke, 2021). The last time such an increase in consumer prices was recorded is 1990.

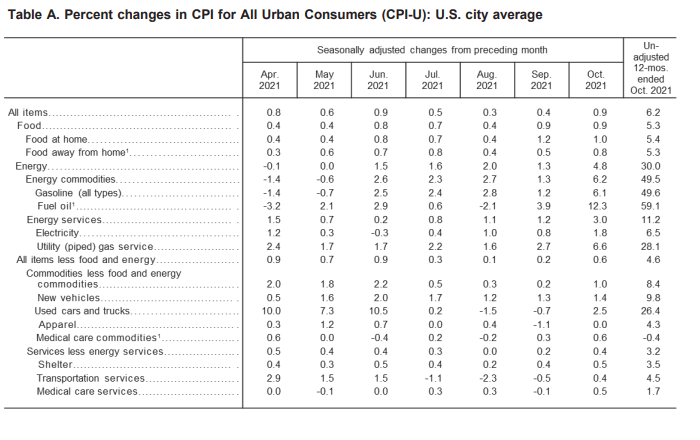

Over the last 12 months, the measure for all items or the ‘core index’ (except for energy and food) increased by 4.6 percent (Thorbecke, 2021). This was the highest increase in one year since August 1991. The core index increased to 0.6 percent in October and 0.2 percent in September. In October 2021, the index for gasoline increased by 6.1 percent, while energy increased by 4.8 percent, compared to the same period last year (Thorbecke, 2021). Gasoline has recorded a consecutive increase for the last five months. According to the Department of Labor, most of the indices in the United States recorded a sharp increase. Some of the most affected include used trucks and cars, food, shelter, and energy prices. However, the prices for alcoholic beverages and airline fares declined in October.

Figure 1: The Percentage Change in Consumer Price Index (Bureau of Labor Statistics, 2021)

Figure 2: The percentage changes in the Consumer Price Index (Bureau of Labor Statistics, 2021)

As Inflation continues to cause pain to many Americans, the Federal Reserve has continued to assure people that the situation is temporary. The Inflation of the 1970s caused a lot of uncertainty and pain in America. Hence it acquired the name ‘Great Inflation.’ About four decades later, the same situation is repeating itself with a sharp rise in prices. Although the United States has the resources and capability to respond to Inflation, there is much pressure among the consumers.

According to the Federal Reserve, Inflation is the rise in prices of services and goods within a certain period. Inflation is not measured by cost increase in one product, but rather it is calculated based on the general rise in overall prices of services and goods in the country.

What Caused Inflation?

When Covid-19 entered the United States, the government imposed measures to slow down the spread of the virus. Such measures include lockdowns or restrictions on movement, closure of businesses such as bars and restaurants, closure of sports activities, and many other things. This led to the economy’s collapse in 2020, where the economic output decreased by more than 31 percent, and more than 22 million jobs were lost (Wiseman, 2021). Businesses started preparing for the long struggle as organizations reduced their investments and changed their long-term plans.

Unexpectedly, the economy did not experience a long-term downturn. However, instead, there was a slow recovery attributed to the mass government spending and the precautionary measures taken by the Federal Reserve. The rollout of vaccines in spring led to shops, restaurants, and bars.

Suddenly, many businesses were struggling to meet the rising demand. Employers could not hire staff or purchase enough commodities to serve the rising orders. The businesses returned, leading to high traffic in freight yards and ports. This led to a big snarl in the global supply chain. The cost of goods increased, and business owners had to pass the same prices to consumers. This was a painful situation for the people because they had used all their savings during the pandemic.

Some economists argue that the Biden Administration applied misguided policies and downplayed Inflation which led to the economic collapse. The government made enormous spending, including $1,400 household checks and a $1.9 trillion coronavirus relief package, which are likely to have overstimulated the economy and caused Inflation (Wiseman, 2021). Although Joe Biden has acknowledged that the current Inflation hurts the pocketbooks of many Americans, he remains optimistic that the situation will come to an end. Most particularly, President Biden believes that the $1 trillion infrastructure package that will be used to finance projects in ports, bridges, and roads; is likely to slow the disadvantages in the supply chain.

There are different views on how people can protect themselves from the impact of Inflation in the United States. The most important thing people should do is to protect their investments. Investing in the stock market is not a very good idea because the implications of Inflation to the economy might push the stock market down, leading to losses. Also, keeping money in cash is very dangerous because the value of money can get eroded easily. Therefore, most economists argue that the best way to keep your investments safe is to open a savings account to continue earning interest during the crises. Keeping money into interest-bearing accounts is the best way of protecting money; in some cases, the money might grow faster than the price of goods.

What will likely happen in the Future?

If employers continue struggling to meet the demand for services and goods, there is a likelihood that consumer price inflation will continue. In 2021, there has been an increase in 5.8 million jobs, which means that people will continue spending on new cars and furniture (Wiseman, 2021). Moreover, the disadvantages of the supply chain have no sign of slowing down. However, other economists suggest that it is very difficult to predict how long the constraints in the supply chain will persist or how they are likely to affect Inflation. Although the global supply chain is very complex, there is hope that they will be back to normal, but this will happen unknown.

What should Policy Makers do?

The Federal Reserve is under high pressure to determine how prices should be controlled. In November, the Federal Reserve announced that it would reduce the purchase of bonds which it had started in 2020. This will act as an emergency measure that will help in boosting the ailing economy. More so, the officials at the Federal Reserve predicted in September that they would raise the interest rate of the Federal Reserve benchmark from the current zero before the end of 2022 (Wiseman, 2021).

References

Bureau of Labor Statistics. (2021). Consumer Price Index- October 2021. Department of Labor.

Wiseman, P. (2021). EXPLAINER: Why US inflation is so high, and when it may ease. AP News.

Thorbecke, C. (2021). Consumer prices soar 6.2% in October, largest jump since November 1990. ABC News.

write

write