Introduction

Cryptocurrency is a digital currency developed as an alternative to the established banking system. An increasing number of people are considering using Cryptocurrency as an alternative to fiat currency due to its many advantages over conventional money, including lower transaction fees, higher levels of anonymity, and more robust security.

Reducing financial crimes committed with fiat currency is one area where Cryptocurrency has shown promise. It’s no secret that money laundering, tax evasion, and fraud are significant issues for governments and financial institutions worldwide. The stability of the international financial system remains at risk from these crimes despite numerous efforts to combat them.

The question that is pegged in the long run, therefore, is how, if at all, could the widespread use of Cryptocurrency reduces the likelihood of the kind of financial crimes that are typically committed with fi Cryptocurrency has the potential to revolutionize the way we think about financial crime prevention, so it uses is of great interest to academics, policymakers, and financial experts. Understanding how Cryptocurrency could be used to reduce financial crime and foster a more secure and stable global financial system requires weighing the pros and cons.

Significance of Study

Studying how bitcoin usage might reduce fiat currency-related financial crimes could help create efficient financial crime prevention methods. Money laundering, theft, and tax dodging impact countries and society. Cryptocurrency and blockchain technology could reduce these crimes.

The study could teach lawmakers and regulators about bitcoin adoption’s potential benefits. This study can help create new policies and laws that encourage bitcoin usage to lower fiat money financial crimes. The study can also reveal bitcoin adoption’s obstacles and how to overcome them to optimize its benefits.

This study could create new and effective measures to combat financial crimes involving fiat money and teach lawmakers and regulators about bitcoin adoption’s pros and cons.

Thesis Statement

By offering provisions for a more transparent, decentralized, and compliant financial system, adopting Cryptocurrency can mitigate fiat currency-related financial crimes. The list of financial crimes includes tax evasion, money laundering, fraud, and fraud corruption.

Hypothesis

H0: The amount of crypto spent is as equal to the value of crypto money spent

H1: The amount of crypto spent is not as equal to the value of crypto money spent

Body

Fiat Currency

Fiat currency came into existence when governments wanted to issue notes that could be used to efficiently conduct trade in place of gold or silver (White, (2023)). FIAT came to be because carrying gold or silver around for trade had become problematic. From here, fiat currency could be accepted as legal tender. However, FIAT currency is not backed by silver or gold. Fiat currency, therefore, only relies on people’s faith in a government and its economy (Lekhi, (2023)). Faith is such that the currency’s value can be used to pay debts and taxes.

Fiat currency’s modern concept derives from the medieval European monetary systems (Kaur et al. 2023). In those times, the paper money and the silvers issued by governments were backed by reserves for gold and silver. The backing of these currencies by these reserves was faced over time, and currently, most currencies in circulation are fiat currencies (Bielig, (2023)). Fiat currency has an existing advantage in the sense that there exists a high level of flexibility in the monetary policy (Hanieh (2023)). Governments can use fiat currency to speed up or slow down an economy. The speed-up is done by printing more currency or buying securities.

Fiat currency is also convenient for daily transactions, unlike gold or silver, because it is easy to carry around and use for trade. The use of fiat currency for millennia has allowed for the practice of safe and efficient banking systems (Salampasis et al., 2023). Additionally, individuals also have the liberty to store riches in liquid form. The drawbacks that come with the use of fiat currency include erosion of a currency’s value through inflation. People’s trust in a government can also be undermined, which leads to a currency losing value (Alfar et al., 2023). Factors that lead to trust erosion include political instability and mismanagement of the economy.

Crypto Currency

Crypto is a digital currency that uses cryptography technology to perform and store transactions (Johnson et al., 2023). Cryptocurrencies are digitalized, and blockchain is the technology under which cryptocurrencies operate. Blockchain technology provides a public ledger of the transactions that have been effected on a currency (Koeswandana & Sugino, 2023). The decentralized nature of cryptocurrency technology makes it resistant to fraudulent transitions and manipulations.

The first and most popular Cryptocurrency is bitcoin, which was created in 2009 by an anonymous person or group of people that went by the pseudonym Satoshi Nakamoto. After 2009, multiple cryptocurrencies were created, but each is unique.

Crypto is fast in transactions, and they also yield high returns, and for this fact, therefore, they have grown in popularity. They have, along the way, be highly volatile. The high volatility rate and lack of regulations make crypto a risky investment area (Asgari et al., 2023). Cryptocurrencies have also been used in illegal activities such as money laundering and tax evasion, raising concerns about their potential for misuse. Cryptocurrency is a complex and rapidly evolving technology in finance (Nadiar et al., 2023). We must rethink our approach to Cryptocurrency as we handle the risks and benefits better and more cautiously.

Fiat Currency in Crime

Like any other form of money, Fiat currency has been used in lawful and unlawful/criminal activities. For decades, several criminal activities associated with fiat currency have been recorded. Of the most apparent criminal activities that are associated with fiat currency, there are:

- Money Laundering: Under money laundering, the proceeds of crime get disguised as legitimate funds. Criminals that have engaged in this type of activity have always employed different approaches, and in the list, there is the use of shell companies and offshore accounts (Wang & Hsieh, 2023). The two are used to launder money through the system.

- Fraud: Illegal activities such as Ponzi schemes, scams, and identity theft are just the range of terms that make up the broad term of fraud (Scharfman, 2023). Fiat currency has been used by criminals to facilitate their criminal activities and to deceive their victims.

- Corruption: For corruption to take effect, power has to be abused by self-centered individuals. Meaning corruption is affected by a person in power for personal gain. Funds have been embezzled, and bribes have been accepted in many cases by public officials and business leaders (Wang & Hsieh, 2023). The two groups broadly engage in corruption. On the other hand, corrupt activities are purely done using fiat money.

- Tax Evasion: This has been termed an illegal activity, which means avoiding paying taxes. The methods criminals have used using offshore accounts and shell companies to hide assets and evade taxes (Calafos & Dimitoglou, 2023).

- Counterfeiting: Under this crime, fake documents get produced to deceive others, and so do fake currency. Counterfeit currency has been treated as real money in the black market in multiple cases, with few cases recorded where counterfeit funds have been used to purchase goods and services (Gibbs, 2023).

- Drug trafficking: Illegal drugs get produced, distributed, and sold under the criminal act of drug trafficking (Kushnirenko & Kharatishvili, 2023). The entire process entails the use of fiat money to make payments through the entire process.

Crypto Currency in Crime

Cryptocurrencies, just like in the case of fiat currency, have been used in criminal activities as well. Of the criminal activity list imposed on crypto, there are:

- Money Laundering: Cryptocurrencies are anonymous, and for this, they can easily be transferred through borders (Wang & Hsieh, 2023). This act makes it easier for crypto to be used in illegal activities.

- Fraud: scams such as Ponzi schemes have been used by fraudsters in Cryptocurrency to deceive victims into sending them money.

- Ransomware Attacks: Under ransomware attacks, a victim’s data or information is held hostage by the criminal until a ransom is paid (Wang & Hsieh, 2023). Ransoms demanded in Cryptocurrency are challenging to track and yet easily transferable.

- Dark Web Markey Place: only specialized types of software can be used in accessing the dark web (Wahrstätter et al., 2023). The dark web has always been used to buy and sell illegal goods and services, and crypto has always been used to make payments.

- Cybercrime: blockchain platforms have been used to facilitate cybercrime as identity theft has been effected, wallets to have had their IDs stolen and therefore crypto taken out of them, and the entire process involves hacking (Schulp et al., 2023).

- Tax evasion: Individuals in cases more than one have used crypto to transfer wealth across borders, sealing the same from the authorities and evading tax.

Discussion of Theories

Several theories have been developed and proven to relate to reducing fiat currency financial crimes by adopting cryptocurrencies. Of the list of financial crime theories developed, there are:

- The Transparency Theory: The transparency theory argues that cryptocurrencies built on blockchain technology provide a more transparent financial system. Transactions on a blockchain are public and can be audited, making it more difficult for criminals to launder money or evade taxes (Hosen et al., 2023). Transparency is done through the use of ledgers in blockchain technology. The ledgers are treated as public ledgers, and they, therefore, record transactions in a decentralized and distributed database. Therefore, a network of nodes is used to maintain these networks (Sousa et al., 2022). The nodes, in multiple settings, verify each transaction using a consensus algorithm; therefore, the same gets added to the ledger as a block. Public ledgers are meant to be transparent and for everyone to see. Still, the catch is that the transparency degree and the degree of implementation might vary from one blockchain to another (Miraz et al., 2022). Bitcoin as a blockchain is deemed fully transparent, yet others may allow for privacy features or limited visibility.

- The Anonymity Theory: The anonymity theory argues that the pseudonymity offered by cryptocurrencies makes it more difficult for law enforcement to trace the origin of funds and track criminal activity. The difficulty comes through because the transactions performed on the blockchain are recorded in pseudonyms or cryptographic addresses instead of real names and other identifying information (Sardá, 2023). The pseudo-recorded means the transactions are transparent but hard to associate with a specific entity in real time. Since duplicate transactions can be made from anywhere worldwide, it would still be difficult for law authorities to identify the parties involved (Firmansyah et al., 2023). Additionally, the crypto exchanges where crypto is traded for fiat currency do not need individuals to provide extensive identity information (KYC-Know Your Customer). The KYC makes anonymous trading easy, hence complicating funds tracing.

- The Decentralization Theory: The decentralization theory argues that cryptocurrencies, which are not controlled by any central authority, provide a more secure and reliable financial system (Hosen et al., 2023). Cryptocurrencies can reduce the risk of fraud and corruption by removing the central control point. Remember that in traditional financial systems, central banks, governments, and financial institutions that comprise the central authorities are responsible for managing and overseeing financial transactions (Hosen et al., 2023). This power yielded by the central authorities leads to several potential issues, including corruption, fraud, and inefficiencies. In contrast to fiat currency, cryptocurrencies are built on decentralized technology. The decentralization allows a decentralized system of nodes to verify the transactions and maintain system integrity (Hsieh & Vergne, 2023). There, therefore, lacks any system of failure or vulnerability. Transactions, therefore, are processed quickly and safely. The processing ensures that there is no need for intermediaries. Additionally, the transparency and immutability of blockchain technology provide a more trustworthy and reliable system that can be used for the storage and transfer of value (Hsieh & Vergne, 2023). The occurrence is because each transaction is recorded on a public ledger that is visible to all participants. In this way, fraud, hacking, and other forms of misconduct are prevented. Any attempt to manipulate the system can easily be detected and prevented.

- The Compliance Theory: The compliance theory argues that cryptocurrencies, which are not regulated by any government or central authority, can help reduce financial crimes by encouraging compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations (Gaviyau & Sibindi, 2023). The compliance theory effectively provides a framework that ensures compliance with the laws and regulations, enabling and preventing criminal activities. Additionally, regulatory oversight ensuring compliance with the set regulations can significantly help raise the legitimacy and the mainstream adoption of cryptocurrencies by businesses, consumers, and institutions. Most of these groups might have in the past hesitated to use the technology as they might have been having concerns associated with criminal activities.

There is no mutual exclusivity with these theories, and the relationship between Cryptocurrency and crimes is complex. Cryptocurrency can reduce financial crimes in one area just as it can increase crime in another. Therefore care is needed while adopting Cryptocurrency (Li & Wei, 2023). It is wise to keep the potential risks and the benefits in mind.

Literature Review

Description and Summary of Publication

Through his publication, Paul de Mortgages (2023) provides a bearish and bullish view in his examinations and expounds on the potential of Cryptocurrency as a disruptive technology and its effect on the future of finance. The author argues that Cryptocurrency has a vast potential to revolutionize finance, and this too by providing a system of finance that is transparent, decentralized, and secure. The bullish view, therefore, talks of the possible benefits of Cryptocurrency, including faster and cheaper transactions, increased financial inclusion, and reduced corruption.

Additionally, Paul de Mortgages acknowledges that there are serious risks that are linked to the adoption of Cryptocurrency. Of the list of risks, there is a lack of regulation, high volatility, and the potential for criminal activities. Together with the warnings he gives on the dangers of cryptocurrency adoption, through his bearish view, he continuously warns of the dangers that loom, such as financial instability, risks of fraud and money laundering, and the opportunity of there being a bubble and a burst.

Gaps Identified in the Market

Well, Paul de Mortanges has provided a comprehensive analysis of Cryptocurrency’s possible benefits and drawbacks. On the other hand, though, he has provided minimal info on how embracing Cryptocurrency would alleviate financial crimes linked with fiat currency. He touches on the topic but does so briefly and fails to provide an elaborative examination or experiential proof to help support claims. The study, therefore, provides shallow Intel into how the adoption of Cryptocurrency could help mitigate crimes related to fiat currency, and this calls for more research to address this gap fully.

Description and Summary of Publication

The book written by Paul and Michael explores the rise of crypto and their impact on the global economy. With the division made into three parts which are; the history and the development of bitcoin, the technology backing crypto and the potential impact that crypto has on the global economy, the argument put forward by the authors is that Cryptocurrency offers a decentralized, transparent and secure financial system that will challenge the fiat currency system. Additionally, they recognized the possible risks and challenges connected with Cryptocurrency, and in the list, there is a lack of regulations, high volatility, and the existence of criminal activities. Optimism lies with them as they proceed that these risks can be significantly reduced provided that new technologies and regulatory frameworks are implemented.

Description of Publication

Although the book contains an elaborative analysis of the possible advantages that could be gained from using blockchain technology, the discussion of the difficulties and constraints that are associated with implementing this technology needs to be improved. The authors must provide a detailed analysis of the potential regulatory and legal challenges that might accrue upon the full adoption of Cryptocurrency and blockchain technology. Additionally, they delve less into how the anticipated challenges might negatively impact the ability of blockchain technology to mitigate fiat currency-related financial crimes. The challenges are sorted out by Jan Lansky (2018) after discussing the benefits and the potential risks associated with Cryptocurrency; he suggests that with the combination of the right technology, Cryptocurrency can be used to mitigate the crimes related to fiat currency. In this line, though, he must state the right technology combinations to consider. The list of studies provided to aid lawmakers and academics forms an understanding of how Cryptocurrency may affect financial crimes and how to regulate them.

Methodology

Case Study Research Design

There will be the examination of a specific instance or event involving the application of Cryptocurrency, which will be the basis of a Case Study Design (Ruokolainen et al., 2023). The event will therefore be used to investigate how Cryptocurrency might reduce the likelihood of fiat currency financial-related crimes.

Case Description

In 2019, several people were apprehended for allegedly using cryptocurrencies to conceal money obtained dishonestly. Large sums of bitcoin would be acquired in this instance, which was then spent on high-priced items and real estate. The inquiry uncovered that it was challenging to track the origin of the funds and identify the people involved due to the use of bitcoin.

Research Questions

- When compared to using traditional cash, how did the use of bitcoin help the people, in this instance, transfer their funds more efficiently?

- What are the possible drawbacks of using bitcoin to prevent financial crimes

- compared to traditional cash currencies?

- Could this case affect how the government handles bitcoin and crypto-related financial crimes?

Data and Data Collection

Data that is to be used in this case is data that will come from past activity, and what this mean is secondary data will be used. The data will be collected from observations, documents, and audio-visual materials.

- Observations: Using observations can be beneficial for developing a more in-depth comprehension of the environment in which the incident occurred (Elshater et al.,2023). Furthermore, observations can shed light on the actions and interactions of the parties involved.

- Documents: Legal documents, letters, and company notes are all examples of documents that can shed light on the specific background of a case. As a bonus, these can shed light on the players’ thought processes in case (Elshater et al., 2023). In particular, for our case study, we will focus on materials such as reports related to Cryptocurrency and financial crimes on that incident.

- Audio-Visual Materials: Additional information about a case may be gleaned from audio-visual materials, including interview tapes and security videos, due to information they can reveal about characters and interactions.

Procedures

There will be a detailed description of the steps taken to carry out the research, including the order taken in carrying out the research, the directions provided to subjects, and any random factors deliberately manipulated.

- Sequence of Events

- The study will provide room for finding instances where bitcoin was used to commit crimes.

- There will be gathering information through several methods, including conversations with relevant parties, a thorough examination of relevant law papers, and a thorough examination of relevant academics.

- In order to answer the study queries, the scholar conducts an analysis of the data.

- Directions for the Participants

In this case, the researcher would give those with a stake specific directions on participating in conversations or provide the necessary paperwork.

- Independent Variables Manipulation

The prevalence of Cryptocurrency related financial offenses is the exogenous variable here. The scholar would not attempt to control this variable but rather look at a single instance where it occurs.

Data Analysis

There will be an elaboration of the statistical techniques used for understanding crypto usage in executing criminal activities. Additionally, after understanding the dynamics of crypto in crime, an illustration of how to improve crypto to combat fiat currency crimes will also be illustrated. The software used for analysis is Excel, which has aided in organizing and analyzing the case study data collected.

- Descriptive Statistics

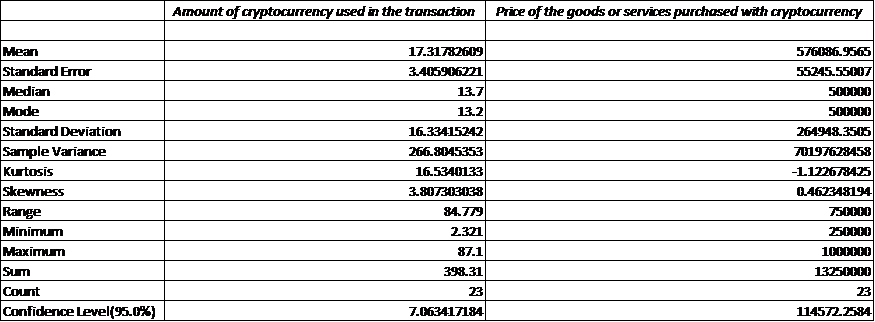

Descriptive statistics gives an analyst information on the measures of the central tendency of the numeric attributes within their data. Having performed this only on two numeric attributes, “Amount of cryptocurrency used in the transaction” and “Price of the goods or services purchased with cryptocurrency,” we have the results as tabulated below:

Table 1: Descriptive Statistics

- Visualization

There will be a pictorial depiction of the dataset variables at this point. The visualizations will help us understand the distribution of each attribute in a pictorial form.

- Pie Charts.

A pie chart is a circle graph that divides data into equal segments to show relative sizes. Each slice’s curve length in a pie chart should correspond to the value it displays:

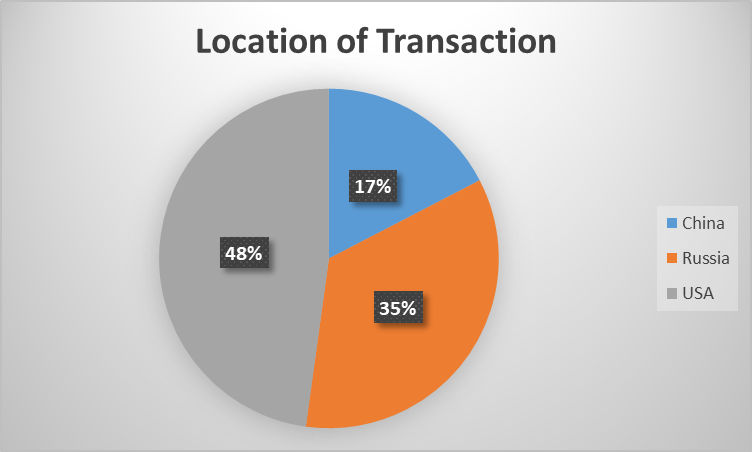

Pie chart 1: Transaction location

According to Pie chart 1, the USA has the highest number of crypto transactions hence the highest number of fraudulent transactions. Russia and, lastly, China follow the same. China’s last position is explainable since they had burnt the use of crypto by 2019.

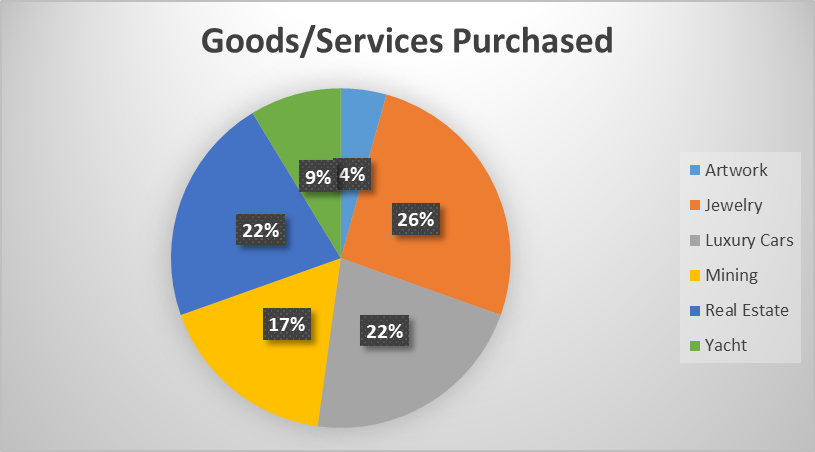

Pie Chart 2: Types of Purchase

Types of purchases made have it that there are more Jewelry, Luxury Cars, and Real Estate that the fraudulent crypto funds were dumped into as indicative by percentages. Yachts and Artwork are the least avenues for investments for crypto frauds.

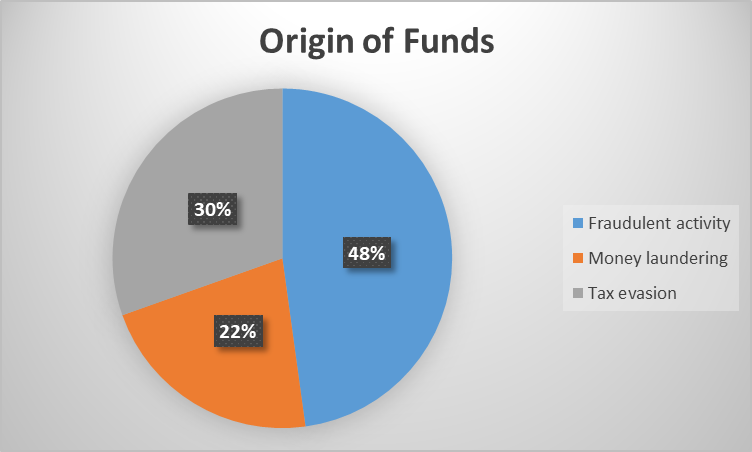

Pie Chart 3:

48% of crypto funds recovered from the 2019 case were from fraudulent activities, which typically explains that more individuals were scammed of their crypto. Most cryptos were stolen from wallets directly. Crypto that is laundered and comes from tax evasion is the least recorded of the three sources.

- Histogram

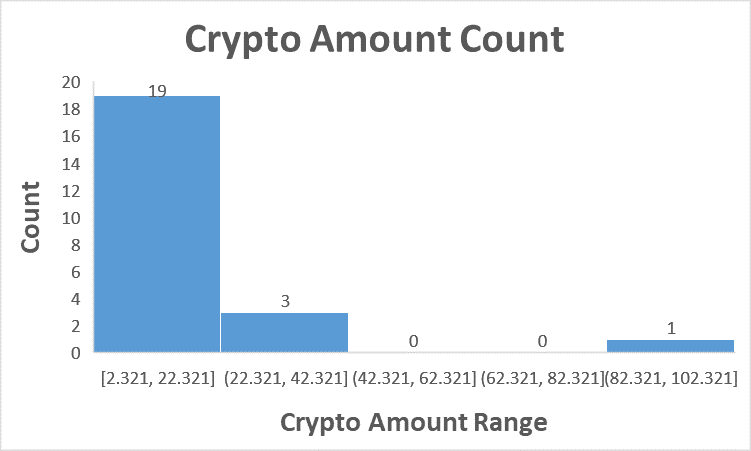

Histogram 1: Amount of Crypto

The count is higher for the crypto amount ranging from 2.321 to 22.321, and the counts drop drastically after that, creating right-skewed data. The transacted crypto amounts stood to be lower.

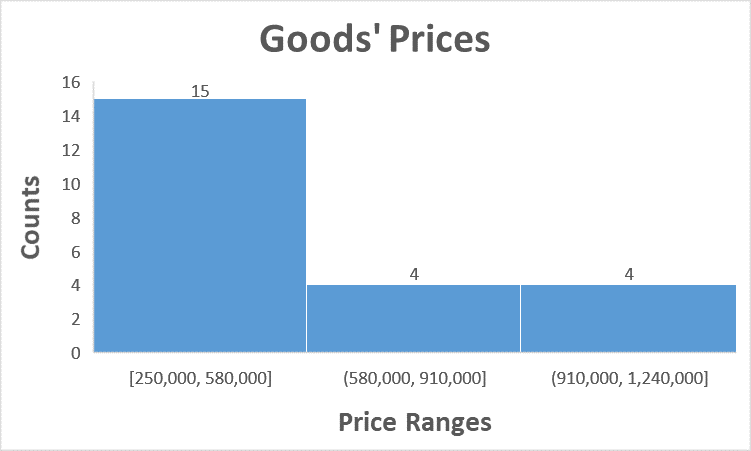

Histogram 2: Goods’ Prices

Looking at the prices of goods, it is evident that it mimics Histogram 1’s alignments and gives rightly skewed data. The deduced findings mean that most goods purchased are lower in price in relation and the number stands at 15.

- Regression

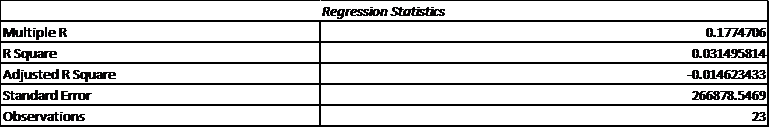

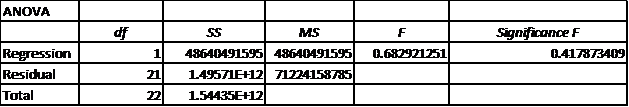

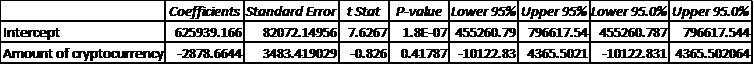

Tables 1: Regression

According to the R Square value, it is way below 0.9 and comes in at 0.03, indicating that the line of fit is way lower and that the stats are not that rightly fitting for a prediction. The deduction makes it clear to understand that the model is not significant, as the significant value of 0.417 is more than 0.05 the significant value. We, therefore, accept the null hypothesis.

Ethical Considerations

Human subjects’ research necessitates adhering to strict ethical guidelines to ensure the safety and well-being of the people involved. Researching the use of bitcoin to reduce financial offenses connected with conventional money raises several moral questions.

- Before giving their permission to engage in a study, participants should have all of their questions answered and be aware of the study’s goals and responsibilities (Huerne et al., 2023). Scholars need to get written permission from each subject, and those individuals need to know they can drop out of the research at any moment.

- Protecting subjects’ names and the confidentiality of their personal information are the responsibilities of the research team (Huerne et al., 2023). The privacy steps are paramount when dealing with private information about money offenses.

- Scholars should take precautions to lessen the possibility of injury to study subjects. Participants vulnerable to the study’s material may benefit from therapy or other mental assistance.

- Scholars are responsible for guaranteeing that their studies are conducted fairly and that all subjects are given equal opportunities and consideration (Huerne et al., 2023). The process involves recruiting a representative population sample and actively engaging with all the study’s subjects to ensure their perspectives are considered.

- Scholars studying human subjects must follow all relevant laws, rules, and standards. The following rules involve submitting your research to an ethics commission or institutional review board (IRB).

To ensure the study is performed responsibly and ethically, researchers must consider and address ethical concerns at every stage.

Conclusion

Money trafficking, tax avoidance, and deception are just some of the financial offenses that have been committed using cryptocurrencies. Many criminals have used cryptocurrencies for their autonomous and anonymous features to launder stolen money. Despite these caveats, the widespread use of cryptocurrencies may reduce the incidence of financial offenses typically linked with conventional money. Blockchain technology can be used for its immutability, openness, and tracking to improve financial purity and less the possibility of financial offenses.

Know Your Client (KYC), and Anti-Money Laundering (AML) laws built on the blockchain are one-way cryptocurrency usage that can reduce the prevalence of financial offenses connected with conventional money. By making monitoring and confirming transactions easier, blockchain technology can help financial organizations and authorities crack down on money laundering and other forms of financial crime. In addition, smart contracts built on the blockchain can facilitate automated conformance with AML laws, eliminating the need for physical involvement and limiting the scope for human mistakes.

Adopting a cryptocurrency can reduce the incidence of financial offenses typically committed with conventional money because of the increased openness and tracking of transactions. Due to block chain’s autonomous structure, any user can view and monitor events on the ledger, making it harder for offenders to hide their activities. In addition, blockchain technology can help people establish their digital names and profiles, which can boost the reliability of business partners and lessen the likelihood of deception.

To sum up, while there are undoubtedly new obstacles to overcome in the fight against financial crimes, there are also exciting new ways in which financial security can be strengthened and the likelihood of illegal activity diminished thanks to the widespread usage of bitcoin. Increased openness and tracking of transactions made using blockchain technology can aid in the reduction of financial offenses involving the conventional currency. The offenses include money laundering and the financing of terrorism. These solutions could be better, and they need to be revised and refined regularly to keep up with the ever-changing threat of financial offenses.

Recommendations

The study, in this case, has focused only and majorly on reducing and eradicating fiat currency-related currency-related financial crimes in general and this too across the globe. The focus needs to be deeper, considering the extent crypto has covered in journey and development. The proposed areas of interest for additional learning and research that should also be focused on include, firstly, the actual jurisdiction of crypto handling across the globe and an in-depth assessment of the development of crypto activities and the crypto adoption in the world. Secondly, the actual fight against crypto adoption by paranoid governments and the actual centralization control different governments seek over different crypto assets, for example, the USA and China. There is also the development of the Central Business Digital Currencies (CBDCs), the currency governments plan to use to monitor citizens when total crypto adoption is reached worldwide. China and the other nine states have developed CBDCs that are in operation, and they are majorly used to limit specific operations that are not deemed favorable to the citizens. A dive into the reactions of different countries on the crypto realm greatly benefits understanding crypto dynamics moving forward. Thirdly, an assessment of the investments into digital assets and the difficulties of choosing assets should also be assessed in a separate study. Investments are also an area where individuals lose money due to the multiple numbers of digital assets developed by digital asset developers worldwide. To understand Cryptocurrency’s dynamic spread, there is also the need to collect relevant and rich datasets to understand numbers and the globe’s crypto activities alignments. Numbers never lie, and neither is accurate data when used well to understand the dynamics of the world.

References

Alfar, A. J., Kumpamool, C., Nguyen, D. T., & Ahmed, R. (2023). The determinants of issuing central bank digital currencies. Research in International Business and Finance, 101884.

Asgari, N., McDonald, M. T., & Pearce, J. M. (2023). Energy Modeling and Techno-economic Feasibility Analysis of Greenhouses for Tomato Cultivation Utilizing the Waste Heat of Cryptocurrency Miners. Energies, 16(3), 1331.

Bielig, A. (2023). Toward a European central bank digital currency: Chances and problems. In Digital Currencies and the New Global Financial System (pp. 128-142). Routledge.

Calafos, M. W., & Dimitoglou, G. (2023). Cyber Laundering: Money Laundering from Fiat Money to Cryptocurrency. In Principles and Practice of Blockchains (pp. 271-300). Springer, Cham.

Elshater, A., Abusaada, H., & AlWaer, H. (2023). In urban planning and design, strengthening research design is crucial. Proceedings of the Institution of Civil Engineers-Urban Design and Planning, 176(1), 1-5.

Firmansyah, E. A., Masri, M., Anshari, M., & Besar, M. H. A. (2023). Factors affecting fintech adoption: a systematic literature review. FinTech, 2(1), 21-33.

Gaviyau, W., & Sibindi, A. B. (2023). Customer Due Diligence in the FinTech Era: A Bibliometric Analysis. Risks, 11(1), 11.

Gibbs, T. (2023). Evolution of Legal and Regulatory Responses to Money Laundering Risks Related to Virtual Assets: The Examples of the European Union and the US. In CYBER LAUNDERING: International Policies and Practices (pp. 197-233).

Hanieh, A. (2023). World Money and Oil: Theoretical and Historical Considerations. Science & Society, 87(1), 50-75.

Hosen, M., Thaker, H. M. T., Subramaniam, V., Eaw, H. C., & Cham, T. H. (2023, February). Artificial Intelligence (AI), Blockchain, and Cryptocurrency in Finance: Current Scenario and Future Directions. In Proceedings of the 2nd International Conference on Emerging Technologies and Intelligent Systems: ICETIS 2022 Volume 1 (pp. 322-332). Cham: Springer International Publishing.

Hsieh, Y. Y., & Vergne, J. P. (2023). The future of the web? The coordination and early‐stage growth of decentralized platforms. Strategic Management Journal, 44(3), 829-857.

Huerne, K., Ells, C., Grad, R., Filion, K. B., & Eisenberg, M. J. (2023). Cannabis-Impaired driving: ethical considerations for the primary care practitioner. Annals of medicine, 55(1), 24-33.

Johnson, B., Stjepanović, D., Leung, J., Sun, T., & Chan, G. C. (2023). Cryptocurrency trading, mental health, and addiction: a qualitative analysis of Reddit discussions. Addiction Research & Theory, 1-7.

Kaur, G., Habibi Lashkari, A., Sharafaldin, I., & Habibi Lashkari, Z. (2023). The Origin of Modern Decentralized Finance. In Understanding Cybersecurity Management in Decentralized Finance: Challenges, Strategies, and Trends (pp. 1-28). Cham: Springer International Publishing.

Koeswandana, N. A., & Sugino, F. A. (2023). Intention to use Cryptocurrency: Social and religious perspective. Jurnal Ekonomi & Keuangan Islam, 91-103.

Kushnirenko, S. P., & Kharatishvili, A. G. (2023). Cryptocurrencies Turnover and Forensic Analysis of the Mechanism of Committing Crimes. Kutafin Law Review, 9(4), 774-792.

Lekhi, P. (2023). Currency and Payment Tech: Cryptocurrencies Transforming the Face of Finance. In Financial Technologies and DeFi: A Revisit to the Digital Finance Revolution (pp. 57-66). Cham: Springer International Publishing.

Lansky, J. (2018). Possible state approaches cryptocurrencies—Journal of Systems Integration, 9(1), 19.

Li, S., & Wei, S. (2023). Cryptocurrencies, Money, and Law. Journal of International Banking Law and Regulation, 38(2), 57-67.

Miraz, M. H., Hasan, M. T., Rekabder, M. S., & Akhter, R. (2022). Trust, transaction transparency, volatility, facilitating condition, performance expectancy towards cryptocurrency adoption through intention to use. Journal of Management Information and Decision Sciences, 25, 1-20.

Nadiar, R., Nor, W., & Safrida, L. (2023). Cryptocurrency Transaction: is it Relevant to Indonesian Accounting Standards?. Riset Akuntansi dan Keuangan Indonesia, 7(2), 217-226.

Ruokolainen, J., Nätti, S., Juutinen, M., Puustinen, J., Holm, A., Vehkaoja, A., & Nieminen, H. (2023). Digital healthcare platform ecosystem design: A case study of an ecosystem for Parkinson’s disease patients. Technovation, 120, 102551.

Sardá, T. (2023). An onion with layers of hope and fear: A cross‐case analysis of the media representation of Tor Network reflecting theoretical perspectives of new technologies. Security and Privacy, e296.

Salampasis, D., Schueffel, P., Dominic, R., & Cameron, D. (2023). Central Bank Digital Currencies: Opening Pandora’s Box or Paving the Future of Money? The Emerald Handbook on Cryptoassets: Investment Opportunities and Challenges, 283-306.

Scharfman, J. (2023). Introduction to Cryptocurrency and Digital Asset Fraud and Crime. In The Cryptocurrency and Digital Asset Fraud Casebook (pp. 1-16). Cham: Springer International Publishing.

Schulp, J. J., Solowey, J., Anthony, N., & Thielman, N. (2023). Overstating Crypto Crime Won’t Lead to Sound Policy.

Sousa, A., Calçada, E., Rodrigues, P., & Pinto Borges, A. (2022). Cryptocurrency adoption: a systematic literature review and bibliometric analysis. EuroMed Journal of Business, 17(3), 374-390.

Wahrstätter, A., Gomes, J., Khan, S., & Svetinovic, D. (2023). Improving Cryptocurrency Crime Detection: CoinJoin Community Detection Approach. IEEE Transactions on Dependable and Secure Computing.

Wang, H. M., & Hsieh, M. L. (2023). Cryptocurrency is new vogue: a reflection on money laundering prevention. Security Journal, 1-22.

White, L. H. (2023). Better Money: Gold, Fiat, or Bitcoin? Cambridge University Press.

write

write