1.0 Introduction

The financial system plays a crucial role in the economy by channelling funds from savers to borrowers and facilitating investment and economic growth. However, it is also exposed to various risks threatening its stability and function (Chattha & Alhabshi, 2020). The Basel Committee on Banking Supervision has identified a group of banks as Global Systemically Important Financial Institutions (G-SIFIs) due to their size, interconnectedness, and systemic importance. These banks are subject to additional regulatory requirements and scrutiny to mitigate the risks they pose to the financial system. Therefore this report critically evaluates the role of the bank’s asset-liability committees (ALCOs) in measuring and managing interest rate and liquidity risk. This report also analyzes UBS’s bank regarding its interest rate, liquidity, operational, and fraud risks. UBS is a Swiss multinational investment bank and financial services company in Zurich. The report uses UBS’s latest Annual and Pillar 3 reports.

1.1. Role of ALCO in Managing Interest Rate and Liquidity Risk

Asset-Liability Committees (ALCOs) are responsible for managing a bank’s interest rate risk and liquidity risk. In the current international regulatory framework, banks must have effective ALCOs to ensure that they can identify, measure, and manage these risks. In this context, it is crucial to critically evaluate the role of ALCOs in measuring and managing interest rates and liquidity risk(Chattha & Alhabshi, 2020).

Interest rate risk is the risk that changes in interest rates will adversely affect a bank’s net interest income or the economic value of its assets and liabilities. On the other hand, liquidity risk is the risk that a bank will not be able to meet its obligations as they become due without incurring unacceptable losses(Chattha & Alhabshi, 2020).

ALCOs play a crucial role in measuring and managing these risks. They are responsible for developing and implementing strategies to manage these risks, monitoring the bank’s exposure to them, and ensuring it has adequate liquidity to meet its obligations.

ALCOs use the gap analysis technique to measure interest rate risk. This involves comparing the bank’s assets and liabilities that reprice or mature within a specific time frame, typically up to one year. The difference between the two is the interest rate gap. If the interest rate gap is positive, the bank’s assets are more sensitive to changes in interest rates than its liabilities. Conversely, if the interest rate gap is negative, the bank’s liabilities are more sensitive to changes in interest rates than its assets. To calculate the interest rate gap, ALCOs compare the number of assets that will reprice or mature within a specified time frame (such as one year) with the number of liabilities that will reprice or mature within the same time frame. The difference between the two is the interest rate gap. For example, suppose a bank has $10 million in assets that will reprice or mature within one year and $8 million in liabilities that will reprice or mature within one year. The interest rate gap is $2 million ($10 million – $8 million) (Chattha & Alhabshi, 2020).

Another technique that ALCOs use to measure interest rate risk is duration analysis. This involves calculating the weighted average time to maturity of the bank’s assets and liabilities. If the duration of assets is greater than the duration of liabilities, the bank is exposed to interest rate risk. To calculate the duration of assets and liabilities, ALCOs assign weights to each asset and liability based on their maturity and the number of cash flows they generate. They then multiply each weight by the time to each cash flow and sum the results. For example, suppose a bank has the following assets and liabilities with the following cash flows:

Assets:

$5 million in 2-year fixed-rate loans with annual cash flows of $1 million

$4 million in 1-year floating-rate loans with quarterly cash flows of $1 million

Liabilities:

$6 million in 2-year fixed-rate deposits with annual cash flows of $1.5 million

$3 million in 1-year floating-rate deposits with quarterly cash flows of $750,000

The weighted average time to maturity for the assets is (5/9) x 2 years + (4/9) x 1 year = 1.56 years. The weighted average time to maturity for the liabilities is (6/9) x 2 years + (3/9) x 1 year = 1.67 years. Therefore, the duration gap is 0.11 years.

These calculations provide ALCOs with important information about the bank’s exposure to interest rate risk and help them develop strategies to manage it.

1.2 Strategies Used By AlCO in Managing Interest Rate Risk and Liquidity Risk

`To manage interest rate risk, ALCOs may use various strategies, such as asset-liability matching, interest rate swaps, and options. Asset-liability matching involves matching assets’ and liabilities’ maturity and repricing characteristics to reduce interest rate risk. Interest rate swaps involve exchanging fixed-rate payments for floating-rate payments or vice versa. Options allow the bank to protect against adverse movements in interest rates. On the other hand, to manage liquidity risk, ALCOs may use techniques such as stress testing and scenario analysis. Stress testing involves simulating extreme scenarios to test the bank’s ability to withstand liquidity shocks. Scenario analysis involves examining the impact of specific events or market conditions on the bank’s liquidity position(Aljughaiman & Salama, 2019)

ALCOs play a crucial role in measuring and managing banks’ interest rates and liquidity risk. The techniques they use, such as gap and duration analysis, help identify these risks. ALCOs also use various risk management strategies, such as asset-liability matching, interest rate swaps, and options. They may use techniques such as stress testing and scenario analysis to manage liquidity risk. Overall, the effectiveness of ALCOs in managing these risks is essential for ensuring the stability and safety of the banking system(Aljughaiman & Salama, 2019)

1.3. Interest Rate and Liquidity Risk

The term “interest rate risk” refers to the possibility that interest rate shifts will hurt an investment’s value. It refers to the possibility that an investment’s value will go down due to a shift in the prevailing interest rate environment. For instance, if you own a bond that pays a fixed interest rate of 4% and interest rates rise to 5%, the value of your bond will decrease because investors can now buy new bonds that pay a higher interest rate. Investors can buy bonds with higher interest rates (Till, 2019).

On the other hand, the term “liquidity risk” refers to the danger that an investor might be unable to sell an investment quickly enough to prevent a loss or seize an opportunity. An investment cannot be sold at the current market price because there are insufficiently interested parties to do so. An investor’s portfolio is susceptible to being significantly impacted by interest rate and liquidity risks. The risk associated with interest rates can result in losses in fixed-income investments. In contrast, the risk associated with liquidity can lead to missed opportunities or sales at less-than-desirable prices. Investors ought to be aware of these dangers and take measures to mitigate them, such as diversifying their holdings and keeping a regular eye on the state of the market(Till, 2019).

2.0 Overview of The Interest Rate Risk In Banks

Interest rate risk is the possibility that interest rate fluctuations will adversely affect a bank’s earnings, capital, and balance sheet. Because they earn interest income on loans and investments and incur interest expenses on deposits and borrowings, banks are exposed to interest rate risk. Interest rate fluctuations can impact the bank’s profitability, asset and liability values, and cash flows. Interest rate risk can be caused by several factors, including fluctuations in market interest rates, the maturity and repricing frequency of assets and liabilities, interest rate derivatives, and the level and volatility of interest rates. Banks manage interest rate risk with various instruments, including interest rate swaps, futures, options, and caps(Till, 2019).

The impact of interest rate risk on banks depends on the nature and size of their assets and liabilities, which are susceptible to interest rate fluctuations. Banks with a more significant proportion of fixed-rate assets and liabilities are more susceptible to interest rate risk than those with a more significant proportion of variable-rate assets and liabilities. Likewise, banks with a more extended maturity profile are more susceptible to interest rate risk than banks with a shorter maturity profile(Till, 2019).

Regulators require banks to quantify and manage interest rate risk as part of their risk management and capital adequacy framework. Banks must conduct regular stress tests to evaluate the effect of adverse interest rate scenarios on their financial position and capital adequacy(Till, 2019).

2.1. UBS Interest Rate Risk Management

UBS is exposed to interest rate risk, which is the possibility that interest rate changes will negatively impact the bank’s financial condition(Till, 2019). To manage this risk, UBS has developed a comprehensive framework for managing interest rate risk, which includes the following components:

Interest rate risk measurement:

UBS employs various techniques, including sensitivity, value-at-risk (VaR), and scenario analysis, to measure interest rate risk. These techniques aid UBS in determining the potential impact of interest rate fluctuations on the bank’s earnings, capital, and liquidity(Till, 2019).

Interest Limits

UBS limits the interest rate risk it will assume based on its risk appetite and business strategy. These restrictions are imposed per transaction and overall portfolio basis(Till, 2019).

Hedging

To mitigate interest rate risk, UBS employs various hedging strategies, including interest rate swaps, options, and futures. These instruments manage the bank’s exposure to interest rate fluctuations and mitigate potential losses(Till, 2019).

Stress Test

UBS conducts regular stress tests to assess the potential impact of extreme changes in interest rates on the institution’s financial condition. These tests assist UBS in identifying potential weaknesses and adjusting its risk management strategies accordingly.

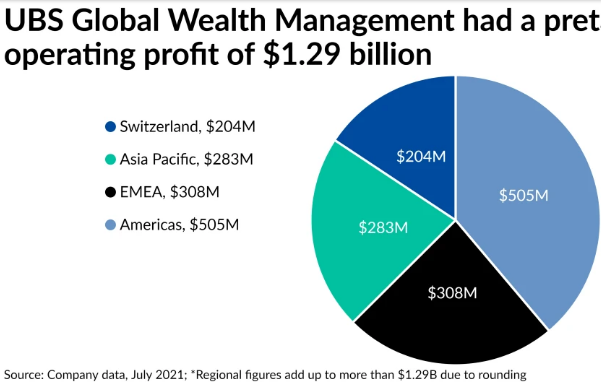

Figure Showing UBS Operating Profit

2.2 Overview of Liquidity Risk In Banks

Liquidity risk is the possibility that a bank cannot meet its obligations to depositors and other creditors as they mature without incurring unacceptable losses. The mismatch between the timing and amount of cash inflows and outflows presents this risk. Maintaining sufficient liquid assets, such as cash, Treasury bills, and other marketable securities, allows banks to manage liquidity risk(Till, 2019).

Liquidity risk can arise from various sources, such as withdrawals of deposits and loan repayments, changes in market conditions, and the loss of funding sources. In addition, contingent liabilities such as lines of credit and lending commitments can expose banks to liquidity risk. Liquidity risk management is a crucial aspect of bank risk management because it can substantially impact a bank’s financial condition and ability to meet its obligations. Banks employ several methods to manage liquidity risks, such as stress testing, asset and liability management, and contingency planning(Till, 2019).

2.3 UBS’S Liquidity Risk Management.

Effective liquidity risk management necessitates a robust framework for monitoring and managing liquidity risk and access to dependable funding sources(Till, 2019). As regulators play a crucial role in overseeing banks’ liquidity risk management practices, banks must also maintain strong relationships with them. Managing interest rate risk is an essential aspect of banking operations, and banks must continuously monitor and manage this risk to ensure their financial stability and profitability(Till, 2019).

UBS significantly emphasizes liquidity risk management to meet its financial obligations and fund its operations under expected and stressed market conditions. The company has a dedicated liquidity risk management team tasked with identifying, measuring, monitoring, and controlling the firm-wide liquidity risk. This team is accountable for establishing and implementing liquidity risk policies, procedures, controls, and reports to senior management and the board of directors. UBS conducts routine stress tests to evaluate its ability to withstand liquidity shocks under various circumstances(Till, 2019).

The company also seeks to maintain a diverse funding base from various sources, such as deposits, debt securities, and wholesale funding markets. UBS has a contingency funding plan that outlines the steps it would take to ensure liquidity access in the event of a severe liquidity shock. In addition, UBS’s robust collateral management framework enables it to efficiently and effectively manage collateral pledged by counterparties as security for loans and other transactions. These liquidity risk management practices help to ensure that UBS maintains a solid liquidity position and can meet its financial obligations on time under various market conditions(Till, 2019).

3.0. Operational Risk and Fraud Risk

Organizations face two sorts of risks: operational risk and fraud risk. While they are related, they are not the same type of risk. The risk of loss caused by inadequate or failing internal processes, people, systems, and external events is referred to as operational risk. Human error, system failures, technological changes, legislative changes, or natural calamities can contribute to operational risk. Financial losses, reputational harm, legal responsibilities, and other consequences can all emerge from operational risk(Till, 2019).

3.1 Fraud Risk

Fraud risk, on the other hand, refers to the risk of financial loss due to intentional fraud or misrepresentation(Till, 2019). Insider fraud, identity theft, cybercrime, financial statement fraud, bribery, and corruption are all examples of fraud risk. Financial losses, reputational damage, legal responsibilities, and other consequences can all result from fraud. While operational and fraud risks share some characteristics, they are fundamentally different. Unintentional errors or omissions are connected with operational risk, whereas intended dishonesty is related to fraud risk. To protect themselves against potential losses and liabilities, organizations must have procedures to manage operational and fraud risks (Till, 2019).

3.2. UBS’S Operational Risk Management.

UBS places a high priority on operational risk management to ensure the safety and stability of its operations(Born, 2022). UBS has built a comprehensive framework to manage operational risk, which comprises the following elements:

Governance and Oversight:

UBS’s board of directors, senior management, and business heads oversee and manage operational risk across the enterprise (Buchetti & Santoni, 2022).UBS has also established a specialized operational risk management division that is in charge of defining rules, standards, and processes, as well as monitoring and reporting on operational risk(Born, 2022)

Risk Identification and Assessment:

UBS uses various tools and procedures to identify and assess operational risk, including scenario analysis, risk control self-assessments, and critical indicators. The outcomes of these assessments are utilized to prioritize and manage operational risks(Born, 2022).

Risk Mitigation and Control:

To manage operational risk, UBS has implemented various controls and processes, including segregation of duties, access controls, and automated monitoring systems. UBS also has a robust business continuity strategy to ensure vital operations can continue during a disruption(Born, 2022).

Monitoring and Reporting:

UBS monitors and reports on operational risk regularly to identify and handle risks successfully. UBS’s operational risk management unit delivers regular reports to senior management and the board of directors, outlining areas of concern and progress in controlling operational risk(Born, 2022).

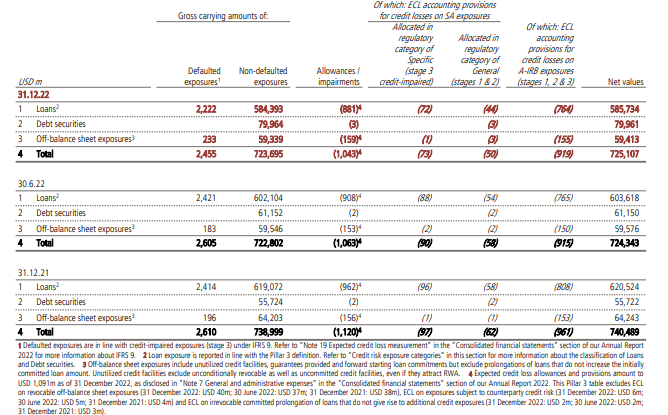

Table Showing Default and Non-Default Loans for UBS

3.3. UBS’S Fraud Risk Management

Being a financial institution, UBS is vulnerable to fraud threats such as money laundering, insider trading, and fraudulent actions performed by employees, clients, and third-party service providers.UBS has established a comprehensive fraud risk management strategy that comprises the following components to handle various fraud risks:

Risk Assessment:

Regularly, UBS undertakes a detailed evaluation of fraud risks to identify and prioritize the areas of the organization that are most vulnerable to fraud. This evaluation considers the organization’s commercial activities, geographic locations, and the types of clients and transactions it deals with (Buchetti & Santoni, 2022).

Policies and Procedures:

UBS has established policies and processes to prevent, identify, and respond to fraud. These policies and procedures address money laundering, bribery and corruption, insider trading, and conflicts of interest(Buchetti & Santoni, 2022).

Control Activities:

To manage fraud risks, UBS has adopted various control activities, including internal controls, segregation of roles, and monitoring and reporting procedures. These controls are examined and modified regularly to guarantee their efficacy.UBS provides its staff with training and awareness initiatives to ensure they understand the importance of fraud prevention and detection and the policies and processes in place to manage fraud risks (Grimwade, 2023).

Incident Management:

UBS has built a structured incident management framework to investigate and respond to fraud situations. This method contains protocols for reporting, investigating, and escalating issues and remedial and preventative actions(Shakya & Smys, 2021).

.Governance and Oversight:

To oversee its fraud risk management framework, UBS has built a governance structure that includes a defined fraud risk management function, executive oversight, and regular reporting to the board of directors(Shakya & Smys, 2021)

4.0 UBS, 3 PILLAR Report For 31/12/2022,

The 3 Pillar Report is a disclosure framework that promotes market discipline through transparency. It requires banks to provide detailed information about their risk, capital, and liquidity positions and their exposure to various types of risks. Therefore, this section explores the 3 Pillar report for the UBS bank. The report is divided into three sections, each of which focuses on one of the three pillars of the framework as discussed below:

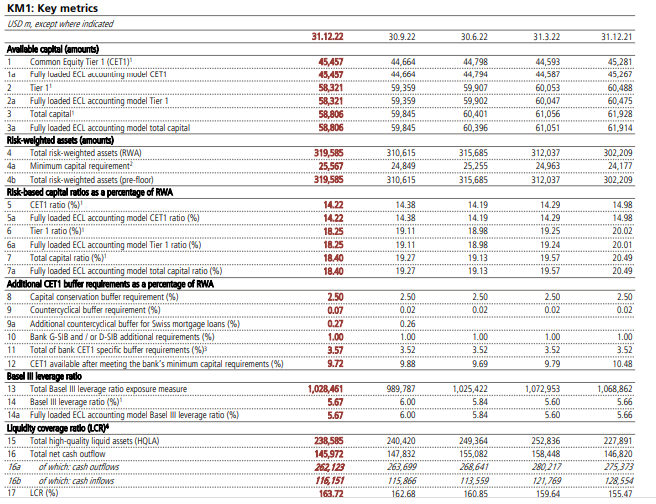

Pillar 1: Minimum Capital Requirements

The Pillar 1 section of the report provides detailed information on UBS’s minimum capital requirements. The report shows that UBS’s total capital ratio was 16.5%, above the minimum regulatory requirement of 12.5%. The report also provides information on the various components of UBS’s capital, such as standard equity tier 1 capital, additional tier 1 capital, and tier 2 capital. It shows that UBS’s standard equity tier 1 capital ratio was 14.0%, well above the regulatory requirement of 7.0%. This indicates that UBS has sufficient capital to absorb any potential losses.

The Pillar 1 section of the report also provides information on UBS’s risk-weighted assets (RWAs), which are used to calculate the minimum capital requirements. It shows that UBS’s RWAs were CHF 191.2 billion, a decrease of CHF 6.8 billion from the previous year. This decrease was mainly due to lower RWAs in the credit risk and market risk categories.

Pillar 2: Supervisory Review Process

The Pillar 2 section of the report provides information on UBS’s supervisory review process (SRP), which regulators use to assess UBS’s overall risk profile and determine whether additional capital buffers are needed. The report shows that UBS’s SRP is based on the Internal Capital Adequacy Assessment Process (ICAAP), which is designed to identify and manage risks specific to UBS’s business.

The report provides information on UBS’s risk management framework, including its risk appetite, limits, and governance structure. It also details UBS’s stress testing methodology, which assesses the impact of various macroeconomic scenarios on UBS’s capital and liquidity positions.

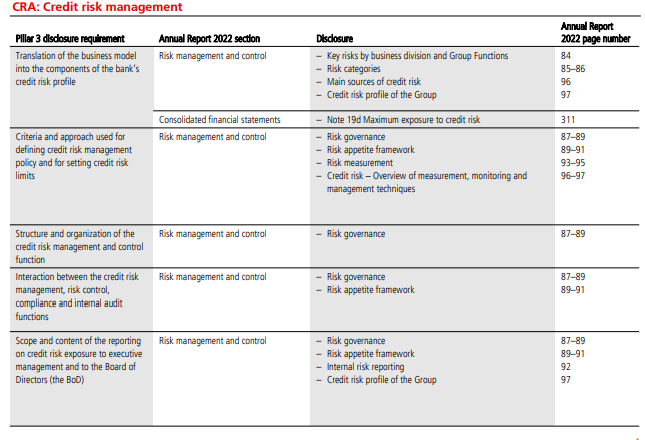

Pillar 3: Market Discipline

The Pillar 3 section of the report provides information intended to promote market discipline by increasing transparency. The report provides detailed information on UBS’s risk exposures, including its credit risk, market risk, and operational risk exposures. It also provides information on UBS’s liquidity position, including its liquidity coverage ratio and net stable funding ratio. The report also includes information on UBS’s environmental, social, and governance (ESG) performance. It details UBS’s ESG strategy, governance structure, and performance metrics. The report shows that UBS has made progress in reducing its carbon footprint and increasing its investment in sustainable finance.

In summary, UBS’s 3 Pillar Report provides a comprehensive view of the bank’s risk, capital, and liquidity positions and its ESG performance. The report demonstrates UBS’s commitment to transparency and provides investors with the information they need to make informed decisions about their investments in the bank.

References

Aljughaiman, A. A., & Salama, A. (2019). Do banks effectively manage their risks? The role of risk governance in the MENA region. Journal of Accounting and Public Policy, 38(5), 106680.

Born, B. (2022). Operational risk management.

Buchetti, B., & Santoni, A. (2022). Why Corporate Governance Matters: Spectacular Defaults. In Corporate Governance in the Banking Sector: Theory, Supervision, ESG and Real Banking Failures (pp. 137-163). Cham: Springer International Publishing.

Chattha, J. A., & Alhabshi, S. M. (2020). Benchmark rate risk, duration gap and stress testing in dual banking systems. Pacific-Basin Finance Journal, 62, 101063.

Grimwade, M. (2023). Approaches for quantifying the financial impacts of reputational damage from climate change. Journal of Risk Management in Financial Institutions, 16(2), 138–157.

Shakya, S., & Smys, S. (2021). Big data analytics for improved risk management and customer segregation in banking applications. Journal of ISMAC, 3(3), 235–249.

Till, M. H. (2019). UBS Risk Premia Conference New York.

Appendixes

UBS Key Risk Management Metrics

write

write