The law of demand and supply in an economy outlines that an increase in the price of goods and services in the economy causes a decline in the demand for goods and services by consumers. An economy is stable when the supply is equal to the demand at a point of equilibrium (Kurniawati 5). Fluctuations in the demand and supply of goods and services in the economy can lead to market failure during business recession when the economy is crippling as a result of less economic activities with less consumption. The circular flow of income illustrates the movement of income between households, business firms, and the government) (Inoue 6). The government collects taxes from business incomes, realized capital gains, corporate income tax, taxes imposed on payroll, contributions to social security, tax on properties, value added tax on goods and services. High taxation increases the cost of production which raises the selling price for goods and services hence reducing the disposable income for individuals to spend in the market.

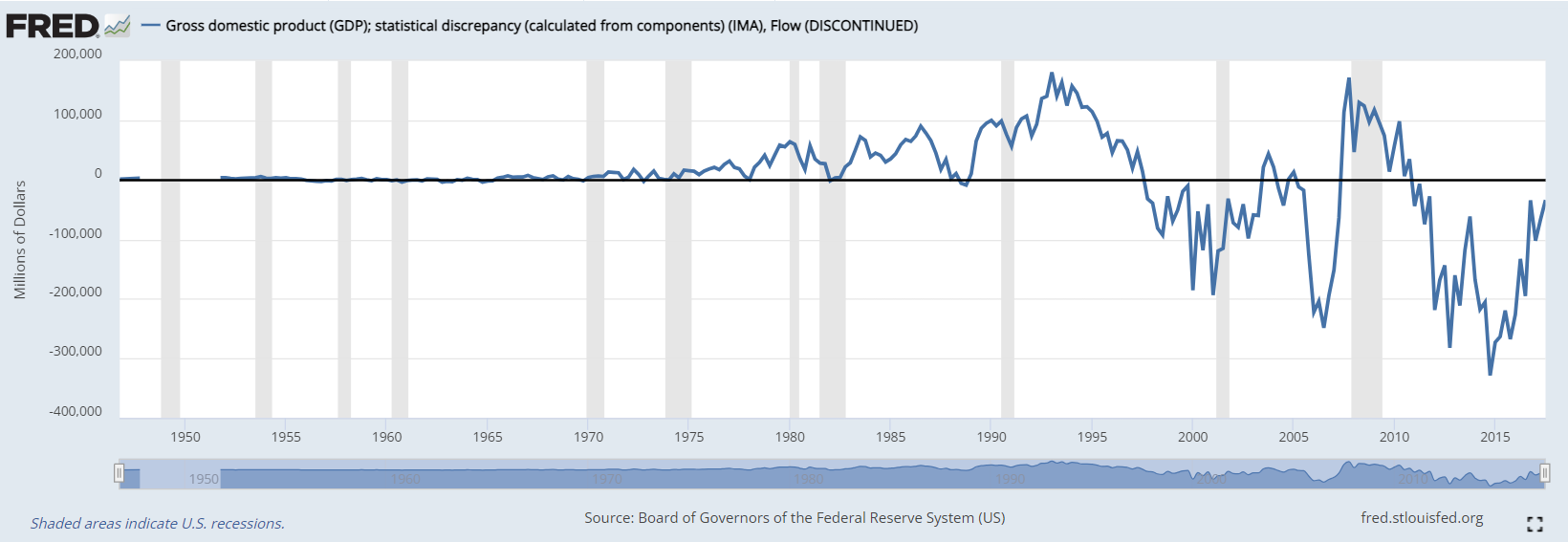

The government raises revenues through the imposition of taxation on businesses and individuals. The rise in taxation for business organizations and individuals reduces the ability for businesses to increase the diversification of the revenue portfolio while the middle-class group who are major contributors to the economy are restricted to spending. An increase in taxation results in a rise in the cost of production. The cost of labour, raw materials, land, and capital increases when taxes increase. The business reduces the total production as a result of high costs incurred in the production process. An increase in taxation reduces the company’s profits. Consumption for the goods and services declines which results in deadweight loss (Sanyal et al. 7). The difference between the buyer’s valuation and the selling price of a product results in loss. The graph below illustrates economic changes during a business cycle changes.

An increase in taxation affects the demand and supply of goods and services in the market. When the government increases taxes, the business incurs more costs in acquiring the inputs required to generate finished products. When operational costs rise, the profits generated reduce. When profits decline, suppliers get discouraged from producing goods and supplying them to the market. In some instances, the suppliers pass the tax to the final consumer. The selling price increases causing a decrease in the quantity demanded in the market. In a perfectly competitive market, changes and shifts in the quantity supplied and quantity demanded in the market can lead to market failure (Kurniawati 8). Some small businesses can get pushed out of the market as a result of high costs of operations.

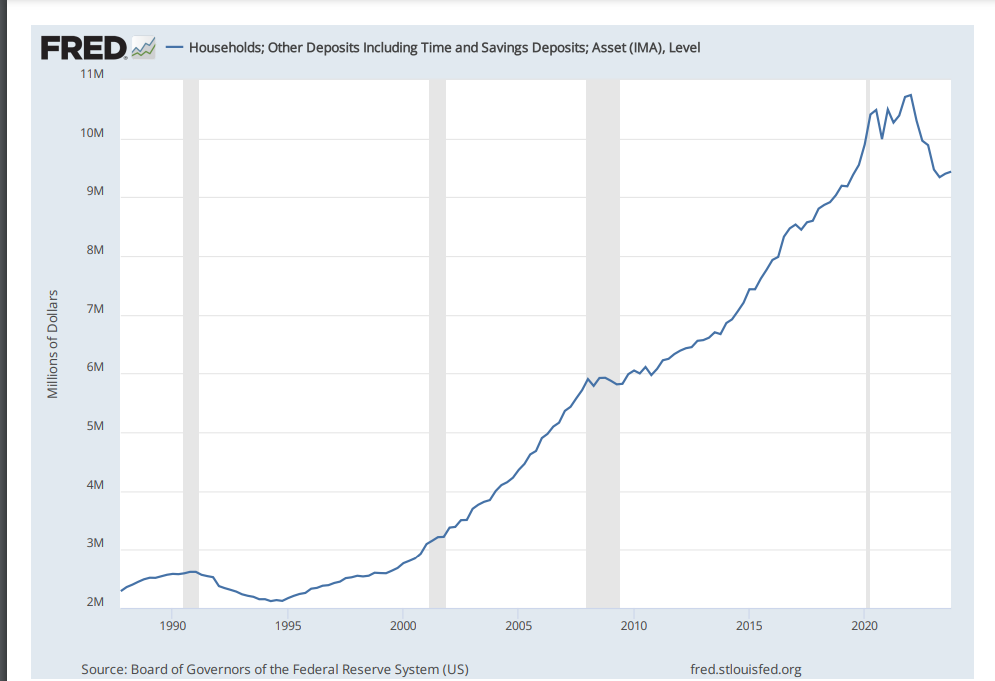

Reduced Savings and consumption from households. For the demand to be complete, the potential customer should be willing and able to buy a desired product. If the customer is not able to purchase a product, then the demand reduces (Al-tarawih 3). Taxation reduces the amount of disposable income which is essential in buying goods and services. Consumers try to adjust between savings and consumption. For savings to remain constant, the consumer is required to reduce consumption or if consumption remains constant, the consumer will be compelled to reduce the savings (Kurniawati 7). Changes in taxation cause an inverse proportion between savings and consumption.

Tax increase causes inefficiency in the market. A rise in taxation reduces the aggregate demand for goods and services in the market. When the demand reduces, customer spending also declines in the market. A decrease in economic activities in the economy results in unemployment, recession, low output, and the national GDP of the country reduces (Dean 6). The government is forced to intervene to regulate the economy. Shrinking of the supply curve causes deficits in the demand and supply of goods and services in the economy. When the government increases spending, people save, increase consumption, and invest as illustrated in the graph below.

Introduction of subsidies and incentives to encourage economic activities in the market. Inadequate aggregate demand and supply causes inefficiencies in the market (Sanyal et al. 7). The government will be compelled to introduce subsidies and incentives to embrace the production of goods and services in the economy. Incentives and subsidies can include tax holidays, employee recognition, direct support of businesses through the reduction of corporate tax rates, and grants for small-scale entrepreneurs. Some businesses respond by increasing the salaries of their employees. An increase in salaries motivates the employees to cope with inflation in the market which affects the cost of inputs.

Increase in government expenditure. Government expenditure raises the aggregate demand. When the aggregate demand increases, the level of economic activities in the economy increases. An increase in the level of economic activities in the market increases the consumption of goods and services (Sanyal et al. 5). Government spending increases the level of economic activities in the market. The government can build essential infrastructure, for instance, schools, bridges, roads, and health sectors which create employment in the economy. People employed in production activities earn income which they spend to increase the aggregate demand in the market (Sanyal et al. 6). Government spending sustains the employment rate in the economy and increases capital circulation in the economy. Income earned through government spending is used to regulate consumption, production, investment, and private savings in the economy.

In summary, consumption and production are essential elements in economic growth and development. An increase in taxation results in a reduction of aggregate demand and aggregate supply of goods and services which causes market inefficiencies in the market. Taxes raise the cost of inputs which are essential in the production of goods and services in the economy. In addition, an increase in taxation reduces the amount of disposable income for the middle class who play a critical role in economic growth and development.

Work Cited

Al-tarawneh, Alaaeddin, Mohammed Khataybeh, and Sami Alkhawaldeh. “Impact of taxation on economic growth in an emerging country.” International Journal of Business and Economics Research 9.2 (2020): 73-77.

Dean, Erik, et al. “Demand, Supply, and Equilibrium in Markets for Goods and Services.” Principles of Economics: Scarcity and Social Provisioning (2nd Ed.) (2020).

Inoua, Sabiou, and Vernon Smith. “The classical theory of supply and demand.” arXiv preprint arXiv: 2307.00413 (2023).

Kurniawati, Hasni Dyah. “Supply and Demand in Microeconomics.”

Sanyal, Rajib Kumar, Nirmalya Mukhopadhyay, and Amrisha Mitra. “Demand and supply cross-explanation and their magnitude in changing open market economy.” International Journal of Scientific Research 12.3 (2021).

write

write