Every country has a constitutional, statutory body responsible for managing its money supply and economy. The Federal Reserve Bank of the United States of America has the mandate of managing the money supply in the nation and curbing economic injuries that may be inflicted on the citizens of the US. The Federal Reserve Bank uses three variant tools, open market operations, reserve requirements, and the discount rate, to achieve a stable money supply and economy. Consequently, in contrast to the operations in the USA, China relies on the People’s Bank of China (PBOC) to control the supply of its money and the economy at large. Their approach is the open market economy or free market, even as the body retains tight control of the economy. The country’s economy relies on the manufacturing sector, which translates to high export to other countries, attracting substantial foreign forex. To manage the quantity of money being supplied within its borders, China places stringent measures on foreign forex rates and the quantity of money that can be printed at any given time. Equally, applying and shifting the reserve ratio at any interval and the acceptable discount rates also helps the country, through its PBOC, to control the supply of money within its territory. This essay analyzes what contributes majorly to the money supply in the US and China and, therefore, the economy established. Equally, it outlines how the money supply contributors affect the economy of the countries and the responsible entities that aid in the same. Although the US and China have different economic models, some similarities exist between the two models.

The US Economy

According to the Federal Reserve Bank of the USA, most Americans feel like something other than the economy is working for them. This phenomenon has affected majorly those individuals who are considered to be vulnerable in various places within the country. The poor economy results from underperformance by various macroeconomics, including investment and capacity utilization. The outcome of this is an economy that does not achieve its maximum potential and threshold, as was established by Mccormack and Novello (2019). Irrespective of a pay increase, the workforce still needs help to afford necessities. There is still the persistence of debts and financial burdens for most households.

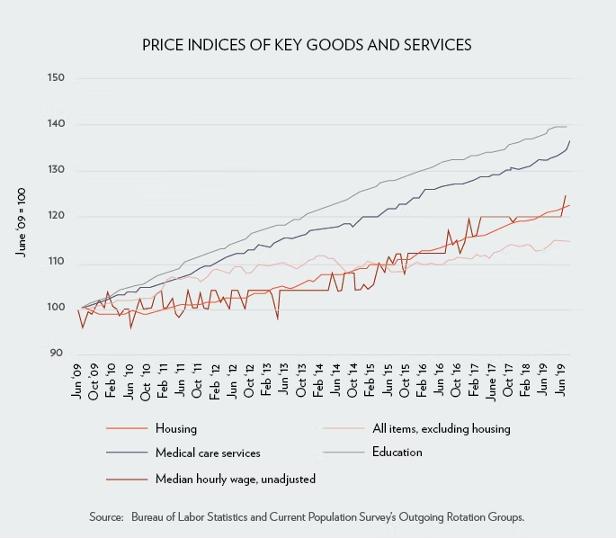

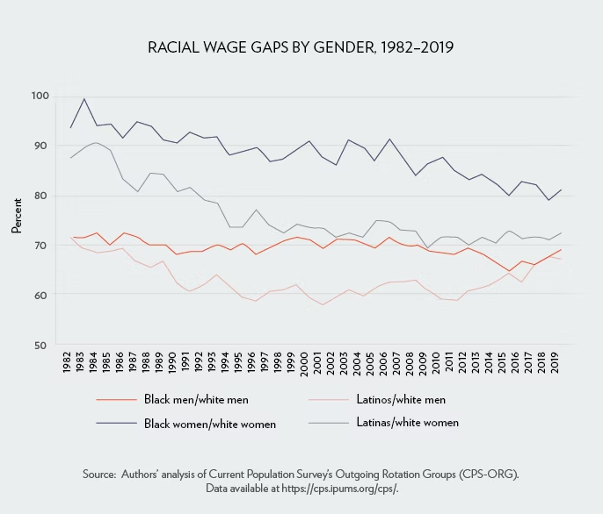

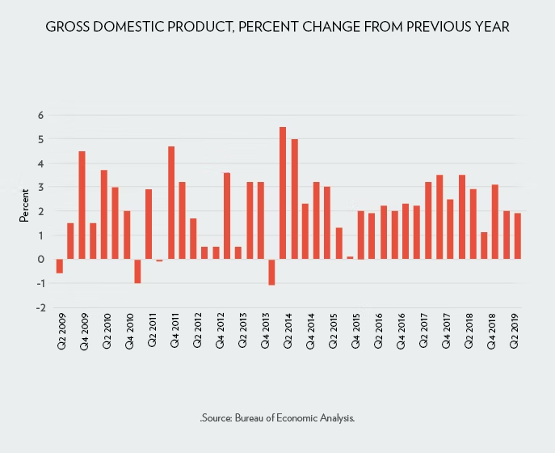

The US economy is also held hostage by the weak wage growth associated with the US consumer. Further, the poor US economy can be attributed to the poorly targeted fiscal stimulus currently needing to be fixed. Moreover, the job act of 2017 and the tax cuts measures initiated by the country are also contributing factors to the poor state of the country’s economy. Generally, the American populace continues to have stagnating wages and incomes. The working population continually struggles to maintain the same living standards as before. Still, the most affected are those with young children to care for, as illustrated in Figs. 1 and 2. Further, the USA still has a considerable wage gap difference between whites and non-whites, as shown in Fig. 3. The country’s GDP is at its lowest, associated with a slow overall growth rate. This scenario has been observed since 2017, when both the Tax Cuts and Job Act were implemented, as shown in Fig. 4.

The USA recognizes that its current economy must be secured from further oblivion. The Federal Reserve Bank has advised that for this to be realized then, there exists a need to increase taxes on some taxable amount that is paid to the workforce while at the same time recruiting people from the marginalized ecosystems into the labor market. This will only be achieved if better pro-worker policies are implemented. These policies should be able to lift workers’ pay and optimize the established work-related conditions. Moreover, policies targeting the interest of marginalized and vulnerable communities must be implemented to guarantee jobs and the security of the same jobs. The country can also reinforce those policies that govern the role of public investment and how the established governments need to spend. If implemented, the country can reserve its money and raise more for the economy. The country’s stability can then be attained, including implementing climate change mitigation measures and maintaining a secure and peaceful nation and even beyond.

The China Economy

China, on the other hand, is a capitalist country and is currently considered an upper-middle-income country. The economic growth and, therefore, money circulation and supply are attributed to the numerous investments within and without the country and the manufacturing sector they currently boast about. However, the country’s low manufacturing capability and exports have led to economic, social, and environmental imbalances. To help leverage itself from these economic turmoils, China had to redesign its policies related to the economy by shifting from manufacturing to high-value services, minimizing investment and capitalizing on consumption, and reducing carbon emissions (Every CRS Report, 2019). China’s economy before 1980 depended on policies that made it poorer, centrally controlled, inefficient, stagnant, and out of touch with global reality. However, in 1980, China began free-market reforms and foreign trade, an investment policy that has seen it scale the ladder and be among the world’s fastest-growing economies. This phenomenon has assisted China in doubling its GDP after every eight years, therefore, being able to offer direct employment to an estimated total population of 800 million people across the globe.

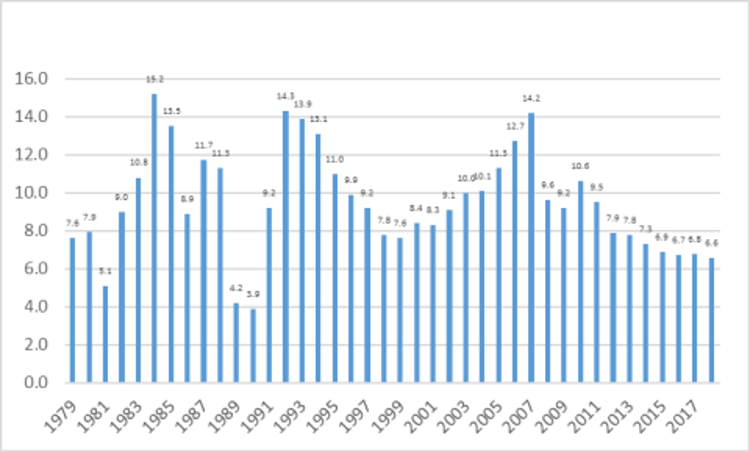

China is currently considered a superpower in the manufacturing and merchandise trade and a large holder of various foreign exchange reserves. With these developments, China has attracted partnerships from some of the world’s best economies, including the USA. However, as shown in Fig. 5, the low GDP has made the PBOC enact a raft of measures. These measures are primed less on fixed investment and exporting and capitalizing on more private consumption, services, and innovation to drive economic growth. Further, innovation and invention have been factored majorly by the Chinese government as a top priority in its economic planning. Based on the economic growth experienced in China and its innovative and inventive nature, the country is currently involved in various economic policies and projects across the globe, with Africa being its primary interest and partner. China uses Belt and Road Initiative (BRI) as a strategy to finance some of the vast infrastructural projects in Africa, Europe, Asia, and more destinations on loans that pay better to their economy. This has helped strengthen China’s economy and position among the world’s superpowers.

Conclusion

The two countries are the primary drivers of the world’s economy, with China being the epicenter of all foreign trade and manufacturing of common and high-valued goods. China has also perfected providing loan facilities to developing countries, expanding its infrastructural base. These loans come with terms that help China scale its economic standards within the country and globally. On the other hand, the US, which controls the money supply to China based on the high dollar rate, relies on China for products into their perceived markets, offering bilateral trade. The two countries, through their respective central banks, are keen on leveraging the living standards of their populace and as well as growing the economy even to higher heights.

References

Bureau of Economic Analysis (2019, Oct. 30). Gross domestic product, third quarter 2019 (advance estimate). https://www.bea.gov/system/files/2019-10/gdp3q19_adv_0.pdf

Every CRS Report. (2019, June 25). China’s economic rise: History, trends, challenges, and implications for the United States. https://www.everycrsreport.com/reports/RL33534.html.

Mccormack, M., & Novello, A. (2019). The true state of the US economy. https://tcf.org/content/report/true-state-u-s-economy/?gclid=CjwKCAjw5dqgBhBNEiwA7PryaFykCFLE7sWdQrtc3t2tsFpuYT9YkVlpxMf4q04vv1zf8IAhqkJwcRoCQjEQAvD_BwE

Semega, J Kollar, M, Creamer, J & Mohanty, A. (2019, Sept. 10). Income and poverty in the United States: 2018. https://www.census.gov/library/publications/2019/demo/p60-266.html.

write

write