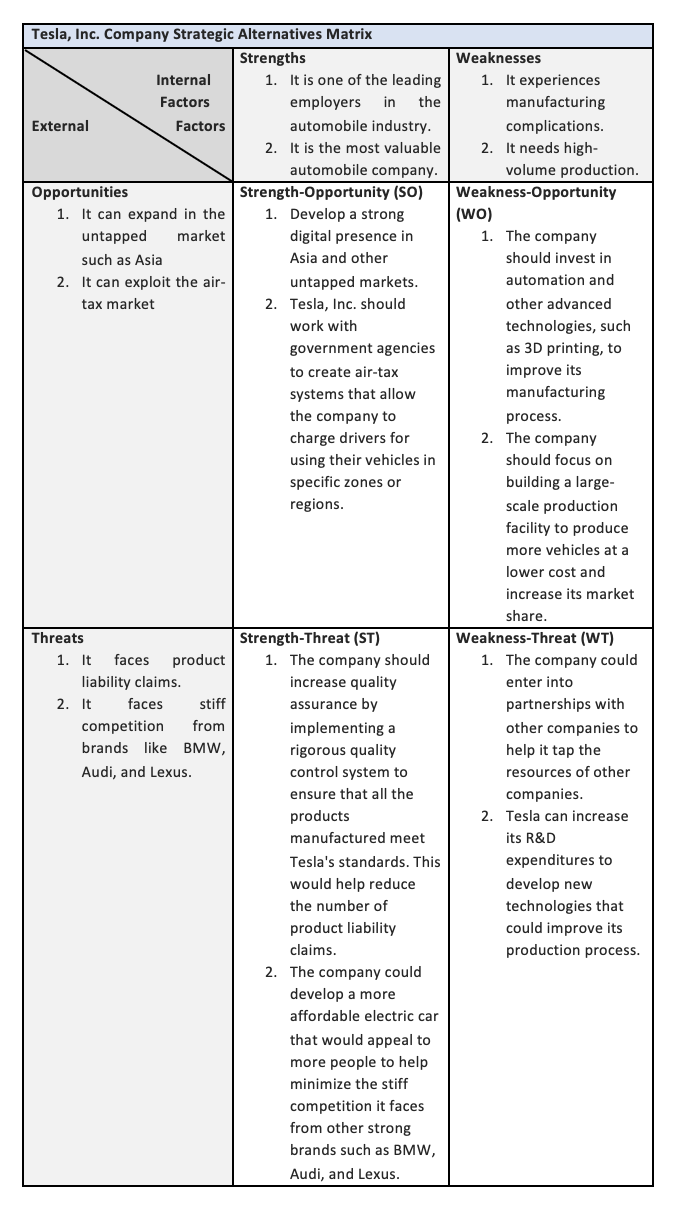

Strategic Alternatives Matrix

Introduction

Tesla, Inc. is a forerunner in the global automotive and energy storage industries, aiming to accelerate the world’s transition to sustainable energy. Since its inception in 2003, the company has expanded rapidly and operates across multiple industries. Tesla provides customers with a comprehensive range of electric vehicles, energy storage products, and services (Ganga Bhavani, 2018). The company’s mission is to create a sustainable future for everyone. Tesla’s strategic options include expanding the company through acquisitions and new markets, developing new products and services, or focusing on cost reduction. The company’s strengths include its leadership in electric vehicles, energy storage, and autonomous driving, its ability to ramp up the production of new products quickly, and its large customer base (Gupta, 2019). However, Tesla faces some challenges, including competition from traditional automakers, scaling production difficulties, and uncertainty about the future of renewable energy. Given these challenges, Tesla is considering a range of strategic options, including developing new products and services, expanding into new markets, and focusing on cost reduction. The company is looking into potential automotive and energy storage acquisitions. Besides that, Tesla is continuing to invest in self-driving technology, with plans to deploy 100 million self-driving cars by 2024 (Someka, 2020).

Strength – Opportunity (SO) Strategic Actions

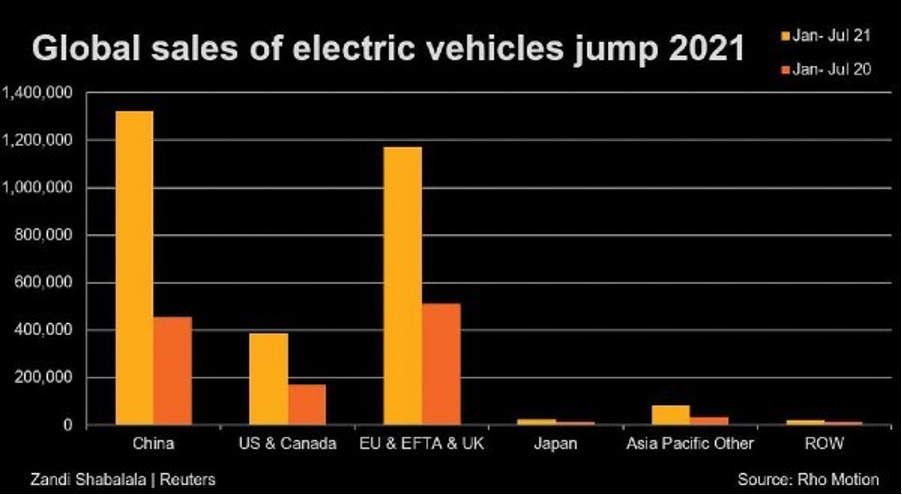

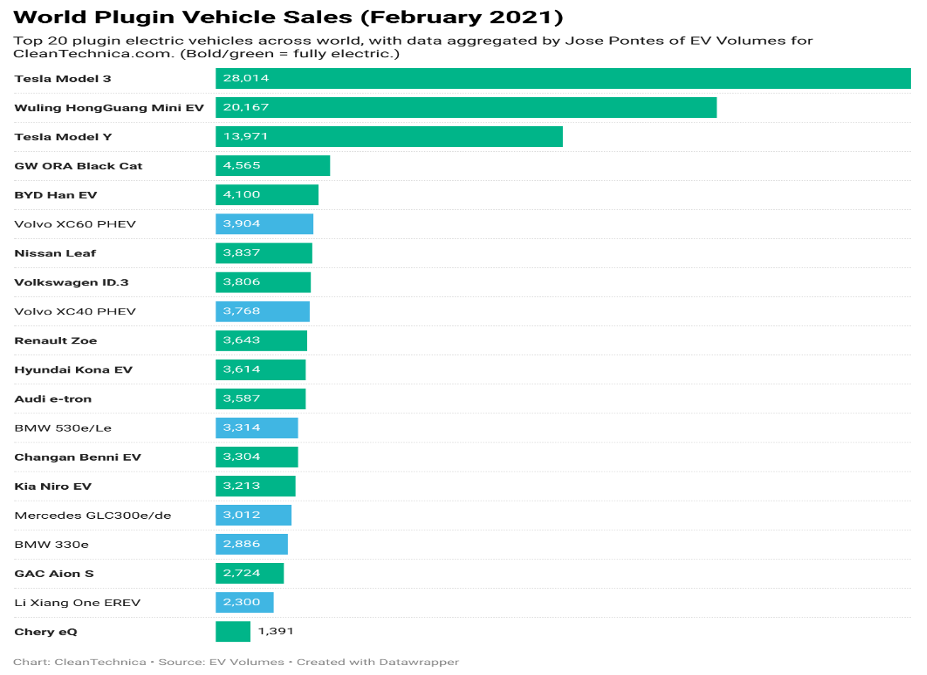

Tesla should focus on expanding its digital presence in Asia and other underserved markets. For example, the company could invest in marketing and advertising campaigns in these areas and create new software and services tailored to these markets. It could increase its market share in these regions by optimizing its website and social media platforms. China and India are rapidly growing economies with many potential customers. Tesla can increase its profits and attract new investors by catering to this market. In addition, the company should continue developing new vehicle models more suitable for the Asian market. This would attract more customers and increase Tesla’s market share.

Another area where Tesla should invest is in air-tax systems. The company could collaborate with government agencies to develop systems that charge drivers for using their vehicles in specific zones or regions. This would allow Tesla to earn more money while reducing congestion and pollution. It would also encourage drivers to use public transportation or car sharing instead of driving their vehicles. This move would assist Tesla in increasing revenue and maintaining its market competitiveness. These two strategic actions would assist Tesla in meeting its SO objectives in the long run.

Weaknesses – Opportunity (WO Strategic Actions)

Automation and cutting-edge technologies can help Tesla reduce production costs and increase efficiency. Automation can help reduce labor costs and increase production consistency, while 3D printing can help the company produce vehicles faster and at a lower cost. For example, 3D printing could be used to create parts for vehicles that are currently not manufactured in this manner, such as the battery pack. Furthermore, automation could help Tesla reduce errors and improve quality control. Another advantage of automating production is that it allows the company to scale up its operations rapidly. This initiative would enable Tesla to enter new markets while creating new jobs.

Another strategic action strategy requires building a large-scale manufacturing facility, which would allow Tesla to produce more vehicles at a lower cost, increasing its market share. This investment would also enable the company to reduce its reliance on third-party suppliers while increasing its control over the manufacturing process. Tesla has already started in this direction by investing in automation and advanced technologies (Someka, 2020). These investments will likely continue because they will aid the company’s overall productivity and competitiveness.

Strength – Threat (ST) Strategic Actions

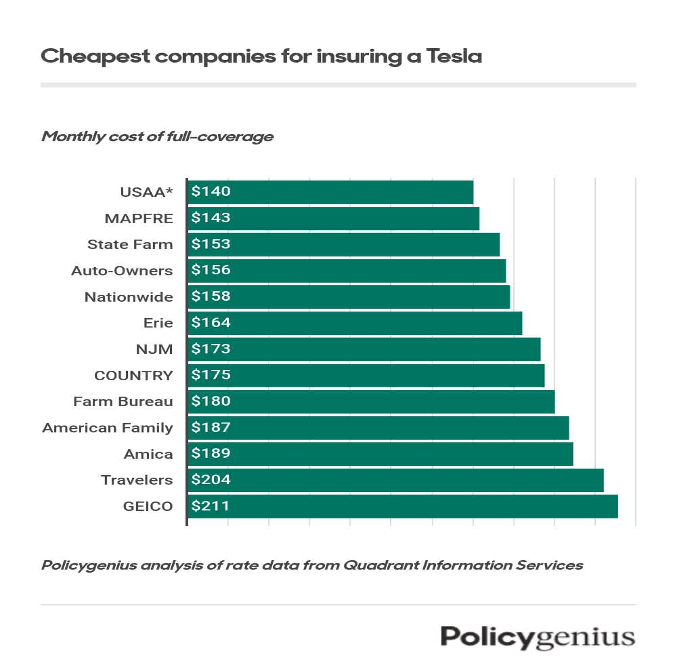

Tesla’s implementation of a strict quality control system is a strength threat (WT). Quality assurance is critical in any business, especially for Tesla, which produces some of the world’s most advanced and cutting-edge technologies (Furrier, 2020). The company could reduce the number of product liability claims by implementing a system that ensures all products meet Tesla’s standards. This strategy would protect the company financially and ensure the highest quality of its products. A strict quality control system could also improve Tesla’s image and reputation, benefiting the company’s overall success.

Designing a more affordable electric vehicle that appeals to a wider range of people could help Tesla reduce its stiff competition from other strong brands such as BMW, Audi, and Lexus. This strategy would allow Tesla to maintain its market share while staying ahead of the competition. Currently, most Tesla customers are wealthy individuals who can afford to buy a more expensive model. However, if Tesla were to develop a lower-priced electric car that was as powerful as, if not more powerful than, its more expensive models, it would be able to appeal to a broader audience and reduce its reliance on high-end buyers. However, to reduce the cost of the car, Tesla would likely have to compromise features and quality. This move could jeopardize its reputation and market position. Furthermore, less expensive electric vehicles are frequently less reliable and more difficult to maintain than more expensive models, resulting in a drop in sales and leaving Tesla vulnerable to competition from other brands.

Weakness – Threat (WT) Strategic Actions

Entering into partnerships with other companies to help tap into their resources could give Tesla access to new markets, technologies, and resources. The company would then be able to broaden its market reach and compete more effectively. This weakness-threat, however, may result in potential conflicts of interest. For example, if Tesla partnered with a company with interests in Tesla’s main competitor, General Motors, a conflict of interest could arise. If Tesla chose to collaborate with a company with no competing interests, this would be considered more valuable.

Another strategy for mitigating Tesla’s production challenges could be to increase R&D spending to develop new technologies that could improve its manufacturing process. Tesla has made significant progress in some key areas, such as vehicle automation and battery technology, but there are many other areas where it could improve. This could include the development of new manufacturing processes or the expansion of existing ones. Increased R&D spending would also allow Tesla to compete more effectively against more established rivals such as General Motors and Ford, both of which invest heavily in R&D. Increasing R&D expenditures, on the other hand, may not be a viable long-term solution to Tesla’s production challenges, as it could be costly and take years to bear fruit. If Tesla needs to improve its manufacturing process quickly, its competitors may catch up or even overtake it in the market. This would result in significant financial losses for the company, which could harm its stock price.

Comparison of Strategic Actions

Some potential strategic alternatives for Tesla, Inc. that may be superior to others include creating a strong digital presence in Asia and other underserved markets. Second, the company could collaborate with government agencies to develop air-tax systems that would allow the company to charge drivers for using their vehicles in specific zones or regions. Finally, the company could partner with other companies to tap into their resources. Each option has advantages and disadvantages that must be considered before deciding. Developing a strong digital presence in Asia, for example, could give the company a competitive advantage, but it could also increase the company’s expenses. Air-tax systems could help Tesla cut costs and generate revenue, but they may be unpopular with drivers. Partnerships may provide the company access to new technologies and resources, but they may also be difficult to negotiate and result in insignificant benefits. The company’s specific situation and needs will likely determine the best strategy for Tesla, Inc.

Conclusion and Final Three Recommendations

Tesla, Inc. has a strong presence in the automotive and energy storage industries and is well-positioned to capitalize on the rising demand for electric automobiles. However, the company confronts tremendous competition from traditional automakers and inventive startups, and to remain competitive, it may need to focus on new product lines or partnerships. The following recommendations could help Tesla, Inc. improve its business performance: First, Tesla should focus on growing its automotive presence by developing additional models and collaborations with existing automakers. It should continue to focus on extending its energy storage options through new product development and utility collaborations. Finally, Tesla could look at new product lines like self-driving vehicles and electric trucks. These advancements may aid the company’s automotive and energy storage competitiveness.

References

Gupta, S. K. (2019, June 30). Tesla SWOT Analysis (2023). Business Strategy Hub. https://bstrategyhub.com/tesla-swot-analysis/

Ganga Bhavani. (2018). Financial Statements Analysis on Tesla. Academy of Accounting and Financial Studies Journal, 22(6), 0–314. https://www.abacademies.org/articles/financial-statements-analysis-on-tesla-7689.html

Someka. (2020, July 21). Tesla SWOT Analysis – Strategic Analysis of Tesla Motors. Someka. https://www.someka.net/blog/tesla-swot-analysis/

Furrier, A. (2020, April 21). Tesla: Business Model and Strategic Analysis – Alec Furrier – Medium. Medium; Medium. https://alecfurrier.medium.com/tesla-business-model-strategic-analysis-c7d00bdc0339

Kumar, A., & Jadon, J. K. S. (2021). A review of electric vehicles and their future. South Asian Journal of Marketing & Management Research, 11(10), 85-91.

Kulustayeva, A., Jondelbayeva, A., Nurmagambetova, A., Dossayeva, A., & Bikteubayeva, A. (2020). Financial data reporting analysis of the factors influencing profitability for insurance companies. Entrepreneurship and Sustainability Issues, 7(3), 2394.

Tesla: vehicle sales by quarter 2022 | Statista. (2022). Statista; Statista. https://www.statista.com/statistics/502208/tesla-quarterly-vehicle-deliveries/

write

write