The growing role of the RMB in global trade that follows from China’s efforts to internationalize its national currency is economically relevant. It may be examined from the perspective of macroeconomic models such as the ones mentioned above. In the context of RMB transcriptions for internationalization, which in turn generates more trade in RMB, the demand for RMB follows. Accordingly, some key variables in monetary policies, like interest rates and exchange rates, will be affected. This part focuses on the effects of the currency RMB higher in purchasing power on the economy and considers two transmission mechanisms – the interest rate channel and the capital price channel.

The interest rate transmission channel established above highlights a more direct link between the growing number of RMB trade settlements and shifts in interest rates. It is critical to go into more detail regarding the manner in which interest rate fluctuations affect the different parts of the economy. In the wake of the continuous RMB trade settlement influx, the rate of interest in domestic investments and the spending behavior of consumers decreases, too. With borrowing rates dropping, more consumers may end up spending on goods and services in this category, which will result in a general economic rise. On the other hand, the extent of the interest rate channel’s influence on investment decisions needs to be analyzed. Lower interest rates encourage capital-intensive industries to be more efficient, intensify technological application, and promote innovations. This is expected to be the mainstay of domestic economic growth and enable the country’s industries to compete more forcefully globally. Therefore, this interest rate transmission effect is of great importance for the economy at large, its productivity, and the overall level of output.

Then, the capital price transmission effect through the mutual relationship between the yuan exchange rate and capital flows becomes the center of our attention. Since the exchange rate fluctuations can significantly affect the volume, intensity, and choice of destination of FDI, an in-depth study of that role is indispensable. Euro clearance might draw in the rise of FDI, a phenomenon arising from the openings provided by the growing global acceptance and availability of the RMB as a means of international trade settlements. The infusion of foreign capital is not a mono-dimensional phenomenon; it affects more than just the capital markets. It can variously help or hurt domestic industries based on their production capacity and competitive edge. This three-dimensional interconnection between RMB trade settlement, interest rates, and capital flows does not leave any opportunity to understand the underlying economic landscape as a whole. While delving into these mechanisms of transmission, one can notice that the internationalization of the RMB encompasses more than just financial market behaviors. It complements overall economic dynamics, resulting in particular types of growth, imports, and exports, as well as the degree of success of monetary policy. This wholesome angle is essential for policymakers, economists, and market participants as they all share this terrain to chart the moving style of China’s currency internationalization and its consequential impacts on the global economic stage.

Interest Rate Transmission Effect

The channel through which the interest rate transmission occurs means that the increased usage of RMB international payments and subsequent increase in RMB demand causes the interest rates to decline; the weaker interest rates, in turn, boost investments and consumption. This impact can be looked at using the IS-LM model, a macroeconomic tool that shows stability between interest rates and real GDP. According to the IS-LM framework, the LM curve presents the equilibrium in the money market at different values of income and interest rates. In adherence to economics theory, an increase in money demand shifts the LM curve to the right. On the contrary, the broadening use of RMB in international trade for settlement transactions means that there is a growing trend in the international market and the market relying on the RMB. As a result, this indicates an increase in money demand; hence, the LM curve shifts rightwards.

The result after the shift to the right of the LM curve is a decrease in interest rates at levels of all income and, in the visual sense, camera movement along the lines of the new LM. Lower interest rates create a favorable environment for business investment and household consumption; as interest rates fall, firms borrow less. Since consumption affects aggregate demand, this interest-led spending produces further economic growth, as shown by the rightward movement of the IS curve. In the end, it is a higher level of GDP and the amount of production for the economy at the new point of IS-LM equilibrium. Consequently, the examination by the IS-LM framework depicting the rise of RMB settlement and related money demand as engineers of interest rates and aggregate output through the channels of transmission of interest rates is perfectly valid. Herewith, in the way of internationalizing RMB, the country could utilize monetary policy more wisely to influence economic conditions timely in a timely manner.

The rightward shift of the LM curve is, in fact, a combination effect. On the one hand, the increase in money demand will change the macroeconomic environment. Along with the developing RMB market, businesses, and financial institutions are forced to change their strategies in order to deal with currency conversion properly. The growth of the RMB in value, instead, leads to more yuan demand, which then implies that there is more global acceptance of the currency that creates a self-sustainable network effect all the time. Together with cheaper interest rates as the trigger, companies can now turn towards a more significant investment portfolio, considering the fact that they can now attain more finances. The shrinkage in borrowing rates not only tends to support domestic investment but also influences foreign entities to engage in monetary transfers involving RMB. Thus, this engagement ensures that the RMB becomes increasingly involved in the global system of financial transactions.

When the LM curve shifts to the right due to decreased interest rates, the net investment rises, which, in turn, leads to higher economic growth. With the increase in the number of business units and the rise in household consumption, the demand for services and products injected into the economy boosts. This pull effect causes the IS curve to shift even more to the right as it shifts to a higher equilibrium with real GDP corresponding to the adjusted interest rate. However, as a result of this scenario, monetary policy becomes much more effective. The fact that central banks’ policies to control interest rates are influential in guiding economic activities. Instructions, transmitter mechanisms, and the promulgation of the internationalization of the RMB not only promote domestic economic growth but also put China’s currency into global financial markets.

The rate of interest transmission mechanism cannot be underestimated in the IS-LM model of the RMB-carrying trade. It only points out how currency internationalization, interest rates, and growth are interrelated. The measurement thus contributes important information for instituting monetary policy in a new way, allowing China to become a significant player in international finance.

Capital Price Transmission Effect

Besides trade settlement and RMB international use, the RMB is affected via the capital price transmission mechanism –the primary purpose of such transmission is to pressure the RMB exchange rate. As the RMB increases its use in international trade and finance, it generates complex two-way interactions such as conflicting RMB demands and flows of capital determining its own exchange rate regime. For example, a boom in international RMB transactions means the RMB exchange rate is susceptible to higher price fluctuations driven by investment capital crossing borders. For instance, if China loses its monetary policy by cutting interest rates, it can be a case of RMB capital outflows since foreign investors transfer capital abroad to other locations with better returns. Through this mechanism, the yuan traded on the foreign currency market is directly affected, leading to the depreciation of the RMB exchange rate.

Following the subsequent RMB depreciation, its effect is transmitted to the actual output through trade channels – a synchronized reaction of the capital price transmission effect. Even though currency depreciation can be seen as good for Chinese exports as their products become more favorable for international markets, the rise in RMB trade settlement will add more volumes into exports, which in return ensures export growth and expansion of the aggregate output. On the other hand, as the RMB depreciates, it establishes higher import costs, which eventually are accurately transmitted into higher domestic consumption prices and to inflation externally, pointing to the combined output and price impacts. Thus, capital price transmission analysis suggests the RMB’s globalization, posing the question of exacerbating the economy’s vulnerability to destabilizing cross-border capital flows and exchange rate fluctuations from which to seep and affect macroeconomic targets. The armed struggle between these trade-offs, meanwhile, makes it hard for Chinese policymakers to be on track to internationalize the RMB.

It needs to underscore that the impact of RMB Trade Settlement is deeper than the quick shakeups of the exchange rates. The intricate relationship between monetary policy, capital flows, and the RMB exchange rate introduces quite a complex situation, and, therefore, a sophisticated analysis will be required in order to get a clear picture of possible consequences. Expanding RMB trade settlement is likely to disrupt RMB currency movements because of the more disordered international economic interaction. This high sensitivity is the final product of this complex RMB demand and capital flow arrangement in addition to the exchange rate policies in China. This is so that when monetary policies are adjusted, for example, through interest rate cuts in order to stimulate economic activity, they still lead to unintended consequences on capital movements across borders. Foreign investors who do not find higher returns in China may swiftly reverse their fund flow, which may cause demand-oriented pressure on the exchange rate of RMB.

This is not only about the exchange rate but also has spillover effects for other issues. This RMB fall starts with the capital flowing out, which in turn triggers a bunch of consequences for the national economy. On the one hand, the devaluation fosters enhanced competitiveness of Chinese exports in the global markets, which could lead to an increase in the volume of output and, thus, the overall economic output. On the other hand, the rises in output prices caused by a weakened exchange rate will force up domestic price levels and inflation. This result reveals that the capital transmission mechanism is complex and, hence, multifaceted. The globalization of the RMB gives rise to the connection to the macroeconomic consequences on GDP growth and export, as well as inflation rates within the domestic market. Accordingly, Chinese policymakers, in their desire for the RMB to become an international currency, are faced with the dilemma of hitting the right balance between costs and benefits. Therefore, maintaining financial stability amid global capital flows and exchange rate movements takes a central place in the overall goal of ensuring stability and sustainability of the macroeconomics. Ultimately, the capital price transmission analysis dissects the rich and multi-dimensional nature of the Chinese economy’s interactions with the global flows of RMB. Officials must handle the fine line between the efforts of exposing RMB to international use and maintaining the stability of relevant material indicators.

Graphical Representation

The graphical analysis helps illustrate the mechanisms linking RMB trade expansion to broader monetary policy outcomes:

Figure 1 shows that the spillover impacts of capital flows are not confined to the foreign exchange market square. Then, the RMB is devalued due to capital outflows from the domestic economy, which in turn causes a series of consequences for that economic system. On the other hand, currency depreciation can make Chinese exports more competitive on the global stage compared to other countries’ exports, resulting in increased export volume, and these exports usually contribute to overall economic output. In this regard, the devaluation of the RMB has a negative impact on import costs, and as a result, domestic prices, as well as the inflation rate, get higher. This two-way effect serves as an illustration of the complexities of the mechanism of capital price transmission. The influence of RMB globalization is manifested beyond the level of GDP growth and exports on inflationary issues in the domestic economy as well. Chinese policymakers, in turn, have to deal with the problem of choosing between different alternatives. All the attention is on managing the danger of heightened fluctuations in capital flows and exchange rates, as this might destabilize the economy and derail its sustainability prospects. By evaluating the RMB globalization transmission with capital prices, we are able to assess the profound influences of the RMB on the Chinese economy. It is highlighted that the policymakers have to act carefully so as to cope with the twin demands of promoting a wider circulation of RMB and stabilizing the macroeconomic variables.

The knowledge of these demands is crucial for the IS-LM stature as it is a macroeconomic model that analyses the interrelationship between interest rates, output, and the money supply. With businesses worldwide expecting to engage in increased trade activity using RMB, the influence of RMB on the model becomes clearer. The IS function is a part of the model that represents the market of goods and services and may be subject to modifications as a result of the substitution of money for trade. Moreover, the LM equation for the money market could, in turn, be affected by the currency preferences in the global sector.

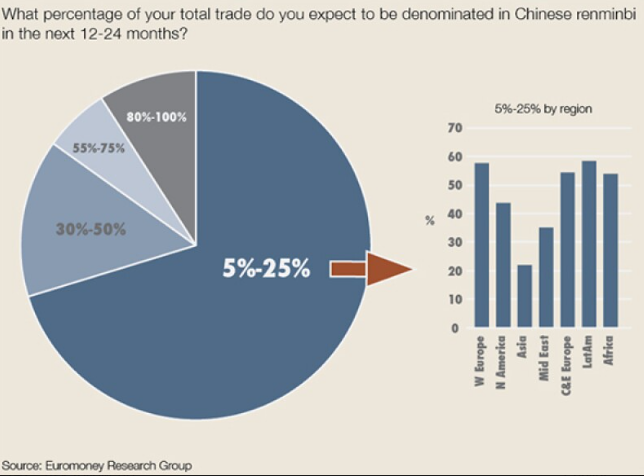

Survey results from the year 2022 give a glimpse of what respondents who are participating in the process of internationalization of RMB expect from the currency movement. When businesses transact in various trade denominations, the IS-LM model proves to be an effective analytical tool that can be used to evaluate the probable effect of such actions on interest rates, as well as on the production level in a broader context of money supply. The fraught terrain of global trade, as shown in Figure 1, supports the need for the makeover and remodeling of these economic models to capture the intricate relationships in a world that keeps getting more and more interlinked.

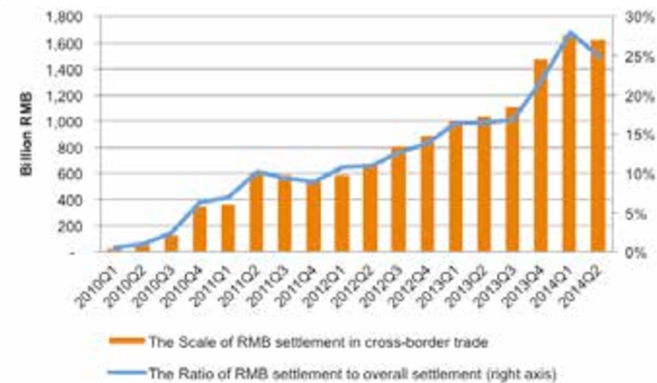

Figure 2: the graph illustrates the growth of the People’s Bank of China, showing the size of cross-border trade settlement in RMB as well as the ratio of RMB settlement to overall transactions from January 2010 to April 2014. The IS-LM model is an instrument of macroeconomics that deals with interest rates, output, and money supply.

The IS-LM model for China’s economy can be used to look at the impacts of monetary policy on the RMB exchange rate. A case in point is a stimulatory monetary policy that would push the interest rate down, which would attract foreign investors to buy RMB-based assets. This, therefore, will increase demand for Renminbi and put pressure on the RMB to appreciate. Correspondingly, the implementation of the contractionary monetary policy could induce an increase in the interest rate while making it hard for foreign investors to invest in RMB-denominated assets. This would make RMB less valuable and, therefore, cause RMB to decrease in value.

The chart indicates that Chinese RMB settlements with trade partners in cross-border transactions grew substantially during the period from 2010 to 2014. This implies that the utilization of RMB in global trade had jumped to a very high level by then. However, the settlement in RMB ratio increased more than the overall settlement rate during this phase; it was at a slower pace. Thus, this shows how the RMB was quickly becoming more significant in global trade. However, it was still not as widely circulated as currencies like the US dollar.

It is a graphic illustration that represents the development journey of renminbi settlements in cross-border trade between Jan 2010 and Apr 2014, which is the official data from the People’s Bank of China. The data shows a significant increase in RMB settlement size during the period, and it is evident that the use of RMB in international trade has been considerably broadened. The upward trend testifies to the fast increase in international discourse about RMB in the world.

The proportion of RMB used in the overall settlement process, in turn, is also on the increase, albeit at a much slower speed. This evolved that despite the fact that the RMB was getting more and more critical in cross-border trade, it was not yet universally accepted on the same level as the US dollar. Further proof of a slower rate of growth in this ratio is the emergence of the position of the RMB as a new currency in global trade, which points out its expanding function in the international economy. That is to say, the graph’s time dimension would allow us to overlay the two trends with changes in monetary policy. An expansionary monetary policy may have been one of the reasons behind the widespread use of the RMB when the interest rate was lowered. RMB-dominated asset acquisition will be more and more accessible for China’s foreign investors, who are now increasingly using RMB for international transactions.

On the contrary, monetary policy tightening, which resulted in more expensive borrowing, could have decelerated the speed of the development of RMB (renminbi) settlements. This growth in cost for foreign investors to participate in RMB-denominated deals is a barrier that affects the demand for Chinese currency settlements. The interaction between monetary policy dynamics and the phenomenon of RMB settlements demonstrates the complex role of macroeconomic objectives and the level of international currency. As the RMB became stronger and stronger in international business, the implications for the Chinese economy quickly went beyond the borders of the nation. While the behavior of RMB settlements not only mirrored the rise and fall of market preferences, it also had a far-reaching influence on exchange rates, foreign trade, and overall economic stability. This interconnection reveals the functional need for a critical interpretation, which merges both the macroeconomic models and the empirical data to understand the multifaceted effect of the RMB internationalization on the quality of the employment of monetary policy.

Conclusion

Through this analysis, the IS-LM model and the capital flow diagram, which represent the interest rate channel and the capital price channel, respectively, have been used to show how the rise in RMB trade settlement, as a result of its internationalization, influences central banking. On the other hand, the IS-LM model, through which lower RMB demand raises interest rates, makes economic output expand. However, the more profound involvement in capital flow fluctuations and exchange rate swings leads to essential compromises on the macroeconomic side. Having a proper grasp of this phenomenon is what China needs as it increases the use of RMB in the global market under unstable economic conditions.

Among other things, it is clearly shown that policymakers perform a challenging balancing act. The interest rate transmission effect supersedes economic growth, but such manipulation must be done with extra precaution to avoid overheating or asset bubbles. The enhancement of RMB trade settlement brings about the expansionary effect, the development of which must be kept under consistent supervision to maintain healthy and stable economic growth. Furthermore, this capital price transmission effect adds to the complexity, making it more relevant for a versatile approach. Consequently, the associated implications of exchange rates, capital flows, and further ramifications on output and prices require a multi-dimensional policy frame. While devising policies to tackle this short-term issue of interest rates and production, policymakers must altogether look for implications on the long-term economic landscape, including trade balance and inflationary pressures. Given the dynamism of the international economy, the CNY keeps growing. China’s chronic efforts to boost the circulation of the RMB as a global currency show the ambition of this nation to have a significant place in the structure of the international monetary system.

Nonetheless, the multifaceted nature of RMB trade settlement on monetary effectiveness mandates researchers to conduct in-depth research and refinements in policies developed. Meanwhile, the analysis emphasizes the need for integrated knowledge of the relations between the internationalization of RMB, monetary policy, and the broader economy. While China gains from the internationalization of the RMB, it also faces the challenges and opportunities presented in the global market. This challenge can be solved if the country has a nuanced and adaptive approach to policymaking to sustain economic stability and growth on a world stage.

References

Bhowmik, D. (2021). Impact of Macroeconomic Indicators on the Yuan-SDR Exchange Rate. Asian Journal of Empirical Research, 11(7), 59-71. https://www.academia.edu/download/78713113/6726.pdf

Cheung, Y. W. (2022). The RMB in the global economy. Cambridge University Press. https://www.cambridge.org/core/elements/rmb-in-the-global-economy/25FCD4A724EF8DA125CC462D30BB2109

Lin, Z., & Tang, T. (2019). The dynamic effects of macroeconomic announcements on the volatilities of renminbi onshore and offshore exchange rates. Available at SSRN 3565647. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4247103

Liu, T., Wang, X., & Woo, W. T. (2019). The road to currency internationalization: Global perspectives and Chinese experience. Emerging Markets Review, 38, 73-101. https://www.sciencedirect.com/science/article/pii/S1566014117304855

Ly, B. (2020). The nexus of BRI and internationalization of Renminbi (RMB). Cogent Business & Management, 7(1), 1808399. https://www.tandfonline.com/doi/abs/10.1080/23311975.2020.1808399

Qin, W., & Bhattarai, K. (2022). Influence of Hong Kong RMB offshore market on the effectiveness of structural monetary policy in Mainland China. https://mpra.ub.uni-muenchen.de/id/eprint/111768

Tobin, D. (2022). Offshoring the uncovered liability problem: Currency hierarchies, state-owned settlement banks and the offshore market for Renminbi. New Political Economy, 27(1), 81-98. https://www.tandfonline.com/doi/abs/10.1080/13563467.2021.1926953

write

write