1.0 Introduction

1.1 Background

Generative AI systems are quickly becoming popular, completely changing how businesses work and make money. By handling tedious tasks and making people more intelligent, this technology frees workers to focus on more significant tasks that help the business grow. The ability of AI to create personalized material and interactions in natural language is beneficial for marketing and customer service. Generative AI also opens new ways to analyze data and find patterns to help people make decisions. There are worries about security and how it will affect jobs, but companies are rushing to add technology to their processes. Finally, the rise of generative AI marks the start of a new era in which technology and human creativity can work together to bring about growth, productivity, and new ideas. Companies that carefully use AI to improve their people and products will be the ones that win.

Even though small and medium-sized enterprises (SMEs) do not have as many resources as big corporations, generative AI can help them be much more productive, creative, and good at analyzing and making decisions based on that data (Soni, 2023). By making text, images, code, and other things that look like they were written by a person, leading generative AI systems like ChatGPT, DALL-E, Copilot, and others help small and medium-sized businesses improve many essential business tasks in areas like marketing, product development, customer service, and operations. With the fast growth of generative AI, small and medium-sized businesses can gain a lot by carefully using these technologies to beat their bigger competitors on a level playing field.

In terms of making financial decisions, generative AI gives small and medium-sized business owners the tools they need to make intelligent, data-driven decisions about planning, investments, resource allocation, and other things. Small businesses no longer have to rely on gut feelings and past experiences. Instead, they can use AI systems to quickly gather and analyze financial data, find patterns and insights, run scenarios, guess revenue, weigh risks and returns, and predict how economic decisions and strategies will likely work out (Kanbach et al., 202 ). Now that small and medium-sized businesses can do advanced, objective, and quick analysis, they can use financial tools and models that were once only available to large companies with lots of resources. SMBs can use AI economic aides and advisers that can be customized to help them make tough strategic and capital allocation choices. A lot of intelligent intelligence and analytics went into making these choices.

1.2 Statement of the Problem

Generative AI could help small and medium-sized businesses make better financial choices. However, many still need to learn how to use these new technologies in their companies best. High start-up costs, trouble integrating with current systems, a lack of in-house AI experts, worries about data privacy, and a lack of trust in algorithms for important financial choices are some things holding back adoption (Soni, 2023). However, SMEs that want to stay competitive must overcome these problems and start testing and using generative AI solutions for finance and business management. This is because rivals and competitors using generative AI for financial planning, analysis, forecasting, and decision support can gain a clear strategic advantage and pull ahead. If small businesses do not use these tools, they might miss out on important information, be unable to see how the market is changing and make bad decisions that hurt their performance.

The main goal of this research paper is to fill in a significant knowledge gap about how these new generative AI technologies affect small businesses’ financial decisions in essential areas like optimizing cash flow, setting investment priorities, allocating resources, budgeting, predicting spending, and long-term planning.

1.3 Research Questions

Key study questions that need to be answered are:

- How does Generative AI impact financial decision-making processes in Small and Medium Enterprises?

- What are the specific applications of Generative AI in risk assessment, fraud detection, and algorithmic trading within the context of SMEs?

- What challenges and barriers do SMEs face in adopting Generative AI for financial decision-making, and how can these challenges be addressed?

- To what extent can the integration of Generative AI contribute to operational efficiency and security measures in the financial services of SMEs?

1.4 Hypothesis

- Integrating Generative AI in SMEs’ financial decision-making processes will improve accuracy and efficiency in risk assessment.

- Generative AI applications, such as fraud detection algorithms, will enhance the ability of SMEs to identify and prevent fraudulent activities.

- Adopting Generative AI in algorithmic trading will lead to optimized trading strategies, contributing to increased profitability for SMEs.

- Despite potential benefits, SMEs may face challenges such as cost constraints, lack of expertise, and data privacy concerns in adopting Generative AI for financial decision-making.

2.0 Literature Review

2.1 Generative AI in Financial Decision-Making

Generative AI is a big step forward in helping people make decisions in many fields, including the financial sector. Leading generative models, such as GPT-3 for natural language processing, DALL-E for computer vision generation, and AlphaCode for code programming, have shown that they can instantly come up with new, helpful information and content. Regarding financial services, autoregressive forecasting models can tell an entrepreneur what the future holds for time series like stock prices, interest rates, and currencies. This information can help one decide what investments to make and how to divide assets. Generative adversarial networks (GANs) also let one use scenario modeling and stress testing models to look at market risks, which helps entrepreneurs plan and reduce those risks better (Shabsigh & Boukherouaa, 2023). Transformer neural networks can look at how people feel about financial news, reports, and social media to help trade strategies. They can make it easier by automatically creating custom analytical content and financial summaries. With the latest release of ChatGPT, advanced features for answering questions from individual investors, explaining financial ideas, and talking about economic trends have been made public.

In the banking and financial services industry, generative AI is constantly helping with essential tasks like customer service, risk assessment, fraud detection, financial reports, and more (Shabsigh & Boukherouaa, 2023). For example, to increase the lifetime value of a customer, it is increasingly suggested to use GAN architectures for personalized and adaptive marketing campaigns. Using generative transformers to monitor transactions, look for patterns, and make anti-money laundering review processes run more smoothly also has much promise (Chatterjee, 2024). In general, empirical studies show that adding generative AI skills has made making decisions based on data easier. However, model flaws, the chance of bias, and the ongoing need for human oversight still need continuing governance and validation systems.

In the future, generative AI will continue to have more and more power to change and improve financial services as computer power and data merging skills keep improving. However, leaders in the field stress that humans and AI working together on designs will continue to be necessary for making trustworthy and moral systems. Adoption is still hard for small and medium-sized businesses because they need more internal knowledge or data (Wei & Pardo, 2022). As a result, progress relies on solutions being easy to find and adapt and their implementation being responsible and straightforward. With the proper rules in place, pre-trained generative models like ChatGPT and GitHub Copilot point to AI-enhanced processes that could completely change how efficiently, productively, and innovatively financial planning, forecasting, and risk analytics work (Chatterjee, 2024). However, human control and ethical concerns about bias, fairness, and honesty are still significant.

2.1 Role of Generative AI in Risk Assessment and Fraud Detection

By using generative AI to look at risks in areas like credit, market, operational, and cybersecurity, small and medium-sized businesses (SMEs) can gain. For stress testing small businesses against thousands of risk scenarios, generative models like GANs can quickly gather much data and run Monte Carlo simulations. Instead of just using past data, this allows for more thorough risk management. Regarding credit risk, AI can monitor both small and large economic factors in real-time to make probabilistic predictions of default risks, which lets lenders make timely loan decisions (Rane, 2023). For market risk, generative models can predict how prices will change and fluctuate for stocks, currencies, and commodities that affect small and medium-sized businesses. AI can find weak spots in controls and processes concerning operational risks by studying data from past incidents. With system logs and event data, generative algorithms can find strange things and new cyber risks that could compromise information security (Agrawal, 2023). How adversarial debiasing methods must fix every data and model designation. Generated AI can significantly improve small businesses’ risk management in many areas.

Generative AI is changing how small businesses find fraud by letting them watch deals from multiple data sources in real-time. Unsupervised anomaly detection models can find strange trends in orders, payments, login attempts, etc. AI looks at vast customer data to build solid profiles and spot strange behaviors (Agrawal, 2023). One example would be a sudden rise in a customer’s purchase value. Natural language models can look through interactions for abnormal patterns that could be signs of social engineering. AI can also combine transaction data sets to make fraud cases more realistic and increase fraud coverage. However, generative models have problems, such as giving false positives and relying on past fraud trends (Wei & Pardo, 2022). Some methods, like antagonistic training, one-class learning, and ensemble models, can help resolve these problems (Rane, 2023). Overall, generative AI helps small businesses find possible scams on a large scale while causing as little trouble as possible for real customers. However, ongoing model testing and being able to explain results are essential for making the technology reliable and fair to use.

2.3 Algorithmic Trading and Generative AI

Regarding algorithmic trade, small businesses can get a lot out of using generative AI models. Based on past data, AI methods like deep reinforcement learning let systems automatically develop trading rules and the best ways to use them. Generative adversarial networks can be used to test trading algorithms on past market situations. Regarding algorithmic trade, small businesses can benefit from generative AI models (Hamadi et al., 2022). Based on past data, AI methods like deep reinforcement learning let systems automatically develop trading rules and the best ways to use them. However, to avoid problems, it is essential to keep looking at data outside the group and set up ways to monitor risks.

In various ways, generative AI can assist small firms in improving their trading procedures. AI methods like reinforcement learning and Monte Carlo tree search can model the outcomes of different trading choices to suggest the best course of action (Hamadi et al., 2022). Also, AI models can combine different data sets to try strategies in new situations. Generative models can quickly look at news flows and social media to find early signs of high-frequency trading. AI can also read earnings calls and regulatory reports to learn new things and make changes to algorithms based on what it knows (Hendershott et al., 2021). However, AI strategies that are only based on data trends often need to understand how the market works. For SMEs, the best models are hybrid ones that combine AI with human trader control. Creative AI helps human traders and lets small businesses keep improving and adapting their trading strategies. However, for long-term success, it is essential to check the model often with data outside the sample to avoid taking unnecessary risks and have human monitoring.

Even though past performance does not always mean future performance, generative AI could make automated trading more profitable for small businesses in the long run if used correctly. AI techniques like deep Q-learning let automatic strategies keep improving by simulating fake data and constantly updating themselves (Kanbach et al., 2023). This allows them to adapt to changing market conditions. AI that reads news and social media and figures out how people feel about it can help with short-term and long-term trades. However, depending only on AI predictions could be dangerous if the model makes wrong assumptions because it needs more training data. Studies have shown that the best trading results come from combining subjective human expertise with AI suggestions based on data (Bhatia et al., 2021). For the most part, generative AI creates new data-driven ways to make more money, but the key to long-term success is to add human control, do thorough backtesting, and put up barriers around risks.

2.4 Customization and Adaptability of Generative AI for SMEs

For generative AI solutions to be used in the real world, they must be tuned to the specific needs of small and medium-sized businesses (SMEs). Some important things to consider are data availability, the amount of in-house technical expertise, the cost, and the speed at which the investment will pay off. Small and medium-sized businesses (SMEs) that do not have much data can use methods like GANs to make their training datasets bigger (Soni, 2023). Through APIs and low-code platforms, solutions should make connecting to current IT systems easy. For non-technical staff to understand AI, interfaces that let them use natural words and see how things work are helpful. SMEs can easily use cloud-based AI solutions without paying a lot upfront by forming vendor relationships. Overall, generative AI solutions can help small businesses be more productive and gain more insights by adapting to their data and skill limitations, making the tools easy to use, and making the adoption process smooth.

Generative AI systems need to be able to change with the needs of small businesses to be helpful in the long run. Instead of just using old data, models should be able to keep learning online as new data sources come online. Models taught in one setting can be used in different ones with the help of techniques like transfer learning (Abrokwah-Larbi, 2023). Models can be more accurate as use cases change, making changing parameters and limits easy. Outputs can be improved with user feedback loops that let users note how well a model works. Open interfaces make it easy to add data and methods from third parties to models to make them more useful. Using modular, microservices-based designs to build AI systems makes them flexible for future growth (Agrawal, 2023). Generative AI solutions can stay in line with the changing needs of small businesses and provide long-term value by focusing on their ability to change. However, constant tracking and human oversight are still necessary to ensure robustness.

2.5 Operational Efficiency and Security Measures

Generative AI helps small financial service businesses run more efficiently by automating repetitive chores that must be done often. By cutting down on manual work, AI methods like optical character recognition improve document processing in loan origination and Know Your Customer (KYC) (Crowdsourcing the Future of SME Financing, 2020). Chatbots handle common requests, which speeds up the process of answering questions and getting new clients. Intelligent process automation bots can copy workflows between systems to do regular tasks like reporting, entering data, and doing math. However, mistakes can be passed on to other steps in the process if automation is done without oversight. The best decision support models are hybrid ones using AI and human guidance. Overall, generative AI helps small businesses be more productive, cut costs, and get their products to market faster by automating repetitive chores in a targeted way.

Generative AI changes the security of small financial businesses by letting them find threats to private data from inside and outside the company in real-time (Chishti et al., 2020). AI methods like one-class learning, anomaly detection, and synthetic data models make it possible to keep a close eye on transactions, access patterns, and network activity to spot strange behaviors that could be signs of security breaches. With AI’s help, cybersecurity helpers can quickly look through harmful data and send valuable alerts. Chatbots, like virtual security guards, make it easy for customers to prove who they are. Habbal et al. (2024) say that attacks meant to trick AI models are a certain kind of risk; hence, it is essential to use negative training to ensure the model is correct and the system is built according to the proper security rules. This is a robust device that can help security teams see risks more clearly, make sure people are who they say they are, and move faster, which makes them stronger.

2.6 Challenges and Barriers to Adopting Generative AI for Financial Decision-Making

Small businesses that want to use generative AI have a hard time because it costs a lot to license and connect to other systems. Kanbach et al. (2023) say that small and medium-sized businesses (SMEs) do not spend less on technology than large companies. It is also hard for small and medium-sized companies to train their AI experts because there are few AI experts, and the market is very competitive. Insufficient training data and reliance on outside sources cause a terrible return on investment (ROI). Kshetri et al. (2023) also say that biases built into AI systems and moral problems about data privacy still need to be carefully thought through. Models that cannot be explained make following harder. On the other hand, small and medium-sized businesses need to save money on model maintenance, upgrades, and monitoring when they use cloud-based low-code AI choices. Little and medium-sized companies can only use AI a little because it needs specialized knowledge and significant expenses over a long period.

Data privacy and confidentiality worries make it hard for small financial businesses to use generative AI, which needs a lot of high-quality data to give correct insights (Kshetri et al., 2023). As AI becomes more common, many small and medium-sized companies are still not good at managing and governing private customer data. Potential data loss or misuse due to inadequate security practices hurts trust among stakeholders. Stringent rules like GDPR limit data flow across borders, making it harder to access global statistics. Maintaining privacy is hard when anonymizing production data for training AI models. Uncertainty about how AI algorithms use personal data makes ethical worries even stronger. Without legal solid and technology protections around collecting, storing, and using data for AI, data privacy will remain a significant issue for small and medium-sized financial businesses interested in generative AI.

3.0 Methodology

3.1 Research Approach

The interpretive method will examine the complex effects of creative AI technologies on the financial decisions made by Small and Medium-Sized Businesses (SMEs). Within interpretive approaches, asking questions and observing things is vital to discovering more about and fully understanding an event (Smith & Nizza, 2022). The interpretivist lens helps to look more closely at how generative AI systems are built into critical financial processes and change how things are done within a company. This way of doing things works well for understanding how small businesses use cognitive tools for basic financial tasks like planning, accounting, analysis, and risk management. This study aims to build a multidimensional picture of the generative AI-finance nexus in small businesses by combining qualitative insights showing how fertile AI is used and its effects on quantitative adoption and outcome data. The interpretive method gives a sufficiently complex view to match the growing sociotechnical complexity as new AI systems become a part of critical SME decision-making.

3.2 Research Methods and Data Collection

This study will employ a mixed-methods approach by integrating complementary qualitative and quantitative data collection and analysis techniques. In-depth semi-structured interviews will be conducted with SME owners, financial managers, accounting heads, and AI experts in implementing generative AI solutions. These exchanges will elicit rich, contextual narratives regarding applied use cases, decision-making changes, challenges, and advantages conferred by deploying productive finance tools. Quantitative surveys will also be administered to chief financial officers across SMEs to gather adoption rates, efficiency impacts, and outcome metrics using generative AI versus traditional planning, reporting, and projections methods. This pragmatic blending of qualitative insights and quantitative measurements provides multiple lenses into the productive AI-SME finance phenomenon.

3.3 Sampling Method

Sampling is a way to conclude a group of people by choosing and studying a small part of that group; this research will employ a purposive sampling method. Purposive sampling is an intentional selection of informants based on their ability to elucidate a specific theme, concept, or phenomenon (Campbell et al., 2020). Purposive sampling will be used to find participants with much knowledge and direct experience using generative AI to help small businesses make financial decisions in fields like manufacturing, professional services, retail, and healthcare. 20-30 people will be recruited for interviews, with essential jobs such as owners, financial controllers, accounting heads, and AI technical experts. This selective hiring process ensures players have real-life experience dealing with the challenges, trade-offs, and changes as generative AI becomes more common in small business finance. It will also use maximum variation sampling to find different implementations, use cases, and productive tools in the SME environment.

3.4 Analysis of Data

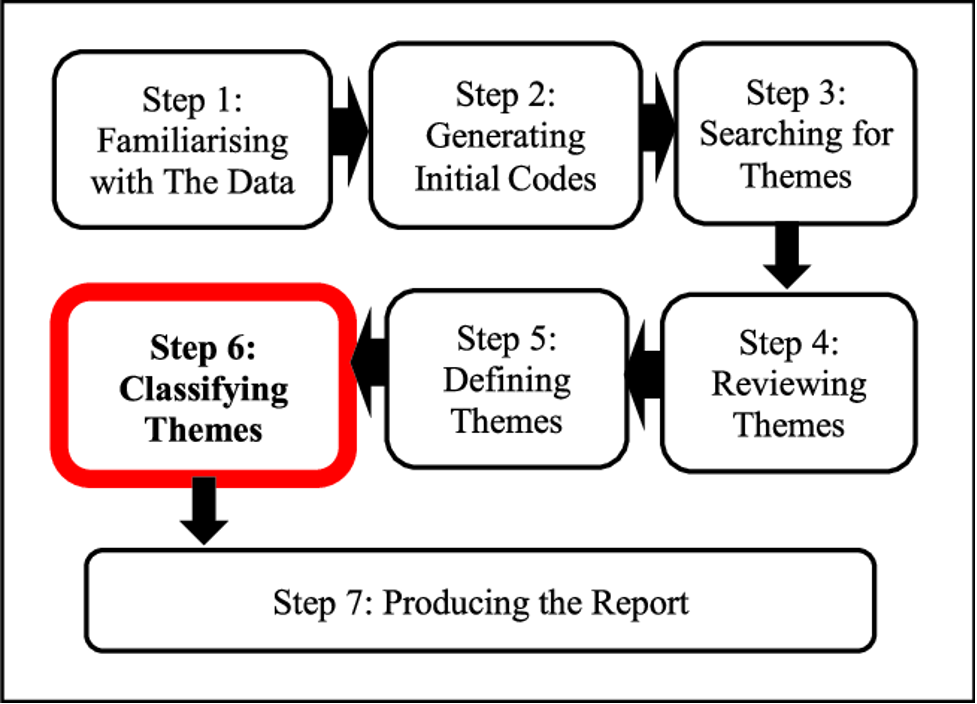

To find the most critical themes about integrating generative AI into small business finance. They will include main challenges, benefits, changes in practices, and new ways of making decisions possible by this technology; the interview texts will be subjected to thematic analysis. Quantitative survey metrics will be analyzed using descriptive and inferential statistical tools to show how widely generative AI tools are used in SME financial planning, accounting, and reporting, as well as the number of adoptions and results. Interviews and surveys will be used to get complementary qualitative themes and quantitative reports of the integration process. Through combining both qualitative and quantitative datasets, this mixed analytical method will provide a deep, multifaceted understanding of how generative AI is starting to fundamentally change how small businesses think about and do finance, as well as their workflows and outcomes.

(Kadir et al., 2021)

3.5 Ethics

Strict ethical guidelines will be followed when interviewing and surveying people for this study. All participants will give their informed consent after being fully aware of the nature and aim of the study. Anyone who wants to can choose not to participate and can do so at any time. Interviewees and survey respondents will stay anonymous in all reports; no personal information will be shared. The recordings, transcripts, and poll data will be kept safe with encryption and access controls to protect privacy. There will be no lying or risk of harm to the participants. Generative AI model training and analytics will only use synthetic data to avoid privacy violations with accurate personal data. The Institutional Review Board has approved the study’s goals and methods to make sure they follow the rules for research ethics. Overall, this study will follow all ethical rules and take all the necessary steps to protect the people who take part and their data.

3.6 Expected Outcomes

The study aims to discover how generative AI changes how small businesses make financial decisions, plan, handle risks, and report on their finances. Qualitative analysis of real-world generative AI deployments should show the most critical problems, benefits, and changes in how things are done. The adoption rates, efficiency gains, and outcome measures that define the integration process will be found through quantitative analysis. Triangulating these different datasets should show how generative AI improves analysis, predictions, and optimizations to improve data-driven financial thought for more accurate predictions, intelligent investments, better cash flow, and less fraud. Barriers and implementation risks will also be discussed to help people accept AI responsibly and ethically. This study gives small and medium-sized businesses helpful strategy advice on using generative AI tools to improve their financial performance. Researchers can use it as a starting point for more studies on how AI can change organizations’ decisions.

References

Bhatia, A., Chandani, A., Atiq, R., Mehta, M., & Divekar, R. (2021). Artificial intelligence in financial services: qualitative research to discover robo-advisory services. Qualitative Research in Financial Markets, ahead-of-print(ahead-of-print). https://doi.org/10.1108/qrfm-10-2020-0199

Campbell, S., Greenwood, M., Prior, S., Shearer, T., Walkem, K., Young, S., Bywaters, D., & Walker, K. (2020). Purposive Sampling: Complex or Simple? Research Case Examples. Journal of Research in Nursing, 25(8), 652–661. NCBI. https://doi.org/10.1177/1744987120927206

Chatterjee, inside if 1–>Kumardev. (2024). Generative AI for transforming financial services: Revolutionising decision-making processes. Www.theasianbanker.com. https://www.theasianbanker.com/updates-and-articles/generative-ai-for-transforming-financial-services-revolutionising-decision-making-processes

Chishti, S., Bartoletti, I., Leslie, A., & MillieS. M. (2020). The AI book: The artificial intelligence handbook for investors, entrepreneurs, and fintech visionaries. Wiley.

Crowdsourcing the Future of SME Financing. (2020). IFC. https://www.ifc.org/content/dam/ifc/doc/mgrt/2020-12-call-for-insights-e-publication.pdf

Habbal, A., Ali, M. K., & Abuzaraida, M. A. (2024). Artificial Intelligence Trust, Risk and Security Management (AI TRiSM): Frameworks, applications, challenges, and future research directions. Expert Systems with Applications, 240, 122442. https://doi.org/10.1016/j.eswa.2023.122442

Hamadi, R., Ghazzai, H., & Massoud, Y. (2022). A Generative Adversarial Network for Financial Advisor Recruitment in Smart Crowdsourcing Platforms. Applied Sciences, 12(19), 9830. https://doi.org/10.3390/app12199830

Hendershott, T., Zhang, X. (Michael), Zhao, J. L., & Zheng, Z. (Eric). (2021). FinTech as a Game Changer: Overview of Research Frontiers. Information Systems Research, 32(1), 1–17. https://doi.org/10.1287/isre.2021.0997

Kadir, S. A., Lokman, A. M., & Tsuchiya, T. (2021). Emotional Responses Towards Unity YouTube Videos: Experts vs. Viewers Perspectives. International Journal of Affective Engineering. ResearchGate. https://doi.org/10.5057/ijae.ijae-d-20-00033

Kalyan Prasad Agrawal. (2023). Towards Adoption of Generative AI in Organizational Settings. Journal of Computer Information Systems, 1–16. https://doi.org/10.1080/08874417.2023.2240744

Kanbach, D. K., Heiduk, L., Georg Blueher, Schreiter, M., & Alexander D.F. Lahmann. (2023). The GenAI is out of the bottle: generative artificial intelligence from a business model innovation perspective. Review of Managerial Science. https://doi.org/10.1007/s11846-023-00696-z

Kshetri, N., Dwivedi, Y. K., Davenport, T. H., & Panteli, N. (2023). Generative artificial intelligence in marketing: Applications, opportunities, challenges, and research agenda. International Journal of Information Management, 102716. https://doi.org/10.1016/j.ijinfomgt.2023.102716

Kwabena Abrokwah-Larbi. (2023). The role of generative artificial intelligence (GAI) in customer personalization (CP) development in SMEs: a theoretical framework and research propositions. Industrial Artificial Intelligence, 1(1). https://doi.org/10.1007/s44244-023-00012-4

Rane, N. (2023, August 30). Role and Challenges of ChatGPT and Similar Generative Artificial Intelligence in Finance and Accounting. Social Science Research Network. https://doi.org/10.2139/ssrn.4603206

Shabsigh, G., & Boukherouaa, E. B. (2023). Generative Artificial Intelligence in Finance. FinTech Notes, 2023(006). https://doi.org/10.5089/9798400251092.063.A001

Smith, J. A., & Nizza, I. E. (2022). Essentials of interpretative phenomenological analysis. American Psychological Association. https://doi.org/10.1037/0000259-000

Soni, V. (2023). Impact of Generative AI on Small and Medium Enterprises Revenue Growth: The Moderating Role of Human, Technological, and Market Factors. Reviews of Contemporary Business Analytics, 6(1), 133–153. https://researchberg.com/index.php/rcba/article/view/169

Wei, R., & Pardo, C. (2022). Artificial intelligence and SMEs: How can B2B SMEs leverage AI platforms to integrate AI technologies? Industrial Marketing Management, 107, 466–483. https://doi.org/10.1016/j.indmarman.2022.10.008

write

write