Introduction

There are macroeconomic factors that affect the growth of an economy. Such macroeconomic factors are external, and thus, they significantly impact an economy’s performance. Examples of macroeconomic factors that influence a country’s performance are the inflation rate, rate of interest, unemployment rate, tax rates, and currency exchange rate (Lee et al., 2021). This report analyzed how the inflation and unemployment rates influenced the country’s performance in West Virginia and Florida. The study focused on studying the unemployment and inflation rate trends between 2001 and 2022 in two United States: West Virginia and Florida.

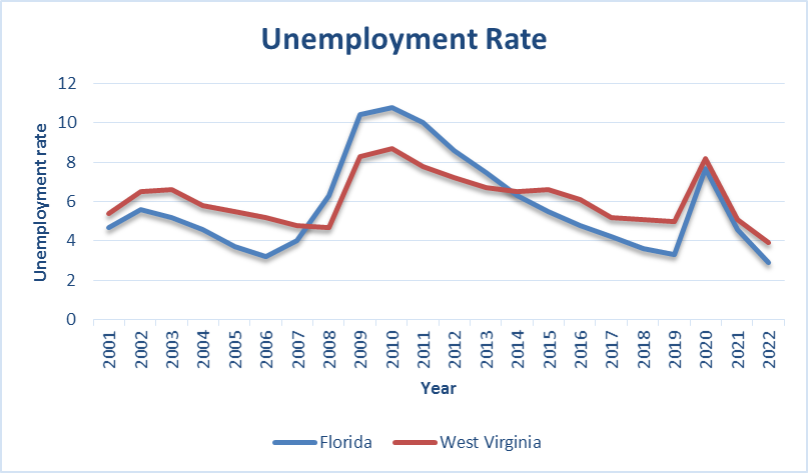

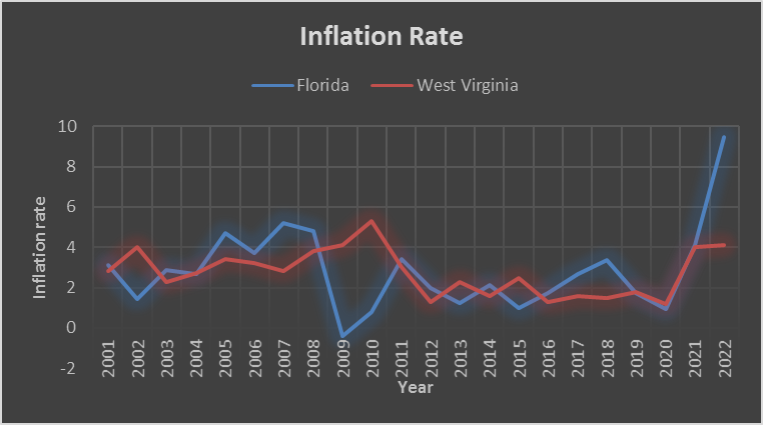

There has been an increased rate of unemployment and inflation in the selected states, which is why this research focused on them to study the trend of macroeconomic factors in the past 20 years (Fazzari & Needler, 2021). An analysis of the unemployment and inflation rate trend will conclude how such factors affected the gross domestic product of the two states. In this regard, we shall observe two significant economic events: the Great Recession (2008-2009) and the recent COVID-19 pandemic (2019-2021). However, the primary focus will be to compare the two variables, the unemployment rate and inflation rate, between the two states in the stated timeframe and then make a graphical presentation to determine how the trend of the variables changed during the Great Recession and the COVID-19 pandemic.

The comparison will be analyzed at length using the macroeconomic theory analysis to compare the causes and impacts of the Great Recession and the COVID-19 pandemic on unemployment and inflation rates. After analysis and comparison of the inflation rates and unemployment rates between the two states from 2001 to 2022, a recommendation will be made on possible measures to minimize the rate of unemployment and also to stabilize the economy through managing the inflation rate and general price control.

Unemployment and inflation rates in Florida and West Virginia

Unemployment is a major threat to the growth of the economy. One of the reasons there is a high unemployment rate in Florida is that major companies in the United States have been outsourcing skills from other countries, which has led to a lack of jobs among the nationals. There has also been an increased number of migrants in Florida, leading to a gap between the employed and unemployed (Fazzari & Needler, 2021). The job openings relative to those qualified and skilled are fewer, which has widened the unemployment gap. The global financial crisis between 2008 and 2009 (Great Recession) significantly affected the economy’s performance, and there was a high number of unemployed in both West Virginia and Florida, thus affecting the gross domestic product and per capita income in both states.

Conversely, inflation represents the overall price increase of commodities, affecting the cost of living in a country. Florida has the highest inflation rate in the United States. The primary cause of the state’s high inflation rate is the shortage of homes. The consumer pricing index considers the housing cost portion, which implies that the inadequate homes in Florida have led to increased inflation rates (Ball et al., 2022). The state has also experienced enormous and significant population growth, which is being fueled by migrants who are settling in the state for employment. The increased population has led to the scramble for available goods, thus increasing the cost of living in the state. The decline in the tourism sector also led to the high unemployment rate.

The Great Recession

The great financial crisis in the United States affected the economy since WWII. The financial crisis led to the recession, negatively affecting the economic value (GDP) of Florida and West Virginia, respectively (Ball et al., 2021). The gross domestic product of the two states declined by almost 4.5% from the last quarter of 2007 to the second quarter of 2009, and this was the highest economic downturn ever.

Impact of the Covid-19 Pandemic

The COVID-19 pandemic (2020) fueled the rate of unemployment and inflation in West Virginia and Florida. There was restriction of movement, some businesses were closed down, and many industries downsized, leading to the loss of jobs and increasing unemployment rates in the two states (Ball et al., 2022). There was a general increase in prices of commodities due to a paralyzed supply chain. This led to a further increase in the inflation rate, not only in Florida and West Virginia but also across the global economy.

Rate of Unemployment by age and sex

The unemployment rate goes with the age set or category of the job seekers age. Generally, people below 45 years are active workers and contribute to the economy’s growth. Young people between 16 and 24 have the highest unemployment rate compared to older people aged 45. Young people are learning skills and knowledge necessary for work, but the increased population in Florida has led to competition over existing jobs (Ball et al., 2021). Many companies also outsource skills and experts from other countries, which has enlarged the employment gap. According to the Bureau of Labor Statistics in the United States, women’s labour force participation in the United States was 57% in 2019, while men’s labour force was 69% in 2019. This implies many unemployed females compared to the number of unemployed men.

Study Findings

The unemployment rate in Florida was high between 2008 and 2010, from 6.3% in 2008 to 10.8% in 2010, and then it went down to as low as 4.8% in 2016 until it increased again in 2020 to 7.7%. The increased rates in those two events are during the Great Recession (2008-2009) and the Covid-19 pandemic (Fazzari & Needler, 2021). The same scenario is witnessed in the unemployment rate in West Virginia, though generally, the unemployment rate in West Virginia is lower compared to Florida, which can be attributed to different population sizes in the two states.

The two states’ inflation rates have not been predictable, though Florida has been experiencing high inflation rates due to home shortage. Florida has an increased population; thus, the available jobs cannot meet the demand of the unemployed (Ball et al., 2021). Florida’s inflation rate is 7.4%, while West Virginia is 3.2%. The government has been trying to stabilize the economy by creating more jobs and implementing contractionary monetary policies to manage inflation.

Recommendation

Some measures were put in place to help the economy recover from the adverse effects of the Great Recession and the Covid-19 pandemic. Some of the measures put in place include having favourable credit terms for businesses and households, which enables the circulation of money in the economy in the states of Florida and West Virginia. The other measure was the large-scale purchase of assets by the governments of West Virginia and Florida, and this was aimed at reducing the borrowing rate in the states and cutting the costs of borrowing in order to bring the inflation rate down. This plan allowed many households and businesses to afford credit facilities, and the cost of properties or assets was reduced.

The fiscal policies in asset purchase greatly supported retailers and small-scale traders who drove the economy and were primarily affected by the recession. Money started circulating in the economy, with reduced costs of credit facilities for both homes and businesses. There was also the implementation of monetary policies to help the economy recover and grow. The two states, West Virginia and Florida, have implemented strategies for sustainable financial management to strengthen the economy, which is working to reduce the unemployment rate and manage the economy’s inflation rate.

References

Ball, L. M., Leigh, D., & Mishra, P. (2022). Understanding inflation during the covid era (No. w30613). National Bureau of Economic Research.

https://www.nber.org/papers/w30613

Ball, L. M., Leigh, D., Mishra, P., & Spilimbergo, A. (2021). Measuring US Core Inflation: The Stress Test of COVID-19 (No. w29609). National Bureau of Economic Research.

https://www.nber.org/papers/w29609

Fazzari, S. M., & Needler, E. (2021). US employment inequality in the Great Recession and the COVID-19 pandemic. European Journal of Economics and Economic Policies: Intervention, 18(2), 223–239.

https://www.elgaronline.com/abstract/journals/ejeep/18-2/ejeep.2021.02.09.xml

Lee, M., Macaluso, C., & Schwartzman, F. (2021). Minority unemployment, inflation, and monetary policy.

https://www.bencebardoczy.com/files/minority-unemployment/paper.pdf

Appendices

Appendix 1 The Unemployment Rate in Florida and West Virginia (2001-2022)

The inflation rate in Florida and West Virginia (2001-2022)

write

write