Abstract

The scope and nature of work within the employment environment have considerably changed over the past years. Managers have considered significant ways of motivating workers to achieve organisational goals and improve performance. Most organisational managers believe that adequate motivation is achieved through financial rewards such as higher pays. Financial rewards are considered monetary incentives employees earn in their workplaces due to their excellent performance. Organisations use financial rewards to boost employee morale, compensate, and retain them. The current study investigated the relationship between financial rewards and motivation to establish whether it is positive or negative. The study integrated the survey design and mixed methods to collect and analyse data to establish the conclusion. Results showed that companies in the manufacturing and service industries had embraced financial rewards to enhance the motivation of their workers. The correlation comparison showed that there is a positive and significant relationship between financial rewards and the motivation of workers.

Chapter One: Introduction

Over the years, the working environment has considerably changed regarding the scope and nature of work. As a result, managers have continuously considered motivating workers to achieve the organisational goals and improve performance (Abdullahand and Wan, 2013). It is not easier to achieve motivation for all employees, considering the complex working environment and employees being human beings, have different needs, aspirations, and perceptions (Adair, 2006). Each organisation needs to have motivated employees for efficiency and optimum performance; however, there are different ways to encourage them (Adzei and Atinga, 2012). The majority of the managers believe that adequate motivation of the workers can be achieved by providing them with financial rewards such as higher pays, paid vacations, and bonuses (Mekonnen and Azaj, 2020). Many scholars consider financial rewards a major motivating factor used in many organisations to retain a motivated workforce (Iqbal, 2019). Thus, the current paper focuses on conducting a critical analysis to establish the relationship between financial rewards and motivation.

1.1. Background Information

All for-profit organisations aim to maximize profit and wealth for shareholders through efficient operations and increased production. According to Hewett and Conway (2016), the concept of human resources determines the organisation’s performance. However, achieving this requires that the people working in the work environment are satisfied to optimize their efforts (Abdullahand, 2013). Motivation is considered an external or internal force that initiates actions and facilitates some specific goals. It makes the workers remain perseverant until when they attain the set objectives, including earning their intended financial rewards (Akgunduz et al., 2020). Therefore, managers need to consider adopting human resource strategies to enhance job satisfaction through the motivation of employees. A motivational strategy entails providing a proper reward system to attract workers (Pratheepkanth, 2011). Monetary rewards are critical in determining employee performance, and this has seen many organisations employing financial incentives in motivating employees.

Financial rewards are the most influential motivating factor used to manipulate individual performance. This is the case because rewards lead employees to become creative, innovative, and effective, contributing their best in an organisation. Both the employees and managers are motivated by a sound reward system that facilitates better outcomes (Aktar et al., 2012). Employees can receive financial rewards through wages, salaries, increased pay, commissions, bonuses, and paid leaves and vacations (Wang, 2020). Monetary rewards have proved effective in reinforcing workers’ performance by increasing their desire to perform better each time. Financial compensation is one of the monetary incentives an employee earns after completing a specific task or good performance (Alexy and Leitner, 2011). Workers are also motivated to exploit their full potential when offered financial rewards such as commissions, pay raises, and bonuses. The employees have many wants and need to satisfy, including bills to pay, and therefore will need finance to meet them; hence a motivator.

1.2. Problem Statement

Previous investigations have revealed the crucial role played by the financial rewards in propelling the workers to increase their effort and improve performance. However, the available information on how financial rewards impacts motivation is limited. Instead, much of the focus by the previous researchers have been on job satisfaction as a motivator (Ali and Akram, 2012). Similarly, the smaller number of studies available on financial rewards has not achieved the consensus on its effectiveness for motivation (Akafo and Boateng, 2015). Though some researchers indicated financial reward as effective in achieving motivation, other scholars have highlighted job security, autonomy, and job satisfaction as key factors to motivation. Therefore, the current study investigated the relationship between financial rewards and motivation due to the existing gap.

1.3. The Objective of the Study

- The study’s objective is to conduct a critical analysis to establish the relationship between financial rewards and motivation.

1.4. Research Question

- Do financial rewards have a positive or negative relationship with motivation?

- Do financial rewards have the same level of motivation to low- and middle-income employees?

- Do financial rewards motivate employees in the manufacturing and service industry equally?

1.5. Structure of the Paper

The paper is structured into six chapters, including the introduction, literature review, methodology and data collection, results/findings, analysis and evaluation, and conclusions and recommendations. The introduction provides background and the context of the paper focusing on the significant areas of financial rewards and motivation. The literature review provides a critical analysis of available knowledge, previous studies, and debates on the research topic to form a fundamental basis for further research. The methodology is the third chapter that involves research philosophy and the methods used in data collection. The results/findings provide the outcome of the data collection process through the analytical form. The analysis and evaluation of the results examine these data relative to the available information to conclude. The conclusion and recommendations chapter links the research questions with objectives.

Chapter Two: Literature Review

2.1. Introduction

This chapter presents a critical synthesis of the previous concepts about the topic of research by highlighting the significant issues relating to financial rewards and motivation. A scholarly work hardly is completed if there is no referencing or drawing ideas from other similar works which already exist. The current study, not being exceptional, focuses on relevant concepts such as available reward system, financial rewards, motivation, the previous views of the relationship between financial rewards, motivation, and performance, and the common theories applicable in the motivation process.

2.2. Reward System

Previous studies have significantly written about the reward system and common rewards provided in the organisation for employees. Gohari et al. (2013) defined rewards to include all tangible services, financial returns, and the benefits given to the employees concerning their employment. Zaraket and Saber (2017) borrowed this idea when they critically argued that every employee expects to get some level of reward, including wages and salaries, when they deliver a particular task according to the expectations of the employers. In designing the reward systems, organisations need to set targets and define the expected behaviour from the employees. Businesses also need to establish a reward system that aims to motivate the workers to attain the set targets or behave in a particular manner (Nnaji-Ihedinmah and Egbunike, 2015).

Critical analysis of reward establishes two categories: intrinsic and extrinsic rewards. Gohari et al. (2013) established the distinction between these types of rewards. The authors noted that extrinsic rewards include external things provided by the managers to serve as incentives for employees. These things include benefits, promotions, money, and bonuses, among others, to influence the employees to increase their productivity levels. Chepkwony and Oloko (2014) associated intrinsic rewards with internal things to the individual that are less tangible in many ways. Intrinsic rewards are highly subjective such that they represent the perceptions and feelings of individuals about work and its value.

The critical analysis identifies some of the common rewards applicable in organisations. Aktar et al. (2013) identified basic pay, performance-based pay, job design, incentives and benefits, and development opportunities as some of the most practiced forms of rewards. Many researchers, including Roberts (2015), discussed basic pay as the essential reward in the work environment, considering it determines how much people receive in monetary form. Tausif (2012) found money essential because it can buy things and define an employee’s worthiness. Aktar et al. (2013) supported incentives and benefits as a form of reward since they enable an employee to earn additional compensation for performing some tasks. These programs entail gain-sharing that provides additional earnings to the individual employees or groups for cost reduction ideas and piecework programs that tie a worker’s earnings to the units produced. Tsede and Kutin (2013) critically analysed long-term compensation that offers additional income to employees and bonus systems that allow managers receive lumpsum payments from special funds depending on how the organisation performs.

2.3. Financial Rewards

Many companies provide financial rewards in compensating their employees for carrying out specific duties. Haider et al. (2015) identified the financial rewards, including bonuses, pay, health insurance, transportation facility, and pensions. Many researchers, including Seman and Suhaimi (2017), supported these forms of financial rewards, arguing that employers offer employees financial payments in the form of commissions or salaries. Malek et al. (2020) provided a more critical examination of these forms of financial rewards, beginning with bonuses. According to Roberts (2005), monetary rewards have proved to be the best mechanism that reinforces workers’ performance by increasing their desire to perform better each time. Financial compensation is one of the monetary incentives an employee earns after completing a specific task or good performance (Alexy and Leitner, 2011). Financial rewards play a crucial role in propelling workers to put more effort and improve their performance (Gikuya, 2014). Most financial rewards are based on performance, and thus, an employee would want to perform as best as possible to receive a higher commission, bonus, or salary (McKinney, 2015). The financial rewards are designed to help in the achievement of organisational goals. Different authors have described rewards differently.

The authors defined a bonus as employee compensation for the hard work performed to motivate them. Ghazanfar et al. (2016) maintained that bonus is given to employees following their performance, including sales increase, creating more deals, and new product line inspiration. Managers use bonuses to motivate their subordinates to achieve specific goals. Pritchard et al. (2017) identified pay as a financial reward commonly applicable in the working environment as a compensation program that considers the portion of a person’s pay at risk. Aslam (2014) argued that the pay takes form as stock or bonus options and that pay is offered as a financial reward to employees for the services they render. However, like bonuses and any other financial rewards, Tausif (2012) closely linked pay to performance and that those workers that achieve the best outcomes are paid reasonably to satisfy their needs. Money has become a significant motivational aspect for workers to satisfy the needs of life. In addition, to pay, employees are given fringe benefits to create an optimistic and motivating work environment and increase sales and output. According to Alexy and Leitner (2011), fringe benefits play a significant role in motivating employees where they are compelled to put more effort. For employees to improve their performance, management needs to create effective benefits programs.

Pension is a significant financial reward commonly used in many private and public organisations. Kumar et al. (2015) defined pension as a deferred income that employees receive after retiring. The amount paid to them is gathered during their working period, and the company decides on the amount that employees have to earn. Terera and Ngirande (2014) supported this as a financial reward since it gives the employees a sense of belonging to the organisation. Employees are motivated to continue working with the company until when they retire. Seman and Suhaimi (2017) argued that commissions should be given priority since they are forms of reward given to sales staff. It is motivating to employees such that even with the small pay, they are assured of the commissions (Hofmans et al., 2013). According to Malek et al. (2020), workers tend to be persuaded to accomplish higher deals when commissions are used as their financial rewards are based on the commissions.

Therefore, organisations have the obligation of designing financial rewards that create value for the entities while at the same time motivating the workforce. Fixed financial rewards are not as motivating as flexible rewards based on performance. A high level of performance will attract higher financial rewards (Dolatabadi and Saeed, 2013), and low performance is not rewarded. Money matters are more effective than non-financial rewards because they are symbolic and have an instrumental value. Money has value and can easily acquire other items, so many workers prefer financial rewards to non-financial rewards (Jehanzeb et al., 2012). However, financial rewards may reduce teamwork as workers focus on individual gains (Merchant and Van der Stede, 2007). It is crucial to formulate financial rewards based on group performance.

2.4. Motivation

Motivation is a complex, challenging, and interesting area of Human Resource Management studies that has rapidly changed its purpose, functions, and application mode. The general agreement by scholars is that employees need to work with the managers, and the effectiveness of this relationship is based on motivation. William (2010) argued that the word motivation means “to move,” adding that the motivation force convinces employees to perform and behave in ways that propel them towards the reward. Solomon et al. (2012) defined motivation as a state that compels individuals to accomplish the planned goals. Therefore, employee motivation is the motive that directs the employee to develop particular behaviours indicated by contentment, commitment, intention to quit, and loyalty. It is the anticipation of being rewarded with reimbursements in return for the efforts and services provided.

The entire process of motivation is voluntary without undue pressure or manipulation. Rajhans (2012) argued in favor of this, noting that manipulation of people does not last over an extended period and sometimes may cause long-run problems. Dobre (2013) maintained that the entire essence of the management practices for human resources involves enhancing employee motivation. The proposal by Shahzadi et al. (2014) suggests motivation as an extent of direction, enthusiasm, and effort persistence which the employees attempt to achieve planned goals. Olusadum and Anulika (2018) describe motivation as the internal or external force that initiates actions and enables specific goals. The workers are perseverant until they achieve particular objectives, including earning financial rewards. According to Mafini and Dlodlo (2014) and Nujjoo and Meyer (2012), employees usually have their wants and need to satisfy, such as paying bills, and thus, they are forced to work harder to earn more in their workplaces. Therefore, variable rewards work best than fixed rewards. The rewards can either be intrinsic or extrinsic, and workers wish to acquire them and satisfy their wants. The intrinsic rewards are known as motivating factors under Herzberg’s Two Factors Theory (Little, 2003). They include the feeling of achievement, responsibility, recognition, and personal growth (Hosain, 2014). Extrinsic rewards are the hygiene factors in Herzberg’s Two Factor Theory and include salary, work conditions, security, remuneration, and company policies.

Human resource management studies on motivation have identified employee performance as highly correlated with the motivational level. According to Kolk et al. (2019), motivation is perceived as a force that drives the eagerness of the employees to work. Obiekwe (2016) found motivation as a key factor that is essential for managers to increase the performance of employees and inspiration of higher performers to enhance their greater productivity. Rajhans (2012) argued that people get inspired to work through motivation by managers individually and as groups in order for them to have the best results in the organisation. The employees will efficiently perform if effectively motivated by their managers. Thus, according to William (2010), the managers’ responsibilities include combining good motivational practices, setting goals for performance, and ensuring that excellent reward systems are in place. This requires providing the right combined motivational programs and the right working environment to improve their performance.

2.5. Financial Rewards and Motivation

Researchers who have investigated rewards as a motivation identified the roles of both extrinsic and intrinsic rewards. Seman and Suhaimi (2017) argued that extrinsic rewards are more effective and powerful when it comes to achieving the motivation of the employees. Monetary compensation has been considered an extrinsic incentive that is key in motivating employees towards their improved performance. Alexy and Leitner (2011) found money important considering that it symbolizes the worthiness of an employee. Financial rewards are necessary for satisfying employees, especially those undertaking formalized tasks. According to Pritchard et al. (2017), the salary-linked performance and monetary rewards increase and positively influence employees’ satisfaction, ultimately enhancing employees’ motivation to work.

Significant studies have been conducted to establish the role of financial rewards role in motivation. Doreen and Nkrumah (2013) researched motivation and performance-based salary increases. A salary increase is one of the financial rewards in organisations (Akgunduz, Goku, and Alkan, 2020). The research results showed that low- and middle-income employees see a performance-based salary increase as an important motivating factor. However, their reasons varied from the population. The low-income employees saw the pay increase as the motivating factor and encouraged them to work harder and earn a higher income (Abdullahand Wan, 2013). The low-income employee has more unsatisfied needs, and thus pay increase motivates them to improve their performance. For middle-income employees, pay rise is essential feedback to their contribution to the organisation and recognition from their managers (Ali and Akram, 2012). Therefore, the low-income employees will increase their efforts due to financial rewards while the middle-income workers will feel recognised.

Shibly and Weerasinghe (2019) researched a manufacturing organisation based in Sri Lanka to investigate the impact of financial rewards on work motivation. They concluded the research that monetary rewards are positively related to work motivation. Their findings were consistent with other researchers such as Aslam (2014), Werner (2004), and Nelson (2004). The studies found a direct relationship between financial rewards and motivation. In their research, Arnolds and Venter (2007) concluded that financial rewards play a crucial role in motivating workers, attracting new talents, and retaining the best employees. According to Werner (2004), financial rewards are recognised as the primary motivators of employees irrespective of their demographics or education. While Nelson (2004) estimated that 78% of employees felt appreciated and recognised by their employers when offered financial rewards after completing a particular task or achieving a set target.

The primary goal of fringe benefits in an organisation is attracting, motivating, and maintaining competent employees (Kamau, 2013). Fridge benefits fall under the financial rewards that workers receive in an organisation. Rahim and Daud (2012) stated that organisations with higher financial benefits attract the best workforce, and they are more motivated than those with low financial benefits. Therefore, any financial benefit needs to be at a level that workers feel motivated and recognised. Another advantage of financial rewards to an entity is maintaining a good relationship between the employees and the management (Aktar, Sachu, and Ali, 2012). The workers are unlikely to strike and aim at offering their best since they are recognised and rewarded for their efforts.

Ali and Akram (2012) researched to investigate the impact of financial rewards on employees’ motivation and satisfaction. The study focused on the pharmaceutical industry in Pakistan. Their study proved a significant positive relationship between financial rewards and employee motivation. It was concluded that it is economical to offer financial rewards to workers since the employees and the organisation benefit. Employees are motivated, and their level of satisfaction increases if they are offered financial rewards by the employer (Akafo and Boateng, 2015). New and existing employees in the entities get more attracted when rewarded in monetary terms rather than non-monetary. The study revealed why many workers were interested in joining the pharmaceutical industry in Pakistan.

Ali and Akram (2012) also compared the level of motivation between males and females. The study showed no difference between responses from males and females. Both genders rated the importance of financial rewards equally. The results are supported by Pepper, Gore, and Crossman (2013) when they found out that the impact of financial rewards on employee motivation based on genders had slight differences. The women were more motivated than men, but the finding was insignificant. Therefore, financial rewards are crucial in motivating both male and female employees.

Göktepe et al. (2020) concluded that organisations should use financial rewards in managing employees’ performance because they are effective motivators. Financial rewards motivate workers to perform a specific task in a particular manner. In support of Eisenberger and Rhoades (2001), Markova and Ford (2011) contended that an organisation that offers good financial incentives to workers has a motivated and satisfied workforce. Employees in third-world countries are more motivated by financial rewards because of the high rate of inflation, which makes them struggle to maintain their social status (Akafo and Boateng, 2015). Mathis, Jackson, and Valentine (2013) revealed that financial incentives are significantly associated with employee commitment. The author emphasised that salary raises, bonuses, and promotions motivated workers leading to high performance and low turnover.

2.6. Research Gap

However, even with the established positive relationship between financial rewards and motivation of employees in workplaces, significant researchers have found negativity. For instance, Malek et al. (2020) argued against rewards that necessarily do not assure employee motivation. Though the authors acknowledged the use of rewards as incentives and that many employers use them to motivate, the real motivations of individuals are within themselves. Mansaray-Pearce et al. (2019) noted that using incentives and rewards such as finance to manipulate people only works for the short term and may cause the company lasting problems in the long run. These arguments have placed the effectiveness of financial rewards into turmoil and the need to have significant research conducted to establish the actual impact. Similarly, the available information on how financial rewards impact motivation is limited, focusing on job satisfaction as a motivator. At the same time, there is a lack of a consensus on the effectiveness of financial rewards for motivation.

Chapter Three: Methodology

3.1. Introduction

The chapter presents a designed method used by the researcher for data extraction, production, and analysis. The researchers define a research design to tackle various investigation processes (Saunders et al., 2016). Thus, this chapter presents the research philosophy, design, and sampling techniques, data collection, the proposed analysis technique, and ethical issues.

3.2. Research Design

The research design presents an overall strategy chosen by the researcher to integrate different study components coherently and logically. The design ensures that the research problem and objectives are addressed effectively through the collection, measurement, and data analysis (Bryman, 2012). For the current study, the appropriate design was the cross-sectional approach that supported data collection and analysis. This research design was considered to collect data from various individuals at a single point in time and therefore limit the researcher’s bias and influence (Dahl and Smimou, 2011). The study is also descriptive and aims at testing an advanced hypothesis and the established relationship between financial rewards and motivation. The research intends to establish the cause-and-effect relationship of two variables.

Similarly, the approach taken in this study involved mixed methods, which involve the combination of the qualitative and quantitative approaches to gather more data and broad scope. Both qualitative and quantitative approach compliments each other (Adair, 2006). The qualitative approach entailed interviewing respondents, while the quantitative process involved a questionnaire (Bryman, 2006). The approaches helped establish the relationship between financial rewards and motivation. The qualitative method widened the research by gathering customized information to analyse the research question (Mugaa, Guyo, and Odhiambo, 2018). A survey questionnaire would be helpful to complement the qualitative approach and make results statistically significant (Amin et al., 2021). Therefore, this study equally adopted the survey approach in collecting the relevant data for analysis.

3.3. Population, Sampling, and Sample Size

Employees who participated in the study were selected from the manufacturing and service industries. This population was considered for fair representation of all organisations because they play a key role in the performance of the companies. However, manufacturing and service sectors continue to record varying results among competitors, which is attributable to workers’ motivation to perform. Both genders, including male and female participants, were considered equal to enable the researcher to include views without favoring a specific side. Therefore, since the population size is pre-determining, the appropriate technique for selecting respondents will be the simple random sampling method (Khan, Zarif, and Khan, 2011). This method was appropriate because the researcher can randomly select participants as a subset of the population, with each individual having an equal chance of selection when used. As a result, 100 respondents from different organisations were involved, including 50 males and 50 females. The main reason for selecting 100 participants was to have more reliable and less objective results because of a large percentage of the population.

3.4. Data Collection

A standard questionnaire was prepared based on required standards of validity and reliability and be used for data collection through self-administration. A questionnaire survey was used to collect primary data, and the process will take three weeks. The questionnaire survey was designed based on Mikander’s measurement scale, which previous scholars have used and approved (Benzing et al., 2009). The survey question had two sections. The first section included demographic questions to help understand the gender, marital status, age group, and monthly income. It facilitated the analysis of the data based on genders, income level, marital and age to produce more simplified results for managers and policymakers. The respondents were above 18 years, sound-minded, and willing to participate in the research. The key target was to conduct quality research that is reliable and acceptable to other scholars and policymakers.

The second section included fifteen items focusing on financial rewards and motivation. The number of items was 15 so that respondents would not get bored to answer, and also enough information will be gathered. The negative coded items were tagged with a bold square sign for easy recognition when entering data and screening. All the 15 items were under a five-point Likert scale ranging from (1) strongly disagree to (5) strong agree. It will be as per the original scale developed by Mikander (2020). Adopting the five-point Likert scale was essential to standardize the questionnaire and make it simple and easy to analyse. Since the interviews consume more time and resources, they were limited to a few workers.

3.5. Data Analysis

For better and simplified results, frequency analysis, regression analysis, and correlation tests were performed during data analysis to test the hypothesis and help make the conclusions. Data analysis was conducted using Statistical Package for Social Sciences (SPSS) and Excel. SPPS statistics is easy to use, offers reliable and fast answers, has many statistical tests, is dynamic, makes use of graphs and tables, and is accessible to anyone because it can be customized to multiple languages (Thompson et al., 2013). The tabulated reports, graphs, charts, trends, and distribution plots produced by the SPSS break big and complex data into meaningful and understandable information (Mugaa, Guyo, and Odhiambo, 2018).

3.6. Access and Ethics

Before conducting the interviews and the survey, the management of the organisations was served with letters asking for permission to involve their workers in the study. The letter informed the management of the research topic, purpose, time is taken per survey, and how the data will be handled. Several factors will be considered, such as confidentiality of collected data, informed consent before starting the interview and survey, voluntariness (Galaro, Celnik, and Chib, 2019). The research emphasised anonymity, whereby the identity of participants was known by the researcher alone. Besides, the information collected was purely used in the study, and only the relevant data were gathered from respondents.

3.7. Limitations

The study’s primary limitation is using ten respondents for interviewees, which may not represent all industries fully. There is a need to increase the length of time taken to gather data to increase the population size for interviews. The qualitative method collects more data than the quantitative method (Akgunduz, Goku, and Alkan, 2020). Another limitation of the study is that it is too broad and needs to focus on a specific age group or income class. The respondents were collected randomly from a working population of all social classes. The effect of financial rewards may not be the same for low- and middle-income employees (Massingham and Tam, 2015). Lastly, there is a need to focus on one aspect of financial rewards as there are many types and may not all have the same impact on employee motivation.

Chapter Four: Results/Findings

4.1. Introduction

The chapter presents an analysis of the collected data from the respondents on financial rewards and motivation of workers. The analysis section answers the following research questions in relation to whether financial rewards have a positive or negative relationship with motivation. The answers to these questions are provided in the analysis below.

4.2. Demographic Information

Table 1: Respondents’ profile

| Category | Characteristics | No. of respondents | Percentage % |

| Response Rate | Respondents | 100 | 100.0 |

| Non-respondents | 0 | 0.0 | |

| Gender | Male | 50 | 50.0 |

| Female | 50 | 50.0 | |

| Age | <25 | 15 | 15.0 |

| 26-40 | 55 | 55.0 | |

| 41-50 | 20 | 20.0 | |

| >50 | 10 | 10.0 | |

| Staff Cadre | Senior Management | 25 | 25.0 |

| Middle level Management | 40 | 40.0 | |

| Unionisable | 35 | 35.0 | |

| Highest level of education | High School certificate | 10 | 10.0 |

| Diploma | 25 | 25.0 | |

| Bachelors Degree | 45 | 45.0 | |

| Masters degree | 15 | 15.0 | |

| PhD | 5 | 5.0 | |

| Length of continuous service with the organisation | Less than five years | 8 | 8.0 |

| 5-10 years | 37 | 37.0 | |

| Over 10 years | 55 | 55.0 | |

| Organisational size | Less than 100 people | 58 | 58.0 |

| 100-500 people | 32 | 32.0 | |

| More than 500 | 10 | 10.0 | |

| Monthly income | Less than $1000 | 35 | 35.0 |

| $1001- 1500 | 48 | 48.0 | |

| $1501-2000 | 15 | 15.0 | |

| Above $2001 | 2 | 2.0 |

Table 1 shows the age, gender, education, income, experience, position, and the size of the company respondents work. Importantly, 48% receive a monthly income of between $1001 and $1500 with only 15% receiving over $1501 monthly as an income.

4.3. Reward Systems

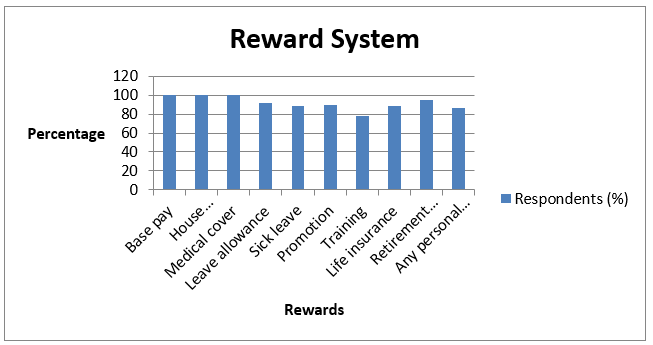

Graph 1: Companies’ reward system

Graph 1 shows the reward systems applicable in various companies represented by the respondents. From the graph, base pay, house allowance or housing, and medical cover were represented by 100% as the rewards that all companies offer. For leave allowance, about 92% of the respondents agreed to be operational in their companies; sick leave, promotion, and training were reported by 88%, 90%, and 78%, respectively.

4.4. Financial Rewards and Motivation

Table 2: Financial Rewards and Motivation

| Items | SD | D | N | A | SA | Mean |

| The basic pay by my organisation is at par with other equivalent players in the market | 5 | 7 | 15 | 53 | 20 | 3.76 |

| I am committed to my employer as a way of appreciation demonstrated for the financial benefits I receive | 2 | 3 | 5 | 67 | 23 | 4.06 |

| The incentive plans such as bonuses and commissions I receive from my employer are adequate | 4 | 6 | 3 | 77 | 10 | 3.83 |

| The retirement benefits scheme offered by my employer is satisfactory and motivating to employees | 3 | 1 | 4 | 68 | 24 | 4.09 |

| My employer offers a medical scheme that is comparable to what is in the market hence a motivator for us to continue working | 1 | 0 | 7 | 68 | 24 | 4.14 |

| My employer embraces new financial compensation trends in the market, which motivates us | 5 | 7 | 15 | 53 | 20 | 3.76 |

| The pensions benefits offered to me are good and key to my tireless work in this organisation | 4 | 6 | 3 | 74 | 13 | 3.86 |

| The fact that I do not incur problems with my arrangements for leave makes me continue being part of this company | 3 | 4 | 15 | 58 | 20 | 3.88 |

| Salary increases make me work extra hard for promotion to earn more for my needs | 3 | 5 | 5 | 74 | 13 | 3.89 |

| The housing allowance provided by my company has facilitated my efforts towards workings for the company | 2 | 1 | 6 | 68 | 23 | 4.09 |

| The fact that my company can provide me with paid sick leave is very encouraging and gives me reasons to continue working in my current job | 4 | 3 | 13 | 60 | 20 | 3.89 |

| Promotions come with more financial benefits; hence I will work hard to achieve a higher rank | 2 | 2 | 7 | 65 | 24 | 4.07 |

1-Strongly Disagree (SD), 2-Disagree (D), 3-Neutral (N), 4-Agree (A), and 5- Strongly Agree (SA)

Table 3: Level of motivation from on financial rewards

| How motivated are you with the following aspects of financial rewards? | Not motivated at all | Somewhat motivated | Motivated | Very motivated | Extremely motivated | Mean |

| Salary | 0 | 4 | 16 | 58 | 22 | 3.98 |

| Performance-based pay | 0 | 2 | 19 | 69 | 10 | 3.87 |

| Incentives (bonuses and commissions) | 2 | 0 | 24 | 62 | 12 | 3.82 |

| Benefits (house allowance, leave allowance, life insurance, health insurance, retirement, etc.) | 2 | 1 | 21 | 61 | 15 | 3.86 |

| Promotional and salary increment | 3 | 2 | 17 | 58 | 20 | 3.90 |

Tables 2 and 3 show the relationships between financial rewards and motivation. Table 2 indicates that the majority of the respondents agreed and strongly agreed with the listed items about financial rewards and motivation. The mean value for all items in Table 2 is more than 2.5; hence smaller standard deviation to demonstrate the high level of agreement among respondents. In Table 3, the performance for mean value is also above 2.5 for all the aspects of financial rewards; hence the high level of motivation attained.

4.5. Correlation Analysis

Table 4: Correlations between Financial Rewards and Motivation

| Financial rewards | Motivation | Salary/base pay | Performance-based pay | Benefits (house allowance etc) | Promotional increment pay | ||

| Financial rewards | Pearson correlation | 1.00 | .379 | .301 | .293 | .211 | .262 |

| Sig. (2-tailed) | .001 | .003 | .012 | .017 | .014 | ||

| N | 100 | 100 | 100 | 100 | 100 | 100 | |

| Motivation | Pearson correlation |

.379 |

1.000 | .311 | .342 | .125 | .134 |

| Sig. (2-tailed) |

.001 |

.009 | .003 | 0.321 | 0.303 | ||

| N | 100 | 100 | 100 | 100 | 100 | 100 | |

| Salary/base pay | Pearson correlation | .301

|

.311 | 1.000 | .085 | .071 | .059 |

| Sig. (2-tailed) | .003

|

.009 | .487 | .524 | .673 | ||

| N | 100 | 100 | 100 | 100 | 100 | 100 | |

| Performance-based pay | Pearson correlation |

.293 |

.342 | .301 | 1.000 | .279 | .309 |

| Sig. (2-tailed) |

.012 |

.003 | .007 | .011 | .004 | ||

| N | 100 | 100 | 100 | 100 | 100 | 100 | |

| Benefits (house allowance etc.) | Pearson correlation |

.211 |

.125 | .241 | .211 | 1.000 | .086 |

| Sig. (2-tailed) |

.017 |

.321 | .013 | .015 | .541 | ||

| N | 100 | 100 | 100 | 100 | 100 | 100 | |

| Promotional increment pay | Pearson correlation |

.262 |

.134 | .367 | .094 | .283 | 1.000 |

| Sig. (2-tailed) | .262

|

0.303 | .002 | .471 | .013 | ||

| N | 100 | 100 | 100 | 100 | 100 |

Table 4 shows that there is a significant and positive correlation between the financial rewards in the working environment and the motivation for employees (0.379). Similarly, this table shows a strong correlation between the financial rewards and motivation in regard to the salary/base pay (0.311), performance-based pay (0.342), benefits (house allowance, etc.) (0.321), and promotional increment pay (0.303). Therefore, the results as shown in the table indicate that the motivation of the employees is dependent on the financial rewards offered.

Chapter Five: Evaluation of Results

5.1. Relationship between Financial Rewards and Motivation

This study aimed to test the relationship between financial rewards and the motivation of the employees in their working environment with specific reference to the manufacturing and service industries. The findings of this research concur with the information mentioned earlier as critically analysed in the literature review. Thus, it means that when the financial rewards are higher for workers, it plays an important role in advancing their motivation. This is evidently shown in the outcomes of the study. Most respondents stated that their motivation would enhance their job performance, as they expect an increment in financial compensation in return. Similarly, a significant number of respondents expressed that motivation tends to encourage the enthusiasm of workers towards their job even in situations that are considered odd provided they expected financial compensation.

Evident in provided in Graph 1 shows that many companies, especially in manufacturing and services, have embraced significant monetary compensation. The identified financial rewards include base pay, house allowance/housing, medical cover, leave allowance, paid sick leave, promotional-based increment, life insurance, retirement benefits, and any personal services. The role of these rewards has been well defined in the literature review, which formed the basis for examining these aspects in the current paper. For instance, Aktar et al. (2013) identified basic pay, performance-based pay, incentives, and benefits as some of the most practiced forms of rewards. The use of these rewards was supported, including basic pay, incentive, and benefits to enable an employee to earn additional compensation for performing some tasks (Amin et al., 202). Most importantly, the financial rewards allow the employees to feel belonging to the organisation.

The most important aspect is how this study established the critical value of financial rewards when it comes to motivating workers. Evidence is provided in Table 2, in which the majority of the respondents agreed with the statements supporting the combination of financial rewards with motivation. For instance, most find it necessary to receive equal basic pay as what is offered in the market. At the same time, another significant group feels the when offered financial benefits such as health insurance, paid leave, or even house allowance; it is a way to appreciate them. This, in turn, enhances their commitment to what they are assigned to do and even does more to earn more financial resources. In any case, these respondents want their respective organisations to keep the pace of any new compensation trend that emerges in the market to continue making them work within the companies.

The literature review has provided information about having financial rewards enhance motivation, as shown in the current investigation. For instance, Seman and Suhaimi (2017) found financial rewards more effective and powerful for achieving the motivation of the employees as they are made to believe in their worthiness. A performance-based salary increase is an important motivating factor for low- and middle-income employees. They find it essential to contribute to the organisation and recognition (Ali and Akram, 2012). Financial rewards include fringe benefits, attracting, motivating, and maintaining competent employees (Kamau, 2013). Additionally, organisations with higher financial benefits attract the best workforce because of feel motivated and recognised. According to Göktepe et al. (2020), financial rewards in managing employees’ performance are considered an effective motivator.

The critical link and integration of the findings of this study show that the advantage of the human asset should be fronted as the most imperative area of interest in any organisation. Most organisations need to consider ways to achieve the highest efficiency and effectiveness outcomes from human motivation. As shown in Table 2, employees agree that they will work hard to achieve a higher rank because promotions come with more financial benefits such as increased housing or even higher health insurance. This finding aligns with the literature that when employees feel or expect to be compensated for hard work by the employers, they would always do their highest as admitted in the current case. It then means that employees can access as many components as possible, including motivation to change their performance.

The concept of motivation has widely been described by Olusadum and Anulika (2018), who found it as a force that initiates actions and enables specific goals which influence workers towards earning financial rewards. Motivation has been characterized as developing various procedures that express and control people’s behaviour towards achieving particular behaviour. The greatest performance of a worker happens when they feel that their efforts are remunerated and repaid (Aslam, 2014). The motivation of the employees comes from the extent to which satisfaction is achieved, which then influences the behaviour of the staff and the specific performance. This is extensively supported in the literature review, with Tausif (2012) supporting money as a significant motivational aspect for workers and a way to satisfy the needs of life. Achieving motivation has been highlighted in Table 3, which shows some of the key aspects of financial rewards, including basic pay or salary, benefits, and incentives.

Extant research has emphasised the relationships between motivation and the financial reward to the extent of employees’ performance. Kumar et al. (2015) established the great impact of financial reward on motivation, arguing that giving high salaries or bonuses motivates the majority of them to the extent of well-satisfying them with jobs. The motivation is based on the desire to meet the needs and difficulties of life, urging them to do well for financial rewards. Based on this, the current research highlights the role of mediating motivation in relationship with financial rewards and how this impacts employees’ performance.

Mansaray-Pearce et al. (2019) argued that the wants and needs for satisfaction among workers, including paying bills, motivate them to improve performance to earn more money to meet their needs. This is reflected back in the results of this study which shows the significant relationships between the independent variables of financial rewards, including basic pay or salary, benefits, performance-based pay, and incentives (Benzing et al., 2009). Before conducting research, these forms of compensation have widely been discussed in the literature review. For instance, basic pay has been described as the most important reward in the work environment since it determines the extent level of pay that people receive in monetary form. Money has been discussed as essential in the sense that it can buy things and defines the worthiness of an employee (Chanza et al., 2013). The use of incentives and benefits enables an employee to earn additional compensation for performing some tasks. Bonus provisions allow managers to receive lumpsum payments from special funds depending on how the organisation performs. In addition, to pay, employees are given fringe benefits to create an optimistic and motivating work environment and increase sales and output.

The results of the correlations analysis in Table 4 show the positive correlation relationship between financial rewards and motivation. The findings indicated in this analysis affirm the hypothesis as it demonstrates that pay and advantages play a key role in achieving employee motivation. Financial rewards have been considered a principal factor that enhances performance (Adzei and Atinga, 2012). Literature review established the need for organisations to use financial rewards in managing employees’ performance because they are effective motivators (Doreen and Nkrumah, 2013). This is the case because financial rewards motivate workers to perform a specific task in a particular manner and often associate employees with commitment. Hence, salary raises, bonuses, and promotions motivated workers leading to high performance and low turnover.

Significant research investigations have established the existence of a strong relationship between financial rewards and motivation. The review by Mathis et al. (2013) indicated that motivation is a great stimulator for the workers to perform well. Similarly, Ali and Akram (2012) found out that the impact of financial rewards on employee motivation based on genders had slight differences. The women were more motivated than men, but the finding was insignificant. Therefore, financial rewards are crucial in motivating both male and female employees. Motivated employees will get satisfied with carrying out their job financially and psychologically, leading them to perform their work successfully. Therefore, those companies with committed workers can enhance the productivity, safety, profit, and high retention rate for employees.

5.2. Limitations of the Study

The study is subject to multiple limitations that may impact its validity and future application, requiring more research than the current. The first form of limitation is concerned about the external validity of the research following the sample size that was limited to manufacturing and service industries. Though these are among the key industries in the marketplace, using samples specifically from these two industries subjects the research to the inherent problems. This is because one cannot generalize findings with certainty hence low external validity. Similarly, the sample shifted significantly towards concentrating more on upper posts grades, limiting generalizing the findings to lower post grades. Similarly, there was a limitation relating to the conceptual framework because only two variables were studied in the current research. Many independent variables, including other rewards and dependent variables such as job satisfaction and performance, are left out of the investigation process by focusing on financial rewards and motivations. Therefore, future research would require that more samples be considered, more so from other industries rather than only focusing on specific industries. Similarly, there needs to be an extension on the variables beyond financial rewards and motivation to give research a wider perspective.

Chapter Six: Conclusions and Recommendations

6.1. Conclusions

The study aimed to establish the relationship between financial rewards and motivation within the working environment. Preliminary information established the need for the managers to motivate workers towards achieving the organisational goals and improving performance. Due to the complex nature of the working environment and since human beings are not homogeneous by nature, achieving not easier to achieving motivation for all employees is not easier. Most organisations tend to use financial rewards to boost employee morale, compensate, and retain them. However, there are instances when the use of financial rewards as an extrinsic reward has been associated with some form of bias and sometimes not being adequate motivators for workers to the extent of demotivating them.

Despite the research gap, there is evidence that a significant number of companies have implemented reward systems based on monetary compensation. For instance, some common rewards identified in the research include base pay which also comes in salaries or the compensation that employees have to receive. At the same time, there are benefits that these companies have considered, such as house allowance or housing, medical cover, life insurance, retirement benefits, and paid leaves. Similarly, a considerable number of these organisations have identified the use of incentives such as bonuses and commissions that have been offered to their employees.

A link between these financial reward aspects and motivation showed a relationship. The investigation established that most employees perceived adequate incentives such as commissions and bonuses from their employers. They also found the benefits as being motivating to them, including health and life insurance. The fact that employees find it easier and compensated for the time they spend at home on leave encourages them to want to do more for the company and stay around. They desire these financial rewards to continue to be in place, and even companies keep pace with the new trends that emerge in the market to have employees work more and perform better. These findings have been supported significantly in the literature and the preliminary studies.

Researchers have argued the existence of many needs and want by the employees being human. Some of the wants and needs for satisfaction among workers include paying bills motivating them to improve performance to earn more money to meet their needs. This is reflected back in the results of this study which shows the significant relationships between the independent variables of financial rewards, including basic pay or salary, benefits, performance-based pay, and incentives. It shows that regardless of the position or the level of management a person occupies in the organisation, providing them with financial rewards motivates them more and increases their level of performance. Basic pay has been identified as a typical financial reward that organisations offer their employees hence the most crucial reward in the work environment. The basic pay sets the stage for the employees to receive compensation for the work done.

The use of incentives and benefits makes employees add extra efforts in how they perform their work. Companies provide a bonus for the workers at all levels to receive lumpsum payments from special funds depending on how the organisation performs. In addition, to pay, employees are given fringe benefits to create an optimistic and motivating work environment and increase sales and output. Therefore, the fact that the relationship between financial rewards and motivation is positive and significant means that the research confirmed all the hypothetical statements made at the preliminary level of the study. Though the study focused more on the manufacturing and service industries, these results may reflect the phenomena around all sectors’ working environments.

However, further research conducted in the area could be appropriate to put to rest the multiple questions that may emerge from these findings. For instance, a similar study should be conducted in other areas or industries such as education and production to establish if financial reward aspects could influence the people working in these industries. Significantly, there should be an extension to include other variables beyond financial aspects and motivation alone to outline the entire working environment. The suggestions made to have further study do not prove the insufficiency of this study, considering that a strong and positive relationship has been established between the study variables. The researcher can empirically argue in support of financial aspects regarding the working environment and influencing employees.

6.2. Recommendations

Though the study established a positive relationship between financial rewards and motivation, responses revealed some key interesting issues. Similarly, the entire research has been highlighted to exhibit some limitations. Therefore, to address some of these issues, the following recommendations need to be considered:

There is the need to consider a different sampling procedure if the researcher wants to have significantly different results beyond the manufacturing and services industries. Some key sectors, including education, depend largely on human production and dedication hence establishing their level of motivation is essential. Similarly, considering a different sample would be effective in dealing with issues related to diversity and social aspects as it plays a role in motivation. An extension should consider various aspects of age, gender, and race because the current study had these elements not taken into account, and the results may be biased in a way.

Even though the findings showed financial rewards as key in the working environment, research gaps still exist, with previous researchers arguing that non-financial rewards such as training and autonomy are significant. Therefore, the need to shift to examine beyond these financial aspects to compare what best influences workers and develop the critical ways that could see high performance achieved in the industry.

A significantly important aspect of being considered is measuring the motivational level for each employee reward. The current study only looked at motivation in general regardless of the variation depending on the reward offered. Establishing the levels depending on the rewards would help companies draw the line on what to offer. Besides, researchers need to consider variations in the industrial environment that affect the motivation of employees. Workers who exist in different places may not be impacted by the same factors, such as financial rewards. There is a need to establish the most influential factors that would motivate workers more depending on the industry.

References

Abdullah, AA and Wan, H.L., 2013. Relationships of non-monetary incentives, job satisfaction, and employee job performance. International Review of Management and Business Research, 2(4), p.1085. doi:10.1.1.681.506. https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.681.506&rep=rep1&type=pdf

Adair, J., 2006. Leadership And Motivation the Fifty-Fifty Rule and The Eight Key Principles of Motivating Others-John Adair. Leadership, 17, p.05. Available at: https://pdfcookie.com/documents/leadership-and-motivation-the-fifty-fifty-rule-and-the-eight-key-principles-of-motivating-others-john-adair-ex2040193 (Accessed:19/07/2021)

Adzei, F.A. and Atinga, R.A., 2012. Motivation and retention of health workers in Ghana’s district hospitals: addressing the critical issues. Journal of health organisation and management. https://www.academia.edu/download/54700474/14777261211251535.pdf

Akafo, V. and Boateng, P.A., 2015. Impact of reward and recognition on job satisfaction and motivation. European Journal of Business and Management, 7(24), pp.112-124. Available at: https://core.ac.uk/download/pdf/234626762

Akgunduz, Y., Adan Goku, Ö. and Alkan, C., 2020. The effects of rewards and proactive personality on turnover intentions and meaning of work in hotel businesses. Tourism and Hospitality Research, 20(2), pp.170-183. doi:10.1177/1467358419841097

Aktar, S., Sachu, M.K. and Ali, M.E., 2012. The impact of rewards on employee performance in commercial banks of Bangladesh: an empirical study. IOSR Journal of Business and Management, 6(2), pp.9-15. doi:10.1.1.1084.5342

Aktar, S., Uddin, M.Z. and Sachu, M.K., 2013. The impact of rewards on job satisfaction and employees’ performance in Bangladesh: A comparative analysis between pharmaceutical and insurance industries. International Journal of Business and Management Invention, 2(8), pp.1-8. https://www.academia.edu/download/31994592/A02820108.pdf

Alexy, O. and Leitner, M., 2011. A fistful of dollars: Are financial rewards a suitable management practice for distributed models of innovation?. European Management Review, 8(3), pp.165-185. https://onlinelibrary.wiley.com/doi/pdf/10.1111/j.1740-4762.2011.01017.x

Ali, A. and Akram, M.N., 2012. Impact Of Financial Rewards on Employee Motivation and Satisfaction in Pharmaceutical Industry, Pakistan. Global Journal of Management and Business Research, 12(17). Available at: http://journalofbusiness.org/index.php/GJMBR/article/view/813 (Accessed: 18/07/2021)

Amin, M., Shamim, A., Ghazali, Z. and Khan, I., 2021. Employee Motivation to Co-Create Value (EMCCV): Construction and Validation of Scale. Journal of Retailing and Consumer Services, 58, p.102334. doi:969698920313424

Aslam, S., 2014. Impact of financial and non-financial rewards on employee motivation. Middle-East journal of scientific research, 21(10), pp.1776-1786. https://www.academia.edu/download/35107307/17.pdf

Benzing, C., Chu, H.M. and Kara, O., 2009. Entrepreneurs in Turkey: A factor analysis of motivations, success factors, and problems. Journal of small business management, 47(1), pp.58-91. doi:10.1111.1540-627.2008.00262

Bryman, A. (2006) ‘Integrating quantitative and qualitative research: How is it done?” Qualitative Research, Vol. 6, no. 1 pp 97-113. https://people.utm.my/uzairiah/wp-content/blogs.dir/1541/files/2016/11/Qualitative-Research-2006-Bryman-97-113.pdf

Bryman, A. (2012) Social research methods. New York: Oxford University Press. (4th edition). https://ktpu.kpi.ua/wp-content/uploads/2014/02/social-research-methods-alan-bryman.pdf

Chamorro-Premuzic, T., 2013. Does money really affect motivation? A review of the research. Harvard business review, 10, pp.1-5. https://hbr.org/2013/04/does-money-really-affect-motiv

Chanza, A.W., Snelgar, R.J. and Louw, G.J., 2013. The motivational value of rewards amongst Malawi’s health professionals. SA Journal of Human Resource Management, 11(1), pp.1-14. doi:10.4102/111.517

Chepkwony, C.C. and Oloko, M., 2014. The relationship between rewards systems and job satisfaction: A case study at teachers’ service commission-Kenya. European Journal of Business and Social Sciences, 3(1), pp.59-70. https://www.academia.edu/download/49775267/THE_RELATIONSHIP_BETWEEN_REWARDS_SYSTEMS_AND_JOB_SATISFACTION.pdf

Choi, S., Cheong, K.K. and Feinberg, R.A., 2012. Moderating effects of supervisor support, monetary rewards, and career paths on the relationship between job burnout and turnover intentions in the context of call centers. Managing Service Quality: An International Journal. doi:10.1108/0960452121128139

Dahl, D.W. and Smimou, K., 2011. Does motivation matter? On the relationship between perceived quality of teaching and students’ motivational orientations. Managerial Finance. doi:10.1108/03074351111140243

Doreen, D. and Nkrumah, S., 2013. Effects of Rewards Systems on Employees Performance (A Case Study of Ghana Commercial Bank Ejisu Branch). Unpublished Master Thesis, Ghana: Christian Service University. doi:8080/123456789/250

Eisenberger, R. and Rhoades, L., 2001. Incremental effects of reward on creativity. Journal of personality and social psychology, 81(4), p.728. doi:2001-18605-013

Eisenberger, R. and Shanock, L., 2003. Rewards, intrinsic motivation, and creativity: A case study of conceptual and methodological isolation. Creativity Research Journal, 15(2-3), pp.121-130. doi:10.1080/10400419.2003.9651404

Elliott, R., Friston, K.J. and Dolan, R.J., 2000. Dissociable neural responses in human reward systems. Journal of neuroscience, 20(16), pp.6159-6165. Available at: https://www.jneurosci.org/content/20/16/6159

Emmanuel, T., 2018. The impact of Reward Systems as a Motivation tool for Employees Performance (Doctoral dissertation, Dublin, National College of Ireland). http://norma.ncirl.ie/3389/1/tayoemmanuel.pdf

Eshun, F.K.D., 2011. Rewards as a Motivation tool for Employee Performance. https://www.diva-portal.org/smash/get/diva2:832968/FULLTEXT01.pdf

Ferreira, N. and Coetzee, M., 2010. Psychological career resources and organisational commitment: Exploring sociodemographic differences. South African Journal of Labour Relations, 34(2), pp.25-41. doi:10.10520/59646

Galaro, J.K., Celnik, P. and Chib, V.S., 2019. Motor cortex excitability reflects the subjective value of reward and mediates its effects on incentive-motivated performance. Journal of Neuroscience, 39(7), pp.1236-1248. Available at: https://www.jneurosci.org/content/39/7/1236

Ghazanfar, F., Chuanmin, S., Khan, M.M. and Bashir, M., 2011. A study of relationship between satisfaction with compensation and work motivation. International Journal of Business and Social Science, 2(1). https://www.researchgate.net/profile/Faheem-Ghazanfar/publication/228752899

Gheitani, A., Imani, S., Seyyedamiri, N. and Foroudi, P., 2019. Mediating effect of intrinsic motivation on the relationship between Islamic work ethic, job satisfaction, and organizational commitment in banking sector. International Journal of Islamic and Middle Eastern Finance and Management. doi:10.110-01-2018-0029

Gikuya, C.N., 2014. Perceived relationship between non–financial rewards and employee motivation at impact marketing (k) limited (Doctoral dissertation, University of Nairobi). Available at: http://erepository.uonbi.ac.ke/handle/11295/77289 (Accessed: 25/07/2021)

Gohari, P., Kamkar, A., Hosseinipour, S.J. and Zohoori, M., 2013. Relationship between rewards and employee performance: A mediating role of job satisfaction. Interdisciplinary journal of contemporary research in business, 5(3), pp.571-597. https://journal-archieves34.webs.com/571-597.pdf

Göktepe, N., et al., 2020. The relationship between nurses’ work‐related variables, colleague solidarity and job motivation. Journal of nursing management, 28(3), pp.514-521. doi:10.1111/12949

Gold, J., et al., 2013. Human resource development: Theory and practice. Macmillan International Higher Education.

Hafiza, N., et al., 2011. Relationship between rewards and employee’s motivation in the non-profit organizations of Pakistan. Business intelligence journal, 4(2), pp.327-334. doi:10.1.1.472.8414

Haider, M., Aamir, A., Hamid, A.A. and Hashim, M., 2015. A literature analysis on the importance of non-financial rewards for employees’ job satisfaction. Abasyn Journal of Social Sciences, 8(2), pp.341-354. http://ajss.abasyn.edu.pk/admineditor/papers/V8I2-10.pdf

Hofmans, J., De Gieter, S. and Pepermans, R., 2013. Individual differences in the relationship between satisfaction with job rewards and job satisfaction. Journal of vocational behavior, 82(1), pp.1-9. https://www.researchgate.net/profile/Roland-Pepermans/publication/235401809

Jehanzeb, K., Rasheed, M.F. and Rasheed, A., 2012. Impact of rewards and motivation on job satisfaction in banking sector of Saudi Arabia. International Journal of Business and Social Science, 3(21). https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1070.749&rep=rep1&type=pdf

Khan, S., Zarif, T. and Khan, B., 2011. Effects of recognition-based rewards on employees’efficiency and effectiveness. IBT Journal of Business Studies (JBS), 2(2). Available at: http://ibtjbs.ilmauniversity.edu.pk/arc/Vol07/i2p1

Kumar, D., Hossain, M.Z. and Nasrin, M.S., 2015. Impact of non-financial rewards on employee motivation. Asian Accounting and Auditing Advancement, 5(1), pp.18-25. https://www.researchgate.net/profile/Dhanonjoy-Kumar/publication/336994971

Mansaray-Pearce, S., Bangura, A. and Kanu, J.M., 2019. The impact of financial and non-financial rewards on employee motivation: Case study NRA Sierra Leone. International Journal of Research in Business Studies and Management, 6(5), pp.32-41. https://www.ijrbsm.org/papers/v6-i5/4.pdf

Pritchard, R.D., Campbell, K.M. and Campbell, D.J., 1977. Effects of extrinsic financial rewards on intrinsic motivation. Journal of Applied Psychology, 62(1), p.9. https://psycnet.apa.org/journals/apl/62/1/9/

Roberts, R.L., 2015. The relationship between rewards, recognition and motivation at an Insurance Company in the Western Cape (Doctoral dissertation, University Of The Western Cape). https://etd.uwc.ac.za/bitstream/handle/11394/217/Roberts_MCOM_2005.pdf?sequence=1&isAllowed=y

Saunders, M., Lewis, P. & Thornhill, A. (2016) Research Methods for Business Students. Harlow, Essex: Pearson. https://www.academia.edu/23374295/Research_Methods_for_Business_Students_5th_Edition

Seman, K. and Suhaimi, S.A., 2017. The Relationship Between Financial And Non-Financial Rewards On Employee’s Job Satisfaction At Manufacturing Industries In Malaysia. International Journal of Accounting, Finance and Business, 2(5), pp.15-23. http://www.ijafb.com/PDF/IJAFB-2017-05-09-02.pdf

Tausif, M., 2012. Influence of non financial rewards on job satisfaction: A case study of educational sector of Pakistan. Asian Journal of Management Research, 2(2). https://www.academia.edu/download/44076383/fulltext_stamped.pdf

Terera, S.R. and Ngirande, H., 2014. The impact of rewards on job satisfaction and employee retention. Mediterranean Journal of Social Sciences, 5(1), p.481. https://www.mcser.org/journal/index.php/mjss/article/viewFile/1925/1924

Tsede, O.A. and Kutin, E., 2013. Total reward concept: A key motivational tool for corporate Ghana. Business and Economic Research, 3(2), p.173. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.919.2979&rep=rep1&type=pdf

Zaraket, W.S. and Saber, F., 2017. The impact of financial reward on Job satisfaction and performance: Implications for Blue Collar Employees. China-USA Business Review, 16(8), pp.369-378. https://www.academia.edu/download/55157483/China-USA_Business_Review_ISSN_1537-1514_Vol.16__No.8__2017.pdf#page=24

write

write