Executive Summary

FTC&I is a financial services company that specialises in trading precious metals like gold, silver, platinum, etc. The company’s want to provide trustworthy service to their customers with while abiding by the law. According to the company’s roadmap, the client onboarding process starts with a consultant or partner adviser acquiring customer data and verifying the necessary documents. Then, risk assessment and financial crime prevention are done using KYC and AML procedures. After the consumers successfully complete these steps, a consultant creates their user accounts and assists them in selecting the kinds of precious metals they wish to purchase.

Customers may also buy precious metals through a brand-new online service at predetermined intervals, enabling them to build up their collections over time. The system employed tracks the number of precious metals that clients hold automatically and calculates the balance to decide when to purchase more. The system is built to adhere to rules, offer a safe platform, and be flexible enough to accommodate new practices like gamification and learning platforms. The roadmap and system design enable FTC&I to provide clients with a dependable and secure service while adhering to legal requirements.

Introduction

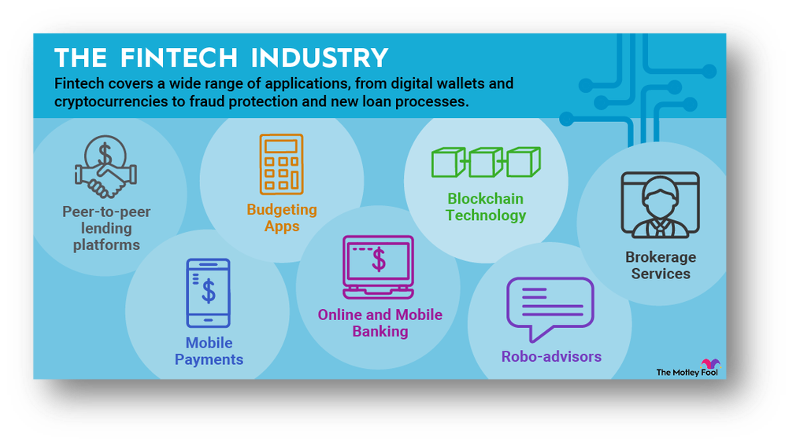

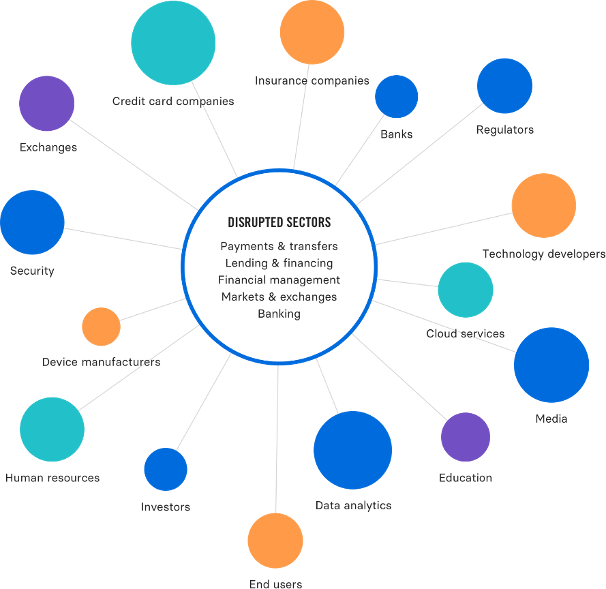

Since 1999, high-net-worth people in Europe have had access to the knowledge and investment options offered by the financial services firm FTC&I in precious metals including gold, silver, and platinum. However, because of the rise of new fintech businesses that provide digital means to invest in fascinating sectors, such as cryptocurrency, the expansion of FTC&I has slowed recently. In 2020, FTC&I created a unique digital system that replaced its paper-based system and improved its procedures in order to remain competitive. The market study revealed that FTC&I’s product had high financial safety but was only available to those with high networks, however, the firm was still in decline despite this. FTC&I needed to reorganize its technology and procedures in order to expand its services to the general public. By doing this, FTC&I would be able to compete with other companies on the market and reach a larger audience.

Case Study: The Know Your Customer (KYC) and Anti Money Laundering (AML) checks are the first steps in the customer onboarding process at FTC&I. After passing these tests and transferring the requisite cash, client accounts are enabled. A digital adviser helps set up financial services and create accounts. Without a consultant, clients may start the KYC procedure online. Customers of the new product can occasionally buy a variety of metals, with purchases being made in accordance with their financial resources and metal prices. The management, advisers, and agent components of FTC&I’s structure each get recurring payments following each transaction. The system is prepared for new themes like gamification, learning platforms, and blockchain and supports regulations like GCPR, KYC, and AML. FTC&I hires an outside auditor to examine their bullion and contrast their clientele’s precious metal holdings with their own. For each transaction involving precious metals, clients receive information on the balance of their accounts.

Important of The Case Study

Adapting to the new fintech revolution and broadening its services to the general public presented hurdles for a successful financial services firm that offered knowledge and services in precious metal investments, as shown in the case study. To enable selling its goods to people and worldwide, the firm had to restructure its technology and procedures and create a unique digital system. The report emphasizes the need to accept digital technologies and market change to stay competitive. It also emphasizes the necessity of the system’s design to be scalable and extensible in order to facilitate future expansion and the creation of new services and product concepts.

Objectives Of the Case Study

Depending on the precise aims and setting of the research, the objectives of a case study might change. However, some typical case study goals are as follows:

- Understanding a specific phenomenon or problem: A case study can be utilised to obtain an understanding of a specific problem or circumstance that is not commonly known.

- Testing hypotheses: Case studies can be used by researchers to evaluate theories on the origins or consequences of a specific occurrence.

- Developing new theories or models: Case studies may be used to create fresh ideas or models that describe how people or organizations behave.

- Evaluating interventions or programs: Case studies may be utilised to assess how well programs or interventions work to get the desired results.

- Identifying best practices: The best practises or lessons from productive initiatives or programs may be found in case studies.

A case study’s primary goal is to offer a thorough knowledge of a particular phenomenon, issue, or circumstance. Researchers can provide novel insights, hypotheses, or models that can guide future study, practice, and policy by thoroughly and methodically analysing the data.

Strategy And Necessary Steps to Consider

Here are some crucial actions to take into account for the conversion of FTC&I.

Evaluate The Current System: The current FTC&I system was created over the course of a year and put into service at the start of 2021. Although it was built as a monolithic system with limited flexibility, it was effective in digitizing all internal procedures. Additionally, it became obvious that customers needed to expend a lot of effort to discover the proper product with the growing number of digital services offered online. Despite this, a market analysis revealed that the product offered by FTC&I had a high level of financial security and could be further improved by the new digital system. To grow its services to a larger customer base, the company sought to revamp its technology and business procedures.

Develop A Digital Strategy: Outlining an organization’s use of digital technology to accomplish its objectives is a key component of developing a digital strategy. This approach often entails finding digital platforms and tools that may be used to connect with target audiences and produce desired results, like boosted sales or engagement (Zhao, et al.,2022). It could also entail creating a plan for putting digital efforts into action, choosing quantifiable goals, and defining success measures. Understanding the organization’s strengths and limitations, its target market, and the competitive environment is essential for developing a successful digital strategy. In order to keep it current and useful, it should also be reviewed and updated frequently.

Build A New Digital System: A new digital system must be built using a number of phases, including business requirements analysis, architectural design, technology stack selection, system development, and testing. The system’s aims and objectives must be defined first, then the needs of the users must be determined. The system architecture is created and the technology stack is chosen for development after the requirements have been decided upon. Code authoring, testing, and debugging are all steps in the development process that continue until the system is ready for launch (Alaassar, et al.,2023). To guarantee that the system continues to operate efficiently and satisfy shifting business requirements, regular upgrades and maintenance are crucial.

Train Employees: It is essential for the new digital system’s installation that FTC&I workers are trained on how to utilize it. The system’s functionality, customer contact, addressing complaints, and technical problems should all be covered in a thorough training program. The training must be delivered by knowledgeable instructors who can clearly communicate the features and advantages of the system. To acquaint staff members with the new system, it ought to incorporate practical practice sessions and simulations. To make sure that staff members are utilizing the system properly and to resolve any problems they may have experienced, follow-up meetings should also be scheduled. Customer satisfaction will increase and business operations will be improved with well-trained personnel.

Develop A Digital Advisor: The client experience may be enhanced by creating a digital adviser, such as a chatbot that helps to automate account creation and onboard new customers. To meet with rules, the adviser should be built to carry out Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. In order to complete the onboarding process, it should also be able to confirm the required financial transfers. The chatbot should also be built to assist clients and respond to their questions. The digital advisor may help consumers around the clock and speed up the procedure of onboarding new clients, increasing the organization’s overall effectiveness.

Implement A Provisioning System: To handle their organizational structure, FTC&I must implement a provisioning system. This system should make it possible to allocate customer payments for provisions to different employees, including management, advisers, and agents, in accordance with their obligations. The danger of mistakes and conflicts should be minimized by a well-implemented provisioning system that offers a clear and equitable process for commission calculations and payouts. In order to track and evaluate the work of the agents, it should also be able to produce reports for management. Overall, the provisioning system ought to simplify things and guarantee that everyone receives just compensation for their labor.

Develop A Customer Support Plan: Making sure that customers have access to high-quality service that fulfills their needs, is a key component of creating a customer support strategy. This may be done by offering customer support agents who can help with any problems or worries that may come up (Baltgailis and Simakhova.,2022). The strategy needs to be all-inclusive and support both the new digital infrastructure as well as the new product and service offerings. Customers’ overall satisfaction with FTC&I will increase as a result of this guaranteeing they have access to the service they require when they need it. The customer support strategy should also be reviewed and revised on a regular basis to make sure it remains relevant to customers’ evolving demands.

Considering Roadmap

A consultant or a partner advisor at FTC&I gathers the customer’s information and confirms their required papers to start the client onboarding process. To guarantee regulatory compliance and stop financial crimes, the obtained data is subsequently sent for KYC and AML processes. These processes aid FTC&I in getting to know their clients better, evaluating risks, and defending the company against any liabilities. By taking this action, FTC&I can offer their clients a safe and reliable service while also abiding by legal standards (Takeda and Ito., 2021).

Clients must successfully pass the KYC and AML procedures before their accounts may be authorized. After that, a consultant sets up user accounts for the clients and helps them set up their financial services. This entails choosing the kinds of precious metals they want to buy and putting up the right investing plan. Clients may receive extra advice from the adviser on the process of purchasing and selling precious metals. In general, this stage is essential to guaranteeing that consumers are adequately onboarded and obtain the assistance they want to make knowledgeable investment selections.

A variety of precious metals, made up of one metal type or a mix of other metals, is the latest product offering from FTC&I. The adviser makes sure the customer has successfully completed the KYC and AML procedures and has transferred the necessary monies before the account is authorized. The adviser is in charge of ensuring that all requirements have been met so that the client may access the new product. This entails confirming the client’s identification, looking into the source of funds, and making sure all legal and regulatory criteria are being followed (Piccolo, et al.,2022).

Users of the new online service can occasionally buy a variety of precious metals. Customers must conduct bank transfers at set intervals in order to keep their status as eligible for the service. With the help of this service, customers may gradually amass their own collection of precious metals. The adviser verifies the current precious metals prices and confirms that the money is accessible on the customers’ accounts. Based on this data, the agent determines how much money is needed for the transaction and how many precious metals may be purchased with the remaining cash. The agent then executes the transfers to and from the accounts of the customers.

When a customer requests to buy precious metals, the adviser verifies both the client’s account balance and the metals’ current market values. The agent determines the client’s provision for the transaction and the number of precious metals that may be acquired with the remaining cash based on this information. This guarantees that the customer is not overpaying and is just purchasing what they can afford. It also guarantees that the adviser is giving the customer appropriate price information and guiding them in making investment selections (Ford., 2020).

The new technology automatically keeps track of both the quantity owned by clients and the amounts of precious metals present in the bullion. It determines whether to buy more precious metals by regularly calculating the balance. The system will automatically buy new precious metals and keep them in the bullion if the balance is low, making sure that customers can access the precious metals they have acquired. Clients won’t have to keep track of their assets or manually buy extra precious metals as needed because of this method (Trad., 2021).

The new technology is made to follow regulations like GDPR, KYC, and AML all the way through the process. This implies that all user data will be treated securely and in accordance with the law (Elsheikh., 2022). Additionally, the structure will be flexible enough to accommodate emerging practices like gamification and client and agent learning platforms. The system will also be prepared for the integration of blockchain technology, which might offer advantages including improved transaction security and transparency. Overall, the framework is designed to be adaptable and able to keep up with changes in the sector.

Required Architectures

Business Architecture:

The consultant or partner adviser at FTC&I who gathers client data and confirms the required paperwork for onboarding is part of the suggested business architecture for the roadmap mentioned above. After that, the data is transferred for KYC and AML procedures to guarantee legal compliance and stop financial crimes. This phase is essential for risk assessment, improved client comprehension, and liability protection for the business. After clients pass the KYC and AML checks, a consultant creates their user accounts and helps them set up their financial services, choose the kinds of precious metals to buy, and create an investing strategy.

The adviser assures clients may access a collection of valuable metals, the newest product from FTC&I, by confirming their identity and source of cash. Customers may use the new online service to make bank transactions in order to buy different precious metals at set intervals. The adviser determines the customer’s provision for the transaction, computes the precious metals’ current market prices, and carries out the transfers (Grassi, et al.,2022).

The latest technology automatically maintains track of the volume of precious metals in the bullion as well as the volume possessed by clients. The system purchases more precious metals and saves them in the bullion so that consumers may access them without the need for manual intervention based on the computed balance. The system complies with rules like GDPR, KYC, and AML while also allowing for new techniques like gamification and agent and client learning platforms. In order to enhance transaction security and transparency, it also incorporates blockchain technology. In general, the business design is flexible and keeps up with developments in the industry.

Data Architecture:

The precious metals service from FTC&I is built with a data architecture that guarantees data security and regulatory compliance throughout customer onboarding and continuing transactions. A consultant gathers customer data and verifies the paperwork required for KYC and AML processes at the start of the process. Clients can only be approved and given accounts after passing these checks (Legowo, et al.,2020). The advisor offers continuing assistance and assists clients in selecting precious metals and creating investment strategies. The system keeps track of user balances and automatically buys more precious metals as needed. The system is intended to be flexible enough to accommodate new laws and technological advancements like blockchain integration and gamification. The design makes sure that user data is maintained legally and securely, shielding both consumers and businesses from legal troubles and financial responsibilities.

Application Architecture:

The design application should follow the strategic roadmap and can able legal compliance like as GDPR, KYC, and AML and safely storing and handling sensitive customer data. It should also be able to help clients with setting up their financial services, choosing precious metals, and making investment selections (Meng, et al.,2021).

The software must be able to monitor client account balances, precious metal costs, and market values in addition to automatically purchasing and storing more precious metals when the balance falls below a certain threshold. In order to improve transaction security and transparency, the system should also be flexible enough to accommodate new practices and be ready for the inclusion of blockchain technology.

In conclusion, the application design for this roadmap necessitates a scalable, adaptable system that can securely store and process sensitive client information, automate onboarding processes, offer investment help, and adjust to shifting market norms and technological advancements.

Technical Architecture:

Several elements are included in the technological architecture of FTC&I’s precious metals investing platform to guarantee regulatory compliance and offer clients a safe and dependable service. A consultant gathers customer data at the beginning of the process and verifies the paperwork needed for the KYC and AML procedures. Before accounts for clients may be approved, they must successfully complete these processes. An adviser creates user accounts, assists customers in choosing investing strategies, and offers extra guidance. Before customers may access the new product, the system also provides a range of precious metals, and the adviser assures compliance with legal and regulatory requirements (Berman, et al.,2021).

Customers can occasionally buy precious metals using the internet service, and the adviser double-checks account balances and current market prices before approving transactions. The system automatically keeps track of how many metals customers hold and how much is in the bullion, and if the balance is low, it will buy additional precious metals. The solution is adaptable enough to take into account new procedures and blockchain technology while adhering to GDPR, KYC, and AML laws. Ultimately, the architecture is built to adapt to industry developments while guaranteeing compliance and offering customers a safe and dependable service.

Proposing a System Architecture:

A web-based application supported by a safe and scalable cloud infrastructure should make up the final System Architecture. To meet clients’ demands, such as setting up financial services, buying precious metals, and getting guidance from advisors, the front end of the application should be created with a user-friendly interface. A solid serverless architecture that can handle the required KYC and AML procedures, autonomous bullion management, and safe data storage should power the application’s back end (Omarova., 2020).

For the purpose of processing transactions and real-time pricing of precious metals, the architecture should also interface with third-party APIs. The system should comply with industry standards like GDPR, KYC, and AML and have built-in security measures to ensure regulatory compliance.

Future extensions, such as the incorporation of blockchain technology or cutting-edge practices like gamification and client and agent learning platforms, should be possible thanks to the flexibility and adaptability of the proposed design. The infrastructure built on the cloud will make it simple to scale up to meet rising user demand while maintaining cost-effectiveness and top performance.

Overall, the suggested System Architecture should help the business achieve its objectives of offering clients secure and dependable services, abiding by the law, and making informed investment decisions.

Conclusion

The new online valuable metals trading service from FTC&I is designed to satisfy regulatory requirements while also providing consumers with a secure and trustworthy experience. The architecture consists of features like automated precious metals buying and monitoring, account creation and maintenance, KYC and AML procedures, and adherence to data security and privacy laws etc. The system is also adaptable enough to include modern methods and advancements like gamification, client learning platforms, and blockchain integration. Finally, this strategy is a comprehensive response that can support the efficient and secure trading of precious metals for FTC&I’s clients while keeping up with the shifting demands of the sector.

References

Alaassar, A., Mention, A.L. and Aas, T.H., 2023. Facilitating innovation in FinTech: a review and research agenda. Review of Managerial Science, 17(1), pp.33-66.

Baltgailis, J. and Simakhova, A., 2022. The technological innovations of FinTech companies to ensure the stability of the financial system in pandemic times. Marketing i menedžment innovacij, (2), pp.55-65.

Berman, A., Cano-Kollmann, M. and Mudambi, R., 2021. Innovation and entrepreneurial ecosystems: fintech in the financial services industry. Review of Managerial Science, pp.1-20.

Elsheikh, A.S., 2022, June. Blockchain Analytics Reference Architecture for FinTech-A Positioning Paper: Advancing FinTech with Blockchain, Data Analytics, and Enterprise Architecture. In Proceedings of the Federated Africa and Middle East Conference on Software Engineering (pp. 1-7).

Ford, C., 2020. A regulatory roadmap for financial innovation.

Grassi, L., Figini, N. and Fedeli, L., 2022. How does a data strategy enable customer value? The case of FinTechs and traditional banks under the open finance framework. Financial Innovation, 8(1), pp.1-34.

Legowo, M.B., Subanija, S. and Sorongan, F.A., 2020. Role of FinTech mechanism to technological innovation: A conceptual framework. International Journal of Innovative Science and Research Technology, 5(5), pp.1-6.

Meng, S., He, X. and Tian, X., 2021. Research on Fintech development issues based on embedded cloud computing and big data analysis. Microprocessors and microsystems, 83, p.103977.

Omarova, S.T., 2020. Dealing with disruption: emerging approaches to fintech regulation. Wash. UJL & Pol’y, 61, p.25.

Palmié, M., Wincent, J., Parida, V. and Caglar, U., 2020. The evolution of the financial technology ecosystem: An introduction and agenda for future research on disruptive innovations in ecosystems. Technological forecasting and social change, 151, p.119779.

Piccolo, R., Papa, A., Scuotto, V. and Del Giudice, M., 2022. How digital transformation connects knowledge exploration and exploitation with business model innovation: A fintech perspective. In Digital Transformation Management (pp. 38-56). Routledge.

Sudhamathi, R.K., 2022. Fintech as a road map to enhance business operations and delivery of financial services. Asian Journal of Research in Business Economics and Management, 12(3), pp.1-9.

Takeda, A. and Ito, Y., 2021. A review of FinTech research. International Journal of Technology Management, 86(1), pp.67-88.

Trad, A., 2021. The Business Transformation Framework and Enterprise Architecture Framework for Managers in Business Innovation: The Alignment of Enterprise Asset Management and Enterprise Architecture Methodologies. In Empowering Businesses With Collaborative Enterprise Architecture Frameworks (pp. 1-38). IGI Global.

Zhao, J., Li, X., Yu, C.H., Chen, S. and Lee, C.C., 2022. Riding the FinTech innovation wave: FinTech, patents and bank performance. Journal of International Money and Finance, 122, p.102552.

write

write