Introduction

In the fundraising ecosystem, entrepreneurs need capital to fund the operations of their businesses. At the same time, investors have excess capital to lend in return for a portion of the business or to generate a return. In this assignment, I will critically review Hometaste Tech Sdn Bhd, which raises its capital through the EFC platform. Also, I will discuss the financing considerations of the entrepreneurs based on Hometaste Tech Sdn Bhd, discuss the valuation methodology, and suggest the appropriate model. To start with, I will give a detailed background of Hometaste Tech Sdn Bhd, discuss crowdfunding as a fundraising method, discuss an overview of crowdfunding in Malaysia, equity crowdfunding in Malaysia, Hometaste Tech Sdn Bhd ECF campaign, Hometaste Tech Sdn Bhd financing consideration, and appropriate valuation methodology.

Background of Hometaste Tech Sdn Bhd

Hometaste Tech Sdn Bhd is a home-cooked food delivery platform based in Malaysia (Hometaste, n.d). Its mission is to share home recipes with its customers, while its vision is to empower food with tech. It was founded in 2017, and since then, it has been actively serving its customers in Malaysia, especially Klang Valley. Through the website of Hometaste Tech Sdn Bhd, customers can order from home chefs in their neighborhood. Hometaste Tech Sdn Bhd then delivers the hearty meal to the customer’s doorstep. In order for the company to maintain its food quality, all its food goes through 3 strict processes before selling to customers. The processes include validation, standardization, and commercialization (Hometaste, n.d). Hometaste Tech Sdn Bhd does this because it aims to make its customers happy and enjoy its services and food. Hometaste Tech Sdn Bhd customers enjoy its home-cooked meals because Hometaste Tech Sdn Bhd’s home chefs prepare the foods from their hearts. Also, Hometaste Tech Sdn Bhd ensures its food recipes meet the requirement of its customers.

Hometaste Tech Sdn Bhd is committed to capitalizing on the data it collects on several demand patterns of customers, food preparation time, custom menus, and delivery routes to optimize its service delivery to the customers (Hometaste, n.d). It is also committed to doing business automation in order to streamline its business operations and remove barriers to data that will help get the order from the customer and into the customer’s hand faster and in an efficient way. The company has been digitizing its operations to improve the efficiency of the business operations, customer experience, management, and resource planning.

Crowdfunding as a fundraising method

Crowdfunding is a way of raising funds to finance businesses or projects (Wasiuzzaman et al., 2021). It enables ventures to collect huge funds from large numbers of people via online platforms. It is used by startups or growing businesses to access alternative funds to grow their businesses. It uses social media and crowdfunding websites to bring entrepreneurs and investors together to raise funds to expand or grow a venture. There are different types of crowdfunding: donation-based, reward-based, equity-based, and debt-based (Wasiuzzaman et al., 2021). Donation-based crowdfunding is where donors do not expect any return or receive the amount contributed to the business. In reward-based crowdfunding, people raise funds online from investors in exchange for a product or service. In contrast, equity-based crowdfunding is where the owner of the business gives a percentage of ownership of the business to the investors in return for their contribution. Investors get rewarded in terms of profits if the company makes higher profits (Wasiuzzaman et al., 2021). In contrast, debt-based crowdfunding occurs when investors expect the business to pay interest and the principal amount contributed over time.

The benefits of crowdfunding are that starting a fundraising campaign is free, especially for top crowdfunding websites, which helps the business retain the maximum money collected or raised for a particular cause (Wasiuzzaman et al., 2021). It also helps the business raise awareness of the business indirectly to many people, which helps secure contributions from donors. Also, sharing your business idea can help you get feedback and advice from experts on how to improve the business idea. Furthermore, it is a good way to taste the public’s reaction to your product. If you see investors invest in your business, you definitely know your business idea is good. Moreover, your investors can easily become your customers in the process of financing (Wasiuzzaman et al., 2021). Lastly, it is an effective way of raising funds, especially when one cannot use other financing methods. For instance, if one cannot get a bank loan to fund the business.

Overview of crowdfunding in Malaysia

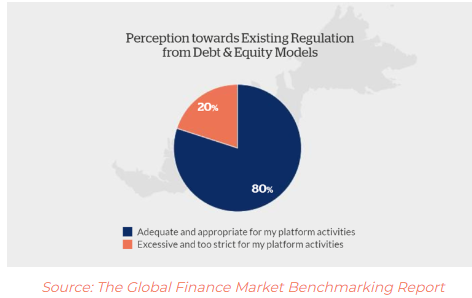

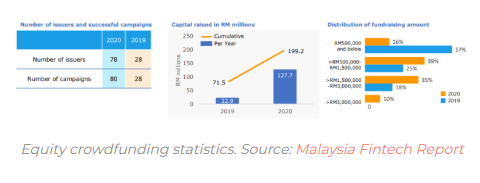

Equity crowdfunding (ECF) thrives because of the government’s support because the Malaysian government sees it good for capital market development. In the last five years, providers have fundraised more than RM 199 million or approximately $48 million. This has resulted in significant growth of the local market by 278% despite the global crisis brought by covid-19, especially the lockdown (Vodolazhska, 2022). Crowdfunding in Malaysia now holds the future for the local market or industry. Malaysia was the first country in the ASEAN region to regulate crowdfunding, focusing on equity crowdfunding and its development. The Malaysian crowdfunding regulation bodies include Bank Negara Malaysia and Securities Commission Malaysia, which act according to the Securities Commission Malaysia Act of 1993 (Vodolazhska, 2022). The main legislative documents for crowdfunding in Malaysia are Public Response Paper No. 2/2014: Proposed Regulation Framework for Equity Crowdfunding, the Capital Market Service Act, and the Guidelines on Recognizing Markets. According to Vodolazhska (2022), the global finance market benchmarking report regarding the regulatory environment in Malaysia, the majority, which represents about 80% of ECF platforms, said that the regulations are appropriate and adequate.

The Malaysian crowdfunding industry is young because its first news emerged in 2015 when Deputy Finance Minister made public that about six companies had been approved by SC Malaysia and were ready to offer crowdfunding services (Vodolazhska, 2022). Since then, more than RM 199 million have been raised, benefiting more than one hundred and fifty (150) issuers through one hundred and fifty-nine (159) campaigns. The regulator reports indicate that in 2020, 57% of funds were raised for business expansion, while 97% of financing issuers raised money for working capital. The reports also indicate that issuers shifted towards large fundraising amounts, with 84% of campaigns raising more than RM 500,000 (Vodolazhska, 2022).

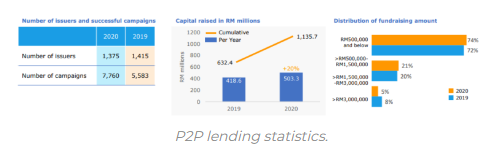

Concerning p2p financing, the reports show that in 2017, 2,801 issuers raised RM 1.14 billion through 15,862 campaigns (Vodolazhska, 2022). Approximately 77% of this amount involved short-term financing.

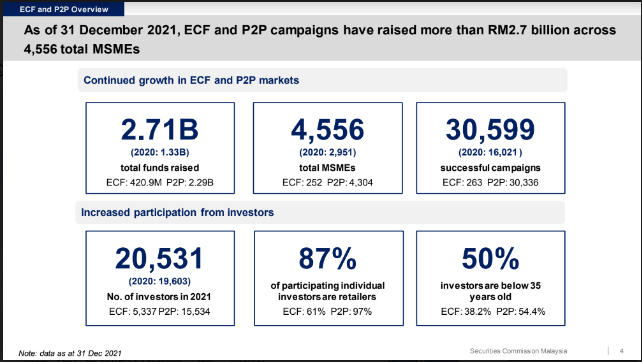

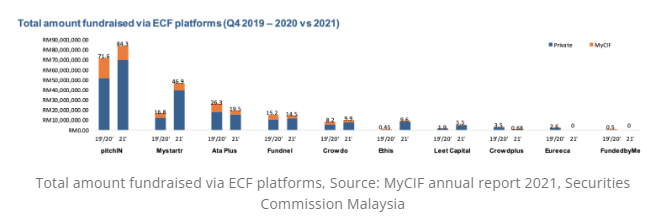

The data shows that between 2020 and 2021, ECF and SMME P2P activities grew significantly in Malaysia. ECF reported a 74% increase in total, while p2p increased by 122%. There was also a 33.3% and 48.8% increase in successful campaigns and participating issuers (Fintech News Malaysia, 2022). The data shows that ECF and p2p campaigns have raised more than RM 2.7 billion as of December 2021.

The above data shows that pitchIN was the leading Malaysian ECF platform in 2021. The data shows that over 38% of all capital was raised via ECF campaigns.

Equity Crowdfunding (ECF) in Malaysia

Equity crowdfunding is a type of crowdfunding where investors receive shares or equity in the company and become shareholders of the company. The focus of the investors is to benefit from the company’s future profits or dividends. Equity crowdfunding in Malaysia is allowed for retail, angel, and sophisticated investors. A company can raise a maximum of RM 10 million through equity crowdfunding. Malaysia is a powerful hub for equity crowdfunding because of its wide investment opportunities (Wasiuzzaman & Suhili, 2023). The government supports the evolution of alternative finance for businesses because it considers it a stimulus for economic growth. The Malaysian regulatory framework is adequate, flexible, and proactive, focusing mainly on facilitating crowdfunding, shariah-compliant financing, and p2p loan (Wasiuzzaman & Suhili, 2023). The data below shows the amount of money raised via ECF platforms in 2021.

The guidelines for equity crowdfunding in Malaysia have stipulated requirements for different market players, such as issuers, platforms, and investors (Haniff et al., 2029). The law requires issuers, platforms, and investors to: The issuers should comply with the registration laws of Malaysia, disclose the financial information of the business, and raise up to RM 3 million within a period of twelve months (Haniff et al., 2029). Also, the business should not advertise its offering through any other platform except the crowdfunding platform. In contrast, equity crowdfunding platforms are required by regulatory bodies to operate fairly and transparently, protect the investors, manage risks associated with crowdfunding activities, and control fundraising and investing limits (Haniff et al., 2029). On the other hand, investors are required to comply with investment limits.

Hometaste Tech Sdn Bhd ECF campaign

Hometaste Tech Sdn Bhd had an ECF campaign in 2021. It successfully raised $56,000, approximately RM 2,410,317, via the pitchIN platform, which is one of the leading equity crowdfunding platforms in Malaysia (AsiaTechDaily, 2021). Hometaste Tech Sdn Bhd attracted the confidence of about eight nine investors in the ECF platform, with the highest individual investment amounting to RM 802,386. The money raised was needed to scale up Hometaste Tech Sdn Bhd as a data-driven multi-brand cloud kitchen because resources limited its potential. The company wants to operate tech-enabled channels where it was targeting approximately seventy cloud kitchens by 2023 in Malaysia and expand to other Southeast Asian countries (AsiaTechDaily, 2021). Hometaste Tech Sdn Bhd wants to grow its marketplace in Malaysia, serving more than fifteen thousand customers and delivering about eighteen thousand home recipe orders per month. The company has proven the success of its business model with a growth of 15x increment of its earnings since it was founded on a yearly basis. Hometaste Tech Sdn Bhd uses data analytics, artificial intelligence, and machine learning to optimize menus and brands to ensure it offers quality services to customers (AsiaTechDaily, 2021). It also ensures that customers have a better experience and quality food. At the time of the crowdfunding campaign, Hometaste Tech Sdn Bhd forecasted that its revenue would exceed RM 10 billion in 2022 (AsiaTechDaily, 2021). While expressing his gratitude Aston Chua, the CEO of Hometaste Tech Sdn Bhd, thanked the pitchIN team for their support and advice in helping Hometaste Tech Sdn Bhd successfully get the funding required for expansion.

Financing Consideration for Hometaste Tech Sdn Bhd

Hometaste Tech Sdn Bhd had many financial considerations before it considering before it decided to raise funds through equity crowdfunding. The first financial consideration is the cost of capital. Raising funds through ECF platforms requires minimal upfront fees (Wasiuzzaman et al., 2021). Also, it is a good method if the business does not have collateral that it can offer as security for a bank loan. Also, the CEO wanted to test the reaction of the investors to his product because if investors are keen on investing, it is a good sign that the business idea is productive or good. The second consideration was the impact on the company’s future growth (Wasiuzzaman et al., 2021). Hometaste Tech Sdn Bhd is on a mission to digitize the F&B industry and needs financial resources to achieve that. The food industry in Southeast Asia is forecasted to reach $23 billion by 2025. The company considered that building a multi-brand kitchen could improve the opportunity of the company and greater venue by increasing the number of times a customer buys. The company has created five brands repeat customers have reached 20 times a year. It is proof that the business model of Hometaste Tech Sdn Bhd is effective. The Southeast Asia market is worth billions of dollars, and the company wanted to capitalize on that advantage.

Valuation methodology for Hometaste Tech Sdn Bhd

The valuation methodology is a process of estimating the value of a business. It helps investors to know the value of an investment (Harvard Business School, 2017). There are many methods of doing business valuation. The common valuation methodology to be used depends on the data available, the purpose of carrying out the valuation, and the business being valued. The valuation approaches include discounted cash flow, market capitalization, enterprise value, asset approach, comparable company analysis, and asset approach (Harvard Business School, 2017). In the case of Hometaste Tech Sdn Bhd, the appropriate model is discounted cash flow model. It is because the CEO said the F&B industry in Southeast Asia is forecasted to reach $23 billion by 2025. Also, it is considered that the company considered building a multi-brand kitchen will improve the opportunity of the company and greater revenue by increasing the number of times a customer buys.

At the time of the crowdfunding campaign, Hometaste Tech Sdn Bhd forecasted that its revenue would exceed RM 10 billion in 2022. Also, the CEO said Hometaste Tech Sdn Bhd had proven success of its business model with a growth of 15x increment of its earnings since it was founded on a yearly basis. It is evident from the CEO’s statement that the best valuation model for Hometaste Tech Sdn Bhd is the discounted cash flow model. This model involves estimating the value of the business based on the earnings or cash flow it is forecasted to generate in the future (Harvard Business School, 2017). The model is best for Hometaste Tech Sdn Bhd because it can help calculate the present value of future earnings of Hometaste Tech Sdn Bhd based on the time period of analysis and discount rate (Harvard Business School, 2017). The advantage of this model to Hometaste Tech Sdn Bhd is that it will reflect the business’s ability to generate liquid assets. An analyst can get the present earnings of Hometaste Tech Sdn Bhd and, given the growth of 15x on a yearly basis, can discount the future earnings to present value to know the company’s value.

References

AsiaTechDaily (2021). Hometaste, Malaysia’s food delivery startup, raises $576K for expansion: AsiaTechDaily – Asia’s leading Tech and Startup Media Platform (2021) AsiaTechDaily. Available at: https://asiatechdaily.com/hometaste-malaysias-food-delivery-startup-raises-576k-for-expansion/

Fintech News Malaysia (2022) ECF and P2P lending has helped Malaysia’s MSMEs raise over RM 2.7 billion in the financing, Fintech News Malaysia. Available at: https://fintechnews.my/32654/malaysia/

Haniff, W. A. A. W., Ab Halim, A. H., & Ismail, R. (2019). The regulation of equity crowdfunding in United Kingdom and Malaysia: A comparative study. Academic Journal of Interdisciplinary Studies, 8(3), 45-56.

Harvard Business School (2017). How to value a company: 6 methods and examples: HBS Online (2017) Business Insights? Available at: https://online.hbs.edu/blog/post/how-to-value-a-company

Hometaste (no date). Home-cooked food delivery around Klang valley. Available at: https://hometaste.my/

Vodolazhska, A. (2022) Overview of crowdfunding in Malaysia, LenderKit. Available at: https://lenderkit.com/blog/overview-of-crowdfunding-in-malaysia/#Crowdlending_and_equity_crowdfunding_in_Malaysia_overview

Wasiuzzaman, S., & Suhili, N. F. (2023). Examination of the success drivers of equity crowdfunding campaigns in Malaysia. Journal of Entrepreneurship in Emerging Economies, 15(2), 425-446.

Wasiuzzaman, S., Lee, C. L., Boon, O. H., & Chelvam, H. P. (2021). Examination of the motivations for equity-based crowdfunding in an emerging market. Journal of theoretical and applied electronic commerce research, 16(2), 63-79.

write

write