Introduction

Financial information refers to all matters associated with an organization’s financial performance and activities. Usually, the data is collected through financial statements and reports covering various tenets of a firm’s finances, including profitability and cash flows (Rusu, 2012). Financial information offers an overview of the business’s past, current, and forecasted performance. This report aims to conduct an economic analysis of De La Pete’s Motels, which has been registering a decline in its performance due to the failure to introduce a new product line and little investment in New Product Development. The report will provide an overview of the overall performance to guide the company’s management to ensure that it improves its performance. The analysis will incorporate using the company’s financial statements to come up with various ratios that will highlight where the company is failing to achieve its financial objectives.

Purpose of Financial Information

Financial information shows a business’s financial well-being and gives insights into its operations, cash flow, and performance. Therefore, the purpose of financial information includes allowing the assessment of the liquidity position of an organisation, which provides information on how a company can offset its short-term obligations and to what extent it is capable of covering them (Rusu, 2012). Financial information is also essential in analyzing the operational efficiency of a firm, which refers to the capability of the management to reduce waste in materials, effort, and time to its best capability. Operational efficiency also helps in analysing how the firm is producing high-quality products and services generating revenues and profits efficiently. It provides the metrics needed to analyze the organization’s profitability, which reflects on the ability of the company to generate profit relative to the costs of running the business (Deepika and Rami, 2014). Consequently, business profitability refers to the manner in which a business is efficient in its operations and does not spend more to generate profits.

Moreover, financial information also provides a basis for gauging the financial strength of a company. Financial strength is basically the ability of an organisation to generate profits and have enough cash flow to offset its obligations to both debtors and investors. Lastly, financial information helps in differentiating different components of a business entity to identify which are performing as to the expectation of the stakeholders. Businesses are composed of such departments as marketing, operations, finance, and management (Stobierski, 2020). In so doing, an analyst is offered the ideal perception of the different components and why some changes are necessary to ensure that the efficiency of realising the strategic objectives of the business is enhanced.

Characteristics of Good Financial Information

The characteristics of good financial information include:

Relevance – means that the information should be predictive and confirmatory information of interested users. The information in the statements should be relevant in ensuring the user evaluates economic decisions, including investment in the business.

Faithful representation – refers to the ability of the statement to confer information representing the phenomena it is supposed to represent (Monteiro et al., 2021). The characteristic indicates that the information should be error-free, unbiased, and complete, which is instrumental in aiding an organization’s financial analysis.

Comparability – infers that users of the statements can compare different aspects of a business at any given time. Hence, analyzing items and their display should be consistent throughout analyzing an organization’s financial performance (Callao et al., 2007). Any inconsistency should be explained effectively to avoid miscommunication and lead to errors.

Verifiability – is also an enhancing characteristic that ensures all information the statements provide can be verified.

Timeliness – is an essential characteristic that indicates that all information provided in the statement reflects the period it purports to represent and that all stakeholders can access the data in time for informed decision-making (Callao et al., 2007).

Understandability – is also essential in ascertaining that the people responsible for preparing financial information classify, characterise, and present the information clearly and precisely.

Explanation of Financial Terminologies

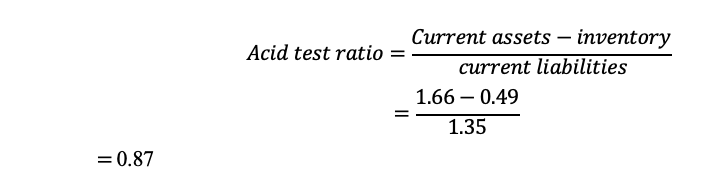

Acid test ratio

The acid test ratio, also known as the quick ratio, is an essential financial analysis tool measuring a business’s ability to offset its current expenses and other short-term obligations with assets that can easily be liquidated to money (Nikolov et al., 2021).

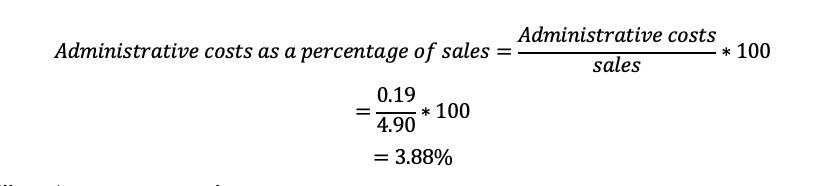

Administrative costs as a percentage of sales

Administration costs refer to the expenses incurred during the organization’s operations. Some administrative costs may include running the office and delegating various tasks to employees, such as cleaning, accounting, cooking, and acquiring office stationery (Mertzanis et al., 2020). It may also refer to the other costs such as payment of electricity and telephone bills.

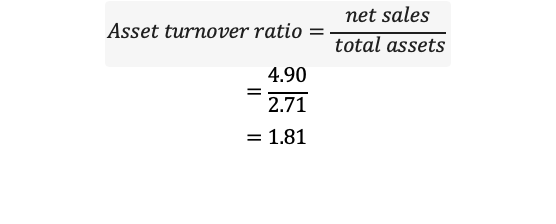

Asset turnover ratio

The ratio is essential in informing management and other interested stakeholders of how efficiently a firm is in converting its assets and capital to generate income (British Business Bank, 2016). A higher asset turnover rate is preferred because it indicates higher efficiency in generating revenue through a firm’s assets.

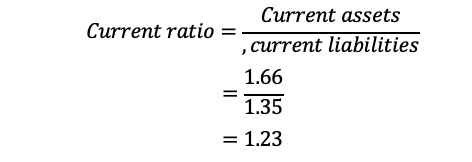

Current ratio

The ratio helps the management and other stakeholders gauge the company’s ability to offset its short-term debt using its current assets (British Business Bank, 2016). The tool is also instrumental in comparing a business to its peers and other competitors in the market.

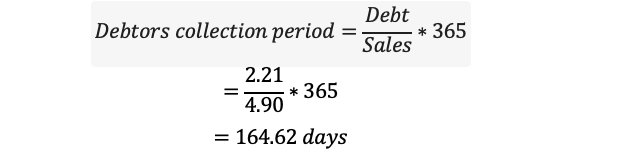

Debtors’ collection period

The debtor’s collection period is the average time a company takes to collect debts, which is also essential in comparing the efficiency of an organization (Shi and Li, 2022). The analysis tool is critical in ensuring that the management and other stakeholders can compare the collection period against the theoretical or granted credit period.

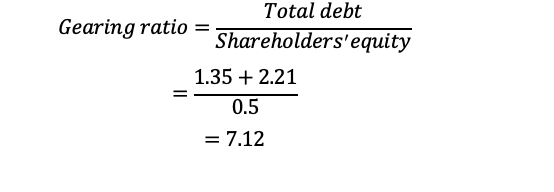

Gearing ratio

The gearing ratio is applied as an indicator of a company’s financial risk (Mertzanis et al., 2020). The ratio helps an organization identify the extent of its debt and evaluate its likelihood of financial distress.

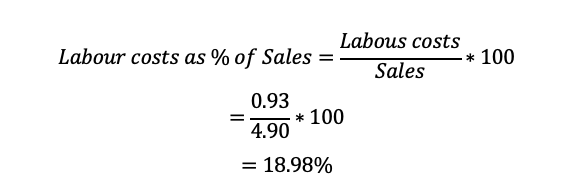

Labor cost as a percentage of sales

Labour costs are those incurred due to paying wages, salaries, and contracts to employees.

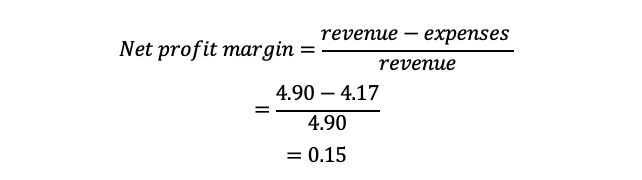

Net profit margin

The ratio is used to gauge how much profit is derived from the sales of a business. Net profit margins help evaluate where a company’s management is efficient in generating sufficient profits from its revenues and if the operating expenses and other costs are managed effectively.

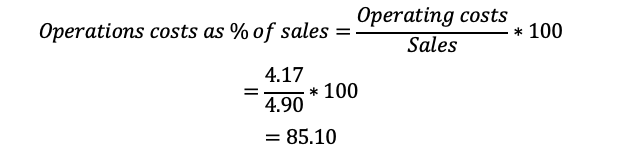

Operating costs as a percentage of sales

The operating costs refer to the expenses incurred in funding the business’s operations.

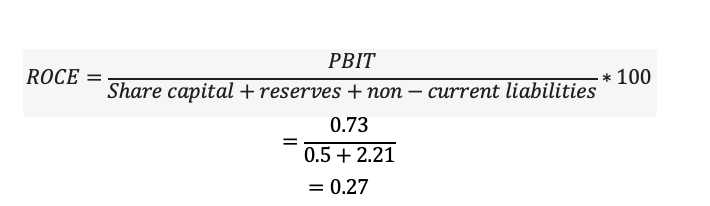

Return on capital employed

Return on capital employed is an effective measure of a company’s performance, which shows if the company is efficient in generating profits derived from the capital.

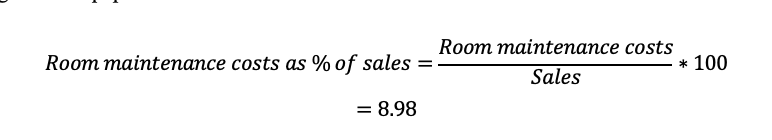

Room maintenance costs as a percentage of sales

Since De La Pete’s Motels is a hospitality business, it has to maintain its rooms to remain competitive and attract more customers (Nikolov et al., 2021). The costs associated with room maintenance include cleaning, purchasing bedding and other furniture used by the clients, and replacing broken equipment.

Analysis and Interpretation of Financial Performance

The company’s acid test is below the average in the industry, which means that the organization may need help offsetting some of its urgent obligations. On this note, the acid test ratio indicates that the management is inefficient in controlling its current liabilities to ensure that it can use its current assets to pay its obligations in the short term (McLaney, 2009). On the other hand, the company’s administration costs are within the industry’s average, which means that the management is efficient in controlling the administrative costs. However, this may also indicate that the firm needs to invest more in some areas that will boost its revenue generation.

The asset turnover ratio of De La Pete’s Motels is higher than the industry average. A higher ratio is preferred because it indicates that the management efficiently capitalizes on the assets to generate revenue (PWC, 2020). Therefore, the firm’s management has played a critical role in ensuring that assets are utilized optimally to generate revenues and profits.

The firm’s current ratio of 1.23 is below the industry’s the sector’s average, although it indicates the business can use its current assets to offset its current liabilities (Animasaun and Babayanju, 2019). Although the ratio indicates that the business management is efficient in controlling its current obligations concerning its assets, it should strive to ensure it can match the sector’s average.

The debtors’ collection period is higher than the sector’s average, so the company does not manage its credit effectively. Ostensibly, companies with higher periods of debt collection are susceptible to economic turmoil, especially if macroeconomic aspects such as the exchange rate hurt the value of the company’s debt.

The company’s gearing ratio is lower than the industry’s average, which is good because it is cushioned against economic downturns. Lower leverage means that the company has a lower amount of debt when compared to the shareholders’ equity (Paine and Srinivasan, 2019). Therefore, the company’s management effectively manages its debt and equity.

De La Pete’s Motels’ labour costs percentage of sales is slightly higher than the sector’s average, indicating that the company’s management needs to control the expenses associated with employee compensation effectively (Hermawan, 2021). On this note, the company can reduce its profit margins because of the high costs, which can hurt its financial health.

The company’s net profit margin is below the average registered in the industry, which means that the firm will have to improve on managing its revenues and expenses. A low net profit margin shows that the firm can face financial hardships at any time because of the reduced ability to pay its obligations with the amount of money it generates (Eniola, 2021). The percentage of the firm’s operating cost to the sales is slightly lower, which means that the company has an effective management style addressing the cost control of the company. However, this indicates that the firm is not investing in critical operations with the potential to harness revenue generation and improve its profit margins.

The ROCE of the company is below the industry standards, which means that it needs to effectively utilize its capital in generating income. Consequently, the firm may face hardships in attracting investors to provide more capital because of the minimal dividends the firm pays out (Shi and Li, 2022). On this note, the company can use the capital to foster new business while ensuring that it is in a position to attract more investors.

The percentage of room maintenance cost to sales is below the industry standards, which means that the firm’s management has effectively maintained its accommodation and, therefore, requires minimal repair costs.

Conclusion

The company needs to address its ability to pay short-term obligations and its profitability. Ratios such as the acid test, current ratio, and net margin indicate that the company is ineffective in managing its assets and expenses. Additionally, the ROCE indicates that the management must develop the ideal means of utilizing its capital to generate revenue. Therefore, failing to invest in New Product Development has led to a situation where some of the capital is not used optimally to generate revenue and increase the profit margin. The firm should divert to the newest products in the industry to ascertain that it is in a position to attract more customers, which will positively impact its financial performance. Investing in new products will be crucial in ensuring that the firm’s ratio is within the desirable industrial averages.

References

Animasaun, R.O. and Babayanju, A.G.A., 2016. Sources of finance and financial performance of downstream petroleum firms in Nigeria. European Journal of Business and Management, 8(33), pp.210-224.

British Business Bank. (2016). The business finance guide: A journey from start to growth. ICAEW, pp. 1–34.

Callao, S., Jarne, J.I. and Laínez, J.A., 2007. Adoption of IFRS in Spain: Effect on the comparability and relevance of financial reporting. Journal of international accounting, auditing, and taxation, 16(2), pp.148-178.

Deepika, M.R. and Rani, M., 2014. We are managing business finance. International Research Journal of Management Science and Technology, 5(2), pp.36-45.

Eniola, A.A., (2021). The entrepreneur’s motivation and financing sources. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), p.25.

Hermawan, E., (2021). Financial Managers as Policy Makers and Company Relations with Financial Markets. Journal of Law, Politic and Humanities, 2(1), pp.13-22.

McLaney, E., (2009). Business finance: theory and practice. Pearson education.

Mertzanis, C., Garas, S. and Abdel-Maksoud, A., 2020. The integrity of financial information and firms’ access to energy in developing countries. Energy Economics, 92, p.105005.

Monteiro, A.P., Vale, J., Silva, A. and Pereira, C., 2021. Impact of the internal control and accounting systems on the financial information usefulness: The role of the financial information quality. Academy of Strategic Management Journal, pp.1-13.

Nikolov, B., Schmid, L., and Steri, R. (2021). The sources of financing constraints. Journal of Financial Economics, 139(2), 478-501.

Paine, L.S. and Srinivasan, S., 2019. A guide to the big ideas and debates in corporate governance. Harvard Business Review, 2.

PWC. 2020. Basic understanding of a company’s financial statements. Price Waterhouse Coopers.

Rusu, A., (2012). National And International Perspectives On The Quality Of Accounting Information38. Revista tinerilor economişti, (18), pp.70-81.

Shi, Q. and Li, B. (2022). Further evidence on financial information and economic activity forecasts in the United States. The North American Journal of Economics and Finance, 60, p.101647.

Stobierski, T. (2020). The beginner’s guide to reading and understanding financial statements. Harvard Business School Online’s Business Insights, pp. 1-8.

write

write