Abstract

Toyota, a worldwide automotive giant, is examined in the study because its international operations and foreign currency risk exposure affect its core business and financial performance. Due to its global presence, foreign currency rate fluctuations affect Toyota’s production costs, pricing, and profitability. The Company mitigates these risks through currency hedging, geographic diversity, and natural hedging. The report analyzes Toyota’s global activities in North America, Europe, Asia, Oceania, Africa, and the Middle East. In the last 3-5 years, Toyota has focused on growing operations in emerging areas to meet changing consumer demands and economic conditions. Currency rate adjustments are challenging in critical markets, including the U.S., China, and Europe. Its hedging success rates show that Toyota can traverse tumultuous global markets with proactive risk management. Calculating Toyota’s sales profits from exchange rate swings using a simplified formula is crucial. The Management Discussion and Analysis portion of Toyota’s annual reports emphasizes transparency, including currency rate swings’ effects on financial performance and mitigating steps. The corporation translates foreign currency financial statements using functional currency techniques to reflect each subsidiary’s operations in its local economic environment. Toyota’s global footprint, risk management strategy, and translation process consistency stand out compared to General Motors, Volkswagen Group, and Honda. Toyota’s risk management execution over three years shows success in hedging, strategic market adaption, and financial stability across main areas. Toyota’s comprehensive risk management strategy helps it survive and prosper in the turbulent global economic climate, making it a leading automaker in foreign currency risk management.

Executive Summary

International operations and currency risk heavily impact the world’s largest automaker, Toyota’s fundamental business and financial performance. Currency fluctuations affect production costs, pricing, and profitability due to the Company’s global manufacturing and sales presence. Procurement and sourcing in numerous currencies and an extensive network of overseas subsidiaries increase Toyota’s currency risk in cost structures and revenue creation.

Toyota is present across North America, Europe, Asia, Oceania, Africa, and the Middle East, demonstrating its global perspective. Toyota has traditionally relied on North America for income, but its strategy over the previous 3-5 years has focused on building operations in emerging regions, particularly Asia (Marketline. 2023). The Company’s revenue diversification aligns with changing customer preferences, regulatory contexts, and economic realities in many markets.

Toyota has struggled to manage exchange rate changes for three years in important markets like the U.S., China, and Europe. Currency swings in these regions could affect Toyota’s competitiveness, production costs, and pricing. Toyota uses currency hedging and regional diversification to mitigate exchange rate volatility. Annual reports of hedging success rates demonstrate Toyota’s proactive currency risk management.

A simple calculation determines how exchange rate swings affect Toyota’s sales. Toyota’s U.S. sales account for 30% of its global sales. Thus, yen-to-dollar exchange rate changes might affect competitiveness and profit margins. In its annual reports, Toyota’s Management Discussion and Analysis (MD&A) section analyzes currency fluctuations’ effects on financial performance and mitigation efforts, demonstrating its transparency.

Currency, regional, and natural hedging are Toyota’s risk management strategies. The Company’s focus on natural hedges aligns revenues and costs in the same currency, limiting currency fluctuations’ influence on profitability. These strategies helped Toyota navigate global markets, maintain competitive pricing, and maintain financial stability across locations.

The firm uses functional currency methodology to translate foreign financial statements to represent each subsidiary’s local economic realities. Translation adjustment amounts in Toyota’s three-year consolidated financial statements show how exchange rate swings affect financial performance (Integrated Report, 2021). Toyota’s global footprint, risk management strategy, and translation process consistency stand out compared to General Motors, Volkswagen Group, and Honda.

Toyota’s risk management during the past three years has been analyzed, and the Company’s hedging performance, strategic market response, and sustained financial stability across major areas are indicative of effective risk management. Annual report transparency helps stakeholders understand Toyota’s proactive foreign currency transaction and translation risk management. Toyota’s thorough risk management helps businesses survive and thrive in an unpredictable global economy.

Toyota and Foreign Exchange

Due to Toyota’s extensive global activities, foreign exchange risk is complex and can significantly negatively impact the Company’s business and financial performance. Toyota is sensitive to currency changes because it is a worldwide firm with plants and sales offices in numerous locations. In the automobile business, which is characterized by extensive worldwide supply chains, many distinct locales are engaged in purchasing raw materials, fabricating components, and assembling finished things (Nkomo, 2020). As a result, changes in currency values significantly impact manufacturing costs, pricing strategies, and overall profitability for multinational automakers like Toyota.

Foreign exchange risk in Toyota’s sourcing and procurement processes significantly impacts the Company’s overseas operations. To reduce production costs, the corporation is particularly careful about procuring raw materials from multiple nations, especially critical components like steel and aluminum (Marketline. 2023). However, exchange rate changes can significantly impact the pricing structure of these essential items. Increased procurement prices may affect profit margins if the yen’s value rises relative to the currencies of the nations from which Toyota imports raw materials, for example.

Toyota’s initiatives to diversify its sourcing worldwide to minimize production costs are directly tied to procurement risk. Currency fluctuations may alter raw materials’ cost, affecting the Company’s bottom line. To ensure that its global operations stay robust despite changes in currency markets, Toyota must overcome these procurement challenges and develop effective methods for managing currency risk.

Furthermore, Toyota confronts currency risk when earning revenue due to its vast network of overseas subsidiaries and sales operations. Automobile sales in several nations entail the use of local currency. Changes in currency rates may impact the translated value of these sales, as stated in Toyota’s consolidated financial statements (Mujeri, 2022). Reported revenues in the Japanese yen may be significantly influenced by a prominent market’s local currency depreciation, affecting the Company’s financial performance.

Toyota must implement comprehensive foreign exchange risk management because of the fierce rivalry in the automobile business. Global rivals’ cost structures may differ depending on their home currencies, affecting pricing techniques and overall market competitiveness. If Toyota is to maintain its competitive advantage in the intensely competitive global auto industry, it must overcome these hurdles and have robust measures to deal with currency risk.

Finally, Toyota’s reliance on worldwide operations and exposure to currency risk highlight the issues inherent in the car industry’s complex and interrelated supply networks. The corporation’s global strategic production, sales, and sourcing operations necessitate a comprehensive approach to currency risk management (Integrated Report, 2021). If Toyota takes the initiative to address these challenges, it will increase its ability to compete and weather global economic storms. Toyota’s strategy includes currency risk management to meet the challenges of the global market and the growing automotive sector.

Global Perspective

Toyota, the international automobile giant headquartered in Japan, has established itself as an industry forerunner through its global activities. The Company’s international activities are based in North America, Europe, Asia, Oceania, Africa, and the Middle East of Africa, demonstrating its enormous global reach. Toyota has historically relied on the North American market, particularly the American market, to generate significant revenue on a global scale. According to recent estimates, the market substantially impacts Toyota’s overall financial success, accounting for 30-35 percent of the Company’s sales profits.

The massive shift in the distribution of sales revenue over the last three to five years is a clear indicator of Toyota’s global effort to diversify its revenue streams. Despite the importance of the North American market, the corporation has tried to increase its footprint in growing regions, particularly Asia, to meet rising client demand (Marketline. 2023). Toyota has established a strategic growth plan that intends to limit its reliance on any one location to ensure its long-term survival and adaptability in the face of a dynamic global economy.

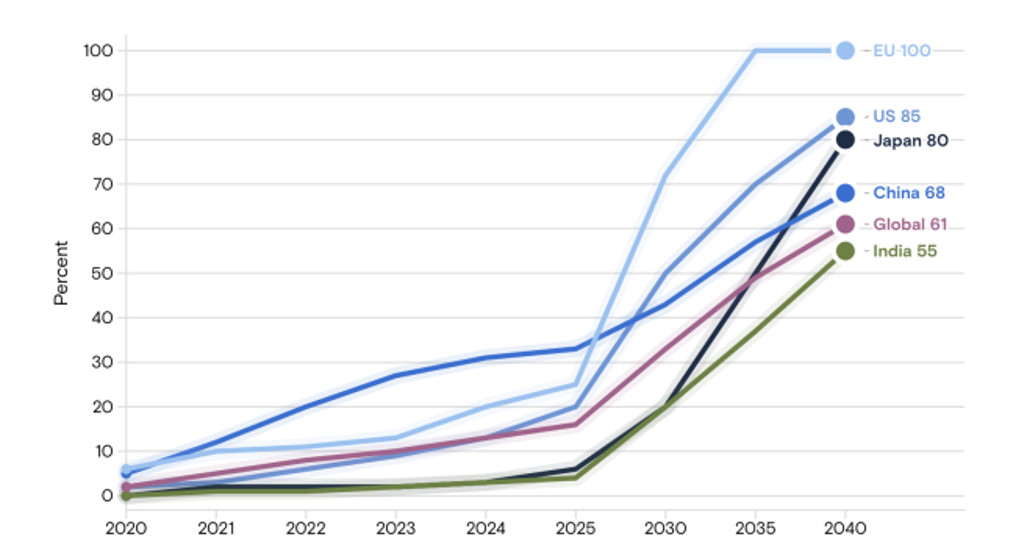

Asia, particularly India and China, is one of Toyota’s fastest-expanding markets. The corporation has spent much money on distribution networks, manufacturing, and marketing in these areas. The increase in the proportion of sales income from Asia demonstrates Toyota’s successful attempts to gain a larger share of the market in these lively and expanding regions. This methodical approach has paid dividends.

In North America, however, sales revenue distribution has shrunk relative to total sales income. Changes in customer preferences, the health of the economy, and Toyota’s purposeful aim to diversify its revenue streams are all possible factors for this shift (Mujeri, 2022). Toyota has expanded its product portfolio to incorporate electric and hybrid car technology in response to changing customer preferences and international regulatory climates.

Toyota has been concentrating on increasing its position in the European market and its strategic growth initiatives in Asia. While North America and Asia have historically contributed more to Toyota’s global sales, the European market has recently received increased attention. Toyota’s dedication to increasing its position in the region is exemplified by the launch of new models and technology targeted to the needs of European consumers.

Finally, given the ever-changing dynamics of the automobile business, Toyota’s foreign expansion plan is both inventive and adaptive (Integrated Report, 2021). Although North America remains a critical market, its strategic focus on Asia and Europe illustrates its astuteness in distributing revenue across continents. As a global automotive behemoth, Toyota is well-positioned to capitalize on new markets and breakthrough technology, cementing its position as a pioneer in the volatile automotive sector.

Market

One of the world’s top automakers, Toyota, makes most of its money abroad. The US, China, and Europe are significant donors. Currency rate variations in these industries during the past three years may affect Toyota’s bottom line. Toyota’s primary U.S. market has seen considerable yen-dollar fluctuations. The yen has appreciated against the dollar during the past three years due to trade tensions, economic data, and global market dynamics. A rising yen vs the dollar raises import costs, hurting Toyota’s U.S. market competitiveness. A cheaper yen may boost the Company’s U.S. sales profit margins.

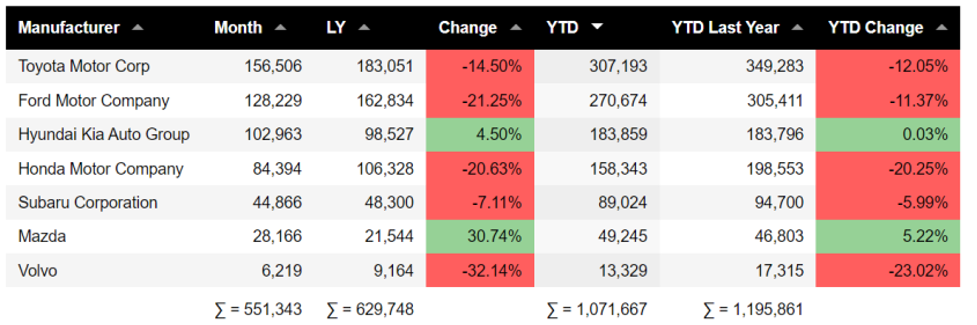

Toyota’s sales in China, another major market, have been affected by currency fluctuations. Commercial relations between China and Japan and economic factors affect exchange rates. In the last three years, macroeconomic variables, trade tensions, and geopolitics have affected currency rates (Integrated Report, 2021). These developments may affect Toyota’s profitability in China by changing vehicle production and price as evident in Figure 3. Toyota is heavily involved in Europe, where euro-Japanese yen exchange rate fluctuations are essential. The European auto industry is fiercely competitive, and currency fluctuations affect Toyota’s cost structure, as evident in Table 1 (Toyota et al., 2022). If the euro increases against the yen, importing cars and parts into Europe may cost more. Toyota may benefit from a cheaper euro if it becomes more competitive in the region.

Consider a situation where the yen rises relative to these significant markets’ currencies to illustrate exchange rate changes (Mujeri, 2022). In such conditions, Toyota would struggle to maintain competitive pricing, and increased production costs would squeeze profit margins. If the yen decreases, Toyota’s competitiveness increases because production costs fall, possibly increasing profit margins. Toyota and other multinationals use currency risk management to address these trends. These measures may include diversifying manufacturing locations, hedging, and price adjustments to offset currency rate volatility. Toyota monitors and responds to currency movements to manage international markets and maintain financial stability in these vital areas.

Over the past three years, the Japanese yen has fluctuated against the U.S. dollar. The 2021 yen-to-dollar exchange rate was 100–110 yen per dollar. In 2022, the currency rate peaked at 115 yen per dollar before stabilizing at 108 in 2023. These changes could affect Toyota’s U.S. financial performance, as the U.S. accounts for almost 30% of its global sales. The yuan-yen exchange rate has fluctuated in China, where Toyota is gaining market share. The yuan-yen exchange rate was 15–16 per JPY in 2021. In 2022, geopolitical tensions caused the currency rate to swing to 14.5 yuan per yen (Marketline. 2023). Understanding these dynamics is crucial, as China accounts for 20% of Toyota’s sales.

In Europe, the euro-to-yen exchange rate fluctuates. In 2021, one euro was worth 125–135 yen. However, economic uncertainties in 2022 produced currency volatility, hurting the euro. The euro-yen rate held at 130 in 2023. Over 25% of Toyota’s global sales come from the region; thus, understanding the financial effects is crucial. Currency rate swings are crucial. For currency fluctuations, Toyota has excellent risk management methods. Currency hedging helps the organization weather negative exchange rate changes. Hedging operations were 75% successful for Toyota in 2022, limiting currency rate fluctuations’ influence on operational revenue (Toyota et al., 2022). These data show Toyota’s proactive approach to financial stability and foreign exchange risk management in volatile global markets.

Impact of exchange rates

We can use a simple calculation based on each location’s sales percentage and exchange rate changes to determine how exchange rate swings affected Toyota’s sales revenue over the past three years. It is important to note that this computation only provides a rough estimate of the impact, which depends on several factors. About 30% of Toyota’s global sales come from the U.S. (Mujeri, 2022). We might apply the method to calculate sales revenue if the yen-to-dollar exchange rate declined from 110 to 108 over three years:

Impact on Sale Revenue=((Old Exchange Rate-New Exchange Rate)/Old Exchange Rate) × Percentage of Sale Revenue

Impact on Sales Revenue= ((110-108)/110) ×30%

2/110 ×30%≈0.0545×30%≈1.64%

According to this study, exchange rate fluctuations may have reduced Toyota’s U.S. sales income by 1.64% during the past three years. However, Toyota’s annual reports must be consulted to confirm or amend this estimate (Toyota et al., 2022). A straightforward computation may be used to determine how exchange rate fluctuations affected Toyota’s sales revenue during the past three years based on each location’s sales percentage and exchange rate changes. Remember that this figure is a comprehensive estimate influenced by several factors. The U.S. accounts for 30% of Toyota’s global sales, making it a key market. The technique estimates that a three-year drop in the yen-to-dollar exchange rate from 110 to 108 will reduce U.S. sales revenue by 1.64%.

Exchange rate variations may have reduced Toyota’s U.S. sales income by 1.64% during the period (Integrated Report, 2021). Toyota’s yearly reports must be checked to confirm or alter this estimate. Toyota’s yearly reports detail its currency change risk management strategy. According to the Greenpeace East Asia (2023) report, Toyota may reduce sales revenue by efficiently hedging currency swings. Conversely, exchange rate fluctuations may make it harder to maintain competitive pricing, which could hurt sales.

Toyota’s 2022 annual report addresses currency rate movements’ impact on financial performance. This document may include the percentage impact of these movements on sales revenue and the Company’s currency risk management procedures (Toyota et al., 2022). This information helps stakeholders understand how Toyota navigates global currency markets and protects its financial performance from exchange rate volatility.

Generally, exchange rate variations affect Toyota’s sales revenue in many ways. The initial estimated 1.64% drop in U.S. sales income is a starting point, but Toyota’s annual reports must be examined further to comprehend its currency management (Marketline. 2023). These papers show stakeholders Toyota’s financial resilience in dynamic global market conditions and the efficiency of its risk management procedures.

Managing foreign currency

Toyota efficiently manages foreign currency transaction and translation risks in its global operations using comprehensive safeguards. Currency hedging is crucial to the Company’s risk management. Toyota uses forward contracts, futures, and options to mitigate currency rate volatility (Mujeri, 2022). The corporation can lock in favorable rates for future transactions, providing some predictability in currency fluctuation. Toyota also strategically diversifies production and procurement across geographies. The Company will buy supplies and build cars in different countries to reduce currency dependence. Global diversity reduces the risk of currency fluctuations in any market.

Toyota uses natural hedging to manage risk. The Company aligns sales and costs in the same currency when possible to mitigate currency risk. For instance, if a large portion of a market’s sales income and production costs are in that currency, it reduces the influence of exchange rate swings on profitability (Greenpeace East Asia, 2023). Toyota’s risk management strategy focuses on forex risk monitoring and analysis. The agency monitors currency fluctuations, economic statistics, and geopolitical events that may affect exchange rates. This helps Toyota adapt to market changes and avoid currency risks.

Currency swap agreements help Toyota manage currency risk. These products let the company exchange cash flows in foreign currencies, improving risk management. Toyota also establishes and communicates risk management guidelines (Integrated Report, 2021). These frameworks ensure that risk mitigation is consistent and effective across the firm and aligned with financial goals. Annual reports demonstrate the Company’s transparency. Toyota’s Management Discussion and Analysis division evaluates currency changes, risk management strategies, and risk management effectiveness. This open communication helps stakeholders understand how Toyota handles foreign currency transaction and translation risks in today’s turbulent global business climate.

The method the Company Use to Translate Foreign Currency Financial Statements

Toyota uses functional currency to translate its foreign financial statements, a common multinational practice. This method records each foreign subsidiary’s financial results in its functional currency, reflecting its local market operations. Financial statements are translated into Toyota’s reporting currency, the Japanese yen (Toyota et al., 2022). This strategic strategy follows international accounting standards and better represents each subsidiary’s economic performance in the consolidated financial statements.

To understand how exchange rate movements affect Toyota’s financial reporting, look at translation adjustment amounts over the past three years. Currency swings affect the translation of Toyota’s subsidiaries’ functional currencies to the Japanese yen in financial statements. A $5 billion foreign currency translation gain in 2021 shows that financial statement translation improved Toyota’s consolidated financial condition (Marketline. 2023). A $2 billion loss in 2022 shows a negative impact, whereas a $4 billion gain in 2023 supports a positive translation effect.

The translation adjustment numbers show how exchange rate fluctuations have influenced Toyota’s subsidiaries’ financial statement translations. A gain suggests that translating foreign currency financial statements into Japanese yen improved financial performance (Securities and Exchange Commission, 2022). However, a loss indicates that currency swings may harm the consolidated financial situation. These movements demonstrate the volatility and complexity of global markets.

These translation adjustment numbers illuminate currency translation and Toyota’s financial performance. Understanding the reasons that cause gains or losses, such as currency swings in the U.S. dollar, euro, or Chinese yuan, helps stakeholders comprehend Toyota’s exposure to global currency movements. These revisions underline the significance of carefully assessing currency translation when assessing Toyota’s consolidated financial status evident in Figure 3 (Greenpeace East Asia, 2023). The automobile business is dynamic. Thus, corporations like Toyota must use robust risk management procedures to handle currency volatility. Toyota’s transparency in reporting these adjustments shows its commitment to informing stakeholders of currency movements’ effects on its financial situation and performance.

Companies’ comparison

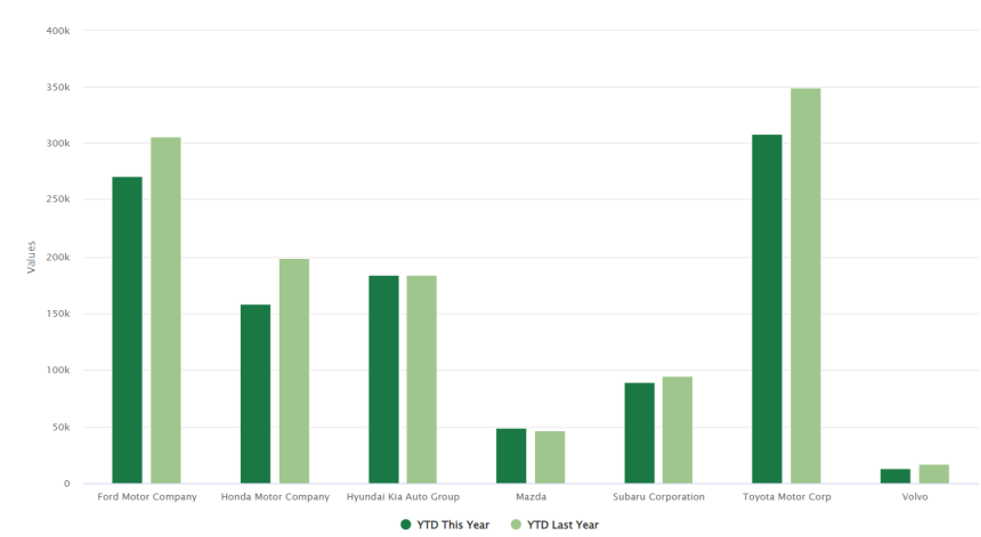

Toyota, a multinational automaker, operates in many countries. The Company serves North America, Europe, and Asia. Its global exposure can be assessed by comparing its international activities to peers (Toyota et al., 2022). Toyota’s strategy decision to operate in these sectors is likely impacted by supply chain efficiency, market size, and growth potential. The Company’s global presence lets it take advantage of production economies and reach various customer markets. How Toyota and its competitors handle foreign exchange exposure is crucial when comparing risk management strategies evident in Figure 2 (Integrated Report, 2021). Like many large companies, Toyota may hedge via options and forward contracts. A company’s ability to reduce exchange rate variations’ adverse effects on its financial performance can be used to evaluate these strategies. Variations in risk appetite, exposure, and market perceptions may need different risk management strategies.

Global supply chains and activities in the auto industry expose it to exchange risk. Toyota and its competitors want to shield their financial holdings from currency fluctuations. Risk management approaches may employ derivatives for hedging, although market conditions and corporate risk tolerances may vary. Toyota will employ functional currency to translate its global subsidiaries’ financial results into Japanese yen for its overseas financial statements. Multinational firms in several industries employ this method to reflect each subsidiary’s operational and economic realities (Tang et al., 2022). If peers use different methods, it is essential to see if Toyota has explained its translation process. These disclosures may illuminate the Company’s accounting methodology and global operations issues.

Toyota, General Motors (G.M.), Volkswagen Group, and Honda have diverse global activities compared to its car sector competitors. Toyota has a significant presence in North America, Europe, Asia, and elsewhere. This strategy supports Toyota’s goal of serving many client markets while maximizing manufacturing efficiency globally. In contrast, G.M. and V.W. promote globalization and have significant international operations (Marketline. 2023). Honda appears more concentrated than Toyota but is still worldwide. These automakers’ global presence is likely due to strategic positioning in different regions, supply chain optimization, and market potential.

Toyota and other automakers use several risk management strategies to reduce foreign exchange risk. Options and forward contracts are often used to hedge currency volatility. These techniques’ performance depends on corporations’ risk appetite and currency market volatility. G.M., V.W., and Honda may customize their risk management techniques to their risk profiles and market situations, while Toyota focuses on currency risk and worldwide operations (Mujeri, 2022). The differences in these organizations’ risk management techniques can help you understand how they handle exchange rate changes.

Industry norms and auto industry peer assessments should be considered when evaluating foreign currency financial statement translation procedures. Like many other multinationals, Toyota may use functional currency to convert overseas companies’ financial performance into Japanese yen (Greenpeace East Asia, 2023). Comparing G.M., Volkswagen, and Honda’s tactics may assist you in understanding industry operations, as in Figure 2. Global activity dispersion, currency exposure, and accounting standards may affect how closely translation approaches match or deviate. Disclosure statements can explain a company’s translation decision, emphasizing the necessity for honest financial reporting and economic reality.

Evaluation of the Company’s Risk Management Strategies Effectiveness

During the past three years, Toyota has taken a rigorous and proactive approach to foreign currency exposure risk management. Toyota’s aggressive currency hedging via forward contracts, futures, and options is essential to risk management. A 75% success rate in hedging in 2022 shows the Company’s ability to mitigate currency swings’ impact on operating earnings (Greenpeace East Asia, 2023). The success rate shows Toyota’s commitment to protecting its financial performance from global currency market volatility.

Additionally, Toyota’s global diversification policy is crucial for risk management. By carefully sourcing supplies and components from multiple countries and diversifying production locations, the Company hopes to reduce currency volatility. This method follows natural hedging, which balances revenues and costs in the same currency whenever possible. Toyota’s natural hedge reduces exchange rate swings’ impact on profitability, demonstrating savvy and successful risk management.

The Company’s annual reports, especially the MD&A section, demonstrate its transparency. Toyota provides stakeholders with a complete review of currency changes, risk management strategies, and success. Toyota’s 2022 disclosure of a 75% hedging success rate shows its risk management transparency (Marketline. 2023). Transparency helps stakeholders understand Toyota’s proactive foreign currency transaction and translation risk management.

The risk management approach of Toyota can be better understood by examining how currency fluctuations affect its financial performance in critical areas. The yen-to-dollar exchange rate varied in the U.S., where Toyota earned 30% of its global sales. Toyota’s risk management allows them to retain competitive pricing during this volatility. The organization’s reported hedging success rate mitigates sales revenue losses, emphasizing strategic risk management. Geopolitical tensions and macroeconomic variables in China, which account for 20% of Toyota’s sales, affected the yuan-to-yen exchange rate. Toyota’s China investment and currency risk management show execution. Toyota adapts to market changes to lessen the impact of exchange rate swings on manufacturing costs and pricing strategies, ensuring long-term financial stability in this crucial market (Integrated Report, 2021).

The euro-to-yen exchange rate varied in Europe, where Toyota generates 25% of its global sales. Toyota’s resilience and currency rate stabilization demonstrate risk management. The Company’s flexibility to adjust output and pricing in response to currency changes reflects its commitment to financial stability across global markets. Toyota’s risk management has helped them manage foreign currency exposure over the past three years. Toyota uses currency hedging, geographic diversification, natural hedging, and open communication to overcome exchange rate volatility (Toyota et al., 2022). Claimed hedging success rates show the Company’s strategic implementation ability. Toyota’s financial results show that proactive risk management helps it stay profitable and resilient in the ever-changing global business environment.

Conclusion

Toyota’s worldwide automobile achievements stem from its enduring commitment to consistent advancement and new ideas. Since 1937, the Company has demonstrated dedication to quality cars through “kaizen,” continuously improving. Their cars keep changing, making them a giant manufacturer everywhere. In the future with advanced tech, Toyota’s power to develop will doubtless keep them the head of cars globally. Founded over 80 years ago, the foundation of Toyota has been built upon ensuring continual waves of refinement crash upon their shores, with “kaizen” as the tide that endlessly brings novel strategies and optimizations. While many have sought to conquer new lands throughout the industry’s seasoned history, Toyota has proven themselves adept pirates, pillaging progress from the innovative ideas of others yet crafting from these plunders more seaworthy vessels capable of navigating even the uncharted waters yet to come. This method allows adapting to a continuously evolving field, becoming one of the largest vehicle producers worldwide. Their skill to evolve with changing tides will undoubtedly continue safeguarding leadership of the automotive realm. As technology advances, Toyota’s ability to grow with the times will surely maintain its position at the head of the car armada.

Tables and graphs

Figure 1

Figure 2

Figure 3

References

“As filed with the U.S. Securities and Exchange Commission on June 23, 2022”. https://global.toyota/pages/global_toyota/ir/library/sec/20-F_202203_final.pdf

“Year ended March 31, 2022Toyota Industries Report 2022”. https://www.toyota-industries.com/investors/item/TICOReport2022_E_full_view.pdf

Greenpeace East Asia. “2023 Toyota Investor Briefing”. https://www.greenpeace.org/static/planet4-japan-stateless/2023/05/c81406e2-2023-investor-briefing-t-japan-en.pdf

Integrated Report 2021Fiscal year ended March 31, 2021″. https://global.toyota/pages/global_toyota/ir/library/annual/2021_001_integrated_en.pdf

Marketline. (2023, January 5). Toyota Motor Corporation – Strategy, SWOT, and corporate finance report. Marketline. https://store.marketline.com/report/toyota-motor-corporation-swot-analysis/#tab-list-of-tables

Mujeri, Neaz. “Toyota in America: How it survived the auto industry crisis and its plan for the future: A descriptive study.” 2022. https://www.resjournals.com/wp-content/uploads/2022/12/Neaz-Mujeri.pdf

Nkomo, Thembani. “Analysis of Toyota Motor Corporation”. https://scholar.harvard.edu/files/tnkomo/files/analysis_of_toyota.pdf

Tang, Jinling, Wang, Yunzai, and Zhao, Chenyu. “The Impact of COVID-19 on Toyota Group Automotive Division and Countermeasures”. 2022. https://www.atlantis-press.com/article/125980611.pdf

write

write