| Historical Ratios | |||

| 9/23/2022 | 9/23/2023 | ||

| Current Ratio | 0.62 | 0.66 | |

| Quick Ratio | 0.58 | 0.61 | |

| Total Liabilities-to-Total-Assets Ratio | 1.56 | 1.41 | |

| Long-Term Debt-to-Equity Ratio | 1.60 | 1.29 | |

| Times-Interest-Earned Ratio | 42 | 30 | |

| Inventory Turnover | 45.20 | 33.82 | |

| Fixed Assets Turnover | 9.36 | 8.77 | |

| Total Assets Turnover | 2.26 | 2.03 | |

| Accounts Receivable Turnover | 14 | 13 | |

| Average Collection Period | 26.09 | 28.10 | |

| Gross Profit Margin % | 43% | 44% | |

| Operating Profit Margin % | 30% | 30% | |

| ROA % | 56% | 50% | |

| ROE % | 157% | 127% | |

Financial Analysis Report

Through a back-ward analysis of such critical ratios as those used to evaluate the performance of this corporation, which ended on the 23rd of September 2022, this study provides a detailed investigation of the growth of this enterprise in the last two years from the 23rd of September 2022 to the 23rd of September 2023. Such evaluations are employed to calculate return on equity or shareholder equity, output, solvency, and debt ratios. Such data will give a comprehensive picture of the business regarding current performance and financial health. These ratios are critical indicators of business well-being.

Liquidity Ratios

The current ratio shows how a business can finance the usage of its short-term assets to clear off its current liabilities. Apple’s current ratio, which improved from 0.62 in 2022 to 0.66 in 2023, indicates that the company is in a better position to meet its short-term loan obligations. On the other hand, the quick ratio also shows fluidity in the short-term, with a value of 0.58, making way for a higher value of 0.61 as current assets and fewer inventories are divided by current liabilities.

Leverage Ratios

The $18.61 billion of $12.47 billion in assets and liabilities gave Apple a total debt-to-assets ratio of 1.56, which now shows 1.41, a dip that implies a worsened stand for credit for the company. Besides, over the long term, the debt-to-equity ratio decreased from 1.60 to 1.29, showing a low level of long-term debt compared to the company’s shareholders. This fact could be used as a company’s strength or financial stability indicator.

Profitability Ratios

Although accepting tax cuts and incentives didn’t significantly affect Apple’s financial performance, its gross profit margin perspective played a pivotal role because it was at 43% in 2022 and in 2023. The fixed asset turnover of the business in the previous two years was the same, which was 4.0 in each case. Then, the reality did not meet forecasts; the ROE significantly dropped from 157% to 127%, and the ROA almost insignificantly did from 56% to 50%. In 2023 profitability ended up lower than in 2022, plus what seems like a decline in liquidity; the latter can be seen in the equity multiplier and asset turnover.

Efficiency Ratios

The number of times the stock was sold and replaced in a given period also reduced from 45.20 to 33.82, illustrating that Apple’s inventory management rate in 2023 was slower than its 2022 performance. The change in fixed assets turnover ratio is also given from 9.36 to 8.77, which implies that the firm’s fixed assets are used less effectively to generate revenue. However, the total assets turnover ratio reduced from 2.26 to 2.03, indicating that Apple had produced more revenue with its total assets in 2022 than in 2023.

Implications and Strategy Creation

Generally, Apple’s financial statistics solidified this year. Capitalization and facility ratios were the major boost areas in the liquidity and leverage concept. On the other hand, though there were some drops in profitability and efficiency ratios, this could hint at areas that should be positively corrected (StudySmarter). Apple should centrally focus on revenue growth through new product releases, market expansion, or performance efficiency to improve profitability. Further, the firm needs to rethink the inventory level of finished goods and the utilization of fixed assets to improve productivity indicators.

Concerning development and product differentiation as a strategy, Apple needs to continue to face the technological sector with innovations, thus keeping its competitive advantage. Apart from that, the company ought to be prudent in its debt management and strive to keep it low compared to assets to continue with investment activities in the future (Pereira, 2023). Overall, Apple’s financial performance was satisfactory in 2023. Still, there are some variables the company faces to improve its sustainability in terms of profitability and growth in the long run.

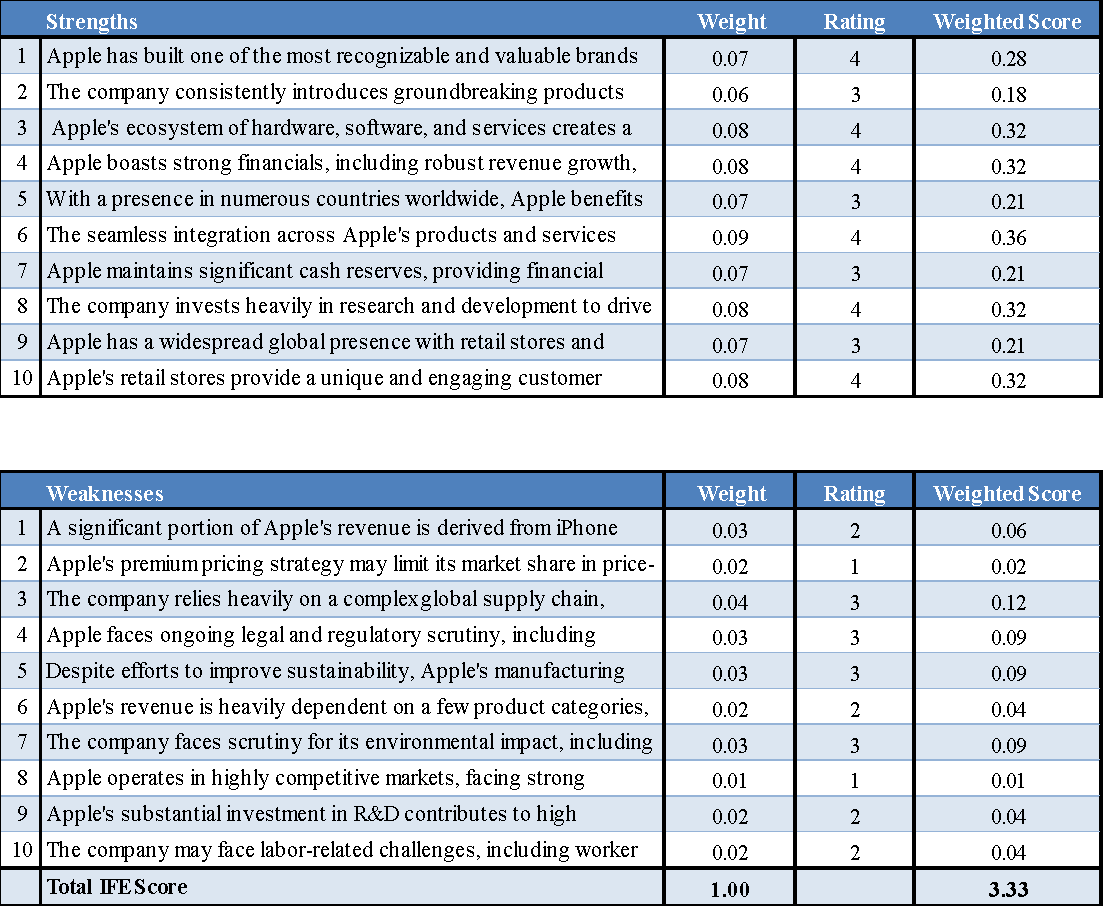

Part II: Internal Factor Evaluation Matrix

Strengths:

Apple has a strong brand, breakthrough product innovation, and a solid financial position that can weather economic downturns. The company’s brand is worldwide popular among consumers for innovation, quality, and loyalty, contributing to its overall competitive edge. Apple Technology, driven by its debut of industry innovation in products and technologies, creates consumer demand and keeps them market kings (Pereira, 2023). Customers are keen on the frictionless integration through Apple’s hardware, software, and services across the board, which also compliments the user experience so that customer loyalty is improved and cross-selling can be enabled(Pereira, 2023). Furthermore, the power of Apple’s financial metrics, such as revenues, profitability, and large cash reserves, gives the company room to maneuver in the direction of investment and acquisitions.

Weaknesses:

Nevertheless, Apple faces difficulties, particularly with its high iPhone sales contribution; that is to say, Apple faces these smartphone market swings. The main advantage of this strategy may be challenging as the brand and products are likely to be not that attractive for the price-sensitive consumer segment, and the company`s manufacturing processes may be exposed to supply chain challenges, such as component shortages and production delays. Apart from the factors that could hamper their progress, such as legal and regulatory scrutiny, environmental concerns, and competition from other players in the industry, Apple also has to face the challenge of competitiveness(Pereira, 2023). Although Apple puts in efforts to make its practices more sustainable, the firm’s manufacturing processes still feature some environmental challenges that could make its name and operating processes unsustainable in a negative way.

Implications:

The IFE analysis leads to Apple’s solid foundation and facets for refinement. By relying on its main competitive advantages, Apple can implement innovation and finance research and development to keep its leading position (Pereira, 2023). Despite this, the company must have a plan that will help it overcome weaknesses such as diversification of revenue streams that go beyond sales of iPhones, management of supply chain risks, and tackling environmental issues, which will help prevent the occurrence of future downturns, thereby promoting sustainability of growth. By combining its strengths with weaknesses, Apple can lead towards increased competitiveness and resiliency in light of the fast-changing market environment.

References

Apple. (2023). Apple reports fourth-quarter results. Apple Newsroom (Kenya). https://www.apple.com/ke/newsroom/2023/11/apple-reports-fourth-quarter-results/#:~:text=CUPERTINO%2C%20CALIFORNIA%20Apple%20today%20announced

Pereira, D. (2023, March 3). Apple SWOT Analysis. The Business Model Analyst. https://businessmodelanalyst.com/apple-swot-analysis/

StudySmarter. (n.d.). Swot Analysis of Apple: Marketing & Business Analysis. StudySmarter UK. https://www.studysmarter.co.uk/explanations/business-studies/business-case-studies/swot-analysis-of-apple/#:~:text=Apple%20Inc

write

write