Introduction

The United Kingdom’s macroeconomic performance has been marked by steady growth, low unemployment, and low inflation in recent years. However, the COVID-19 pandemic has significantly impacted the economy, leading to a sharp decline in economic activity and increased unemployment.

GDP and Economic Growth

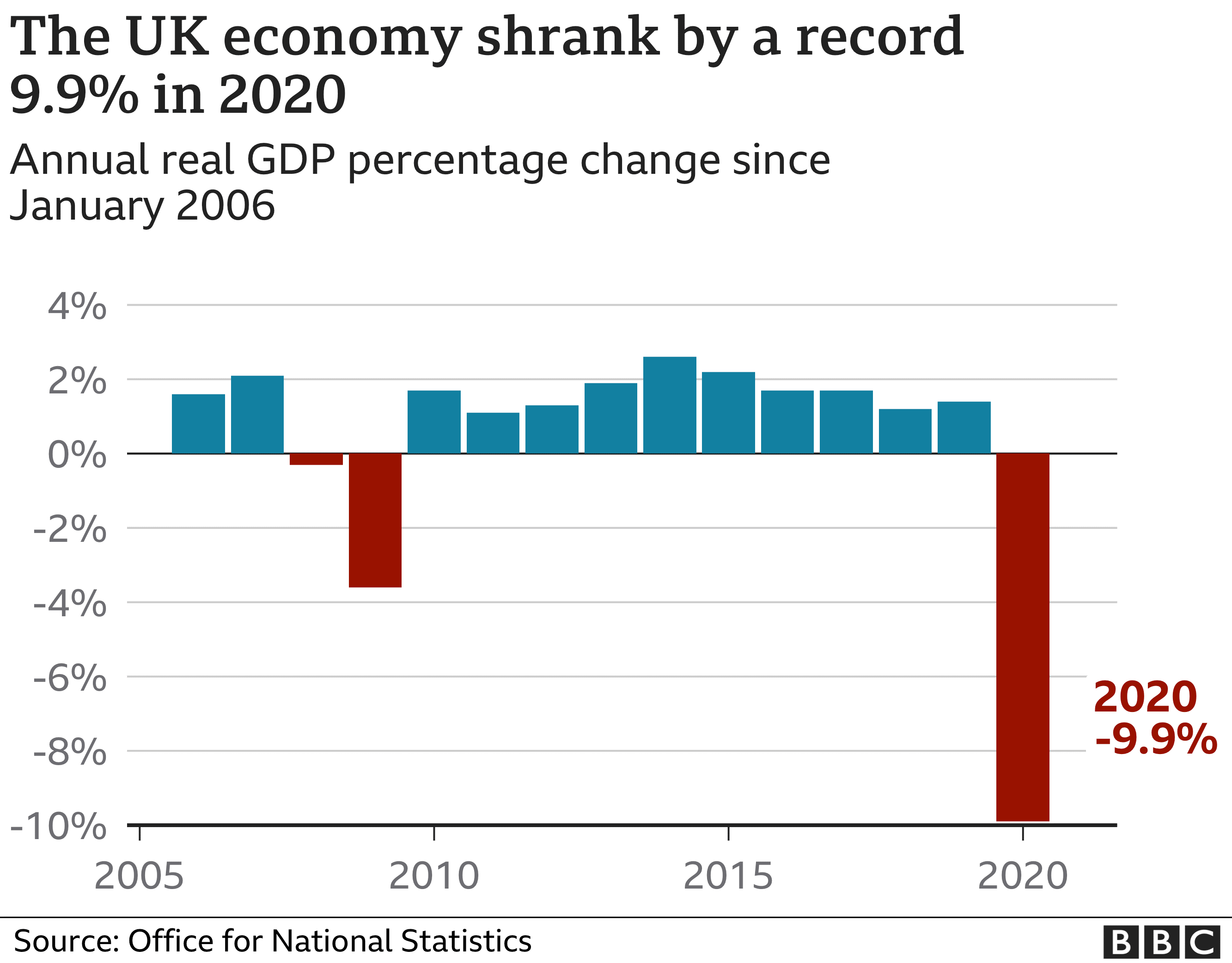

The United Kingdom’s Gross Domestic Product (GDP) has been growing steadily in recent years, prior to the COVID-19 pandemic. However, the pandemic has led to a sharp decline in economic activity, with GDP contracting by 9.9% in 2020 (Rakha, 2021). The GDP per capita, which is a measure of the economic output per person, would also have been affected by this decline. The government and the Bank of England have implemented several measures to support the economy, such as cutting interest rates and launching a quantitative easing program to mitigate the pandemic’s impact and support economic recovery. These measures will help boost GDP and GDP per capita in the coming years. GDP per capita in the UK has been steadily increasing over the last decade. In 2010, GDP per capita was around £22,000 (using 2010 prices), and by 2019, it had increased to £28,000. However, due to the COVID-19 pandemic, the GDP per capita in the UK decreased by 9.9% in 2020, resulting in a GDP per capita of around £25,200 (Bandyopadhyay, 2020).

Figure 1

Low-interest rates and quantitative easing by the Bank of England were significant drivers of economic development in the UK over the past ten years, among other factors. Because borrowing is more affordable when interest rates are low, consumption and investment may grow. A method of monetary policy used by central banks to expand the money supply and boost economic activity is quantitative easing. Utilizing these instruments, the Bank of England supported economic activity and promoted growth. Another crucial element in the UK’s economic development over the past ten years has been robust consumer spending. This was facilitated by low unemployment and growing earnings, which gave people more money to spend and increased economic confidence. This increased consumer spending helped to drive economic growth, as consumer spending is a major component of GDP. A growing service sector also contributed to the UK’s economic growth over the last decade. Industries such as finance, healthcare, and education are part of the services sector and have been growing in recent years. This has helped to create jobs and boost economic growth.

The COVID-19 pandemic, which has caused a dramatic contraction in economic activity as governments worldwide adopted lockdowns and social distancing measures to stop the spread of the virus, is the primary cause of the fall in 2020. (Sheridan, 2020). Due to this, consumer spending has decreased, businesses have shut down, and jobs have been lost, contributing to the GDP reduction. To lessen the effects of the epidemic and promote economic recovery, the government and the Bank of England have undertaken a number of economic assistance measures, including reducing interest rates and starting a quantitative easing program.

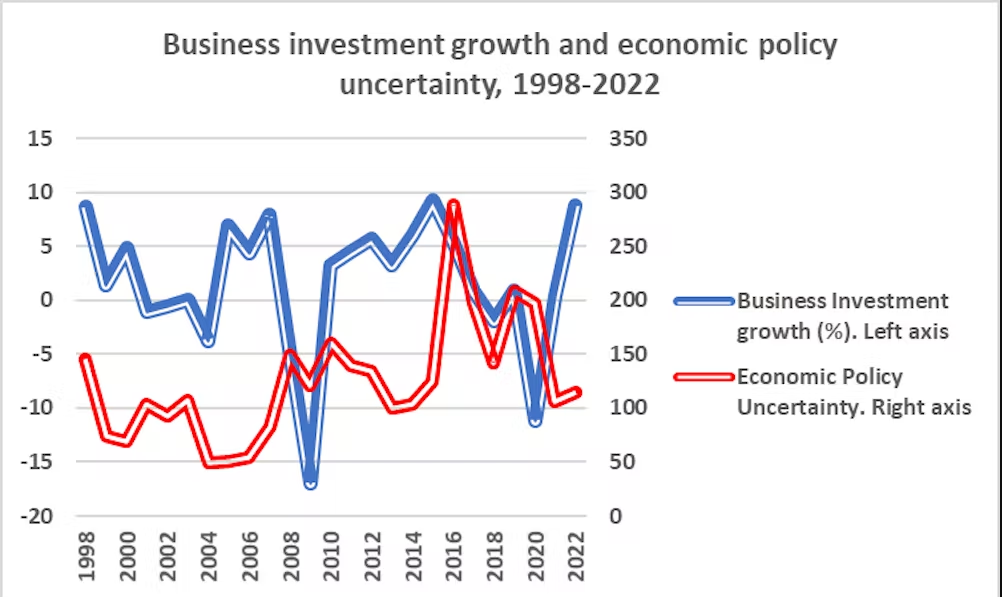

Figure 2

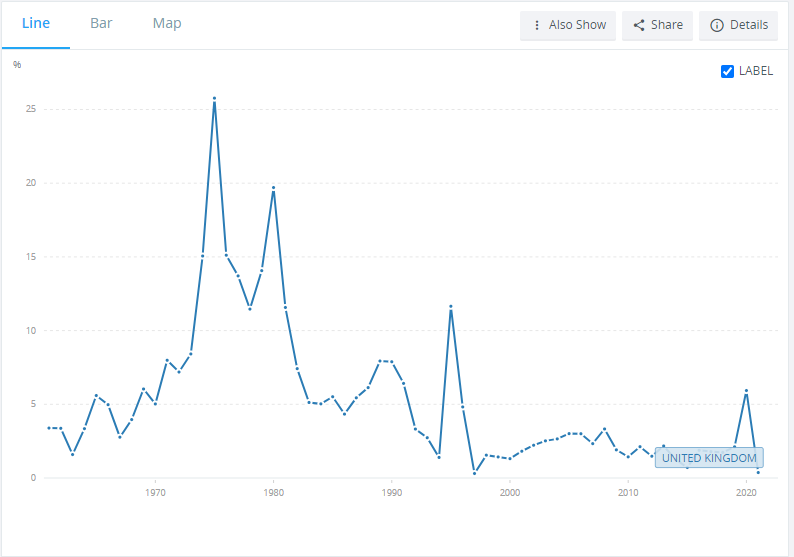

The business and economic cycles in the UK are influenced by several variables, such as energy costs, inflation, interest rates, and world economic circumstances. These variables point to a likely UK recession over the next three quarters, according to the EY ITEM Club Autumn Forecast. Increasing energy costs, high inflation, rising interest rates, and a weakening global economy are all predicted to have a detrimental influence on the UK economy (Harari, 2022). However, the probability of a significant slump has decreased thanks to government action on energy prices.

In addition, the prediction anticipates that the UK’s GDP would decrease by 0.3% in 2023, down from the earlier estimate of 1% growth for the same time frame. However, the Office for National Statistics has revised past statistics, increasing the growth prediction for 2022 from 3.7% to 4.3%. (ONS). The UK economy’s future is uncertain, according to the EY ITEM Club, and there are significant risks to the prediction (Worrell, 2023). The government will continue to take steps to strengthen the economy and lessen the effects of the current economic crisis.

Unemployment

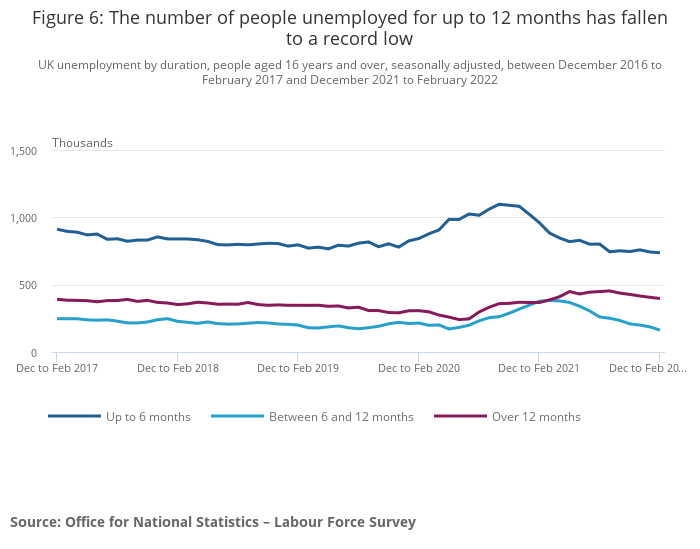

In recent years, the unemployment rate in the UK has stayed low, but the pandemic has caused it to rise. From December 2021 to February 2022, the unemployment rate in the UK was predicted to be 3.8%, returning it to pre-coronavirus pandemic levels. Compared to the preceding three months, this is a drop. As well, a record low number of persons have been unemployed for up to 12 months (Lea, 2022). Additionally, compared to the previous three-month period, the economic inactivity grew while the employment rate remained broadly stable.

Figure 3

To help employees and lower unemployment during the epidemic, the government has put in place a number of programs. The Job Retention Scheme is one such scheme that has helped to safeguard employment by enabling firms to temporarily furlough workers and get government assistance to pay a portion of their salary. This has avoided significant employment losses and lessened the effects of the epidemic on the labour market.

Investing in job development and training programs is another measure that can successfully lower unemployment. To help people acquire the skills required for in-demand sectors, the government can offer financing and incentives to enterprises that engage in programs for education and training. The government may also concentrate on helping small enterprises, which frequently suffer the most during economic downturns. In order to assist them to weather the economic hardships and retain their staff, this may be accomplished through tax cuts, grants, and loans.

In order to boost employment in the construction sector, the government might also concentrate on infrastructure development. This might involve funding for housing, energy, and transportation initiatives that raise living standards nationwide and generate jobs. By adopting initiatives like the Job Retention Scheme, investing in job creation and training programs, assisting small companies, and prioritising infrastructure development, the government may successfully lower unemployment in the economy.

Inflation and Balance of Payments

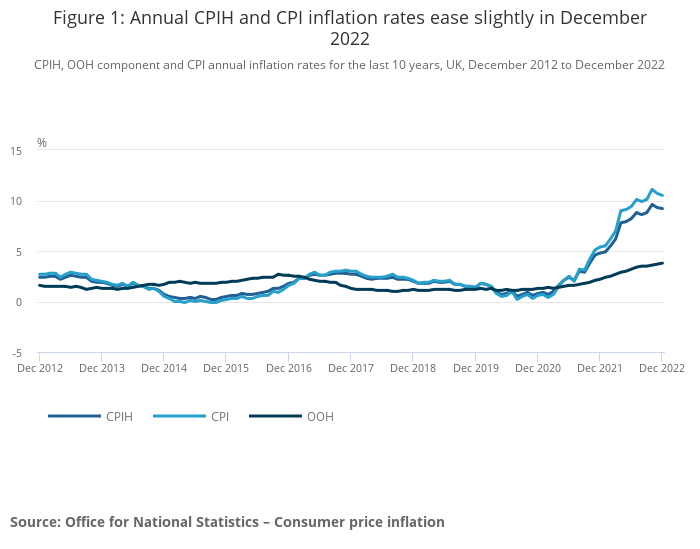

The Consumer Price Index (CPI) has been below the Bank of England’s objective of 2% for several years, indicating low inflation in the UK. This has supported economic development and allowed the central bank to retain its liberal monetary policy stance (Greenwood, 2022).

Since the UK imports more products and services than it exports, the country’s balance of payments has been in deficit. Since the UK’s exit from the European Union has raised trade obstacles with the EU, the UK’s major trading partner, the prolonged uncertainty surrounding Brexit poses a serious threat to the UK economy. Exports and corporate investment have fallen as a result. This inflation increase may pressure the central bank to adjust its monetary policy stance and hurt economic growth.

Additionally, the UK economy continues to face substantial challenges due to the prolonged uncertainty surrounding Brexit, which has led to higher trade barriers with the EU, which is the country’s main trading partner. As a result, there has been a reduction in corporate investment and exports, and the balance of payments imbalance has persisted. These elements could continue to affect the UK economy and present new difficulties for policymakers.

Figure 4

Since the UK imports more products and services than it exports, its balance of payments has been in deficit. The prolonged uncertainty surrounding Brexit, which has resulted in higher trade barriers with the EU, the UK’s leading trading partner, is the main contributor to this gap. The UK’s balance of payments has suffered due to reduced exports and corporate investment. The UK’s substantial goods trade deficit and modest service surplus contribute to the deficit. A larger imbalance results from the pound’s depreciation since imports are now more expensive and exports are now less expensive.

As measured by the Consumer Price Index (CPI), inflation in the UK has remained low, enabling the central bank to keep its accommodating monetary policy stance. Maintaining low-interest rates, making borrowing less expensive, and promoting spending and investment, have supported economic development. Low inflation also contributes to maintaining a reasonable standard of life for consumers.

Since the UK imports more products and services than it exports, the country’s balance of payments has been in deficit. The UK’s major commercial partner, the EU, has seen higher trade obstacles as a result of the continued uncertainty around Brexit, which has decreased company investment and exports. This might have a detrimental effect on the economy by decreasing job prospects and economic growth while also raising the price of imported items for consumers. Additionally, a balance of payments imbalance may cause capital to leave the country, devaluing the national currency. This may increase the cost of exports and widen the trade imbalance.

Economic Policy

To address the issues the UK economy is experiencing, the government and the Bank of England have undertaken a number of monetary and fiscal measures. Monetary policy, notably the use of interest rate changes by the Bank of England, has been one economic strategy employed to influence the economic cycle in the UK (Morgan, 2022). This policy tries to curb inflation by altering borrowing costs and stabilize the economy. For instance, the Bank of England may increase interest rates during periods of high inflation to discourage borrowing and spending, slowing the economy and lowering inflation. The Bank of England, on the other hand, may cut interest rates when the economy is in a recession to promote borrowing and spending, so promoting economic growth.

Figure 5

Fiscal policy, especially through the use of government spending and taxation, is another economic measure that might be used to influence the UK’s economic cycle. By modifying levels of taxation and expenditure by the government, this policy seeks to impact the economy. For instance, during a recession, the government may raise expenditures on infrastructure projects and social welfare programs to boost economic development and generate employment. In order to put more money in the hands of consumers and companies and promote investment and spending, the government may also lower taxes. In contrast, the government may restrict expenditure and raise taxes during high inflation or economic expansion to slow down the economy and lower inflation.

One example of fiscal policy used to impact the economic cycle in the UK is the use of “Private Finance Initiatives”, which is a policy of using private firms to build public facilities like roads, schools, and hospitals. This way, the state does not borrow for investment. However, the private firm does. The state pays the firm an annual fee to cover the interest and capital charges and, in some cases, the operating costs with the firm running the facility. Some argue that this policy may be more efficient at running projects, and borrowing does not show up as a government liability. However, others point out that the private sector has a higher cost of borrowing, and therefore, this policy does not necessarily lead to cost savings.

Conclusion

In conclusion, the UK economy has performed well in recent years, with steady growth, low unemployment, and low inflation. However, the COVID-19 pandemic has significantly impacted the economy, leading to a decline in economic activity and increased unemployment. The government and the Bank of England have implemented several monetary and fiscal measures to support the economy during the pandemic. Brexit’s ongoing uncertainty is also a significant challenge facing the UK economy. In response, the government has pursued trade deals and immigration policies to diversify the country’s economy and reduce its dependence on the EU.

References

Bandyopadhyay, S., 2020. Is the Indian Economy Moving Towards a Slump? Economy Polity Environment: An International Peer-reviewed Journal of Social Studies, 2(1), pp.46-85.

Greenwood, J. and Hanke, S.H., 2022. On monetary growth and inflation in leading economies, 2021–22: Relative prices and the overall price level. Economic Affairs, 42(2), pp.288-306. Available at https://www.bankofengland.co.uk/monetary-policy-report/2022/november-2022

Harari, D., Francis-Devine, B., Bolton, P. and Keep M., 2022. The rising cost of living in the UK. London: House of Commons Library https://commonslibrary.parliament.uk/research-briefings/cbp-9428.

Lea, R., 2022. Bank expected to raise Bank Rate in February as inflationary pressures mount. Available at https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS

Morgan, J., 2022. Systemic stablecoin and the defensive case for Central Bank Digital Currency: A critique of the Bank of England’s framing. Research in International Business and Finance, 62, p.101716. Available at https://www.bankofengland.co.uk/monetary-policy

Rakha, A., Hettiarachchi, H., Rady, D., Gaber, M.M., Rakha, E. and Abdelsamea, M.M., 2021. Predicting the economic impact of the COVID-19 pandemic in the United Kingdom using time-series mining. Economies, 9(4), p.137. Available at https://www.cnbc.com/2021/02/12/uk-economy-shrank-by-9point9percent-in-2020-its-largest-contraction-on-record.html#:~:text=The%20U.K.%20economy%20contracted%20by,a%20resurgence%20of%20Covid%20cases.

Sheridan, A., Andersen, A.L., Hansen, E.T. and Johannesen, N., 2020. Social distancing laws cause only small losses of economic activity during the COVID-19 pandemic in Scandinavia. Proceedings of the National Academy of Sciences, 117(34), pp.20468-20473. Available at https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world

Worrell, D., 2023. Development and Stabilization in Small Open Economies: Theories and Evidence from Caribbean Experience. Taylor & Francis. Available at https://www.ey.com/en_uk/news/2022/10/uk-economy-expected-to-be-in-recession-until-summer-2023

https://www.ey.com/en_uk/news/2022/10/uk-economy-expected-to-be-in-recession-until-summer-2023

https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/balanceofpayments/julytoseptember2022

Image references

Figure 1 https://www.bbc.com/news/business-56037123

Figure 2 https://data.worldbank.org/indicator/NY.GDP.DEFL.KD.ZG?locations=GB

Figure 3 https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/employmentintheuk/april2022#unemployment

Figure 4 https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/december2022

Figure 5 https://theconversation.com/uk-political-resignations-the-current-uncertainty-could-affect-the-economy-for-nearly-two-years-186610

write

write