Abstract

Capital management is a broad concept that plays a pivotal role in ensuring the smooth running of the business. The main objectives of capital management are to ensure that the business runs effectively and operationally. This case scenario presents two viable investment opportunities. The first investment opportunity focuses on investing in Hampshire Inn Inc. (NHI), where Larry needs to become an 8% equity owner of the company. The second viable opportunity involves becoming an equity owner of Vermont Inn Inc. (VI – 8%). These investment approaches utilize two common working capital, management models. The first model is the Weighted Average Cost of Capital which indicates the rate expected to be paid by the company. A lower WACC portrays a good investment chance of attracting potential investors at a lower cost. The value of WACC is 12.5% for VI, while that of NHI was 17.5%, despite having a high WACC compared to that of the industrial average (S&P 500).

On the other hand, an investment opportunity with a high expected return rate is considered good for investment. CAPM is the second approach utilized under working capital management. The model assists investors in measuring what sort of investment provides a good investment opportunity. Investments that have a high expected return are considered good for investment. Under this approach, Larry should consider investing in VI due to its high expected rate of investment return.

The study utilizes several assumptions under capital management. These assumptions are the expected return, and WACC estimates represent a long-term risk and return forecast for every opportunity.

Analysis

Capital management plays a pivotal role in ensuring that the organization runs efficiently. The management normally uses this aspect to make short-term decisions. It simply ensures that all the business’s current assets and liabilities are effectively used through monitoring and control. Skills under capital management are essential in investment analysis. However, capital management depends on various factors hence varies from firm to firm (Pettengill et al., 2020). These factors include the nature of business, supply chain conditions, marketability conditions, and seasonality and production policies. If these aspects are carried out efficiently and effectively, an organization portrays growth and good health. Most organizations invest in short-term operations for long-term investments and purposes.

As the name suggests, working capital management adopts “working capital” for investment activities. Working capital simply means all aspects involved in current assets and current liabilities. These are simply short-term operations. An organization should be sufficiently liquid to venture into investment activities. This means that the firm should meet its short-term obligations. Hence the current ratio should be not less than one. The current ratio is calculated by dividing all the current assets by the current liability. It shows how an organization is liquid to pay off its short-term debts effectively (Wurstbauer et al., 2016).

Under this scenario, there are two investment opportunities. The first opportunity relates to becoming an equity owner of New Hampshire Inn Inc. (NHI). This business is under 100% equity with no debt. Projected earnings before interest and tax accumulate to $600,000, which is a good figure. The marginal tax rate is roughly 24%, and lastly, the company has a market value of equity worth USD 4.8 Million. The second investment opportunity is investing in Vermont Inn Inc. (VI). This business operates under both equity and debt. The capital structure consists of 63% equity and 37% debt. The projected earnings before interest and tax equal that of NHI, $600,000, and a marginal tax rate of 24%. However, this business operates under bond, with a stated coupon rate and market rate of 6% and a market value of USD 2 Million. VI has a current market value of equity worth USD 3.428 Million.

There are two main approaches to determine the best viable investment for Larry. These approaches include determining viable investment opportunities through WACC and CAPM methods.

Weighted Average Cost of Capital (WACC).

WACC simply represents the average cost of all capital sources within an organization. These capital sources include bonds, common stock, and other forms of debt. The approach is commonly used in determining the required rate of return. This aspect expresses the return of each bond that each shareholder demands. When the value of WACC is high, it means that an organization entails a volatile stock; hence investors might demand a high return on their investments. In investment analysis, WACC plays a vital role for various reasons.

Most importantly, this approach analyzes the potential benefits of acquiring another business through taking on investment decisions. For example, in merging companies, the company with a high WACC can obtain the other company, hence becoming a good choice. If the management obtains a potential fall-out in this model, there are high possibilities of the company having a shortfall; hence might opt to invest their capital on other projects.

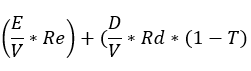

Moreover, if an organization depends on one source of financing – common stock- there is simplicity in calculating WACC. For example, suppose an investment opportunity has a 5% rate of return. In that case, this means that the organization’s cost of capital will be equal to the cost of equity obtained through the investment – say, 5%. This is equally true in debt financing. If an organization’s average yield is 10% in the payment of outstanding bonds, then the cost of debt will be equal to the average yield – say, 10%. The calculation of WACC is simplified to ensure that all the costs of equity and debt are put in place. The formula is given as:

Where T is the corporate tax rate, this formula is used in the investment analysis in this scenario.

In the first investment opportunity, under NHI, the breakdown is as shown in the table below:

| Description | Acronym | Value |

| Market Value of Equity | E | 4,800,000 |

| Market Value of Debt | D | 0 |

| Total Market Value | V | 4,800,000 |

| Cost of Equity | Re | 100% |

| Cost of Debt | Rd | 0% |

| Corporate Tax Rate | T | 24% |

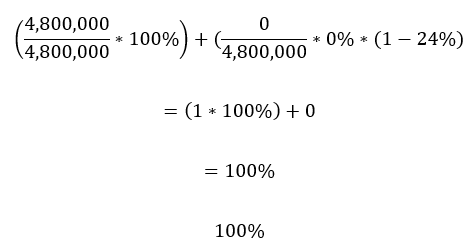

The calculations are as follows:

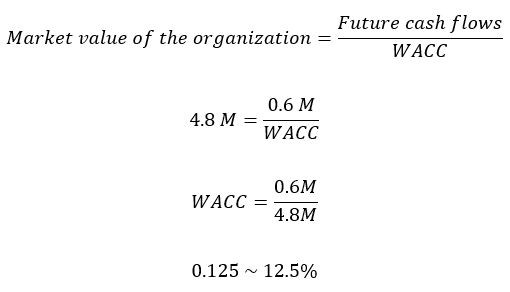

The value of WACC under the NHI investment approach is 100%. This means that the organization’s capital structure is equal to the cost of equity – say, 100%. However, to get a more detailed view of the capital structure of this investment, altering the capital structure might affect the overall decision made by an investor. Given the premises of the organization’s market value and the present value of any future cash flows, then the value of WACC can be obtained through a second option. This approach gives the company’s market value using future cash flows discounted by the Weighted Average Cost of Capital. Hence;

The value of WACC under this scenario is 12.5%. This value is considered favorable. Under the rule of thumb, a good WACC should be in line with the industrial average. Considering these investment decisions fall under the S&P 500 industries, the industrial WACC average is 6.6%. Therefore, this investment decision has a high WACC than the industrial average. This means that the organization should make investments greater than 12.5%, as stipulated in the calculations.

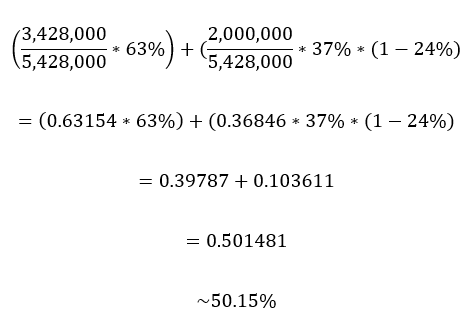

In the second investment decision, the crackdown is similar to NHI investment. However, there is a slight difference in the cost of equity and debt. NHI is financed by equity alone, whereas the VI is financed by equity and debt, with rates accumulating 63% and 37%, respectively. The breakdown is shown in the table below.

| Description | Acronym | Value |

| Market Value of Equity | E | 3,428,000 |

| Market Value of Debt | D | 2,000,000 |

| Total Market Value | V | 5,428,000 |

| Cost of Equity | Re | 63% |

| Cost of Debt | Rd | 37% |

| Corporate Tax Rate | T | 24% |

The calculations are as follows:

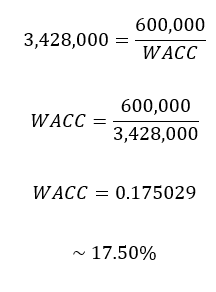

The value of WACC under this approach in this investment is 50.15%. This means that the management needs to make investment decisions greater than the value of WACC for profitability. This value is extremely high considering that a high WACC is unfavorable for investment decisions. This approach is essential, indicating that the return on investment might be attributed to both debts and external equity (Pettengill et al., 2020). However, using the market value approach, the estimated value of work seems to be less. The market value of this company is USD 3.4278 Million. Future cash flows are equal to NHI – say, USD 0.6 Million. Therefore, the estimated WACC will be:

Under the VI investment approach, WACC is better than that of the NHI investment opportunity. However, the value is greater than the average industrial average under S&P 500 organizations –6.6%.

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) is a financial metric that examines the financial market price securities and their expected returns. The objective character of the anticipated value of equity that the model may produce is a major advantage of CAPM. Because CAPM reduces the complexity of financial markets, it cannot be employed in isolation (Sattar, 2017). However, in their efforts to establish the accurate and effective cost of equity assessments, financial managers might use it to enhance other methodologies and judgments. The modern financial theory is now routinely used in investment management, despite application continuing use to stir heated discussion. The same strategies are increasingly being used to solve difficulties in corporate finance. The backlash is expected to be just as ferocious. The capital asset pricing model, or CAPM, encapsulates the notion (Sattar, 2017).

The modern financial theory is based on two assumptions: (1) financial market is highly competitive and efficient (that is; relevant information about companies is widely disseminated and absorbed); and (2) these markets are monopolized by rational, risk-averse venture capitalists seeking to maximize satisfaction from investment returns (Wurstbauer et al., 2016). The first presumption assumes a financial market filled with highly intelligent, well-informed sellers and buyers. The second assumption applies to investors who value wealth and would rather have more than less. Furthermore, in current financial theory, hypothetical investors seek a charge in the form of higher projected returns for the risk they are taking. The two assumptions are common in the calculation of CAPM. They are the cornerstones of the modern financial theory with limited assumptions (Wakil, 2012). If the money had not been invested in LIIX, it would have been invested in a mutual fund that mimics the S&P 500. If LIIX needs any additional funding for the investment, it can borrow from the 2nd National Bank of Evening Shade at 4.5%. LIIX is in the 17% marginal tax bracket. Currently, the 90-day Treasury bill rate is 0.25%, the 5-year Treasury Rate is 1.75%, and the 10-year Treasury rate is 2.95%. The S&P 500 is expected to return 9.25% in the upcoming year. NHI has a Beta of 1.25, while the Beta for VI is 1.80. The Beta for LIIX is 1.45.

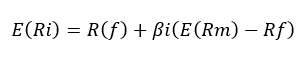

This model deals with the risk and return of financial securities in portfolio investments. It examines the rate at which an investor receives after buying the common stock and holding it for longer periods through capital gains. The formula for obtaining the expected Capital asset return is given as:

Where is the risk-free rate, Is the expected return in the market, and the Beta value represents the sensitivity of the risk.

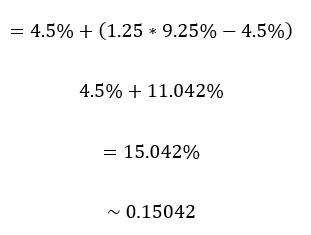

In the first investment opportunity, NHI, the value breakdown is as follows:

| Description | Acronym | Value |

| Risk-Free Rate | R(f) | 4.5% |

| Sensitivity | Bi | 1.25 |

| Expected Return in the Market | E(Rm) | 9.25% |

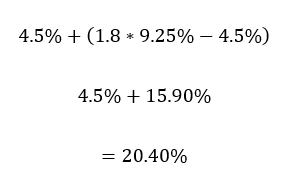

In the second investment, VI, the Expected return will be:

| Description | Acronym | Value |

| Risk-Free Rate | R(f) | 4.5% |

| Sensitivity | Bi | 1.80 |

| Expected Return in the Market | E(Rm) | 9.25% |

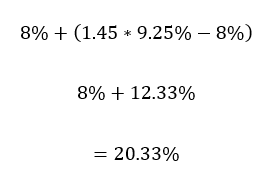

The second investment has a high expected rate of return than the first investment. A high CAPM rate is considered a more risky investment than a lower CAPM rate. If the model considered a beta value for LIIX, 1.45, then the value of CAPM at 8% shareholding would be:

The second investment has an equal expected rate of return similar to Larry’s Investment Company. This model indicates that Larry should go for the second investment, despite having a high risk. This investment portrays a greater potential in the rate of return.

Conclusion

In a nutshell, Larry should focus on the opportunity with a high rate of return. The VI entails a lower WACC than the first investment opportunity, NHI. This portrays a viable investment opportunity for LIIX Company. Moreover, investing in VI has a higher CAPM value than NHI. According to the rule of thumb, a good investment should have a high expected rate of return despite the high potential risk. Therefore Larry should go for VI investment, and NHI should be an opportunity cost for this approach.

References

Pettengill, G. N., DeBondt, W. F., Hur, J., & Singh, V. (2020). The intricate relation between return, market value and past performance of common stocks in the United States 1926-2006. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1930216

Sattar, M., & -, J. (2017). CAPM vs Fama-French three-factor model: An evaluation of effectiveness in explaining excess return in Dhaka stock exchange. International Journal of Business and Management, 12(5), 119. https://doi.org/10.5539/ijbm.v12n5p119

Wakil, G. (2012). Value relevance of firm size proxies in predicting stock returns: Market capitalization or total book assets? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2100394

Wurstbauer, D., Lang, S., Rothballer, C., & Schaefers, W. (2016). Can common risk factors explain infrastructure equity returns? Evidence from European capital markets. Journal of Property Research, 33(2), 97-120. https://doi.org/10.1080/09599916.2016.1169211

write

write