Introduction

An investment can be defined as the appreciation of value over a given period. The asset, once acquired is held for a given period after which it has increased the wealth due to the appreciation of their prices over the same period. One of the most important features associated with any given type of investment is that the only way to attain the asset’s appreciation is to always keep the set financial goals in mind, which will keep one looking after it over the specified period. The set financial goals will encourage the investor to generate income and boost an asset’s value. The investment of funds can be made on various types of assets, for instance, bonds and stocks (Baele, De Jonghe & Vander Vennet, 2017).

The starting point for any investment usually begins with analyzing the selected assets; for instance, in my case, I was able to choose the stocks from the most significant US companies for the past ten years beginning from Mid-March 2012 to the same period in 2022. The analysis is essential in first understanding the value expected of the assets gained by the funds invested with the same companies if it was invested over the past ten years. The data used for the analysis was obtained from Yahoo finance since they have the daily update data for the period under study.

Investment Analysis

The investment I made chose the stocks from Apple, Amazon, Walmart, Tesla, and Coca-Cola. These companies are currently classified as the S&P 500 companies, forming the biggest top 500 companies in the United States. The average returns from these companies recorded are 13.6% for the past ten years, and this form the benchmark returns from the same companies. The daily stock returns are calculated with their respective standard deviation from the daily stock prices. The average returns estimate what should be expected from an investment depending on the frequency, say daily, monthly, or annually. On the other hand, the standard deviation is essential for explaining the risks associated with the specified types of stocks (Zaimovic, Omanovic & Arnaut-Berilo, 2021). The daily average returns for the selected reserves were computed and summarized in the following table.

| Daily Statistics | |||||

| Companies | Apple | Amazon | Coca Cola | Tesla | Walmart |

| Mean Returns | 0.08% | 0.11% | 0.03% | 0.19% | 0.04% |

| Standard Deviation | 1.80% | 1.92% | 1.12% | 3.50% | 1.23% |

Table 1: Daily Return Statistics

The average returns and standard deviation associated with the five stocks returns are given here. I also used the daily average returns to compute the annual returns and their respective standard deviations (Zaimovic, Omanovic & Arnaut-Berilo, 2021). The table below shows the average annual returns and their standard deviation.

| Annual Statistics | |||||

| Company | Apple | Amazon | Coca Cola | Tesla | Walmart |

| Mean Returns | 30.92% | 40.15% | 12.20% | 68.84% | 16.04% |

| Standard Deviation | 28.51% | 30.56% | 17.77% | 55.57% | 19.50% |

Table 2: Annual Return Statistics

Table 2 above shows that, Tesla had the highest average returns of 68.84% for the last ten years, while Coca-Cola recorded the lowest annual returns of 12.20% (Zaimovic, Omanovic & Arnaut-Berilo, 2021). By comparing the average returns with the benchmark returns, one can note that only Coca-Cola Company had its returns below the benchmark level of 13.60% (Siegel & Schwartz, 2022).

The standard deviation for the same returns is essential for checking the risk level associated with the various companies’ returns (Zaimovic, Omanovic & Arnaut-Berilo, 2021). One can also note that the standard deviation for Tesla stock returns is the highest among the five companies, and Coca-Cola also has the lowest risks associated with them (Siegel & Schwartz, 2022). It generally shows that, among the five different stocks, Tesla stocks are the riskiest while Coca-Cola stocks have the lowest risks.

Diversification

The diversification of the investments is usually done to any buy to increase consistency of the returns from one financial year to the other (Peng, 2022). The diversification of the investments is typically done to spread the risks across all assets considered in a portfolio of investments (Baele, De Jonghe, & Vander Vennet, 2017). Generally, diversification reduces the volatility associated with asset returns from one financial period to another. The fact that, it will reduce the volatility of the returns through the diversification process, the higher the accuracy when projecting the future returns associated with the same portfolio of investments (Zaimovic, Omanovic & Arnaut-Berilo, 2021).

The five stocks selected were used to create a portfolio to spread the risks associated with the various stock returns. I made the portfolio, and its portfolio returns and standard deviation were computed and summarized in table 3 below.

| Companies | Weights | Mean Returns | Standard Deviation |

| Apple | 0.2 | 28.51% | 28.51% |

| Amazon | 0.2 | 40.15% | 30.56% |

| Coca Cola | 0.2 | 12.20% | 17.77% |

| Tesla | 0.2 | 68.84% | 55.57% |

| Walmart | 0.2 | 16.04% | 19.50% |

| Portfolio Returns | 33.15% | ||

| Portfolio Standard Deviation | 14.87% |

Table 3: Annual Portfolio Returns

Table 3 above shows that, the annual portfolio returns were obtained as 33.15% while the standard deviation is at 14.87%. One can note from this information that the average returns is lower than some companies included within the portfolio while the risks associated with the portfolio returns is lower compared to some stock returns as well.

Information Ratio

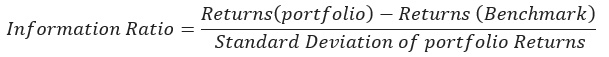

This is one of the financial metric used for measuring the excess returns associated with a given portfolio of assets (Peng, 202). The lowest ratio usually indicates the level of consistency managers beat the market and vice versa shows the high volatility associated with the same returns(Zaimovic, Omanovic & Arnaut-Berilo, 2021). The information ratio was obtained as 1.31 which shows that the portfolio managers have the highest possibility of beating the market benchmark consistently from one financial year to the other.

Conclusions

Any type of investment is essential to boost its returns while at the same time reducing significantly its associated risks as well. The portfolio created from the five stocks above shows that the returns have been boosted from what was expected in a given year from the individual stocks and also the risks obtained is also very low. The creation of the portfolio of investments plays a critical role in ensuring there is consistency of the returns realized from one financial year to the other and thus making projection of the returns associated with the same investments more accurate.

References

Baele, L., De Jonghe, O., & Vander Vennet, R. (2017). Does the stock market value bank diversification?. Journal of Banking & Finance, 31(7), 1999-2023.

Peng, Z. (2022, January). Stocks analysis and prediction using big data analytics. In 2019 international conference on intelligent transportation, big data & smart City (ICITBS) (pp. 309-312). IEEE

Siegel, J. J., & Schwartz, J. D. (2022). Long-term returns on the original S&P 500 companies. Financial Analysts Journal, 62(1), 18-31

Zaimovic, A., Omanovic, A., & Arnaut-Berilo, A. (2021). How Many Stocks Are Sufficient for Equity Portfolio Diversification? A Review of the Literature. Journal of Risk and Financial Management, 14(11) 551

Appendix

Information Ratio

The following table shows the details calculations leading to the information ratio. The following formula is also applied to obtain the information ratio.

write

write