Executive summary

Corporate Governance is the way firms organize themselves in terms of leadership. A firm with good corporate Governance ensures shareholder value is created. Good Corporate Governance has benefits that make shareholders content with company operations. In firms’ Governance, executives and Board of directors are vital in running company operations. Good corporate Governance improves a company’s financial performance, hence a high level of dividends to shareholders. Corporate governance variables that affect shareholder value are the ownership concentration, executive directors’ proportion, and Chair and CEO being the same person. The report concludes that firms should avoid letting chair and CEO positions to one person.

Corporate Governance and financial performance

Research has provided convincing evidence for a positive connection between a firm’s corporate social responsibility and financial performance. The researchers have further discovered that corporate social responsibility impacts a firm’s value by improving finance access by media evaluation of CEO compensation and counteracting downward pressure on prices of shares exerted by short-sellers (Chen, 2021). Current trends in executives’ compensation include the application of CSR criteria, and firms adopting the technique are discovered to have higher shareholder value than others.

Corporate Governance is not the only determinant towards improving shareholder value. The competition level in a particular industry plays an essential role in enhancing shareholder value. An industry with stronger competition has improved shareholder value as managers are pressured toward efficient use of resources. Good Governance in a client firm sometimes depends on an industry’s economic conditions. Shareholder rights are precious when the industry conditions in an industry prosper and vice versa when there are poor industry conditions.

Furthermore, a firm’s life cycle stage is essential; for instance, there is a higher need for monitoring; thus, there should be a higher management team than the Board of directors. In younger firms, there is minimum monitoring and management; hence Board of directors should be more than the management team to offer advice on how the company should operate (Goel, 2018). A firm’s performance deteriorates when the Governance fails; hence, every organization should maintain withstanding Governance.

Benefits of good Corporate Governance

The main benefit of good corporate Governance is building predictability and trust, which makes investors feel comforted. However, good corporate Governance has other critical benefits discussed below.

Improved capital flow

First, good corporate governance helps improve the flow of capital in a company. Robust financial management reporting increases banks’ and investors’ confidence. However, confidence does not only help in enhancing capital access, but it also helps minimize both equity cost & capital cost. Therefore, resulting in an improved flow of Capital. Good Corporate Governance has a crucial element in making a good choice on which capital structure is appropriate. Regarding all the investor’s interests, transparency will assist in commanding a lower risk premium, thus reducing the equity and capital costs.

Risk mitigation

Second, good corporate governance ensures risk mitigation. Furthermore, shareholders provision to non-listed companies regardless of their exits which may be challenging, the management and Board will help safeguard their interest. However, a good corporate governance framework also induces exit strategies with reflection (Rathod, 2018). The corporate also gives prospective shareholders more comfort in deciding whether to make their investment in the company.

Reputational boost

Good corporate governance should help boost its reputation by acting quickly and transparently. The way a company deals with its staff, suppliers, media, government bodies, and vendors will help in boosting its brand as well as its reputation. Also, the transparency of a company’s internal policies and its control mechanisms promotes its reputation. However, companies with a strong positive reputation are capable of attracting more investors.

More effective decision-making

Good corporate governance ensures more effective decision-making. Good Governance helps ensure faster access to good communication and information among stakeholders leading to the best results. Furthermore, good corporate governance aims to fast the decision-making process by clearly delineating roles between the management & owners (Felicite, 2021). For the owners and managers to make more fact-based & informed decisions there is need for improved reporting. However, effective decision-making contributes to optimized reduced costs and sales margins.

Focus on compliance

Another benefit of good corporate governance is focusing on compliance. Good corporate Governance focuses on what policies require a company to stay compliant with regulations & local laws. However, Good Governance synchronizes compliance and risk management to help the company with suitable control mechanisms. The company is allowed to meet its objectives and operate in terms of processes, information, people, and technology efficiently.

Higher staff retention

Good corporate Governance helps in higher staff retention in the company. Particularly, when a company with communicated and we’ll define direction & vision, an increase in staff motivation and retention is expected from senior staff. However, when a company focuses on its core business makes it simple to go to the market and attract the shareholder’s interest. In addition, the labor market’s biggest single group ranks an organization’s commitment to responsible business activities higher in their employment choices.

Components of governance

How the company’s value is affected by good corporate Governance matters little when it succeeds but has critical consequences when it fails. However, good governance definitions vary widely; it is also hard to measure the corporate governance impacts. The firm’s value exact linkages are also difficult to be pinned down. The effect of good Governance on the firm, either positively or negatively, depends on the life cycle stages in which the firm is within (Wernicke, 2019). Also, it depends on the firm’s home country’s institutional characteristics & the country where the stock market listing of the firm is done.

Complementary governance components

It is challenging to give a universally applicable corporate governance definition even when given available theoretical perspectives multitude & Corporate governance diversity practices in the world. However, the Organization of Economic Cooperation (OECD) defines corporate governance as how business operations are controlled and directed. The corporate governance structure specifies the responsibilities and rights distribution among distinct participants like managers, shareholders, the Board & other stakeholders (Barlow, 2020). Furthermore, corporate Governance spells out the procedures & rules for corporate affairs decision-making. The OECD’s definition goes above an approximately small focus on how to finance suppliers who promise themselves have a return on their investment. The suppliers also assure themselves of the activities subsumed on Corporate Social Responsibility (CSR).

Foremost, based on the index, which has 24 governance rules reflecting the rights of shareholders in giant public firms situated in the U.S. However, it is estimated that a firm’s portfolio that has the index outperforms the highest scores. The firm’s portfolio returns with the shareholder’s rights of the weakest by 8.5% every year. Researchers found similar impacts for firm value with reduced & refined index.

From recent studies, we have two takeaways. First, the firm’s Governance positively affects the firm value as well as share prices. Second, regardless of using different indexes sizes, past studies concluded that not all governance rules & provisions always matter similarly. Some governance components are complementary to each other, whereas others are substitutes. For instance, firms with concentrated ownership with few shareholders have vast amounts of shares, Board of directors matters less than those with many shareholders holding minimal stakes (Price, 2019). Likewise, in legal environments where the firm’s hostile takeovers are relatively costly & hard, at an individual level, the provisions of anti-takers matter less. However, the shareholder’s advisory firms are advantaged to have developed huge, equal indexes. Also, the shareholders are advised to vote to favor proposals that improve rankings.

The vital role of the Board of directors

Generally, researches have strong evidence that the shareholders’ rights are protected more substantially, specifically for shareholders holding only small stakes and laws that enable the firms to take over each other’s outcomes in higher firm value. Furthermore, there are also governance institutions in the firms, for instance, the Board of directors, which affects the firm value, as shown in the research. However, in the firm, the Board of directors has numerous functions such as monitoring managers and providing the resources & executives with advice (Ezenwa, 2021). The study finds that firms having smaller boards are associated with higher firm value.

The Board of directors appoints the most suitable individuals as the CEOs. However, the CEOs significantly affect the firm’s value & performance and their CSR performance. Also, the CEO’s character matters directly for the firm’s Governance. For instance, CEOs with many narcissistic personality traits are considered to increase the possibility that the firm can be implied in financial fraud cases (Harjoto, 2021). Researchers have provided evidence that CEOs who have character traits that make people more likely to follow the rules and regulations are not easily implied in financial fraud.

Separation of CEO and Chair position

Board in an organization is headed by a chairperson who has more influence on the direction to be taken by the Board. In most cases, the CEO serves as board chair. The CEO holding the top management position being named as the board chair gives him powers to approve decisions. Companies that have rapidly grown tend to retain the initial founder in their roles rather than electing new leaders, and that’s where the double leadership to one individual case comes up (Mohr, 2021). It is a hot topic in determining if holding both roles decrease the Board’s efficiency. There are reasons why One person should not occupy Chair and CEO positions in a company.

Executive compensation

When the Chair and CEO of a company are the same people, he has more power to make decisions that favor their salary. Raising the executive’s compensation gets company shareholders’ attention. The increased payments to the CEO are an expense to the company profits regardless of some research arguing that executives’ competitive pay leads to hard work and keeping talents. The CEO should not determine any increase in CEO compensation but from voting and the Board of directors’ agreement. CEO being the Chair simultaneously leads to a conflict of interest as the CEO himself votes for his compensation (McCann, 2019). Legislations require the Board of directors to be comprised of independent individuals. Still, the CEO, the Chair of the Board, can incite the board members to vote according to his wish.

Poor Corporate Governance

The primary role of the Board of directors is to ensure company operations are in conjunction with the shareholder’s will and mandate of the company. CEO is a top position in the management of every company, while the Board of directors is watchdogs sent by shareholders to ensure everything aligns with their interests. The CEO having a combined role leads to oneself monitoring, and the door for abuse opens up. A board led by an independent Chair lacks incitements, and the Board works towards their objectives and roles (Trong, 2020). The Board acts upon areas of the company that are drifting by taking corrective measures to correct the failures.

Ownership concentration

Client company decisions can be influenced mainly by the shareholders with the most significant value of shares. Ownership concentration is how shareholders can control company decisions to protect their interests. Agency theory states that increasing ownership concentration by shareholders enhances the role of supervision by significant shareholders in the management of the company. With the shareholder’s interference, managers’ decisions are limited, and the company mitigates inefficient behaviors (Madhani, 2020). Management teams operate in the interest of the shareholders with higher ownership concentration as they have the power to make decisions in case there is an abuse of power.

Management proportion

Management proportion in the Board of directors is the ratio of members in the Board from management to independent members. An executive director is a member who is already on the management team but still participates in the Board’s decision-making and monitoring of the organization. A non-executive director participates in the monitoring of the company operations and makes decisions toward the company goal. The non-executive director does not perform managerial duties as they are mandated to oversee the company operations (Conyon and Peck, 2019). In most cases, it is preferred that non-executive directors account for more than 50% of the total number of directors on the Board.

Market book value

Market book value is the net value of assets in a firm, and it accounts for the amount shareholders could receive if the company is liquidated. Based on the outstanding shares in the market, market book value is the company’s total worth depending on shares invested in the company. Market book value is used in measuring shareholders’ value creation which is the firm’s performance (Kenton, 2019). A company with a high market level to book value depicts that if all the company operations are liquidated, the company has high worth and cannot sell the company at a loss. High market to book value means there is high shareholder value creation and a low level of market book value represents deficient shareholder value creation.

Methodology

A survey was done on 380 United Kingdom firms to determine how corporate Governance affects shareholder value. The variables obtained from firms included the market-to-book value of each company. Ownership concentration of each firm was collected in the percentage of the shares they own in the company. The proportion of executive directors on the Board was the other data collected in percentage. In Companies in the sample collected, some companies have the CEO and chairman on the board, one person indicated as one and other firms have other options displayed as 0. Total assets of the companies are collected and recorded in pounds millions which depict the company’s size. The sample of firms collected are from different industries, and the industries in the sample are energy, manufacturing, transportation, and another service.

Results

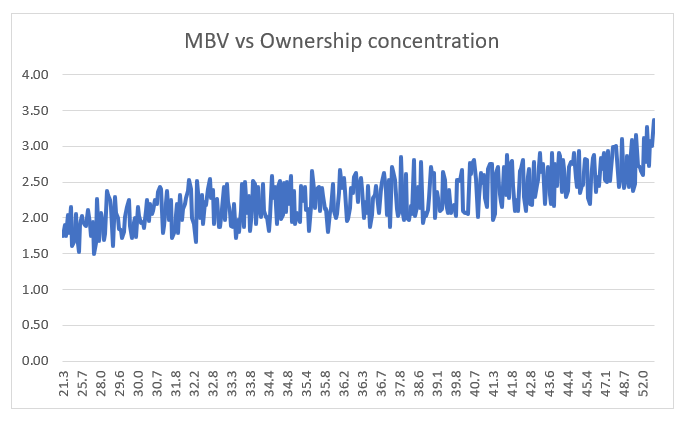

From the sample of 380 firms, data relating to ownership concentration and market to book value was collected.

Figure 1: MBV vs Ownership concentration

The graph above shows the relationship between the market to book value and ownership concentration. The firms with the lowest level of ownership concentration have a low market-to-book value; hence there is limited shareholder value creation. As seen from the graph, the values of market book value move zigzag as the ownership concentration increases. This means that not all companies obey the rule of high ownership concentration increases market book value. However, a deep analysis of the graph shows an increasing trend in the market level to book value as ownership concentration rises. A company with low ownership concentration has a low market-to-book value hence low shareholder value creation (Amico, 2020). In most companies with high ownership concentration, it depicts that shareholder with high shares influence the company’s decision-making to achieve shareholder interest; hence high value is created towards shareholders’ wish.

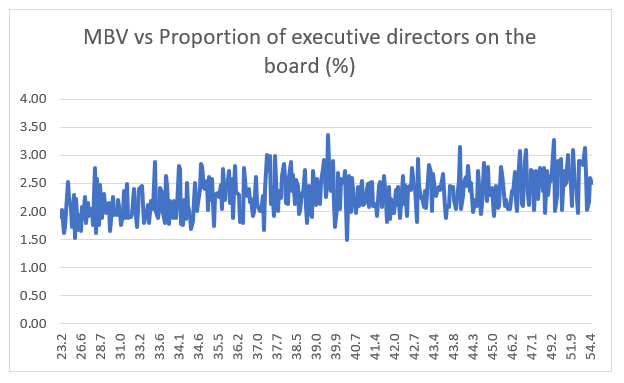

Figure 2: MBV vs proportion of executive directors on the board

The other data collected for each company is the proportion of executive directors on the Board. Executive directors are members of the board who participate in managerial activities and monitor the firm’s operations. The graph below is plotted market book value against the proportion of executive directors on the Board in %.

Like in the case of market book value against ownership concentration graph, the proportion of executive directors on the Board affects shareholder value creation. In this case, the higher the number of executive directors on the Board, the higher the book value. This depicts that the presence of executive directors on the Board leads to effective decision-making (Estevez, 2021). The reason for efficient decision-making is that the executives are familiar with and aware of the company’s strengths and weaknesses, hence making decisions that mitigate the company’s risks. Firms with a low number of executives on the Board have poor decision-making; therefore, shareholder value is not created.

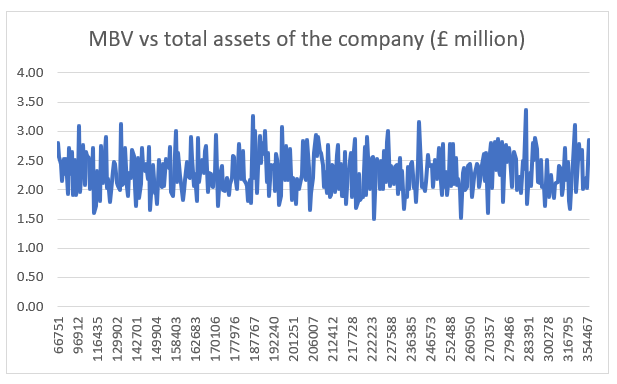

Figure 3: MBV vs total assets of the company

Data relating to the size of each firm was collected, and a graph of market book value against the company’s total assets was presented.

As per the above graph, the company’s size does not affect shareholder value creation. The chart shows a stagnant trend where market-to-book value does not progressively rise due to the increased assets of the company. For a company to create shareholder value, the value of total assets should be high, with the relative value of liabilities being low (Rappaport, 2020). A company with a high value of investments and small value of liabilities enjoys huge profits; hence shareholders receive large amounts as dividends.

Table 1: Board chairman and CEO position

| Dummy | MBV average |

| If the chairman is the CEO | 2.11 |

| Otherwise | 2.5 |

Data relating to firms with Chair and CEO being the same person and otherwise were collected from the sample firms. Otherwise, the option might be a company with the Chair of the Board and CEO being different people. The average MBV of companies with a CEO and Chair of the same person is 2.11. The average MBV of the CEO and Chair of Board being different people is 2.5. In the case of the Chair and CEO being different, there is no abuse of power, and the CEO has no voting rights towards compensation determination (Virahsawmy, 2019). In the case of the CEO and Chair being the same person, the CEO maybe incites directors to vote for compensation increase at the expense of shareholders hence lowering shareholder value creation.

Table 2: Type of industry and MBV average

| Industry | MBV average |

| Energy | 2.55 |

| Manufacturing | 2.32 |

| Transportation | 2.18 |

| Other services | 2.01 |

The type of industry plays a massive role in shareholder value creation. Operation in the energy industry is termed one of the profitable industries. The energy industry creates shareholder value as companies from the sample depicted that the energy industry has a high market to book value average than the manufacturing and transportation industry (Kelm, 2018). Other services industries have a low market-to-book value average with low shareholder value creation.

Conclusion

In conclusion, corporate Governance plays a significant role in ensuring shareholder value creation. Factors that lead to high shareholder value creation are; high ownership concentration, which allows for shareholders with high shares to influence decision-making. The inclusion of executive directors on the Board does not essentially hinder the company’s profits; hence the factor is not a consideration when a company needs to create shareholder value. Whenever a company needs to create shareholder value, it should ensure that the Chair of the Board and CEO are not the same person and operate in more profitable energy industry, thus creating shareholder value.

References

Amico, A., 2020. Why Ownership Concentration Matters. [online] The Harvard Law School Forum on Corporate Governance. Available at: <https://corpgov.law.harvard.edu/2020/02/24/why-ownership-concentration-matters/> [Accessed 9 April 2022].

Barlow, J., 2020. Board Governance Models: A Comprehensive List | BoardEffect. [online] BoardEffect. Available at: <https://www.boardeffect.com/blog/board-governance-models-a-comprehensive-list/> [Accessed 10 April 2022].

Chen, J., 2021. What Corporate Governance Means for the Bottom Line. [online] Investopedia. Available at: <https://www.investopedia.com/terms/c/corporategovernance.asp> [Accessed 9 April 2022].

Conyon, M. and Peck, S., 2019. Board Control, Remuneration Committees, and Top Management Compensation. [online] Available at: <https://www.jstor.org/stable/257099> [Accessed 9 April 2022].

Estevez, E., 2021. The Basics of Corporate Structure. [online] Investopedia. Available at: <https://www.investopedia.com/articles/basics/03/022803.asp> [Accessed 9 April 2022].

Ezenwa, J., 2021. THE ROLE OF BOARD OF DIRECTORS IN CORPORATE GOVERNANCE. [online] Linkedin.com. Available at: <https://www.linkedin.com/pulse/role-board-directors-corporate-governance-joseph-ezenwa-2f?trk=articles_directory> [Accessed 10 April 2022].

Felicite, J., 2021. 8 ways good corporate governance creates company value. [online] Ocorian. Available at: <https://www.ocorian.com/article/8-ways-good-corporate-governance-creates-company-value> [Accessed 10 April 2022].

Goel, P., 2018. Implications of corporate governance on financial performance: an analytical review of governance and social reporting reforms in India. [online] Available at: <https://ajssr.springeropen.com/articles/10.1186/s41180-018-0020-4#:> [Accessed 9 April 2022].

Harjoto, M., 2021. Corporate Governance and Firm Value: The Impact of Corporate Social Responsibility. [online] Available at: <https://www.jstor.org/stable/41476031> [Accessed 10 April 2022].

Kelm, K., 2018. Shareholder Value Creation during R&D Innovation and Commercialization Stages. [online] Available at: <https://www.jstor.org/stable/256745> [Accessed 10 April 2022].

Kenton, W., 2019. Understanding the Book-to-Market Ratio. [online] Investopedia. Available at: <https://www.investopedia.com/terms/b/booktomarketratio.asp> [Accessed 9 April 2022].

Madhani, P., 2020. Ownership Concentration, Corporate Governance and Disclosure Practices: A Study of Firms Listed in Bombay Stock Exchange. [online] Papers.ssrn.com. Available at: <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2892486#:> [Accessed 9 April 2022].

McCann, D., 2019. Should the Chairman and CEO Roles Be Held Separately? – CFO. [online] CFO. Available at: <https://www.cfo.com/corporate-finance/2019/10/should-the-chairman-and-ceo-roles-be-held-separately/> [Accessed 9 April 2022].

Mohr, A., 2021. 3 Reasons to Separate CEO and Chair Positions. [online] Investopedia. Available at: <https://www.investopedia.com/financial-edge/0912/3-reasons-to-separate-ceo-and-chairman-positions.aspx> [Accessed 9 April 2022].

Price, N., 2019. The Roles and Responsibilities of a Board of Directors | Diligent. [online] Diligent.com. Available at: <https://www.diligent.com/insights/board-of-directors/the-roles-and-responsibilities-of-a-board-of-directors/> [Accessed 10 April 2022].

Rappaport, A., 2020. Ten Ways to Create Shareholder Value. [online] Harvard Business Review. Available at: <https://hbr.org/2006/09/ten-ways-to-create-shareholder-value> [Accessed 9 April 2022].

Rathod, L., 2018. 6 Ways Boards Benefit From Good Corporate Governance | Diligent. [online] Diligent – English UK. Available at: <https://www.diligent.com/en-gb/blog/6-ways-boards-benefit-from-good-corporate-governance/> [Accessed 10 April 2022].

Trong, T., 2020. SEPARATION OF CHAIRMAN AND CEO – BENEFITS FROM ASPECT OF CORPORATE GOVERNANCE. [online] Linkedin.com. Available at: <https://www.linkedin.com/pulse/separation-chairman-ceo-benefits-from-aspect-than-trong-ly> [Accessed 9 April 2022].

Virahsawmy, M., 2019. Must We Separate The Roles Of Chairman And CEO? – Corporate/Commercial Law – Mauritius. [online] Mondaq.com. Available at: <https://www.mondaq.com/corporate-governance/852122/must-we-separate-the-roles-of-chairman-and-ceo> [Accessed 9 April 2022].

Wernicke, G., 2019. Corporate governance: how does it affect the value of a company? – ID4D. [online] ID4D. Available at: <https://ideas4development.org/en/corporate-governance-how-does-it-affect-the-value-of-a-company/> [Accessed 10 April 2022].

write

write