Chapter 4: Findings

4.1 Chapter Introduction

The following chapter will provide a comprehensive analysis of people’s perceptions of eco-friendly banking and its Impact on environmental sustainability. In addition to the statistical assessment of correlation and regressions, this section will provide the overall perception of the respondents in a summarised manner. The Thai chapter includes the descriptive analysis, Pearson correlation, regression, and coefficient for extracting the data and information from the survey respondents regarding the present subject matter.

4.2 Findings

4.2.1 Descriptive analysis

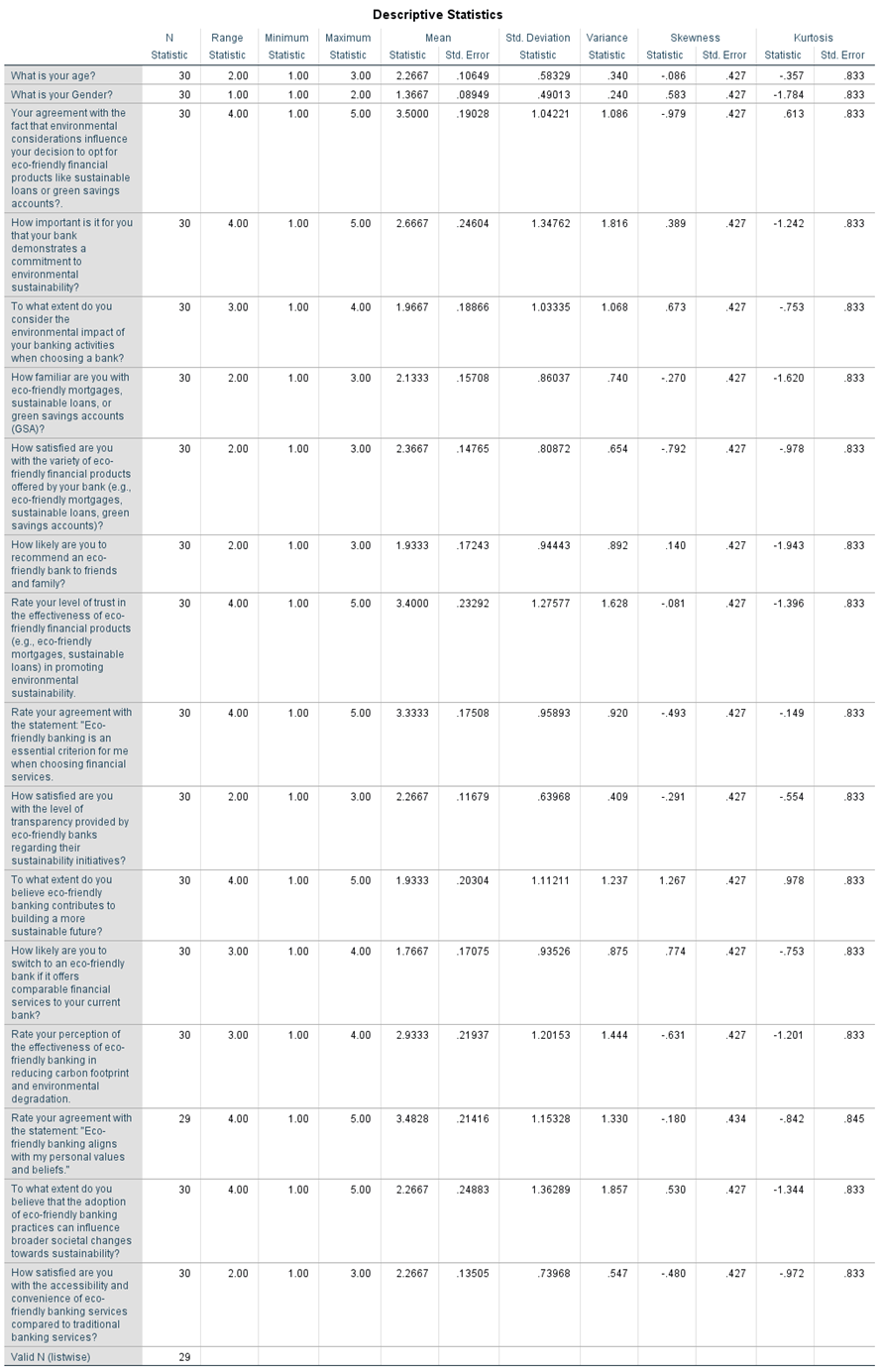

Table 1 in index

- Influence of environmental considerations to opt for eco-friendly financial products: Depending on the provided descriptive statistic, Gen Z and the millennials exhibit a moderate level of agreement as the mean is 3.5, which signifies that the environmental considerations are influencing their choices for eco-friendly financial products. With mild kurtosis and a slight negative score of skewness, the data delivers a fairly normal distribution (Shershneva and Kondyukova, 2020).

- Commitment of the bank on environmental sustainability: As the mean in this case is 2.67, this signifies an average level of importance. The score of the positive skewness (.389) implies that the more participants in the survey lean towards the lesser importance. Moreover, the negative kurtosis exhibits a flatter distribution rather than the normal curve.

- Recommendation of eco-friendly banks to family and friends: As the average response or mean is 1.93, this signifies a relatively low recommendation of eco-friendly banks to family and friends. The score in the standard deviation (0.94) indicates a moderate variability in the responses. Moreover, positive skewness (0.14) exhibits a leaning of the respondents towards the lower level of likelihood.

- Sustainable loans, eco-friendly mortgages, and green saving accounts: As the mean value is 2.13, it implies a moderate degree of familiarity among the respondents. This indicates that some individuals are well acquainted with environmentally conscious financial products. Moreover, the negative value of skewness (-0.27) indicates the lean of the survey respondents towards the higher level of familiarity. On the other hand, the value of kurtosis (-1.62) signifies a flatter distribution in the descriptive statistics, which highlights the requirement of constant efforts to understand endurable banking options and promote awareness (Choubey and Sharma, 2022).

- Satisfaction for the level of transparency delivered by eco-friendly banks: The average survey response, or the mean value in this case, is 2.27, which signifies a moderate degree of satisfaction among the respondents. The value of standard deviation (0.64 ) exhibits the transparency span of eco-friendly banks, which provides more clarity in the information. Moreover, the negative value of skewness represents the higher level of satisfaction of the survey respondents. This implies the majority of the participants find the level of transparency acceptable (Charan, Dahiya, and Kaur, 2019).

- The alignment of eco-friendly banking with personal values and beliefs: The mean value was 3.48, which signifies a moderately high tendency to support eco-friendly banking through values and ethics. In this case, the response with the rate of 1.15 suggests that participant responses show a significant variability. Some respondents consider this statement to be a more to-the-point version of the original statement, but others may not. The slightly negative skewness of -0.18 shows that others are closer to the higher agreement but without many significant positive numbers. An absent peculiarity of -0.84 specifies a flatter distribution than a normal one. Finally, respect for the ecosystem synchronizes with many personal principles and creeds throughout society and stresses the role of responsible financial operations.

- Adoption of eco-friendly banking practices to influence the border society changes towards sustainability: The mean response is 2.27, suggesting that there is an acceptance by the participants that environmental banking can play a role in the bigger picture of sustainability. With a value of 1.36, there is an appreciable amount of dissimilarity among the responses. The slope of 0.50 indicates that more than half of the participants tend to be more inclined toward believing, with no prominent significance. A negative kurtosis value of -1.34 shows that the distribution is flatter than the normal one. There isn’t strong skewness around the mean, but the data doesn’t have any extremely outlier observations. Many different opinions exist, but taking note of the role of sustainable banking practices in shaping societal understanding for promoting sustainable behaviors is very important (Ellahi, Jillani, and Zahid, 2023).

4.2.2 Statistical analysis

4.2.2.1 Correlation

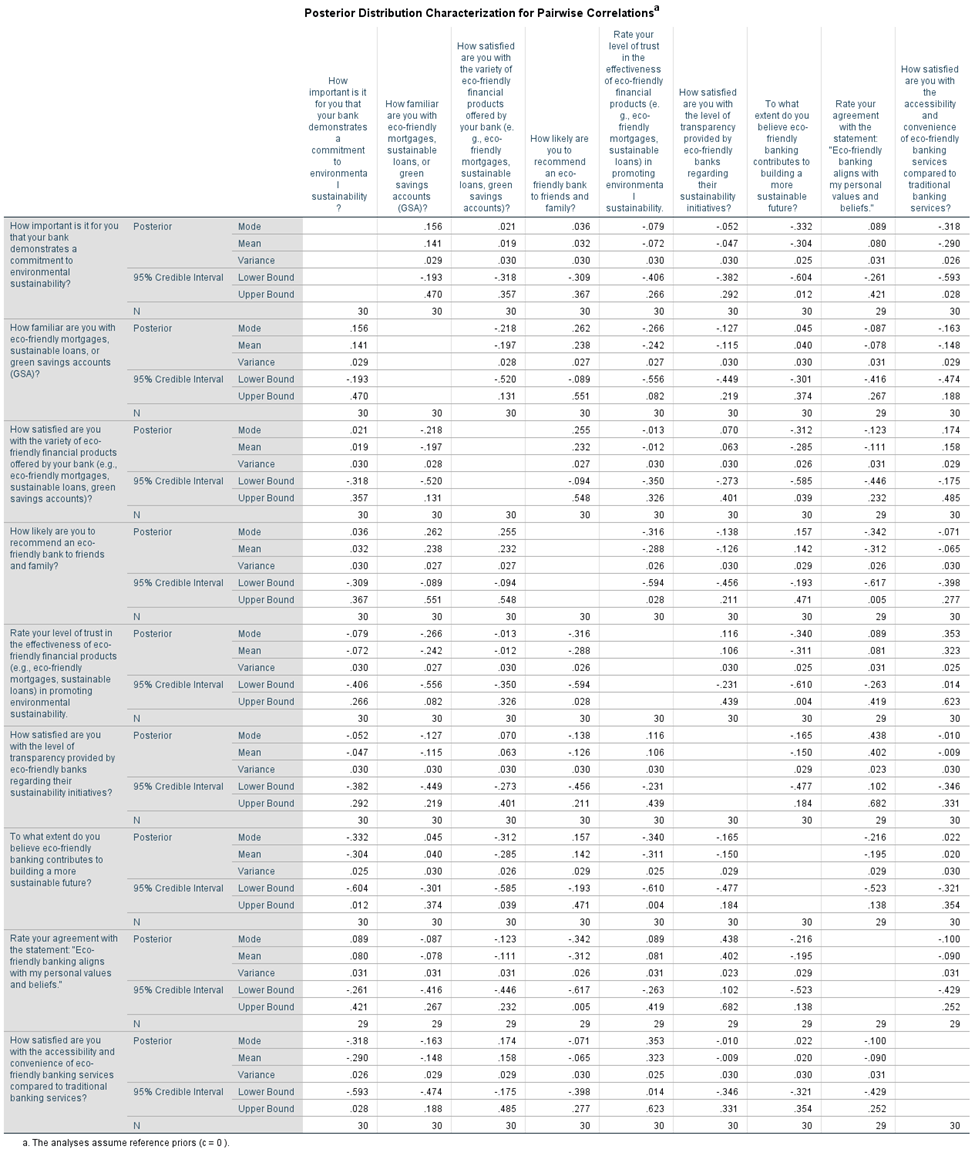

Table 2 in index

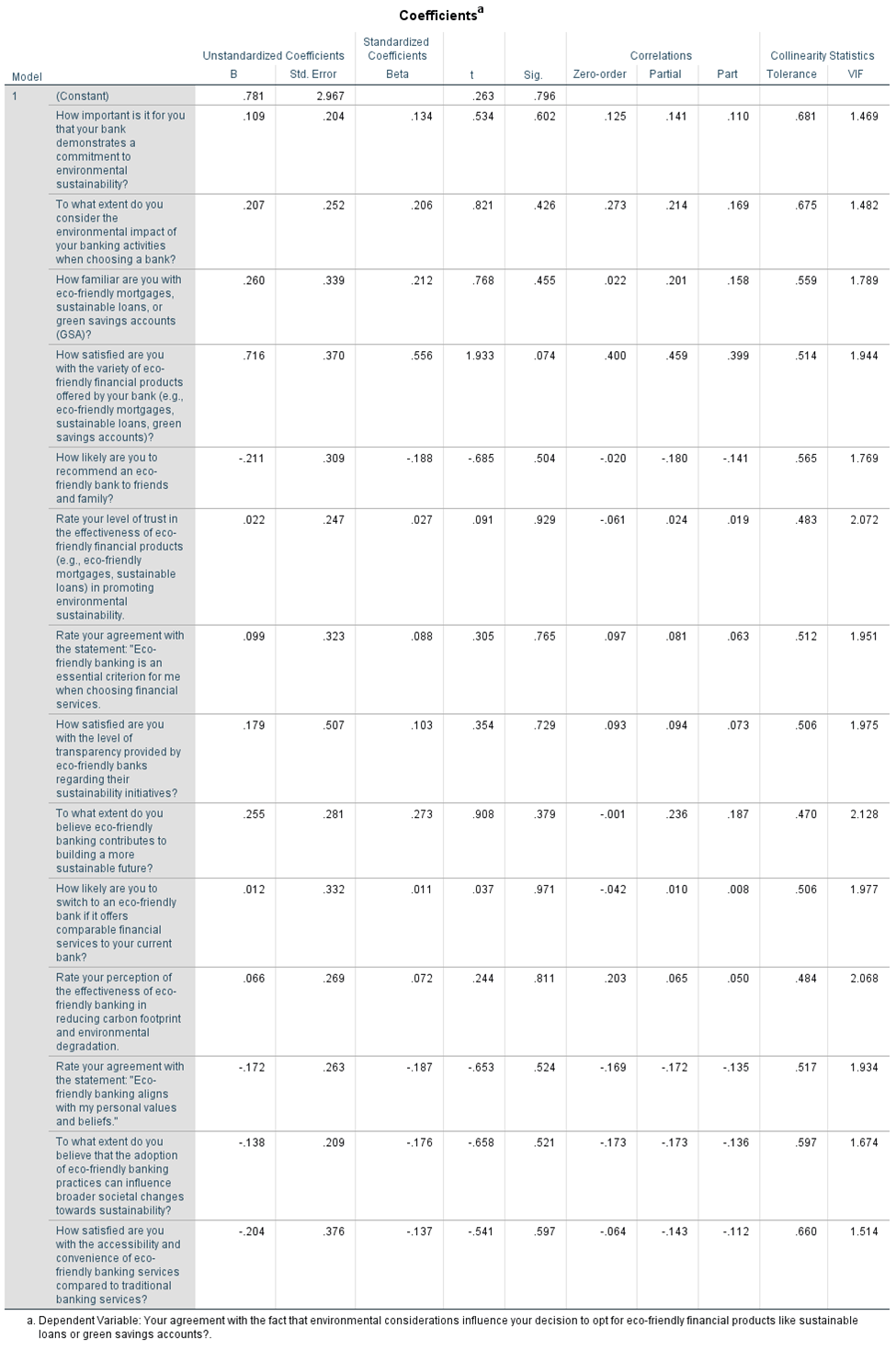

Table 3 in index

The above table showcases people’s perceptions of eco-friendly banking and its Impact on environmental sustainability. A common trait about all the metrics is that sentiments are generally positive, which indicates a favorable perception and an appreciation of eco-friendly financial products as a means to promote sustainability. At the initial stage, the considerable average score of trust in the efficiency of green financial products 2.072 and low standard deviation of 0.119 indicate a strong agreement among respondents. This shows that there is a strong prevailing perception among consumers that they can rely on these products for sustainable environmental practices, which means that these products almost certainly are trustworthy and effective in driving environmental sustainability. Among the other factors, the people stated that eco-friendly baking plays a crucial role in their choice of financial services, which might represent a shift in preferences from consumers who now value environmental sustainability. The mean score, as well as the standard deviation, reflect the measure of attention that clients give to the green actions while deciding on a provider of financial services. A grade higher in this attribute will ensure that there is a considerable number of respondents who value eco-friendly banking or are in alignment with their financial choices with their environmental beliefs and values. In addition, the satisfaction level of transparency offered by the eco-friendly banks in disclosing the details of sustainability projects is a test of the accountability and fairness expected from financial institutions. Significantly, a higher score in the awareness aspect would mean that respondents are satisfied with the information provided by eco-friendly banks concerning the environmental projects that are implemented, which results in higher trust and confidence in their operations. The number of respondents who perceive eco-friendly banking as a driver of a more environmentally friendly future communicates something about the total view of these programs.

4.2.2.2 Regression

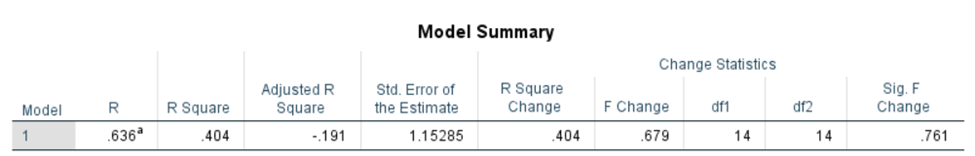

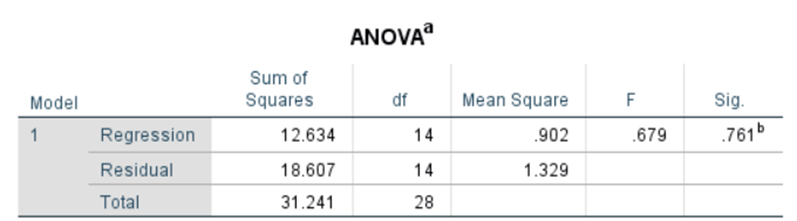

Table 4 in index

Table 5 in index

The above table showcases people’s attitudes towards eco-banking and their possibility of advocating for eco-banks to other people. With an R Square equal to 0.404, the model contains the variation of 40.4%, which indicates that the model has approximately 40.4% of the variations in the likelihood of the customers of the bank to recommend the bank to their environmentally-aware people. This finding indicates that the model accounts for a vast proportion of the variance in recommendation behavior; there still are others that are not part of the model, which also play a role in affecting people’s probability to recommend. A statistics section on the model presenting the relationship between several variables clearly underlines the need to integrate diverse factors as it is highlighted that including all 14 variables in the model leads to a remarkable change in model fit. This is demonstrated by the F value of just over 14, which is followed by a value of less than 0.001. This improvement indicates that considering a variety of components like the trustworthiness of eco-friendly banking products, openness satisfaction, and backers’ belief in the Impact of eco-friendly banking on sustainability might help increase our understanding of the likelihood of ecological banking recommendations. The regression significance test adds more assurance to the stability of the model. With a p less than 0.001, the model overall is statistically significant according to the very low significance value. This indicates that the relation among the factors of the absolute independent variables, as well as the rate of recommending the ecological kinds of the financial institutes, is not just a coincidence, and there is a higher possibility of association among these factors. However, this particular association implies that people are more likely to make improvements to an environment-friendly bank if their attitude is positive towards such financial institutions.

4.3 Discussion

4.3.1 The awareness and understanding of eco-friendly banking products between Millennial and Gen Z Consumers

The literature review has already differentiated the millennials and Gen Z in 2.2. Born between 1997 and 2012 are Gen-Z, and 1981-1996 are millennials. However, Britannica (2024) differentiated them with respect to the decision-making process and have differences in the process of incorporating digital technology into their daily lives. The millennial generation is the first to use social media more constructively and incorporate digital technology into their everyday life. However, Rai et al. (2019) suggested in the literature review that eco-friendly banking is the movement that lowers financial firms’ carbon footprint and supports green practices. This idea is comparable to traditional banking in that it places equal emphasis on ecological and environmental aspects to protect the environment and natural resources. Banks, as per Taneja and Ali (2021), have made investments in environmentally friendly practices and programs that address change and promote climate change. However, this may or may not affect the consumers’ choice of bank. This is something that the participants of this research survey have also accepted. According to the survey of this study, when asked about the consideration of banks on the sustainability and environmental Impact, a maximum of the participants agreed with somewhat important 12%. The other 6% thought it was not important, 8% agreed with moderately Important, 3% with very Important, and the lowest number of people, i.e., 1%, answered with extremely important. The mean value that was found in the fourth chapter, i.e., 4.2.1, shows that the mean value of the results is 35000. Additionally, as calculated, the Skewness and Kurtosis values are -979 and 613, respectively.

Ellahi et al. (2023) depicted in the literature review section that environmentally conscious banking has greatly impacted financial organizations’ strategy-making procedures and helped them obtain a competitive edge in the market. It saves energy and safeguards the environment for coming generations. However, the survey does not align with this fact. The possible reason behind this could be the low and minimum promotion of sustainable products by banks to their customers.

The primary benefit of environmentally friendly banking is the reduction of carbon emissions and the preservation of the environment, as highlighted by Taneja and Ali (2021) in the literature review. Financial institutions have embraced environmental financing standards, which may benefit future generations. When the participants were asked about the extent to which they consider the environmental Impact of their banking activities when choosing a bank, 13% of people agreed with “slightly,” which is the maximum population. However, the second least people, i.e., 3%, accept “very much,” and not a single individual agreed with “extremely,” which completely shows a gap between the promotion of banks to their customers about their sustainable products and the need strong way of transparent communication between banks and their customers.

4.3.2 Key factors that influence the attitudes of Millennial and Gen Z consumers towards adopting eco-friendly banking products

According to Prabhu (2021), which is recorded in the literature review of 2.4 includes green savings plans, green checking accounts, online and mobile banking, sustainable loans, and eco-friendly mortgages are some of the key factors that influence the attitudes of millennials and Gen Z. By providing advantageous conditions for environmentally friendly home improvements or energy-efficient houses, Siemionek-Ruskań and Fanea-Ivanovici (2023), suggested that these strategies can seek to encourage sustainable homeownership. Long-term improvement of the borrower’s sustainability profile is encouraged via sustainability loans. The newest developments in environmentally friendly banking as depicted by Mejia-Escobar et al., (2020), are mobile and internet banking, which let customers manage their accounts from home without going to banks. However, a similar problem arises when it comes to practical implementation. The survey questionnaire included a question related to the familiarity of participants with eco-friendly mortgages, sustainable loans, or green savings accounts (GSA). Surprisingly, only a few people, i.e., 9% people, agreed with somewhat familiar, which is the maximum result of this question. Additionally, the second maximum number of responses, which is 7% of people, are not even familiar with the concept of eco-friendly mortgages, sustainable loans, or green savings accounts (GSA). However, in this context, the findings of the report calculated a mean of 2.1333, which shows a non-reasonable value in today’s innovative and data-driven society. However, the skewness and kurtosis are both negative, -270 and -1.620 respectively. These negative data of both skewness and kurtosis provide a flatter curve in place of a normal curve.

Shershneva and Kondyukova (2020), highlighted that these banking products are in line with environmental sustainability goals, and they have become very popular in the financial sector. According to theoretical studies provided in the literature review, environmentally friendly mortgages can promote sustainable homeownership by offering favorable terms for homes with energy-efficient features or environmentally friendly renovations.

4.3.3 Impact of the decision-making process and loyalty of millennial and Gen Z consumers on eco-friendly banking products

Sharma and Choubey (2022), in the literature review, suggest that financial organizations are becoming more interested in eco-friendly organizations and are becoming more interested in eco-friendly banking activities. They contend that clients can access a variety of services and manage their money more easily without having to visit the bank’s physical location. Green banking helps homeowners and furthers environmental objectives by providing financial advantages, including lowered interest rates and waived closing expenses.

According to Rakshitha and Chaya (2023), GSAs meet the increasing need for ethical banking solutions by giving clients a place to deposit money set aside for environmentally friendly investments. According to Shameem and Haleem (2021), these choices let clients balance their financial choices with their environmental ideals. Different customers have different opinions about sustainable loans. However, when asked in the survey questionnaire, ‘how satisfied people are with the variety of eco-friendly financial products offered by your bank (e.g., eco-friendly mortgages, sustainable loans, green savings accounts),’ most of the population, which is 10% people, agreed with nothing at all. They voted for neutral. However, 7% of people, which is the second highest score, agreed with dissatisfaction and very dissatisfaction. And only 6% believed and agreed that they are mostly satisfied with the eco-friendly products that banks serve them.

Some see them as a way to fund projects that benefit the environment, like installing renewable energy sources and developing sustainable infrastructure. Consumers want assurances of openness and that the money they spend is going toward socially conscious projects and activities. The calculations regarding the findings show that the mean is 2.67, which is an average level of importance. However, from the positive skewness, which is +.389, it can be concluded that more participants in the survey agreed with the minimum importance. Moreover, the negative kurtosis, which is -978, exhibits a flatter distribution.

According to a review by Akomea-Frimpong et al. (2022), borrowers can utilize sustainable loans to match their values with financial decisions, which promotes a sense of fulfillment. Herath and Herath (2019), highlighted in the literature review that banks have taken steps to safeguard client assets and are mindful of security protocols. Communication is crucial for fostering opportunities for cross-selling and upselling. The value of environmentally friendly banking practices in encouraging clients to switch to paperless banking and using financial messaging platforms to cut expenses.

4.3.4 Impact of sustainable banking products on the recommending process

As per Riti and Shu, (2016), which is mentioned in the literature review, customers have been greatly impacted by eco-friendly banking promotion of technology and the development of innovative infrastructure. As a result, emerging nations are now more competitive and have better resource management. Rabie and Franck, (2018), mentioned in the literature review section that these strategies are some of the main reasons customers prefer the banks to their family and friends, resulting in gaining more recognition. People like low-carbon green development, which has also become a necessary tactic to combat economic issues and climate change. However, the survey results join its support in the discussion on this. When the populations were asked to rate their level of trust in the effectiveness of eco-friendly financial products (e.g., eco-friendly mortgages,

sustainable loans) in promoting environmental sustainability, the responses were good. The maximum number of people, consisting of 9%, agreed with this question; however, the second highest score, which is 8% of people, answered that they strongly disagreed that they do not believe their banks on eco-friendly financial products.

With the increasing concerns about climate change and the need to adopt sustainable products, people are more often attracted to these types of strategies. Sun et al. (2020) depicted that the emphasis on reducing customer effort has a significant and effective impact on people’s decision-making for selecting environmentally friendly banking practices and, henceforth, recommending it to their friends and family.

Customers who care about the environment are more inclined to look for eco-friendly banking solutions; hence, building a trusted process in eco-friendly approaches by a bank is important to gain customers (Ibrahim et al., 2016). Customers who value morality and ecologically friendly business practices are more drawn to banks that exhibit a commitment to sustainability and CSR programs. Customers are encouraged to select eco-friendly banking since there are green financial goods and services available, including paperless banking solutions, eco-friendly investment portfolios, and green loans.

Banks have worked to make sure security measures are in place and to safeguard the funds of their clients. However, these theoretical points are in contrast to the survey results of this research. The calculation of the results in the findings chapter shows a mean of 0.94, which is quite acceptable. However, the skewness of +0.14 and the kurtosis of -1.943 suggests a flattering curve.

These strategies help banks promote cross-selling and upselling opportunities that require effective communication. Miah et al. (2021) mentioned in the literature review that banks should educate their customers to accept paperless banking through the use of cost-effective financial messaging systems with eco-friendly banking practices. Finally, the most contradictory point is the survey reports that show the most number of people, which is 14%, do not want to recommend the eco-friendly product to their friends and family.

4.4 Chapter conclusion

The chapter concludes by focusing on the awareness and understanding of eco-friendly banking products among millennial and Gen Z consumers. Millennials are the first to incorporate digital technology into their daily lives, and eco-friendly banking is a movement that lowers financial firms’ carbon footprint and supports green practices. However, the survey shows a gap between the promotion of sustainable products by banks and the need for transparent communication between banks and customers. Key factors influencing attitudes towards adopting eco-friendly banking products include green savings plans, green checking accounts, online and mobile banking, sustainable loans, and eco-friendly mortgages.

Reference

Britannica, (2024). GenZ. [online] Available at: Gen Z | Years, Age Range, Meaning, & Characteristics | Britannica [Accessed on 19 March 2024]

Charan, A., Dahiya, R. and Kaur, M., (2019). Customers Perception towards Green Banking Practices in India. Think India Journal, 22(4), pp.3653-3665.

Choubey, A. and Sharma, M., (2022). Green banking: the case of the commercial banking sector in Delhi NCR. Journal of Environmental Planning and Management, 65(11), pp.1975-1998.

Ellahi, A., Jillani, H. and Zahid, H., (2023). Customer awareness on Green banking practices. Journal of Sustainable Finance & Investment, 13(3), pp.1377-1393.

Ellahi, A., Jillani, H. and Zahid, H., (2023). Customer awareness on Green banking practices. Journal of Sustainable Finance & Investment, 13(3), pp.1377-1393.

Herath, H.M.A.K. and Herath, H.M.S.P., (2019). Impact of Green banking initiatives on customer satisfaction: A conceptual model of customer satisfaction on green banking. Journal of Business and Management, 1(21), pp.24-35.

Mejia-Escobar, J.C., González-Ruiz, J.D. and Duque-Grisales, E., (2020). Sustainable financial products in the Latin America banking industry: Current status and insights. Sustainability, 12(14), p.5648.

Miah, M.D., Rahman, S.M. and Mamoon, M., (2021). Green banking: The case of commercial banking sector in Oman. Environment, Development and Sustainability, 23, pp.2681-2697.

Prabhu, G.N., (2021). Green Banking practices–A case study on Indian Green Banking system. Journal homepage: www. ijrpr. com ISSN, 2582, p.7421.

Rabie, M. and Franck, C.M., (2018). Assessment of eco-friendly gases for electrical insulation to replace the most potent industrial greenhouse gas SF6. Environmental science & technology, 52(2), pp.369-380.

Rai, R., Kharel, S., Devkota, N. and Paudel, U.R., (2019). Customers perception on green banking practices: A desk. The Journal of Economic Concerns, 10(1), pp.82-95.

Rakshitha, J. and Chaya, R., (2023). Driving Sustainability: Exploring Global Green Banking Initiatives for a Greener Future. Journal of Development Research, 16(1), pp.89-105.

Shameem, A.L.M.A. and Haleem, A., (2021). A study on green banking practices in banking industry: Sri Lankan context. The journal of contemporary issues in business and government, 27(1), pp.490-505.

Sharma, M. and Choubey, A., (2022). Green banking initiatives: a qualitative study on Indian banking sector. Environment, Development and Sustainability, 24(1), pp.293-319.

Shershneva, E.G.E. and Kondyukova, E.S., (2020), February. Green banking as a progressive format of financial activity in transition to sustainable economy. In IOP conference series: Materials science and engineering (Vol. 753, No. 7, p. 072003). IOP Publishing.

Shershneva, E.G.E. and Kondyukova, E.S., (2020, February). Green banking as a progressive format of financial activity in transition to sustainable economy. In IOP conference series: Materials science and engineering (Vol. 753, No. 7, p. 072003). IOP Publishing.

Siemionek-Ruskań, M. and Fanea-Ivanovici, M., (2023). How Sophisticated is Green Banking in Poland and Romania? A Case Study of Bank Offers. Journal of Environmental Management & Tourism, 14(3), pp.698-704.

Taneja, S. and Ali, L., (2021). Determinants of customers’ intentions towards environmentally sustainable banking: Testing the structural model. Journal of Retailing and Consumer Services, 59, p.102418.

Appendix

Table 1: Descriptive statistics

Table 2: Pearson correlation

Table 3: Coefficients

Table 4: Model Summary

Table 5: ANOVA

write

write