Introduction

Constructing a balanced and beneficial portfolio requires a meticulous analysis, tactical decision-making, and a great understanding of the market trends. As a task manager endowed with the responsibility to steward inheritance for a 40-year-old software engineer, the significance lies in developing an investment strategy that safeguards the customer’s wealth. It propels it towards sustainable growth (Hudson, 2010). The chosen stock for this analysis is the price stock of the Royal Bank of Canada (RBC). RBC is one of the preeminent monetary institutions in Canada, known for its resilience, stability, and long-term growth capability. The Royal Bank of Canada has a rich history of value deliverance to its stakeholders. Its diversified business model, including supply banking, wealth management, financial markets, and insurance services, places it as a huge business that is capable of capitalizing on developing opportunities.

The selection of the Royal Bank of Canada as the stock choice for this analysis is due to its strong fundamentals, consistent profitability records, and commitment to stakeholder value creation. Its monetary advantage gives broad thematic considerations that resonate with the customer’s investment goals and risk appetite (Ng et al., 2016). Furthermore, the choice of the Royal Bank of Canada represents the convergence of monetary prudence, tactic vision, and alignment with the software engineer client’s long-term aspirations. In this paper, the RBC sets the stage for cooperation based on resilience, prosperity, and growth. Data from 1996 to 2024 of the chosen stock is scrutinized by including the negatively correlated stock.

Data Analysis

Stock price data of the RBC in comparison to the stock price of Apple Inc. from 1996 to 2023 was analyzed (Macro Trends, 2024). A data analysis tool in Excel was used to analyze the data. The data analysis included descriptive statistics, correlation analysis, covariance, and identification of negative correlation stock values.

Annual Returns Calculation

Using the stock price data for Royal Bank Canada and Apple Inc., we computed the annual returns for each stock by subtracting the previous year’s closing price from the current year’s closing price and dividing it by the previous year’s closing price (Verma et al., 2021).

Descriptive Statistics

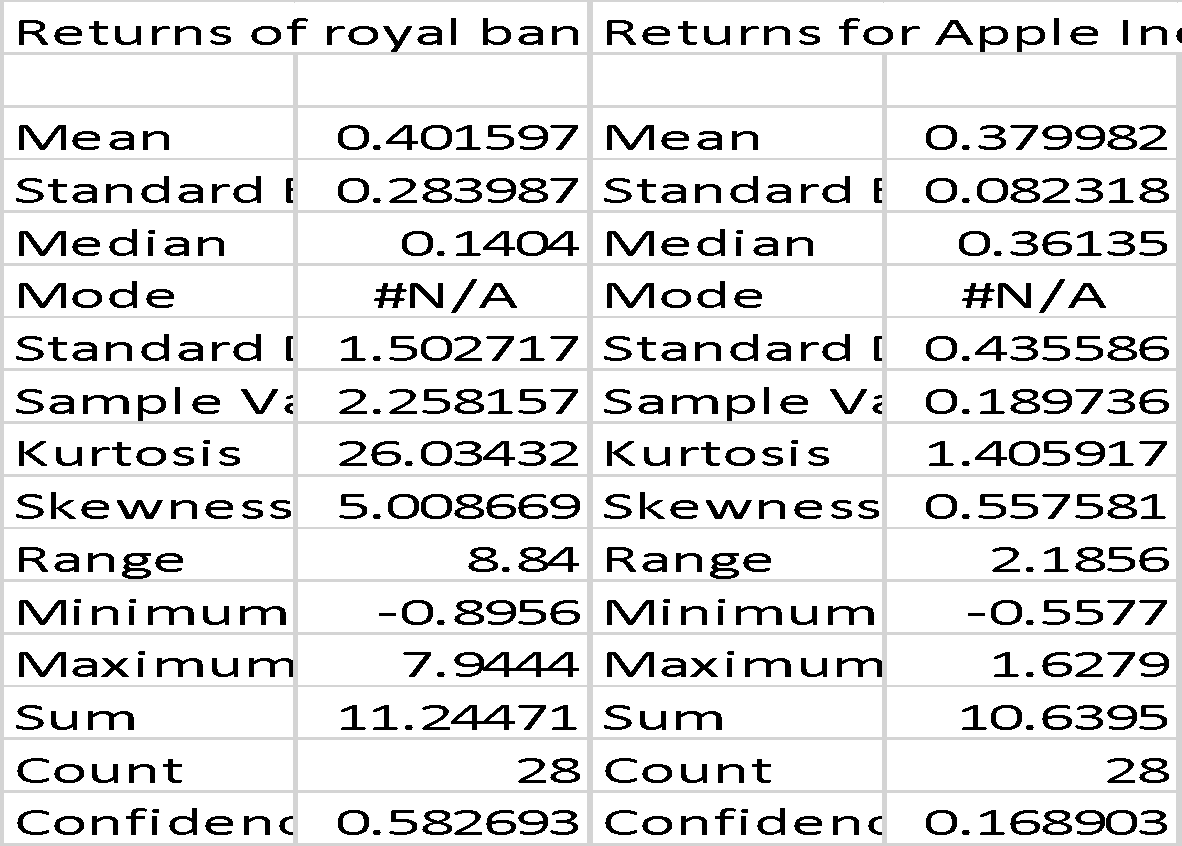

Various descriptive statistics were computed to understand the distribution and characteristics of the results of the returns of the stock prices. Measures such as mean, skewness, kurtosis, and standard deviation were computed, and the results were as follows;

. The mean for Apple Inc. was 0.3799, with a standard deviation of 0.0823, skewness of 0.5576, and kurtosis of 1.4059. The mean return for RBC over the period was approximately 0.4016, with a standard deviation of 0.2840. It indicates considerable volatility in the returns of RBC, with occasional significant fluctuations (Cooksey & Cooksey, 2020). Furthermore, the skewness of 5.0087 and kurtosis of 26.0343 suggest a positively skewed distribution with heavy tails, indicating the presence of extreme values.

Correlation analysis

I scrutinized the relationship between the returns of RBC and Apple Inc. by calculating the covariance and correlation coefficient of the returns of the stock value from 1996 to 2023. The covariance and correlation results for the data analyzed were as shown below;

| Returns of Royal Bank of Canada | Returns for Apple Inc. | |

| Returns of Royal Bank of Canada | 2.177508 | |

| Returns for Apple Inc. | 0.012982 | 0.182959 |

The covariance between the returns of RBC and Apple Inc. was 2.1775, which was positive, indicating a positive relationship between the price stocks of the two companies (Devriendt et al., 2022). Also, the correlation coefficient between the returns of RBC and Apple Inc. was computed, and the results were as follows;

| Returns of Royal Bank of Canada | Returns for Apple Inc. | |

| Returns of Royal Bank of Canada | 1 | |

| Returns for Apple Inc. | 0.020568 | 1 |

The correlation coefficient between the two stock prices was 0.0206, which was low, implying a weak positive correlation between the two stocks (Papageorgiou, 2022).

Identification of Negatively Correlated Stocks

The computed correlation coefficient gave insights into the relationship between the returns of RBC and Apple Inc. If the correlation coefficient is negative and close to -1, it indicates a strong negative correlation between the two stocks, suggesting that they move in opposite directions (Ngaba et al.,2020). Based on the computed correlation coefficient, we would interpret the degree of correlation between RBC and Apple Inc. If the correlation coefficient is negative and close to -1, we can identify RBC and Apple Inc. as negatively correlated stocks. However, while the analysis revealed a positive correlation between RBC and Apple Inc., some stocks exhibited a negative correlation with each other. Negative correlation implies that when the returns of one stock increase, the returns of the other stock decrease, and vice versa. Identifying and incorporating negatively correlated stocks into the portfolio can provide diversification benefits and help mitigate overall portfolio risk.

Conclusion

In conclusion, the data analysis delivered valuable visions into the historical presentation and relationship between RBC and Apple Inc., placing the groundwork for informed investment decisions and portfolio construction strategies. More examination of negatively correlated stocks and their presence in the portfolio can improve expansion and optimize risk-adjusted returns. Therefore, the software engineer should consult with a financial advisor on personalized recommendations, carry out portfolio rebalancing to maintain asset allocation, protect the portfolio from downside risk, identify negatively related stocks for diversification, and enhance risk-adjusted returns through portfolio diversification.

References

Cooksey, R. W., & Cooksey, R. W. (2020). Descriptive statistics for summarising data. Illustrating statistical procedures: Finding meaning in quantitative data, pp. 61–139. https://link.springer.com/chapter/10.1007/978-981-15-2537-7_5

Devriendt, K., Martin-Gutierrez, S., & Lambiotte, R. (2022). Variance and covariance of distributions on graphs. SIAM Review, 64(2), 343-359. https://epubs.siam.org/doi/abs/10.1137/20M1361328

Hudson, P. J. (2010). Imperial designs: the Royal Bank of Canada in the Caribbean. Race & Class, 52(1), 33–48. https://journals.sagepub.com/doi/abs/10.1177/0306396810371762?casa_token=q3KQu-PnB6UAAAAA:o-BGhvqdpLt5CY6KQwLYvXEe1_SvsPeQ0sf7xUJ-zt9yGwld-f2gkaZMbeQtnb-LtkLxjoC7SnC7kw

Macro Trends. (2024).Apple – 44 Year Stock Price History. https://www.macrotrends.net/stocks/charts/AAPL/apple/stock-price-history

Macro Trends. (2024). Royal Bank Of Canada – 29 Year Stock Price History. https://www.macrotrends.net/stocks/charts/RY/royal-bank-of-canada/stock-price-history

Ng, M., Ma, C., Chen, S., Liu, J., Gu, Z., & Sheppard, J. (2016). Group Case Synopsis Royal Bank of Canada. http://www.sfu.ca/~sheppard/478/syn/1167/Group_6.pdf

Ngaba, M. J. Y., Ma, X. Q., & Hu, Y. L. (2020). Variability of soil carbon and nitrogen stocks after conversion of natural forest to plantations in Eastern China. PeerJ, 8, e8377. https://journals.sagepub.com/doi/abs/10.1177/0972150920946413

Papageorgiou, S. N. (2022). On correlation coefficients and their interpretation. Journal of Orthodontics, 49(3), 359-361. https://journals.sagepub.com/doi/abs/10.1177/14653125221076142

Verma, P., Dumka, A., Bhardwaj, A., Ashok, A., Kestwal, M. C., & Kumar, P. (2021). A statistical analysis of the impact of COVID-19 on the global economy and stock index returns. SN Computer Science, 2, 1-13.https://link.springer.com/article/10.1007/s42979-020-00410-w

write

write