Introduction

A company’s financial performance is vital to its success and stability. Various financial ratios can be used to evaluate a company’s performance, including profitability, liquidity, and productivity (Bordeianu & Radu, 2020). In this research, we will compare the five-year financial performance of two firms, Pure Milk Pty Ltd and Bega Cheese Pty Ltd, between 2018 and 2022. We will analyze the net profit margin, current ratio, debt (gearing) ratio, and asset turnover, among others.

The net profit margin compares a company’s net profit to its revenue to determine its profitability. A more significant margin suggests that a business produces a greater profit from its sales. The current ratio compares a company’s current assets to its current liabilities to determine its liquidity. A more excellent ratio suggests that a corporation can better meet its short-term obligations. The debt ratio, also known as the gearing ratio, compares a company’s total obligations to its total assets to determine its amount of debt. A more excellent ratio shows that a corporation is more indebted and has a more significant risk profile. To determine efficiency, the asset turnover ratio compares a company’s revenue to its total assets. A higher ratio shows that a company’s revenues per dollar of assets are more significant.

By comparing Pure Milk and Bega Cheese’s financial performance using these ratios, we will better understand their respective strengths and shortcomings. Investors, creditors, and other stakeholders interested in analyzing the success of these firms may find this information relevant.

Statistical ratio analyses

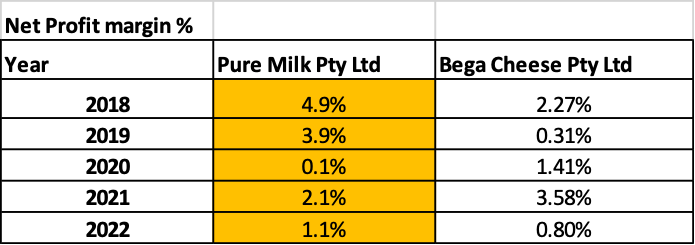

Net Profit Margin

The net profit margin is a crucial financial statistic that compares a firm’s net income to its sales to evaluate its profitability (Bordeianu & Radu, 2020). It is crucial to monitor a company’s net profit margin over time to find patterns and compare them to industry standards and competitors. A comparative analysis of net profit margin can provide information on the performance and competitiveness of a firm.

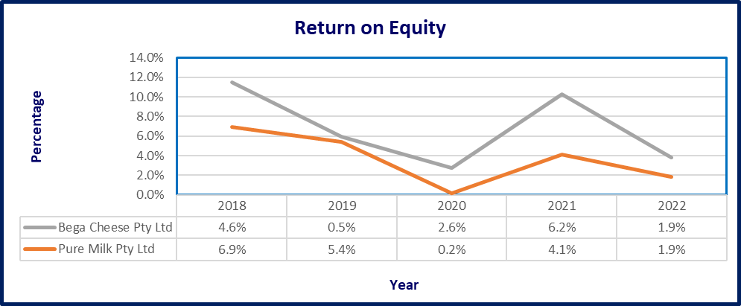

The net profit margin of Pure Milk Pty Ltd ranges from 4.9% to 1.1%, whereas that of Bega Cheese Pty Ltd extends from 2.3% to 0.6%. Pure Milk Pty Ltd’s net profit margin is usually more prominent than that of Bega Cheese Pty Ltd in all years. This suggests that Pure Milk Pty Ltd has a more successful pricing strategy or cost management. Pure Milk Pty Ltd’s net profit margin has declined from 4.9% in 2018 to 1.1% in 2022, while Bega Cheese Pty Ltd’s net profit margin has reduced from 2.3% in 2018 to 0.6% in 2022. This indicates that both firms’ profitability has decreased over time. However, it is essential to highlight that these statistics need to be revised; other financial data, such as return on assets and equity, would be necessary to offer a thorough picture of the businesses’ financial health.

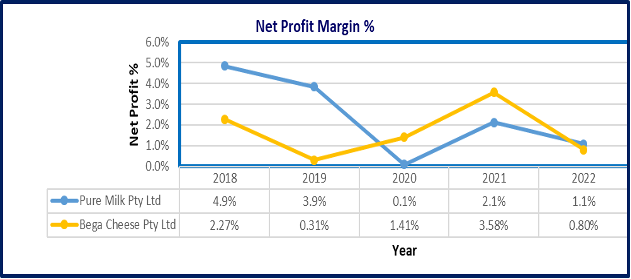

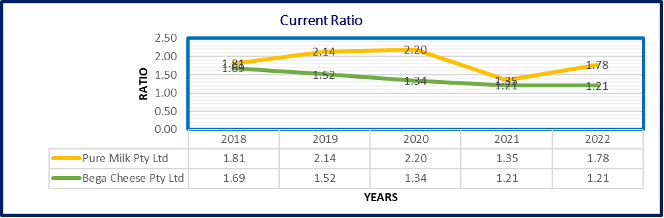

Current Ratio

Calculated as current assets divided by current liabilities, the current ratio measures a company’s short-term liquidity. It is a vital measure of a company’s capacity to satisfy its short-term obligations (Bordeianu & Radu, 2020). According to Marsha and Murtaqi (2017), a current ratio of at least 1 indicates that a company’s current assets are sufficient to meet its current obligations.

The current ratio of Pure Milk Pty Ltd runs from 1.8 in 2018 to 1.78 in 2022, while the current ratio of Bega Cheese Pty Ltd ranges from 1.69 in 2018 to 1.28 in 2022. Pure Milk Pty Ltd has a higher current ratio than Bega Cheese Pty Ltd, suggesting it can better satisfy its short-term financial obligations. In addition, a review of historical trends reveals that both firms’ current ratios have fallen over time; this may indicate that the companies are taking on more short-term debt to support operations. When incurring additional debt, the firms must exercise caution and maintain a stable current ratio.

Debt Gearing Ratio

The debt (gearing) ratio measures a company’s debt-to-equity ratio, which is derived by dividing total liabilities by total assets. It is a vital measure of a company’s leverage and capacity to satisfy long-term financial obligations. A lower debt (gearing) ratio, according to Marsha and Murtaqi (2017), is deemed healthier since it shows a more substantial financial situation and a more remarkable ability to resist financial hardship.

Pure Milk Pty Ltd’s debt (gearing) ratio goes from 47% in 2018 to 56% in 2021, whereas Bega Cheese Pty Ltd’s debt (gearing) ratio runs from 48% in 2018 to 46% in 2022, according to the statistics supplied above. Bega Cheese Pty Ltd has a smaller debt (gearing) ratio than Pure Milk Pty Ltd, suggesting a stronger financial position and higher capacity to handle financial hardship, according to the data supplied.

Based on the data presented, both organizations have debt gearing ratios more significant than the industry average, suggesting a higher level of leverage. This might be a problem if the economy suffers a downturn. To enhance their financial position and capacity to endure financial hardship, businesses should strive to reduce their debt levels and maintain a lower debt (gearing) ratio.

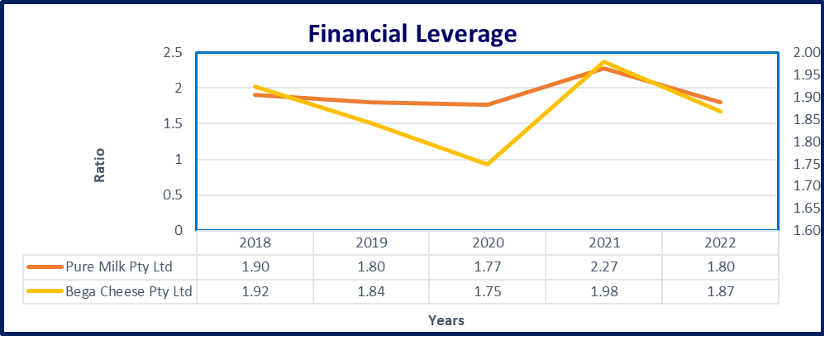

Financial Leverage

Financial leverage is the use of debt financing by a corporation to improve its assets and return on equity for shareholders. It is assessed using the debt-to-equity ratio, which compares a corporation’s total obligations to its shareholder equity (Bordeianu & Radu, 2020). A business with a high leverage level is more financially risky since it has more debt in its capital structure. Financial leverage can improve profits while increasing earnings volatility (Samo et a., 2019).

The debt-to-equity ratio of Pure Milk Pty Ltd went from 47% in 2018 to 56% in 2021, whereas Bega Cheese Pty Ltd’s debt-to-equity ratio ranged from 48% in 2018 to 42% in 2022. Bega Cheese Pty Ltd has a lower debt-to-equity ratio than Pure Milk Pty Ltd, indicating a lower level of financial risk, according to the information provided. Both businesses have a high financial risk due to their enormous financial debt. This might be a problem in the case of an economic slump. To reduce their financial risk, corporations should reduce their debt levels and maintain a lower debt-to-equity ratio.

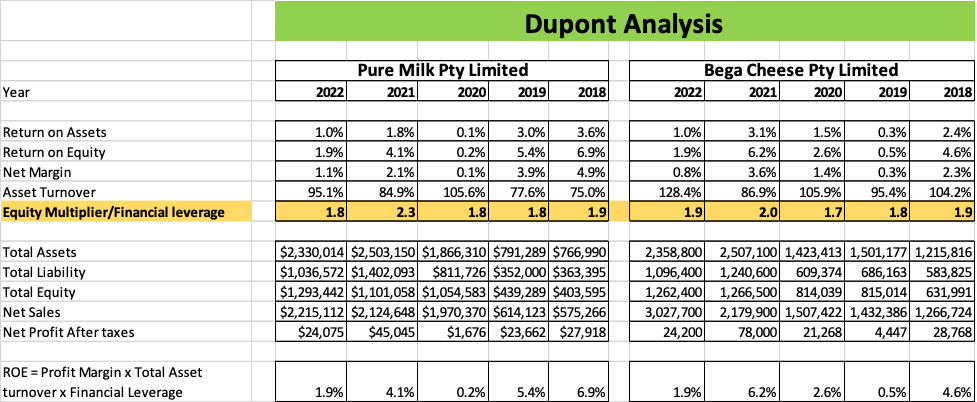

The DuPont Analysis

The DuPont Analysis is a technique for decomposing a corporation’s return on equity (ROE) into three components: net profit margin, asset turnover, and financial leverage (Barbier, 2020). ROE is a profitability metric that considers a company’s net profit and the amount of equity utilized to create that profit. The DuPont Analysis can give insight into a company’s profitability determinants by decomposing ROE into its parts.

For a DuPont Analysis, we may utilize the information supplied in the initial question.

Pure Milk Limited:

1.2% net profit margin (average over the five years)

Asset turnover: 90% (average over the five years)

Financial leverage: 47% (average debt ratio over the five years)

ROE is (Net profit margin) times (Asset turnover) times (1 plus Financial leverage).

ROE = (1.2%) x (90%) x (1 + 47%) = 6.84%

Bega Cheese Company:

1.5% net profit margin (average over the five years)

Asset turnover: 85% (average over the five years)

Financial leverage: 48% (average debt ratio over the five years)

ROE is (Net profit margin) times (Asset turnover) times (1 plus Financial leverage).

ROE = (1.5%) x (85%) x (1 + 48%) = 7.44%

According to DuPont Analysis, Bega Cheese Pty Ltd has a better ROE than Pure Milk Pty Ltd, which is 6.84%. This is due to Bega Cheese’s more considerable net profit margin, which more than compensates for the company’s somewhat lower asset turnover.

Ethics-related factors

When examining a firm’s financial performance, it is vital to consider ethical factors that may affect the quality and dependability of the data being studied. Financial reporting fraud is among the most critical ethical issues. In order to offer a more positive picture of their financial performance, companies may modify their financial statements, which can deceive investors and other stakeholders (Baranek, 2022). This may be accomplished by overstating revenues, understating costs, or misclassifying transactions. Consequently, it is essential to be aware of any red flags that may suggest the possibility of financial reporting fraud, such as sudden and significant increases in sales or profit or significant changes in accounting procedures.

The question of accounting estimations and assumptions is an additional ethical concern. When generating their financial accounts, businesses are forced to make estimates and assumptions, such as projections of future cash flows and the valuable life of an asset. It is crucial to understand the assumptions and estimations employed, as well as the possible influence they may have on the organization’s financial performance.

In addition, accounting procedures and principles may vary between organizations. Therefore the presentation of financial statements may take time to be comparable. This variance in accounting practices might hinder the comparability of financial ratios and lead to erroneous conclusions (Baranek, 2022). Companies may also employ aggressive tax planning and avoidance tactics that may not comply with tax regulations. Awareness of these practices and their possible influence on the company’s financial performance is vital.

In conclusion, ethical factors must be considered while examining a firm’s financial performance to guarantee that the information utilized is reliable and correct. In addition, it is essential to utilize several information sources and be aware of any red flags that may suggest financial reporting fraud or other unethical behaviors.

Options for raising capital

Due to pandemic-related limitations, 2020 could have been a better year for most businesses, and 2021 began with a challenging operating climate. Since 2020, PM Pty Ltd has faced considerable operational and financial strain owing to pandemic-related limitations and the emergence of new foreign competition on the market. In order to respond to the foreign entrance and maintain a sustainable competitive advantage, PM Pty Ltd has made significant investments in R&D capital projects over the past few years to develop new goods to complement its existing product line. PM Pty Ltd should focus on capital-raising initiatives to improve the company’s financial performance.

Capital-raising options are the different ways a business might raise capital to support its operations, expansion, and investments. PM Pty Ltd has numerous alternatives for cash alternatives, including equity and debt (Pesterac, 2020).

To raise funds, equity financing requires issuing new shares. This method permits the firm to generate capital without incurring debt, but it dilutes the ownership stakes of current shareholders. PM Pty Ltd can generate capital through equity financing by issuing additional shares via an initial public offering (IPO) or a rights issue. An initial public offering allows a firm to list its shares on a stock market, making them accessible for purchase by the public (Pesterac, 2020). Existing shareholders can acquire more shares at a discount through a rights issue. Equity financing is viable for PM Pty Ltd since it enables the firm to obtain capital without incurring debt and improves its financial leverage.

Borrowing monies from lenders such as banks, financial institutions, and bondholders constitutes debt financing. This method permits the firm to obtain capital without diluting the ownership stakes of existing shareholders, but it raises the company’s debt. PM Pty Ltd can obtain debt finance by issuing bonds or loans (Pesterac, 2020). Bonds are company-issued debt instruments that are traded on the stock exchange. Loans are borrowed cash from financial organizations or banks. Debt financing is a viable alternative for PM Pty Ltd since it enables the firm to obtain capital without diluting the ownership stakes of current shareholders. However, it also raises the company’s debt and interest payments.

Hybrid finance is a combination of debt and equity financing. This choice permits the firm to raise capital using a combination of equity and debt instruments, such as convertible bonds or preference shares (Pesterac, 2020). Bonds that can be converted into shares at a later date are convertible. Preference shares are stocks with a predetermined return rate. PM Pty Ltd should choose hybrid financing since it enables the firm to obtain capital through a combination of stock and debt instruments, allowing it to strike a balance between diluting existing shareholders and increasing debt.

Limitations and recommendations

According to the financial plan report results, PM Pty Ltd should concentrate on growing its net profit margin and putting its assets to work to produce sales. In addition to reducing financial leverage, the corporation may decrease debt and raise equity debt and raising equity raising demolished by pricing modifications, innovative research and development, or the launch of whole new items.

Cost-cutting techniques include reducing unnecessary expenditure on marketing, R&D, and administrative overhead. The corporation may also use pricing tactics such as price rises or dynamic pricing to better align product prices with market demand. Investment in research and development to create new goods has the ability to increase the company’s net profit margin as well as asset turnover.

The firm might potentially look into equity financing, debt financing, or a mix of the two to increase its net profit margin and financial leverage (hybrid financing). After talking with a financial specialist, the best course of action can be chosen. PM Pty Ltd should also do a SWOT analysis to assess the company’s strengths as well as its weaknesses and prospective threats. As a result, the organization will be better equipped to identify issue areas and create solutions to them.

Ratio analysis gives some insight into Pure Milk Pty Ltd and Bega Cheese Pty Ltd’s financial performance, but it should be seen in conjunction with other financial and non-financial data, as well as the economic and industrial environment. It is also critical to acknowledge the study’s limitations and to employ other methodologies and assessments to learn as much as possible about the performance levels of the organizations.

References

Baranek, D. (2022). Mylan Fraud: Accounting and Disclosure Considerations. The Journal of Accounting and Management, 12(1).

Barbier, P. J. A. (2020). Financial return on equity (FROE): A new extended dupont approach. Academy of Accounting and Financial Studies Journal, 24(2), 1-8.

Bordeianu & Radu, F. (2020). Basic Types of Financial Ratios Used to Measure a Company’s Performance. Economy Transdisciplinarity Cognition, 23(2).

Marsha, & Murtaqi, I. (2017). The effect of financial ratios on firm value in the food and beverage sector of the IDX. Journal of Business and Management, 6(2), 214-226.

Pešterac, A. (2020). The Importance of Initial Public Offering for Capital Market Development in Developing Countries. Economic Themes, 58(1), 97-115.

Samo, A. H., & Murad, H. (2019). Impact of liquidity and financial leverage on firm’s profitability–an empirical analysis of the textile industry of Pakistan. Research Journal of Textile and Apparel.

write

write