Introduction

In the volatile ocean of World Finance, Citibank Inc. remains in full charge as her crew members weave a sophisticated tapestry, which changes continuously based on the scenarios. Emerged in 1998 through the merger of Citicorp and the Travelers Group, Citigroup became more than just a large financial services company, with a global footprint and clients from every walk of life (Citi, 2023). This paper will begin with a historical analysis of Citigroup, including the internal structure, leadership dynamics, external environmental influences, and critical aspects of operational management. This paper is set to dig into the strategic dogma behind Citigroup’s Successful performance and closely examine the challenges the financial industry faces nowadays.

General Information

a) History of the Company

Citigroup Inc., a New York-based firm, was launched in 1998 due to the Citicorp and Travelers Group merger. Citi’s history began in 1812 as a City Bank of New York. This acquisition unites two of the leading financial service providers in the world, bringing to bear the banking capacities of Citicorp and the insurance and investment services of Travelers Group (Britannica, 2020).

b) What They Sell and Usage of Product

One of Citigroup’s business model pillars is a wide range of financial products and services, including private banking, corporate and investment banking, margined investing, and individual wealth maintenance. Among them are credit and debit cards, residential and private-owned home loans, personal loans, and investment products. The use of Citigroup’s products usually relates to one’s financial needs and, therefore, the specific geographical area.

c) Mission Statement

Citigroup’s mission puts forward progress and advancement of clients, people, and communities. The magnitude of the match between Citigroup and its mission will be an element to be assessed via operation relevance and the provision of public wealth in particular.

d) Main Customers and Competitors

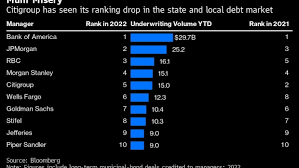

At various layers of credibility, ranging from individuals to corporations, governments, and institutions, Citigroup provides services that deliver the needs of its customers in multiple nations. With its multifaceted line of financial products and services that cover the different needs of diverse client segments, Citigroup illustrates its vast geographical clout and significance as a fiscal agent. In the pool of competitors where Citigroup stands, its biggest rivals hold their ground: JPMorgan Chase, Bank of America, and Wells Fargo (Citi group, 2023). These primary financial institutions have international scopes, engaging in similar activities and competing to be the best among the competing brands. Competition provides innovation and forces better service delivery of financial services that are critical in strategic decisions of the financial sector. Citigroup’s ability to satisfy the needs of its clients from the settings of competitors’ powerful impacts is of great importance to keep its primary positions in the global market, which increasingly becomes diversified daily with new players.

e) Profitability

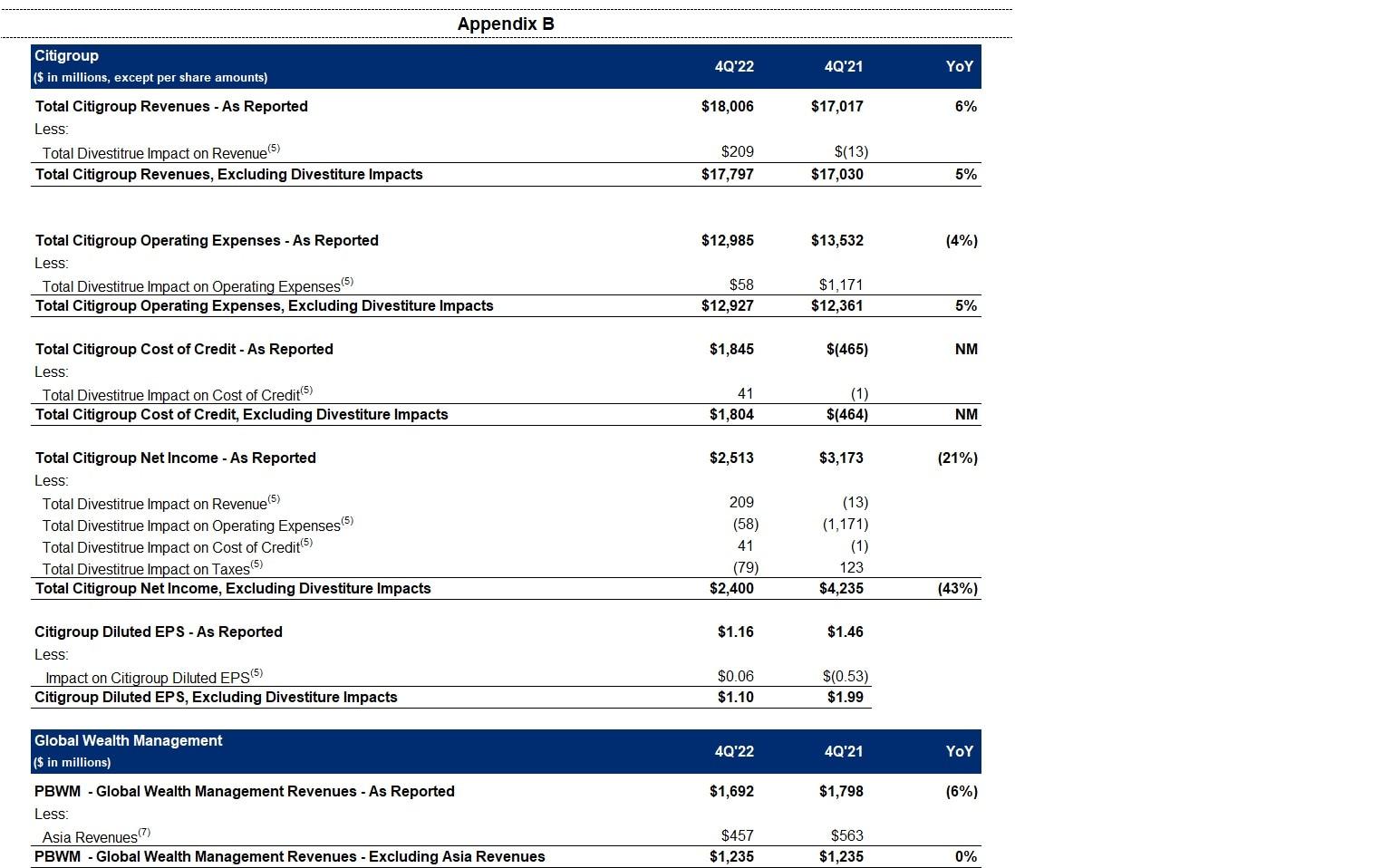

Being able to see Citigroup’s profitability in the form of financial statements for the fourth quarter of 2023 is vividly presented there: the bank shares a net loss of $(1.8) billion, $1.16 per diluted share on revenues of the sum up of $17.4bn (Citi, 2023). As against the net income reported in the fourth quarter of 2022, which was $2.5 billion, or $1.16 per diluted share, on revenues of $18.0 billion, this quarter’s financial situation is not flattering (Citi, 2023). Among the main issues influencing the due period entity are costs associated with a Federal Deposit Insurance Corporation (FDIC) special assessment, a reserve build for transfer risk in Russia and Argentina) and turnover due to a devaluation of the Argentine peso and reorganization costs, perceived as organizational simplification efforts.

Balance sheet

statements of shareholder equity

Stock and bond

Income analysis

For the whole accounting sector in 2023, Citigroup realized a net income of $9.2 billion on revenues of $78.5 billion. In contrast, in the same period in 2022, the recorded net income was $14.8 billion, and revenues were $75.3 billion.Notwithstanding obstacles in the 4th quarter, Citigroup’s CEO, Jane Fraser, stressed the forward animation of the company’s core agendas while at the same time showcasing significant achievements in executing these plans in 2023. The refocusing of the five core businesses, rise in public demand for the key sectors, and staying in touch with shareholders. At the same time, giving value through dividends and share buybacks signifies Citigroup’s success and adaptability in a lithe financial sector.The report, which was disheartening, showed that the fourth quarter lagged. However, Citi’s strategic long-term plan, coupled with its operational efficiency, will, in the future, ensure that the Bank grows and is resilient in the market.

f) Insights from Company History

The evolution of Citi Bank towards its immense global extension cements its breathing status among the leading financial institutions. This historical narrative opens the curtain on Citigroup’s diversified strategies as it faced different kinds of change, be it the market environment dynamics or regulatory and economic agencies (Citi Inc Company, 2022). Attentiveness to the company’s past makes the ones who participate in it prone to perceive its ability to survive crises and use its innovativeness for tackling vibrant financial environments (Citi et al. Bank n.d). Through all the ups and downs, Citigroup’s historical chain not only demonstrates the company’s past but also provides guidelines on the progression to the next level in the current where the financial world is constantly changing.

g) Any Other Pertinent Information

Citigroup’s voyage has been characterized as a series of virtually formidable encounters, including crises and endeavoring through the waters of financial crises. However, this supposedly invincible fortress suffered a series of setbacks over the following years and, even today, remains known around the globe for its massive scale and reach. Its penetrating presence symbolizes the continuous existence of the community, as well as the endeavor for more flexibility and sustainability. Citigroup’s aptitude toward adapting to changing situations and staying steadfast as one of the best global financial institutions demonstrates how fast-thinking it is and that one of the things that helps it serve its customers and stakeholders worldwide is its commitment. This growth would preserve its glorious history, symbolizing its long and prosperous existence in the banking sphere.

h) Three Additional Interesting Facts About Your Company

The iconic Citigroup has its mark on history with significant events showcasing one’s influence on the global level and contribution to social progress. Many people may need to be aware that Citigroup set foot in Iraq as the first American to express the US government and the people’s longing for a more secure world and financial stability, mainly known as an intricate part to achieve in challenging conditions. Institutionally, Citigroup operates native markets of more than 160 countries and jurisdictions, making it the most globally diversified financial institution that economically connects and grows the entire planet (Citi Inc Company, 2022). On the other hand, Citi’s efforts in philanthropy, specifically in areas such as financial inclusion and community development, are the true reflection of that corporation’s commitment to making a positive change in the world. Citigroup aims to form partnerships and programs that uplift and give disadvantaged individuals and communities access to financial-related services, thus reflecting the organization’s core values of responsible and sustainable enterprise. Other factors place the dimensions on which Citigroup has emerged as a change agent in the financial sector and the global community.

Organizational Structure and Leadership

a) Formal Organizational Structure

Citigroup’s formal organizational structure demonstrates the complex forms that are unavoidable in massive transnational corporations. This company’s structure comprises several key divisions that accomplish different corporate functions. These parts of business consist of the consumer banking sector, which is directed to individual customers’ financial requirements; institutional clients group, which hosts providing financial services to corporate groups and customary, as well as corporate functions designated for the main household and operational matters of the company (Forbes, 2020). The business structure of Citigroup, as vertically hierarchical, enables the group to run diverse operations in different sectors and locations flawlessly, as well as retain the role of specialization and enhancement of efficiency within each unit. This setup supports Citigroup’s competitive strength and, not only that, its continuing mastery over the global financial framework.

b) Top Leadership

CEO Jane Fraser, a woman who made history in February 2021 as the CEO of a prominent Wall Street leading Bank, is steering the wheel of Citigroup. One of the most prominent women in the financial sector who has made a name for herself as the decades-old global financial powerhouse is the appointment of Fraser to Citigroup’s higher echelons; therefore, it serves as a case in point that the industry is evolving toward gender diversity and inclusion. Her leadership style is structured on a strategic vision that guides Citigroup through multifaceted market dynamics without overseeing operational efficiency and implementing robust risk management (Forbes, 2020). Fraser’s message here shows that this will be done in an enduring operations fashion that balances sustainable growth and investor returns with the ever-changing financial market landscape. The CEO’s compensation is performance-based and subject to different stakeholders’ reviews from boards, investors, and other stakeholders in the market. Fraser paved the way for the new Citigroup, which is notable for innovation, endurance, and loyalty while pursuing the goals of the clients and the shareholder’s success.

c) Corporate Culture

Citigroup’s corporate culture’s values encompass the triad of prudence, diversity, and inclusion fostered beneath the strongest ethical conduct and corporate responsibility umbrella. Innovation is a focal point of Citigroup’s corporate culture, with its success not only accepted but acknowledged as the primary engine for the Bank’s emergence and readiness to cope with the constantly changing financial realm (Citibank, 2021). Diversity and inclusion underline the corporation’s intrinsic principles, and the collaborative and diverse environment allows people from all backgrounds to explore their preferences and relate to others. In addition, Citigroup represents confidence in ethical practices and corporate social responsibilities by stressing its reliability and effectiveness in all its tasks (Citi et al.). This culture is the most muscular leg supporting Citigroup’s interactions with customers, employees, and stakeholders. It is also a benchmark for making responsible global corporate citizens who are making the world where it serves better.

Organizational External Environment

a) Factors in the Organization’s General and Task Environment

Citigroup plays in a multiple-faceted organizational arena whose internal structure is shaped by various external notions. The regulatory environment is the primary hurdle to adapting financial services to the digital and crypto realms. This sector is closely scrutinized, and frequent changes are made. Citigroup needs all the time to reshape its business activities and operations to keep in line with the developing regulations. This can signify specific complications within the Bank’s trade chains and profit losses (Citibank, 2021).

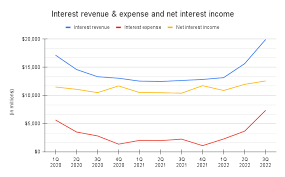

Similarly, global economic circumstances, such as movement in key interest rates, change in currency values, and growth rate of economies, have an immediate and pronounced impact on Citigroup’s financial performance and growth trajectory. Technological advances, foremost in digital banking, have caused the deepening of the revolution in the financial sector (Sec, n.d). Citigroup needs to explore beyond tradition and spend on advanced technologies to avoid being beaten and be relevant to the pressing customer demands. Moreover, the competition from well-established financial institutions and newcomer fintech startups is pressuring Citigroup to stand out and implement the best strategies to sustain and enhance its market leadership position. In essence, these outside influences jointly determine the direction in which Citigroup maneuvers in terms of strategies and tactics during the evolving competitive environment of the modern financial system.

Organizational External Environment:

The general environment refers to broader societal factors that affect all organizations, while the task environment comprises specific factors directly influencing an organization’s operations. In Citigroup’s case, factors such as the regulatory environment, global economic conditions, technological advancements, and competition significantly impact its operations. Regulatory changes, for instance, necessitate constant adjustments in Citigroup’s business activities to comply with evolving laws, potentially leading to increased operational costs or changes in revenue streams. Global economic conditions, including interest rates and currency values, directly affect Citigroup’s financial performance and growth prospects. Moreover, technological advancements and competition drive the need for innovation and digital transformation in Citigroup’s operations to remain competitive and meet customer expectations.

In Citigroup’s case, several environmental factors have impacted its operations. For instance, regulatory changes, such as financial regulations imposed after the 2008 financial crisis, have required Citigroup to enhance risk management practices and compliance measures, affecting its operational costs and profitability. Economic downturns, such as the global financial crisis and the recent COVID-19 pandemic, have also posed challenges for Citigroup, leading to decreased consumer spending, increased loan defaults, and reduced profitability. Technological advancements have forced Citigroup to invest in digital banking platforms and cybersecurity measures to adapt to changing customer preferences and mitigate cyber threats. Intense competition from traditional financial institutions and fintech startups has pressured Citigroup to innovate and differentiate its products and services to maintain market leadership and attract customers.

Impact of COVID-19 on Your Organization

The COVID-19 pandemic entailed a bevy of government mandates and policies directed toward controlling the further spread of the virus and reinvigorating the economy. Citigroup encountered unexpected regulatory decisions like lockdowns, careful social distance actions, and general restrictions on travel during that time. The reality was that customers could not get face-to-face with Citigroup’s staff because of branch closures, remote work arrangements, and disruptions in supply chains. Fiscal stimulus packages and safety nets launched by the governments also affected the way Citigroup managed its lending activities and the risks it took.

Citigroup had to turn on the knob and make some changes in order to keep up with the pandemic. First, it promoted its digital transformation, raising the level of online bank account management and customer service for transactions and communication to be possible remotely. Secondly, Citigroup provided the opportunity to employees of flexible work arrangements and invested in information technologies (theory) of remote work. Last but not least, the company strived to reshape its risk management techniques to avoid severe outcomes like higher default rates and economic slumps due to the pandemic. In addition, Citi Group was providing its financial help and relief programs targeted to customers adversely affected by the global financial crisis. This is to demonstrate Citigroup’s corporate social responsibility.

Innovation/Diversity

Innovation was critical in Citigroup’s pathway to prosperity, an essential multiple of the dynamic environment and customer requirement changes. Citigroup has been applying cutting-edge technologies like artificial intelligence, machine learning, and blockchain to improve the Bank’s products and services, improve operations, and mitigate risks. Moreover, Citigroup creates a culture of diversity and inclusion in a business environment, which is considered a crucial feature in managing risk and making better decisions. While the inclusion of diversity enhances the working environment favorable to all employees and attracts customers of diverse preferences, it enables citizens to participate more deeply in the politics of their community.

International Environment

The international environment, through its direct influence on Citigroup’s presence and operations network, which is widely spread over the world and more than 160 countries and jurisdictions, is what affects Citigroup’s operations. In addition to regional economic and political changes, they are reflected in financial results, regulatory compliance, and risk management. Furthermore, currency fluctuations, trade tensions, and political problems can influence Citigroup’s revenues, expenses, and assets(“egos”). In addition, because of different regulation requirements worldwide, Citigroup’s business process has to be tailored to specific local laws and regulations, making it more pricey and complicated to run.

Sustainability

Citigroup, along with its concern towards environmental sustainability and environmental-friendly resource management, is supposed to create the same entity by utilizing responsible resources that bring a less harmful impact on the environment in the form of environmental concern. The company has already carried out numerous measures to show its willingness to practice good stewardship of nature and reduce the environmental effects of its operations. First and foremost, Citigroup has installed energy-saving mechanisms in the organization’s structures by using renewable energy that significantly reduces energy consumption and greenhouse gas emissions. For instance, Citi is constantly working with NGOs to support these initiatives for biodiversity conservation, ecosystem restoration, and environmental conservation. The third item that Citigroup devotes to is building up sustainable finance initiatives, which include green bonds and renewable energy projects to finance environmentally friendly projects and as a transition to a low carbon economy.

The Future

As a large financial institution, Citigroup is exposed to many potential risks and opportunities in the fluid corporate environment. Risks include uncertainties in regulation, loss in economic cycles, cybersecurity problems, and growing competition from other technologies. In order to curb them, Citigroup should be delving into the areas of regulatory compliance and risk management, already convinced that cyber-security can be noticed and differentiating customer experience and products through embracing innovation. Arising opportunities for Citigroup include integrating digital technologies for development, increasing with emerging markets, creating more sources of revenue, and minding the shifts in customers’ aspirations. However, doing this means that Citigroup will be able to take a competitive place in the future market with a self-reliance on sustainable growth of this industry.

Recommendation

To add a competitive edge to Citigroup and achieve the desired long-term growth, one has to follow strategic plans, which may include getting through the hardships in the current financial environment. Second, it is essential to identify the core mighty tech and invest more in them. Being able to run the company more efficiently and be more responsive to the growing move towards digitization is crucial to Citigroup’s stay competitive (Stanley et al., n.d). Through cutting-edge technologies like machine learning and blockchain, Citigroup can demonstrate impressive efficiency gains and digital service improvements for its customers. In addition, since the digital banking arena is developing quickly, Citigroup will gain a competitive edge by capitalizing on such advancements.

A top-notch priority is spotlighting a corporate culture shaped by diversity, inclusion, and ethical business behavior. Cultivating an environment that celebrates and values different opinions helps to build trust and cohesion, which is the first step towards harnessing ideas for problem-solving and decision-making (Stanley et al., n.d). Through promoting cultural and social diversity competition, Citigroup can recruit top personnel, motivate employee involvement, and develop more robust customer and community relationships. Conversely, Citigroup must adapt to regulatory enterprises and economic disquiet. Citigroup’s early recognition of regulatory changes and market trends is the ability to promptly update its strategies, mitigate potential risks, and maximize on changing markets. Citigroup benefits from the positive outcomes of its ability to be future-oriented and make good use of its regulatory compliance skill set. Consequently, Citigroup could emerge as a sound and workable financial institution from significant hurdles.

Conclusion

With the dynamic nature of the financial environment being considered, Citigroup’s path from its founding years to the mergers and global expansion has shown how resilience and adaptability are the main factors that led the Bank to its current position. Although completing past challenges remains a goal, the company continuously gives its best and focuses on making a difference in business strategy and fairness. Guided by the policies of the day and ready to embrace new technologies – these same features will define the company’s future role in the global economy. Through this comprehensive effort, Citigroup is steered towards triumph in handling the complex financial terrain. However, it will also shape the future of global finance, thereby bringing people the lasting results they always aspire for. This will solidify its role and strength in the financial market.

References

Citi group (2023). https://www.citigroup.com/rcs/citigpa/storage/public/citi-2022-annual-report.pdf

Citi ( 2023) https://www.citigroup.com/global/news/press-release/2024/fourth-quarter-full-year-2023-results-key-metrics

Citi Global Investment Bank (n.d) https://www.citigroup.com/rcs/citigpa/storage/public/Citi-2023-proxy-statement.pdfl

Citibank (2021) https://www.citi.com/

Citi Inc Company (2022). https://www.globaldata.com/company-profile/citigroup-inc/

Citi History (n.d) https://www.citibank.com/icg/sa/emea/czech/english/insights/history.html

Britannica (2020) https://www.britannica.com/topic/Citigroup

Forbes (2020) https://www.forbes.com/companies/citigroup/

Stanley, H. M. Citigroup Goldman, Sachs & Co. JP Morgan.https://www.oblible.com/Prospectus/www.oblible.com__US037411BA28.pdf

Sec (n.d) https://www.sec.gov/Archives/edgar/data/831001/000110465914015152/a14-3681_6ex21d01.htm

write

write