Introduction

Sampa videos are thinking about another venture to construct another site to expand its availability by offering clients the choice to arrange recordings. For Sampa Inc. to overcome the decreasing competitiveness, the management plans to provide a $1.5 million investment. With the focus on the firm’s value at the current financial record, the discussion in this paper will be based on the investment option. This assignment consists of a case analysis of Sampa Video Inc. Given the quantitative aspects of this case, the emphasis will be on the quantitative methods used by the organization. More importantly, what is the impact of the quantitative methods used by the organization on society? The purpose of this assignment is to examine the importance of finance management. The Case Study involves an analysis of the company Sampa Video Inc. The main products of this company are videos, DVDs, and CDs. The main goal of the company is to produce the largest number of entertainment products that are sold in the market. The management will conduct a valuation program based on the assumption that the firm is equity-financed. Another consideration will be based on the assumption that the firm uses the debt as a source of income to fund the project (Berk and DeMarzo, 2017). Based on this understanding, at unlevered cost of 15.8% cost of capital that accounts to 1228485 dollars; this means that the yields from the project as at the current currency will be over million dollars in profit. In this case, two different methods (APV & WAAC) will be utilized, and a discussion of offered afterward.

Value of the project

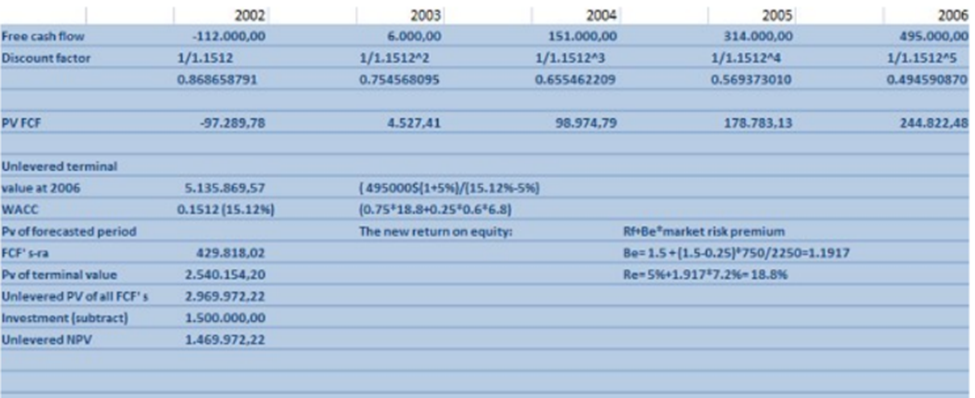

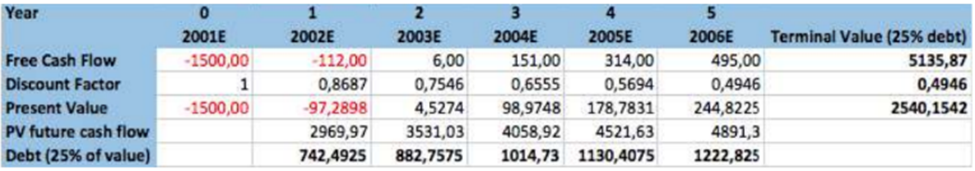

The first step in this process will involve estimating the value of firms’ equity. In order to arrive at the stated valuation, there must be a calculation to determine cash flow present value. In this case, the project is assumed to have no value since the firm is entirely equity-financed. The computations depend on the incomes from 2002 to 2006 and the consistent development of the free payments after 2005 of 6% is likewise thought about. The free revenues are determined and limited and showed an organization worth $1,228,485.

Value the project using the APV

The changed present worth methodology accepts that value and financing incomes have various dangers thus are limited at different rates (Berk and DeMarzo, 2017). As per Lucas and Montesinos (2019), APV valuation is equivalent to the current worth of unadulterated value incomes and incidental effect incomes of supporting, which may be optimistic and undesirable if the expense of monetary trouble is considered.

The yearly assessment safeguard from bringing $750,000 up in interminability emerges to be $20,400, and the terminal worth of expense safeguards appears to be $300,000. Thus the current price of duty safeguards, limited at the expense of obligation of 7%, from funding emerges to be $400,000. The project’s total value is the sum of the current cash flows, that is, the amount investors get today for assuming the risk of the project’s future cash flows. The sum of the present values of a set of cash flows is the sum of the current values of those cash flows.

Tallying the secondary outcome incomes of funding to the underlying NPV of $1,225,585 provides us with an APV of $1,525,475, inferring that totaling $650,000 of obligation in unendingness will expand the undertaking’s benefit by $400,000.

When the organization considers acquiring a consistent obligation of $750000, the current worth of the assessment safeguard ought to be additional to the price of the uninfluenced safe. For the computation of the duty safeguard, the expense degree should be increased with the premium installments. Because of the way that this extra obligation equal is detained continually in unendingness, we may expect that this obligation abides a similar gamble as the Tax Defense (Lucas and Montesinos, 2019). It suggests the Tariff Protection should be limited with the obligation price of investment (7%). In the wake of ascertaining the Present Value of the Tariff Defense (PVTS), the secure worth expanded to $ 1,527,385.

WACC approach

We want to track down the new profit from value and compute the undertaking value beta by utilizing the WACC technique. Given the undertaking value beta, hazard-free rate, and market hazard premium, we get another profit from a value of 18.8%. Presently we can observe the WACC expecting a consistent obligation to advertise esteem proportion in interminability; this multitude of computations depend on the WACC of 15.12% and can be found in Appendix 2. The WACC approach was developed for calculating the value of a company. WACC is computed as the weighted average cost of capital. The WACC calculation uses the following equation: WACC = ((Beta*Capital)+(M*Rate of Interest))/(1+Beta*Rate of Interest) Where: Beta is beta, the market interest rate, i.e., the interest rate in the market; Capital is the capital base, i.e., the total. The firm is a manufacturer of video recorders, and it is a very successful firm. The firm has an asset base of $20,000,000. The firm has a positive book value of $5,000,000 and a negative net working capital of $1,000,000, and the firm is profitable. The firm is also a very successful consumer product because it has developed a new product and high market share.

The value of the project is determined using the WACC method, which is calculated by dividing the company’s total debt by the firm’s total shareholder equity. An arranged obligation to-worth of 20% suggests an obligation to-value proportion of 25%. By using the beneath recipe, the value beta emerges to be 1.69. The analysis aims to assist the readers in understanding the value of the project and the rationale for its valuation.

β value = β resource + (Debt/Equity)(1 – Marginal Tax rate)(β resource – β obligation)

Comparison between APV and WACC

The degree of obligation funding in the APV tactic is secure at $650,000; consequently, the attention charge safeguards are limited at the expense of obligation just as they accept no extra gamble. In any case, on the off chance that commitment to a part of the venture esteem is fixed, the interest charge safeguards will likewise change with the worth of the undertaking. Subsequently, we rebate the profit charge safeguards at the WAAC to mirror the common gamble.

The change was the addition of the new asset, the lease. The value of the lease added to the company’s net asset value. The valuation results were obtained using the DCF model. The DCF model is an important method to value a company by measuring its future cash flows. The company you love is profitable, and the DCF model can be used with a simple forecast. The value of Sampa Video was calculated using the NPV and IRR method. It is a common valuation technique. The formula is: previously, you valued Sampa Video at $2.50 per share. The valuation results change due to the use of different assumptions. The key assumptions are (1) the expected life of the equipment and (2) the discount rate. In the case of Sampa Video Inc, the expected life of the equipment is five years, and the discount rate is set at 15%.

Accepting the all-value unlevered firm, the principal approach has the most reduced valuation since there is no assessment safeguard to think about (Berk and DeMarzo, 2017). Thinking about the extra two methodologies (WACC & APV), it very well may be expressed that the APV approach (NPV+PVTS) with a steady measure of the obligation of seven hundred and fifty thousand dollars prompts the most formal evaluation. With the WACC attitude, the WACC diminishes from 16% to 15%, with a moral obligation-to-esteem proportion of 26%. The distinction in NPVs with various methodologies is because of the numerous upsides of the duty safeguard (Mari and Marra, 2019). If the obligation is settled, the duty safeguard remains something very similar. In any case, when there is a moral obligation to-esteem proportion, the responsibility relies upon the firm’s worth.

The APV was $1,527,486, while the NPV from the WACC method emerged to be $1,606,017. The advanced NPV from WACC doesn’t intend that the task will be more productive if somebody uses the WACC approach and an obligation to-worth of 20% (Mari and Marra, 2019). It just mirrors a distinction in presumptions concerning working, and subsequently, the two methodologies are not practically identical in the strictest sense.

There are various suppositions behind the APV and WACC techniques. When the firm has a decent obligation to-esteem proportion over the lifetime of the speculation, it is more fitting to utilize the WACC technique (Mari and Marra, 2019). The APV strategy is proper when there is a consistent obligation measure since it will make esteem due to the expense safeguard. Overall, it ought not to make any difference which strategy will be utilized because the end worth should hypothetically be very similar.

Assumptions behind the two valuation

There has remained accepted that the task worth could stay consistent throughout the long periods of its lifespan. The year’s end obligation balance inferred by a 20% obligation to-esteem proportion is determined through adding the underlying speculation of 1.5 million dollars to the NPV of $1,606,017, which produces the task esteem. The undertaking esteem is then duplicated by the 21% objective obligation to-esteem proportion. It has an obligation surplus of $541,202, by reproducing the obligation equilibrium by the expense of-obligation of 7% profits yearly attention installments of $42,601.

Valuation based on the discounted cash flow model uses assumptions about fast cash flows. If the cash flows are assumed to be very rapid, the valuation is very high. Conversely, the valuation is very low if the cash flows are assumed to be very slow. Because of this uncertainty, it is common to conduct a sensitivity analysis to estimate the range of valuations expected by varying the assumptions. In a nutshell, the financial markets provide a competitive price that reflects our relative ability to pay and borrow money.

The first approach, a discounted cash flow approach, assumes that the video company will continue to produce a steady stream of cash. The second, an intrinsic value approach, believes that the video company will make a steady stream of profits in perpetuity. This case is an example of the difference between the two approaches. The first approach, called the discounted cash flow (DCF) approach, involves estimating the stream of revenues generated by the company and the stream of costs related to the company’s operations. The second approach, called the equity value approach, involves calculating the firm’s value based on the value of its shares. In this case, the equity value is lower than the DCF value.

Project interest coverage

Right now, Sampa Inc.’s advantage installments emerge to be three hundred thousand dollars yearly, as should be visible on the dominate page. Separating the attentiveness installments by the existing EBITDA of $ 2.5 million harvests as a profit inclusion proportion of 13%.

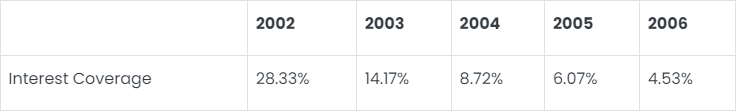

Assuming Sampa Inc. brings $750,000 up paying off debtors for a long time to come in interminability, then, at that point, the interest inclusion proportion for every one of years is as per the following:-

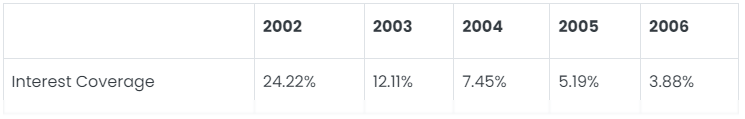

Assuming Sampa video rather chooses to keep an obligation to-worth of 20% for a long time to come in interminability, then, at that point, the interest inclusion proportion for every one of years is as per the following:-

As it very well may be seen, the interest inclusion proportion continues diminishing as the years continue to advance, essentially because the EBITDA continues to increment as the venture develops toward the finish of its life. Subsequently, the two approaches yield better interest inclusion proportions close to the furthest limit of the undertaking life (Berk and DeMarzo, 2017). Nonetheless, in the underlying steps, the undertaking is incredibly unsafe. It returns profits inclusion proportions of almost twofold the current proportion inferring that the venture conveys a superfluous gamble in its commencement. Henceforth, to check the chance or keep a level interest inclusion proportion, the organization should seriously think about keeping a variable obligation to-esteem proportion over the lifetime of the undertaking to ensure it doesn’t assume the pointless responsibility, which will add to its task hazard.

Assuming to be a potential buyer of Sampa Inc.

As a potential buyer, I would understand how much money Sampa Video would need to generate to pay back the money it had borrowed from the bank. If the amount is high, I might think about buying the business while Sampa Video is still in the process of paying off its debt. The case study is Sampa Video, which is a video service provider. The company has four products: DVD, video streaming, on-demand, and VOD. The company is new and is entering a market that an existing competitor has heavily saturated. However, the answer lies in understanding the potential buyer’s needs and wants. As a buyer, the main concern you must have is meeting the demand. If the company can consistently meet the direction of their new product line, then you have a good deal. As a potential buyer, I want to know what the current management is doing how the direction.

References

Berk, J., & DeMarzo, P. (2017). Corporate finance, 4th global ed. Harlow: Pearson.

Lucas, D., & Montesinos, J. J. (2019). A Fair Value Approach to Valuing Public Infrastructure Projects and the Risk Transfer in Public Private Partnerships. In Prepared for the NBER Conference on Economics of Infrastructure Investment. Retrieved from: https://doi.org/10.7208/chicago/9780226800615-010

Mari, C., & Marra, M. (2019). Valuing firm’s financial flexibility under default risk and bankruptcy costs: a WACC based approach. International Journal of Managerial Finance. Retrieved from: https://doi.org/10.1108/IJMF-05-2018-0151

Appendix

1:

2:

write

write