Introduction

DD plc is a vegetarian food production firm based in the United Kingdom and portions of Europe. This essay will examine how DD plc will decide between two business ideas. Furthermore, the company’s strategic management will spend money in one of two initiatives that will produce either smoothies or nondiary milk. The article will focus on the business decisions made for two projects through the use of investment assessment methodologies. Furthermore, this article depicts financial and non-financial aspects that might aid in decision-making.

Decision-making

Every leader has his or her unique leadership style. It is critical to make judgments based on your own preferences and leadership style as much as feasible. Nevertheless, you must strike a balance between your personality and the interests of your employees. If you have an autocratic management style, for example, you must balance your personal independence in decision-making with your workers’ desire to contribute. A more approachable leadership style can help you engage staff, yet you may need to act independently when time is of the essence in a decision (Alyammahi et al., 2020).

You must also consider the influence of your actions on your staff and the overall ambiance of your firm. If you decide to reduce benefits in order to reduce human resource expenses, for example, you may achieve your cost-cutting aims while risking alienating personnel. Employees who are happy and positive are typically more useful in the long run than the few bucks saved by overzealous cost management. Every action a manager takes should take into account the impact it will have on staff.

The financial repercussions of a choice can weigh heavily on a management. Essentially, each choice taken by a for-profit management must consider whether the ultimate outcome is a gain in revenue or a decrease in expenditures. Even if a firm chooses to act responsibly in terms of the environment, this option may result in short-term expenses but long-term rewards in terms of public image. Expansion of a business or product, product development, sales, and service operations all require expenditures with the expectation of a return (De Smidt and Botzen, 2018).

The decision-making process may be described as the many stages performed by the company’s managers to choose the best choice or courses of action to suit their business requirements. Furthermore, the decision-making process entails identifying the goals, gathering the relevant information, assessing the risks involved, and then implementing the appropriate strategy. The payback period may be defined as the amount of time it takes an investor to repay the original cost of a project. Furthermore, when long-term cash flows are difficult to anticipate, the payback time must be calculated. A short payback time is regarded favorable since it assures that the risk of investment is limited to the original expense. The payback period for DD plc’s proposed projects A and B is determined here (Hassannezhad et al., 2019).

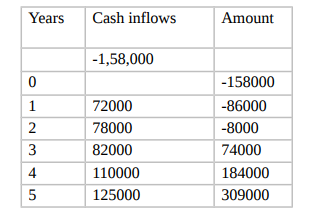

Project A’s payback time is calculated as follows

Table 1: shows project A’s payback period (source, self-generated).

The formula for calculating the payback period for project=

Where,

A implies amount for last year

D implies the last negative amount

E implies net cash inflows

Therefore, 2nd year + (8000/82000) x 12

Or, 2nd year + 1.17 months is the payback period for project A

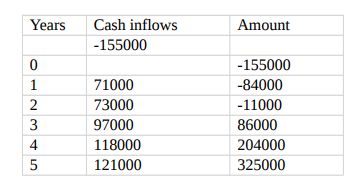

Calculation of payback period for project B

Table 2: shows project B’s payback period (source. Self-generated).

The formula for the calculation of payback period for project =

Where,

A implies amount for the last year

D implies the last negative amount

E implies net cash inflows

Therefore, 2nd year+ (11000/97000) x12

Or, 2nd year + 1.36 months is the payback period for project B.

Net present value (NPV) can be defined as the present value of future net cash flows divided by the invested amount. Furthermore, NPV analyzes a company’s investment in a new initiative. The NPV estimate for both projects for DD plc is presented below:

Calculation of net present value of project A

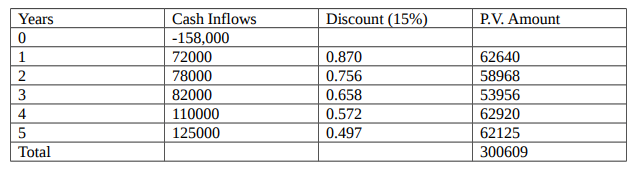

Table 3: shows net present value for project A (source, self-generated).

The formula for calculation of NPV = (P.V amount – Initial investment)

Where, P.V amount is £ 300,609.

Initial investment = £ 158,000.

Therefore, the NPV = (300,609 – 158,000) = £ 142,609.

By applying the formula, the NPV for project A will be £ 142,609.

Calculation of net present value of project B

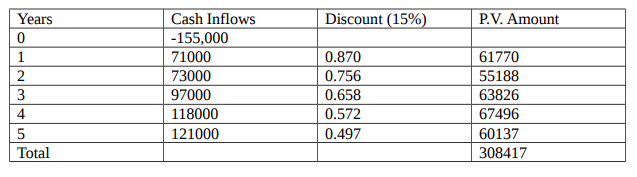

Table 4: shows net present value of project B (source, self-generated).

The formula for calculating the NPV = (P.V amount – Initial investment)

Where, P.V amount = £ 308,417.

Initial investment= £ 155,000.

Therefore, the NPV = (308,417 – 155,000) = £ 153,417.

By applying the formula, the NPV for project B will be £ 153,417.

The managers of DD plc estimated the payback period in order to decide whether to spend money in a profitable project. The computation reveals that project A has a payback time of 2nd year + 1.17 months and project B has a payback period of 2nd year + 1.36 months. This indicates that DD plc should invest in project B since its payback period is shorter, requiring less time to repay the original cost of investment. Furthermore, the NPV of project A is £ 142,609, whereas that of project B is £ 153,417. It is recommended that DD plc select project B based on the NPV calculations since it delivers an accurate result that will aid in making proper judgments. It will be more profitable for DD plc since it will give the firm with a better return on investment (Metcalf et al., 2019).

DD plc must investigate the financial and non-financial aspects that influence a company’s profitability and aid in decision making. The financial variables, such as investment return, are critical for the organization to consider. The project’s return on investment can help DD plc make appropriate judgments regarding whether the project will produce the required level of return. A cash flow statement is another financial component that assists a firm in making decisions by showing the proper amount of money moving into and out of the organization. The availability of resources, which is critical for decision making inside a corporation, is one of the non-financial elements that aid in decision making (Pranjić, 2018). The corporation may pick projects based on the resources it has available without spending any more money. Division of labor may aid in decision-making since assigning the appropriate task to the appropriate worker may also aid in enhancing the company’s production.

Conclusion

The paper has gone into great length over whether DD plc will invest in project A or project B. Based on the payback period and net present value, DD plc has opted to invest in a viable approach that will increase the company’s profitability. Furthermore, this essay has persuaded DD plc to engage in project B because it has proven to be more practical and beneficial for the corporation. The article emphasizes the financial and non-financial variables that aid the firm in its decision-making process.

References

Alyammahi, A., Alshurideh, M., Kurdi, B. A., and Salloum, S. A. (2020, October). The impacts of communication ethics on workplace decision making and productivity. In International conference on advanced intelligent systems and informatics (pp. 488-500). Springer, Cham.

De Smidt, G., and Botzen, W. (2018). Perceptions of corporate cyber risks and insurance decision-making. The Geneva Papers on Risk and Insurance-Issues and Practice, 43(2), 239-274.

Hassannezhad, M., Cassidy, S., and Clarkson, P. J. (2019). Connectivity as the capacity to improve an organization’s decision-making. Procedia CIRP, 84, 231-238.

Metcalf, L., Askay, D. A., and Rosenberg, L. B. (2019). Keeping humans in the loop: pooling knowledge through artificial swarm intelligence to improve business decision making. California Management Review, 61(4), 84-109.

Pranjić, G. (2018). Decision making process in the business intelligence 3.0 context. Ekonomska misao i praksa, (2), 603-619.

write

write