Abstract

In developed countries, the connection between corporate management and the declaration of social business responsibility is more significant. As a result, the study’s primary goal is to examine theoretical perspectives on board composition and CEO remuneration, and appraisal of Kingfisher Plc and Crest Nicholson Holding Plc compliance with UK Code of Corporate Governance. The variables in this study were assessed on the Kingfisher Plc and Crest Nicholson Holding Plc control boards using descriptive statistics and a cholinergic combination and diagnostic model. The board meetings of the two companies, as well as the formation of the board of directors, should not reveal public responsibility. Because CSR assessments require independent and ambiguous personal interpretation, research is limited in a number of ways. In addition, research programs were restricted to specific corporate firms.

Introduction

The business Council has a wide range of obligations and responsibilities. All board decisions must consider how it affects employees, customers, suppliers, associations and shareholders. The difference in functionality between managers and supervisors is at the heart of independent directors. Board members were not directly involved in the company’s day-to-day operations and did not believe that micromanagement should be avoided. The main function of the board is monitoring and planning. Despite the breach, the Board may assign some liability to the CEO (Chief Executive Officer) or CFO (Chief Financial Officer) in certain circumstances (García Martín and Herrero, 2018). The board often delegates several duties to the board of directors on a regular basis.

The Corporate Governance Committee functions as a complete subgroup of management. The organizations selected in this report are Kingfisher Plc and Crest Nicholson Holding Plc. Kingfisher’s board of directors consists of a chairman, senior management, and four non-executive directors. Its employees play an important role in running a company backed by confidential media. Similarly, Crest Nicholson Holding Plc’s board of directors consists of a part-time independent chairman, one chief executive officer, six directors, and four part-time directors. This report focuses on perilous review different perspectives on board composition theory and CEO compensation. It also provides a critical assessment of how well these companies comply with the requirements of Sections C and E of the UK Corporate Governance Code 2018.

Theoretical Perspectives On Board Composition, And CEO Remuneration

Agency Theory

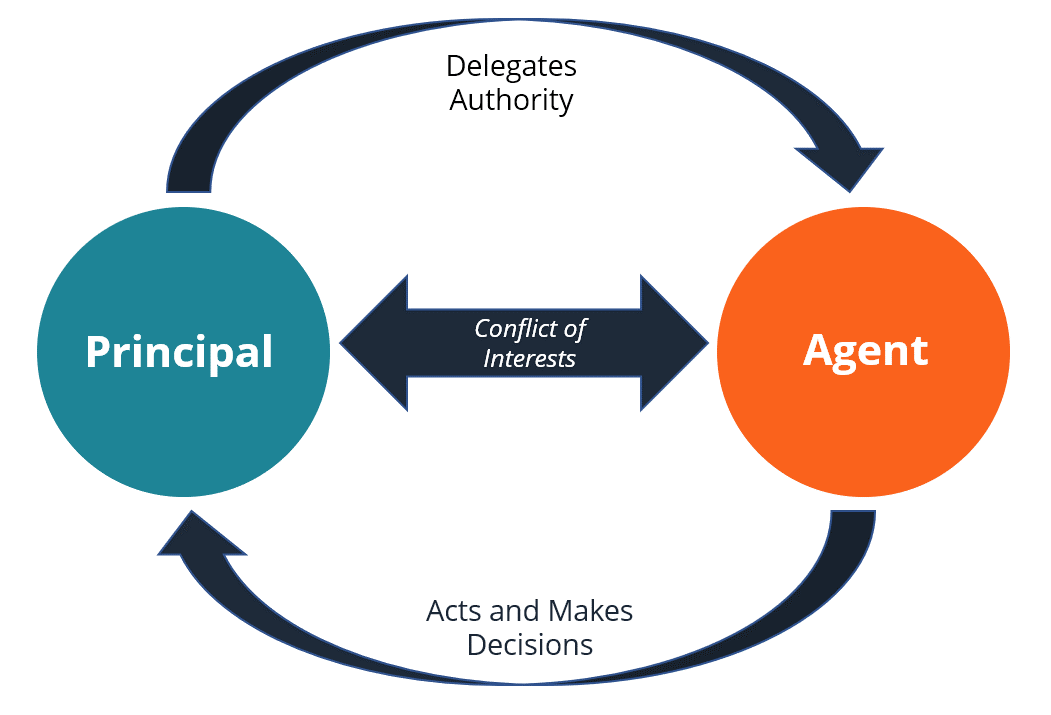

The separation of the firm’s asset management program brought several discrepancies to properly manage the profits of company executives and other stakeholders. The research scientist Adam Smith identifies this problem in 1776, and the distribution and management of property claimed that distribution and management of property constituted a disincentive of managers to operate the business successfully. Today’s corporate governance theoretical theory is based on the classic work of TarighI et al. (2022). Agent Theory is widely recognized to function as a starting point for discussions on corporate governance and its procedures. TarigHi et al. (2022) emphasized the separation of ownership from problem-based company management, which was largely centred on the separation of control between managers and shareholders. In today’s business, the property owner often does not actively involved in the operation of the organization, so they recruit human resource to act on their behalf. This makes it impossible for administrators to ignore director’s (shareholders) concerns, generate interests first, make it harder to gain personal wealth through imperial buildings, and get accounting management more difficult. The disparity between agent activity and manager interests is a concern for the agency.

Jeffrey, Rosenberg and McCabe, (2019), in addition to the preceding discussion, provide a thorough description of interaction between substantial agents. An agency relationship is defined as a contract between two parties in which the owner such as the director delegated specific obligations to managers, particularly bailiffs, on their behalf. More specifically, because shareholders are more invested in the organization’s success, it is possible to choose how some responsibilities will be delegated to the expert panel. In general, the connection between the principal and the representative is concerned with two issues. To begin with, the conflict is the result of a conflict of interest between the two parties. Second, shareholders and management have different perspectives on risk. Furthermore, according to Seifi and Crowther (2018), information disparities foster conflicts between managers and shareholders within the company compliance.

Figure 1: Agency Model

Stewardship Theory

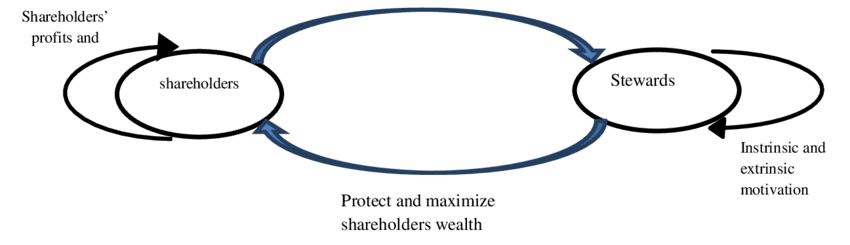

Another crucial theory of corporate governance is management theory, which opposes the concept of agency. Anantharaman, Gao, and Manchiraju (2021) assert that a manager, as a utility manager, safeguards and maximizes the shareholders’ wealth through the performance of a corporation. According to management theory, managers are hired to effectively manage a company’s operations, and a manager’s accomplishment and success are measured by the company’s performance, so the manager’s primary goal is to maximize the company’s performance. Corporate managers, who are the firm’s administrators and see the organization’s mission as their goal, are motivated by the best performance of a corporation. This concept of care replaces managers’ misunderstanding, whereas agency theory refers to power and authority while maintaining an ethical proclivity (Seifi and Crowther, 2018).

The guardian hypothesis, in contrast to the agent theory, demonstrates that internal directors and managers perform more effectively and always serve the owners. Because independent directors have access to more confidential information, internal directors are acutely aware of the company’s activities. Besides, Nour, Sharabati, and Hammad (2020) argue that managers protect shareholders’ interests by making sound decisions to improve their company’s efficiency because they want to maintain their market reputation as excellent decision-makers. Managers and directors, according to Seifi and Crowther (2018), manage their careers in order to be perceived as competent proprietors of their respective organizations.

Figure 2: Stewardship Model

Stakeholder Theory

Agency theories and management theories have illustrated their limited nature over time, focusing primarily on shareholders and being viewed as the only source to allow future firm study. To broaden stakeholders’ perspectives, Prince, (2021) states that a firm or corporation strives to improve the balance of interests of various stakeholders, each of whom is interested (Rashid, 2018). Furthermore, Dorobantu et al., (2019) emphasize that the company is no longer only accountable to its shareholders, but also to the society in which they live. As a result, stakeholder theory better explains the function of corporate governance by separating diverse features of the corporation from agency theory or government theory. Employees, customers, suppliers, shareholders, potential investors, creditors, the government, banks, society, and other stakeholders are all members of a company’s interest group. According to stakeholder theory, corporations are self-sufficient and interconnected with various countries in order to achieve their goals (TarigHi et al., 2022). They also stated that management is accountable for making informed decisions and making every effort to achieve results that are acceptable to all stakeholders. Furthermore, Jeffrey, Rosenberg, and McCabe (2019) emphasized that the Board’s obligation to protect stakeholders’ interests should not be overlooked.

As various scholars have explored regarding the impact of a firm’s operations on the external environment, stakeholder theory advocates for reporting to all stakeholders, not just shareholders. Significantly, this concept is enshrined in law in thirty-eight US states, demonstrating the significance of stakeholder theory to US businesses (Manning, Braam and Reimsbach, 2018). Basuony (2021), on the other hand, criticizes the concept of stakeholders for confirming a value-oriented purpose independent of the company’s voters. He claims that a corporation’s performance is never judged by a single factor that determines what percentage a group receives. Organizational structure, information flow, work environment, and so on are all important factors to consider. He did, however, invent the concept of enlightened agents, whose application was limited to issues involving empirical facts. Mattera and Baena (2019) developed a stakeholder theoretical model in which all parties have an equal opportunity to benefit from the enterprise.

Figure 3: Stakeholder Theory

Company Compliance

Kingfisher Plc

In June 2020, the corporation created new strategic plan. Today, Kingfisher is a very different company in terms of productivity, financial stability, and productivity, with the ultimate goal of realizing the company’s full potential. For many years, Kingfisher has worked to revitalize the home improvement industry and strengthen its reputation as a pioneer in providing consumers with environmentally friendly products (Demirag, 2018). They will be able to develop their business safely, sustainably, and ethically for the benefit of everybody if they allocate capital orders to meet the demands and expectations of its changing world. Kingfisher Plc world class home improvement business offering products and services and trade professionals who shop in their stores and e-commerce channels. They make better homes accessible for everyone and provide tradespeople with the relevant products in the right place to get their work done quickly. They aspire to make a genuine and long-term constructive contribution to society, in addition to providing long-term benefits to their shareholders.

According to Part C of the UK Charter, management must present a fair, balanced, and transparent assessment of the company’s situation and prospects. The board should decide on the type and scope of significant risks it is willing to take in order to achieve its strategic goals. A solid internal control and risk management framework should be supported by the board (Dorobantu et al., 2019). Management should prioritize the formalization of corporate information, risk management, and internal control principles, as well as formal, transparent agreements with company auditors. The Board monitors and assesses progress toward its objectives through routine receiving the information on the delivery of the Strategic and long strategic plan and financial performance (Kingfisher, 2022). Throughout the year, the Board broadened the scope and application of a commercial dashboard to include market dynamics, competitor information, and customer insight, as well as to help the Board track key information across the corporate. The Board directs and reviews Kingfisher’s activities through the powers conferred to its Committees, allowing risk to be managed and monitored within defined guidelines. The Board of Directors is collectively responsible to the Company’s shareholders for the proper operation and profitability of the organisation.

According to Section E of the UK Charter, the objective must be mutually agreed upon with shareholders (Basuony, 2021). It is the overall responsibility of the Board of Directors to maintain positive interactions with shareholders. The board should use the general meeting to promote and encourage investor participation. All actions, some of which are collaborative initiatives with community groups, promote access to professional care to improve the emotional well-being and support of employees who show early signs of depression. All employees have access to employee assistance programs and other tools to help them improve their well-being.

Crest Nicholson Holding Plc

Crest Nicholson Holding Plc is focused towards becoming a better business, where high-quality construction and the development of attractive, sustainable communities are backed by strong organizational effectiveness. Crest Nicholson is committed to meet its responsibilities to stakeholders and to seek continued growth in the standards that are applied across the company (Crest Nicholson, 2022). The company reviews its strategies and management systems on a regular basis to ensure that they are fully implemented in day-to-day work.

According to Part E of the UK Contract, the company’s primary stakeholders are shareholders, employees, regulators, customers, and business organizations. To communicate effectively with stakeholders, the Advisory committee strives to interact with them and analyzes its participation methods on a regular basis. Crest Nicholson strives to create a work environment that fosters talent and encourages personal development, and it has a distinct team and company culture that is managed by a professional and experienced operations management staff (Crest Nicholson, 2022). They are relieved that in 2020, they were able to respond to the global epidemic’s problems while also continuing to transition to a fully functional home-based business and maintaining a high level of personnel, safety, and well-being. Its workforce planning has been flexible and responsive to industry changes, and it plans to continue investing in team expansion and talent development.

Conclusion and Recommendations

According to the findings of the preceding research, the importance of corporate governance is determined by its contribution to both the development and accountability of businesses. As a result, the UK Securities and Exchange Commission is working to improve corporate governance standards in the country. In March 2002, they issued the Corporate Governance Code, which was the first significant attempt. It was then incorporated into the listing regulations of the three stock exchanges and applied to publicly traded corporations. Management standards, according to the amended contract, are dynamic and must be updated to promote healthy governance. As a result, the process of revising the Charter to define the business sector, the transformation of the financial market, and the management requirements that emerge has begun.

The goal is to improve corporate governance standards in the country while maintaining international corporate governance trends in mind. The key to good corporate governance is a mental shift. This is the responsibility of all stakeholders, not just regulatory authorities. It should be regarded as a means of achieving value and stability, and should benefit only from long-term economic growth and macroeconomic development. The Board is asked to seek a balance of CEOs and nonexecutive directors with the necessary skills, proficiencies, knowledge, and expertise for core competencies and multi-stakeholder groups, including people and minority interests.

References

Anantharaman, D., Gao, F. and Manchiraju, H., 2021. Does Social Responsibility Always Begin at Home? The Relation Between Firms’ Pension Policies and Corporate Social Responsibility (CSR) Activities. SSRN Electronic Journal,.

Basuony, M., 2021. Corporate governance: Does it matter for corporate social responsibility disclosure via website and social media by top listed UK companies?. Corporate Ownership and Control, 19(1), pp.84-93.

Crest Nicholson, 2022. Corporate governance | Crest Nicholson. [online] Crestnicholson.com. Available at: <https://www.crestnicholson.com/investors/corporate-governance> [Accessed 5 April 2022].

Demirag, I. (2018). Corporate Social Responsibility, Accountability and Governance: Global Perspectives. Boca Raton, FL: Routledge

Dorobantu, S., Aguilera, R., Luo, J. and Milliken, F., 2019. Sustainability, stakeholder governance, and corporate social responsibility. 5th ed. London: Emerald Group Publishing.

García Martín, C. and Herrero, B., 2018. Boards of directors: composition and effects on the performance of the firm. Economic Research-Ekonomska Istraživanja, 31(1), pp.1015-1041.

Jeffrey, S., Rosenberg, S. and McCabe, B., 2019. Corporate social responsibility behaviors and corporate reputation. Social Responsibility Journal, 15(3), pp.395-408.

Kingfisher, 2022. Corporate Governance. [online] Available at: <https://www.kingfisher.com/en/investors/corporate-governance.html> [Accessed 5 April 2022].

Manning, B., Braam, G. and Reimsbach, D., 2018. Corporate governance and sustainable business conduct-Effects of board monitoring effectiveness and stakeholder engagement on corporate sustainability performance and disclosure choices. Corporate Social Responsibility and Environmental Management, 26(2), pp.351-366.

Mattera, M. and Baena, V., 2019. The key to carving out a high corporate reputation based on innovation: corporate social responsibility. Social Responsibility Journal, 11(2), pp.221-241.

Nour, A., Sharabati, A. and Hammad, K., 2020. Corporate Governance and Corporate Social Responsibility Disclosure. International Journal of Sustainable Entrepreneurship and Corporate Social Responsibility, 5(1), pp.20-41.

Prince, J., 2021. Ownership Characteristics,Corporate Social Responsibility, Resource Productivity And Firm Performance: An Empirical Study. Indian Journal of Corporate Governance, 14(1), pp.71-85.

Rashid, A., 2018. The influence of corporate governance practices on corporate social responsibility reporting. Social Responsibility Journal, 14(1), pp.20-39.

Seifi, S., and Crowther, D. (2018). Stakeholders, governance and responsibility. Bingley: Emerald Publishing Limited

Tarighi, H., Appolloni, A., Shirzad, A. and Azad, A., 2022. Corporate Social Responsibility Disclosure (CSRD) and Financial Distressed Risk (FDR): Does Institutional Ownership Matter?. Sustainability, 14(2), p.742.

write

write