Overview of the Company in China and the United States

Apple Inc. is an American multinational corporation that focuses on technological innovation. Apple Inc. primarily manufactures iPhones, Macs, Apple Watches, iPads, iPods, and AirPods headphones (Levy, 2023), among other electronic devices. Apple has released several different operating systems, a browser for the internet, a musical identifier, and several different computer programs, including Final Cut Pro and XCode. Apple also provides its clients with high-quality online services, such as Apple Music, the iTunes Store, iMessage, and other iCloud, AppleTV+, and many more (Levy, 2023). Apple Computers, Inc. was established in 1976 by Steve Wozniak, Steve Jobs, and Ronald Wayne (Reuters, 2020). With more than $260 billion in sales in 2019, Apple is a very profitable company by 2020 standards (Reuters, 2020). Reuters (2020) states that Tim Cook(CEO) and Jeff Williams (COO) are the most influential people in the organization. Apple is expanding its operations worldwide despite its already considerable success.

AAPL.O, Amazon, Google, Microsoft, and Facebook constitute the Big Tech oligopoly. Consumer electronics and associated software are among the items and services it provides for consumers(Levy, 2023). Because of this fruitful focus, the corporation now rules the markets of the Americas and Europe. Additionally, Apple is a frontrunner in the booming I.T. markets of Japan, China, the city of Hong Kong, and Taiwan. This paper examines the Apple Smartphone market in China and the USA. The report’s author is Apple’s top economic counsellor, and it aims to provide light on how the two nations’ macroeconomic environments influence Apple’s bottom line.

Analysis of the Market Structure

United States

The United States has a vast population and a relatively high per capita income, making it a leading smartphone market. Only China and India have larger consumer bases than the United States. Ninety-one per cent of American homes have mobile devices, and most have smartphones (Okusolubo, 2020). According to Mordor Intelligence, the smartphone industry was worth $714.96 billion in 2019, and it is projected to be worth $1,351.8 billion in 2025 at a compound annual growth rate (CAGR) of 11.2% between 2020 and 2025 (Crabtree, 2020). The smartphone industry in the United States produces an estimated $75 billion in annual income. Apple and Samsung constitute approximately 34 of the country’s smartphone market and maintain their dominant positions. Apple has over 48% of the market among its rivals, while Samsung controls 25% (Crabtree, 2020). Apple and Samsung remain at the top of the corporate food chain despite a very competitive market in the United States. Due to distribution constraints and government restrictions, it is challenging for new companies to enter the American market.

A worldwide technology leader, Huawei is an unlucky example of overseas growth in the United States. The Trump administration’s administrative ban on Huawei’s activities in the nation hurt the firm even though it is the world’s top smartphone supplier. Due to issues related to national security, the President has ordered several companies, including Huawei, to limit their operations (Perper, 2022). Repeated allegations of industrial espionage have damaged Huawei’s image. In addition, the investigation by the government showed that Huawei infringed U.S. sanctions by lying to banks about its business in Iran. At the moment, American businesses require government approval before they can do business using Huawei (Perper, 2022). The rule reduced the Chinese tech giant’s access to Android upgrades and Google services. This eliminates a potential threat to Apple’s market share. Samsung is the firm’s biggest rival in the American market.

China

China’s economy is expanding at double that of the United States, making it the world’s second-biggest. Given the ‘youth’ underlying the Chinese market, government policy is more accommodating to foreign companies looking to shop there. As a result, the Chinese market is flooded with several rival brands, including Huawei, Apple, Oppo, Xiaomi, Vivo, and countless more. Huawei dominates the Chinese market for 5G smartphones, with a 60% share as of 2020 (Crabtree, 2020), in stark contrast to its American counterparts. For instance, Crabtree (2020) notes that “Huawei controls 46% of the Chinese smartphone market,” more than the market shares of its competitors Oppo, Vivo, & Xiaomi put together. As a result of the worldwide pandemic, the Chinese smartphone market has dropped by 17% (Crabtree, 2020). Vivo, Oppo, & Xiaomi have all seen losses of roughly 30% of their market share. However, positive shifts and gradual market stabilization are expected in 2020’s second half.

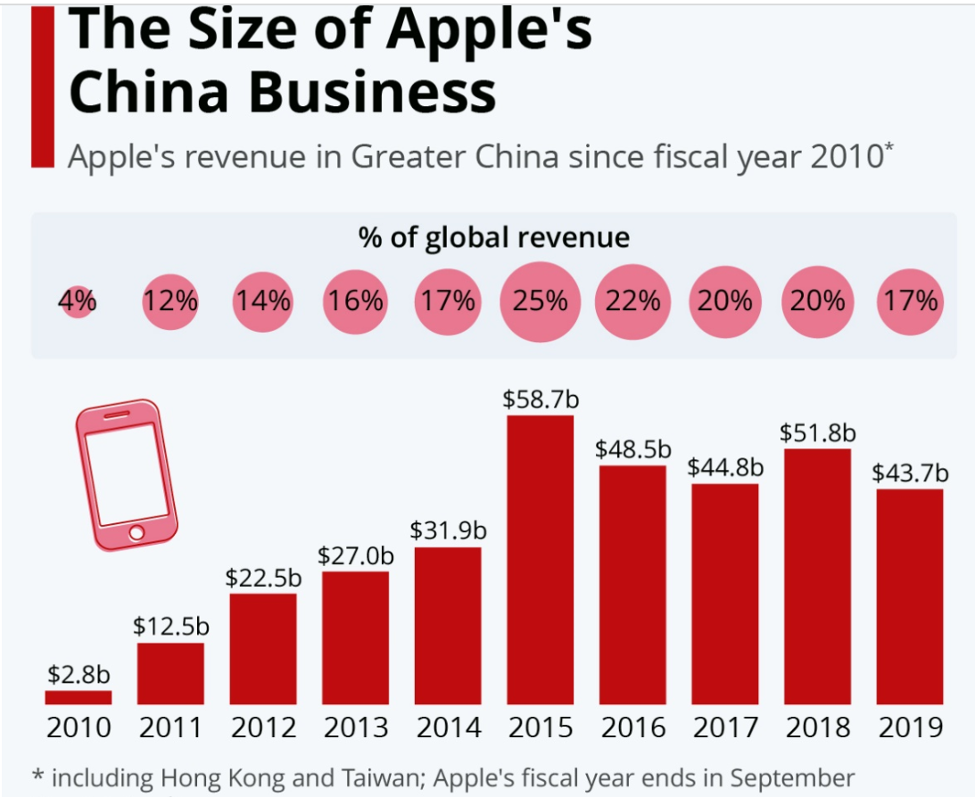

The size of Apple’s China business

Apple’s efforts to establish a foothold in China have met with resistance due to restrictions imposed by the government. Apple’s sales in China have increased by over twenty since the company entered the market in 2010 (Kolakowski, 2021). China contributed $25 billion to Apple’s total sales in 2015, a record high of $58.7 billion (Kolakowski, 2021). The proportion, however, has dropped in only four years to 17% (Kolakowski, 2021). Economic and political disputes between the United States and China led to this decision.

Comparative Analysis of Macroeconomic Indicators

GDP Growth Rate

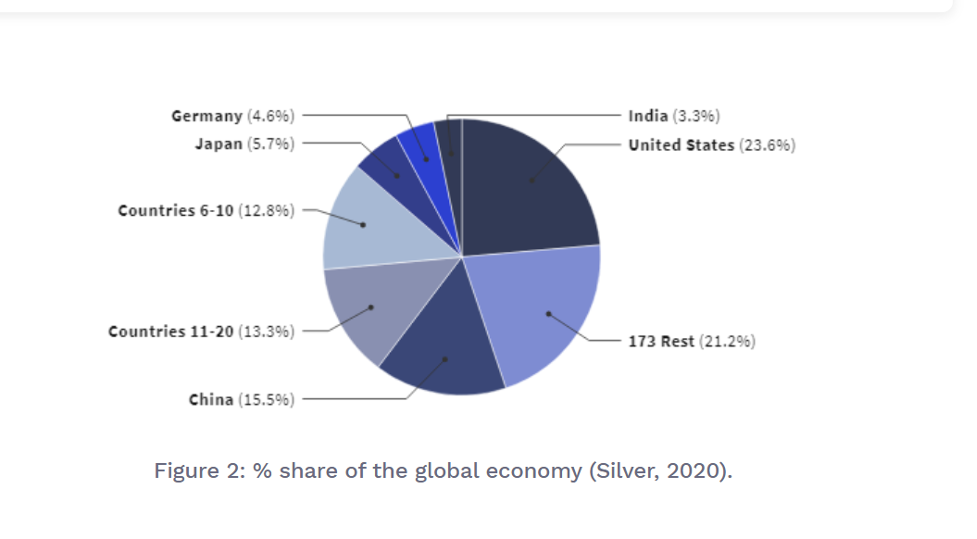

Both the Chinese and American economies felt the effects of the worldwide recession between 2007 and 2009. The recovery and increasing trend of both the Chinese as well as American economies are seen in the graph. Increased wealth and income in order disparity, according to Macrotrends (2020), is the main reason the U.S. economy is growing slower than it did in the 1980s and 1990s. In nominal terms, the United States economy was worth more than $20,000,000,000 in 2018 (macrotrends, 2020). Since the United States economy accounts for one-fourth of the world economy, it is often called an economic superpower. The United States has economic success due to its well-developed infrastructure, technological innovation, and plenty of natural resources.

Regarding PPP, China has overtaken the United States as the world’s leading economy. The U.S. economy was valued at $21.44 trillion, whereas China’s GDP (PPP) was $27.51 trillion. Over time, the gap between the U.S. and China’s economies has shrunk considerably. China’s economy was the world’s seventh biggest in 1980, according to data compiled by Trading Economics (Trading Economics, 2019). As of 2018, China’s nominal GDP was $13.37 trillion, putting it $7.2 trillion behind the United States. According to estimates (TRADING ECONOMICS, 2019), the gap will narrow to $5.5 trillion by 2023. The gap between China and the United States regarding nominal GDP is forecasted to narrow. Apple Inc.’s business decisions have been heavily affected by the United States financial benefits, such as its advanced infrastructure, cutting-edge technology, and plentiful natural resources. The country’s vast and prosperous middle class has a lot of buying power, which is excellent news for the corporation.

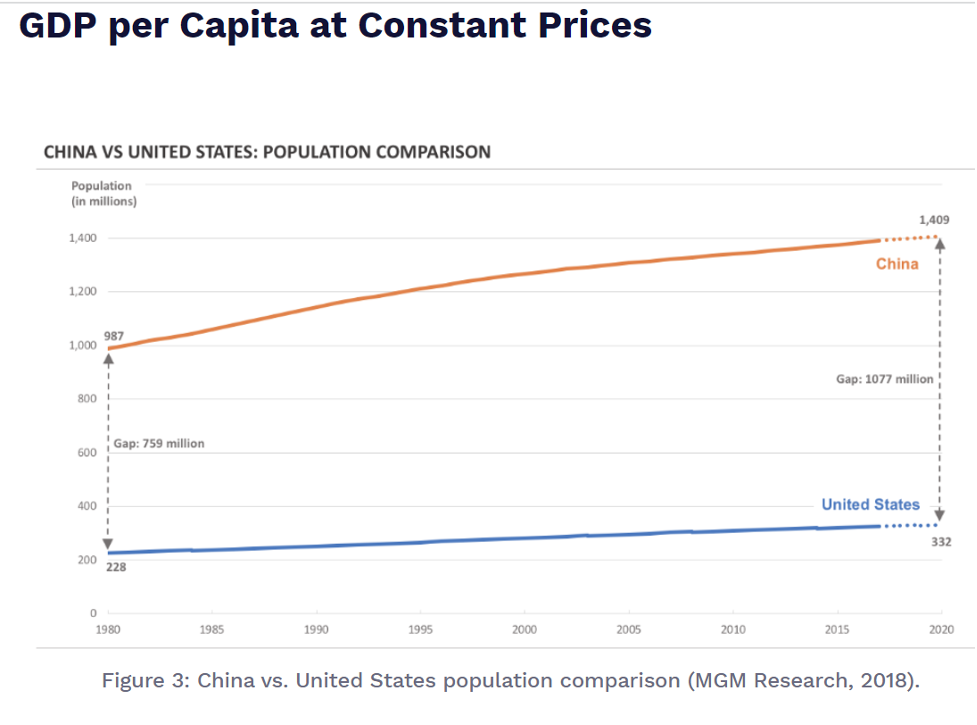

GDP per capita at Constant Prices

CHINA VS UNITED STATES: POPULATION COMPARISON

Before comparing GDP per capita, check on populations. Experts predict that Chinese population growth will match American growth. According to Statistics Times (2021), China had about four times the population of the U.S. in 1980 and would stay approximately the same in 2020. China’s estimated GDP per capita of $10,971 by 2020 is still lower than America’s $12,55 in 1980. Statistics Times, 2021 China and the U.S. have different GDP per capita measurements. These figures show American and Chinese consumer disparities. American families have more purchasing power and discretionary money. Americans value innovation as well as brand recognition above pricing. Due to the lower GDP per capita, Chinese customers are more price sensitive, which might affect Apple’s sales. Chinese shoppers may choose cheaper brands or alternatives. Apple might have to alter its price strategy, provide cheaper products, or highlight the benefits of its premium products to compete in China. Apple’s reputation as a brand and reputation for development also influence Chinese customers’ buying choices, enabling the business to stay strong despite pricing.

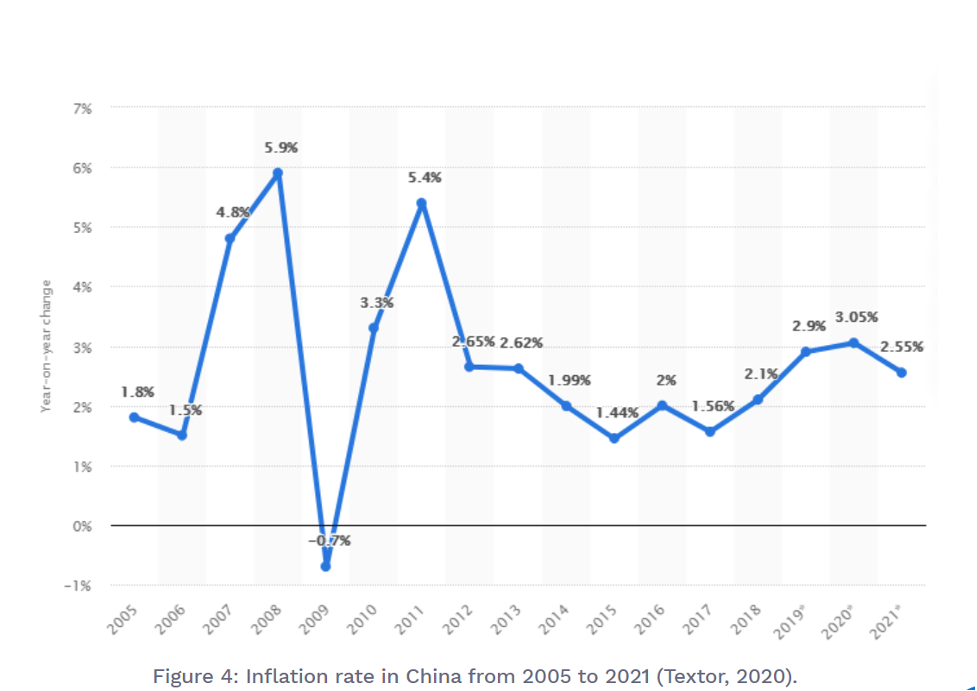

Inflation Rate

The United States generally had moderate inflation rates, except in 2007–2009. One of the most devastating economic disasters in history, the global financial crisis 2008, caused inflation rates to spike in China and the United States. In contrast, American rates have stabilized during the last several years (Leswing, 2022). This meant that Apple had a few challenges when trying organic expansion. The American economy has stability, which might have helped the corporation.

China’s annual inflation rate was over 21%, up from nearly 17% the year before. China’s inflation rate is modest relative to other emerging markets. Most of any budget should go toward necessities like housing, food, transportation, clothing, and entertainment. Leswing (2022). Inflation in China fell to 2.4% in August 2020 from 2.7% in July 2020, following market expectations (Macrotrends, 2020). This follows the Chinese government’s efforts to return the economy to its pre-Covid status. China’s anti-virus measures are successful, showing the nation can weather economic storms.

Unemployment Rate

According to the latest data, China and the United States have significantly different unemployment situations. Despite many company failures, China’s unemployment rate grew during the coronavirus epidemic from 5.2% (reported at the end of 2019) to 5.9%. However, China has changed its approach to collecting employment statistics, moving from keeping tabs on registered urban inhabitants to conducting monthly surveys among city dwellers. According to this shift, the stated unemployment rate may not reflect the nation’s fundamental level of job losses. However, the global financial crisis of 2007-2009 profoundly affected the American job market, with the unemployment rate reaching a high of 9.63% in 2010.

After a decade of decline, the U.S. jobless rate fell below 3.5 per cent in February 2020. However, due to the widespread disruptions brought on by the COVID-19 pandemic, the unemployment rate peaked at 14.7% in April 2020 and is expected to rise much more in the following months. Apple, which may have had difficulties owing to disrupted supply chains and lower customer demand, notably in China, might be affected by the employment gap between China and the United States.

According to government data, unemployment rates in China and the United States have followed separate paths. As a result of changes in how China reports its statistics, the country’s official rate likely understates the true extent of its employment losses. The unemployment rate in the United States rose sharply during the 2008 financial crisis, then fell briefly before rising again after the COVID-19 epidemic. Apple, which has operations in both countries, may have been affected by the disparate market circumstances and interruptions brought on by the epidemic.

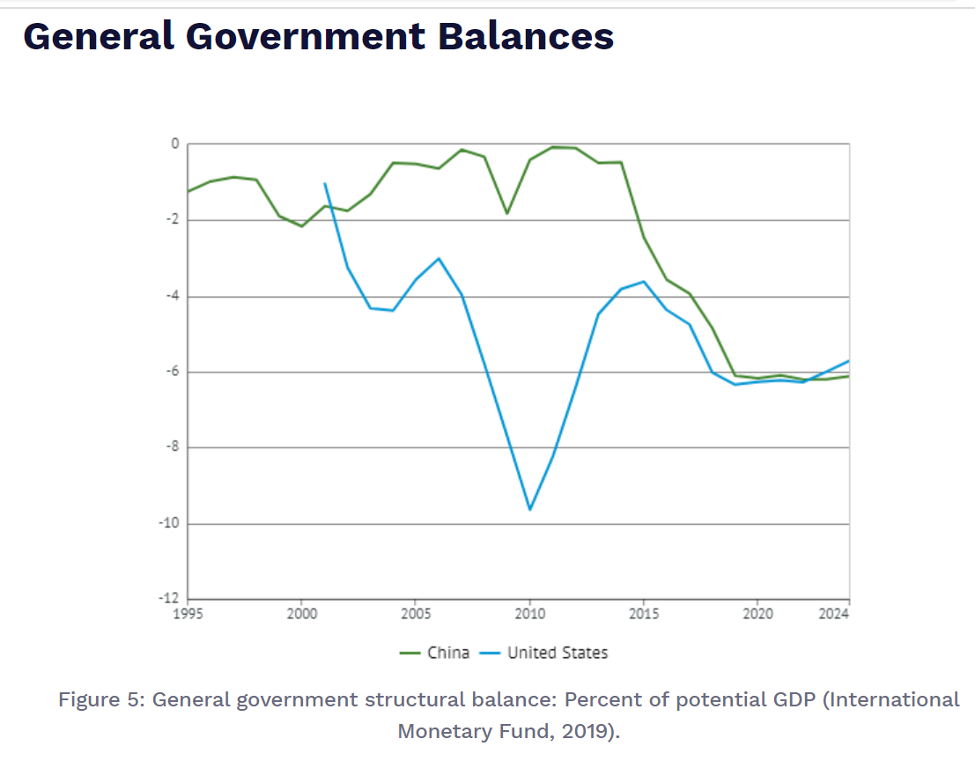

General government balances

General government finances of China and the United States vary little. One example is the -6.1% structural balance of the Chinese government in 2019 (Washington, 2020). The number went up and down throughout the years but decreased significantly from 2000 to 2019. Up from -6% in 2018 (Washington, 2020), the general federal structural balance in the United States rose to -6.3% in 2019. Apple’s business operations benefit from the budget deficits in both nations because they enable Apple to expand and prosper over the long term. Apple may benefit from the relative government stability in the United States and China. Both nations’ budget deficits help Apple develop and expand by creating a favourable setting where the company may do business (-6.3% in the U.S. and -6.1% in China, respectively).

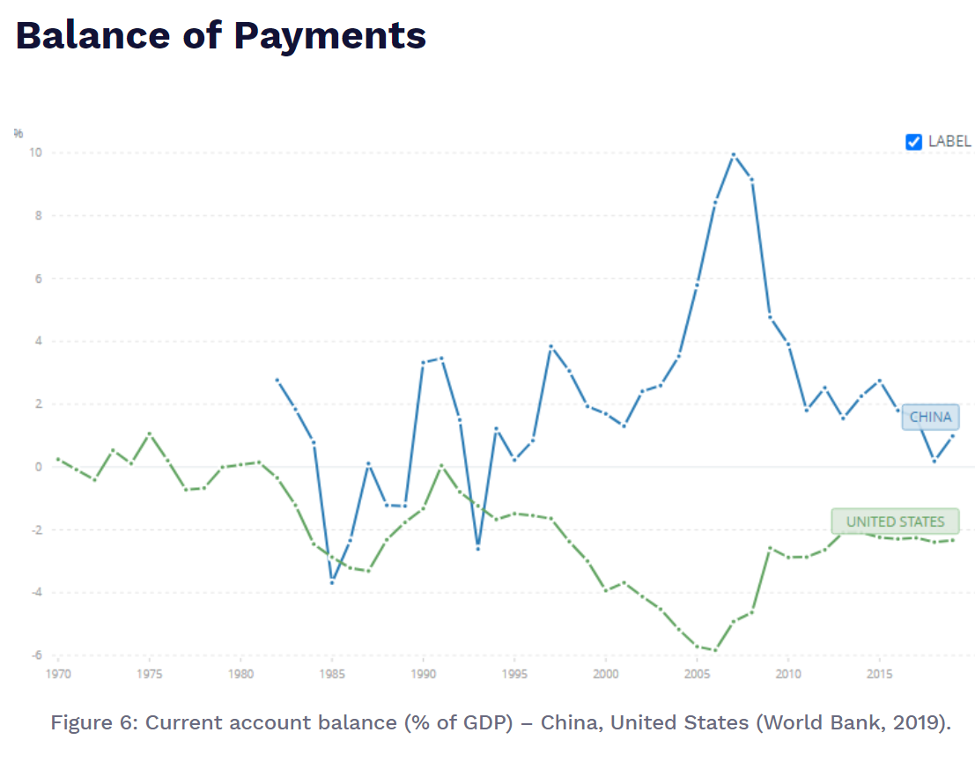

Balance of Payments

Current Account Balance (% GDP)

The economic relationship between China and the United States was defined by American overconsumption and Chinese overproduction, as seen in the graph below. Since then, however, a trade war has erupted between the world’s two biggest economies (TRADING ECONOMICS, 2023), and the situation has shifted. The financial balance between the two nations has been more even during the previous decade. Nonetheless, the United States cannot manufacture enough products to satisfy domestic demand in 2019 (TRADING ECONOMICS, 2023), as shown by the country’s negative current account of -2,332. However, China’s balance of trade is +0.985. Though far lower than its 2007 high of about 10, China’s trade surplus between imports and exports significantly contributes to its rapid economic expansion. Apple may be affected by the ongoing trade dispute between the United States and China. If either nation imposes tariffs or other trade restrictions, Apple’s supply chain might be disrupted, and consumer prices could increase. Sales and operations at Apple need to be improved by market tensions and unpredictability in both the United States and China.

Analysis of the Monetary and Fiscal Policy

The primary contrast between Chinese and American monetary policies is the emphasis on free market policies in the United States and the dominance of government expenditures in China. The Chinese economy has been relatively stable because of the government’s heavy involvement in investing rather than the private sector. Recent changes, however, have decentralized power even more to small firms, which may influence economic swings. However, improvements in output and efficiency have resulted from China’s reforms.

China’s monetary policy is considered neutral and conservative, and the country has adequate cash on hand. Due to the country’s aggressive fiscal strategy, investments in new businesses, technologies, and sectors have bolstered China’s competitive position. The United States, on the other hand, has an open market policy that is good for businesses like Apple that are based there. The U.S. government uses unorthodox policy measures to increase access to credit and reduce borrowing costs. When people deposit checks with the Federal Reserve, the funds are used to buy government assets, increasing the money supply.

Due to the worldwide market consequences of the epidemic, the significance of monetary policy has been underlined in the United States in recent years. Government attention shifts from fiscal policy to monetary policy as a means of economic stability. Apple is an international corporation, and the economic operations in each country may be severely affected by the policy differences between China and the United States. Apple’s supply chain, manufacturing prices, and market access are susceptible to changes in China due to the government’s control over investments and economic volatility. Legislative changes and adjustments in competitive dynamics may affect Apple’s operations and market position brought about by reforms favouring local firms.

Federal Reserve monetary policy influences borrowing prices and credit availability in the United States, which affects consumer spending and demand for Apple’s goods. Apple’s sales and profits in the U.S. market may be affected by the greater focus on monetary policies to stabilize the economic measures.

Analysis of Foreign Trade Policy Instruments

As was previously said, the United States’ excessive consumption habits make the nation reliant on importing resources and exporting finished goods. The United States has traditionally had a trade deficit, but President Trump has enacted policies (such as tariffs) to reduce the imbalance. The President’s goal in raising tariffs and erecting other trade barriers in 2018 was to slow the flow of goods from China (Siripurapu & Berman, 2022). The Chinese government retaliated by imposing higher tariffs on all U.S. imports. There are some winners in the spat between two of the world’s economic powerhouses, and Samsung is one of them. The trade conflict cleared the way for non-Chinese manufacturers to enter profitable markets unopposed. However, things are not looking good for Apple at the moment.

The Chinese reaction to American actions has directly impacted Apple’s business in China for several reasons. Second, Apple’s supply network has traditionally been based in China. This supply chain, which can be defined as a complicated and intricate web, brings components from all over the globe to Chinese facilities, where they are assembled by outsourcers like Foxconn and Pegatron (Siripurapu & Berman, 2022). Therefore, Apple’s dependence on China is vulnerable in light of recent developments. As Chinese customers have shown more loyalty to domestic companies like Huawei (Crabtree, 2020), the firm has seen a fall in revenue. Apple has a degree of political protection because it employs more than 5,000,000 Chinese nationals (Siripurapu & Berman, 2022). Despite this, the Chinese government pressured the corporation into removing HKmap.live from the AppStore (Siripurapu & Berman, 2022). Apple should give up hope that relations between the U.S. and China may be repaired. The company should instead begin shifting some of its manufacturing to other sites, although on a minimal scale.

Conclusion:

In conclusion, market dynamics, macroeconomic indicators, government regulations, and trade agreements all impact Apple Inc.’s economic operations in China and the United States. Although there is a sizable and well-off market for Apple’s wares in the United States, breaking into the market is difficult due to the country’s intense competition and limited distribution channels. While China’s expanding economy and massive population provide enormous opportunities, government limitations and fierce competition from local businesses present particular obstacles for Apple. The buying power of consumers and the market’s desires are affected by differences in macroeconomic data between the two nations. Moreover, foreign trade policy tools, such as disparities in monetary and fiscal policies, may impact Apple’s supply chain, production costs, and market access. Apple must adjust its plans, consider China’s pricing sensitivity, handle trade concerns, and diversify its manufacturing base to succeed in this environment.

References

Crabtree, J. (2020, May 24). Apple has found itself caught between China and the U.S. Wired U.K. https://www.wired.co.uk/article/apple-china.

Huld, A. (2022, June 10). China’s Economic Stimulus Explained – Monetary and Fiscal Policy. China Briefing News. https://www.china-briefing.com/news/chinas-economic-stimulus-explained-monetary-fiscal-policy/

International Labour Organization. (2022a). China: Labour Market and Income Insecurity. Www.ilo.org. https://www.ilo.org/public/english/protection/ses/info/database/china.htm

International Labour Organization. (2022b). Trends 2022 ILO Flagship Report World Employment and Social Outlook EXECUTIVE SUMMARY. https://www.ilo.org/wcmsp5/groups/public/—dgreports/—dcomm/documents/publication/wcms_834067.pdf

Kolakowski, M. (2021, March 17). At $1 Trillion, Apple is Bigger Than These Things. Investopedia. https://www.investopedia.com/news/apple-now-bigger-these-5-things/

Krugman, P. (2022). International Aspects of U.S. Monetary and Fiscal Policy. https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=e013871df04c30e10b7f4107dd59aee2226d7b8d

Leswing, K. (2022, July 1). How inflation will affect Apple. CNBC. https://www.cnbc.com/2022/07/01/wealthy-customers-will-help-apple-resist-the-effects-of-inflation.html

Levy, S. (2023). Apple Inc. In Encyclopedia Britannica. https://www.britannica.com/topic/Apple-Inc

Macrotrends. (2020). U.S. GDP Growth Rate 1961-2020. Macrotrends.net. https://www.macrotrends.net/countries/USA/united-states/gdp-growth-rate

Macrotrends. (2020). U.S. Inflation Rate 1960-2020. Macrotrends.net. https://www.macrotrends.net/countries/USA/united-states/inflation-rate-cpi

McKitterick, W. (2022). THE SMARTPHONE MARKET, BY COUNTRY: Adoption, platform, and vendor trends in the U.S., China, and India. Business Insider. https://www.businessinsider.com/the-smartphone-market-by-country-adoption-platform-and-vendor-trends-in-the-us-china-and-india-2016-4?r=US&IR=T

Okusolubo, G. (2020). (PDF) Organizational Analysis (A Case Study of Apple Inc.). ResearchGate. https://www.researchgate.net/publication/340950157_Organizational_Analysis_A_Case_Study_of_Apple_Inc

Perper, R. (2022). Apple has reignited a privacy battle with the Trump administration by declining to unlock a mass shooter’s iPhones. Business Insider. https://www.businessinsider.com/apple-reignites-privacy-battle-with-trump-administration-over-shooting-2020-1?r=US&IR=T

Siripurapu, A., & Berman, N. (2022, March 1). The Contentious U.S.-China Trade Relationship. Council on Foreign Relations. https://www.cfr.org/backgrounder/contentious-us-china-trade-relationship

StatisticsTimes. (2021). Comparing China and the United States by population – StatisticsTimes.com. Statisticstimes.com. https://statisticstimes.com/demographics/china-vs-us-population.php

TRADING ECONOMICS. (2019, January 21). China 2018 GDP Growth Weakest in 28 Years. Tradingeconomics.com; Trading Economics. https://tradingeconomics.com/china/gdp-growth-annual

TRADING ECONOMICS. (2023). China – Current Account Balance – 1982-2018 Data | 2020 Forecast. Tradingeconomics.com. https://tradingeconomics.com/china/current-account-balance-bop-us-dollar-wb-data.html

Trading Economics. (2019, July 27). United States GDP Annual Growth Rate. Tradingeconomics.com; TRADING ECONOMICS. https://tradingeconomics.com/united-states/gdp-growth-annual

Transcribers, M. F. (2020, April 30). Apple Inc. (AAPL) Q2 2020 Earnings Call Transcript. The Motley Fool. https://www.fool.com/earnings/call-transcripts/2020/04/30/apple-inc-aapl-q2-2020-earnings-call-transcript.aspx

Washington, D. (2020). UNITED STATES SECURITIES AND EXCHANGE COMMISSION. https://s2.q4cdn.com/470004039/files/doc_financials/2020/ar/_10-K-2020-(As-Filed).pdf

write

write