Introduction

Smith & Nephew Company is a global medical technology producer. It manufactures advanced orthopedic reconstruction products, wound management products, and arthroscopy products (Smith & Nephew, 2022). Smith &Nephew Company is listed on the London Stock Exchange and part of the FTSE 100 Index. The company’s headquarters are based in Watford, England. It currently employs 17,500 people. In 2021, the company recorded a revenue of $5.212 Billion and a net income of $524 million. The company has acquired various subsidiaries in an attempt to expand its product range (Smith & Nephew, 2022). In February 2014, Smith & Nephew acquired ArthroCare. They did this in an attempt to broaden Smith & Nephew’s sports medicine range for noninvasive surgery. In October 2015, Smith & Nephew acquired Blue Belt Technologies for US$275 million so as to secure a position in the orthopedic robotics-assisted surgery sector. In March 2019, the company acquired Brainlab’s orthopedic joint reconstruction so as to strengthen their position in the robotic surgery sector. In June 2019, the company announced the acquisition of the Swiss-based Atracsys Sàrl, a manufacturer of optical tracking utilized in computer-assisted surgery. In January 2021, the company announced the acquisition of Integra Lifesciences extremity orthopedics business. In January 2022, Smith & Nephew made an acquisition of Engage Surgical, a partial knee implant company (Mergr, 2022). This paper analyses various aspects of Smith & Nephew and how they influence the company.

Opportunities and Threats in the Business Environment

One of the threats that Smith &Nephew Company may face is the slowdown of the economy due to the Covid-19 pandemic. Fernandes (2020) points out that Covid-19 has had a negative impact on economies across the globe, with the global economy falling by 3.2%. The economy of the United Kingdom has fallen by nearly 10%, although it is predicted to grow by 6.5% this year. The growth can be attributed to the reduction of lockdown restrictions, but with the constant changes in Covid variants, the improvement in the economy is not certain. The sluggish growth of the economy may cause a reduction in the revenue generated by Smith & Nephew in the coming years as its consumers will be less inclined to spend in the falling economy. The slowed economic growth also affects the companies that supply Smith & Nephew with the raw materials they need to manufacture their products (Afonso & Furceri, 2010). This would result in an increase in the prices of raw materials, and the company would consequently have to increase the prices of its products which would push away their customers.

The fallout from Brexit would also be a potential threat for Smith &Nephew. According to Bloom et al. (2018), Brexit would increase the cost of importing raw materials from suppliers who reside in European Union countries. This would put the company in a tough spot where they would have to choose to forward extra costs to the customer and run the risk of losing clients, or they could take the hit and shield the client. Either way, the company would find itself in a lose-lose situation. These extra costs would cut into Smith & Nephew’s profit margins. Additionally, the changes that will happen in the United Kingdom’s regulatory frameworks as they distance themselves from European Union frameworks would cause challenges for the company as they try to navigate their way through these changes in regulation and determine how they are going to affect their business processes such as contracts (Moschieri & Blake, 2019).

Despite the threats that Brexit is bound to bring about, it is also expected to bring about some exciting opportunities too. The British government has introduced some incentives for businesses such as Smith & Nephew in regards to their manufacturing. In March 2021, the British government introduced the Super Deduction, which gave companies investing in new plant and machinery assets for their production an opportunity to offset 130% of the cost against their tax bill (Bernstein, 2021). This would give Smith & Nephew a chance bills by to cut their tax bills by a quarter. This would give the company an opportunity to increase its manufacturing plants in the country at a lower cost. Brexit would also allow the company to sell its products in more markets as the United Kingdom will no longer be bound to the European Union trade restrictions. They will now be provided the opportunity to trade in untapped emerging markets.

Business Objectives and Strategies

Smith & Nephew aims to use technology to remove the limits of living by helping medical professionals do the best they can (Smith & Nephew, 2022). They do this by creating a culture of empathy toward their customers, where they step into the customer’s shoes to anticipate their needs so that they can deliver the best products through innovation. They try to understand their patients so that they develop their products with the customer in mind. This would help Smith & Nephew to continuously improve and expand the positive impact that their products bring to the world. Smith & Nephew also strives to build a culture of collaboration so that they can achieve this objective. They join forces with their companies in the industry so that they can provide their consumers with products that are efficient. According to Smith & Nephew(2022), they maintain transparent communication to have a shared sense of purpose between its subsidiaries. They strive to emphasize the impact of an individual subsidiary on the company’s collective goal. To provide their customers with the best products, they encourage learning and innovation in the company by encouraging their stakeholders to push the industry’s boundaries and search for solutions through talent and will.

Measures of Success

Smith & Nephew is doing really well as their liquidity ratios look promising. They have a current ratio of 2.17% and a liquidity ratio of 0.61% (ADVFN, 2022). This indicates that the company has more than enough assets to pay its debts. The company, however, would have a tricky time paying debts from sources that do not originate from cash flow as their total debts to net current assets ratio stands at 2.15% (ADVFN, 2022). In spite of this, Smith & Nephew is recording good profitability ratios as their net profit margin ratio currently stands at 10.05%. The company’s revenue grew 14.3% in 2021, from $4.56 billion in 2020 to $5.212 billion in 2021. Their operating profit also increased by 101%, from $295 million in 2020 to $593 million in 2021. Their trading profit also increased in 2021 as they recorded trading profits of $936 million as opposed to $683 million in 2020 (ADVFN, 2022). The company has also been innovative as it introduced new products into the market in the first quarter of 2022. They recently announced that they would feature sports medicine technology. They also announced a new study that showed that their product GRAFIX Membrane cuts the recurrence rate of foot ulcers by half in comparison to other competitors in the industry.

Corporate Growth and Development

Smith & Nephew has grown exponentially at the corporate level, as indicated by the number of mergers and acquisitions that the company has undertaken since its inception. Smith & Nephew has acquired 34 companies in its lifetime, with 8 of these acquisitions happening in the last half-decade. 8 of the 34 acquisitions have come from private equity companies. The largest acquisition that the company has made took place in 2015 when it acquired ArthoCare for $1.5 billion(Mergr, 2022). The company made its most recent acquisition in January 2021, when it acquired the Extremity Orthopaedics business of Integra Life Sciences Holdings Corporation. This acquisition supported the company’s strategy to make investments in higher-growth segments. The acquisition would strengthen the company’s extremities business, with the fruits from this acquisition taking shape with the launch of a shoulder replacement technology which is to be commercially available in 2022. The company’s sectors targeted in its acquisitions have been the medical products and the life science sectors. The company has also divested 4 of its assets. The largest sale the company ever made occurred in 2016 when they sold Smith & Nephew – Gynecology Business to Medtronic for $350 million (Mergr, 2022). The acquisitions made by Smith & Nephew have enabled the company to provide its customers with top-shelf products. This acquisition can be linked to the company’s increase in its market share over the last decade.

Capabilities, Competing and Competitive Behaviours

The most relevant revenue area for Smith & nephew is the wound management sector. They offer wound management products for the treatment of wounds such as leg, diabetic, pressure ulcers, burns, and post-operative wounds. Their wound management company generates sales of up to $24.78 million, with 253 companies being under the Smith & Nephew Wound management corporate family (Dan & Bradstreet, 2022). Some of the top competitors of the Smith & Nephew wound Management Company are 3M Health Care, Organogenesis, Medline Industries, BSN medical, Systagenix Wound Management, and Molnlycke Health Care. All these companies are direct competitors of Smith & Nephew Wound Management as they produce similar products and they target the same client base. The company sustains a competitive advantage through both positioning and resources. The company has developed better products than those produced by its competitors, an example being GRAFIX Membrane, which reduces the rate of recurrence of diabetic foot ulcers by half compared to the other leading competitors in the industry (Grafix PL, 2022). The company also has both physical and human capital resources that are dedicated to the company’s research and development hence giving the company a competitive edge. The company holds a 14% market share in the wound management market, coming second to its main competitor, 3M Health Care.

International Perspectives

Smith & Nephew operates in over 100 countries around the globe. They are situated on almost all continents, including Africa, Asia, Europe, America, Australasia, and the middle east. The company has attained this international expansion through various modes. In 2011, Smith & Nephew signed a distribution agreement with Graftys, a French biotechnology company. This gave them distribution rights to the fast-setting macroporous calcium Phosphate bone void filler in the United States of America and any other countries worldwide (Nephew, 2022). PLC (2022) mentions that The company signed a partnership with St. Louis’ National Medical Billing Services to offer revenue cycle management solutions to the Ambulatory Surgery centers all over the United States. This move would improve the company’s brand exposure in the United States. Smith & Nephew has also expanded into international markets through the acquisition of local companies. In the United States, the company has acquired Engage Surgical, Kalypto Medical, and ORATEC interventions, among others. This has helped the company penetrate this market and to profit from it.

CSR and Sustainability

Smith & Nephew has undertaken corporate social responsibility and corporate sustainability with a high degree of commitment. According to Smith & Nephew (2022), they have committed approximately ten thousand hours to volunteering in communities around whom they live and work. They have also donated $1.4 million in products to underprivileged communities. They have also committed to achieving zero waste in landfills at their facilities. In 202, they reduced the waste sent to landfills by 9%, indicating that they are in the right direction. They also reduced their carbon emissions by 30%. They have also included a sustainability review in their new product development phase for all the new products they develop. They have also initiated discussions with their suppliers to partner up in an attempt to create a database that provides visibility on all the packaging materials and their composition. This would go a long way to reducing plastic waste that comes about as a result of their products. The company aims to revise its social responsibility strategy and implement it globally continuously. Smith & Nephew has been assessed in regards to the FTSE4Good criteria, and they have met all the requirements needed to be a part of the FTSE4Good Index Series. The company is also a member of the Dow Jones Sustainability Indices, and it has been a member since 2002. The company is a trendsetter in corporate social responsibility among its competitors.

Business Hot Topic and Smith & Nephew: Blockchain

Smith & Nephew have been rather silent on their usage of blockchain. However, the company has created and is implementing a technology roadmap which has offered them the opportunity to prioritize its technological investments in the business. According to RADMA (2022), the company is looking to make investments in crucial emerging technologies in its product sectors in an attempt to facilitate its growth in the future. The technological roadmap focuses on the key areas of its business so as to identify the areas that are in need of innovation.

The Medical technology industry has experienced problems in cyber security. Linchpin (2022) points out that the industry has made a lot of progress in the aspect of robotics, and these systems are susceptible to security breaches. Hackers can gain access to these devices with relative ease and tamper with them, thereby affecting the quality of the product and causing harm to the patient. Smith & Nephew have taken the initiative to hire cyber security engineers to ensure that their products are top shelf and they are not prone to cyber-attacks.

Conclusion

Smith & Nephew is a medical technology manufacturer that supplies its product to over 100 countries around the globe. Smith & Nephew is listed on the London Stock Exchange and is a part of the FTSE 100 Index. The United Kingdom-based company is experiencing threats due to the slow economic growth caused by Covid-19 and Brexit. The company may experience a reduction in revenue due to the slow economic growth being witnessed worldwide as consumers are reluctant to spend during these harsh times. The company may also find it hard to adjust to the changes resulting from Brexit. Despite this, the company aims to use technology to remove the limits of living by helping medical professionals do the best they can. They have various strategies that have been put in place to achieve this. The company is experiencing financial growth as indicated by its liquidity ratios as well as corporate growth as indicated by the numerous acquisitions that the company has made. Smith & Nephew has also dedicated itself to corporate social responsibility and corporate sustainability as they undertake several measures to accomplish this. The company has also developed a technological roadmap that will enable them to advance its products.

References

ADVFN, 2022. Smith & Nephew Company Financial Information. [online] Uk.advfn.com. Available at: <https://uk.advfn.com/stock-market/london/smith-nephew-SN./financials> [Accessed 4 May 2022].

Afonso, A. and Furceri, D., 2010. Government size, composition, volatility, and economic growth. European Journal of Political Economy, 26(4), pp.517-532. https://www.sciencedirect.com/science/article/abs/pii/S017626801000008X

Bernstein, A., 2021. Deductions at the source. Optician Select, 2021(4), pp.236536-1. https://www.magonlinelibrary.com/doi/full/10.12968/opti.2021.4.236536

Bloom, N., Bunn, P., Chen, S., Mizen, P., Smietanka, P., Thwaites, G. and Young, G., 2018. Brexit and uncertainty: insights from the Decision Maker Panel. Fiscal Studies, 39(4), pp.555-580. https://onlinelibrary.wiley.com/doi/abs/10.1111/1475-5890.12179

Dan & Bradstreet, 2022. Smith & Nephew Wound Management. [online] dun & Bradstreet. Available at: <https://www.dnb.com/business-directory/company- profiles.smith__nephew_wound_management.f6ad0280c0eefa70a072d6c187466e5a.html > [Accessed 4 May 2022].

Fernandes, N., 2020. Economic effects of coronavirus outbreak (COVID-19) on the world economy. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3557504

Grafix PL, 2022. GRAFIX PL Membrane and GRAFIX◊ Cryopreserved Placental Membrane. [online] Grafixpl.com. Available at: <https://www.grafixpl.com/grafix-prime- cryopreserved-placental-membrane-significantly-more-patients-diabetic-foot-ulcers- dfus> [Accessed 5 May 2022].

Linchpin, 2022. Medical Device Industry Challenges And Marketing Opportunities In 2022 By Linchpin SEO. [online] Linchpin SEO. Available at: <https://linchpinseo.com/medical- device-industry-challenges-and-opportunities/> [Accessed 5 May 2022].

Mergr, 2022. Smith & Nephew Mergers and Acquisitions Summary | Mergr. [online] Mergr.com. Available at: <https://mergr.com/smith-%26-nephew-acquisitions> [Accessed 4 May 2022].

Moschieri, C. and Blake, D.J., 2019. The organizational implications of Brexit. Journal of Organization Design, 8(1), pp.1-9. https://link.springer.com/article/10.1186/s41469-019- 0047-8

Nephew, S., 2022. Smith & Nephew Signs Distribution Agreement for Unique Injectable Bone Void Filler With Graftys. [online] Prnewswire.com. Available at: <https://www.prnewswire.com/news-releases/smith–nephew-signs-distribution- agreement-for-unique-injectable-bone-void-filler-with-graftys-122499338.html> [Accessed 5 May 2022].

plc, S., 2022. Smith+Nephew announces partnership with National Medical Billing Services, a leader in revenue cycle management. [online] Prnewswire.com. Available at: <https://www.prnewswire.com/news-releases/smithnephew-announces-partnership-with- national-medical-billing-services-a-leader-in-revenue-cycle-management- 301052593.html> [Accessed 5 May 2022].

RADMA, 2022. Creating and implementing a technology roadmap – Smith & Nephew | R&D Today. [online] R&D Today | RnD Today is the RADMA outreach website to make world-leading knowledge and expertise more widely accessible. Available at: <https://www.rndtoday.co.uk/case-study/creating-and-implementing-a-technology- roadmap-smith-nephew/> [Accessed 5 May 2022].

Smith & Nephew, 2022. [online] Smith-nephew.com. Available at: <https://www.smith- nephew.com/global/assets/pdf/corporate/smith%20nephew%20sustainability%20report% 202021%20interactive.pdf> [Accessed 5 May 2022].

Smith, &., 2022. [online] Smith-nephew.com. Available at: <https://www.smith- nephew.com/global/assets/pdf/corporate/smith%20nephew%20fourth%20quarter%20and %20full%20year%202021%20results.pdf> [Accessed 4 May 2022].

Smith, &., 2022. Smith+Nephew Company History | Smith & Nephew. [online] Smith- nephew.com. Available at: <https://www.smith-nephew.com/about-us/who-we-are/our- history/> [Accessed 4 May 2022].

Appendix

Appendix 1.

PESTLE Impact Table.

| Political Factors. | Brexit.

Tax Policies. Trade Restrictions Tariffs Labour Laws |

| Economic Factors | Consumer Confidence.

Economic Growth Rate. Interest rates. Efficiency of Financial Markets. Currency Exchange Rate. |

| Social Factors | Demographics.

Culture Entrepreneurial Spirit. Societal Class structure. Social conventions |

| Technological Factors | Technological development by competitors.

Cost structure in Medical Appliances Technological diffusion. Impact of technology on product offering |

| Legal Factors | Intellectual property Law.

Data Protection. Consumer Protection. Health and Safety Law |

| Environmental Factors | Waste management.

Recycling. Climate Change. Regulations on Environmental Pollution. |

Appendix 2.

Company’s Health.

| (Leverage Ratios) | ||

| Debt Ratio | 36.65 | % |

| Debt-to-Equity Ratio | 0.58 | |

| Debt-to-Equity Ratio (excl. Intgbl) | 2.73 | |

| Debt-to-Equity Market Value | 0.21 | |

| Net Gearing | 37.20 | % |

| Net Gearing (excl. Intangibles) | 62.18 | % |

| Gross Gearing | 49.01 | % |

| Gross Gearing (excl. Intangibles) | 81.92 | % |

| Gearing Under 1 Year | 19.51 | % |

| Gearing Under 1 Year (excl. Intgbl) | 32.62 | % |

| Assets/Equity | 1.96 | |

| Cash/Equity | 23.17 | |

Appendix 3.

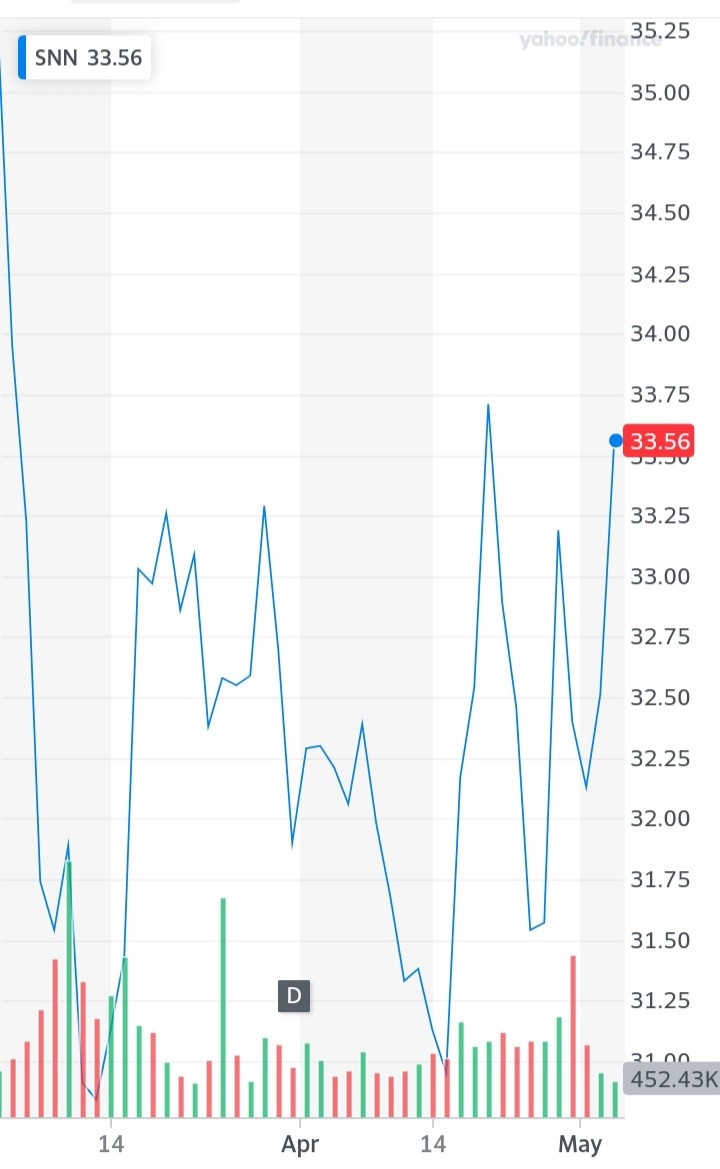

4-Week Share Watch.

write

write