Bear Stearns succumbed to financial pressure and collapsed in 2008. It was established in 1923 and played a crucial role in trading, banking, and investment management. In its heyday, Bear Stearns was a substantial international power. It was not a single isolated event but punched into the world markets, becoming one of the most glaring pieces of evidence representing cresting by disaster (Broughman, 2023). The Undoing of Bear Stearns Was Complex, Risky Manoeuvering and the Nervousness Regarding Crises in Liquidity. Understanding its evolution is the key, thus identifying events that inevitably resulted in financial bankruptcy.

Liquidity risk and the blood of financial institutions are crucial to maintaining balance in banking. Liquidity works as a lubricant, allowing the markets and institutions to function smoothly. The 2008 financial crisis revealed the inherent complexities of liquidity risk, as even reputed global giants had weaknesses (Finney, 21). This is why institutions like Bear Stearns must face liquidity risk challenges, which involve balancing settling obligations and daily operations and responding to market events. This equilibrium is evident in the thickness of the liquidity risk fabric that combines market behaviour and regulation (Henry & Goldstein, 2007). It needs to be constantly monitored as financial systems are ever-changing.

This analysis delves deep into the rocky waters of liquidity risk, revealing what pulled Bear Stearns down. In this attempt, we are trying to reveal itself and pinpoint potential weaknesses that could have brought the financial titan down. This analysis acts as a lighthouse, shining into Bear Stearn’s misfortune and guiding contemporary financial institutions, regulators, and market actors. We want to show something more than what Bear Stearns showed: glimpses into ways financial stability can be increased in the dynamic economy.

Overview of Bear Stearns

The story of Bear Stearns develops in financial history after World War I, which ended in 1923. It boomed in the speculative Roaring Twenties and had issues over the years. In this regard, its vulnerability during the 2008 financial crisis is highlighted. The essence of Bear Stearns’ journey is its distinct business philosophy. It led securities trading, investment banking, and asset management (Broughman, 2023). Its operational framework, involving several risk factors and market exposures, significantly contributed to its liquidity problem. There are intricacies in the details of operations that took place within Bear Stearns and contributed to its crisis. A critical analysis aspect of this giant turns to financial ratios and quantitative indicators of Bear Stearn’s health. We get an overview of the firm’s situation before the crisis by analyzing liquidity ratios, leverage ratios, and profitability measures. Therefore, this study seeks to pinpoint any indicators of trouble in Bear Stearns’ financial records. This analytical part reveals the numerical features that predicted Bear Stearns’ sudden downfall.

Table 1: Ratio of Mortgage Positions to Shareholder’s Equity (Kensil & Margraf, 2012)

| Quarter of Failure | MBS and ABS ($ Billion) – Bear Stearns | Shareholders’ Equity ($ Billion) – Bear Stearns | The ratio of MBS and ABS to Equity – Bear Stearns | MBS and ABS ($ Billion) – Lehman Brothers | Shareholders’ Equity ($ Billion) – Lehman Brothers | Ratio of MBS and ABS to Equity – Lehman Brothers |

| 1 Quarter Prior | 38.2 | 11.9 | 3.2 | 72.5 | 26.3 | 2.8 |

| 2 Quarters Prior | 46.1 | 11.8 | 3.9 | 84.6 | 24.8 | 3.4 |

| 3 Quarters Prior | 55.9 | 13.0 | 4.3 | 89.1 | 22.5 | 4.0 |

| Average | 49.4 | 12.2 | 3.8 | 82.1 | 24.5 | 3.5 |

Table 1 compares MBS and ABS against shareholders’ equity as it was pre-crisis for Bear Stearns and Lehman Brothers cases. When the ratio rises, there is an increased risk of stuck mortgage positions. Bear Stearns consistently exhibits a higher ratio in the considered period than Lehman Brothers. This implies a significant increment in risk between holding illiquid and Equity. This analysis suggests an increase in risk related to illiquid assets compared to the general financial structure linked with Equity. More significant numbers for Bear Stearns indicate an evident tendency toward increased risk. This pattern sounds alarming, demonstrating the complex correlation between financial vulnerability and the transience of Equity in a risky situation.

Table 2: Level Assets as a % of Total Assets (Kensil & Margraf, 2012)

| Quarter | Level 3 Assets (%) – Bear Stearns | Level 2 Assets (%) – Bear Stearns | Level 1 Assets (%) – Bear Stearns | Level 3 Assets (%) – Lehman Brothers | Level 2 Assets (%) – Lehman Brothers | Level 1 Assets (%) – Lehman Brothers |

| 3Q ’07 | 5.1 | 47.3 | 7.5 | 5.3 | 25.5 | 12.0 |

| 4Q ’07 | 9.9 | 79.8 | 7.5 | 6.1 | 25.6 | 10.5 |

| 1Q ’08 | 9.4 | 83.5 | 6.6 | 5.4 | 25.4 | 7.9 |

| 2Q ’08 | N/A | N/A | N/A | 6.5 | 25.3 | 7.1 |

Table 2 presents information on the distribution of assets across levels (Leveli, Levelii, and Leveliii) for Bear Stearns. Level 3 assets are the least liquid, and it is most difficult to value them. Notably, the portfolio of Level 3 assets held by Bear Stearns has continued to rise in Q4/2007. This increase points to a significant buildup of liquid assets and makes valuation challenging. On the other hand, although it was more consistent in distribution, Lehman Brothers had issues maintaining liquidity and showed that it was proportionate to Level 3 assets. The above data draws attention to illiquidity problems across different asset tiers. While Lehman Brothers shows a smoother pattern, Stearns is ahead in Level 3 assets, indicating other kinds of issues with liquidity events. It is interesting because it paints a delicate relationship in which stability seems demanded and undermined by the financial architecture of Bear Stearns and Lehman Brothers, providing more elements to an already intricate pre-crisis geography.

Liquidity Risk Factors

Wholesale Funding Risk

The complex liquidity risk in Bear Stearns’ wholesale funding, covering external liabilities not from its ordinary customers, needs a systematic assessment. Understanding wholesale liability risks emerging from the diversity of behaviour and characteristics takes work. In contrast to retail funding, where the danger usually revolves around preventable bank runs, wholesale financing risk is much more intricate. Although wholesale liabilities usually adhere to set repayment schedules, adding different stakeholders makes this scenario more complex. History shows that prolonged liquidity vacuums have developed from this type of leveraged funding involving intricate interactions (Henry & Goldstein, 2007). Wholesale funding risk is associated with participants’ identities rather than properties of traded financial products. The fact that wholesale markets are unstable is reflected by the steady repayments of scheduled payments into human capital due to their tendency towards unexpected changes. As the former Governor of Bank England mentioned, there were massive disruptions to wholesale markets, such as a bank run.

In 2008, liquidity-dependent wholesale markets dried up again to the equivalent of a bank run. Complex vehicles, such as securitization conduits and structured investment vehicles (SIVs), transformed banks into liquidity providers. Financial institutions that are interdependent through the symbiotic relationship are based upon market liquidity, which runs well in favourable conditions, but disruption leads to a difficult environment (Broughman, A. 2023). This financial system became complicated due to the advent of repurchase agreements (repos). The correlation within this developing context was based on the appraisal of securities posted as collateral and another layer in its liquidity. This correlation became a major determinant of the financial crisis, mainly its increase during and after this incident.

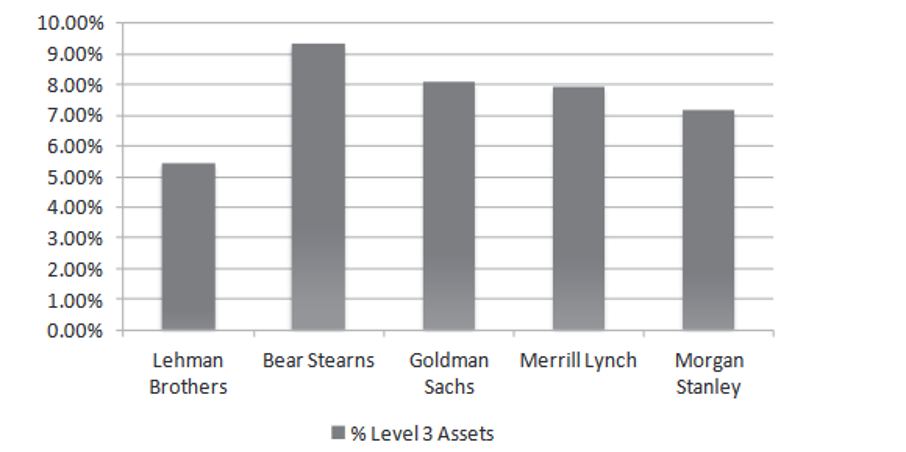

As Kensil & Margraf (2012) stressed, Bear Stearns suffered from wholesale funding risks. However, this can be seen in the striking 9.36% Level III resources. The complex risk profile of Bear Stearns was primarily associated with these assets, whose illiquidity and reliance on internal valuation models were considerable. Findings reported by Warrington (2014) indicate that factors other than the “Too Big To Fail” determinant meaningfully shaped executive risk-taking at Bear Stearns. Likewise, Bear Stearns tended to favour rapid, short-term funding, as shown through overnight repos, higher borrowing ratios, and Level 3 assets dominating its balance sheet. This combination intensified the risks of funding challenges and diversity of capital structure to St. Stearns. The interdependence between the market players and their dependence on liquidity created an instance whereby Bear Stearns suffered severe penalties following a rapid pullback in terms of liquidity, just like it occurs during high tide (Henry & Goldstein 2007). Figure 1 below shows a summary of level 3 assets for Bear Stearns as compared to other players;

Figure 1: Level 3 Assets 1st Quarter 2008

The Bear Stearns incident shows that financial institutions should manage liquidity risk well. Failing to diversify short-term wholesale funding could result in catastrophic results. Stakeholder confidence can be built when institutions focus on steady and diverse funding sources, conduct stress tests periodically, and maintain transparency. Secondly, Warrington (2014) notes that TBTF is not the only factor responsible for executives’ risk-taking. Risk-taking incentives are further enforced by factors such as executive compensation structure, investment banking business models in totality, and interactions with asset managers. Therefore, institutions should carefully analyze and harmonize these factors for effective executive decision-making to ensure long-term stability is fostered instead of chasing short-term profits.

Short-term Funding and its Exposure to Mortgage-Related Assets

The complex liquidity structure of Bear Stearns emerged in 2008, and it was attributed mainly to its fund architecture relying on a highly perverse strategy, utterly different from an average retail model. When it comes to a significant investment banking conglomerate, Bear Stearns’ structure was so short that it relied on institutional lenders and the wholesale market. The company’s dependence on short-term financing, primarily through such means as overnight repos and other similar types of instruments, provided it with operational flexibility but increased its vulnerability to liquidity risks. In the financial markets of 2008, uncertainty levels increased that riddled Bear Stearns with a built-in fragility within it (Henry & Goldstein, 2022)

Retail deposits are considered secured in financial institutions, but Bear Stearns did not hold its liquidity based on the widespread use of retail deposits. It relied on interim lending by institutions. The year 2008 was relatively aggressive in terms of st: rumors and concerns, which rapidly dissolved Bear Stearns’ perceived strength, resulting in a veritable fund outflow from the company. To begin with, the significant loss in confidence of not only retail but also institutional depositors caused a substantial drop in Bear Stearns’ funding, which compounded the liquidity crisis.

Unwound financial mayhem later occurred at Bear Stearns due to the retail deposit withdrawal and the hurdle in getting wholesale financing. This triggered a series of negative results. Retail and institutional investors lost confidence, which resulted in a massive flight of funds from the struggling institution (Broughman, 2023). The high speed at which cash resources were exhausted made Bear Stearns incapable of meeting short-term liabilities and maintaining adequate cushions in liquidity.

The systemic complexity of the connection between financial institutions in the larger context of the global economy further compounded Bear Stearns’ liquidity crisis. Due to the fear of their implants going to a dwindling institution, counterparties demanded additional collateral and became more reluctant to do business with Bear Stearns. The most troubling consideration is that tightening liquidity conditions imposed a ‘vice’ on Bear Stearns’ ability to roll over short-funding and manage its daily operational needs. The liquidity nature turned out to be a more rigid and demanding challenge for Bear Stearns in navigating the intricacy of its day-to-day financial dynamics.

Intra-day Liquidity Risk

The problem of intra-day liquidity risk is a critical threat for financial institutions such as Bear Stearns. It includes possible delays in delivering promptly the requirements for meeting intra-day payment and settlement obligations. Therefore, the intraday payment systems’ features play an essential role, especially for Bear Stearns, as they are significantly involved in complex trading. By joining international payment systems such as BACS in the UK, Bear Stearns thus manages to deal with constant pay flows during trading hours. The focus does not end up with net figures but instead on the timing of repayments and emphasizes temporal specificity in implementation. Intra-day risks are posed by gross liquidity outflows, where this is a trivial fraction of the bank’s liabilities (Sidel, 2008). But this, seeminisficant part, could perpetuate a temporary funding failure, which is likely to wreak havoc on other financial institutions and shake the payment systems. The complex scenario of intra-day liquidity risk shows a rather complicated picture. Even loyal withdrawals, however slight as a portion of total liabilities, can have significant consequences. The effects of these ripples beyond the perimeter of Bear Stearns affect other interdependent financial institutions and, as such, add subtlety to the hitherto unseen pay system terrain.

The European money industry has changed and adapted to regulations such as the LCR (Liquidity Coverage Ratio) and NSFR (Net Stable Funding Ratio). These measures are designed to evaluate risks arising from funding outflows and the resiliency of banks in such scenarios. Nevertheless, the LCR and its focus on liquidity risk monitoring stand in marked contrast to the essential intraday complexities of intra-day liquidity. This gap is addressed by the Basel Committee on Banking Supervision (BCBS), which chooses to promote reporting and monitoring instead of imposing specific mandates for intra-day risk.

In the case of Bear Stearns, real-time liquidity risk assessment allows one to determine what funds are at one’s disposal during a day when settlement systems operate and receive real-time payments. This assignment involves interpreting the cash flow streams and managing payments for stakeholders and clients’ intra-day liquidity repercussions. Bear Stearns utilizes different mechanisms, including maintaining cash balances in the central bank, strategically keeping unencumbered liquid assets on hold, securing credit lines from other banks, and selling collateral to settlement banks. These tactical methods demonstrate how Bear Stearns manoeuvres the risky terrain of intraday liquidity danger (Kotz, 2008).

As with other financial institutions, Bear Stearns was carrying out how intra-day liquidity needs were gauged (Sidel, 2008). This characterization took into account regular day-to-day business and emergencies, taking note of the variations in times when funds flow as a resultant factor that influences financial activities run by this institution. In turn, recognizing the challenges of intraday liquidity patterns, BCBS produced recommendations for specific indicators. These markers, much like the symbols on a financial emblem, were very purposeful in providing an overall glimpse of this intricate facet of day-to-day liquidity risk that is part and parcel of the monetary empire.

Intra-group Liquidity Risk

The company’s structure is complex as it involves a network of subsidiaries and affiliates to which Bear Stearns belongs. It is necessary to comprehend this elaborate system for liquidity risk assessment within the group. It becomes essential to decode the structure of this large group with intricate relations among its components. The entities within the conglomerate engage in several activities, including investment banking, securities trading, and asset management, thereby making for a complicated setting in which careful analysis is to be done. The intertwined entities within Bear Stearns underscore the need for a comprehensive analysis to comprehend liquidity risk in this complex conglomerate’s myriad financial operations (Henry & Goldstein, 2007).

As an essential component of its risk management strategy, Bear Stearns uses intra-group liquidity support. The Bear Stearns group entities are interdependent and very well support each other in a particular ecosystem of financials. This concerted series of liquidity guarantees the parade motion of capital between subsidiaries in addressing short-term funding voids, building a financial safety buttress for Group-wide. The objective is to avoid a potential rapid liquidity collapse in any single firm of the group that might cause devastating consequences to the entire structure.

Bear Stearns was under tremendous pressure to review its intra-group liquidity thoroughly. This included an in-depth evaluation process to know the efficacy of their risk mitigation measures. The assessment assessed the capacity of the group to share liquidities, clarity, and transparency in liquidity transfer methods, as well as superior risk management practices across its subsidiaries. The main objective was to anticipate the imminent liquidity issues in different conglomerate areas to prevent them from becoming a widespread problem. Intra-group liquidity risk management during the financial crisis of 2008 was a severe challenge to Bear Stearns (Broughman, 2023). The interconnected support system, designed to be robust, became a two-sided challenge. Vulnerabilities in one part of the conglomerate started affecting neighbouring areas negatively. The crisis exposed limitations in Bear Stearns’ intra-group liquidity framework, significantly contributing to the liquidity risks that engulfed the struggling institution.

Off-balance Sheet Liquidity Risk

Since 2007, we have evaluated Stearns’ off-balance sheet liquidity risk by using insights from the European System of Central Banks (ESCB), which gives a better understanding of the financial landscape and strategic decisions for decision-makers. In Europe in 2016, the increase was high, with almost 53% of on-balance strike assets here. According to the Senior Supervisors Group, this increase caused questions about whether these financial institutions fully understand or manage their operational conduits’ liquidity risks. In addition, a glaring omission was the lack of mentioning reputation risks associated with SIV activities. This disclosure reinforces that interdependencies between off-balance sheet actions, liquidity constraints, and reputation challenges are complicated.

Off-balance sheet liquidity risk at Bear Stearns requires that different categories are dissected, which can affect cash flow in their own right. These are undrawn credit limits, CCAs, and contingent liquidity support to investment vehicles. Second, lending pipeline commitments are associated with new business undertakings, liquidity certainties, and securities for derivatives postures. Identifying Bear Stearns’ off-balance sheet on challenges is challenging, given the company’s vast growth overlaid with increasing leverage. The $50-$70 billion that is orchestrated on a nightly basis through repurchase agreements explains the dependency on short-term finance. The strategic transformation of Bear Stearns is reflected in the change from unsecured commercial paper to secured repo borrowing, indicating a movement toward funding consistency. The holdings of unsecured commercial paper decreased from 20.7 billion dollars to 3.9 billion dollars while secured repo borrowing increased by $69B-$102 B, which is generally financial evolution (Kensil & Margraf, n;d).

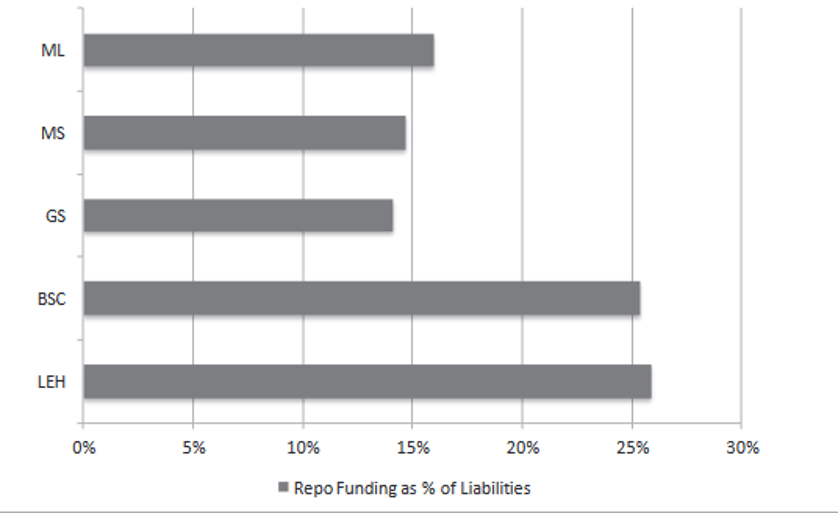

Bear Stearns and Lehman Brothers faced fragility due to heavy reliance on short-term funding, surpassing peers like Merrill Lynch and Goldman Sachs. In 2008, both had a significant portion of fiscal liabilities in repurchase agreements (repos) exceeding 25 years (Warrington, 2014). The peril of overleverage loomed, especially when collateralization involved short-term loans with illiquid assets, notably mortgage-backed securities. Bear Stearns’ tumultuous journey exposes the complex nature of off-balance sheet liquidity risks. Understanding these risks requires insight into financial fluctuations, strategic funding, and prudent collateral selection (Kotz, 2008). Contemporary financial institutions must fortify their defences with advanced risk management and real-time data analytics to navigate off-balance sheet intricacies, ensuring resilience and sustainability.

Cross Currency Liquidity Risk

Bear Stearns was confronted with the complicated Foreign Exchange risk, FX Risk. This complex risk is associated with the different balance between assets and liabilities denominated in other currencies, exposing an institution to vulnerability as exchange rate changes are unpredictable. As an international entity in the financial arena, Bear Stearns was subject to exposure from uncontrollable changes in FX rates. The balance sheet of Bear Stearn exposed a cosmopolitan intricacy, where assets and liabilities had various currencies (Sidel 2008). These include foreign investments that help demonstrate world-level expertise and varied sources of finances in several currencies. Its business’s natural variety, embracing financial eccentricity at its heart, placed the firm in many spaces associated with volatility in the dance of exchange rate movements. This unstable exposure, like walking on a tightrope during the exchange rate fluctuations, became extremely difficult when there was increased currency volatility that multiplied all the problems facing this institution in financial complexity.

In the 2008 crisis, international financial institutions faced more pronounced FX challenges when the currency valuations were seized. The global economic stage was unsettled during the volatility days of the currency markets. The unstable currency movements weighed a lot on Bear Stearns, one of the most powerful financial firms. Major FX faced severe challenges, affecting the asset prices and institutional loans for many firms such as Bear Stearns like Kotz (2008). The interdependence of international financial markets caused many adverse currency movements to function as the signalling mechanisms for troubled institutions embedded within the intellectual aspect of finance. This chain reaction, analogous to the spread of FX problems, intensified the financial crises in Bear Stearns. The unnecessary entanglement of FX challenges within the broader financial complexities intensified the liquidity problems, which formed an integral part of the intricate symphony of economic complexity faced by this investment bank.

Funding Cost Risk

As a secondary liquidity risk in Bear Stearns’ financial story, the funding cost risk developed coupled with market conditions and assumed credit risks (Shorter 2008). With funding costs up, Bear Stearns stood at a critical turning point as threats to its operations surfaced. The lack of long-term capital inflows pushed Bear Stearns into a situation where its need for financing grossly exceeded the availability, causing a critical increase in rates—liquidity risk was creeping out from the shadow of credit exposure and materializing itself as drastically rising costs. The bank’s operational resilience, however feasible as it was to secure the sources of funding at a reasonable cost, proved a daunting challenge requiring prudent management and deliberate attention.

During the 2007 financial crisis, Bear Stearns faced the dilemma that short-term finance had underpinned its growing debt. The economic turmoil created a need for short-term funding on which the banks relied but also masked the weaknesses (Sidel, 2008). Bear Stearns used the nightly borrowing dance through repurchase agreements (repos) for amounts ranging from $50 to $70 billion. The crisis was a deep bottom rock by the tainted name of unsecured commercial paper that had always been seen as a risky instrument. Having been excluded from the Federated Investors’ list of approved counterparties, Bear Stearns moved to repo lending as a safer alternative to commercial papers. This transformation lowered the unsecured commercial paper holdings from $20.7 billion to $3.9 billion, while secured repo borrowing jumped from $69 Billion to and102 (Kensil & Margraf, 2012).

However, this increasing demand for the nightly repos posed a significant threat to Bear Stearns. Loans, frequently connected to mortgage-related assets, became a problem: they required constant renewal and resembled the hydra (Kotz 2008). This faulty condition of the company brought out its weakness of Being small compared with investment banks, which required more help from a consumer banking or retail division for supplementary capital. Bear Stearns’ vulnerability was reflected in the Lehman Brothers troubles in the first quarter of 2008 (Warrington, 2014). Both institutions, in which the repo and outstanding commercial paper played a significant role, became more exposed to risk by collateralizing these loans with illiquid assets, particularly mortgage-related securities. This situation became the melting pot of their vulnerability. This data is summarized in Figure 2 below;

Figure 2: Reliance on Repo Funding 1st Quarter 2008

In finance, which is often complicated, such costs for funding appeared simple but brought about unseen dangers to Bear Stearns’ longevity. Expenses for managing the recurring liabilities are increasing, which might threaten the firm’s functioning. While the availability of funds appears to be very accessible, uncertainties arise compared to the rising cost burdens. This type of temporary financial aid is a fitting analogy that “pissing in your shoes won’t keep you warm for long” to emphasize how easy accessibility becomes very cold when the pricing goes out the window. However, the primary issue is understanding if a change in the market dynamics occurs as an anomaly or whether changes have been made permanent about financial conditions (Shorter 2008). But as the market adjustments unfold, this analytical puzzle gets even more complicated. It is a precarious balancing act for Bear Stearns, needing to carefully comprehend the endurance of anomalous market conditions and determine if borrowing accommodations can coordinate with developing patterns in loan costs (Henry & Goldstein, 2007).

Asset Risk

Bear Stearns leveraged its asset portfolio a lot. This financial tactic was very profitable but not free of risks. A form of leverage — borrowed funds can morph into a hazardous tool when the fluctuating market values create the likelihood of liquidity issues (Kotz, 2008). During its growth, Bear Stearns had operations in multiple asset classes, with mortgage-backed securities making up a significant part. The bank’s source of funding was borrowing against these assets, the financial confusions that were involved. However, such great dangers lurking in this approach were fully revealed shamelessly during the 2008 financial crisis, making a superb catastrophe for Bear Stearns.

The contrast between liquidity and illiquidity assets from the UK regulator would aid in understanding Bear Stearns. Instead of the UK’s emphasis on smoothening asset convertibility, Bear Stearns found it challenging in America because of issues with mortgage-backed securities. The UK regulatory focus on liquidity was supposed to reflect the position of Bear Stearns, which had assets that were illiquid and did cause some complications about liquidity risk during the financial crisis. The liquidity risk was present in the case of Bear Stearns because its assets, especially the mortgage-backed securities, were not very marketable since their revaluation heavily declined. These assets could only be liquidated into cash slowly, exacerbating Bear Stearns’ funding difficulty. Collateralized borrowing was considered prudent before the market’s crumbling confidence in mortgage-backed securities.

The illiquidity of assets in the portfolio held by Bear Stearns allowed counterparties and lenders to refuse them as collateral (Henry & Goldstein, 2007). This distrust resulted in the rising collateral requirements and barriers to short-term financing. This culminated in the downfall of Bear Stearns, which led to its acquisition by JPMorgan Chase owing to the eroding market confidence. Thus, Bear Stearns’ asset risk was crucial to its overall liquidity risk (Sidel 2008). The struggle to quickly convert illiquid assets and their continuous depreciation amid stressed market conditions became critical elements, defining Bear Stearns’ liquidity challenges and its eventual collapse in 2008.

Funding Concentration Risk

Bear Sterns planned to strengthen its liquidity resilience with different funding approaches, designing an intricate plan that would lead to financial strength. Financial institutions must diversify their funding sources to avoid exposure from a particular channel and to reduce risks (Kotz, 2008). Yet, Bear Stearns found it very difficult to find a balanced structure of the funding. With time, Bear Stearns relied heavily on short-term financing through overnight repos and commercial paper. Although these lenders allowed Bear Stearns to collect capital, the high dependence could be dangerous. This made Bear Stams vulnerable to short-term funding markets, and channelling funds in such a market created a possibility of liquidity constraints during the turbulent situation.

In an evaluation of funding concentration at Bear Stearns, one looks closely at proportions drawn from different sources and the terms to maturity in financial inflows. The dominance of the short-term funding was a significant source of concentration risk for Bear Stearns. Under this analysis, the total financing is also unpacked, and the registered contributions from overnight repos, commercial paper, and other short-term investments are included. Geographical and many counterparty issues are also evaluated in Bear Stearns’ financial sphere. Globally oriented, Bear Stearns experienced a concentration in its funding sources, which were either regional or related to certain counterparties (Warrington 2014).

Critically, the limited number of funding sources that Bear Stearns used were very crucial to its liquidity troubles in 2008. However, as the liquidity disappeared and confidence waned when financial markets tightened, the effects of this dependence were apparent. Cautious counterparties made the concentration risks more severe, leading to liquidity stresses (Kotz 2008). In retrospect, there were many holes in Bear Stearns’ liquidity strategy, as a much bolder system was needed. Diversification became critical not only in the instruments but also in terms of maturity and counterparties. The essence is an intelligently structured liquidity plan, identifying the upcoming disruptions and resilience against concentration risks (Broughman 2023).

Correlation and Contagion Risk

Bear Stearns faced the complex task of managing various funding sources. Each source had strengths, weaknesses, opportunities, and threats, forming a detailed SWOT analysis. Examining these funding streams through a SWOT lens reveals insights into the institution’s ability to navigate correlation complexities and contagion risks.

| Bear Stearns had a strong network of quick short-term funding, allowing it to obtain capital swiftly. This rapid access to financial resources was a notable strength, especially in normal market conditions, supporting smooth operational functioning. | Relying heavily on short-term channels like overnight repos and commercial paper became a significant vulnerability. This concentrated approach increased the risk of being greatly affected by market disruptions, making the liquidity precarious and likely to disappear rapidly. |

| Bear Stearns had the potential to strengthen itself by diversifying its funding sources with more stable financial instruments. If done wisely, this shift could provide a strong defence against sudden disruptions in liquidity and increase the institution’s resilience in challenging situations. | Bear Stearns faced a threat in the complex connection of its various funding channels. In times of market crisis, one channel’s weaknesses could quickly become significant threats to the entire liquidity framework, causing a chain of harmful effects—a potential contagion effect. |

Bear Stearns needed to understand its SWOT factors to grasp correlation and contagion risks in its complex liquidity management. Weaknesses in one area could affect the entire system. This risk arises when different funding sources or market instruments move together. Bear Stearns faced high correlation risk due to its reliance on short-term funding. In stressful times, these linked instruments caused liquidity to decrease, worsening the situation. Contagion risk involves spreading issues from one part of the financial system to another. In Bear Stearns’ case, vulnerabilities in its funding structure could apply to other institutions, potentially triggering a systemic crisis.

Conclusion

Complex liquidity risks running through the financial institutions were brought to light by the collapse of Bear Stearns in 2008. This study focuses on risks such as wholesale and retail funding obsolescence, intraday liquidity hazard, off-balance sheet liquidity risk, and cross currency among other challenges associated with the abovementioned source of funds. Following this path demands a lot of tact and also discretion. Wholesale funding risk is also very apparent in Bear Stearns’ short-term dependence on instruments, proving diversification’s great importance. As retail funding risk looms large on the horizon, a comprehensive approach is needed to face any financial uncertainties. Intraday liquidity, viewed from Bear Stearns’ problems with real-time payment responsibilities, demonstrates the requirement for efficient tracking devices and stress testing. Liquidity risk arising from the off-balance sheet requires a sound backward assessment to prevent the case of misjudgments. Hence, it is necessary to strategize for the cross-currency liquidity risk, funding cost, and asset risk as wellness of the funding concentration. Unity in correlation and contagion risk entails a lot of coordinated actions accompanied by many preventive steps, similar to joint responsibility within the financial system.

Bear Stearns’ implosion is a cautionary tale against too much short-term reliance, blind eyes to off-balance sheet complexities, and the lack of diversification. The critical elements in modern financial institutions must be prudence, strengthened risk management systems, compreh and stress testing, and real-time surveillance to detect looming risks. Thus, current institutions need to focus on resilience, diversification, and preemptive risk control in the new era of finance. It is essential to strengthen liquidity planning planning with subtle risk strategies to cope effectively with the complicated fiscal environment. Adopting technological innovations, especially live monitoring, is crucial to enhance the capability to withstand liquidity risk. Collaboration with the regulating agencies is vital, ensuring regulatory balance and evidencing a proactive stance for financial stability. Bear Stearns’ downfall is that institutions can build a strong defence against unpredictable liquidity dynamics, fostering stability, sustainability, and triumph in the economic realm.

References

Broughman, A. (2023). The Collapse of Bear Stearns, or Skinny Dipping on the Street. Ohio Northern University Law Review, 36(1), 11.

Henry, D., & Goldstein, M. (2007). The Bear Flu: How it Spread ‘. Business Week, 4065, 30-32.

Kotz, D. H. (2008). Office of Inspector General SECs Oversight of Bear Stearns and Related Entities The Consolidated Supervised Entity Program.

Warrington, N. (2014). Bear Stearns and Lehman Brothers:“Too Big To Fail’s” Impact, 3 J. Marshall Global Mkt. LJ 49 (2014). John Marshall Global Markets Law Journal, 3(1), 3.

Sidel, R., Ip, G., Phillips, M. M., & Kelly, K. (2008). The week that shook Wall Street: inside the demise of Bear Stearns. The Wall Street Journal, p. 18.

Shorter, G. W. (2008). Bear Stearns: Crisis and” rescue” for a major provider of mortgage-related products. Washington, DC: Congressional Research Service.

Finney, D. M. (2008). How the Bear Stearns Collapse Affects the Financial Markets. Available at SSRN 1113625.

write

write