Introduction

For an organisation to achieve its objectives over the business life cycle, it needs strategic management that involves strategy formulation, implementation, and evaluation. Strategy formulation, which is the focus of this essay, is choosing actions to ensure an organisation exploits and maximises its strengths and opportunities while minimising the effects of threats and weaknesses in the business environment. This process involves identifying an organisation’s internal strengths and weaknesses and its external opportunities and threats, which can be done using the internal factor evaluation (IFE) and external factor evaluation (EFE) matrices. These analytical frameworks give forecasts and best estimates of the impacts of identified factors on the firm’s performance and ability to achieve set objectives. For a more in-depth understanding of strategy formulation and, more generally, strategic management, this essay examines the external and internal factors that might affect Ryanair’s strategy in the next three years. It begins with an overview of the company, then an internal and external audit, which informs the conclusions of the most critical factors that might affect its long-term strategy.

Company Analysis

Overview

Ryanair is an airline company under the parent company Ryanair Holdings plc, considered Europe’s most green and clean airline group (Ryanair, n.d.). The Irish-based airline is Europe’s biggest airline and among the largest in the World. While it began as a small airline operating daily flights from Waterford to London, it has grown to flying about 121 million people in 2021 and competing with other major airlines, including American Airlines, United Airlines, and Delta Airlines (O’Halloran, 2022). Like any other company, its performance is influenced by various forces in today’s dynamic business environment, as discussed in the sections below.

External Audit

Country Environment Analysis – EFE Matrix

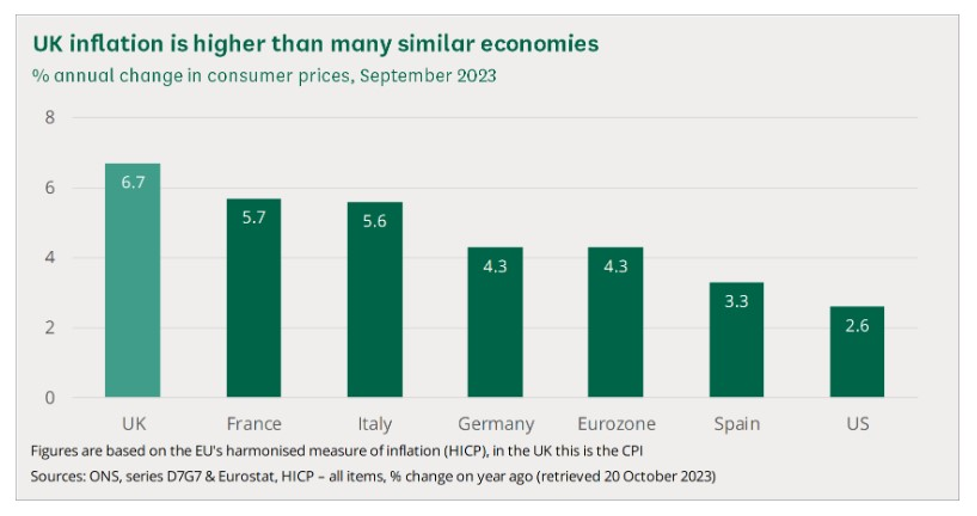

As mentioned, an external audit of Ryanair can be done using an EFE matrix, which summarises and evaluates the company’s external business factors and competitive information. External business factors will be considered using the PESTEL analysis to identify the opportunities and threats (Perera, 2017) that will inform the matrix’s evaluation. Some political factors in the UK currently influencing Ryanair’s business include government instability marked by the rapid successions of prime ministers and senior ministers (Belam, 2022) and the ongoing conflicts within the Conservative party (Bush, 2023). The implications of Brexit have also caused political instability (White, 2023), especially in policy-making, which is reportedly complex, causing geopolitical tensions (Dudley and Gamble, 2023). These have trickled down and exacerbated economic issues in the UK, such as the cost of living crisis (House of Commons Library, 2023). The rise in global energy prices has caused high inflation rates in the country, as shown in Figure 1 since the country is over-reliant on imported gas (Schomberg, 2023). This has, in turn, affected household income, evidenced by the fact that millions of UK citizens now live in poverty (McRae et al., 2023), reducing their purchasing power. Again, “currency fluctuations affect the company’s results” (Ryanair, 2023, p.63). Still, the large number of international students (Universities UK, 2022) and tourists the UK attracts yearly (ONS, 2022) boosts the economy through travel earnings.

Figure-1:

High Inflation Rates in the UK compared to other Countries

(House of Commons Library, 2023)

A look at sociocultural factors affecting the organisation reveals that the UK has a vast consumer market with growing consumer confidence (Romei, 2023) despite the economic outlook. Also, a considerable percentage of the country is ageing, meaning various commercial and operational provisions will have to be made for these prospective passengers (Graham et al., 2019) who are increasingly travelling for leisure and socialising (Glover, 2020). While this would mean additional costs for the airlines, there is an opportunity to gain from this population through innovations that create pockets of privilege in their flight network (Bouwer et al., 2022). There is also an opportunity to harness the UK’s healthy and well-placed technological sector (Department for Culture, Media & Sport, 2022), whereby developing age-friendly technological innovations may encourage travel among this demographic and benefit the airline industry (Glover, 2020). Regarding technology, the country’s high internet connectivity and usage (Petrosyan, 2023) creates opportunities for boosting business operational needs such as marketing, sales, and inflight connectivity (Khamis, 2023).

The analysis thus far depicts the UK as a country bolstered by human activity, which has affected the physical environment. Evidence of this is seen in different manifestations of climate change, such as extreme weather events: high temperatures (Department for Energy Security and Net Zero, 2023), heavy rains, and strong winds (Banfield-Nwachi, 2023). These threaten airlines and airline manufacturers’ business due to delays, cancellations, and additional costs of manufacturing planes that withstand harsh weather conditions (Curello, 2023). These conditions may also deter travel, causing losses. Fortunately, the country’s advanced legal environment is punctuated with laws and regulations, such as the Climate Change Act 2008, that help reduce the impact of business activities on the environment. Organisations such as Ryanair that engage in sustainable business activities (Ryanair, n.d.) stand to derive strategic advantage following the growing trend of responsible and eco-friendly consumption (Rice et al., 2020). Besides, the advent of sustainable aviation fuels (SAF) introduced by the SAF mandate in the UK will not only decarbonise the sector but also provide investment opportunities (Open Acess Government, 2023; Thomsen, 2023) for the airline. However, implementing this and other such laws (Ryanair, 2023, p.61) may increase costs and thus affect pricing strategies) (Ryanair, 2023, p.61).

From this analysis, the EFE matrix can be presented as follows:

Table-1:

EFE Matrix

| Key External Factors | Weight | Rating | Weighted Score |

| Opportunities | |||

| Using technological advancements to boost profitability | 0.05 | 3 | 0.15 |

| Huge consumer market with growing consumer confidence | 0.06 | 2 | 0.12 |

| Ageing UK population | 0.10 | 3 | 0.3 |

| Earnings from tourist and international students | 0.13 | 3 | 0.39 |

| The high internet connectivity and usage in the country can boost business operational needs | 0.07 | 2 | 0.14 |

| Investments in sustainable aviation fuels (SAF) | 0.05 | 3 | 0.15 |

| Adherence to environmental laws gives a competitive advantage | 0.05 | 4 | 0.2 |

| Strategic advantage following increasing sustainable consumption patterns | 0.07 | 3 | 0.21 |

| Threats | |||

| Rising cost of living reduces disposable income | 0.08 | 2 | 0.16 |

| Technological advancements may increase competition | 0.05 | 2 | 0.1 |

| Political instability may affect industry policy | 0.06 | 2 | 0.12 |

| Economic instability | 0.09 | 2 | 0.18 |

| Additional costs of catering to the ageing population | 0.04 | 3 | 0.12 |

| Climate change | 0.04 | 4 | 0.16 |

| Laws and regulations may affect pricing strategies and increase business costs | 0.06 | 2 | 0.12 |

| TOTAL | 1.0 | 2.62 | |

(Author’s Own, 2023)

From Table 1, the effectiveness of the firm’s strategy in dealing with the threats and opportunities in the market is just above average, with a total weighted score of 2.62 based on the two crucial factors of earnings from tourist and international students (opportunity) and economic instability (threat). These two factors are considered the most important since they determine the organisation’s financial performance to a more significant extent, as discussed under PESTEL. It can be concluded that the company is responsive to external factors. Also, the gap between the weight score of opportunities (1.66) and threats (0.96) is significant enough that the opportunities can offset environmental threats.

Competitive Analysis – Competitive Profile Matrix

Another aspect of the external environment analysis is the competitor analysis, which involves identifying competing players and what gives them a competitive edge in the market, industry or sector. With a focus on industry competition, one strategic tool that can be used to analyse competition is the competitive profile matrix (CPF). According to Sohel et al. (2014), this tool allows companies to weigh themselves against competitors based on the industry’s critical success factors (KSFs). Critical success factors are specific competitive elements that affect the ability of companies in an industry to thrive in the marketplace (Grunert and Ellegaard, 1992). In context, the first step of this analysis is identifying some KSFs and attaching weight to them based on their importance. Some of the airline industry’s KSFs include attracting customers through airline service and marketing (Yifru, 2017), managing its people, fleet and finances (McCabe, 2006) and load factor (Jenatabadi and Ismail, 2007).

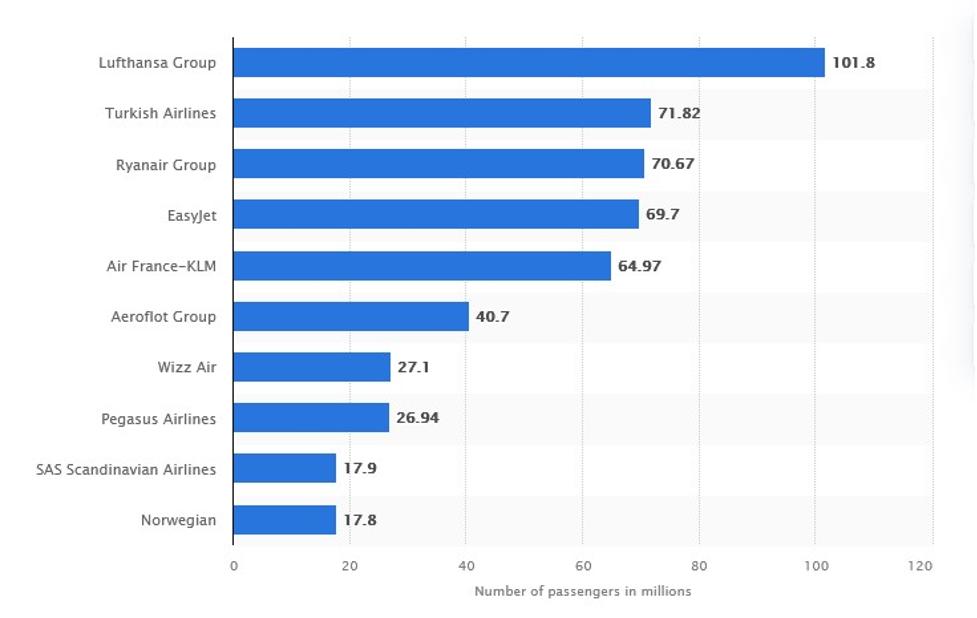

The next steps include identifying the main competitor of Ryanair and ranking them on the KSFs, and after that, finding the weighted score by multiplying the 1-4 ranking by the weight of the KSFs. An analysis of the competitive landscape reveals that some of Ryanair’s main competitors include Lufthansa, Turkish Airlines, EasyJet and Air France, as shown in Figure 2 below.

Figure-2:

The Competitive Landscape of the Airline Industry in the UK Based on Brand Popularity

Statista Research Department (2023)

An evaluation of Ryanair’s ranking on the KSFs against its two main competitors shows the following:

Table 2:

The Competitive Profile Matrix of the Airline Industry in the UK

| W | Ryanair | Lufthansa | Turkish Airline | ||||

| Key Success Factors (KSFs) | R | WS | R | WS | R | WS | |

| Attracting customers through airline service and marketing | 0.23 | 2 | 0.46 | 4 | 0.92 | 3 | 0.69 |

| Managing people | 0.11 | 2 | 0.22 | 3 | 0.33 | 3 | 0.33 |

| Managing fleet | 0.12 | 3 | 0.36 | 4 | 0.48 | 2 | 0.24 |

| Managing finances | 0.24 | 2 | 0.48 | 4 | 0.96 | 3 | 0.72 |

| Load factor | 0.30 | 4 | 1.2 | 3 | 0.9 | 3 | 0.9 |

| TOTAL | 1.0 | 2.72 | 3.59 | 2.88 | |||

(Author’s Own, 2023) W- Weight, R- Rating, WS-Weighted Score

From the analysis that informed this competitive profile matrix (see Appendix), Ryanair is lagging behind its competitors, who enjoy more competitive advantages by a margin of 0.16 and 0.87.

Internal Audit

Internal Analysis -IFE Matrix

Apart from the external environment, an internal environment analysis also matters for strategy. The analysis looks into different aspects of the company, such as management, operations, accounts, finance, marketing and research and development (R&D), to identify strengths and weaknesses that determine if a company can strategically position itself to exploit opportunities and avoid threats (Indris and Primiana, 2015). The internal audit of Ryanair can be done using the IFE matrix, which will be informed by the SWOT tool. First, some of the company’s strengths include a high load factor, valuable strategic partnerships, cost-efficiency, valuable human resources despite associated issues, high bargaining power with suppliers, airports and governments (Prichinet and Le Duc, 2020), structured management and large company size (Madar, 2018). Contrarily, its weaknesses include human resources issues evidenced by frequent employee strikes (Khomyak, n.d.), irregular business income and profitability and poor brand perception (Madar, 2018). These can be ranked in the IFE matrix as follows:

Table-2:

IFE Matrix

| Key Internal Factors | Weight | Rating | Weighted Score |

| Strengths | |||

| High load factor | 0.18 | 4 | 0.72 |

| Valuable strategic partnerships | 0.12 | 3 | 0.36 |

| Cost-efficiency | 0.12 | 4 | 0.48 |

| Valuable human resources | 0.09 | 3 | 0.27 |

| High bargaining power | 0.12 | 4 | 0.48 |

| Structured management | 0.07 | 3 | 0.21 |

| Large company size | 0.08 | 3 | 0.24 |

| Weaknesses | |||

| Human resources issues | 0.08 | 1 | 0.08 |

| Irregular business income and profitability | 0.07 | 2 | 0.14 |

| Poor brand perception | 0.07 | 2 | 0.14 |

| TOTAL | 1 | 3.12 | |

(Author’s Own, 2023)

The above-average (2.5) score indicates that Ryanair has a strong internal position. From Table 2, the top two internal factors are high load factor (strength) and human resource issues (threat). These factors are considered top based on their high scores and the fact that the load factor and human resource issues are directly related to corporate, in this case, airline profitability (Renold et al., 2023; Macke and Genari, 2019).

Current Strategy and Culture

Other factors to be considered in an analysis are the firm strategy and culture. From the three generic strategies outlined by Johnson et al. (2020), Ryanair’s current strategy falls under the cost-leadership strategy, which involves pricing products and services at a low price to gain a competitive advantage. According to Saleh (2016), the company maintains this strategy by keeping its costs down through reduced airport charges and cost-cutting measures for passenger luggage handling and check-ins. This strategy is the most appropriate given the competition in the industry, as determined in the section above. Important to note is that Ryanair has aligned the entire company to this price orientation to effectively and efficiently support this strategy (Kraaijenbrink, 2019). Among the areas integrated into this strategy is organisational culture. Organisational culture depends on an organisation’s management style, the employees’ attitudes and belief systems and the environment in which it operates. The internal and external analysis above shows that Ryanair’s organisational culture is market-driven. This culture is more focused on results and performance than on employee satisfaction. While this culture focuses on profitability, human resource issues such as those reported by Khomyak (n.d.) and Madar (2018) may adversely affect the brand and consequently. Ryanair should, therefore, strive to change its culture to accommodate consumer perceptions, which is increasingly crucial in determining brand equity.

Conclusions

The top two internal and external factors that might influence Ryanair’s strategy in the next three years include earnings from tourists and international students (opportunity), economic instability (threat), a high load factor (strength) and human resource issues (threat). These are considered the most important based on the high scores on the matrixes and their current and prospective direct impact on Ryanair’s business operations.

References

Banfield-Nwachi, M. (2023) UK weather: Storm Babet to bring heavy rain and strong winds. October 16, The Guardian. Available at: https://www.theguardian.com/uk-news/2023/oct/16/uk-weather-storm-babet-heavy-rain-strong-winds [Accessed 12 November 2023].

Belam, M. (2022) UK crisis: a beginner’s guide to the political turmoil as Liz Truss quits. October 20, The Guardian. Available at: https://www.theguardian.com/politics/2022/oct/20/uk-crisis-a-beginners-guide-to-the-political-turmoil-as-liz-truss-quits [Accessed 12 November 2023].

Bouwer, J., Dichter, A., Krishnan, V. and Saxob, S. (2022) June 28, McKinsey & Company. The six secrets of profitable airlines. Available at: https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/the-six-secrets-of-profitable-airlines [Accessed 12 November 2023].

Boyle, S., Keogh, G. and Bentley, P. (2023) Ryanair bosses ‘don’t treat crew like humans’: Air stewardess reveals how she was forced to sell more snacks to be closer to her ill grandmother as staff tell of their appalling treatment. September 14, The Daily Mail. Available at: https://www.dailymail.co.uk/news/article-5192355/Ryanair-bosses-dont-treat-crew-like-humans-say-staff.html [Accessed 12 November 2023].

Bush, S. (2023) Tories are stuck in a short- and long-term crisis. September 21, Financial Times. Available at: https://www.ft.com/content/a77fff0c-6f14-4552-bc09-9295d04dfd34 [Accessed 12 November 2023].

Companies Market Cap (2023) Revenue for Turkish Airlines (THYAO.IS). Available at: https://companiesmarketcap.com/turkish-airlines/revenue/#:~:text=According%20to%20Turkish%20Airlines’s%20latest,sale%20of%20goods%20or%20services. [Accessed 12 November 2023].

Curello, M. (2023) Another effect of climate change? More flight delays and cancellations. July 27, CBS News. Available at: https://www.cbsnews.com/news/climate-change-flight-delays-and-cancellations-travel/ [Accessed 12 November 2023].

Department for Culture, Media & Sport (2022) Policy Paper: UK Tech Competitiveness Study. Available at: https://www.gov.uk/government/publications/uk-tech-competitiveness-study/uk-tech-competitiveness-study [Accessed 12 November 2023].

Department for Energy Security and Net Zero (2023) Climate change explained. Available at: https://www.gov.uk/guidance/climate-change-explained [Accessed 12 November 2023].

Dudley, G. and Gamble, A., 2023. Brexit and UK policy-making: an overview. Journal of European Public Policy, 30(11), pp.2573-2597.

Glover, J.F., 2020. Age-Friendly Airports: A Qualitative Study of Older Adults Aged 55 and Older. The University of Texas at Arlington.

Graham, A., Budd, L., Ison, S. and Timmis, A., 2019. Airports and ageing passengers: A study of the UK. Research in Transportation Business & Management, 30, p.100380.

Grunert, K.G. and Ellegaard, C., 1992. The concept of key success factors: theory and method (Vol. 4, pp. 505-524). Toronto, ON, USA: MAPP.

House of Commons Library (2023) Rising cost of living in the UK. Available at: https://commonslibrary.parliament.uk/research-briefings/cbp-9428/ [Accessed 12 November 2023].

Indris, S. and Primiana, I., 2015. Internal and external environment analysis on the performance of small and medium industries SMEs in Indonesia. International journal of scientific & technology research, 4(4), pp.188-196.

Jenatabadi, H.S. and Ismail, N.A., 2007. The determination of load factors in the airline industry. International Review of Business Research Papers, 3(4), pp.125-133.

Johnson, J., Whittington, R., Regnér, P., Angwin, D., Johnson, G. and Scholes, K., 2020. Exploring strategy. Pearson UK.

Johnson, J., Whittington, R., Regnér, P., Angwin, D., Johnson, G. and Scholes, K., 2020. Exploring strategy. Pearson UK.

Khamis, M. (2023) How inflight connectivity can transform air travel? July 28, The Aviator Middle East. Available at: https://www.theaviatorme.com/airlines/inflight-connectivity-transform-air-travel#:~:text=By%20enabling%20real%2Dtime%20data,sustainable%20approach%20to%20air%20travel. [Accessed 12 November 2023].

Khomyak, A., Ryanair business strategy analysis in the face of Covid-19 crisis.

Kraaijenbrink, J. (2019) EasyJet Vs. Ryanair: How Low Can Low Cost Go? February 1, Forbes. Available at: https://www.forbes.com/sites/jeroenkraaijenbrink/2019/02/01/easyjet-vs-ryanair-how-low-can-low-cost-go/?sh=800e338696ab [Accessed 12 November 2023].

Lufthansa Group (2023) ANNUAL REPORT 2022. Available at: https://www.lufthansagroup.com/en/themes/annual-report-2022.html [Accessed 12 November 2023].

Lufthansa Group (n.d.) Investor Relations. Fleet. Available at: https://investor-relations.lufthansagroup.com/en/corporate-facts/fleet.html#:~:text=Fleet%20structure%20to%20be%20further,previous%20year%3A%2012.7%20years). [Accessed 12 November 2023].

Macke, J. and Genari, D., 2019. Systematic literature review on sustainable human resource management. Journal of cleaner production, 208, pp.806-815.

Madar, A., 2018. “Ryanair” is Looking for New Solutions to Cope with the Competition. Bulletin of the Transilvania University of Brasov. Series V: Economic Sciences, pp.95-102.

May 19, Financial Times. Available at: https://www.ft.com/content/1465853b-3295-42c3-8021-7597bd314847 [Accessed 12 November 2023].

McCabe, R. (2006) Airline Industry Key Success Factors. Available at:https://gbr.pepperdine.edu/2010/08/airline-industry-key-success-factors/ [Accessed 12 November 2023].

McRae, I., Westwater, H. and Glover, E. (2023) UK poverty: The facts, effects and solutions in the cost of living crisis. October 24, Big Issue. Available at: https://www.bigissue.com/news/social-justice/uk-poverty-the-facts-figures-effects-solutions-cost-living-crisis/ [Accessed 12 November 2023].

Memon, O. (2023) How Has Turkish Airlines’ Fleet Developed In The Last 20 Years? October 13, Simple Flying. Available at: https://simpleflying.com/turkish-airlines-fleet-development-guide/ [Accessed 12 November 2023].

O’Halloran, B. (2022) Ryanair confirmed as Europe’s biggest airline. September 1, The Irish Times. Available at: https://www.irishtimes.com/business/2022/09/01/ryanair-confirmed-as-europes-biggest-airline/ [Accessed 12 November 2023].

Office for National Statistics (ONS) (2022) Travel trends: 2022. Available at: https://www.ons.gov.uk/peoplepopulationandcommunity/leisureandtourism/articles/traveltrends/2022 [Accessed 12 November 2023].

Open Acess Government (2023) Decarbonising aviation: Sustainable aviation fuels are coming to UK flight. Available at: https://www.openaccessgovernment.org/decarbonising-aviation-sustainable-aviation-fuels-are-coming-to-uk-aviation/165641/ [Accessed 12 November 2023].

Perera, R., 2017. The PESTLE analysis. Nerdynaut.

Petrosyan, A. (2023) Internet usage in the United Kingdom (UK) – Statistics & Facts

Prichinet, G.C. and Le Duc, N., 2020. Strategic analysis of Ryanair.

Renold, M., Vollenweider, J., Mijović, N., Kuljanin, J. and Kalić, M., 2023. Methodological framework for a deeper understanding of airline profit cycles in the context of disruptive exogenous impacts. Journal of Air Transport Management, 106, p.102305.

Rice, C., Ragbir, N.K., Rice, S. and Barcia, G., 2020. Willingness to pay for sustainable aviation depends on ticket price, greenhouse gas reductions and gender. Technology in Society, 60, p.101224.

Romei, V. (2023) UK consumer confidence rises to highest level in more than a year

Ryanair (2023) Ryanair Group. Annual Report 2023. Available at: Ryanair-2023-Annual-Report.pdf [Accessed 12 November 2023].

Ryanair (n.d.) Sustainability. Available at: https://corporate.ryanair.com/sustainability/ [Accessed 12 November 2023].

Ryanair (n.d.) Welcome to Ryanair Corporate. Available at: https://corporate.ryanair.com/?market=gb [Accessed 12 November 2023].

Saleh, P., 2016. How does Ryan Air’s Cost Leadership Strategy Play a Role in the Way Customers Perceive the Level of Service in Relation to Benefits and Price? (Doctoral dissertation, University of Huddersfield).

Schomberg, W. (2023) Explainer: Why is inflation so high in the UK? June 21, Reuters. Available at: https://www.reuters.com/world/uk/why-is-inflation-so-high-uk-2023-06-21/#:~:text=Britain%20has%20struggled%20more%20than,of%20Britain’s%20high%20inflation%20problem. [Accessed 12 November 2023].

September 29, Statista. Available at: https://www.statista.com/topics/3246/internet-usage-in-the-uk/#topicOverview [Accessed 12 November 2023].

Sohel, S.M., Rahman, A.M.A. and Uddin, M.A., 2014. Competitive profile matrix (CPM) as a competitors’ analysis tool: A theoretical perspective. International Journal of Human Potential Development, 3(3), pp.40-47.

Statista Research Department (2023) Annual revenue of Ryanair from 2010 to 2023

Statista Research Department (2023) Most popular airlines in the United Kingdom (UK) in Q1 2023. August 31, Statista. Available at: https://www.statista.com/statistics/951250/most-popular-airlines-uk/ [Accessed 11 November 2023].

Thomsen, M.A. (2023) Creating a virtuous circle of investment in Sustainable Aviation Fuel. October 17, International Airline Transport Association. Available at: https://www.iata.org/en/pressroom/opinions/creating-a-virtuous-circle-of-investment-in-sustainable-aviation-fuel/ [Accessed 12 November 2023].

Universities UK (2022) International students boost UK economy by £41.9 billion. Available at: https://www.universitiesuk.ac.uk/latest/news/international-students-boost-uk-economy#:~:text=In%20total%2C%20381%2C000%20first%20year,leading%20destinations%20for%20international%20students. [Accessed 12 November 2023].

White, H. (2023) Government in 2023: what challenges does Rishi Sunak face? January 12, Institute for Government. Available at: https://www.instituteforgovernment.org.uk/publication/government-2023 [Accessed 12 November 2023].

Yifru, A., 2017. Determinants of Airline Business in Aviation Industry: A Case Study on Ethiopian Airlines.

Appendix

An Analysis of The Competitive Profile Matrix of the Airline Industry in the UK

Ryanair’s revenues for the year 2022/2023 were about 11 Billion Euros (Statista Research Department, 2023), while that of Lufthansa (Lufthansa Group, 2023) and Turkish Airlines was about 33 Billion Euros and 17 Billion Euros (Companies Market Cap, 2023) in 2022. On the other hand, the company operates 558 aircraft (Ryanair, 2023) compared to Lufthansa’s 710 (Lufthansa Group, n.d.) and Turkish Airlines’ 429 (Memon, 2023). Lastly, people management at Ryanair is not as impressive (Boyle et al., 2023) as that of Lufthansa and Turkish Airlines, which do not have reported complaints.

write

write