Abstract

COVID-19 pandemic is one of the most world deadly viruses that has affected many nations from almost all perspectives. Many countries put very stringent measures on mobility to stem the transmission of the virus, bringing economic activity to a halt. This research uses questionnaires, semi-structured interviews, and data from last financial setback to anticipate later economic repercussions in the United Kingdom (UK) (Flynn et al., 2020). The performance of three key business in the United Kingdom (building, creation, and industries) was studied comparing with the pattern of prior economic challenges. According to continuous value estimates, GDP growth in 2021 was expected to stay stable, although with a 7% decline compared to the reference values before the virus (De Lyon & Dhingra, 2021).

Furthermore, the categorical projections imply that after the first quarter of 2021, there will be no quarterly reduction in GDP (Wylie, 2020). This research will offer evidence-based data on COVID-19’s economic consequences, which is utilized to plan essential recovery processes and execute suitable financial assistance activities. Despite the massive drop in GDP, the unemployment rate remained very low during the pandemic, rising only to 6.0 percent in the fourth quarter of 2020. Inflation fell to less than 1 percent towards the end of 2020, following GDP, and will stay stable for the rest of the year. As a result, the UK faced massive inflation by 2020, although inflation remained over 0% (Jallow et al., 2020). During the pandemic, the UK implemented several monetary and health measures that influenced the economy. The health policy of the United Kingdom had the most extensive economic effect, with the restriction producing important drops in financial sector and Gross Domestic Product. Though, the state’s immunization campaign is the key to ending of restrictions and resuming pre-pandemic financial activities. The UK must promote consumption and keep unemployment low to facilitate a faster economic recovery.

Keywords: COVID-19; economic impact; UK; gross domestic product (GDP); industry; lockdown

1.0 Introduction

The Coronavirus brought a world health calamity, requiring several governments to implement drastic preventative solutions to stem the deadly virus transmission, through worldwide lockdowns and social isolation. As a result, numerous enterprises were forced to shut down, and the national economy was altered in every way. Even though all countries and businesses are affected, the effects vary greatly (Barua, 2020). The length and nature of the lockdown and the social distancing steps enforced by authorities to curb the coronavirus spread have resulted in asymmetric consequences not just across nations but also among economic areas and in every country’s demand and supply networks. This imbalance of the economic shock might signal that forecasting the gross domestic product (GDP) will be difficult and that the actual values may deviate remarkably from those speculated (Flynn et al., 2020).

Before an official lockdown, was declared late March 2020, the UK government issued its first social distancing guidance in early March 2020. Consumer demand fell, businesses and factories closed, and supply chains were disrupted, as they were in other afflicted nations. However, early statistics suggested that the UK was less afflicted than other European nations. As the epidemic progressed, the UK’s performance deteriorated compared to those of other European countries. While initially, significant emphasis was placed on the British government superior presentation in contract to other nations, the UK government has since sought to portray the illness spread in a favorable light (Wylie, 2020).

The unpredictable and shifting circumstances make projecting economic progress and anticipating present and future financial repercussions difficult for various reasons. factors like the COVID-19 global nature (Barua, 2020), which disrupted demand and supply chains, mass transit regulations, national cost-cutting- cutting almost all enterprise, the virus’s long duration, the great job losses and dramatic increase in joblessness rates, how learning and other businesses are transported, and the absence of same technique that can be used to foresee future performance. The government’s capacity to act and take mitigating steps to achieve a balanced recovery of all sectors will be limited by business stagnation, a loss in national tax revenue, and a decline in GDP (Alradhawi et al.). For future scheme and allocation of the already-stretched measures, statistics on the presentation of various fields and precise forecasting of presentation and regaining are required. Furthermore, a reliable forecasting model that considers the virus’s multifaceted structure and incorporates lessons learned before economic crises and pandemics is needed (Wylie, 2020). Developing intelligent systems that may assist governments in anticipating growth and financial results and providing solution models can be highly beneficial in multiple crises. It can help in addressing future crises and issues.

1.1 Research background

A computerized overall balance technique was deployed to study the impact of Coronavirus related behaviors, and regulations on the British economy. Scientist and scholars used a computable general equilibrium technique together with a community epidemiological technique to study the COVID-19’s potential macroeconomic effect on the British economy. In accordance with the report, the government’s alleviation measures will decrease mortality rates by less than 30% while costing the economy around 13.5 percent or more of the GDP owing to companies shutting down and lost labor from working parents during school closures. Alleviation measures for a virus that takes longer could minimize mortality by more than 90% while increasing the entire cost to the UK economy to around 29% of Gross Domestic Product (GDP), with learning institution closing amounting for 8% of Gross domestic Product and company closures accounting for 20% of GDP (Flynn et al., 2020). The scientists and scholars concluded that COVID-19 could have an extraordinary monetary effect on the UK economy, with the unintended costs of pandemic mitigation likely to outweigh the direct costs. The timeframe that infection counteraction programs are set up is significant in assessing the financial advantage.

One more research took a look at the UK economy in June 2020, analyzing the general impacts of the pandemic on GDP using a web-based poll and the Monthly Business Survey (MBS) as the huge information hotspot for 70% of manufacturing and 55% of service enterprises. The writers found that the COVID-19 pandemic fundamentally affected general benefits yield in mid-2020, with production falling 12.6 percent beneath February 2020, the last month of “typical” working conditions. as a result of people working from home, the Covid has hit the transportation area (Wylie, 2020). Land transportation, eminently the London Underground, has seen a drop in ridership, with use at 23% in mid-2020. Mid-2020 absolute assembling yield was 7.5 percent lower than February 2020, the last month of “typical” working circumstances. Putting on clothes was 32% lower in July 2020 than in February 2020. Manufacturing production was 11% lower than it was in February 2020. A five-section system has been developed to inspect why the UK did seriously compared to other different countries as far as the COVID-19’s clinical, social, and financial issues. They said there were issues with how proof concerning the scourge and its normal effects was procured, handled, and scattered. Accordingly, policymakers’ ability to survey risk was hurt, and they were given lacking data to address the pandemic’s numerous troubles with the fitting approach response.

The research also showed that the United Kingdom institutional background may have contributed to the country’s weak response to the epidemic. The authors stated that lawmakers in the United Kingdom may have placed too much reliance on medical science at the cost of other (social) scientific findings. Another research emphasized broadening organizational decision-making as a strategy for dealing with the pandemic’s difficulties. The author defined “organizational involvement” and gave a paradigm for several sorts of participation, claiming that a merger of co-determination and work environment consciousness is most likely to have a great effect. The author stated that the government’s reaction might lead to a more productive approach to dealing with the epidemic. He underlined the importance of developing effective participation mechanisms at all levels of human organization.

The effect of Coronavirus on the United Kingdom economy was explored by applying real-time data from the coalition of British Industry to analyze COVID-19’s influence on companies’ operations and forecast the economic repercussions of the government’s preventive actions (Flynn et al., 2020). The authors show that the epidemic has resulted in a remarkable decrease in nominal wage growth. Before the pandemic, paltry salaries had increased by 3% over the preceding year, compared to roughly 1% a year afterward. Nevertheless, average prices have risen by 0.5 percent during the epidemic, with the ONS reporting 0.6 percent producer increasing costs for all manufactured goods. Lower earnings diminish usage products and services, putting descending price pressure on them. Prices have risen despite decreasing wage growth since the outbreak (Wylie, 2020). At least in the industrial sector, this can partly be explained by growing average costs. The rise in expenses was mainly due to high input prices due to the increased trade barriers amid the United Kingdom and the European union (EU) caused by Brexit, as well as high cost of administration, and the adoption of new technology and management methods due to the epidemic. The above expenses contributed to a significant drop in United Kingdom trade in 2021, resulting in greater costs, and worse productivity.

Rachel Griffith and coworkers examined COVID-19 effects on share prices in the United Kingdom. Applying data on the portion prices of companies registered on the UK Stock Market, these writers explained how the COVID-19 epidemic impacted different businesses (Wylie, 2020). The stock market’s value represents how well a firm is performing now and how well it is predicted to perform in the near future. Share prices also imitate market predictions for changes in ultimate demand and supply constraints (Su et al., 2021). According to the authors, tourism and leisure, finance, insurance, and merchants are among the areas that have been struck the worst. On the other hand, Capital-intensive enterprises may lose workers’ talents and expertise if social distancing techniques persist. Such businesses are more likely to collapse if they fail to cut the expenses or get support from the government.

1.2 Research objectives

The aims of this research is to assess the macroeconomic implications Covid-19 had on the UK economy. To aid the economy and policy prescriptions move ahead, the government will use artificial intelligence to approximate the future economic/financial effects of the pandemic in the UK. To anticipate the influence of future measures, this thesis focuses on both continuous and categorical time series predictive approaches. It looks into the employment situation and unemployment rate during the Covid-19 Epidemic.

1.3 Research questions

Two major research topics emerged from the study: What are the overall pandemic’s financial costs to the UK economy?

How has the employment and unemployment situation evolved as the Coronavirus outbreak pandemic has progressed?

During the Coronavirus Epidemic, did the British government implement suitable policies?

2.0 Literature review

In comparison to its international competitors, the British was heavily hit by the economic implications of the Coronavirus epidemic. Between July and September, the UK economy was down by 10% from previous pandemic levels, as well as twice the drop evidenced in United States and European Union. The United Kingdom’s loss of less than a quarter between April and June was the most of any comparable nation, and additionally twice the Organization for Economic Co-operation and Development (OECD) average of less than 10%. The United Kingdom was the second-worst country in the first half of this year. (Flynn et al., 2020).

Additionally, even before the additional limits were announced, Britain’s ‘draw back’ was faltering, with monthly growth in the third quarter of only 1.1 percent. Despite continuous growth of five consecutive months, the rate dropped from less than 10 percent in mid-2020 to less than 7 percent in July and less than 3 percent in August 2020. In the most current research ONS BICs furlough statistics, 9% of the workforce is still on partial or complete permission, this figure is likely to increase if lockout limitations and the Work Preservation Scheme are tightened.

2.1 Pandemic Literature from the Past and Economic Impact

This section will look at prior pandemics that have impacted the United Kingdom and the rest of the planet and what happened throughout the pandemics. Since the Justinian Plague of the sixth century, records of the economic consequences of pandemics have been kept. Due to the fatalities, there was a significant drop in tax income, which resulted in lower-quality target coins, unreliable copper coins, and starvation. The economic implications have varied as economies have grown more industrialized and integrated due to globalization, but pandemics have always had financial consequences.

The Spanish Flu epidemic of 1918-1919 was one of the death-dealing epidemics in history, killing between 40 to 50 million people worldwide. Scientists and scholars utilized various non-pharmaceutical techniques during the Epidemic, including closing schools, a prohibition on social assemblies, and staggered opening times for non-essential enterprises. Retail sales in the United States fell 2% in November and 6% in December due to this and individuals adjusting their behavior to prevent illness. Nevertheless, after the Spanish Flu in the United States, Brainerd and Siegler (2003) discovered a link between ethical and economic development. This is an unexpected link, but numerous reasons other than the pandemic might have contributed to the surge in economic growth. Increasing education and industry are two influences (Brainerd and Siegler, 2003). This is in contrast to the UK, whose Gross Domestic Product fell by more than 5%.

By assessing the financial repercussions of the Spanish Flu in Sweden, the economic effects of World War I will be decreased. This is because Sweden did not need to raise borrowing to fund a war effort, nor did it incur a significant population decline due to war casualties. Because of the high degree of risk during the pandemic, revenues in Sweden declined mainly in food and accommodation (Flynn et al., 2020). As predicted, the Spanish Flu had undesirable economic impacts in the UK and Sweden, but it had beneficial benefits in the United States, which saw GDP growth. When investigating the Spanish Flu, one key issue is the impact of World War I on the statistics since this had a significant effect on economic growth and employment.

The British government’s response to the Spanish Flu was non-existent. Local governments and authorities were given carte blanche to execute any policy, resulting in an unstructured and chaotic approach. Three waves of diseases hit the United Kingdom: one in the spring of 1918, another in the autumn of 1918, and another in early 1919. The British authorities did not announce the Spanish Flu until October 1919. In the UK, it is believed that more than 200,000 people perished (Ozili & Arun, 2020). Following World War I, the United Kingdom underwent a period of strictness and monetary deflation to eliminate the large budget deficits and high inflation that the country had accumulated during the war. The UK economy stalled in the 1920s due to this, along with increasing fatalities from the Spanish Flu and contractionary monetary and fiscal policies, and it even experienced deflation in the early 1920s (Flynn et al., 2020).

The H1N1 influenza virus, sometimes known as Swine Flu, was identified in 2009 and produced a catastrophic global epidemic. The H1N1 influenza virus, like the Spanish Flu, is a form of influenza virus. However, it is far less dangerous. Swine Flu killed roughly 200,000 individuals worldwide during the Epidemic, which lasted from 2009 to 2010. This is a far cry from the 40-50 million people who perished during the Spanish Flu.

Furthermore, the worldwide economy has changed dramatically since the early twentieth century, with a larger reliance on global travel, putting an immense strain worldwide and United Kingdom economies than throughout the Spanish Flu period (Ozili & Arun, 2020). Between 2008 and 2009, the UK lost 1.6 million tourists due to swine flu. The Swine Flu cost the tourism industry £940 million in lost revenue. Because of the Worldwide Financial Disaster and low lethality, however, the research on Swine Flu is sparse and mostly focused on the tourist industry (Flynn et al., 2020). The Swine Flu pandemic, on the other hand, prompted researchers like Smith et al. and Keogh-Brown et al. to investigate the impacts of future influenza pandemics, which formed the basis of this study.

SARS (severe acute respiratory syndrome) is a coronavirus strain of virus comparable to Covid-19. SARS was found in China in 2002 and quickly spread to other nations, including COVID-19. Although there was no big epidemic in the UK, SARS, which belongs to the same virus family as Covid-19, can provide helpful insight into the economic repercussions of the UK shutdown This similarity helps to contextualize what might occur throughout coronavirus pandemic. SARS- mostly affected states, such as China and Hong Kong, saw “huge, though short-lived negative demand shocks,” primarily due to those attempting to prevent infection. Restaurants, hotels, and public transportation were among the industries hit hardest. With only 7000 confirmed cases and 700 deaths between them, China, Hong Kong, Singapore, and Taiwan are projected to have lost $13 billion in GDP. This is the financial effect of a modest but lethal epidemic on a country (Flynn et al., 2020). However, the above losses were only transitory since the illness eruption was short-lived, and user self-assurance swiftly returned. While the worldwide economic impact of SARS was less than that of the Spanish Flu COVID, it is nevertheless crucial to realize for two reasons. SARS is a virus related to Covid-19, and it demonstrates how a little pandemic can have a large impact on industrialized countries.

Table 1: Major word Pandemics and Historical timeline

| Name | Time Period | Type/Pre-human host | Estimated Death Toll |

| Antonnie plague | 165-180 | Believed to be either smallpox or measles | 5 million |

| Japanese smallpox epidemic | 735-737 | Variola major virus | 1 million |

| Plague of Justinian | 541-542 | Yersinia pestis bacteria/rats, fleas | 30 to 50 million |

| Black Death | 1347-1351 | Yersinia pestis bacteria/rats, fleas | 200 million |

| New World Smallpox Outbreak | 1520 | Variola major virus | 56 million |

| Great Plague of London | 166 | Yersinia pestis bacteria/rats, fleas | 100,000 |

| Italian plague | 1629-1631 | Yersinia pestis bacteria/rats, fleas | 1 million |

| Cholera Pandemics 1-6 | 1817-1923 | V. cholerae bacteria | 1 million plus |

| Third Plague | 1885 | Yersinia pestis bacteria/rats, fleas | 12 million (China and India) |

| Yellow Fever | Late 18th C | Virus/Mosquitoes | 100,000-150,000 (USA) |

| Russian Flu | 1889-1890 | H2N2 (avian origin) | 1 million |

| Spanish Flu | 1918-1919 | H1N1 virus/pigs | 40 to 50 million |

| Asian Flu | 1957-1958 | H2N2 virus | 1.1 million |

| Hong Kong Flu | 1968-1970 | H3N2 virus | 1 million |

| HIV/AIDS | 1981 up to date | Virus/chimpanzees | 25 to 35 million |

| Swine Flu | 2009-2010 | H1N1 virus/pigs | 200,000 |

| SARS | 2002-2003 | Coronavirus/bats, civets | 770 |

| Ebola | 2014-2016 | Ebolavirus/ wild animals | 11,000 |

| MERS | 2015 up to date | Coronavirus/bats, camels | 850 |

Source: World economic forum (2021)

Pandemics will significantly negatively impact commercial activity, in short run. The consequences include:

- Avoidance behaviors caused by social distancing tactics.

- Direct costs for example medical charges).

- Loss of labor input and output.

- Service and travel interruption.

Various researchers have tried to forecast the financial effect the outbreak (Ozili & Arun, 2020). For instance, Jonung and Roeger (2006) estimated that an imaginary world outbreak could cause the European Union to lose 1.6 percent of its Gross Domestic Product because of demand and supply-side variables.

2.2 Current Literature on the Covid-19 Pandemic

Covid-19 epidemic is still ongoing, prompting many nations to implement compulsory lockdowns to prevent the virus’s deadly spread and preserve lives. The closure of numerous less important enterprises due to Pandemic has had a remarkable impact on usage in many firms, including retail, hospitality, and tourism. Many researchers and scholars are writing literature to understand better the present financial situation and the policies most suited to support the economy during the epidemic, even though it is still ongoing (Flynn et al., 2020). The recent economic collapse is being dubbed the worst since the Great Depression of the nineteenth century.

Contrary to the Great Depression and previous economic decline, this was triggered by an “inevitable effect of actions to prevent the spread of the virus” rather than a fall in demand. Economic activity went down dramatically due to the immediate and unexpected action needed to minimize transmission. Many nations have been urged to implement exceptional measures to help the economy, provide income to its citizens, and keep industries and monetary markets afloat. Grants and subsidies must be used to ensure household incomes are secure to aid the economy and those who are most impacted. According to Gopinath (Ozili & Arun, 2020). for economic activity to continue, the nation’s medical facilities must be ready to deal with the sickness (Sherif, 2021). This will enable a compromise between saving lives and safeguarding the economy and people’s incomes.

The Covid-19 epidemic has had a dramatic effect on the United Kingdom and the rest of the universe. The UK’s first lockdown began at the end of March 2020 and was succeeded by reopening the country in mid-June 2020. No non-essential companies were permitted to resume during this time. Retail stores, bars and hotels were among them. individuals were also compelled to work without supervation and advised not to leave their houses unless necessary to acquire food or medicines. The Bank of England estimated that GDP would fall by a quarter in 2020 due to this significant economic shock

According to the Statistics, the gross Domestic Product declined by less than 20% from the first to the second quarter of 2020. The United Kingdom went under another restriction in November 2020, which continued until the end 2020. Both restrictions were shorter and less severe than the first one in the United Kingdom. Education institutions were permitted to continue operating, but all non-essential enterprises, such as retail and hospitality, were forced to close. This will also result in a drop-in business activity. By April 2020, 25% of British businesses had temporarily shuttered, and nearly half of those reported less-than-average turnover. Due to the apparent effects of decreased GDP, such as deteriorated human resources and reduced world trade, Gross Domestic Product Following previous pandemics, it took more than two years to go back to previous pandemic levels. (Sherif, 2021). Many programs were launched during the time of lockdown to assist keep businesses surviving and people engaged in different occupations and to help limit the possible Gross Domestic Product loss. This ensures that employees are paid and free firms of payroll obligations, hence lowering unemployment and work stoppages.

If an employee was suspended by their industry, the plans permitted by the administration to cover almost 90% of their salaries. The plans kept workers working, which helped lower unemployment, which was expected to rise to almost 5% during the three-month lockdown (Ozili & Arun, 2020). During this time, growth and inflation needed to remain minimal to avoid conflicts among aims such as sanitation, supporting enterprises and families, and the monetary soundness of the United Kingdom. Interest rates are projected to reduce as consumer confidence drops during the outbreak. Still, buyers are essential to raising their savings as a backup plan because of the greater danger of being jobless. Since individuals cut back on their spendings and boost their investments, the Gross Domestic Product will fall further. We can anticipate inflation to reduce due to the rise in savings.

The current Covid-19 writing is grounded on approximations from prior epidemics and the beginning Coronavirus pandemic (Ozili & Arun, 2020). It’s crucial to recall all pandemics are not the same has different economic implications. Bearing in mind that pandemics are distinct, there must be commonalities in strategies employed to control outbreaks. Thus, the estimations and previous pandemics will offer a framework for the investigation.

3.0 Research Methodology

3.0 Introduction

Given that the economic impacts of the Covid-19 pandemic are still being felt, and the potential of future outbreaks looms, the true scope and duration of the epidemic’s impact on the United Kingdom economy have yet to be determined. The nature of the data to be collected for analysis was also considered in this study. Quantitative data from credible sources was used to offer essential values and numbers that attempted to quantify the current state of the UK economy. Authors, publishers, and media reports, on the other hand, gave qualitative data that contributed to the conversation.

The study concentrated on the economic effects between March 2020 and the beginning of May 2021. As a result, the study highlighted current events that impacted the economy during a pandemic while also contributing to existing knowledge.

Because the dissertation’s goal was to look into how Covid-19 affected the UK economy, it was vital to look into the results of reputable sources in various sectors to offer a comprehensive and current picture of the pandemic’s effects on the UK economy (Ozili & Arun, 2020). As a result, the World Health Organization, Her Majesty’s Revenue and Customs, Office for National Statistics (ONS), House of Commons Library online news stories, and reports on the impact of COVID-19 from recently published articles were studied and cited in this dissertation.

3.1 Sample Section

The Department of Statistics and the UK’s leading independent data generator provided the information for this study. It was critical to assess how the epidemic affected economic fields and how each industry would affect the economy. Month-to-month information sectors such as the manufacturing sector, service sector, and the construction sector and gross domestic product (GDP) were carried for this study. The quarterly data collected from 1997 to 2021 was used in the prediction analysis. Data on GDP was also gathered from 1947 to February 2021 to compare with earlier outbreaks and calculate economic growth. The statistics for the service industry came from a report of the Monthly Business Survey on service industry turnover. The total output of all sectors was examined and specific different areas within the industry. The data for the manufacturing sectors was gathered from the production industries’ MBS turnover. The overall turnover for the production and manufacturing firms and nearly 45 distinct industry sectors were measured. Seasonally and non-seasonally adjusted output data for the construction industry were observed. Growth was also noticed on a yearly and quarterly basis.

A nowcasting model based on a dynamic factor model was utilized to anticipate quarterly GDP for 2021 in this study by examining monthly GDP data. Before the official data is provided, this model employs real-time and high-frequency data to better analyze the UK’s economic implications.

3.2 The pandemic’s financial cost

As we previously stated, responding to the epidemic has brought at a high monetary cost. Even though the whole economic consequences must be unknown for time now, information from the state Bureau of statistics enables us to place the recognized costs and projected imminent spending, which sums up to the total fee, into perspective. The approximated duration for the national administration prices for new Coronavirus related projects totaled about a quarter of a trillion pounds (£271 billion) as of January 2021. (Sherif, 2021). This equates to approximately £9,700 per household. Over half of the expected national administration outlay (£116 billion) has already been used. It’s important to remember that the management hasn’t provided a cost evaluation for several of the measures, such as support for insolvent colleges and compensation for lost revenue to local governments (Ozili & Arun, 2020).

Only a twenty percent of the entire expense for these upcoming programs supports health and social care – mainly the NHS Test and Trace program, personal protective equipment, vaccine supply, and additional healthcare spending. This expenditure includes a variety of actions and services, using private-sector health centers and keeping pharmacists and GP clinics open during holidays are examples.

On the other hand, as people’s knowledge of the consequences of limits improved, industries, users, and the management all deployed. For instance, the state was capable of using more focused actions. During the first lockdown, output was 25% lower than pre-pandemic levels, then 8% lesser towards the end of 2020. The British Government adopted extraordinary measures to aid the economy’s recovery from the outbreak. As a result of the Covid-19, the administration has provided more than £400 billion in direct economic support. This has aided in protecting jobs and industries in every country of the UK and has driven the UK’s faster-than-expected economic rebound after the boundaries were relaxed.

In the United Kingdom, the Coronavirus Job Retention Scheme assisted 11.7 million jobs and 1.3 million entrepreneurs, while the entrepreneurship Income Support Scheme assisted approximately 3 million entrepreneurs. As limitations were eliminated in 2021, consumer activity soared, reinforced by the vaccination rollout, propelling the economy forward. Business confidence and investment increased as uncertainty decreased. In November 2021, the economy regained its pre-pandemic size, which was faster than expected. The Omicron variant’s introduction, workforce absences owing to infection and isolation, and Plan B procedures in England have had a recent effect on the economy, with GDP decreasing 0.2% percent at the end of 2021.

The remarkable rebound of the labor market has been assisted by government involvement. In January 2022, there were 436,000 more salaried commercial workers than in February 2020. In the three months running up to January 2022, vacancies remained at an all-time high of 1.3 million. Supply pressures imposed by Coronavirus has operated as a restriction on output in numerous nations, plus the United Kingdom, following the lifting of restrictions in the summer of 2021 (Sherif, 2021). This is due to labor market restrictions, worldwide plant closures, and rising consumer demand for goods. While supply limitations persist, there are early signs of relief, with transport costs starting to fall in October 2021.

Furthermore, the likelihood of new outbreaks around the world and different countries’ reactions to COVID-19 could pose additional dangers to the UK economy. Individuals who were told to self-isolate before this date will still be entitled to receive assistance payments for the next 42 days. The Regulations on Health Protection (Coronavirus, Restrictions) (England) should be repealed entirely. Home-grown authorities will continue to control COVID-19 outbreaks in high-risk scenarios in the same manner, the same way they contain other infectious illnesses. As of March 24, the COVID-19 provisions in the Statutory Sick Pay and Employment and Support Allowance regulations will be phased down (Sherif, 2021). Provided you have COVID-19, you may still be eligible for benefits if you match the other criteria.

Whether or not the healthcare system can secure additional funds, it is evident that the costs of broader economic assistance will swamp direct care expenses.

3.2.1 Economic costs of the pandemic on the UK during the Covid-19

As the world ushered in 2020, shocks resulting from supply and demand disruptions, high levels of uncertainties, and compromised, public health made these the most severe economic shocks in recent history. The UK economy is in a catastrophic recession, according to Chancellor Rishi Sunak, “the likes of which we have not seen.” Various economic observations preceding this confirmation.

In 2020, the GDP had dropped by 9.7%, the largest reduction since reliable records began in 1948. “The shrinkage in 2020 was the same as it was in 1921,” according to preliminary GDP estimates dating back further. One must go back to 1709 to find the most significant collapse.

Combined with concomitant non-pharmaceutical interventions (NPIs), the virus had significant economic consequences, with the UK’s GDP contracting by 9.4% in 2020 (Sherif, 2021). This triggered the worst recession in history. The state offers more focused interventions to rescue the situation after realizing the consequences of limitations on users and enterprises. In contrast to pre-pandemic levels (February 2020), output was 25% lower during the first lockdown (April 2020), 7% lower during the second lockdown (November 2020), and 8% lower during the third lockdown’s peak (December 2020). (January 2021).

During the worst periods of the outbreak, the UK government took extraordinary steps to help the economy. During this epidemic, the UK government has provided almost 400 billion pounds of indirect economic assistance. Because of these interventions, many firms and employment across the country have experienced a faster recovery due to the limitations being lifted. In 2021, the Self-Employment Income Support Scheme benefitted 1.3 million employers, and the Coronavirus Job Retention Scheme supported 11.7 million jobs across the United Kingdom.

The vaccine deployment that set the path for the restrictions to be lifted in 2021 resulted in greater consumer activity. As a result, the economy has improved, as has investor and corporate confidence. By November 2021, economic growth had returned to pre-pandemic levels throughout the same year. However, the Omicron variant outbreak resulted in employee absences owing to illness and isolation. The government implemented plan B steps to alleviate the decreasing GDP, which stood at 0.2 percent in December 2021 (Sherif, 2021).

The prime minister declared in January 2022 that the limits and principles put aside to combat the spread of the Omicron variety would be lifted. These included eliminating required certification, allowing organizations to choose whether or not to use the NHS Covid pass, easing work-from-home directives, removing face masks, easing visits to care homes, and retaining self-isolation for sick people (Papadopoulos et al., 2021). The self-isolation regulation was supposed to expire on March 24.

3.3 Current State of UK Economy

In March 2022, the inflation rate had risen to 7% due to the relaxation of regulations. By the winter, this is expected to reach 10%. The country will have to wait until 2024 to get back to a 2 percent inflation rate. Meanwhile, the government is grappling with high inflationary energy, fuel, and labor expenses (Sherif, 2021). By October 2022, the energy price will grow by another 40%. The annual bill will be around 2800 pounds on average. The Bank of England also expects the economy to contract signed by the end of the year. According to Andre Bailey, Governor of the Bank of England, economic growth in 2023 will be exceedingly low. To avoid an increase in inflation, the bank increases the cost of borrowing (interest rates). According to the governor, consumer spending behavior will determine how the global economy changes. With the growing global connection, the UK economy’s improvement will depend on other trading partners’ financial stability. The ongoing Russia-Ukraine conflict is an unusual element affecting the global economy, including the UK. The impact of a pandemic on the UK economy is still in its initial stage, and my research is not about it.

4.0 Findings Data Analysis

4.1 Anticipated Changes in Unemployment throughout the Covid-19 pandemic

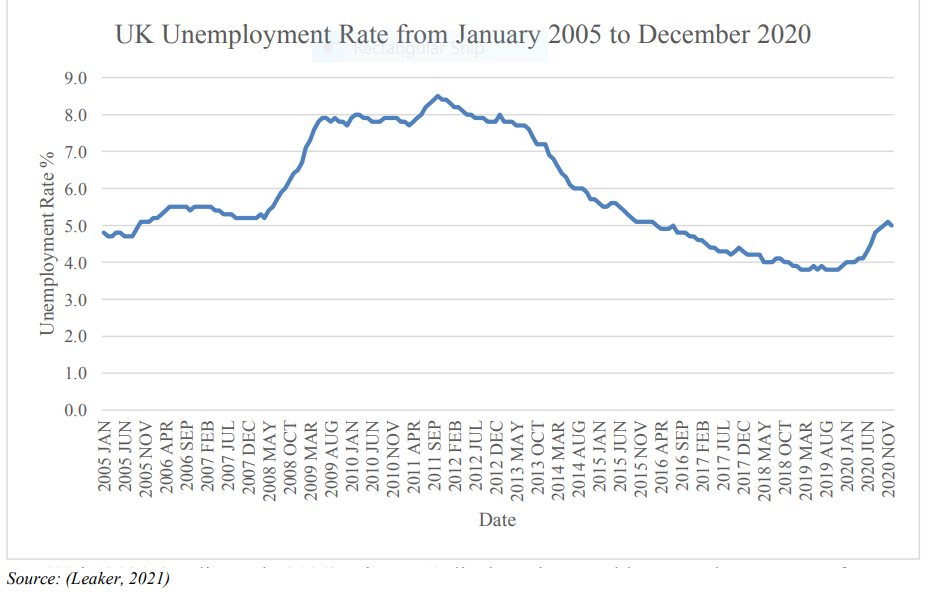

When economies undergo a significant decrease in GDP, the joblessness rate increases intensely. As GDP declines, unemployment is expected to rise due to a lack of demand, firms shutting down, and job layoffs. As unemployment rates are expected to increase significantly, with a substantial drop in Gross Domestic Product of approximately 19% in the second quarter of 2020 (Jeris & Nath, 2020). Furthermore, according to the National Bureau of Statistics, a three-month lockdown in the UK would increase joblessness among 16 of age and above from 2005 to the end 2020 (Wylie, 2020).

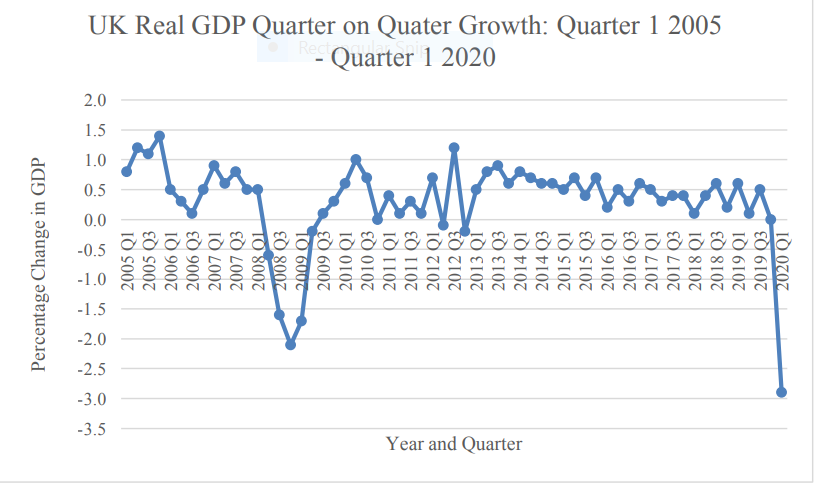

To be categorized as unemployed, a person must have been seriously looking for job for a month week and be able to start work within a fortnight. When contrasting Figure 2 to Figure 1, joblessness grew from nearly 5.3 percent in April 2008 to 7.9 percent in June 2009 during the 2008 Global economic Crisis, the last downturn (Hu, 2020). The UK suffered five quarters of undesirable growth, with an average quarterly drop of nearly 1.24 percent and a maximum quarterly rise nearly of 2.1 percent in 2008. The Covid-19 epidemic and the shutdown in the second quarter of 2020 produced a 19 percent drop in GDP. Therefore, there was a significantly more significant increase in unemployment in the UK from March 2020 to December 2020 (Wylie, 2020).

Figure 1 shows. UK Real GDP Quarter on Quarter Growth: Quarter 1 2005 – Quarter 1 2020

Figure 2 shows Unemployment Rate from January 2005 to December 2020

4.1.1 Unemployment Analysis during the Covid-19 Pandemic

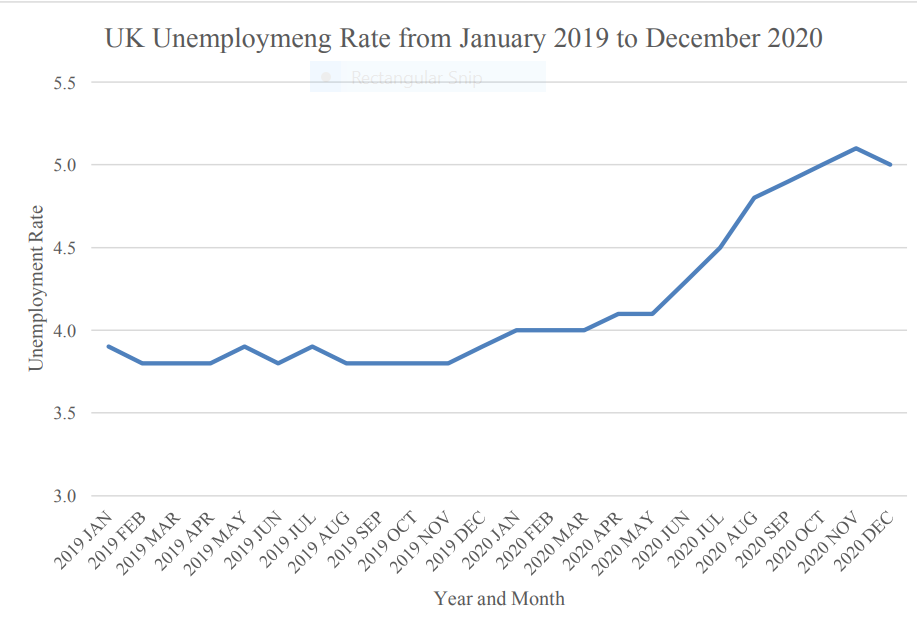

The joblessness rate was constant and dependable in 2019, before the outbreak, with jobless charges ranging with a difference of 0.2 percent each month. The joblessness rate was approximately 4.0 percent when the Coronavirus pandemic and its restrictions started in March, and it had ascended to 5.0 percent by the end 2020 (McBride et al., 2021), as highlighted in Figure 3. The joblessness rate was at its most significant peak in November 2020, at 5.1 percent. Given that GDP fell by 19 percent in the second quarter of 2020, this increase in joblessness is minor and did not contribute significantly to the decrease in GDP (Wylie, 2020).

Figure 3 shows Unemployment Rate in the United Kingdom from January 2019 to December 2020

The Coronavirus Job Retention measure and the Self-Employment Income Support move are two of the greatest critical policies that the British government developed to retain its citizens working and provide wages to workers during the outbreak (Jeris & Nath, 2020). The Coronavirus Job Retention measure and the Self-Employment Income Support move were deployed at the commencement of the United Kingdom lockdown to sustain employment while the country was under quarantine because of the covid-19 epidemic (Wylie, 2020). The administration would pay wages for employees who are furloughed by their administrators. Furloughed employees were paid 80% of their pay up to £2,500 per month. By the end of 2020, approximately 9.6 million people had received their payment for the scheme’s life, which cost the nation’s government around £34.08 billion in 2020 (Jeris & Nath, 2020).

The Self-Employment Income Support move is a similar policy for entrepreneurs, and it has led in the state backing up 2.6 million entrepreneurs. To put this scheme into success, the total UK labor force is approximately 34,707,922 individuals, with both policies paying wages to nearly 12.2 million workers. As a result, the UK government paid the salaries of nearly 34.57 percent of the UK employees on furlough throughout 2020. As a result of these programs, the jobless rate continued relatively low despite the increase in GDP (Wylie, 2020). Without them, the joblessness rate could have been much advanced because businesses would not have been able to pay the employees’ salaries due to the decrease commercial activity.

In conclusion, The UK’s joblessness rate rose throughout the Covid-19 outbreak. However, it has grown far more slowly than expected, implying a massive 19 percent reduction in Gross Domestic Product in the second quarter of 2020. During Covid-19, important government programs like the Coronavirus employment Retention measure and the Self-Employment Income Support move have aided in the preservation of many people’s jobs and pay. Without these programs, the UK’s unemployment rate would have climbed to much higher levels than it is presently. With the government covering the wages of about 12.2 million individuals, it’s possible that many of them may be jobless by 2020. Keeping an average unemployment rate will help the economy rebound after Covid-19 because people are already employed and so quite productive.

4.2 Inflation

During the epidemic, the UK’s inflation rate followed the apparent pattern, declining. Because the nation was on lockdown and the GDP declined. The major problem with a large drop in Gross Domestic Product (GDP) is the possible of deflation that UK has already avoided. Consumers save money when prices fall; therefore, increasing consumption would be challenging if the United Kingdom experienced deflation during the Covid-19 outbreak. Low inflation suggests that deflation is still a potential, but as the economy resumes, inflation may increase in tandem with increased spending. Excessive inflation is another risk that could arise if the United Kingdom economy loosens its limits and uses pent-up demand. As an effect, the Bank of England’s capacity to curb inflation due to the Covid-19 outbreak was critical (Jeris & Nath, 2020). Deflation has been avoided thus far, ensuring that whenever restrictions are eased, consumption would rise, providing a faster economic recovery.

4.3 The Policies Implemented by the UK Government and Against the Economic Impact of Covid-19

The UK government adopted several interventions during the epidemic to mitigate and control the economic effect of the epidemic. The UK basic strategy was fiscal, with increases in government spending and tax cuts, and deferrals (Chronopoulos et al., 2020). These economic strategies aimed to manage and overturn the virus, enhance Promote public services while also promoting jobs and businesses. To help the economy throughout the outbreak, the Bank of England’s Monetary Policy Committee raised interest rates and revised its quantitative easing program. The UK government launched significant health steps to assist stop the spread the deadly virus (Barua, 2020).

4.3.1 Monetary Policy During the Covid-19 Pandemic.

In reaction to the outbreak, the Monetary Policy Committee lowered interest rates to 0.1% in March 2020, the lowest they have ever been. They also increased their quantitative easing program by about £200 billion initially, and the Monetary Policy Committee decided to another £250 billion boosts in quantitative mitigation during the pandemic. At the time of the epidemic and restriction, the Monetary Policy Committee improved its quantitative easing program by nearly £450 billion (Phillipson et al., 2020). The MPC seeks to support both consumer spending and the economy throughout Covid-19 by dropping interest rates.

However, this program was ineffectual due to the forced lockdown, and that interest rates were relatively low to a nearly at 0.75 percent. Hence, a decrease to 0.1 percent was not important, and consumption declined by half in the second quarter of 2020. As a result, the reduction in interest rates had little effect on the economy.

4.3.2 Fiscal Policy during the Covid-19 Pandemic

Covid-19 employment Retention measure and the Self-Employment Income Support move were two essential programs established, as previously mentioned. For those unable to work due to the pandemic, the plans provided 80% of their wages up to £2,500 per month. These rules were drafted to help enterprises succeed and keep individuals at work making money. These measures were quite effective in keeping individuals busy, and they aided in maintaining the wages of 12.2 million workers. Because a significant fraction of these employees may have gone unemployed, the joblessness rate could have been much advanced than it is now. As a result, when the two schemes expire, the UK could challenge a joblessness catastrophe. To avoid this, the leadership may be forced to pay a lower percentage of workers’ earnings while they are still able to work until their company can pay their wage obligation. These projects have been highly fruitful in keeping individuals in a payroll and providing income during the crisis.

4.3.3 Health Policy During the Covid-19 Pandemic

To combat coronavirus pandemic, the UK implemented massive non-pharmaceutical health interventions, which had significant economic consequences. These policies result in considerable falls in usage and investment and a substantial drop in Gross domestic product (GDP). This happened since industries being compelled to close and residents being encouraged to stay at home (Nicola et al., 2020). During the outbreak, government policy must assist both economic and public health in guaranteeing that both are safeguarded to the greatest of the government’s capabilities. Vaccination is an important health strategy that can improve the economy.

5.0 Discussion

The global economic effect of COVID-19 outbreak has been substantial, and UK economy included. The United Kingdom is expected to be hit worse than most other nations. My findings show that the Virus has resulted in the UK’s greatest quarterly Gross Domestic Product drop since records began in 1948 (Keogh-Brown et al.,2020). Succeeding the dramatic spike in the propagation of the pandemic in the UK, a sharp decrease in the Gross Domestic Product index was noticed beginning in early 2020. From April to June, the second quarter of 2020 was the greatest drop in quarterly GDP figures (Jeris & Nath, 2020). This loss in quarterly GDP was greater compared to any other dip in quarterly GDP in the UK over the last six decades years (20.4 percent, p 0.0001). GDP climbed by 1.0 percent in 2020 Quarter 4 (October to December), following a 16.1 percent increase in 2020 between July and September. Compared to past catastrophes, the second-highest quarterly GDP loss occurred in the first quarter of 1974, at 2.7 percent, eight repetitions fewer than the Pandemic Quarter 2 decline. The third most substantial reduction in Gross Domestic Product occurred in the second quarter of 1958 when Gross Domestic Product fell by less than 3 percent. This loss in quarterly GDP was greater compared further dip in quarterly GDP in the UK over the last six decades (20.4 percent, p 0.0001). GDP climbed by 1.0 percent in 2020 Quarter 4 (October to December), following a 16.1 percent increase in 2020 between July and September (Jeris & Nath, 2020). Compared to past crises, the next biggest quarterly Gross Domestic Product loss occurred in the first quarter of 1974, at 2.7 percent, which was approximately eight times less than the COVID-19 Quarter 2 decline. The third most substantial reduction in GDP arose in the next quarter of 1958 when GDP fell by 2.4 percent.

Due to the recent spike in coronavirus cases in October 2020 and January 2021, stronger lockdowns were re-introduced across British Government by the start 2021. As a result, the first two quarters of 2021 are anticipated to see GDP shrink much more than expected (Barua, 2020). Though, the drop in GDP was not anticipated to be as significant as the first restriction. The economic prospect prediction predicted annual GDP growth of 12.4% and 5.2% in 2020, respectively, but the observed decline was 8.4%. Using the dynamic factor model, PwC forecasted annual and monthly GDP growth rates (Jeris & Nath, 2020). However, their forecast model differed slightly from the actual data.

For example, in September 2020, they forecasted a 14 percent drop in GDP for the third quarter of 2020, with an overall drop of 11 to 12 percent. However, according to ONS data, third-quarter GDP was up 15.5 percent from the last quarter and down 12.4% from the baseline quarter, with an annual GDP decline of 8.4 percent (Jeris & Nath, 2020). GDP increased by 2.2 percent in 2020 Quarter 4, much higher than the 3.7 percent forecasted in the previous PwC economic report. The average prediction for GDP growth in 2021 ranged from 3.7 percent to 4.3 percent. Based on the lockout effect, the average prediction for 2021 Q1 GDP was a drop of 3.5 percent to 4% from the previous quarter.

6.0 Conclusion

The outbreak of Covid-19 has led to the most significant quarterly decrease in GDP ever in history. Throughout the Covid-19 outbreak, GDP was the worst-performing macroeconomic statistic. With a small increase in joblessness rate (Wylie, 2020). This is appreciations to inclusive measures like the Coronavirus Job reservation Scheme, which was essential to keep many employees employed and rewarded during Covid-19 pandemic. If not for this program, joblessness would be substantially higher, and the United Kingdom economy might face a higher unemployment rate (Flynn et al., 2020). The inflation rate has fallen to low levels and GDP, raising concerns about deflation. Also, preventing deflation will inspire people to spend more once the UK economy restarts (Barua, 2020).

The current vaccination program must remove the need for other Covid-19 restrictions, and for the reason of low unemployment, the United Kingdom should recover earlier than anticipated, rewinding to pre-pandemic economic activity (Wylie, 2020).

To safeguard business, employment and incomes, a monetary policy has been endorsed during the pandemic. The strategy employment has been fruitful thus far with these purposes in mind. There is a chance that unemployment could increase when these programs expire thus suspending economic recovery (Jeris & Nath, 2020). Furthermore, as the UK lessens limits, the rise in quantitative easing during 2021 can inspire the economy by rising the money supply, decreasing the time needed to put Gross Domestic Product back to previous epidemic levels. The United Kingdom amalgamation of economic and health policies has put it where economic recovery might be quick.

The British’s institutional environment might have also played a role in this poor response to the epidemic. It led to the supply of incomplete evidence, which hampered the pandemic’s evaluation and policy implementation. The necessity to build successful systems of involvement at all stages of human association is one of the most critical measures in coping with the epidemic. The pandemic brings not only extra costs to the United kingdom’s economy but also struggles in stabilizing the state’s various economic goals, such as increasing jobs and encouraging efficiency while matching the pandemic’s impact on the UK (Wylie, 2020). Implementing alleviation techniques would reduce mortality rates and help combat the epidemic, but they would come at a far higher cost, in the end, costs that could present policymakers with even more issues in the future

References

Keogh-Brown, M. R., Jensen, H. T., Edmunds, W. J., & Smith, R. D. (2020). The impact of Covid-19, associated behaviours and policies on the UK economy: A computable general equilibrium model. SSM-population health, 12, 100651.

Flynn, D., Moloney, E., Bhattarai, N., Scott, J., Breckons, M., Avery, L., & Moy, N. (2020). COVID-19 pandemic in the United Kingdom. Health Policy and Technology, 9(4), 673-691.

Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Iosifidis, C., … & Agha, R. (2020). The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International journal of surgery, 78, 185-193.

Jeris, S. S., & Nath, R. D. (2020). Covid-19, oil price and UK economic policy uncertainty: evidence from the ARDL approach. Quantitative Finance and Economics, 4(3), 503-514.

Alradhawi, M., Shubber, N., Sheppard, J., & Ali, Y. (2020). Effects of the COVID-19 pandemic on mental well-being amongst individuals in society-A letter to the editor on “The socio-economic implications of the coronavirus and COVID-19 pandemic: A review”. International journal of surgery (London, England), 78, 147.

Su, C. W., Dai, K., Ullah, S., & Andlib, Z. (2021). COVID-19 pandemic and unemployment dynamics in European economies. Economic Research-Ekonomska Istraživanja, 1-13.

Barua, S. (2020). Understanding Coronanomics: The economic implications of the coronavirus (COVID-19) pandemic. Available at SSRN 3566477.

Rakha, A., Hettiarachchi, H., Rady, D., Gaber, M. M., Rakha, E., & Abdelsamea, M. M. (2021). Predicting the economic impact of the COVID-19 pandemic in the United Kingdom using time-series mining. Economies, 9(4), 137.

Hu, Y. (2020). Intersecting ethnic and native–migrant inequalities in the economic impact of the COVID-19 pandemic in the UK. Research in Social Stratification and Mobility, 68, 100528.

Chronopoulos, D. K., Lukas, M., & Wilson, J. O. (2020). Consumer spending responses to the COVID-19 pandemic: an assessment of Great Britain. Available at SSRN 3586723.

De Lyon, J., & Dhingra, S. (2021). The impacts of Covid-19 and Brexit on the UK economy: early evidence in 2021. London: Centre for Economic Performance, London School of Economics and Political Science.

Jallow, H., Renukappa, S., & Suresh, S. (2020). The impact of COVID-19 outbreaks on United Kingdom infrastructure sector. Smart and Sustainable Built Environment.

Ozili, P. K., & Arun, T. (2020). Spillover of COVID-19: impact on the Global Economy. Available at SSRN 3562570.

Sherif, M. (2020). The impact of Coronavirus (COVID-19) outbreak on faith-based investments: An original analysis. Journal of Behavioral and Experimental Finance, 28, 100403.

Phillipson, J., Gorton, M., Turner, R., Shucksmith, M., Aitken-McDermott, K., Areal, F., … & Shortall, S. (2020). The COVID-19 pandemic and its implications for rural economies. Sustainability, 12(10), 3973.

Wylie, E. (2021). The Impact of Covid-19 and the Lockdown on the UK Economy.

Brown, R., Rocha, A., & Cowling, M. (2020). <? covid19?> Financing entrepreneurship in times of crisis: exploring the impact of COVID-19 on the market for entrepreneurial finance in the United Kingdom. International Small Business Journal, 38(5), 380-390.

Papadopoulos, T., Baltas, K. N., & Balta, M. E. (2020). The use of digital technologies by small and medium enterprises during COVID-19: Implications for theory and practice. International Journal of Information Management, 55, 102192.

McBride, O., Murphy, J., Shevlin, M., Gibson‐Miller, J., Hartman, T. K., Hyland, P.& Bentall, R. P. (2021). Monitoring the psychological, social, and economic impact of the COVID‐19 pandemic in the population: Context, design and conduct of the longitudinal COVID‐19 psychological research consortium (C19PRC) study. International journal of methods in psychiatric research, 30(1), e1861.

Appendix

1. What is your gender?

- Male

- Female

2. What is your age?

- Under 18

- 18-25 years old

- 26-35 years old

- Over 35 years old

3. What is your title?

- Professional

- Full-time Student

- Part-time Worker

- Part-time Student

4. How well would you say you were handling your finances before the official lockdown was declared on March 23, 2020?

- Living comfortably

- Doing all right

- Finding it quite difficult

- Finding it very difficult

5. How do you think your present financial status compares to what it was before the official lockdown on March 23, 2020?

- I’m worse off

- I’m a little worse off

- I’m about the same

- I’m a little better off

6. I’m concerned about my future financial situation

- Firmly agree

- Neither agree nor disagree

- Disagree

- Firmly disagree

write

write