Abstract

The gasoline prices in the United States have been rippling due to the cumulative inflation burden. Notably, the increased margin has always been minimal, in a range that the general consumer can easily cope with or not even notice. Within California, the increase in prices is relatively higher than in other states due to the level of taxes imposed in the state. However, gas prices in the U.S. are getting higher than ever before due to the combined effects of various economic drivers, including trade sanctions and the Covid-19 pandemic. In California, the prices are soaring higher than in any other state, with the average price as of March 10th, 2022 being $5.69, up from $4.68 the previous month and a national average of $4.32. The residents of California are continuously finding it hard to keep up with the prices, creating a collective appeal to find a solution to the menace.

The driving factors leading to the increase in gasoline prices are ideally out of the control of the state, but the state lawmakers can still intervene. The sanctions that followed Russia’s invasion of Ukraine, coupled with the supply and demand for oil imbalances following the pandemic lows, have spiked the prices. California’s gas prices tend to be higher than the other states due to the increased taxes on environmental fees and infrastructural development and maintenance. In 2017, state lawmakers passed a bill to raise the gas tax by 12 cents to account for transit projects, roads, and bridges. The consumers are now bearing the burden of all the factors combined, calling for both Democrat and Republican lawmakers to come together in aid. Albeit the diversity in political opinions, the state lawmakers are tasked with ensuring that the general population’s needs are met.

As a result of the burden of the increasing gas prices on the residents of California, and the subsequent call for reforms, state lawmakers are tasked with ensuring the people’s voices are heard, and their needs met. This will entail proposing various methods for the state to develop solutions to the problem. These solutions should ensure the end consumer feels the effects of the reform in place. For instance, some reforms might see gas prices lowering by very minimal margins in cents, which might accumulate to millions in state savings but are not felt by the end consumer. Additionally, the reductions to the prices should be significant in savings to the pump owners to transfer the same to the end consumers. In consideration, the proposals brought about by these lawmakers do not have to be related to gas prices and taxes directly. Still, they can include other reforms that ensure that money is put back into the people’s pockets. This can be achieved by regulating the prices and taxing other commodities apart from gasoline. Thus, the end goal is to ensure the consumer’s costs on other expenditures like rent and electricity are significantly reduced to cater to gas prices.

This is a proposal to reform tax laws governing gas prices in California by wiping away the state’s 51 cents per gallon tax for one year to provide short-term relief for consumers. The tax relief will mark a significant reduction in gasoline prices across the state once the bill is implemented, over one year, marking the possible recovery period post the economic depression. To achieve this, the gas sellers will also be mandated to pass the savings along to gas consumers as these laws do not cut down directly to them but apply to them. Since the tax money to be cut down on this tax relief is essentially used for infrastructural developments in standard cases, the lost tax money would be made up for through other avenues post the recovery period. One of these avenues is a one-time infusion of other state funds into infrastructure accounts.

Introduction

Gasoline prices in the United States of America have seen a gradual increase. The advent of the Covid 19 pandemic coupled with the Russia-Ukraine war has tipped these prices over the top. In California, gasoline prices have increased rapidly, which is relatively higher than that in other states. This can be attributed to the high levels of taxation in the state. The average price of gasoline in California as of April 5th, 2022, was $5.89. This increased from $5.77, which was recorded in the preceding month (AAA, 2022). The onset of the Covid-19 pandemic created a disruption in oil supply around the globe. The reduced demand did not create that much impact during the pandemic as people were locked in their houses, and they did not travel as much; hence the gasoline demand was also down. However, the Covid 19 restrictions were gradually lifted towards the end of 2021, and people started to leave their houses. This created a rapid increase in the gasoline demand, but the supply rate had not yet improved. This led to slight demand-pull inflation (Patton, 2022). The price increase was pushed over the top by the invasion of Ukraine by Russia. Russia has been one of the largest suppliers of oil around the globe. Liadze et al. (2022) point out that in light of the war, many people feared that the supply of oil would be disrupted, and they rushed to the pumps. This created a sudden elevation in demand for it. The gas prices were further elevated by the sanctions put on Russia by western nations in response to the invasion of Ukraine. The sanctions limited the export of oil from Russia into western countries (JP Morgan, 2022).

The people in California are having a hard time keeping up with the increase in gasoline prices and are calling for the government to institute reforms that will come to their aid. Despite these calls, most of the factors that have caused the rise in gas prices are out of the control of state officials. Although the factors that have caused the increase in gas prices are external, there are some measures that policymakers can take internally, to cushion the residents of California against the high cost of gasoline. This proposal advises the State of California to reform the tax laws that govern gas prices in the state. These reforms would go a long way to helping the residents of California to get access to gasoline at reasonable and affordable prices. This paper proposes that the officials remove the 51 cents per gallon tax for one year to offer relief to the residents of the state in this challenging period.

Analysis of the Problem

The prices of gas in the United States of America have been steadily rising over the last year. Although the rise can be heavily attributed to the conflict between Russia and Ukraine, the rise started way before then. The sharp increment in oil prices began during the Covid 19 pandemic. The supply of oil during the pandemic was reduced to the lockdown protocols instituted around the world. The lockdown also reduced the demand for gasoline as people remained indoors and did not travel as much (OECD, 2022). When the restrictions were lifted, and people had the need to travel, the gasoline demand increased dramatically. This became a problem since the supply did not increase at the expected rate, which resulted in high demand and low supply. This increased prices. The increase in demand was further increased with Russia’s invasion of Ukraine. Since Russia is one of the biggest exporters of oil globally, many people panicked and rushed to the filling stations as they feared the supply of oil would reduce. These fears came true as western countries instituted sanctions against Russia, dramatically reducing the amount of oil exported to the country (JP Morgan, 2022). This further led to the imbalance in the supply and demand of gasoline in the country, resulting in a dramatic rise in its price all around the country.

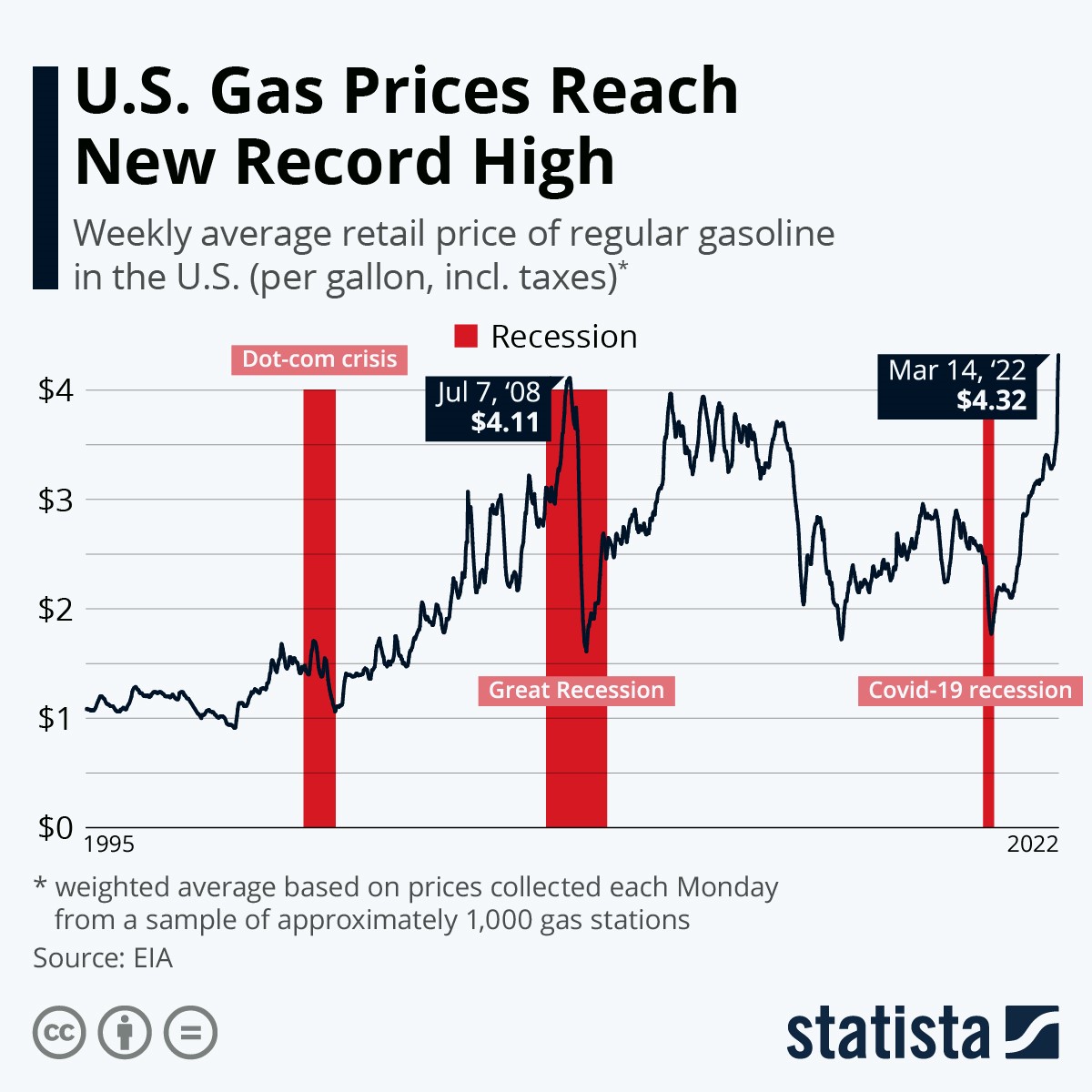

As illustrated in Figure 1, the oil price is now at the highest it has ever been since the recession of 2008. Oil prices are currently above $109 a barrel, and the average price across the country is over $4 (Statista, 2022). The graph indicates the weighted average of oil prices collected from 1000 gas stations across the country. The graph indicates that after the recession of 2008, gas prices had steadily dropped, but after the Covid-19 recession, there was a sudden spike in gas prices.

Fig 1: Source: Statista. (2022). Infographic: U.S. Gas https://www.statista.com/chart/24450/average-weekly-price-of-gasoline/.

The gasoline prices are highest in California, where they are paying $1 plus above the nation’s average price. This is attributed to the high tax rates that the residents are paying for gas (Woo, 2022). The residents of California have the highest tax on gasoline as they pay an additional 51 cents in state taxes. Henney (2022) points out that reports indicate that this tax is expected to rise to 53.9 cents by July 2022. As indicated in figure 2, the average gas price in California is increasing by the day. The additional tax is burdensome for the residents to afford it.

CALIFORNIA AVERAGE GAS PRICES

| Regular | Mid-Grade | Premium | Diesel | |

| Current Avg. | $5.829 | $6.019 | $6.158 | $6.508 |

| Yesterday Avg. | $5.821 | $6.012 | $6.151 | $6.510 |

| Week Ago Avg. | $5.741 | $5.935 | $6.080 | $6.435 |

| Month Ago Avg. | $5.770 | $5.989 | $6.120 | $6.318 |

| Year Ago Avg. | $4.100 | $4.280 | $4.403 | $4.111 |

Fig 2: Source: AAA. (2022). California Gas Prices. Retrieved May 9th, 2022, from https://gasprices.aaa.com/?state=CA.

Consequently, the rise in the cost of gasoline usually has an effect across the board. The central aspect affected is transportation. An increase in gas prices usually means that the means of transport become more expensive. It also affects the prices of food, as farmers have to pay more so as to operate their equipment and ship the food. The cost of heating at home also goes up as well as the price of electricity.

Political Climate Regarding the Issue

The temporary suspension of the 51-cent tax on gasoline in California may be contentious. According to Principi (2022), a bill to permanently abolish the tax was put forth before the State Assembly in March 2022. The bill required a two-thirds majority vote to pass, but it failed miserably as less than a third of the policymakers agreed to this. The bill was put forth by the Republicans as they took note of the soaring gas prices. The bill was brought down by the Democrats, who took the proposal to amend the bill as a way for the leaders in oil companies and oil countries to line their pockets and take advantage of the high oil prices (AAA, 2022). The bill is brought to the state policymakers is bound to fail if the Republicans do not convince the Democrats that the tax relief will go back to the average resident of California and not the Oil conglomerates. With California being a stronghold for the Democrats, It will be difficult for the bill to pass without the two parties coming together for the good of the residents of California.

Options for Solutions

The current proposal is focused on reforming tax laws governing gas prices in California by doing away with the state’s 51 cents per gallon tax for a period of one year in order to provide short-term relief for consumers. Despite this option, there are a number of options that can be put into consideration instead of the proposed 51 cents per gallon tax. The segment will consider the options for solutions to reducing the current gas prices in the state of California.

Reduced Funding for Local Programs

In the state of California, the fuel excise taxes led to the development of revenue that supports transportation projects such as road and local street rehabilitation and maintenance. In this case, the Governor of California should propose the use of the State Highway Account to backfill money for road and local street rehabilitation and maintenance (Astrov et al., 2022). The move will ensure that the revenue which would be lost due to the proposed tax holiday is offset. This proposal will result in a reduction in the state highway funding and not money for the local programs.

Ban Oil Sales outside the State of California

In 2012, California stood at the third position among states that produce oil in the USA. The state was behind Texas and North Dakota. The number one Gross Domestic Product in California is oil, meaning the industry is one of the most productive and profitable in the region. Currently, the state is the seventh-largest producer of oil in the country, with most of the industries centered in San Joaquin Valley and Kern Country. According to Astrov et al., 2022), in 2021, the state produced 130 million barrels of oil, as stated by the Department of Energy in the USA. Based on these statistics, oil exports from the state to other states and nations should be banned. The move will ensure that there is enough fuel for domestic consumption in the State (Mbah & Wasum, 2022). However, this ban should be put into effect for six months. This will ensure that other nations and states are not spurted to lower their oil exports and thus ensure that gas prices do not go up in other regions and that global supplies are not affected.

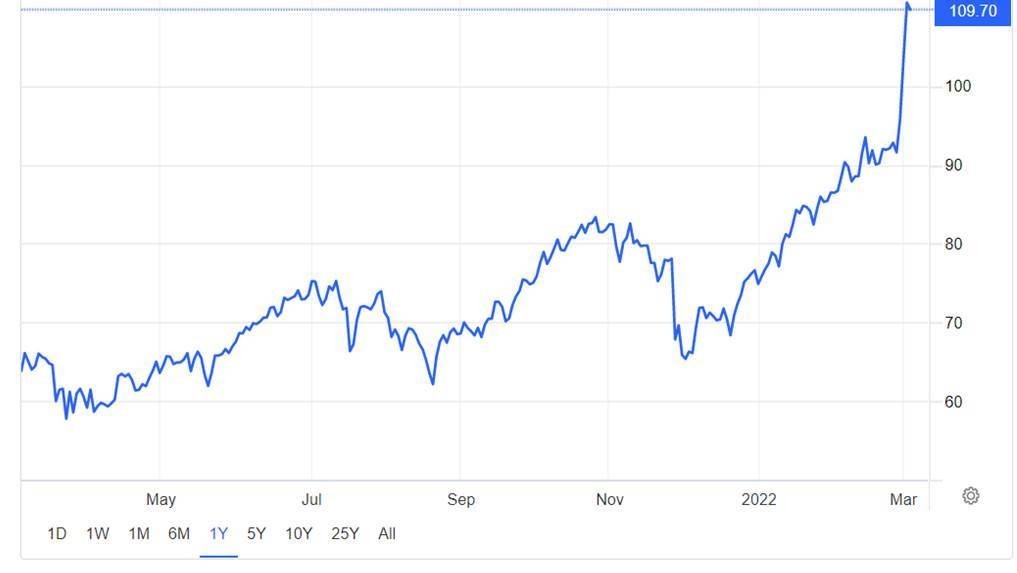

Oil Prices over the Past Year

Fig 3: Oil prices over the past year. Source: tradingeconomics.com: https://www.weforum.org/agenda/2022/03/how-does-the-war-in-ukraine-affect-oil-prices/

Reduce Fuel Use

Several strategies can be put into place to reduce fuel use. First, the State of California can work in close collaboration with agency customers to ensure that better management of vehicles is achieved. This means that the state can also consider reducing the cost associated with purchasing hybrid vehicles. Moreover, the state government should also work closely with manufacturing companies focused on low-use vehicles (AAA, 2022). The move will ensure that low-use vehicle companies can establish themselves and provide customers with vehicles that consume low levels of fuel and thus play a long-term role in dealing with fuel shortages.

Reduce Mobility

The state of California should also create programs that will educate the populace on the need to reduce their mobility. An increase in fuel prices has affected the mobility of people, and this has forced people to drive less. However, some believe that a campaign on having them reduce their mobility will interfere with their freedom of movement. However, this is an exaggeration; the campaign will help people consider other modes of transportation, especially for short distances (Mbah & Wasum, 2022). A reduction in driving will also help reduce the carbon footprints of the California state, and this will be a significant step toward the realization of sustainability. Additionally, the program on reducing mobility will also educate the populace on mobility management practices that will increase consumer benefits, including health benefits associated with cycling and walking and cost savings due to a reduction in the parking cash-out.

Plan for Action

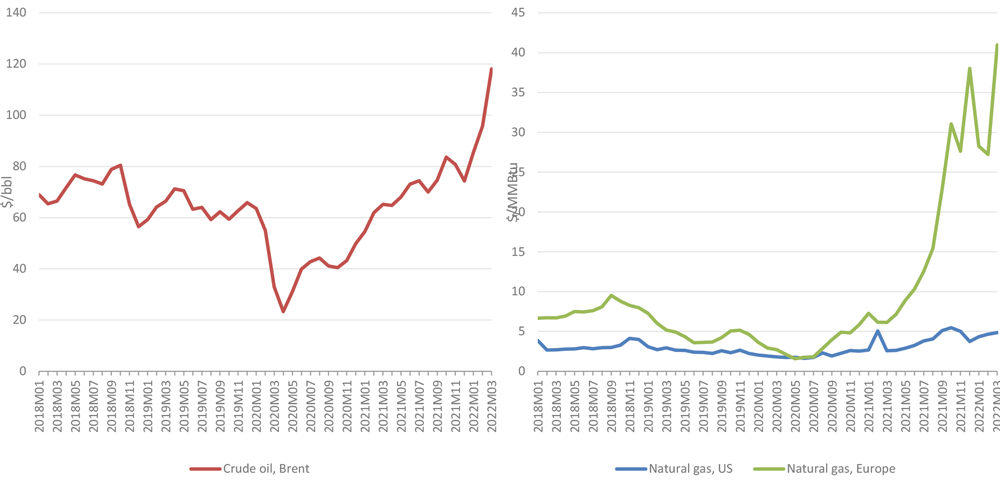

Monthly average prices for crude oil and natural gas, January 2018 – March 2022

Fig 4: Source: World Bank, U.S. Energy Information Administration, Federal Reserve Bank of St. Louis. https://www.wto.org/english/news_e/pres22_e/pr902_e.htm

The proposal suggests wiping away the State of California’s 51 cents per gallon tax for one year to provide short-term relief for consumers. The implementation of the proposal calls for the development of an action plan. The wiping-off will be there for a year, and the benefits will be passed down to the consumers (Mbah & Wasum, 2022). The move will ensure that the consumers are relieved from the burden of surging gas prices resulting from factors like imposed trade sanctions and the Covid-19 pandemic (AAA, 2022). The first step in the action plan will be identifying the price structure (Neuhoff et al., 2022). This means that there is a need to formulate a formula that will be adopted for one year and will see the wiping off of the 51 cents per gallon tax. Identifying and developing a price structure will ensure that the action plan is transparent (Tubb, 2022). The second step is to decide on the net target tax for the various fuel products. Fuel tax levels in California vary across the various fuel products. The maintenance of specific taxes will ensure that the state’s fuel budget is protected from inflation (AAA, 2022).

Moreover, the action plan should also include a reference price. Developing a reference price will play a vital role in smoothing the prices and ensuring that the plan is implemented within the one-year time frame. In this case, the implementation of the 51 cents cap will be adopted with monthly price adjustments, and this will only be achieved through the adjustment of the variable tax.

Moreover, the responsibilities of the involved parties should be specified in implementing the 51 cents cap per gallon. There needs to be synchronization and coordination in outlining the procedure that will be followed to announce and implement the price changes (Neuhoff et al., 2022). This is crucial as it will ensure routine and timely implementation of the proposal. If possible, the state government should also assess the cost structures of all fuel products whose costs are controlled by the state.

From the above, it is clear that the speed of adjustment and the proposal’s implementation will depend on the increase in international fuel prices, the length of the Russian-Ukrainian crisis, and the level of price smoothing put into consideration the short time increase on the fuel prices. Moreover, measures can be implemented to reinforce and refine the pricing mechanisms.

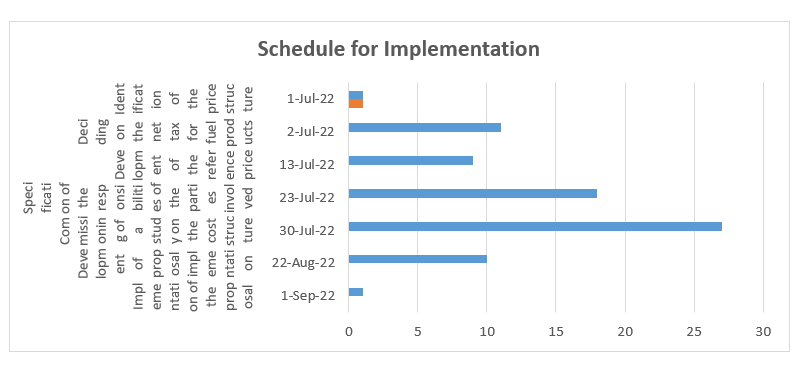

Schedule of Implementation

| Task | Start Date | Duration |

| Identification of the price structure | 1-Jul-22 | 1 |

| Deciding on the net tax for fuel products | 2-Jul-22 | 11 |

| Development of the reference price | 13-Jul-22 | 9 |

| Specification of the responsibilities of the parties involved | 23-Jul-22 | 18 |

| Commissioning of a study on the cost structure | 30-Jul-22 | 27 |

| Development of proposal implementation | 22-Aug-22 | 10 |

| Implementation of the proposal | 1-Sep-22 | 1 |

Table 1: A Depiction of the Proposal’s Implementation Table

Fig 5: A Gantt chart Representation of the Implementation Schedule

Conclusion

Fuel subsidies are fiscally expensive and inefficient approaches to protecting citizens from rising fuel prices and eliminating them can significantly affect households in the State of California and the United States of America at large. Therefore, the 51 cents cap per gallon for one year will help maintain fuel prices in the State of California. However, other mechanisms can be considered to supplement the 51 cents per gallon, which will help make up for the lost taxes. The discussion has been able to identify several options that include; reducing funding for local programs, banning oil sales outside the State of California, reducing fuel use, and a reduction of unnecessary mobility by consumers. Moreover, the discussion has highlighted an action plan for the implementation of the proposal and a timeline for its implementation. In summary, the proposal’s application will go a long way in managing the current fuel prices in the State of California.

References

AAA, 2022. Gas Prices. [online] AAA Gas Prices. Available at: <https://gasprices.aaa.com/?state=CA> [Accessed 9 May 2022].

AAA. (2022). California Gas Prices. Retrieved May 9th, 2022, from https://gasprices.aaa.com/?state=CA.

Astrov, V., Ghodsi, M., Grieveson, R., Holzner, M., Landesmann, M., Kochnev, A., … & Tverdostup, M. (2022). Russia’s Invasion of Ukraine: Assessment of the Humanitarian. Policy. https://wiiw.ac.at/russia-s-invasion-of-ukraine-assessment-of-the-humanitarian-economic-and-financial-impact-in-the-short-and-medium-term-dlp-6132.pdf

Henney, M. (2022). California to raise its gas tax, already the highest in the nation. Fox Business. Retrieved May 9th, 2022, from https://www.foxbusiness.com/economy/california-raise-gas-tax.

JP Morgan, 2022. How are sanctions against Russia impacting oil and gas prices? | Energy Outlook | J.P. Morgan. [online] Jpmorgan.com. Available at: <https://www.jpmorgan.com/insights/research/oil-gas-energy-prices> [Accessed 9 May 2022].

Liadze, I., Macchiarelli, C., Mortimer-Lee, P. and Juanino, P.S., 2022. The economic costs of the Russia-Ukraine conflict. NIESR Policy Paper, 32. https://www.niesr.ac.uk/wp-content/uploads/2022/03/PP32-Economic-Costs- Russia-Ukraine.pdf

Mbah, R. E., & Wasum, D. F. (2022). Russian-Ukraine 2022 War: A review of the economic impact of the Russian-Ukraine crisis on the USA, UK, Canada, and Europe. Adv. Soc. Sci. Res. J, 9, 144-153. https://www.researchgate.net/profile/Ruth-Endam-Mbah/publication/359512955_Russian-Ukraine_2022_War_A_Review_of_the_Economic_Impact_of_Russian-Ukraine_Crisis_on_the_USA/links/6241fcdd21077329f2dd2c3d/Russian-Ukraine-2022-War-A-Review-of-the-Economic-Impact-of-Russian-Ukraine-Crisis-on-the-USA.pdf

Neuhoff, K., Weber, I., Szulecki, K., & Goldthau, A. (2022). How to Design EU-Level Contingency Plans for Gas Shortages? Evidence from Behavioural Economics, Policy Research, and Past Experience. DIW Berlin: Politikberatung kompakt, 177. https://www.researchgate.net/profile/Kacper-Szulecki/publication/360065532_How_to_design_EU-level_contingency_plans_for_gas_shortages_Evidence_from_behavioural_economics_policy_research_and_past_experience_Final_report/links/625fcc489be52845a911d730/How-to-design-EU-level-contingency-plans-for-gas-shortages-Evidence-from-behavioural-economics-policy-research-and-past-experience-Final-report.pdf

OECD. (2022). The impact of coronavirus (COVID-19) and the global oil price shock on the fiscal position of oil-exporting developing countries. OECD. Retrieved 9 May 2022, from https://www.oecd.org/coronavirus/policy-responses/the- impact-of-coronavirus-covid-19-and-the-global-oil-price-shock-on-the-fiscal- position-of-oil-exporting-developing-countries-8bafbd95/.

Patton, M., 2022. The Real Reason Behind Surging Gas Prices. [online] Forbes. Available at: < https://www.forbes.com/sites/mikepatton/2022/03/09/the-real- reason-behind-surging-gas-prices/ > [Accessed 9 May 2022].

Principi, L. (2022). Suspension of California’s 51-cent gas tax fails to pass State Assembly – KION546. KION546. Retrieved 9 May 2022, from https://kion546.com/news/2022/03/14/republican-state-lawmakers-call-for- immediate-suspension-of-Californias-51-per-gallon-gas-tax/.

Rahman, S., Carll, K., Pearl, E., Liou, M., & Park, J. (2022). Current Status of the War in Ukraine. Foreign Policy. https://www.yipinstitute.com/policy/current-status-of-the-war-in-ukraine

Statista. (2022). Infographic: U.S. Gas Price Reaches New Record High. Statista Infographics. Retrieved May 9th, 2022, from https://www.statista.com/chart/24450/average-weekly-price-of-gasoline/.

Tubb, K. (2022). Policy Proposals for Reducing Record-High Gasoline Prices. https://www.heritage.org/sites/default/files/2022-05/BG3708.pdf

Woo, E. (2022). Why California Gas Prices Are Especially High. Nytimes.com. Retrieved May 9th, 2022, from https://www.nytimes.com/2022/03/09/us/california-high-gas-prices.html.

write

write