Introduction

In this era of financial market evolution, accurate prediction of financial indices such as the stock market is significant to the traditional investors, stock traders, and financial analysts. The uncertainties of market intricacies often need to be explained due to their complexity, that incorporates various unpredictable elements, making the task not easy. Despite these constraints, RNNs have provided a way to improve the forecasting accuracy in financial time series data through the use of advanced machine learning algorithms, with there being great promise in this area. Now, this essay descends into the domain of using RNNs for forecasting financial information, and it does so by describing the architecture of these networks and their benefits and it is doing that against the background of other deep learning networks.

Background

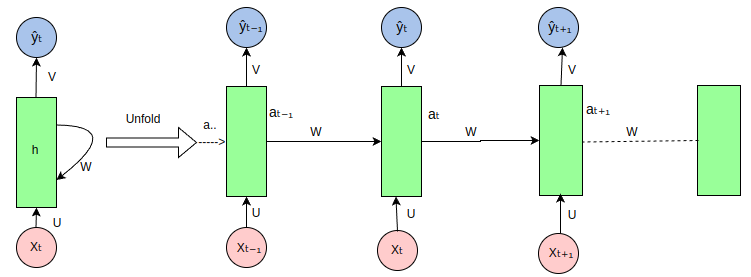

Volatility and non-linear dynamics make financial markets a complicated environment. The many elements that affect market movements—economic statistics, political happenings, and investor sentiment—make it complicated. Forecasting and analysis are difficult because these components interact unpredictably. Traditional statistical approaches are valuable but frequently fail to capture this complexity. They presume linear connections and struggle with financial data’s volatility and non-linearity. Thus, there is an increasing interest in improved methods to describe and anticipate financial market unpredictable behavior. In this sense, neural networks are financial solid forecasting tools. Machine learning’s neural networks are modeled after the brain. Interconnected nodes or neurons process incoming data like real neurons. Neural networks’ capacity to learn from data without scripting is a significant asset. This learning capacity lets them spot complicated data patterns and linkages, including non-linear interactions that typical statistical tools overlook (Rout et al., 2017). Recurrent Neural Networks (RNNs) are promising financial forecasters. As seen in Fig 1, RNNs have loops that store information throughout the network, making them distinctive. This architecture lets RNNs analyze sequential data, making them ideal for time series analysis.

Fig 1: Recurrent Neural Network (RNN) Architecture

Stock prices, currency rates, and market indexes are sequential and temporal. Traditional feedforward neural networks cannot recall prior information. In contrast, RNNs can remember prior inputs and utilize them to impact future outputs. Financial time series data prediction requires this capacity to retain and use prior knowledge. Past events frequently affect financial market pricing and patterns (Zulqarnain et al., 2020). Political announcements and economic reports may affect market prices gradually. RNNs excel in modeling and forecasting financial time series data because they capture temporal dependencies. They can discover patterns and trends in previous data to predict future movements more accurately and nuancedly than models that cannot account for temporal linkages. RNNs’ versatility in handling variable-length sequences enhances their financial forecasting performance. Financial time series data ranges from intraday to historical patterns in temporal resolution and duration. Financial analysts and investors may use RNNs to analyze sequences of different lengths without pre-defined input sizes to adapt to financial data’s diversity.

RNNs in Financial Forecasting

Architecture and Training

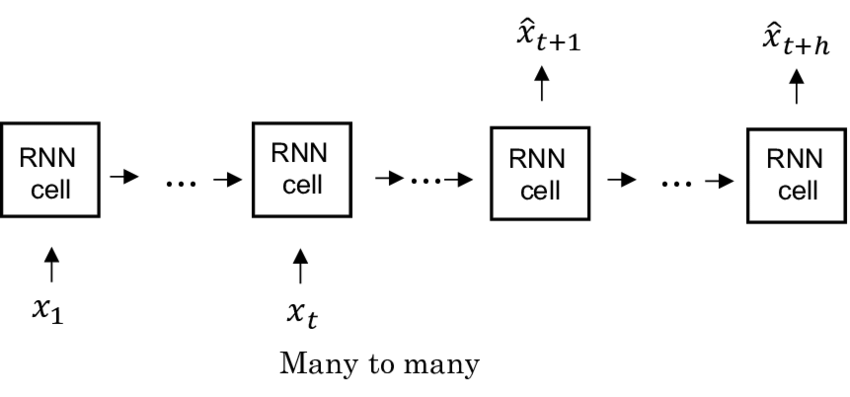

The architecture and training approaches embedded in Recurrent Neural Networks (RNNs) have an evolution of the usage of the model to predict the financial time series data.

Fig 2: Basic architecture of an RNN for time series forecasting.

The distinctive architecture where RNNs take a central role is the core of this model unlike in other neural network models. This architecture can be described as a layered network which has neurons that are connected in a loop, enabling the network to be maintained in its state or to carry information that was saved from the previous inputs (Moghar and Hamiche, 2020). As they process sequential data, RNNs indeed get the ability that leads to dynamic performance in time. This habit is a critical requirement of time series analysis, especially when we are trying to find a causal link between the present and the future. Learning RNNs to use financial data in this way necessitates sophisticated techniques where the training is conducted via backpropagation through time (BPTT). BPTT designated a version of the Backpropagation Algorithm from Well-Known Stochastic Gradient Descent, which is defined to take into account the sequential nature made by RNNs to process, that is, its own set of data (Tölö, 2020). In BPTT, the algorithm manages to “educate” itself by varying the weights to make their predictions align with our data as closely as possible, and doing this for all data points sequence by sequence. In this process, the errors are passed from one workplace to another and through time, where weight is facilitated by making the result more exact.

Evolutionary computation methods have also been found very helpful in the training of RNNs for financial forecasting. One such techniques is Differential Evolution (DE), which is a method implemented to optimize the network’s weights. This type of optimization entails a changing of pace from gradient-based optimization techniques of the past, as it provides a new angle to methodically deal with the intricate maze of parameters of the network. These evolutionary algorithms, like DE, are pretty distinct in the sense that they operate on a population of potential solutions rather than solving an equation or trying to unravel an encoding. They continue to use operations, such as mutation, cross-overs, and selection, to continuously evolve the solutions towards optimality. Under the RNNs, DE and analogous algorithms give machines a capability to explore the parameter space for more compelling configurations effectively, thus the network may be able to model and forecast financial time series data. In particular, the evolver-based RNNs with DE for trading have been shown to achieve better predictive performance than both RNNs and other low-complexity neural networks, when evaluated on financial data (Sako et al., 2022). This significant performance enhancement can be ascribed to the feature that the evolutionary algorithms exhibit to maneuver around local minima and thoroughly explore the parameter space as compared to gradient-based methods. Through the fine-tuning of the network weights, the DE in RNNs is critical to explore and understand the underlying trends and variations in financial time series better that have a higher fidelity and accuracy for predictions.

Comparative Performance

The relative effectiveness of various neural network models for financial forecasting, particularly stock prediction, is examined in depth in the research community. Among the types of models used, evolutionary algorithms appear as champions in terms of Recurrent Neural Networks (RNN) trained with them (Sermpinis et al., 2021). A clear example of the outstanding supremacy of recurrent CEFLANN, which is based on the Differential Evolution (DE) algorithm, is observed in the new RNN version. It surpassed all its rivals, RNNs, as well as other neural network models that were doing stock prediction before, whether by statistical time-series analysis or neural computation (Zheng and He, 2021). The Great CEFLANN Recurrent model’s remarkable accuracy can be traced back to several critical capabilities and decisions. Firstly, the model architecture, which involves RNNs with FLANN principles, permits the system to effectively to the input sequential data processing and learning (Lin et al., 2020). This is particularly beneficial in financial time series forecasting, where structural dependencies are heavily used from the past as it helps in comprehending and using up time-faded patterns. The chronological nature of what finances are, with sequences of patterns and trends following one after another along time, suggests that we need a model to be able to remember past data which can then be applied to future predictions (ArunKumar et al., 2021). The recursive structure of CEFLANN is apparent by nature since it allows to go through the variables in time.

DE training for the Recurrent CEFLANN model alongside this makes the prediction capability of the model more powerful. DE is one of the evolutionary algorithms which is very efficient in finding the set of parameters for highly complex functions, and it is thus the best alternative for training neural networks on the stock market prediction problem (Hansun and Young, 2021). Through the DE procedure which improves the optimality of the weights, the Recurrent CEFLANN model can at last embrace a good time series data model. DE method well maneuvers the model’s parameter space for ensuring the best possible fit, which is the one with minimum forecasting errors. During this process of the physical optimum, the accuracy is found to be, mostly, critical in financial forecasting world where the slightest of improvement in this area can further keep huge implications (Freeborough and van Zyl, 2022). The other thing as well is that a training procedure with the inclusion of the transfer of knowledge or DE in the training is expected to allow the Recurrent CEFLANN model to conveniently learn complex patterns in the data. The financial markets are positively affected by a series of elements such as capital resources, political events, and the market sentiment which give dynamic and nonlinear characteristics to the information (Nasirtafreshi, 2022). The adaptability of the Recurrent CEFLANN model having been enhanced by DE, allows it to uncover these intricate models, and provide a solution henceforth. This flexibility thus eventually proves to be an edge as the model can continue to perform even as market dynamics shift.

Advantages of RNNs in Financial Forecasting

RNNs, being one of the most popular deep neural network types as they can deal with sequential data, are very well suited to financial time series due to their distinctive features that match the characteristics of the financial time series data. The high-ranked consequence of this is the fact that RNNs can deal with sequential data themselves and so they are an ideal application of time series analysis. This competency is the key to the RNN’s capability to capture the temporal dynamics that are typical of the marketplace, i.e., past events that shape the future events. The single most important skill that we must possess is being able to interpret and replicate these temporal relationships if the financial projections are to be correct (Hewamalage et al., 2021). A yet another major advantage of RNNs in analyzing financial data is their ability to process uneven sequence of data. Let us consider such financial data that are composed of various length of sequences due to possible irregular trading days, missing data, and often data coming from different time frames (Dautel et al., 2020). RNNs can do this in a manner which preserves the data’s integrity and, at the same time, ensures the accuracy of the financial time series model since previous data is not lost through data padding or truncation.

The application of RNNs, together with evolutionary algorithms like DE for optimization purposes, among other applications, amplifies their forecast capabilities. Evolutionary algorithms can also optimize network weights and architecture that allows RNNs to identify and learn from those complex, nonlinear patterns hidden in the data that could probably be hard to spot with conventional training paradigm (Dixon and London, 2021). This optimization strategy is particularly good when financial forecasting is being considered, because the distinction of even “faint” patterns has potential to increase accuracy of the predictions. Furthermore, the RNNs can be paired with other neural network architectures like the Convolutional Neural Networks (CNN) so as to give rise to the hybrid model further still. They may combine both the spatial and temporal trends in the data. By doing so, these models provide more complete instead of isolated analysis. Consider CNNs as an example. They can recognize spatial features of financial indicators (Dey et al., 2021). In their turn, RNNs can find how these features change after some time. This mixture is the one that can increase the effectiveness of financial forecasting methodologies since the human brain is in charge of the financial data processing and the merits of the neural networks are harnessed to understand the market complexity.

Challenges and Limitations

Recurrent Neural Networks (RNNs) have drawbacks in financial forecasting, notwithstanding their benefits. Overfitting is a major concern with RNNs. This is especially troublesome with noisy and fluctuating financial data. Overfitting happens when a model learns too much information and noise in training data and performs poorly on fresh data (Bas et al., 2022). This implies that although the model may perform well during training, it may struggle to generalize to new data. Financial forecasting relies on this constraint to properly anticipate market changes. RNN training is computationally intensive, making financial forecasting with them difficult. RNNs, particularly ones that capture complicated temporal connections, may be computationally intensive. Researchers and practitioners with limited resources may struggle with high processing power and memory. RNN training requires altering many parameters, which may be time-consuming and computationally costly, especially for big financial datasets. Additionally, RNNs have the vanishing gradient issue. The gradients used to update the network’s weights might become too tiny during training (Escudero et al., 2021). The network’s learning process might slow down or stop, making it difficult to capture long-term data dependencies. Standard RNNs struggle with lengthy sequence data, which is common in financial time series research.

Future Directions

Future studies might explore unexplored aspects of Recurrent Neural Networks (RNNs) that need more attention. Those include overcoming existing challenges and the introduction of new technology based on cutting edge (RNNs) to forecast financial data. A commendable direction of investigation could be the invention of more advanced regularization methodologies in order to fight the overfitting, an issue which usually arises in RNNs due to the complexity of the financial datasets with noisy input. The implementation of such methods is possible through novel means like applying Dropout or Early Stopping or even explore the variation of the methods by developing new regularization techniques specifically for time series data. The second but equally important stream might focus on improving the existing RNN architecture. The training of RNNs involves a great computational lot, especially in the case of large financial datasets. It would, therefore, be interesting to either optimize existing algorithms or think about new training methods that navigate this trade-off by reducing computational requirements without compromising performance. This could consist in the application of improved backpropagation methods and of employing the current developments in the hardware area, hence GPUs and TPUs techniques, for neural network training.

Despite advancements from LSTM and GRU units, the vanishing gradient issue remains difficult in certain cases. Future research might investigate other RNN architectures or activation functions to address the vanishing gradient problem, improving long-term dependency modeling in financial time series data. RNN integration with other machine learning methods and data sources might be promising for future study. By better capturing spatial and temporal connections in financial data, hybrid models that combine RNNs with CNNs or attention mechanisms may perform better. RNN models might also benefit from adding social media mood or macroeconomic information to provide a more complete picture of financial markets and better forecasts. Finally, evolutionary algorithms and other sophisticated optimization methods might be used to RNN training. These approaches have showed promise in discovering optimum network designs and hyperparameters, and further study might improve financial forecasting optimization methodologies.

Conclusion

RNNs could be the key for successfully carry out forecasting analysis in financial sector because they are able to capture the non-linear temporal nature of financial markets. Beyond from their best higher performance turn out in reality is a proof from analysis studies, financial forecast accuracy will be increased. And while the issues of overfitting, computational problems, and gradient problem vanishing pose the problems of continuous research and development in this direction. The state of art in RNNs and training procedure will definitely bring greater accuracy to forecasting with the possibility of new approaches.

Bibliography

ArunKumar, K.E., Kalaga, D.V., Kumar, C.M.S., Kawaji, M. and Brenza, T.M., 2021. Forecasting of COVID-19 using deep layer recurrent neural networks (RNNs) with gated recurrent units (GRUs) and long short-term memory (LSTM) cells. Chaos, Solitons & Fractals, 146, p.110861.

Bas, E., Egrioglu, E. and Kolemen, E., 2022. Training simple recurrent deep artificial neural network for forecasting using particle swarm optimization. Granular Computing, 7(2), pp.411-420.

Dautel, A.J., Härdle, W.K., Lessmann, S. and Seow, H.V., 2020. Forex exchange rate forecasting using deep recurrent neural networks. Digital Finance, 2, pp.69-96.

Dey, P., Hossain, E., Hossain, M.I., Chowdhury, M.A., Alam, M.S., Hossain, M.S. and Andersson, K., 2021. Comparative analysis of recurrent neural networks in stock price prediction for different frequency domains. Algorithms, 14(8), p.251.

Dixon, M. and London, J., 2021. Financial forecasting with α-rnns: a time series modeling approach. Frontiers in Applied Mathematics and Statistics, 6, p.551138.

Escudero, P., Alcocer, W. and Paredes, J., 2021. Recurrent neural networks and ARIMA models for euro/dollar exchange rate forecasting. Applied Sciences, 11(12), p.5658.

Freeborough, W., & van Zyl, T. (2022). Investigating explainability methods in recurrent neural network architectures for financial time series data. Applied Sciences, 12(3), 1427.

Hansun, S. and Young, J.C., 2021. Predicting LQ45 financial sector indices using RNN-LSTM. Journal of Big Data, 8(1), p.104.

Hewamalage, H., Bergmeir, C. and Bandara, K., 2021. Recurrent neural networks for time series forecasting: Current status and future directions. International Journal of Forecasting, 37(1), pp.388-427.

Lin, Y.F., Huang, T.M., Chung, W.H. and Ueng, Y.L., 2020. Forecasting fluctuations in the financial index using a recurrent neural network based on price features. IEEE Transactions on Emerging Topics in Computational Intelligence, 5(5), pp.780-791.

Moghar, A., & Hamiche, M. (2020). Stock market prediction using LSTM recurrent neural network. Procedia computer science, 170, 1168-1173.

Nasirtafreshi, I., 2022. Forecasting cryptocurrency prices using recurrent neural network and long short-term memory. Data & Knowledge Engineering, 139, p.102009.

Rout, A.K., Dash, P.K., Dash, R. and Bisoi, R., 2017. Forecasting financial time series using a low complexity recurrent neural network and evolutionary learning approach. Journal of King Saud University-Computer and Information Sciences, 29(4), pp.536-552.

Sako, K., Mpinda, B. N., & Rodrigues, P. C. (2022). Neural networks for financial time series forecasting. Entropy, 24(5), 657.

Sermpinis, G., Karathanasopoulos, A., Rosillo, R. and de la Fuente, D., 2021. Neural networks in financial trading. Annals of Operations Research, 297, pp.293-308.

Tölö, E. (2020). Predicting systemic financial crises with recurrent neural networks. Journal of Financial Stability, 49, 100746.

Zheng, L. and He, H., 2021. Share price prediction of aerospace relevant companies with recurrent neural networks based on pca. Expert Systems with Applications, 183, p.115384.

Zulqarnain, M., Ghazali, R., Ghouse, M.G., Hassim, Y.M.M. and Javid, I., 2020. Predicting financial prices of stock market using recurrent convolutional neural networks. International Journal of Intelligent Systems and Applications (IJISA), 12(6), pp.21-32.

write

write