Abstract

This research analyses the use of artificial intelligence (AI) and machine learning (ML) in the technology division of Tata Motors, a prominent Indian multinational car manufacturing firm. This paper aims to provide a thorough market analysis of the FinTech sector in the technology product cluster. It will specifically focus on the roles played by key players, possible disruptions, and the possibilities of artificial intelligence (AI) and machine learning (ML) for Tata Motors. The paper focuses on the company’s ongoing efforts in artificial intelligence (AI) and machine learning (ML), the competitive environment, and the possible advantages and obstacles to using these technologies. The investigation results in recommendations that assist Tata Motors in capitalizing on new trends in the FinTech sector and sustaining its competitive advantage in the automotive industry.

Introduction

Tata Motors is a prominent Indian multinational automobile manufacturing firm with a long and illustrious history of over 75 years. It is a flagship company of the Tata Group. Tata Motors, established in 1945, has expanded to become the largest automobile manufacturer in India (Tata Motors, 2020). They provide a wide selection of vehicles, encompassing passenger cars, trucks, vans, coaches, buses, and military vehicles. The firm’s primary goal is to offer inventive, environmentally friendly, and competitive transportation options to its global clients while also generating value for all parties involved. Tata Motors has a robust presence in India and operates in several other countries via its subsidiaries and joint ventures. The corporation has a worldwide presence encompasses the renowned Jaguar Land Rover brand in the United Kingdom, Tata Daewoo in South Korea, and Tata Technologies in the United States. Tata Motors’ global presence enables it to utilize its experience and resources effectively to cater to customers’ changing demands in various areas.

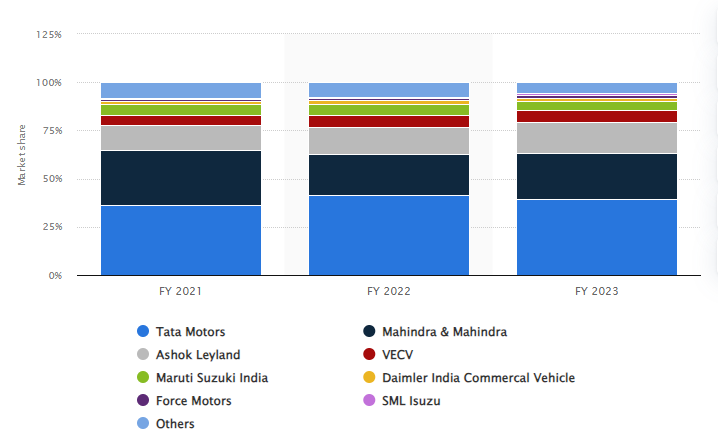

Tata Motors had a total revenue of 3.5 trillion Indian rupees in the fiscal year 2023, highlighting its substantial size and market standing (Statista, 2023). The company’s financial operations span several facets of the automotive value chain, including research and development, production, sales, and after-sales services. Tata Motors has been investing significantly in innovative technologies, including electric cars and connected car solutions, to maintain a competitive edge in the constantly changing automotive sector. Its robust brand reputation and dedicated client base strengthen Tata Motors’ market position. The firm has continually maintained its position as one of the leading automotive brands in India, with a market share of over 14% in the passenger vehicle category and over 40% in the commercial vehicle segment (Sun, 2023). Tata Motors has achieved domestic and international success by growing its worldwide presence. It has exported its products to more than 125 countries, including Europe, Africa, the Middle East, South Asia, South East Asia, South America, Australia, CIS, and Russia.

Tata Motors has been aggressively using digital technology to improve its operations and customer experience in response to the automotive industry’s major changes caused by technical breakthroughs and evolving consumer demands. The corporation has allocated resources toward the use of artificial intelligence (AI) and machine learning (ML) technologies to enhance the efficiency of its supply chain, optimize production processes, and foster innovation in the development of new goods and services (Luckow et al., 2018). Tata Motors demonstrates its dedication to innovation and sustainability via its efforts to create electric vehicles and minimize their impact on the environment. Tata Motors has introduced many electric vehicle (EV) models, including the Tata Nexon EV and the Tata Tigor EV, and has established lofty goals for EV sales shortly (India Today, 2022). Tata Motors prioritizes corporate social responsibility, demonstrating a robust commitment to projects in education, health, and environmental protection.

Figure 1: Market share of commercial vehicles across India in financial years 2021 and 2023 by manufacturer (Sun, 2023)

Analysis of Technology Cluster:

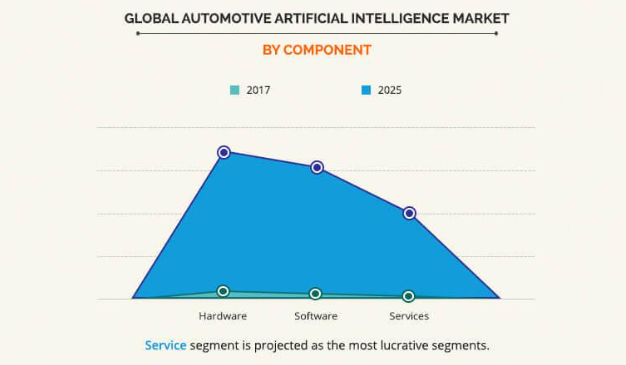

The technological cluster is a key driver of innovation in the financial technology (FinTech) industry, which has grown rapidly. In this cluster, machine learning (ML) and artificial intelligence (AI) have become important facilitators, providing businesses with enormous chances to improve decision-making, streamline operations, and improve customer experiences (Deloitte, 2021). AI and ML are used in the automobile industry for several purposes, such as supply chain optimization, predictive maintenance, autonomous driving, and customized consumer experiences. According to Allied Market Research (2020), the global market for artificial intelligence (AI) in the automotive sector is projected to expand at a compound annual growth rate (CAGR) of 45% between 2018 and 2025, valued at $8.8 billion.

Figure 2: Global Automotive AI Market by Component (Allied Market Research, 2020)

To maintain its competitiveness in the market, Tata Motors, a well-known automaker, has been investing in AI and ML technology. The business has utilized these technologies to enhance client experiences, optimize supply chain management, and improve production processes (Tata Motors, 2021). Predictive maintenance is one of the primary uses of AI and ML in the automobile sector. These technologies can reduce downtime and increase vehicle dependability by predicting probable breakdowns and scheduling preventative maintenance by analyzing massive volumes of vehicle data (Fernández-Castro and García-Coego, 2022). Tata Motors has been putting predictive maintenance solutions into practice to maximize its after-sales services and save maintenance costs. Autonomous driving is another area where AI and ML are used in the automobile industry. Through its subsidiary Jaguar Land Rover, Tata Motors has invested in developing autonomous vehicle technology (Tata Motors, 2021). Autonomous cars can sense their surroundings, react quickly, and drive safely, thanks to the inclusion of AI and ML in these systems.

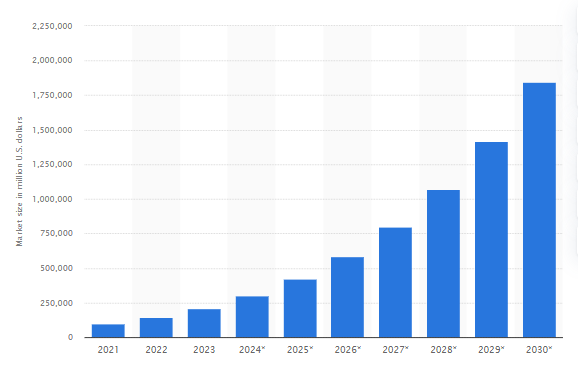

Figure 3: Artificial intelligence (AI) market size worldwide in 2021 with a forecast until 2030 (Thormundsson, 2023)

Relevance of AI and ML Technology

The swift progress of artificial intelligence (AI) and machine learning (ML) has completely transformed the financial technology (FinTech) sector, offering both prospects and difficulties for automotive firms such as Tata Motors. Tata Motors, a prominent participant in the Indian automotive industry, has been aggressively investigating the possible uses of these technologies in its financial operations, namely in car finance, insurance, and leasing services.

AI and ML have the potential to improve fraud detection and prevention. By utilizing sophisticated algorithms and predictive analytics, the organization can more precisely and effectively detect potentially fraudulent actions. This results in reduced financial losses and the safeguarding of consumer confidence (Bao, Hilary, and Ke, 2022; Deloitte, 2021). This is especially pertinent for Tata Motors Finance, the company’s specialized financing division, which is pivotal in enabling car acquisitions and leasing for individual and corporate customers. Additionally, AI and ML can potentially empower Tata Motors to provide customized financial services specifically designed to meet its client’s individual requirements and preferences. The organization may create tailored financing solutions, such as adjustable loan terms or leasing agreements, by examining extensive consumer data, which includes credit histories, income levels, and spending habits (Ashta and Herrmann, 2021). Implementing a data-driven strategy in financial services may enhance client happiness and loyalty while optimizing the company’s lending processes and risk management measures.

AI and ML can substantially influence evaluating and determining credit risk in the underwriting process. Conventional credit scoring systems sometimes depend on a narrow range of data and may not accurately assess an individual’s creditworthiness. By integrating artificial intelligence (AI) and machine learning (ML) algorithms into its risk assessment procedures, Tata Motors may examine a wider array of data sources, such as alternative credit data, to provide credit profiles that are more thorough and accurate (Kamuangu, 2024). Consequently, this can result in enhanced lending judgments, decreased default rates, and improved overall financial success for the organization.

Trends in using AI and ML as FinTech in the Automotive Industry:

The automotive industry has been at the forefront of adopting artificial intelligence (AI) and machine learning (ML) technologies in its financial technology (FinTech) applications (Nasir et al., 2021; Arslanian and Fischer, 2019). Two key trends that have emerged in recent years and hold significant promise for companies like Tata Motors are AI-powered underwriting and usage-based insurance (UBI).

AI-Powered Underwriting

One of the most prominent trends in the automotive FinTech space is using AI and ML algorithms to streamline and optimize the underwriting process for vehicle loans and leases. Traditionally, underwriting has been a time-consuming and labor-intensive task involving manual evaluation of credit applications and risk assessment (Schmitt, 2020). However, with the advent of AI and ML, automotive companies can now automate and accelerate this process, leading to faster and more accurate credit decisions. A recent McKinsey (2020) study found that AI-powered underwriting can reduce the time taken to process loan applications by up to 70% while improving the accuracy of credit risk assessment by 20-30%. This is achieved by analyzing vast amounts of data, including credit histories, income statements, and alternative credit data such as utility bills and rental payments. By leveraging machine learning algorithms, automotive lenders can identify patterns and correlations that may not be apparent to human underwriters, enabling them to make more informed and precise lending decisions.

Moreover, AI-powered underwriting can help automotive companies expand their customer base by providing access to credit for individuals who may have been previously underserved or denied financing due to traditional credit scoring methods. A report by Odinet (2021) suggests that using alternative credit data and AI-driven risk assessment, automotive lenders can increase their approval rates significantly without compromising on loan quality or default rates.

Usage-Based Insurance (UBI)

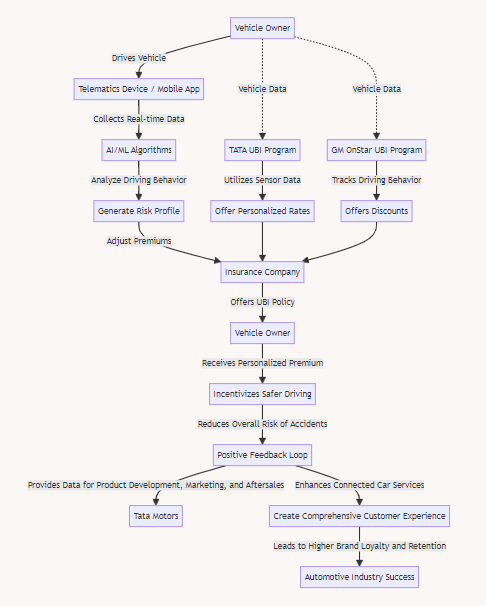

Another significant trend in the automotive FinTech landscape is the growing adoption of usage-based insurance (UBI) models, which leverage AI and ML technologies to personalize insurance premiums based on individual driving behavior and vehicle usage patterns. Unlike traditional insurance policies that rely on broad demographic and historical data to determine premiums, UBI policies use telematics devices and mobile applications to collect real-time data on driving habits, such as speed, acceleration, braking, and mileage. By analyzing this data using machine learning algorithms, insurance companies can generate more accurate risk profiles for individual drivers and adjust premiums accordingly. A study by Soleymanian, Weinberg, and Zhu (2019) estimates that UBI policies can result in premium savings of up to 30% for safe and low-mileage drivers while incentivizing safer driving behavior and reducing the overall risk of accidents.

The adoption of UBI models has gained momentum in recent years, with a growing number of automotive manufacturers and insurance providers partnering to offer integrated UBI solutions. For instance, Tesla has recently launched its own UBI program, which uses data from its vehicles’ advanced sensor systems to provide personalized insurance rates to its customers (Ptolemus Consulting Group, 2022; Tesla, 2019). Similarly, General Motors has partnered with American Family Insurance to offer a UBI program for its OnStar subscribers, which tracks driving behavior and offers discounts for safe driving (Wayland, 2020). The potential benefits of UBI extend beyond cost savings for consumers. For automotive companies like Tata Motors, offering UBI solutions can provide a valuable source of data on vehicle performance and customer driving patterns, which can inform product development, marketing strategies, and after-sales services. Moreover, by integrating UBI with other connected car services, such as predictive maintenance and emergency assistance, automotive companies can create a more comprehensive and engaging customer experience, leading to higher brand loyalty and retention.

Figure 4: UBI Process Flow Chart in the Automotive Industry

Stakeholder Analysis

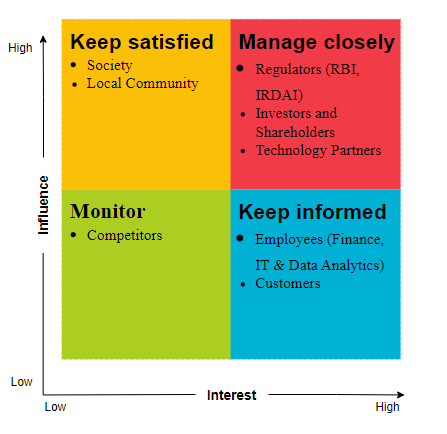

The Influence-Interest Matrix analysis of stakeholders indicates that regulators (such as RBI and IRDAI), investors and shareholders, and technology partners are classified as having both strong interest and high influence about Tata Motors’ deployment of AI and ML in the FinTech sector. These stakeholders exert a substantial impact on the company’s adoption of artificial intelligence (AI) and machine learning (ML) and are deeply invested in its success (Ruehle, 2020). Regulators provide norms and standards; investors contribute financial resources, and technological partners supply experience and solutions (Fenwick, Vermeulen, and Corrales, 2018; Lauterbach, 2019). Finance, IT, data analytics employees, and clients fall into the group of strong interest but little impact. They experience immediate effects from the deployment of AI and ML and have a strong interest in the resulting results. However, their ability to influence strategic decisions may be restricted. Society and local communities are categorized as stakeholders with moderate interest but significant impact. Although they may not own a direct stake in Tata Motors’ use of AI and ML, they can exert a substantial effect on public perception and regulatory frameworks.

Regarding Tata Motors’ implementation of AI and ML in FinTech, all identified stakeholders have either a high interest or high impact on the process, eliminating the presence of any stakeholders in the low-interest, low-influence group. To effectively use AI and ML in its financial operations, Tata Motors should prioritize interacting with influential stakeholders while also addressing the demands and concerns of stakeholders with a strong interest in the matter.

Figure 5: Stakeholder Influence-Interest Matrix

Conclusion and Recommendations

Tata Motors has enormous potential to transform its financial processes, improve customer experience, and spur sustainable development via artificial intelligence (AI) and machine learning (ML) technology in the automotive FinTech sector. According to the report, usage-based insurance (UBI) and AI-powered underwriting are significant developments with enormous potential for the business. By utilizing these technologies, Tata Motors can increase its client base, provide individualized financial services, and expedite its financing procedures. But for implementation to be effective, a strategic strategy that considers the impact and interests of many stakeholders is needed. It is imperative that high-interest stakeholders, such as consumers and workers, be met while interacting with high-influence stakeholders, such as investors, regulators, and technology partners.

Tata Motors has to create a thorough AI and ML strategy that fits with its goals and the demands of its customers to take advantage of new trends. Investments in governance, staff skill development, and data infrastructure should be given top priority in this plan. Maintaining an advantage in the quickly changing FinTech market will require cultivating an innovative and cooperative culture inside and with ecosystem partners. As it sets out on this revolutionary path, Tata Motors must continue to be alert to possible threats and difficulties, such as as data privacy, algorithmic prejudice, and employment displacement. The organization may minimize risks and establish enduring, sustainable connections with its stakeholders by using a customer-centric strategy, giving precedence to trust and openness, and proactively resolving issues through conscientious and ethical activities.

In summary, Tata Motors stands to gain a competitive advantage, stimulate innovation, and unlock the full potential of these technologies by implementing AI and ML. The report’s recommendations will help the company successfully navigate these complexities and realize the full potential of these technologies to meet its strategic and financial goals.

References

Allied Market Research (2020). Automotive Artificial Intelligence (AI) Market Size, Share, and Industry Trends. [online] Allied Market Research. Available at: https://www.alliedmarketresearch.com/automotive-artificial-intelligence-market [Accessed 8 Mar. 2024].

Arslanian, H. and Fischer, F. (2019). The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial Services. [online] Google Books. Springer. Available at: https://books.google.com/books?hl=en&lr=&id=u9KiDwAAQBAJ&oi=fnd&pg=PR7&dq=Trends+in+using+AI+and+ML+as+FinTech+in+the+Automotive+Industry:&ots=COXeYy57lV&sig=74-PVyO7upSNryxlCiEwTjROIek [Accessed 8 Mar. 2024].

Ashta, A. and Herrmann, H. (2021). Artificial intelligence and fintech: An overview of opportunities and risks for banking, investments, and microfinance. Strategic Change, 30(3), pp.211–222. doi:https://doi.org/10.1002/jsc.2404.

Bao, Y., Hilary, G., and Ke, B. (2022). Artificial Intelligence and Fraud Detection. Innovative Technology at the Interface of Finance and Operations, [online] 11, pp.223–247. doi:https://doi.org/10.1007/978-3-030-75729-8_8.

Deloitte (2021). Fintech | On the brink of further disruption. [online] Deloitte.com. Available at: https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/financial-services/deloitte-nl-fsi-fintech-report-1.pdf.

Fenwick, M., Vermeulen, E.P.M. and Corrales, M. (2018). Business and Regulatory Responses to Artificial Intelligence: Dynamic Regulation, Innovation Ecosystems and the Strategic Management of Disruptive Technology. Robotics, AI and the Future of Law, pp.81–103. doi:https://doi.org/10.1007/978-981-13-2874-9_4.

Fernández-Castro, B. and García-Coego, D. (2022). ML & AI Application for the Automotive Industry. Management and industrial engineering, pp.79–102. doi:https://doi.org/10.1007/978-3-030-91006-8_4.

India Today (2022). Tiago EV, Tigor EV, Nexon EV & more: Tata Motors’ electric vehicle portfolio to have 10 models by 2026. [online] India Today. Available at: https://www.indiatoday.in/auto/cars/story/tiago-ev-tigor-ev-nexon-ev-tata-motors-electric-vehicle-portfolio-to-have-10-models-by-2026-2006089-2022-09-29 [Accessed 8 Mar. 2024].

Kamuangu, P.K. (2024). AI and Machine Learning advancements in FinTech Industry (2016-2020). [online] Social Science Research Network. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4727972 [Accessed 8 Mar. 2024].

Lauterbach, A. (2019). Artificial intelligence and policy: quo vadis? Digital Policy, Regulation and Governance, 21(3). doi:https://doi.org/10.1108/dprg-09-2018-0054.

Luckow, A., Kennedy, K., Ziolkowski, M., Djerekarov, E., Cook, M., Duffy, E., Schleiss, M., Vorster, B., Weill, E., Kulshrestha, A. and Smith, M.C. (2018). Artificial Intelligence and Deep Learning Applications for Automotive Manufacturing. [online] IEEE Xplore. doi:https://doi.org/10.1109/BigData.2018.8622357.

McKinsey (2020). Rewriting the rules: Digital and AI-powered underwriting in life insurance. McKinsey & Company. [online] 31 Jul. Available at: https://www.mckinsey.com/industries/financial-services/our-insights/rewriting-the-rules-digital-and-ai-powered-underwriting-in-life-insurance [Accessed 8 Mar. 2024].

Nasir, A., Shaukat, K., Iqbal Khan, K., A. Hameed, I., Alam, T. and Luo, S. (2021). Trends and Directions of Financial Technology (Fintech) in Society and Environment: A Bibliometric Study. Applied Sciences, 11(21), p.10353. doi:https://doi.org/10.3390/app112110353.

Odinet, C.K. (2021). Fintech Credit and the Financial Risk of AI. [online] papers.ssrn.com. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3917638.

Ptolemus Consulting Group (2022). How Tesla is planning to conquer the auto insurance market with its usage-based insurance programme. [online] PTOLEMUS Consulting Group. Available at: https://www.ptolemus.com/insight/how-tesla-is-planning-to-conquer-the-auto-insurance-market-with-its-usage-based-insurance-programme/ [Accessed 8 Mar. 2024].

- Ruehle, C. (2020). Investigating Market and Regulatory Forces Shaping Artificial Intelligence Adoptions. Muma Business Review, 4, pp.177–192. doi:https://doi.org/10.28945/4644.

Schmitt, M. (2020). Artificial Intelligence in Business Analytics: Capturing Value with Machine Learning Applications in Financial Services. [online] Available at: https://scholar.archive.org/work/6hz2sxqgs5aqjdas5wuys5xtli/access/wayback/https://stax.strath.ac.uk/downloads/t435gd37n

Soleymanian, M., Weinberg, C.B. and Zhu, T. (2019). Sensor Data and Behavioral Tracking: Does Usage-Based Auto Insurance Benefit Drivers? Marketing Science, 38(1), pp.21–43. doi:https://doi.org/10.1287/mksc.2018.1126.

Statista (2023). Tata Motors: revenue 2023. [online] Statista. Available at: https://www.statista.com/statistics/316925/revenue-of-tata-motors/#:~:text=Tata%20Motor%20saw%20a%20total [Accessed 8 Mar. 2024].

Sun, S. (2023). Commercial vehicle market share India FY 2021-2023, by manufacturer. [online] Statista. Available at: https://www.statista.com/statistics/610484/commercial-vehicle-market-share-by-manufacturer-india/ [Accessed 7 Mar. 2024].

Tata Motors (2020). Company Profile | TATA Motors – 75th Annual Report. [online] investors.tatamotors.com. Available at: https://investors.tatamotors.com/financials/75-ar-html/company-profile.html [Accessed 8 Mar. 2024].

Tata Motors (2021). JAGUAR LAND ROVER. [online] Tata Motors. Available at: https://staging.tatamotors.com/wp-content/uploads/2023/10/jlr-annual-report-2020-21.pdf [Accessed 8 Mar. 2024].

Tesla (2019). Tesla Insurance. [online] Tesla.com. Available at: https://www.tesla.com/support/insurance [Accessed 8 Mar. 2024].

Thormundsson, B. (2023). Artificial Intelligence Market Size 2030. [online] Statista. Available at: https://www.statista.com/statistics/1365145/artificial-intelligence-market-size/ [Accessed 8 Mar. 2024].

Wayland, M. (2020). GM to offer auto insurance that uses data from connected vehicles to price rates. [online] CNBC. Available at: https://www.cnbc.com/2020/11/18/gm-to-offer-auto-insurance-that-uses-data-from-connected-vehicles-to-price-rates.html [Accessed 8 Mar. 2024].

write

write