With the current age of digitization in most sectors and businesses today, it is common to see physical shops and stores move online. The fact that most people use the internet today means any business moved towards an online platform gains access to a larger customer base and ultimately stands to increase profits. By definition, cloud kitchens are rented storage spaces with cooking equipment and professional chefs who work to prepare restaurant-grade food for delivery-only services and, thus, no physical dining space (Bunnag & Hossain, 2020). These kitchens are also called ghost, virtual, or dark kitchens. They have been on the rise for many years now, with the factors influencing their growth being the growth of food delivery networks, ease of scaling up, the high price of real estate, and, more recently, the social distancing laws brought by COVID-19 (John, 2021).

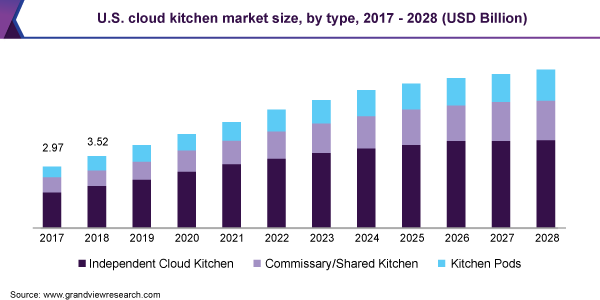

The trend of ordering products online has been present for a while now, with pioneers such as Amazon being at the forefront, which has consequently developed delivery networks for food delivery. With the popularity among millennials in online ordering and disposable income for convenient deliveries to their doorsteps, food delivery companies such as Uber Eats and Door Dash have emerged to fill this niche (Bunnag & Hossain, 2020). The trend in online food ordering and delivery has seen substantial growth, especially with the recent laws implemented for COVID-19 preventing physical dining in restaurants. Thus, people ordered food online, leading to the rise and establishment of new cloud kitchens at a compounding annual growth rate of 11%. The revenue generated is expected to reach USD 200 billion by 2025 (Bunnag & Hossain, 2020). Cloud kitchens are also replacing home cooking with the convenience of fast deliveries, as seen in workplaces opting to use deliveries instead of company kitchens.

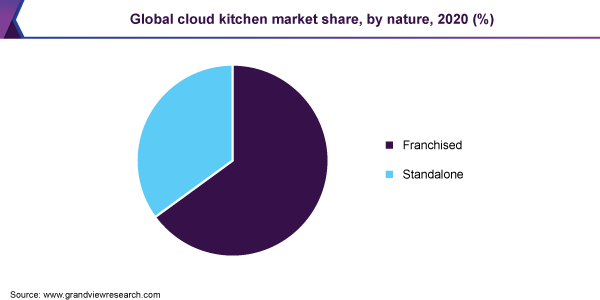

(Cloud Kitchen Market Share Analysis Report, 2021-2028, n.d.)

With the current rise in real estate prices worldwide, businesses are shifting to buildings with smaller square footage, including restaurants which are eliminating dining spaces (Khan et al., 2023). Traditional restaurants are very capital-intensive to start because they require a large, aesthetically pleasing building to attract customers (John, 2021). On the other hand, cloud kitchens only utilize a single room for cooking since all food is delivered and does not have to be aesthetically pleasing as long as it is functional. Additionally, the location of a cloud kitchen is quite versatile because it can be anywhere as long as it is in proximity to residential areas where the food is sold as opposed to traditional restaurants that have to be strategically located to be seen by customers.

The upfront cost of starting and managing a cloud kitchen is significantly lower than a traditional restaurant because of the business structure and cost-effectiveness, thus making the industry undergo rampant growth (Khan et al., 2023). Large restaurants with ample space mean other sole proprietors can work with those restaurants in the same space to optimize productivity and minimize costs. Also, with an ever-increasing customer base, expanding the cloud kitchen could mean opening another kitchen in another location to increase delivery points, which is quite efficient in developing franchises.

(Cloud Kitchen Market Share Analysis Report, 2021-2028, n.d.)

Cloud kitchens have greatly enhanced the food and beverage (F&B) experience by increasing the variety of food offered, offering cheaper prices because of low operations costs and specific food options. Due to the great number of cloud restaurants, customers can now experience the many options offered, from sushi in one kitchen to burgers in others, all delivered to the doorstep quickly because of attention given to specific foods in different cloud restaurants (Peters, 2021). Recommendations to further improve the F&B experience in cloud kitchens would be to use AI to make personalized suggestions to customers and sustainable packaging to help in environmental conservation. In contrast, thousands of deliveries are made every day.

References

Bunnag, T., & Hossain, T. B. (2020). The New Normal After COVID-19: Cloud kitchen business opportunities in Bangkok. Thammasat University, Faculty of Commerce and Accountancy, Master of Business Thesis.

Cloud Kitchen Market Share Analysis Report, (2021-2028). (n.d.). https://www.grandviewresearch.com/industry-analysis/cloud-kitchen-market#:~:text=The%20global%20cloud%20kitchen%20market%20size%20was%20valued,the%20major%20factors%20contributing%20to%20the%20market%20growth.

John, K. T. (2021). Digital disruption: the hyperlocal delivery and cloud kitchen driven future of food services in post-COVID India. International Hospitality Review.

Khan, T. A., Khan, S. A., Haque, S., & Ayub, M. F. B. (2023). A Study on the Prospect of the Cloud Kitchen Model in Dhaka. International Journal of Business and Management, 18(1).

Peters, A. (2021, September 30). Cloud kitchens: the F&B industry’s digital savior? Global Franchise. https://www.global-franchise.com/news/cloud-kitchens-the-fb-industrys-digital-savior

write

write