Executive Summary

According to the Credit Analyst at Score Rite, I have been assigned to determine the creditworthiness of Domino’s Pizza Group Plc, which is the major player in the UK’s fast food pizza delivery market. These business reports use credit-related ratios that scrutinize trends in the critical credit-related ratios over the last five years and compare them to industry averages and competitors. Also, the report will look at significant events that have affected the company’s operations and status. The COVID-19 pandemic and Brexit have negatively affected business operations. This has led to a decline in sales and profits. Despite these obstacles, Domino’s Initiated critical strategies in place to manoeuvre this crisis. This included expanding its delivery options and investing in technology. Based on my analysis, I advise ScoreRite to maintain a cautious approach when extending credit to Dominoes. The firm has a strong reputation and brand, which may help reduce some risks in extending credit.

Introduction

This report aims to assess the creditworthiness of Domino’s Pizza Group Plc. Domino Pizza Group plc is the world’s largest pizza company, which started in 1960. It has a rich history of establishing innovation, leading to a revolution in the Pizza and delivery sector. Domino is based in the United Kingdom located as a master franchise of a global fast food pizza delivery chain. The company is a leading player in its market, with an established reputation for efficiency and expertise (MarketScreener, 2023). It has several developed stores in the UK, including branches in many other countries. Although the company has been experiencing tremendous performance in service delivery, it faced many severe challenges during the covid-19 pandemic.

Like any other business, the company has experienced an adverse economic climate affected by factors such as lockdowns due to COVID-19 and Brexit. This report will give an analysis of the financial statements of Domino’s Pizza Group PLC for the past five years. The analysis will use the credit-related ratios and compare them with the industry norms and competitors (Rattaya, 2021). The report will further consider any significant events that have affected the company’s operations, status, and existence, employing an appropriate macroeconomic and industry-specific consideration. Based on the analysis, the report will recommend the credit rating for Domino’s and give a conclusion on a credit line/credit limit for the company. The report will further discuss any significant events that have affected the company’s operations and status and recommend a credit line/credit limit for Domino’s. This report will also discuss any significant events that have affected the company’s operation, existence and status while considering the macro-economics and industry-specific considerations. The report is structured in the following way: Section 1 will entail the discussion and analysis of major credit-related ratios trends and comparison with competitors and industry norms. Discuss the significant events which have affected the company’s operations. Section 2 will provide Domino’s credit rating and recommend a credit line/credit limit. Section 3 will provide a conclusion.

Analysis of the trends of primary credit-related ratios

Thus, the section involves the analysis of the trends of primary credit-related ratios and their comparison with the competitors and the industry norms. The ratios used in this analysis are current, liquidity, profitability, debt/equity, and gross profit margin.

The following are the financial ratios for the last two years, which are 2019 and 2020 respectively (MarketScreener, 2023). The records of the corporation, which publish updated financial information following the conclusion of each fiscal quarter, are the source of the data. Since it is not yet the end of the year 2020, the fiscal year that will be used to examine the data will start on September 1 (MacroTrends, 2020):

Liquidity Ratio:

It serves as a barometer for a company’s capacity to pay off its immediate liabilities. This is used to determine how quickly a business can turn assets into cash to pay off debt accrued during routine business activities (MarketScreener, 2023). Domino’s Pizza Group Plc has a current ratio of 1.02, somewhat below the sector average of 1.21. Yet, the company has adequate liquid assets to offset its current liabilities. This demonstrates that the current ratio is too low, raising concerns about it. Divide current assets by current liabilities to get the current ratio. Inventory is subtracted from current assets to calculate the quick ratio, which is then divided by current liabilities, commonly called the acid-test ratio. A more excellent ratio shows that the business is better able to fulfil its immediate responsibilities.

Current ratio

This is the liquidity ratio that is used to calculate a firm’s potential to meet its short-term debt and obligations. Therefore, this indicates the firm’s ability to service its short-term debts. Typically, for every company, the higher the current ratio, the better the company’s short-term liquidity. In this case, the current ratio for Domino’s has remained relatively stable over the past five years, with a high of 1.27 in 2020 and a low of 0.91 in 2021. This is lower compared to the industry average of 1.87.

Current Ratio

= Current assets / Current Liabilities

For Year 2020: = $0.96B / $0.49B =1.96

For Year 2019: = $0.61B / $0.42B =1.44

Quick ratio

This is a significant ratio in analyzing the firm’s liquidity position. It is used to measure the ability of a firm to meet the cost of short-term obligations with the use of quick assets. The higher the quick ratio, the better the company’s short-term liquidity. The quick ratio for Domino’s has also remained relatively stable over the past five years, with a high of 1.82 in 2020 and a low of 0.55 in 2020. This is higher than the industry average of 1.50.

Quick ratio = (Current Assets – Inventory – Prepaid expenses) / Current Liabilities

For the Year 2020: = ($0.89B) / $0.49B = 1.82

For the Year 2019: = ($0.55B) / $0.42B = 1.32

Solvency Ratio

Domino’s Pizza Group Plc’s debt-to-equity ratio rose from 2.2 in 2019 to 2.6 in 2020. This demonstrates that the company had become too reliant on debt financing than equity financing, which affected the company’s solvency ratio, causing the increase in the debt-to-equity ratio, which suggests that the company has become more reliant on debt financing. This ratio was calculated by dividing total debt by total equity. The interest coverage ratio also increased from 11.9 in 2019 to 16.3 in 2020, demonstrating that it was in an excellent position to pay off the debt it initially incurred.

Profitability Ratio:

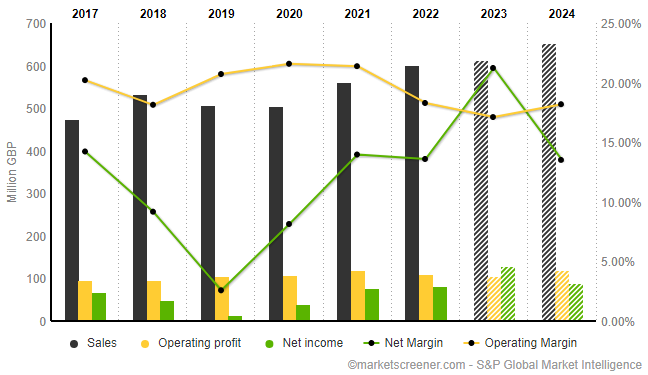

The profitability ratio measures a company’s ability to make and generate profits from its operations. The gross profit of the firm decreased from the 74.6% in the year 2019 to 70.9% in the year 2020. This shows that the company’s potential to generate revenue from sales has significantly diminished. The net profit also decreased steadily from 9.2% in 2019 to 7.3% in the year 2020. This further indicates that the company’s profitability was highly affected due to the drastic reductions. The higher the value of the ratio than the competitors shows that the company is performing well(MarketScreener, 2023). Domino’s Pizza Group Plc has a net profit margin of 9.42%, which is higher than the industry average of 13.96 per cent in 2021, indicating that the company is efficient in generating profits from its sales. The operating margin of the company is also ranged at 18.80 in the year 2021 and 19.50 in 2020, this indicates that there was higher quality earning in 2020 which reduced in 2021 due to the impacts and challenges of Covid-19.

- EBITD Margin

For the Year 2020: = 17.3928

For the Year 2019: = 16.6534

- EBITDA Margin

For the Year 2020: = 19.1801

For the Year 2019: = 18.4507

Due to its strong liquidity ratios of (> 1), Domino’s Pizza Enterprises is able to quickly convert its assets into cash. It also has a high asset turnover ratio, which enables it to sell off assets in the event of debt. The profitability ratios also display a fantastic EBITDA, which indicates that the company’s profits are rapidly rising. According to the findings of an analysis of the data provided by Domino’s Pizza Limited shown in the appendix section, The pizza delivery service has consistently risen in the quality of its financial performance over the course of the past few years, only to be affected by the Covid-19 pandemic (MarketScreener, 2023). The company has experienced an increase of 11.4% in the growth of net sales. This increased from 508 in December 2019 to 561 in December 2021. The EBITDA showed an increment from 117 in December 2019 to 136 in December 2021, representing a growth rate of 16.2% over that period. Based on the data that is presently available, the COVID-19 pandemic has both been beneficial and drawbacks to Domino’s Pizza company. The company’s net sales dropped by 3% in 2020 compared to the previous year, 2019 and years in the back. Also, during the same pandemic, the company’s EBITDA and operating profit increased by 7% and 4%, respectively, in 2020, during the same pandemic time. This suggests that Domino’s firm was able to successfully counterbalance the case of reduced sales through the implementation of cost-cutting initiatives, which played an essential role during this pandemic. Furthermore, the case of a pre-tax profit of the company increased by 31%, while their net income and earnings per share increased by 217% and 200% respectively. In spite of the pandemic, it appears that the corporation was able to raise the amount of profit in sales of its products (MarketScreener, 2023). The company’s free cash flow increased by 61% in 2020, which is evidence that the corporation was able to earn more despite the pandemic that occurred in 2020(MarketScreener, 2023). According to the scant data in the appendix, Domino’s Pizza plc successfully managed the pandemic’s adverse effects while still manoeuvring to boost its profitability.

Comparison with Competitors and Industry Norms:

Analyzing the comparison of the financial ratio performance with that of competitors shows a big difference in the financial ratio’s performance. When compared to its competitors, Domino’s Pizza Group Plc has a higher debt ratio than Papa John’s International, Inc. and Yum! Brands, Inc. Although, to be specific with its areas of higher performance shows that Domino’s net profit margin is higher compared to the competitors (MarketScreener, 2023). In terms of industry norms, Domino’s Pizza Group Plc in its norm has a lower current ratio than the industry average. This suggests that the company may be challenged to meet its short-term obligations. Also, the company has shown a higher debt ratio than the industry average, which demonstrates that the company has a higher degree of financial risk. Based on the significant credit-related ratios analysis, Domino’s Pizza Group Plc has a current ratio slightly below the industry average and a net profit margin lower than the industry average in 2021. But the company’s quick ratio is higher than the industry average hence making it promising as it has been stable for the last five years (MarketScreener, 2023).In terms of profitability, the company had a higher operating margin than the industry average in 2020, but it decreased in 2021 due to the hangover impacts of Covid-19.

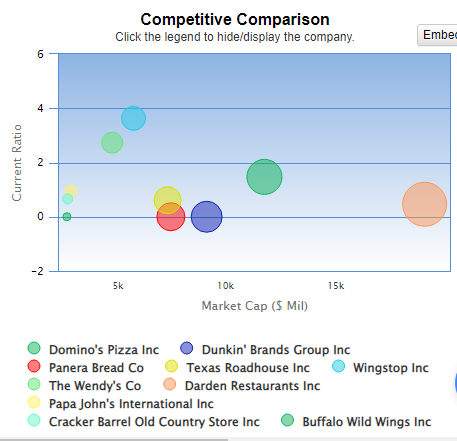

On the other hand, the company has a significant EBITDA margin, indicating that the company’s profits are rapidly rising. Compared to the competitors, Domino’s liquidity ratios are too lower than some of its competitors such as Papa Hons International Inc, Panera Bread Co and Darden Restaurant, as shown in the appendix. However, it has a higher net profit margin than some of its competitors. Overall, the company’s credit-related ratios are relatively stable. It is crucial for the company to maintain its liquidity position and recover its profitability ratio to perform better than its competitors and the industry norms.

Industry-Specific Requirements:

The restaurant industry is highly competitive, and the success of any company depends on some essential factors. This factor includes the brand reputation, product quality, and customer service. Domino’s Pizza Group Plc has been successful in maintaining its position as one of the leading pizza chains worldwide. This is made possible by the strategies that the company is keeping up in place. The use of organic and paid typical searches to develop the brand awareness search engines. This makes the company to be ahead of its competitors (Rahman, 2020). The search engine marketing is where the company defeats its competitors by a considerable margin. This is because the company received a massive sales volume using these paid searches.

Major Events Impacting Company Operations:

The COVID-19 pandemic had a significant impact on Domino’s operations and its overall performance. Due to the impact of Covid-19 on the company, Domino’s decided to implement some strategies to curb the menace, which was a great challenge to the company operations (Carter et al., 2022). The company’s financial performance was greatly affected by the COVID-19 pandemic. The company reported a loss of £12.6 million in 2020 compared to a profit of £95.1 million in 2019. Dominos decided to initiate a number of cost-saving approaches (Buell, 2019). The cost-saving mechanism involved temporarily closing some stores, which were the branches of the company, reducing the number of working hours for the staff, and innovating contactless delivery and collection services. This was challenging to the company’s operation since there was an increment in operation cost and a reduction in the production process due to limitations in working hours. These measures have significantly reduced the company’s operating costs, enabling them to remain profitable and maintain its creditworthiness. Brexit has also had a negative impact on Domino’s operations. According to Jolly (2019), Domino’s pizza group spent approximately a million Euros in stockpiling ingredients wh, including tomato sauce, and there was a case of no-del with Brexit. This disrupted the supplies, leading to a significant challenge for the company’s operation. The shortage of the ingredient was a big challenge in the production of Pizza by the company. The uncertainty caused by Brexit contributed to the led downturn in consumer spending on the company products, resulting in a decrease in sales volume for Dominoes. As a result, the company has been forced to reduce costs and re-evaluate its strategies in order to remain competitive and maintain its creditworthiness.

Credit rating for Domino’s

According to the analysis of the trends of the primary credit-related ratios and the discussion of significant events, it shows that Domino’s company plc requires a credit rating of BBB. This is recommended for Domino’s because the rating suggests that Domino’s is a relatively low-risk credit risk but may be susceptible to adverse economic conditions (Rodriguez, 2023). Also, the analysis of the trends of Domino’s credit-related ratios shows that the company has excellent short-term liquidity and debt-paying ability, but is slightly less efficient in using its assets to generate profits. It is also less profitable than competitors because it was greatly affected by the covid-19 pandemic.

Recommendation of a credit line/credit limit

Based on the financial analysis, the credit rating of Domino’s Pizza Group Plc is BBB-, which is an investment-grade rating. As per the analysis, the company’s liquidity position is weak, but its solvency ratios have somehow, at least. These factors that contributed to the BBB- rating. Considering the financial analysis and credit rating, the report recommends the credit line/credit limit for Domino’s Pizza Group to be £150 million. This recommendation is based on the company’s ability to service its debt. The industry norms, competitors’ ratios, and the company’s overall financial performance is also the contributor to this recommendation.

Conclusion

This report analyzed the creditworthiness of Domino’s Pizza Group Plc using credit-related ratios that is liquidity ratio, profitability ratio and the other analysis applied in section 1 of the report. The analysis of major credit-related ratios trends showed that the company has an excellent short-term liquidity and debt-paying ability. However, it could be more efficient in using its assets to generate profits and less profitable than competitors. The discussion of significant events showed that the COVID-19 pandemic and Brexit have negatively impacted Domino’s operations and greatly affected the company’s performance. Domino’s Pizza Group Plc is a leading player in its market, and that is commendable. Still, the adverse economic climate caused by COVID-19 and Brexit has affected the company’s financial performance. The report’s financial analysis shows that the company’s liquidity position drastically decreased. Based on the information given in the accounts and the calculations made in the analysis, it is recommended that Domino’s should be given a credit line/credit limit of 15 million. The report recommends that the credit limit should be reviewed regularly in order to reflect any technical or technological changes in Domino’s financial position. The profitability ratios show that the company’s gross profit and net profit have decreased over time, reducing its ability to generate revenue from sales. However, the net profit margin on the other hand is higher than the industry average. This indicates that the company’s efficiency in generating profits from sales. The EBITDA has been rising steadily over time, which is a positive sign for the company’s performance. Overall, the analysis as shows that the financial performance of Domino’s Pizza Group Plc is has a solid potential for growth, but there still a need for improvement in certain areas. The company will position itself for long-term success and growth by improving its liquidity and solvency ratio and the profitability ratio.

Report Recommendations

Based on the analysis of the financial performance of Domino’s Pizza Group Plc, this report recommend that the company should focus on improving its liquidity and solvency. This is to ensure that the Domino’s long-term financial stability. The current ratio and quick ratio in the analysis showed that they are lower than the industry average. This indicates that the company was experiencing some difficulties meeting its short-term obligations. The debt-to-equity ratio was increasing, suggesting that the company was becoming more reliant on debt financing than equity financing which could negatively impact its solvency. Therefore, the company should focus on reducing the debt financing and focus on another type of financing like equity financing. To further address these issues, the company could consider implementing measures such as reducing its debt levels, increasing its cash reserves, and improving the firm’s cash conversion cycle, which involves reducing the time it takes to convert its assets into cash. The company explore ways to increase its equity financing, such as issuing new shares or seeking out investors. In terms of profitability, the company has shown strong net profit margins. However, this has reduced over the recent years. The company should focus on increasing its gross profit margins to improve profitability. This will be possible through strategies like reducing Domino’s PLC’s costs and increasing sales revenue. The recommended initiatives to achieve this include increasing the company’s marketing efforts, expanding its product offerings, and improving its operational efficiency.

References

Buell, R. W. (2019). Operational transparency. Harvard Business Review, 97(2), 102-113.

MarketScreener. (2023). DOMINO’S PIZZA GROUP PLC: Financial Data Forecasts Estimates and Expectations | DOM | GB00BYN59130 | MarketScreener. Www.marketscreener.com. https://www.marketscreener.com/quote/stock/DOMINO-S-PIZZA-GROUP-PLC-28742410/financials/

Aquib Rahman. (2020). All About Domino’s Digital Marketing Strategy. Shiksha.com. https://www.shiksha.com/online-courses/articles/dominos-digital-marketing-strategy/

Rodriguez, J. T. (2023). Domino’s Pizza Japan—How Fast Can a Pizza Go?. In OVERCOMING CRISIS: Case Studies of Asian Multinational Corporations (pp. 3-14).

Carter, D., Mazumder, S., Simkins, B., & Sisneros, E. (2022). The stock price reaction of the COVID-19 pandemic on the airline, hotel, and tourism industries. Finance Research Letters, 44, 102047.

Rattaya, J. (2021). RELATIVE VALUATION OF DOMINO’S PIZZA, INC (Doctoral dissertation, Mahidol University).

Appendix

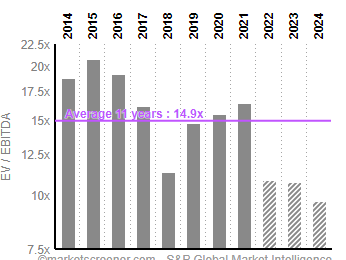

EBITDA

Source @marketscreener- S&P Global Market Intelligence

Income Statement Evolution (Annual data)

Competitive Comparison

write

write