Introduction

This study thoroughly examines Geico’s Ethical Culture and relationships, conducting an in-depth analysis of the organization’s ethical structure and its effects on internal and external partnerships. The research presented here is of great importance due to the critical influence that ethical considerations have on the formation of corporate culture, stakeholder relationships, and consumer confidence. Practitioners and academics can gain valuable insights by examining how Geico manages these challenges in a progressively competitive and ethically conscious insurance industry. The primary aim of this study is to analyze Geico’s ethical culture, encompassing response to ethical challenges, employee relations, customer engagement, community involvement, and decision-making procedures. Examining pertinent scholarly works, interviews with key personnel, and analyzing company policies collectively contribute to a comprehensive comprehension of Geico’s ethical position. By implementing a comprehensive methodology, this study endeavours to not only shed light on the complexities of Geico’s ethical environment but also offer practical recommendations for other institutions seeking to fortify their ethical frameworks. The objective of the subsequent study is to engage the reader by elucidating the intricate relationship between Geico’s internal and external relations and the manner in which these factors interact.

Ethical Framework at Geico

Gecio’s ethical framework is a base for the organization’s corporate culture and decision-making process. One essential part of the model is encompassed within its central Value and mission statement. The analysis of Geico’s stated values and mission indicates that the organization emphasizes honesty, openness, and customer focus. That commitment is more than tokenism, as Geico incorporates these principles daily in their corporate practices. Analysis of such alignment includes evaluating whether the stated values correspond with what happens in a company. This exploration offers a clue on what Geico considers ethically right and wrong. In addition, the efficiency of Geico’s ethical framework will depend on how effectively these values are shared within and without. Value communication within the organization affects employee culture and work behaviour (Horyslavets & Trynchuk, 2018). Such includes looking at how Geico spreads its ethical rules in the firm, like the employee handbook, learning, and an internal message. The external communication of values forms public opinion about the company. Examining Geico’s outward communication, specifically in marketing efforts towards consumers and the community, offers insight into how the organization tries to align its brand with accepted ethics. It is important to understand how consistent and clear these communications are to evaluate how genuine and persuasive the ethical message of Geico is.

Other important parts of the Geico ethical framework are ethical decision-making processes. Ethical decision-making processes at Geico investigate how ethics is embedded into a business judgment system and organization. Scrutiny of the policies in place will be conducted, including the review of the frameworks, guidelines, and the ethics committee. Case studies that explore the practical manifestation of ethics in decision-making at Geico also help to shed light on the matter. These cases serve as real-life illustrations of how Geico handles ethical challenges and demonstrate in practice what it means by a corporate ethics framework (Leikas et al., 2019). Such analysis informs any person on the company’s ability to adapt ethical principles with regard to varying circumstances. Essentially, the ethics analysis of Geico shows that the company promotes the right environment. This underscores the need to match one’s values to his or her actions and how subtle communication between internal and external factors shapes organizational ethics (Leikas et al., 2019). The procedural analysis and the real-world case study allow for a comprehensive understanding of how GEICO implements its ethical foundation, making it imperative for organizations aspiring to enhance their ethics here.

Good ethics serve as a cornerstone for Geico’s profitability by establishing trust among stakeholders and strengthening the company’s reputation. Integrity in decision-making, openness in communication, and fairness in dealing with customers are all examples of ethical business practices that help establish credibility and trust in a company. Customers who place a premium on morality are drawn to and kept by such a business. In addition, when an organization is built on moral principles, it attracts and retains more dedicated and enthusiastic personnel. Maintaining a good reputation and garnering the support of locals and key players is essential for long-term success (Leikas et al., 2019). Good ethics at Geico bring the firm in line with public standards and help considerably to its long-term success and profitability by building consumer trust in the company’s products and services and encouraging employees to act with honesty and integrity.

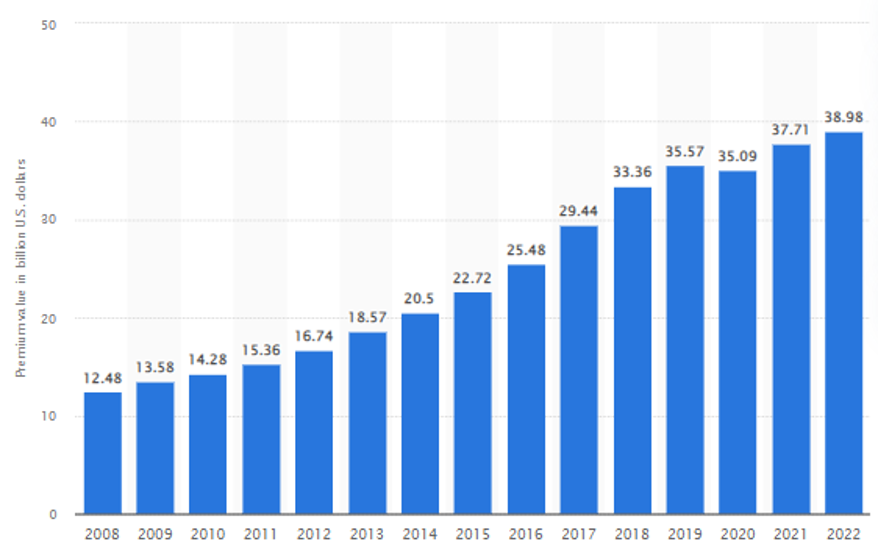

The figure below illustrates the Value of earned premiums of GEICO from 2008 to 2022;

Value of earned premiums of GEICO from 2008 to 2022

From 2008 to 2022, GEICO’s earned premiums climbed each year, with the exception of 2020, when they decreased somewhat. In 2022, GEICO received premiums of about 38.9 billion U.S. dollars – an increase of roughly 1.1 billion U.S. dollars from the previous year and the greatest figure attained throughout the time period under study (Jennifer, 2023). Earned premiums for GEICO increased by almost $26 billion between 2008 and 2022.

Employee Relationships

The assessment of its workplace culture forms one of the dimensions that showcases how seriously Geico takes its employee relations. Evaluation of Geico’s workplace assesses communication, teamwork, and organizational work-life. Doing so helps us understand what employee experience is like for Geico. Employee testimonies form another pillar of this evaluation by showing how the employees view their organization’s culture (Hudson et al., 2019). Thus, by taking into cognizance workers’ experiences, we can evaluate Geico’s endeavours toward generating a fair and productive environment.

Another significant element of Geico’s employee relations approach is diversity and inclusion. The concept of diversity in Geico also involves discussing the practices that Geico engages in for recruitment, training, and promotion, among others, that lead to diversification of the workforce. This includes looking into recruitment processes, equal opportunity, as well as support structures for disadvantaged groups. The breadth and depth of Geico’s commitment to diversity will tell us how they overcome the challenges of creating a diverse environment. When coupled with the ethical norms of a given organization, initiatives and policies supporting a diverse workforce also improve employee satisfaction and commitment within a given organization (Horyslavets & Trynchuk, 2018). Geico strengthens this through its training and development programmes, which reinforce ethical conduct among staff. The study examines what goes on in Geico’s ethical training by examining its contents, frequencies, and delivery modes. Such programs become ways of cultivating moral principles and the framework for making managerial decisions in the organizational culture.

This understanding includes understanding what impact ongoing development has on fostering ethics in work amongst the workers. This looks at the incorporation of ethical concerns in organizational development (Leikas et al., 2019). Continuous learning is one of the pillars upon which Geico relies for employees to understand and effectively handle ethical challenges. Geico has a comprehensive assessment of its work culture and dedication toward promoting diversity as well as employee empowerment through the provision of training and other forms of development programs. The connection of these elements indicates that the company has a culture which offers a contented and well-informed staff ready to make the right decision at their job. With these findings, many organizations could learn how to improve relations among employees under the context of ethics.

Geico’s Relationship with Customers

GEICO’s good relationship with customers is demonstrated by fair handling, transparent communication, and strong information protection procedures. Examination of Geico’s policies for fairness during customer interactions involves examining the company’s stipulations, guidelines and procedures. It involves checking for the fairness of pricing policies, claims treatment, and overall customer experience. This evaluation shows how Geico upholds fairness as a core value when dealing with its customers. Secondly, there is also an evaluation of customer satisfaction surveys and feedback, which measures whether customers think Geico’s actions are fair enough. In terms of ethics, how Geico chooses to communicate policy information is important as it helps in building transparency that should be at the forefront of all customer relations. The communication of Geico about the policies, terms, and conditions to its customers highlights the firm’s transparency. A case in point is a research assessment of the level of transparency in communication, availability of data for examination by the consumers, and usage of simple expressions for the purposes of letting the clients get properly prepared towards making suitable decisions (Leikas et al., 2019). An analysis of Geico’s approach towards complaint management and dispute resolution system reveals transparency in dealing with disputes and upholding ethical conduct.

Privacy and data protection are very crucial issues in today’s digital universe. The ethical framework of Geico includes measures for guarding customer information. This entails examining the security measures in place in terms of encryption techniques and access controls that protect customers’ confidential information (Zarifis et al., 2019). An examination of how Geico has handled cases related to privacy and security in the past provides a glimpse into how quickly the company can modify itself after facing difficulties. Besides fulfilling regulatory standards, data ethics strengthens customers’ credibility regarding your organization’s conduct.

Geico Relationship with Community and Stakeholders

Geico’s CSR initiatives highlight their involvement in the community and support their stakeholders. A discussion of Geico’s CSR programs includes a detailed analysis of the company’s activities in relation to philanthropy, environment, and communities. The scope and scale of Geico’s philanthropic initiatives give us an understanding of Geico’s motivation to go beyond just running its business to enhance lives around it. Furthermore, impact assessment and community involvement help judge how efficient the community members have become due to such plans (Hudson et al., 2019). Through this, we are able to comprehend the ethical underlining of GEICO’s approach to CSR that aims at adding Value to society.

In terms of ethics, engagement by one company’s employees requires consideration of different stakeholders, who might have different expectations towards such a company. This analysis entails looking at what communication channels Geico use in order to interact with different stakeholders. These practices have an ethical dimension because they are inclusive and transparent (Hudson et al., 2019). Besides, geico has to strike a fair balance among the varying interests of customers, employees, investors, and society. Maintaining a balance implies continuous dialogue and responsiveness so that their business moves are ethically correct at that moment in time and acceptable to all stakeholders. Generally, Geico’s community and stakeholders’ relations reveal the company’s commitment to the ethics of corporate citizenship and the complex practice of compromising between multiple stakeholders to promote reciprocal advantages.

Ethical Challenges and Responses

Geico, a well-known insurance provider, is no exception to the rule that running a business comes with its fair share of moral conundrums. There have been earlier ethical debates about how Geico handles claims and treats its customers. Concerns were raised regarding the company’s dedication to ethical business practices due to unjust claim rejections and coverage disputes. Careful investigation found that some of these problems originated from ambiguity around disseminating policy information and interpreting coverage terms. In response, Geico adopted initiatives to increase openness in policy documents and invested in training for claims agents to guarantee uniform and fair evaluations (Horyslavets & Trynchuk, 2018). These adjustments aimed to improve upon previous practices and encourage a more moral attitude while interacting with customers.

Especially in the ever-changing realm of data protection and cybersecurity, Geico faces persistent ethical problems today. Geico confronts the issue of protecting consumer data from cyber-attacks since it deals with huge volumes of personal and sensitive information. The growth of cyber assaults in the insurance business highlights the significance of comprehensive cybersecurity measures (Horyslavets & Trynchuk, 2018). Geico has responded with decisive measures, including adopting cutting-edge cybersecurity solutions, scheduling frequent audits, and establishing strong data protection standards. Geico exhibits its dedication to its policyholders’ confidence and the integrity of its operations by avoiding possible ethical issues in the digital sphere. Geico’s proactive approach to ethical issues is indicative of a dedication to responsible and ethical business operations in an age where data breaches and privacy concerns are crucial.

Conclusion

Exploring Geico’s ethical terrain reveals several noteworthy findings showing that the organization operates on various ethics frontiers. This research summarizes the key points of this dissertation. It brings Geico’s healthy ethical code of conduct in light involving core values, ethical decision-making processes, positive relations between employees and customers, and their commitment towards the communities and other stakeholder groups in general. Additionally, a closer look at former ethical dilemmas and current concerns demonstrates that Geico is an enterprise that has learned to confront difficulties and adapted its operating philosophy. Altogether, this indicates the complexity of the interconnected relationship in ethics and how it influences a company’s performance, image, and relations with its stakeholders and partners.

Recommendations

Furthermore, this research has wider implications for other companies that seek to improve their ethical cultures. The incorporation of ethics in corporate activities makes Geico’s case an example. For instance, other companies should embrace strong core values, appropriate ethical decision-making processes, supportive staff relations, fair treatment of customers, as well as active engagement in corporate social responsibility initiatives. The finding recommends upholding the moral moves by GECIO, frequently checking for new morals and always upholding transparency and stakeholder participation. Adherence to the outlined recommendations will ensure the building of an ethical foundation that matches societal norms and will be beneficial in operations sustenance over time.

References

Jennifer, R. (2023). GEICO: earned premiums 2008-2022 | Statista. Google.com. https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.statista.com%2Fstatistics%2F916817%2Fearned-premiums-geico%2F&psig=AOvVaw1jg-oMYZU3ubMv73WgF23T&ust=1700809508947000&source=images&cd=vfe&ved=0CBMQjhxqFwoTCLidmbfH2YIDFQAAAAAdAAAAABAE

Horyslavets, P., & Trynchuk, V. (2018). Experience marketing and its tools in promoting insurance services. Innovative Marketing, 14(1), 41. https://www.businessperspectives.org/images/pdf/applications/publishing/templates/article/assets/10356/IM_2018_01_Horyslavets.pdf

Hudson, P., De Ruig, L. T., de Ruiter, M. C., Kuik, O. J., Botzen, W. J. W., Le Den, X., Persson, M., Benoist, A., & Nielsen, C. N. (2019). An assessment of best practices of extreme weather insurance and directions for a more resilient society. Environmental Hazards, 19(3), 301–321. https://doi.org/10.1080/17477891.2019.1608148

Leikas, J., Koivisto, R., & Gotcheva, N. (2019). Ethical Framework for Designing Autonomous Intelligent Systems. Journal of Open Innovation: Technology, Market, and Complexity, 5(1), 18. https://doi.org/10.3390/joitmc5010018

Zarifis, A., Holland, C. P., & Milne, A. (2019). Evaluating the impact of AI on insurance: The four emerging AI- and data-driven business models. Emerald Open Research, 1, 15. https://doi.org/10.35241/emeraldopenres.13249.1

write

write