Introduction

The overall context would propose the impact and usability of big data analytics on Marks & Spencer over the years. Marks & Spencer is a major British multinational company with headquarters in London, England. It is known to specialize to sell clothes, home clothes as well as different types of food products in the United Kingdom and across the globe. The company established its business presence in 1884 as a fashion stall in Leeds, Yorkshire. The company of Marks & Spencer has acquired its unique selling proposition (USP) as it emerged to become a long-standing institution that continues to be involved over the years. Speaking about the brand values of Marks & Spencer are quality, service, trust, and innovation. The original customers of Marks & Spencer made the company much successful as it allows the customers to buy high-quality products based on high sales volume as well as with low-profit turnover. The company has been able to gain a competitive advantage over its competitors by using its strategic acquisitions and collective investment opportunities.

Big data analytics

Big data analytics is the advanced use of analytics techniques against large and sophisticated data sets which are available to global companies to target customers. Speaking in detail, big data is defined as the datasets which remain beyond the ability to get the transactional database to process and manage the data with low latency. The characteristics of big data analytics which is used to analyze big data sets are high velocity, high volume, and high variety (Cheng et al. 2018, p.403). With the help of big data analytics, organizations can make faster decision-making that is driven by machine learning, artificial intelligence (AI), the internet of things (IoT), and other emerging technologies such as blockchain technology. Big data operations enhance the ability of companies to have more efficient business operations, high revenue turnover, and more satisfaction to the customers as it engages the customer’s needs with the brand priorities. Big data analytics aids organizations to reduce operational costs making faster and more effective decisions, and developing new products and services.

Big data analytics for Marks & Spencer

The multinational retail company Marks & Spencer has been constantly making major improvements in increasing the efficiency under its inventory management with the basic use of Big data analytics technology. However, the firm is still not able to put the Big data technology to the best use as the company earlier has set high expectations from the use of Big data technology that can be integrated into the systems. These expectations appeared to be unrealistic and it has cost huge expenditures for the company to hire the best team of big data experts and to work on the project. Apart from that, the board of directors at Marks & Spencer has found that the company can make the best use of Big data as it can drastically help the supermarket chain to ensure that its global stores are stocked with inventories that can meet the customer’s demands most appropriately (Hamilton and Sodeman, 2020, p.93). In other words, Big data can prevent the company from reducing the storage costs as the warehouses would not be required to fill with excess inventories, and thereby, it can make the procurement process more efficient over the period. The analytics system can provide a deep and better understanding of the consumer buying behavior process for Marks & Spencer in the multi-channel environment. As a result, the analytics system significantly helps in the improved decision-making process for its device attribution model.

The business analytics system further helps the company of Marks & Spencer to continue improving the digital platform as it comprehends the in-house capabilities to make data-driven business decisions. For a long period, Marks & Spencer was aiming to have the smart and key efficient data usage to be its key focus to execute its strategic decisions to fuel better customer insights, brand loyalty, and customer engagement (Cao, Tian, and Blankson, 2021, p.6). In recent years, Marks & Spencer has boosted its business insights with Azure synapse analytics, Azure data bricks, and Azure data lake storage. With the basic use of big data analytics by the firm, it has been found that the right use of Big data analytics can drastically help the company to optimize its supply chain management light from sourcing the materials, manufacturing of the finished products, and framing the logistics to deliver it to the shopping cart. The best incorporation of big data can subsequently help the organization of Marks & Spencer to use the big data for enhanced efficiency and productivity using the effective tools of Google Maps, Google Earth along the advent of social media.

Validity of the sales data

Based on the sales data that has been collected, it can be claimed that the identification of key metrics such as win rate and average deal size has been undertaken in the spreadsheet. To be specific, the sales productivity and performance have been keenly measured up accurately by considering the sales productivity, lead response time, opportunity win rate, and average deal size throughout 2021. The sales productivity has been measured for every different department by measuring the sales performance in terms of efficiency and average performing sales reps which is about 35% of the direct selling and 65% of the activities selling the non-core business products (Boone et al., 2019, p.173). However, the sales data as of 2021 has been generated by undertaking the ‘Inside sales notes’ that can experience the qualifications, and thereby, it has captured the interest to qualify the lead. Also, the opportunity win rate is measured with the opportunities to get converted into closed deals. These key performance indicators (KPIs) are the parts of big data analytics that significantly helped the companies to measure and track the sale performance based on the revenue generated from the different departments of Marks & Spencer (Mariani and Nambisan, 2021, p.121009). Through the consideration of big data analytics, the company has further reduced the expenditures incurred in the inventory and converted the available stock into sales. It helped the key areas to observe the sales forecast and specify the best delivery schedules in the optimization of inventory costs.

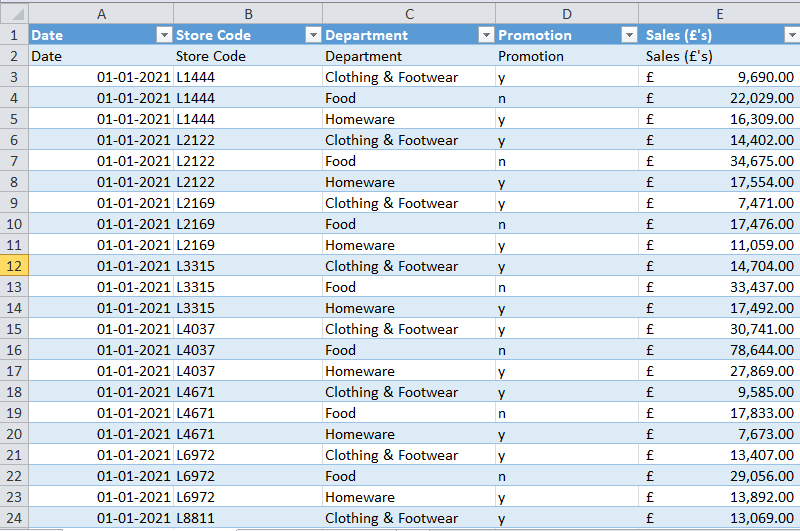

Figure 1: Cleansing of sales data

(Source: MS Excel)

Point of interest from the sales data

Based on the data sets that have been provided in the data set of Marks & Spencer, it can be found that online sales have accounted for 34% of the total sales that have been generated. In addition to this, the analysis of the validity enjoyed a 9% percent rise in sales by the year 2021. As per the company and analysis of its sales revenue, it can be said that the company has broadly recorded a high financial performance of 10% jump in the food sales which occurs in the substantial improvement across the clothing and homeware business. Throughout the fourth quarter of 2021, the company has recorded a low sales revenue as the company majorly struggled with the sudden hit of the Covid-19 pandemic. The company has previously upgraded the earnings after it got beaten by the profit forecasts for the first half of the year. In the fiscal year of 2019 and 2020, the retailer has provided a recorded revenue of $402 million whereas, in 2020-21 fillings, it has reported a net profit of $30 million (Wachter and Mittelstadt, 2019, p.494). This simplifies that there is a17% decrease in the generation of sales revenue compared to the past year of 2019. However, the total expenses for the fiscal deficit have fallen from $352 million in 2020 to $50 million in 2021. It can be found that the company of Marks & Spencer generated $9.13 billion British pounds in sales revenues in the United Kingdom and across the globe. In other words, there has been an 11% decrease in the year 2021 (Ahmad et al., 2020, p.2632). As the retail company of Marks & Spencer offers a wide range of products and services such as fashion apparel, food commodities, and other accessories, the company has expanded its stores in more than 26 countries which have high market growth potential, and gradually, it has opened 1000 new stores all over the United Kingdom and 472 across the countries of Singapore, New Zealand, Australia, and Italy.

Over the first quarter of 2021, UK sales for the year 2021 grew by 18% and it shot up to $3 billion during the first quarter of 2021 (Urbinati et al., 2019, p.28). However, the company of Marks & Spencer has recorded the sales to have grown up to 18.5% to $3.5 billion within last year against the previous year. The international sales have been driven by its clothing and home segment in the Republic of Ireland and the growth of sales has been substantially increased by 17% to $272 million. It can be specified that the sales of the home and clothing segment have risen by 37% against the first quarter of 2021 and 3.2% of the total sales has come up from the food segment of its business. However, the food sales of Marks & Spencer have increased by 10.36% excluding the sales generated from the hospitality sector. In addition to this, the expansion of its in-store fulfillment services has been increased with the year-to-year growth in sales by 51% but on the other hand, the sales have dropped by 11% to the consecutive period of 2021. The department of clothing and home has delivered the full growth for the 2nd quarter which is further supported by the increasingly online and full paced growth of sales. From the data, it can also be regarded that the company of Marks & Spencer has signed the credit facility of $850 million. In response, the full-year profit and tax adjusting returns have been $500 million.

Monte Carlo simulation

The Monte Carlo simulation is a computerized technique used in mathematics that allows people to assess the risk possibility in the quantitative analysis as well as the decision-making process. With that regard, the Monte Carlo simulation has been further used within the context to elaborate the sales performance and use of big data in evaluating the risk in each of the profitability levels over the period. The Monte Carlo method is a probability simulation that has been used in this research assignment to estimate the possible outcomes of the sales revenues generated from the different departments of Marks & Spencer throughout 2021 (Urbinati et al., 2019, p.27). The Monte Carlo simulation has been further calculated using specific steps which are the identification of transfer equations, defining the input parameters, setting up the simulation to engage well in the workplace, and simulating the process output considerably. Within the context, the Monte Carlo Simulation assessed the risk analysis by constructing the model of possible results by the substitution of variables with the probability distribution.

The results have been calculated using a different set of random values from the probability functions. Speaking in detail, the average of the overall sales data has been specified and the standard deviation measures the dispersion of data concerning the mean of the overall data set (Chen, Wang, and Xu, 2019, p.100889). Descriptive analytics has implied the data points to get more close to the mean of the data set and in this case, the high standard deviation, in this case, has implied the data points to be spread out over the broader range of variables and values (Mubarik, 2019, p.213). With the consideration of both average and standard deviation under descriptive statistics used to model the probability in a process that cannot be easily predicted based on the interpretation of variables. The impact of risk for Monte Carlo Simulation to improve the sales performance is relatively low and also, there is a low impact of uncertainty and risk to forecast the analytical models.

| Date | Store Code | Department | Promotion | Sales (£’s) | Monte Carlo Simulation | |

| 13-01-2021 | L6972 | Home wear | y | £ 10,156.00 | Average | £ 27,245.13 |

| 15-01-2021 | L4037 | Home wear | y | £ 24,527.00 | Standard deviation | 241642.531 |

| 20-01-2021 | L4671 | Home wear | n | £ 3,885.00 | Prob >5 | £ 0.20 |

| 25-01-2021 | L2122 | Home wear | n | £ 7,128.00 | ||

| 08-02-2021 | L2169 | Home wear | y | £ 6,455.00 | ||

| 26-03-2021 | L9476 | Home wear | n | £ 8,408.00 | ||

Table 1: Monte Carlo simulation

(Source: MS Excel)

Optimization process to minimize transportation costs

Stating about the optimization process that has been undertaken in the company of Marks & Spencer to reduce the transportation costs in the northern distribution centers, the company has adopted specific strategies to turn this into the actual reality. First of all, freight cost optimization has been the primary step highlighted by the firm to ship and associates the costs to reduce the freight charges (Dubuc, Stahl, and Roesch, 2020, p.15356). The steady lane volume is another story that has been brought into the place by the company of Marks & Spencer in which it has been the regular work for the carrier daily and it is reluctantly based on the costs since the carrier efficiency has been higher. Apart from that, the company has considered the shipping off-peak days in which the product has been put to yield measurable savings (Jaiswal et al., 2020, p.563). The off-period peak day has been an excellent optimization process that has been considered by the firm of Marks & Spencer that the carriers or shippers generally opted for. In addition to this, consolidation of programs for smaller shipments has combined the LTL shipments to ship the mass retailers and it can be observed by the clothing accessories that have been offered by the particular company.

To optimize the organizational process, one of the best initiatives that have been carried out is by developing the relationships to show the management approach towards the reduction of freight costs (Mooney and Pejaver, 2018, p.103). The long-term contract has allowed the long-term contract of Marks & Spencer has allowed the time to establish the customers to create a more effective network with more precise deadlines over the period. Another approach is the long-term approach which protected the market fluctuation and inflation and as a carrier, it is committed to several long-term contracts that eventually provided better and more effective services in the long term period (Mach-Król and Hadasik, 2021, p.6993). The characteristics of process optimization which is used to analyze big data sets are high velocity, high volume, and high variety. With the help of these strategies, organizations can make faster decision-making that is driven by machine learning, artificial intelligence (AI), the internet of things (IoT), and other emerging technologies such as blockchain technology. Big data operations enhance the ability of companies to have more efficient business operations, high revenue turnover, and more satisfaction to the customers as it engages the customer’s needs with the brand priorities.

Impact of big data on Marks & Spencer

Over the period, big data has prevented the company from reducing the storage costs as the warehouses would not be required to fill with excess inventories, and thereby, it can make the procurement process more efficient over the period. The analytics system can provide a deep and better understanding of the consumer buying behavior process for Marks & Spencer in the multi-channel environment. As a result, the analytics system significantly helps in the improved decision-making process for its device attribution model. The business analytics system further helps the company of Marks & Spencer to continue improving the digital platform as it comprehends the in-house capabilities to make data-driven business decisions (Al Hadwer, Gillis, and Rezania, 2019, p.205). For a long period, Marks & Spencer was aiming to have the smart and key efficient data usage to be its key focus to execute its strategic decisions to fuel better customer insights, brand loyalty, and customer engagement. In recent years, Marks & Spencer has boosted its business insights with Azure synapse analytics, Azure data bricks, and Azure data lake storage. Big data operations have further enhanced the ability of companies to have more efficient business operations, high revenue turnover, and more satisfaction to the customers as it engages the customer’s needs with the brand priorities.

Big data analytics has broadly helped the organization of Marks & Spencer to reduce operational costs, to make faster and more effective decisions, and development of new products and services. However, the firm is still not able to put the big data technology to the best use as the company earlier has set high expectations from the use of Big data technology that can be integrated into the systems. These expectations appeared to be unrealistic and it has cost huge expenditures for the company to hire the best team of big data experts and to work on the project (Wachter, 2019, p.15359). Apart from that, the board of directors at Marks & Spencer has found that the company can make the best use of Big data as it can drastically help the supermarket chain to ensure that its global stores are stocked with inventories that can meet the customer’s demands most appropriately. In other words, Big data can prevent the company from reducing the storage costs as the warehouses would not be required to fill with excess inventories, and thereby, it can make the procurement process more efficient over the period.

Conclusion

It can be concluded that the best incorporation of big data can subsequently help the organization of Marks & Spencer to use the big data for enhanced efficiency and productivity using the effective tools of Google Maps, Google Earth along the advent of social media. Over the period, the firm of Marks & Spencer has typically used predictive analytics through which its sales performance has been drastically improved. However, the project managers and big data experts on Marks & Spencer need to consider the discrepancy to improve its production capabilities and to optimize the organizational process most efficiently.

References

Ahmad, S., Miskon, S., Alabdan, R. and Tlili, I., 2020. Towards sustainable textile and apparel industry: Exploring the role of business intelligence systems in the era of industry 4.0. Sustainability, 12(7), p.2632.

Al Hadwer, A., Gillis, D. and Rezania, D., 2019, March. Big data analytics for higher education in the cloud era. In 2019 IEEE 4th international conference on big data analytics (ICBDA) (pp. 203-207). IEEE.

Boone, T., Ganeshan, R., Jain, A. and Sanders, N.R., 2019. Forecasting sales in the supply chain: Consumer analytics in the big data era. International Journal of Forecasting, 35(1), pp.170-180.

Cao, G., Tian, N. and Blankson, C., 2021. Big data, marketing analytics, and firm marketing capabilities. Journal of Computer Information Systems, pp.1-10.

Chen, R., Wang, Q. and Xu, W., 2019. Mining user requirements to facilitate mobile app quality upgrades with big data. Electronic Commerce Research and Applications, 38, p.100889.

Cheng, Y., Kuang, Y., Shi, X. and Dong, C., 2018. Sustainable investment in a supply chain in the big data era: an information updating approach. Sustainability, 10(2), p.403.

Dubuc, T., Stahl, F. and Roesch, E.B., 2020. Mapping the big data landscape: technologies, platforms and paradigms for real-time analytics of data streams. IEEE Access, 9, pp.15351-15374.

Hamilton, R.H. and Sodeman, W.A., 2020. The questions we ask: Opportunities and challenges for using big data analytics to strategically manage human capital resources. Business Horizons, 63(1), pp.85-95.

Jaiswal, A., Dwivedi, V.K. and Yadav, O.P., 2020, March. Big Data and its Analyzing Tools: A Perspective. In 2020 6th International Conference on Advanced Computing and Communication Systems (ICACCS) (pp. 560-565). IEEE.

Mach-Król, M. and Hadasik, B., 2021. On a Certain Research Gap in Big Data Mining for Customer Insights. Applied Sciences, 11(15), p.6993.

Mariani, M.M. and Nambisan, S., 2021. Innovation analytics and digital innovation experimentation: the rise of research-driven online review platforms. Technological Forecasting and Social Change, 172, p.121009.

Mooney, S.J. and Pejaver, V., 2018. Big data in public health: terminology, machine learning, and privacy. Annual review of public health, 39, pp.95-112.

Mubarik, M., 2019. Triad of big data supply chain analytics, supply chain integration and supply chain performance: Evidences from oil and gas sector. Humanities and Social Sciences Letters, 7(4), pp.209-224.

Urbinati, A., Bogers, M., Chiesa, V. and Frattini, F., 2019. Creating and capturing value from Big Data: A multiple-case study analysis of provider companies. Technovation, 84, pp.21-36.

Wachter, S. and Mittelstadt, B., 2019. A right to reasonable inferences: re-thinking data protection law in the age of big data and AI. Colum. Bus. L. Rev., p.494.

Wachter, S., 2019. Data protection in the age of big data. Nature Electronics, 2(1), pp.6-7.

write

write