Introduction

Super Eco Holdings is a leading maritime company that continues to thrive in the industry. The company engages in global maritime material transport, with its headquarters located in Piraeus. One of Super Eco Company’s goals is to ensure zero accidents and spillage in the sea through continuous improvement. Another goal is to enhance the efficient and timely movement of transit goods through the sea. Super Eco has five branch offices in London, Naples, Dubai, Singapore, and Geneva. The company has a strong fleet of twenty ships, and it is divided into Super Eco Tankers Management and Super Eco Bulkers Management( Super Eco Tankers Management, 2020). Family businesses face diverse challenges ranging from family conflicts, informal culture and structure, and favoritism. Such challenges might negatively impact the businesses, including loss of market share, profitability, and management issues. Therefore, every company needs effective strategies to deal with the challenges. Family businesses account for approximately 63% of the Greek maritime industry (Papathanasiou, Cole & Murray, 2020). This implies that family businesses account for the largest share of businesses globally. The primary purpose of this report is to explore the challenges facing Super Eco and their implications, the governance structure for each challenge, the skills of the family members, the advisory board, and SMART analysis.

Context and issues/challenges

Family members manage family businesses. Therefore, there is a likelihood that other family members feel superior to the rest regarding the business’s management leading to conflict (Qiu & Freel, 2020). One of the major challenges facing Super Eco is the conflict between family members on the board of directors. The family members cannot appropriately balance family and business interests. The primary implication of this challenge is that it leads to bad decisions that negatively impact the company’s viability and profitability (Chahal, & Sharma, 2020). Moreover, the conflict of interest propels disunity among the board of directors, detrimental to its success.

Another challenge facing the company is generational differences in leadership styles. Every successor comes with a new leadership style in the business. The founder of the company embraced dictatorial leadership. This leadership approach gives firm owners complete control over all operational decisions (Rosing, Boer & Buengeler, 2022). Nicos, his successor, likewise adopted the dictatorial management style. Nicos’s successors later adopted the democratic leadership approach, allowing everyone to participate in decision-making (Rosing, Boer & Buengeler, 2022). The primary implication of this challenge is that it leads to delays in the company’s adaptability during each face of succession (Leib & Zehrer, 2018). Moreover, a lot of time is taken to adapt to the new leadership changes.

The final challenge facing the company is favoritism. This involves giving unfair treatment to people or a person at the expense of another person (Vveinhardt & Bendaraviciene, 2022). This practice is common in family businesses, especially during the hiring process. Some business members lack the necessary skills to hold major positions in the company; however, they are given a chance at the expense of qualified individuals to serve on the board of directors. Favoritism is unethical since it denies some people the opportunity to explore their skills (Akuffo & Kivipold, 2019). In the case of Super Eco, all their heirs join the board of directors, promoting meritocracy. Here, family bonds and considerations are vital more than skills and commitment (Super Eco Tankers Management, 2020). The primary implication of this challenge is that it makes the company make decisions based on personal interests rather than the business’s interest, negatively impacting the business operations.

Family governance structure

The family council is one of the most effective governance areas for the conflict between family members on the board of directors. Family businesses can use the family council to carry out various tasks to fulfill their missions. The primary task of the family council is to develop assertions of the family’s ideals, mission, and vision that are captivating and clarifies the foundational pillars that guide the family’s direction and main goals (Suess-Reyes, 2017). The family council aids in developing and placing skilled family members into positions within the family business where they may successfully engage with key tasks and resources (Michel & Kammerlander, 2015). This governance structure can enable Super Eco to establish family discipline in support of principles, norms, commitments, and decision-making processes that result in the prosperity of the family and the business. Another governance structure to utilize in this case is the management team. Super Eco needs a management team to create a succession and business plan (Widz & Michel, 2018). Succession is the primary issue causing the conflict with the board of directors. Therefore, having a management team that outlines the succession process is crucial.

The family assembly is the most effective governance area for generational differences in leadership style/succession. The company needs an operational business assembly that guides the succession process. The family assembly serves as a forum for the family council of the Super Eco Company to address the entire family about the state of the business, its prospects, and any other issues it regards to be of great significance (Azila-Gbettor et al., 2018). It also provides a platform for communicating and reinforcing the family’s fundamental beliefs and traditions. Another governance area to utilize in this case is the family association. Succession is a major issue in Super Eco. Therefore, having an effective family association enables the company to select the most appropriate individuals within the family with impeccable character to take over the business operations (Sreih, Lussier & Sonfield, 2019). The family association needs to be made up of the family council members. This will enable Super Eco to have a smooth succession process.

The best governance area for favoritism is the owner’s council. The owner’s council work by ensuring that Super Eco has the right leadership consisting of family and non-family members with the right skills, knowledge, and expertise to manage the business. The owner’s council works with the board of directors to ensure that all the company’s managers meet the demands (Suess-Reyes, 2017). Another governance area essential in this category is the board of advisors. Incorporating the board advisors in the management of Super Eco reduces cases of favoritism since the board must advise the board of directors and other members of the company’s leadership about the skills and competency required of each individual. Consequently, the team must comprise impartial, multidisciplinary family advisors within and outside the company (Reay, Pearson & Dyer, 2013). The members give direction and assistance in strategic decision-making without concern for recrimination from other family members.

Skills of the family members

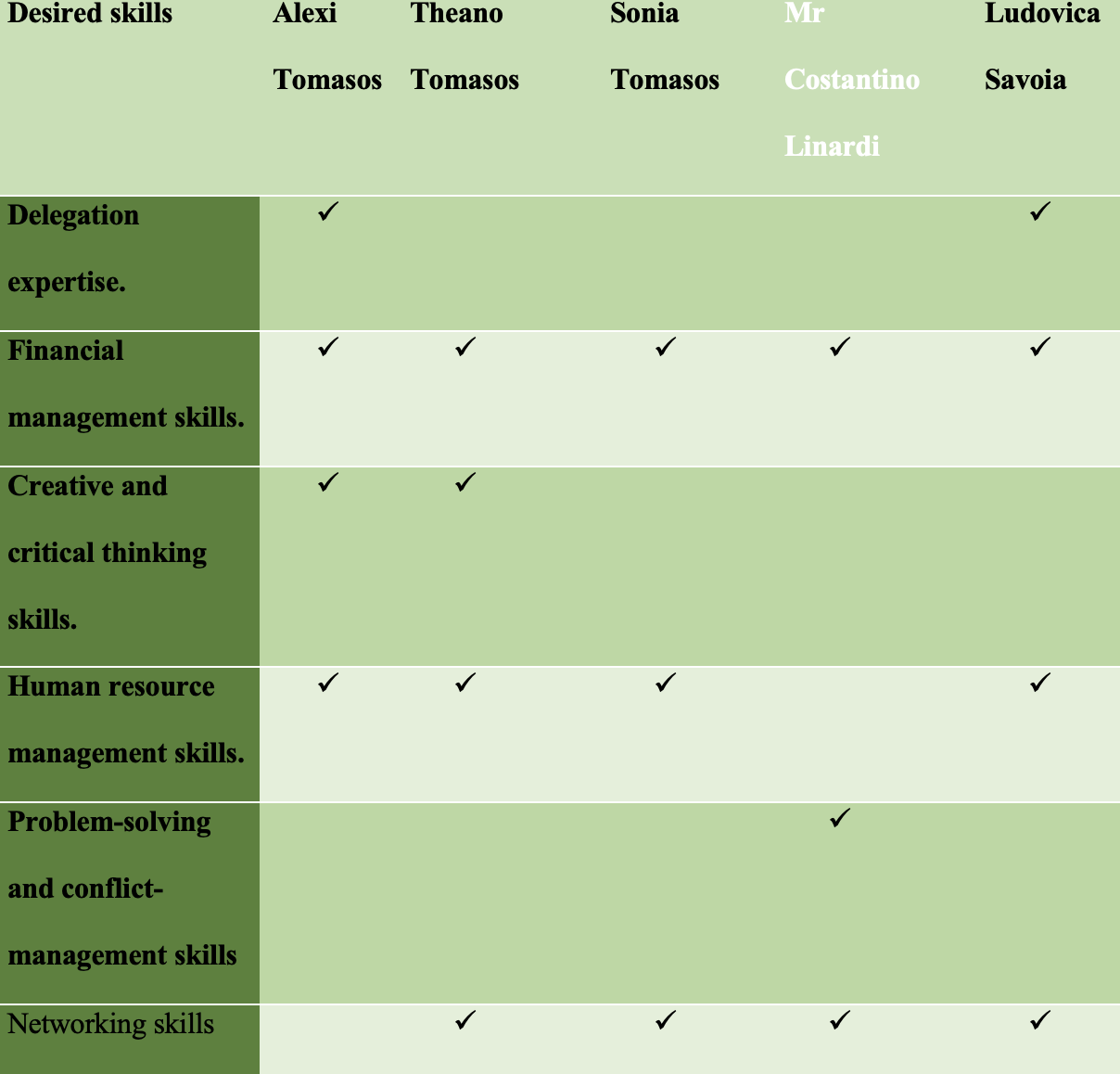

Director names

One of the primary skill gaps that exist in the family business is delegation expertise. Only two out of the five directors of the family business have effective delegation and time management skills. This makes it challenging for Super Eco Company to work within teams since the managers lack the skills required to delegate duties among the team members. The delegation skill enables the directors to delegate duties to the younger family members (Ugoani, 2020). Therefore, a lack of this skill implies that the younger family members are not exposed to the company’s management hence making the succession process cumbersome.

Another skill gap that exists among the family members is creative and critical thinking skills. Only two of the family business directors have effective creative and critical thinking skills. Creative and critical thinking skill is essential since it promotes innovation (Wechsler et al., 2018). It enables the family members to identify the challenges in the succession process and deduce new ideas to change the situation. The final skill gap that exists among the family members is problem-solving and conflict management skills. Only one member of the family business has proper problem-solving and conflict-resolution skills. This poses a threat to the company as a result of the increased favoritism and family conflicts.

The advisory board

Evaluation of the challenges/advisory role.

One of the challenges facing the family business is the conflict between family members on the board of directors. Counseling and mediation could be effective advisory roles to tackle the issue. This involves using reconciliation techniques such as deep mutual healing to enable the conflicting individuals to heal and work as a team (Michel & Kammerlander, 2015). The advisory role for favoritism in Super Eco Company could be mentoring and coaching. It is essential to mentor the young family members using the group mentoring technique to prepare them for management roles than preferring unqualified individuals. Coaching is a technique for instructing, guiding, or training an individual or a group on how to acquire abilities that improve productivity (Gray, 2018). The advisory role that could be effective for curbing the succession problem is facilitating and consulting. Facilitation and consulting entail working as a team to make decisions about the best succession approach.

Evaluation of the advisor/type of advisor

A specific organizational structure such as the board of directors can help Super Eco Business resolve its succession problem. the board of directors can involve the CEOs of other companies to advise the firm on the advantages of training the company’s successors proactively for their positions to streamline the succession process, (Umans et al., 2020). The primary role of the advisory board is to formulate policies allowing the successors to actively participate in the company’s management and leadership.

The type of advisors required to solve the family conflict and favoritism in the firm are external team-building specialists, organizational consultants, and fiduciaries. Organizational consultants and team building specialists and fiduciaries formulate policies that govern the relationship among members of the family business (Gersick, 2015). This approach enables the family members to work towards achieving a common goal hence promoting cohesion. Moreover, they ensure that the family members have equal opportunities in the business, curbing favoritism.

Decide on the advisory role

Counseling and mediation is the most effective advisory role to tackle the family conflict in Super Eco Company. Counseling and mediation entail applying reconciliation techniques such as deep mutual healing to enable the conflicting individuals to heal and work as a team (Michel & Kammerlander, 2015). The conflicting family members can be counseled using therapeutic techniques to enable them to work together to achieve the company’s goal. Mentoring and coaching is the most effective advisory role for favoritism in Super Eco Company. It involves mentoring the young family members through the group mentoring technique to prepare them for management roles than preferring unqualified individuals. Coaching is a technique for instructing, guiding, or training an individual or a group on how to acquire abilities that improve productivity (Gray, 2018). Coaching entails training the family members about the benefits of working as a team and leadership and preferring the best candidates with the right skills to run the business (Mickel, McVeigh & Leger, 2018). Facilitating and consulting is the appropriate advisory role for curbing the succession problem. Facilitation and consulting entail working as a team to make decisions about the best succession approach. Expert facilitation technique is appropriate in this case as it involves external consultants in designing the succession plan.

Steps in the advisory process

The first step in the advisory process is conducting a damage report. This is done at the onset of the process. The damage report is used to foresee the potential dangers of the interventions used to solve the problems (Strike, 2013). It is done through analysis of data from other companies that used a specific intervention to solve a similar problem. The second step in the advisory process is controlling emotional response. This implies that the company needs to use facts such as data rather than feelings to implement the interventions to curb the company’s challenges. The third step is focusing on long-term goals. The company’s long-term goals must be considered during the advisory process. This is done by assessing whether incorporating the interventions in the organization will negatively impact its ability to achieve its long-term goals (Strike, Michel & Kammerlander, 2018). The fourth step in the advisory process is effectively communicating the challenges. The advisory process is challenging therefore, it is essential to communicate challenges through timely reports. This helps deduce effective strategies to overcome such challenges. The final step in the advisory process is to settle on attainable solutions. The company needs to choose solutions that fit the family business’ viability by checking on the solutions that yield prompt results.

Alternative intervention process

An alternative intervention process to overcome the company’s organizational challenges is to Leverage formal governance structures to mitigate conflict. One problem researchers have observed in several family businesses is a lack of a platform for family members to communicate problems in the company (Leib & Zehrer, 2018). Organizational Structures like family councils, boards, and forums can provide families with a secure, organized platform to discuss problems and resolve disputes. Therefore, super eco needs to make good use of the governance structures as an effective intervention to deal with the challenges. One challenge associated with this intervention is delayed decision-making. Involving all the organizational structures in dealing with the issues is time-consuming since all the members must participate in the process. This delays the process of finding a solution to the problems.

The primary protagonists in this process are the family council, family assembly, board of advisors, and management team. The role of the family council is to implement policies that promote the smooth running of the family business. The family assembly meets regularly to review the family’s process and deduce effective resolution approaches. The board of advisors advises the company’s board of directors about the intervention approaches to solve family problems. The management team implements the policies formulated by the family council, family assembly, and advisory board.

Design and Reporton your family business advisory solution to your family business board

The most effective way to deal with the challenges facing the company is to have governance areas such as the family council and assembly. These organizational structures need to work together by formulating policies that guide the company’s operations. For instance, one of the policies to implement in the company is that all the company’s successors must have at least ten years of experience working in the company. This will limit the number of young family members struggling to inherit the company. Another solution to the business succession challenge is involving the potential successors in the company’s management early. This prepares them for future roles in the company hence curbing succession issues. The company needs to have external business consultants to guide the board of directors about some decisions in the company (Widz & Michel, 2018). For instance, external business consultants can recommend less involvement of family members who embrace favoritism in key decisions about Super Eco Company.

SMART Analysis

The primary objective of the advisory process is to solve organizational challenges, including conflict between family members on the board of directors, generational differences in leadership style (succession), and favoritism, by having monthly reports about the progress. This will help to identify the primary issues to be addressed and develop a proper solution approach in one year. Organizations have begun using smart objectives to improve their goal-setting process(Ogbeiwi, 2017) The goal is specific since it aims at finding solutions to the challenges in Super Eco Company (Bjerke & Renger, 2017). The goal is measurable since it is possible to measure the progress using monthly reports. It is also attainable since it requires proper planning within the time frame. The goal is relevant since it defines the key issues in the company, including conflict between family members on the board of directors, generational differences in leadership style (succession), and favoritism. The goal is also time-based because it provides a one-year period for its attainment.

Recommendations/conclusion

Conclusively, Super Eco is one of the leading maritime transport companies in the world. However, the various challenges the firm has encountered and is currently experiencing, like conflict between family members on the board of directors, generational differences in leadership style (succession), and favoritism/pressure to hire family members, are typical problems in large family corporations(Super Eco Tankers Management, 2020). The advisory process should involve five major steps including, conducting a damage report, controlling emotional response, focusing on long-term goals, effectively communicating the challenges, and settling on attainable solutions. Governance areas including family council, family assembly, and board of advisors formulate policies that govern family relationships in the company. The most effective advisory recommendation to deal with the succession problem is to identify the right successors with the right knowledge and skills to run the business (Michel & Kammerlander 2015). Consequently, it is important to prepare potential successors for the role by training them about what the role entails. Family disputes can be solved effectively through open communication. This enables all the family members to express their ideas. Favoritism can be resolved by prioritizing only individuals with the right skills, knowledge, and experience. Moreover, it is essential to outline the duties and responsibilities of the family members.

References

Akuffo, I. N., & Kivipold, K. (2019). Influence of leaders’ authentic competencies on nepotism-favoritism and cronyism. Management Research Review.

Azila-Gbettor, E. M., Honyenuga, B. Q., Berent-Braun, M. M., & Kil, A. (2018). Structural aspects of corporate governance and family firm performance: a systematic review. Journal of Family Business Management.

Bjerke, M. B., & Renger, R. (2017). Being smart about writing SMART objectives. Evaluation and program planning, 61, 125-127.

Chahal, H., & Sharma, A. K. (2020). Family business in India: Performance, challenges and improvement measures. Journal of New Business Ventures, 1(1-2), 9-30.

Gray, J. A. (2018). Leadership coaching and mentoring: A research-based model for stronger partnerships. International Journal of Education Policy and Leadership, 13(12):12.

Leib, G., & Zehrer, A. (2018). Intergenerational communication in family firm succession. Journal of Family Business Management.

Michel, A., & Kammerlander, N. (2015). Trusted advisors in a family business’s succession planning process—An agency perspective. Journal of Family Business Strategy, 6(1), 45-57

Ogbeiwi, O. (2017). Why written objectives need to be SMART. British Journal of Healthcare Management, 23(7), 324-336.

Papathanasiou, A., Cole, R., & Murray, P. (2020). The (non-) application of blockchain technology in the Greek shipping industry. European Management Journal, 38(6), 927-938.

Qiu, H., & Freel, M. (2020). Managing family-related conflicts in family businesses: a review and research agenda. Family Business Review, 33(1), 90-113.

Reay, T., Pearson, A. W., & Dyer, W. G. (2013). Advising family enterprise: Examining the role of family firm advisors. Family Business Review, 26(3), 209-214.

Rosing, F., Boer, D & Buengeler, C, 2022). When timing is key: How autocratic and democratic leadership relates to follower trust in emergency contexts. Front Psychol; 13:904605. Doi: 10.3389/fpsyg.2022.904605.

Sreih, J. F., Lussier, R. N., & Sonfield, M. C. (2019). Differences in management styles, levels of profitability, and performance across generations, and the development of the family business success model. Journal of Organizational Change Management.

Strike V.M., Michel A. & Kammerlander N. (2018), Unpacking the black box of family. Business advising: Insights from psychology. Fam. Bus. Rev; 31: 80-124

Strike, V. M. (2013). The most trusted advisor and the subtle advice process in family firms. Family Business Review, 26(3), 293-313.

Suess-Reyes, J. (2017). Understanding the transgenerational orientation of family businesses: the role of family governance and business family identity. Journal of Business Economics, 87, 749-777.

Ugoani, J. (2020). Effective Delegation and its Impact on Employee Performance. International Journal of Economics and Business Administration, 6(3), 78-87.

Umans, I., Lybaert, N., Steijvers, T., & Voordeckers, W. (2020). Succession planning in family firms: family governance practices, board of directors, and emotions. Small Business Economics, 54, 189-207.

Vveinhardt, J., & Bendaraviciene, R. (2022). How Does Nepotism and Favouritism Affect Organisational Climate? Frontiers in Psychology, 12, 710140.

Wechsler, S. M., Saiz, C., Rivas, S. F., Vendramini, C. M. M., Almeida, L. S., Mundim, M. C., & Franco, A. (2018). Creative and critical thinking: Independent or overlapping components? Thinking skills and creativity, 27, 114-122.

Widz, M., & Michel, A. (2018). Family Firms Advisors and Engagement in Radical

Innovation. Academy of Management Proceedings.

write

write