The executive summary

This paper seeks to generate a comprehensive Lean Startup Analysis Report for Theranos. The firm’s target audience includes individuals of all ages, such as working adults, the elderly, young kids, and infants; people with chronic diseases like cancer, HIV, and diabetes; and health-conscious individuals, such as anti-aging, nutrition, fitness, and cholesterol levels. Blood test procedures under the U.S. health system are quite expensive. Besides, the market is dominated by Quest Diagnostics and LabCorp, which have a joint share of around 80%. Therefore, Theranos promised to render blood tests cheaper, quicker, and more straightforward. Its initial MVP of Theranos was a device that could run hundreds of diverse blood tests on a single drop of blood. Moreover, with the rising technological breakthroughs for establishing innovative blood testing devices, the blood test market is likely to grow in the coming future. Hence, consumer gratification and retention are major indicators of success. Theranos’ business model is created on the impression that it could provide hundreds of simple blood tests straight to patients at a reduced cost compared to conventional blood labs, preferably utilizing its technology to conduct the tests with only a fingerprick’s merit of blood. Its revenue streams involve consumer or insurance supplier payments for lab tests. Other revenue streams entail partnerships with public and private hospitals to utilize its lab tests and sell novel, user-friendly finger stick tools and other wearables. Its cost structure includes equipment and manufacturing costs, sales and marketing expenses, research and development charges for proprietary technology, and overall administrative costs, like legal fees, rent, and salaries. Thus, using social media as an engagement device and not just a platform and holding a consumer-engagement summit are the key methods of engaging with consumers. The company could improve services and products through consumer feedback and build consumer loyalty.

Introduction

Theranos is a customer healthcare technology startup created in 2003 by Elizabeth Holmes (Kelley et al., 2017). Its mission is to transform the healthcare industry with an innovative blood-testing machine. In other words, the startup seeks to render actionable health data accessible to individuals anywhere at the time it matters. According to Holmes, the startup had generated a device that could effectively, economically, and quickly test blood compared to any other prevailing device. Thus, Holmes found investors and began raising finances. The organization positions itself as a laboratory that could conduct several tests on an incision worth of blood through branded technology and processes (Kelley et al., 2017). As of 2004, the startup engaged in early financing, raising about $6.9 million at an assessment of around $30 million (Leiva, 2019). As of 2007, Theranos’ assessment attained around $197 million following its engagement in early-round financing. By 2010, the firm had achieved an estimate of over $1 billion following its participation in numerous financing rounds. Its quick rise enabled the firm to raise about $700 million from various rounds of funds (Leiva, 2019). This is prominent as these investors originated from the exterior of Silicone Valley. Additionally, Theranos collaborated with the Cleveland Clinic and Walgreens, drugstore giants. This was a choice that subjected the general public to Theranos, hence creating more exposure. As a result, the organization was valued at about $9 billion in 2014 (Kelley et al., 2017). Its market positioning in the diagnostic industry successfully designed its ‘electrical grid,’ rendering it the globe’s best healthcare firm. As of 2015, Theranos was approved by the Food and Drug Administration (FDA) to test for herpes simplex virus infection (Leiva, 2019). Thus, this paper seeks to generate a comprehensive Lean Startup Analysis Report for Theranos.

Target audience

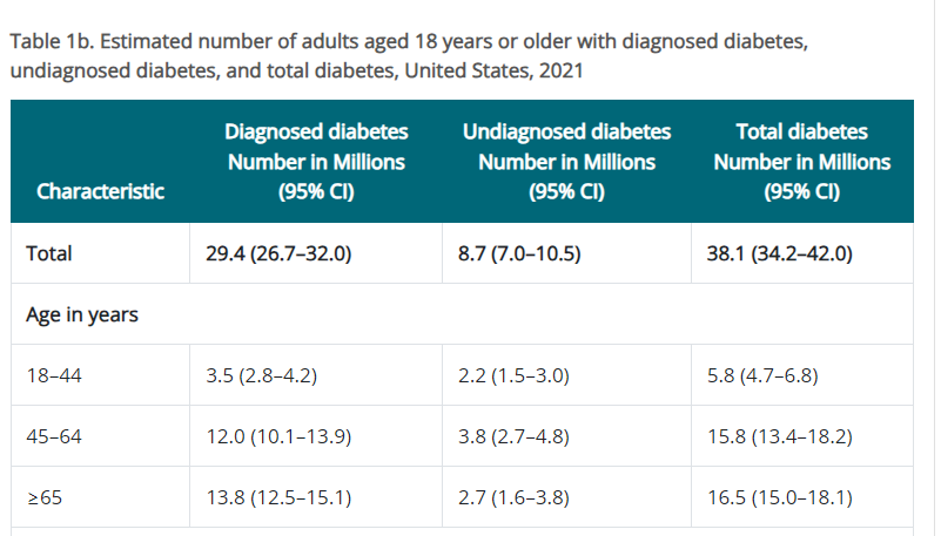

According to Williams (2022), Theranos’s target audience consists of individuals of all ages, such as working adults, the elderly, young kids, and infants. It also involves patients with chronic diseases like cancer, HIV, and diabetes and health-conscious individuals, such as anti-aging, nutrition, fitness, and cholesterol levels. According to the Centers for Disease Control and Prevention (2023), as of 2021, about 38.4 million individuals of all ages (about 11% of the United States population) were diagnosed with diabetes. About 38.1 million adults aged 18 and above years (around 14.7% of all U.S. adults) were diagnosed with diabetes. About 8.7 million adults aged 18 and above were undiagnosed with diabetes, as shown in Figure 1 below.

Figure 1: Approximated number of diagnosed, undiagnosed, and total diabetes in the U.S., 2021 (Centers for Disease Control and Prevention, 2023)

Problem-Solution Fit

According to Williams (2022), Theranos aimed to solve problems related to products and technology. Loria (2015) notes that the firm claimed to have established a technology that could automate and reduce blood tests by utilizing minute blood volumes, as shown in Figure 2 below. This implies that patients would only need to present a few tubes of blood for testing. A few drops could be sufficient to find signs of cancer, diabetes, cholesterol, and other illnesses (Williams, 2022). Thus, the organization promised to render blood tests cheaper, quicker, and more straightforward. As a result, patients could benefit from a painless process and inexpensive tests that seemed costly under the U.S. health system. By doing so, Theranos would have challenged key market players like Quest Diagnostics and LabCorp, who utilize numerous tubes of blood for tests and results taking numerous days before they are released, as Williams (2022) notes.

Figure 2: Theranos blood test procedure (Loria, 2015)

According to WSJ (2013), since the 1960s, blood testing in the United States has hardly evolved. Besides, from a customer viewpoint, blood draws remain ineffective since they need substantial blood samples and long needles, and the results can take several weeks. Again, the procedure can be more expensive if patients are uncovered with insurance. Nevertheless, over ten billion lab tests were conducted yearly, of which about 70% embodied the foundation for medical decisions, as Parloff (2021) asserts. Thus, blood tests became much more accessible by mixing the “nanotainer” and the Edison. Moreover, consumers could receive the results within minutes. Besides, by utilizing its lab devices instead of purchasing third-party supplies and tools, the organization claimed to lower costs by about 90%, as Crow (2016) establishes.

Solution analysis

Lenarduzzi & Taibi (2016) describe the Minimum Viable Product (MVP) as a condensed version of a product the organization is developing that has the minor features and needs for a product to be released to the marketplace so that it could be tested to determine its performance, effectiveness, and acceptance. In other words, it is a version of a novel product that could enable a team to gather the most significant amount of proven learning concerning consumers with minimal effort. According to Kelley et al. (2017), the initial MVP of Theranos was a device that could run hundreds of diverse blood tests on a single drop of blood. Its key features include the design, functionality, usability, and reliability (Leiva, 2019). The blood test device had a suitable design, satisfying the interaction and visual aspects. With the promise of cost-effectiveness, the device had sufficient value, and many consumers were ready to use it. Besides, such consumers could trust the device due to the promises of painlessness and simplicity attached to the blood testing procedure (Leiva, 2019). Additionally, the device had the needed functions to solve issues related to blood testing procedures.

According to Kelley et al. (2017), with modern improvements in biochemical and microfluidics devices, the vision appeared reasonable despite unclear details. Moreover, the blood testing sector was ready for interruption. Besides, a cleaner, cheaper, and more effective way of running blood tests is a solution for the pharmaceutical sector; thus, everybody accepted it. According to Leiva (2019), the two giant test labs were worth around $40 billion and comprised numerous producers of blood testing kits. However, Theranos would be worth around $100 billion if they completed half of what they designed, attracting many investors, as Kelley et al. (2017) explain.

Product-Market Fit

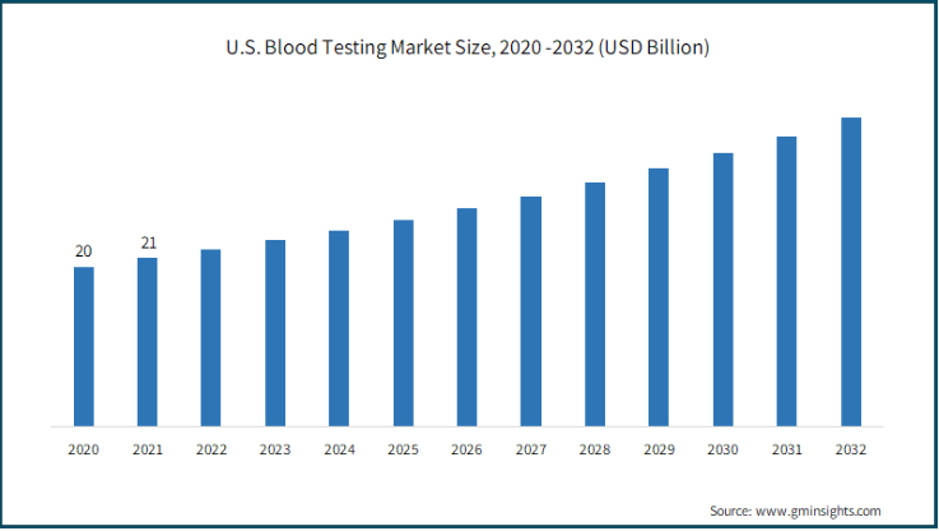

The blood testing market is highly fragmented, with key players like Quest Diagnostics and LabCorp. According to Global Market Insights Inc. (2023), the U.S. blood testing market size was approximately $43.4 billion in 2032, as shown in Figure 3 below. This growth is attributed to supportive government programs, strong healthcare infrastructure, an increasing burden on chronic diseases, and robust favorable compensation policies. Focusing on early disease detection, preventive healthcare, and diagnostic devices could also improve growth (Global Market Insights Inc., 2023).

Figure 3: The U.S. blood test market size between 2020-2032 (Global Market Insights Inc., 2023)

The rising technological breakthroughs for establishing innovative blood testing devices could improve the industry’s position. According to Global Market Insights Inc. (2023), many organizations, such as Theranos, concentrate on establishing highly accurate, cost-effective, and non-invasive technologies to offer patients dependable results. Glucose testing is also a trend that drives the blood testing market. According to Mordor Intelligence (2024), a blood glucose test determines the quantity of glucose in the blood. Symptoms of numerous disorders, such as diabetes, normally appear abruptly and are the reason why levels of blood sugar should be checked often. Thus, the increasing incidence of type 1 and 2 diabetes, together with the growing number of hereditary diabetes, fosters the growth of the blood testing market (Mordor Intelligence, 2024).

According to RIZVANOVIĆ (2023), customer satisfaction is one of the key indicators of success (Product-Market Fit). Asking consumers how gratified they are with the product is a better way of gauging success. Theranos promised to establish a technology to automate and reduce blood tests by utilizing minute blood volumes. With such promises, consumers are likely to be satisfied with the device. As RIZVANOVIĆ (2023) notes, a normal metric to gauge consumer gratification is the Net Promoter Score (NPS), which asks consumers how likely they are to suggest the device to others on a scale of 0 to 10. A more excellent NPS shows consumers are satisfied with the device and ready to recommend it to others. Another significant indicator of success is consumer retention. According to RIZVANOVIĆ (2023), consumer retention gauges the percentage of consumers who continue using Theranos blood test devices after a particular time, like a year or a month. Theranos blood test device is simple, fast, painless, and cost-effective. Therefore, many consumers would like to continue using them if they meet their needs.

Business model

According to DaSilva & Trkman (2014), a company’s business model guarantees its strategies to market its commodity, expenditure, and profit to a target audience. A business model is essential for a firm’s development, motivating workers, and attracting clients’ attention. Thus, companies must adjust their business models regularly to forecast upcoming barriers and trends (DaSilva & Trkman, 2014). Besides, many investors employ business models to evaluate organizations that are attractive for investments. According to Pflanzer (2016), Therano’s business model is created on the impression that it could provide hundreds of simple blood tests straight to patients at a reduced cost compared to conventional blood labs, preferably utilizing its technology to conduct the tests with only a fingerprick’s merit of blood (Pflanzer, 2016). This means that patients would not be needed to provide various tubes of blood for testing. Rather, they would be needed to offer a small number of blood drops to find signs of chronic diseases like cancer, diabetes, and cholesterol, as Williams (2022) explains.

Revenue streams

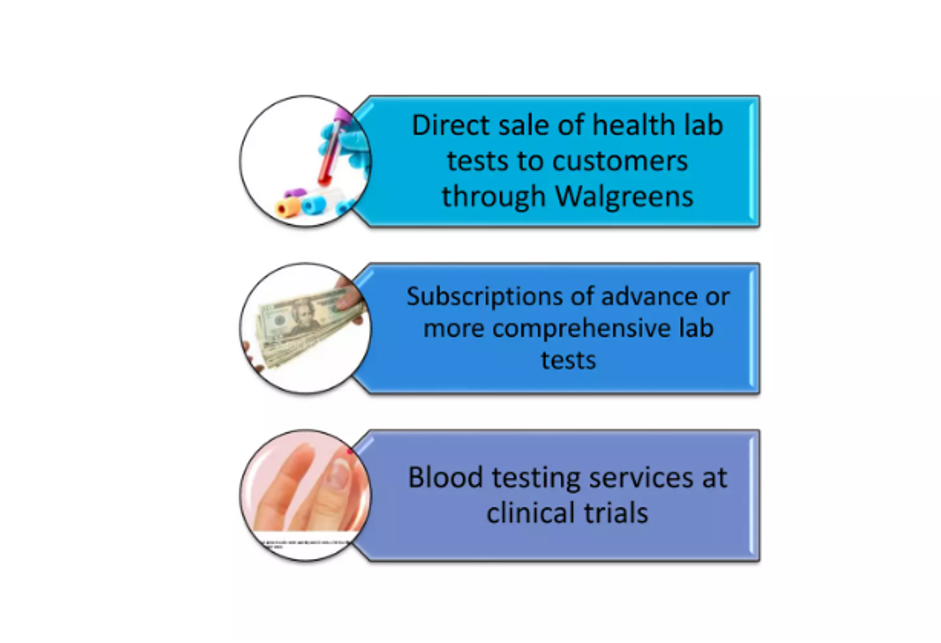

According to Williams (2022), Theranos’ key revenue stream is the payment from consumers or its insurance suppliers for lab tests. Additionally, the organization has other revenue streams, including long-term strategic partnerships with public and private hospitals to utilize its lab tests and sales of novel user-friendly finger stick tools and other wearables (Williams, 2022). Other revenue streams entail blood testing services at clinical trials, subscription of more detailed or advanced lab tests, and direct sale of health lab tests to consumers via Walgreens, as Kelley et al. (2017) note.

Figure 4: Theranos revenue streams (Kelley et al., 2017)

Cost structure

Crow (2016) states that Theranos has a substantially superior cost structure. Its cost structure includes equipment and manufacturing costs, sales and marketing expenses, research and development charges for proprietary technology, and overall administrative costs, like legal fees, rent, and salaries.

Financial performance analysis

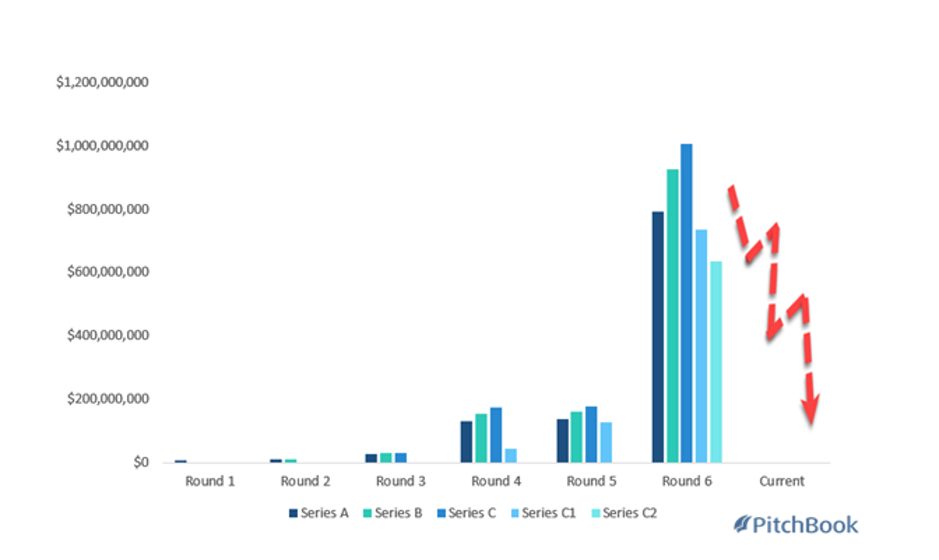

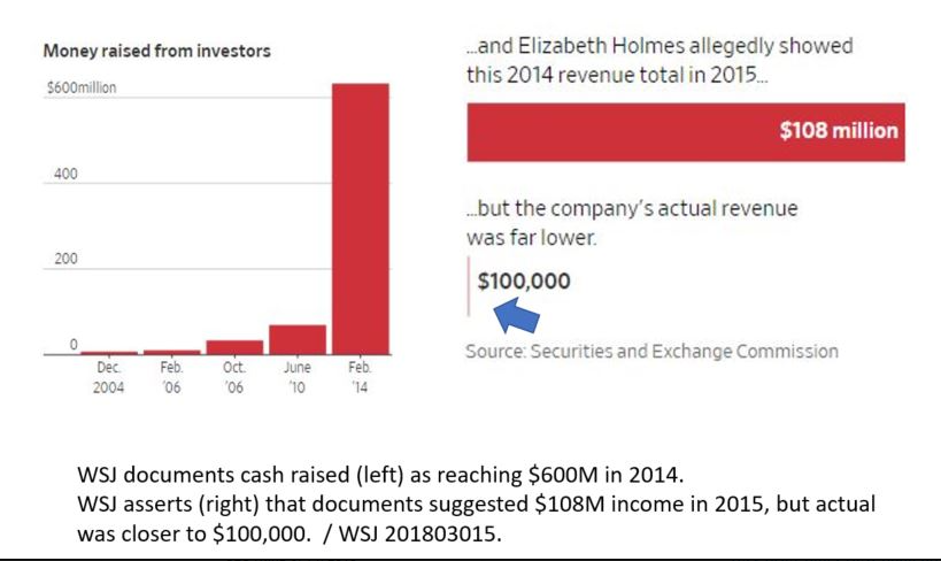

Leiva (2019) notes that after participating in numerous financing rounds, Theranos raised over $700 million of funds from private investors and venture capitalists, eventually accomplishing a valuation of around $10 billion, as shown in Figure 5a below. According to Williams (2022), as of 2014, Theranos’ revenue was anticipated to be around $100 million. Such revenue was projected to reach around $140 million in 2015 and over $990 million in 2016, as shown in Figure 5b below.

Figure 5a: Theranos funding rounds (https://pitchbook.com/news/articles/hot-to-not-the-valuation-implosion-at-theranos)

Figure 5b: Amount raised from investors, suggested revenue, and actual revenue (https://www.discoveriesinhealthpolicy.com/2018/03/theranos-sec-action-see-cms-theranos.html)

Competition

Williams (2022) states that Theranos’ key competitors in the U.S. blood testing market include Quest Diagnostics and LabCorp. Quest Diagnostics was established in 1967 and offers diagnostic testing, services, and data. It also offers non-hospital-based anatomic pathology testing, drug abuse testing, routine medical testing, and esoteric testing (Williams, 2022). Additionally, the organization runs patient service centers, quick response laboratories, and a state system of full-service laboratories (Williams, 2022). Lapcorp was established in 1978 and provides clinical lab tests utilized by medical experts in disease treatment, disease monitoring, patient diagnosis, and routine testing. Labcorp also develops clinical trials, specialty testing processes, and diagnostic genetics.

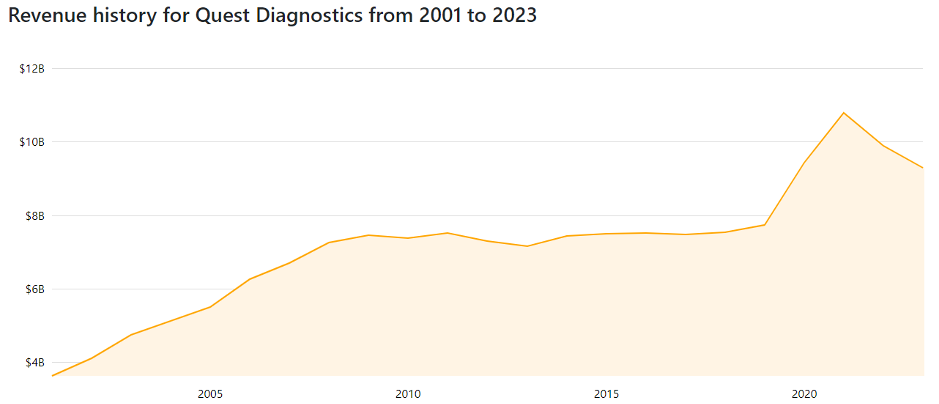

As Williams (2022) notes, the U.S. blood testing market is dominated by Quest Diagnostics and LabCorp, which have a joint share of around 80%. As of 2023, Quest Diagnostics’ revenue was $9.29 billion (companiesmarketcap.com, 2024). As of 2022, the organization generated an income of $9.88 billion, a decline from the 2021 revenue of $10.78 billion, as shown in Figure 6 below.

Figure 6: Quest Diagnostics’ revenue from 2001 to 2023 (companiesmarketcap.com, 2024)

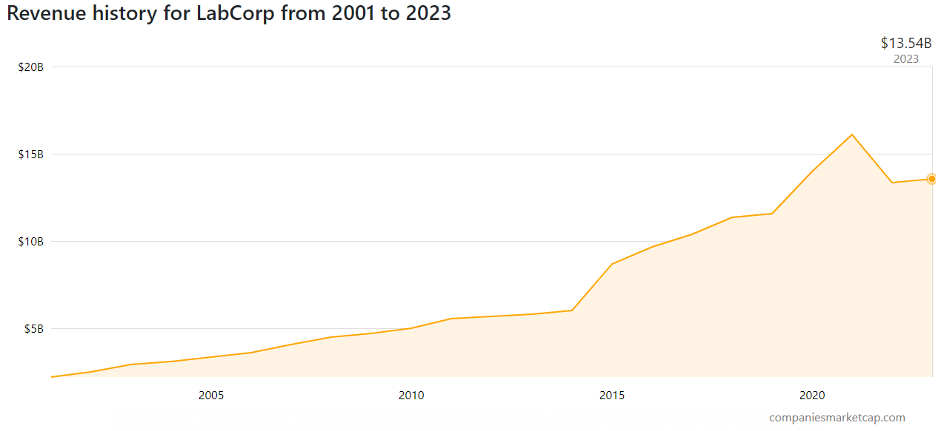

Similarly, as of 2023, Labcorp’s revenue was $13,54 billion (companiesmarketcap.com, 2024). As of 2022, the organization generated a revenue of $13.36 billion, a decline from the 2021 revenue of $16.12 billion, as shown in Figure 7 below.

Figure 7: Lab Corp’s revenue from 2001 to 2023 (companiesmarketcap.com, 2024)

Compared to Theranos, which cost over $100 million in 2014, Quest Diagnostics generated an income of $7.43 billion, and LabCorp made a revenue of $6.01 (companiesmarketcap.com, 2024). Quest Diagnostics and LabCorp were critical players in the United States’ blood test market, holding a more significant share. Thus, to succeed in such a market, Theranos needed to adjust its strategy. The organization needed to make the blood testing industry prettier, quicker, and more convenient using standard devices, as Williams (2022) claims.

Customer Validation and Feedback

Customer engagement

According to Lim et al. (2022), consumer engagement has surfaced as a crucial factor in generating profitability in today’s competitive business setting. It is not about selling a commodity but creating a relationship and developing a remarkable experience promoting loyalty and lasting relationships. One of the key methods of engaging with consumers is using social media as an engagement device and not just a platform. Lim et al. (2022) explain that when consumers follow Theranos on Twitter or like its page on Facebook, they undertake such actions as believing that the organization will assist them. Thus, using social media to identify questions, share, connect, and generate content that appeals to consumers will enable the company to successfully engage with its consumers, as Lim et al. (2022) assert. Another method of engaging with consumers is by holding a consumer-engagement summit. Lim et al. (2022) claim that nowadays, there are numerous learning methods, such as multimedia, articles, newspapers, magazines, and blogs. Nevertheless, attending a conference or a summit could widen an organization’s horizons and dramatically update its learning curve. According to Lauren (2022), adobe researched the influence of summits on attendees’ existences. The organization discovered that about 98% of attendees sustained or surpassed their anticipation. About 80% of such attendees found novel talents to affect their career and company, as Lauren (2022) notes. Thus, by holding such a summit, Theranos will be able to engage with its consumers.

Feedback Insights

According to McColl-Kennedy et al. (2019), consumer feedback denotes suggestions, opinions, comments, and information consumers offer regarding their experiences with the company, its service, and its product. Meanwhile, key insights are the more profound patterns and understandings stemming from examining consumer feedback and information (McColl-Kennedy et al., 2019). Thus, in summary, consumer feedback refers to the raw input offered by consumers, while key insights denote the precious conclusions depicted from examining such feedback. After engaging with consumers, the organization can gather feedback and key insights. Thus, one of the key actions based on such feedback is improving services and products. According to McColl-Kennedy et al. (2019), consumer feedback could result in product improvements, the establishment of novel features, or even the innovation of completely new commodities that correlate to consumer expectations and desires. Another key action is building consumer loyalty. Consumers value firms that keenly heed their feedback and take action (McColl-Kennedy et al., 2019). Thus, by executing changes based on consumer feedback, the company could develop trust and loyalty, establishing lasting consumer relationships.

Test and measure

In today’s fast-paced and information-driven business setting, crafting informed decisions is vital for success (Altmann & Correio, 2020). Thus, Key Performance Indicators (KPIs) have appeared as essential devices that could encourage the company to monitor, measure, and handle its performance. These indicators are quantifiable measures utilized to assess the product, team, or business performance or success. They serve as a measure to trace development toward particular objectives and goals. Goals and objectives. In commodity management, KPIs are essential for measuring a product’s success and health. Thus, one of the KPIs is at least a 20% increase in user engagement levels. This could be indicated by a score of at least 7 to 10 on the Net Promoter Score (NPS). Another KPI is at least a 10% conversion rate indicated by the number of visits users engage with Theranos devices. After testing the device on the target audience, users are likely to love the device or offer feedback for enhancements. According to Crow (2016), Theranos firm claimed to have established a technology that could automate and reduce blood tests by utilizing minute blood volumes. Thus, utilizing its lab devices instead of purchasing third-party supplies and tools, the organization claimed to lower costs by about 90%. With such a promise, consumers will likely react positively to the tests, offering better results.

Recommendations

- It is vital to define the problem the startup is attempting to solve and the solution it is providing to assist the firm in concentrating on its mission and the consumer segment it is targeting.

- The organization should also be prepared to learn fast whether its strategy for resolving a difficulty is practical and be ready to end or adjust if it is not functioning.

- The company could also establish an ad test MVP on potential target consumers to collect feedback and identify areas for enhancement.

Conclusion

Theranos is a customer healthcare technology startup created in 2003 by Elizabeth Holmes to transform the healthcare industry with an innovative blood-testing machine. The paper has generated a comprehensive Lean Startup Analysis Report for Theranos. Its target audience entails individuals of all ages, such as working adults, the elderly, young kids, infants, and people with chronic diseases like cancer, HIV, and diabetes, and health-conscious individuals, such as anti-aging, nutrition, fitness, and cholesterol levels. With the expensive blood test procedure under the U.S. health system and a market dominated by Quest Diagnostics and LabCorp, which have a joint share of around 80%, Theranos promised to render blood tests cheaper, quicker, and more straightforward. Its initial MVP of Theranos was a device that could run hundreds of diverse blood tests on a single drop of blood. Additionally, with the rising technological breakthroughs for establishing innovative blood testing devices, the blood test market is likely to grow in the coming future. Thus, consumer gratification and retention are significant indicators of success. Theranos’ business model is created on the impression that it could provide hundreds of simple blood tests straight to patients at a reduced cost compared to conventional blood labs, preferably utilizing its technology to conduct the tests with only a fingerprick’s merit of blood. Its revenue streams entail paying consumers or insurance suppliers for lab tests and partnerships with public and private hospitals to utilize its lab tests and sell the novel, user-friendly finger stick tools, and other wearables. Its cost structure includes equipment and manufacturing costs, sales and marketing expenses, research and development charges for proprietary technology, and overall administrative costs, like legal fees, rent, and salaries. Using social media as an engagement device and not just a platform and holding a consumer-engagement summit are the key methods of engaging with consumers. The organization could improve services and products through consumer feedback and build consumer loyalty.

References

Altmann, M. V., & Correio, J. M. (2020). Adoption of key performance indicators in Brazilian startups. Desenvolve Revista de Gestão do Unilasalle, 9(2), 09-26. http://dx.doi.org/10.18316/desenv.v9i2.6690

Centers for Disease Control and Prevention. (2023, November 29). National Diabetes Statistics Report. Centers for Disease Control and Prevention. https://www.cdc.gov/diabetes/data/statistics-report/index.html

Crow, D. (2016, April 8). Blood simple. Financial times. https://www.ft.com/content/71523196-fc45-11e5-b5f5-070dca6d0a0d

DaSilva, C. M., & Trkman, P. (2014). Business model: What it is and what it is not. Long-range planning, 47(6), 379-389. https://doi.org/10.1016/j.lrp.2013.08.004

Global Market Insights Inc. (2023). Blood Testing Market Size & Share – Analysis Report, 2032. https://www.gminsights.com/industry-analysis/blood-testing-market

Kelley, C., Lee, S., Shields, V., & O’Rourke, J. (2017). Theranos, Inc.: Managing Risk in a High-Flying Biotech Startup. The Eugene D. Fanning Center for Business Communication, Mendoza College of Business, University of Notre Dame. DOI:10.4135/9781526444813

Lauren, L. (2022, May 19). 13 easy and effective customer engagement strategies. BuildFire. https://buildfire.com/customer-engagement-strategies/

Leiva, L. (2019). Keep track of the Theranos scandal with this detailed timeline. Elizabeth Holmes Theranos Scandal: A Complete Timeline. https://www.refinery29.com/en-us/2019/01/222855/theranos-scandal-timeline-what-happened-elizabeth-holmes-documentary

Lenarduzzi, V., & Taibi, D. (2016, August). MVP explained: A systematic mapping study on the definitions of a minimal viable product. In 2016, the 42nd Euromicro Conference on Software Engineering and Advanced Applications (SEAA) (pp. 112-119). IEEE. DOI:10.1109/SEAA.2016.56

Lim, W. M., Rasul, T., Kumar, S., & Ala, M. (2022). Past, present, and future of customer engagement. Journal of Business Research, 140, 439-458. https://doi.org/10.1016/j.jbusres.2021.11.014

Loria, K. (2015, October 19). What we know about how Theranos’ “revolutionary” technology works. Business Insider. https://www.businessinsider.com/how-theranos-revolutionary-technology-works-2015-10?r=US&IR=T

McColl-Kennedy, J. R., Zaki, M., Lemon, K. N., Urmetzer, F., & Neely, A. (2019). Gaining customer experience insights that matter. Journal of Service Research, 22(1), 8–26. https://doi.org/10.1177/1094670518812182

Mordor Intelligence (2024). Blood testing market – trends, Size, and share. Blood Testing Market – Trends, Size & Share. https://www.mordorintelligence.com/industry-reports/blood-testing-market

Parloff, R. (2021, June 16). This CEO is out for blood. Fortune. https://fortune.com/2014/06/12/theranos-blood-holmes/

Pflanzer, L. R. (2016, May 20). Theranos made one critical mistake that has caused it the most grief. Business Insider. https://www.businessinsider.com/the-biggest-mistake-theranos-made-2016-5?r=US&IR=T

Quest Diagnostics (DGX) – revenue. CompaniesMarketCap.com – companies ranked by market capitalization. (n.d.). https://companiesmarketcap.com/quest-diagnostics/revenue/

Labcorp (LH) – revenue. CompaniesMarketCap.com – companies ranked by market capitalization. (n.d.). https://companiesmarketcap.com/labcorp/revenue/

RIZVANOVIĆ, B. (2023). OPTIMIZING PRODUCT-MARKET FIT: A DIGITAL MARKETING APPROACH FOR PERFORMANCE MEASUREMENT. https://run.unl.pt/bitstream/10362/160295/1/Rizvanovic_2023.pdf

Williams, M. (2022). Elizabeth Holmes and Theranos: A play on more than just ethical failures. Business Information Review, 39(1), 23–31. https://doi.org/10.1177/02663821221088899

WSJ. (2013). Joseph Rago: A drop of blood. An instant diagnosis https://www.wsj.com/articles/SB10001424127887324123004579055003869574012

write

write